Comprehensive Annual Financial Report - City of Cerritos

Comprehensive Annual Financial Report - City of Cerritos

Comprehensive Annual Financial Report - City of Cerritos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

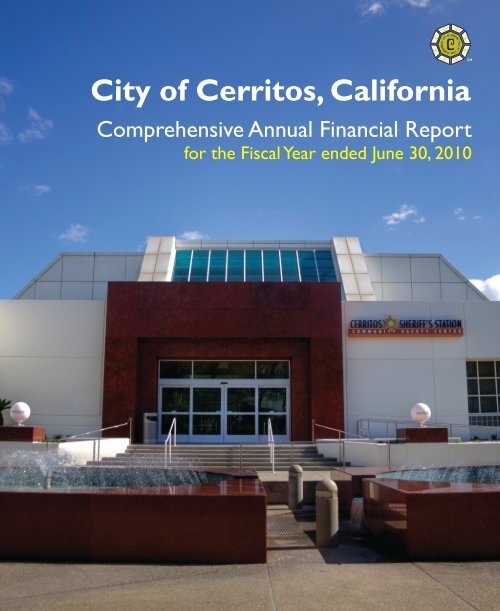

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>, California<br />

<strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong><br />

for the Fiscal Year ended June 30, 2010

CITY OF CERRITOS, CALIFORNIA<br />

COMPREHENSIVE ANNUAL<br />

FINANCIAL REPORT<br />

WITH REPORT ON AUDIT<br />

BY INDEPENDENT<br />

CERTIFIED PUBLIC ACCOUNTANTS<br />

FISCAL YEAR ENDED JUNE 30, 2010<br />

Prepared by:<br />

Administrative Services Department<br />

Denise D. Manoogian, Director <strong>of</strong> Administrative Services<br />

Nita McKay, Finance Manager

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

<strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong><br />

For the year ended June 30, 2010<br />

Table <strong>of</strong> Contents<br />

Page<br />

INTRODUCTORY SECTION<br />

<strong>City</strong> Manager and Director <strong>of</strong> Administrative Services Letter <strong>of</strong> Transmittal ................................................. i<br />

Principal Officials ...................................................................................................................................................... v<br />

Organization Chart.................................................................................................................................................... vi<br />

GFOA Certificate <strong>of</strong> Achievement for Excellence in <strong>Financial</strong> <strong>Report</strong>ing ........................................................ vii<br />

FINANCIAL SECTION<br />

Independent Auditors’ <strong>Report</strong> ............................................................................................................................... 1<br />

Management’s Discussion and Analysis (Unaudited) ...................................................................................... 3<br />

Basic <strong>Financial</strong> Statements:<br />

Government-wide <strong>Financial</strong> Statements:<br />

Statement <strong>of</strong> Net Assets ............................................................................................................................... 17<br />

Statement <strong>of</strong> Activities ................................................................................................................................. 18<br />

Fund <strong>Financial</strong> Statements:<br />

Governmental Fund <strong>Financial</strong> Statements:<br />

Balance Sheet .......................................................................................................................................... 22<br />

Reconciliation <strong>of</strong> the Governmental Funds Balance Sheet<br />

to the Government-Wide Statement <strong>of</strong> Net Assets ..................................................................... 23<br />

Statement <strong>of</strong> Revenues, Expenditures and<br />

Changes in Fund Balances ............................................................................................................. 24<br />

Reconciliation <strong>of</strong> the Governmental Funds Statement <strong>of</strong> Revenues,<br />

Expenditures and Changes in Fund Balances to the Government-Wide<br />

Statement <strong>of</strong> Activities and Changes in Net Assets ................................................................... 25<br />

Proprietary Fund <strong>Financial</strong> Statements:<br />

Statement <strong>of</strong> Net Assets ........................................................................................................................ 28<br />

Statement <strong>of</strong> Revenues, Expenses and Changes in Net Assets ....................................................... 29<br />

Statement <strong>of</strong> Cash Flows ....................................................................................................................... 30<br />

Notes to Basic <strong>Financial</strong> Statements ............................................................................................................... 31

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

<strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong><br />

For the year ended June 30, 2010<br />

Table <strong>of</strong> Contents, Continued<br />

Page<br />

FINANCIAL SECTION, Continued<br />

Required Supplementary Information (Unaudited) ........................................................................................ 75<br />

Notes to Required Supplementary Information ............................................................................................. 76<br />

Budgetary Comparison Schedule:<br />

General Fund ................................................................................................................................................. 77<br />

Schedule <strong>of</strong> Funding Progress:<br />

Defined Pension Plan ................................................................................................................................... 78<br />

Other Post Employment Benefits ............................................................................................................... 78<br />

Supplementary Information:<br />

Non-Major Governmental Funds:<br />

Combining Balance Sheet ............................................................................................................................ 82<br />

Combining Statement <strong>of</strong> Revenues, Expenditures and Changes in Fund Balances ........................... 86<br />

Schedule <strong>of</strong> Revenues, Expenditures and Changes in Fund Balances – Budget and Actual:<br />

Street Improvements Special Revenue Fund ..................................................................................... 90<br />

Traffic Congestion Special Revenue Fund ......................................................................................... 91<br />

Drainage Special Revenue Fund .......................................................................................................... 92<br />

Sewer Special Revenue Fund ............................................................................................................... 93<br />

SB 821 Special Revenue Fund ............................................................................................................... 94<br />

Proposition “A” Special Revenue Fund ............................................................................................. 95<br />

Proposition “C” Special Revenue Fund .............................................................................................. 96<br />

Assessment District #6 Special Revenue Fund .................................................................................. 97<br />

Los Coyotes Lighting District Special Revenue Fund ...................................................................... 98<br />

Local Law Enforcement Grants Special Revenue Fund ................................................................... 99<br />

COPS Grants Special Revenue Fund .................................................................................................. 100<br />

Library Grants Special Revenue Fund ................................................................................................ 101<br />

Environmental Grant Special Revenue Fund .................................................................................... 102<br />

AQMD Special Revenue Fund ............................................................................................................. 103<br />

Measure “R” Special Revenue Fund ................................................................................................... 104<br />

Internal Service Funds:<br />

Combining Statement <strong>of</strong> Net Assets .......................................................................................................... 106<br />

Combining Statement <strong>of</strong> Revenues, Expenses and Changes in Net Assets ......................................... 107<br />

Combining Statement <strong>of</strong> Cash Flows ........................................................................................................ 108

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

<strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong><br />

For the year ended June 30, 2010<br />

Table <strong>of</strong> Contents, Continued<br />

Page<br />

STATISTICAL SECTION (Unaudited)<br />

Description <strong>of</strong> Statistical Section Contents ............................................................................................................ 109<br />

<strong>Financial</strong> Trends:<br />

Net Assets by Component – Last Eight Fiscal Years ..................................................................................... 110<br />

Changes in Net Assets – Expenses and Program Revenues - Last Eight Fiscal Years .............................. 112<br />

Changes in Net Assets – General Revenues - Last Eight Fiscal Years ......................................................... 114<br />

Fund Balances <strong>of</strong> Governmental Funds - Last Eight Fiscal Years ................................................................ 116<br />

Changes in Fund Balances <strong>of</strong> Governmental Funds - Last Eight Fiscal Years ........................................... 118<br />

Governmental Activities Revenues by Sources - Last Ten Fiscal Years ...................................................... 120<br />

Revenue Capacity:<br />

Assessed Value <strong>of</strong> Taxable Property - Last Ten Fiscal Years ........................................................................ 122<br />

Property Tax Rates – All Direct and Overlapping Governments – Last Ten Fiscal Years ....................... 124<br />

Ten Largest Secured Taxpayers – Current Year and Nine Years Ago ........................................................ 125<br />

Property Tax Levies and Collections - Last Ten Fiscal Years ....................................................................... 126<br />

Debt Capacity:<br />

Ratios <strong>of</strong> Outstanding Debt by Type - Last Eight Fiscal Years ..................................................................... 128<br />

Schedule <strong>of</strong> Direct and Overlapping Bonded Debt ........................................................................................ 130<br />

Legal Debt Margin Information- Last Eight Fiscal Years .............................................................................. 132<br />

Demographic and Economic Information:<br />

Demographic and Economic Statistics - Last Eight Fiscal Years .................................................................. 134<br />

Principal Employers – Current Year and Eight Years Ago ........................................................................... 135<br />

Operating Information:<br />

Full-Time and Part-Time <strong>City</strong> Employees by Function - Last Eight Fiscal Years ...................................... 136<br />

Operating Indicators by Function - Last Eight Fiscal Years .......................................................................... 137<br />

Capital Asset Statistics by Function - Last Eight Fiscal Years ...................................................................... 138

dI<br />

nvDcOIN)mIDMMM<br />

800Z LclI-916 (19c) :xvi. ico-o (g)<br />

oclc-coLo6 viioiiiv ‘soiini• ocic xog oi<br />

fl}JAV auwooi ciii )i2JhJ2D DIAID<br />

December 2, 2010<br />

Honorable Mayor, Members <strong>of</strong> the <strong>City</strong> Council, and Citizens <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

It is our pleasure to present the <strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong> (CAFR) <strong>of</strong> the <strong>City</strong><br />

<strong>of</strong> <strong>Cerritos</strong> (the <strong>City</strong>) for the fiscal year ended June 30, 2010.<br />

This report consists <strong>of</strong> management’s representations concerning the finances <strong>of</strong> the <strong>City</strong> <strong>of</strong><br />

<strong>Cerritos</strong>. Management assumes the responsibility for the accuracy <strong>of</strong> the presented data,<br />

the completeness and fairness <strong>of</strong> the presentation and all disclosures. To provide a<br />

reasonable basis for making these representations, management has established a<br />

comprehensive internal control framework that is designed both to protect the <strong>City</strong>’s assets<br />

from loss, theft, or misuse and to compile sufficient reliable information for the preparation<br />

<strong>of</strong> the <strong>City</strong>’s financial statements in conformity with generally accepted accounting principles<br />

(GAAP). Because the costs <strong>of</strong> internal controls should not outweigh their benefits, internal<br />

controls have been designed to provide reasonable rather than absolute assurance that the<br />

financial statements will be free from material misstatements.<br />

The <strong>City</strong>’s financial statements have been audited by Caporicci & Larson, Inc., a subsidiary<br />

<strong>of</strong> Marcum, LLP, a firm <strong>of</strong> certified public accountants. The auditors have issued an<br />

unqualified opinion on these financial statements. Such an opinion states that the auditors<br />

feel the <strong>City</strong> followed all accounting rules appropriately and that the financial reports are an<br />

accurate representation <strong>of</strong> the <strong>City</strong>’s financial condition. Their report is located at the front<br />

<strong>of</strong> the financial section <strong>of</strong> this report.<br />

Management’s discussion and analysis (MD&A) immediately follows the independent<br />

auditor’s report and provides a narrative introduction, overview, and analysis <strong>of</strong> the basic<br />

financial statements. This letter <strong>of</strong> transmittal is designed to complement the MD&A and<br />

should be read in conjunction with it.<br />

Pr<strong>of</strong>ile <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> is located approximately 20 miles southeast <strong>of</strong> Los Angeles along the<br />

border <strong>of</strong> Orange County. Beginning as an unincorporated area known for its strawberry<br />

farms and dairy operations, the <strong>City</strong> experienced a major transformation into a more urban<br />

environment beginning in the late 1960s. In 1973, a unique and innovative General Plan<br />

was adopted, which has guided development in a master planned fashion to create a parklike<br />

community with balanced development. Today the <strong>City</strong> is a progressive, affluent<br />

community with a highly educated and ethnically diverse population.<br />

The <strong>City</strong> is home to over 50,000 residents and several large business organizations.<br />

<strong>Cerritos</strong> enjoys the distinction <strong>of</strong> being a large sales tax generator, resulting in significant<br />

revenues to support <strong>City</strong> operations.<br />

i

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

ORGANIZATIONAL CHART<br />

RESIDENTS OF CERRITOS<br />

CITY COUNCIL<br />

REDEVELOPMENT AGENCY<br />

ECONOMIC DEVELOPMENT<br />

COMMISSION<br />

FINE ARTS & HISTORICAL<br />

COMMISSION<br />

PARKS & RECREATION<br />

COMMISSION<br />

PLANNING<br />

COMMISSION<br />

PROPERTY PRESERVATION<br />

COMMISSION<br />

CITY ATTORNEY CITY MANAGER/EXECUTIVE DIRECTOR CITY CLERK/TREASURER<br />

COMMUNITY<br />

DEVELOPMENT<br />

PUBLIC WORKS<br />

WATER AND<br />

POWER<br />

COMMUNITY AND<br />

SAFETY SERVICES<br />

ADMINISTRATIVE<br />

SERVICES<br />

THEATER<br />

Geographic Information<br />

Systems<br />

Engineering<br />

Water<br />

Operations<br />

Community Participation/<br />

Senior Center<br />

Communications<br />

Business Management<br />

Advance Planning<br />

Environmental<br />

Services<br />

Reclaimed Water<br />

Operations<br />

Recreation Services<br />

Finance/Water Billing<br />

Performance Marketing<br />

and Sales<br />

Redevelopment Team<br />

General<br />

Maintenance<br />

Electric Utility<br />

Operations<br />

Community Safety<br />

Human Resources/<br />

Risk Management<br />

Performance Management<br />

Front <strong>of</strong> House<br />

Current Planning Parks/Trees Maintenance<br />

Code Enforcement<br />

Support Services<br />

Operations and Security<br />

Municipal Library<br />

Special Event Services<br />

Management Information Systems<br />

Ticket Office<br />

vi

vii

This page intentionally left blank.<br />

viii

-<br />

I UJODidD1-3MMM<br />

SSUVJUflOO3V 3flqncJ pd7ftJ.1d3<br />

JJ7 Wfl3JVWJO Csvzpsqn V<br />

DUI ‘UOSJWJ 29 !DDPOdtD<br />

rio<br />

INDEPENDENT AUDITORS’ REPORT<br />

Honorable Mayor and<br />

Members <strong>of</strong> the <strong>City</strong> Council<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

<strong>Cerritos</strong>, California<br />

We have audited the accompanying financial statements <strong>of</strong> the governmental activities, the businesstype<br />

activities, each major fund, and the aggregate remaining fund information <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>,<br />

California (<strong>City</strong>), as <strong>of</strong> and for the year ended June 30, 2010, which collectively comprise the <strong>City</strong>’s<br />

basic financial statements as listed in the foregoing table <strong>of</strong> contents. These basic financial statements<br />

are the responsibility <strong>of</strong> the <strong>City</strong>’s management. Our responsibility is to express an opinion on these<br />

basic financial statements based on our audit.<br />

We conducted our audit in accordance with auditing standards generally accepted in the United States<br />

<strong>of</strong> America and the standards applicable to financial audits contained in Government Auditing Standards,<br />

issued by the Comptroller General <strong>of</strong> the United States. Those standards require that we plan and<br />

perform the audit to obtain reasonable assurance about whether the basic financial statements are free<br />

<strong>of</strong> material misstatement. An audit includes consideration <strong>of</strong> internal control over financial reporting<br />

as a basis for designing audit procedures that are appropriate in the circumstances but not for the<br />

purpose <strong>of</strong> expressing an opinion on the effectiveness <strong>of</strong> the <strong>City</strong>’s internal control over financial<br />

reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis,<br />

evidence supporting the amounts and disclosures in the financial statements. An audit also includes<br />

assessing the accounting principles used and significant estimates made by management, as well as<br />

evaluating the overall basic financial statement presentation. We believe that our audit provides a<br />

reasonable basis for our opinions.<br />

In our opinion, the basic financial statements referred to above present fairly, in all material respects,<br />

the respective financial position <strong>of</strong> the governmental activities, the business-type activities, each major<br />

fund, and the aggregate remaining fund information <strong>of</strong> the <strong>City</strong> as <strong>of</strong> June 30, 2010, and the respective<br />

changes in financial position and cash flows, where applicable, there<strong>of</strong> for the year then ended in<br />

conformity with accounting principles generally accepted in the United States <strong>of</strong> America.<br />

In accordance with Government Auditing Standards, we have also issued our report dated<br />

December 2, 2010 on our consideration <strong>of</strong> the <strong>City</strong>’s internal control over financial reporting and on our<br />

tests <strong>of</strong> its compliance with certain provisions <strong>of</strong> laws, regulations, contracts, and grants. The purpose<br />

<strong>of</strong> that report is to describe the scope <strong>of</strong> our testing <strong>of</strong> internal control over financial reporting and<br />

compliance and the results <strong>of</strong> that testing, and not to provide an opinion on the internal control over<br />

financial reporting or on compliance. That report is an integral part <strong>of</strong> an audit performed in<br />

accordance with Government Auditing Standards and should be read in conjunction with this report in<br />

considering the results <strong>of</strong> our audit.

Honorable Mayor and<br />

Members <strong>of</strong> the <strong>City</strong> Council<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

<strong>Cerritos</strong>, California<br />

Page 2<br />

The accompanying Required Supplementary Information, such as Management’s Discussion and<br />

Analysis, budgetary comparison information and other information, is not a required part <strong>of</strong> the basic<br />

financial statements, but is supplementary information required by the Governmental Accounting<br />

Standards Board. We have applied certain limited procedures, which consisted principally <strong>of</strong> inquiries<br />

<strong>of</strong> management regarding the methods <strong>of</strong> measurement and presentation <strong>of</strong> the Required<br />

Supplementary Information. However, we did not audit the information and express no opinion on<br />

the Required Supplementary Information.<br />

Our audit was conducted for the purpose <strong>of</strong> forming opinions on the financial statements that<br />

collectively comprise the <strong>City</strong>’s basic financial statements. The accompanying Supplementary<br />

Information is presented for purpose <strong>of</strong> additional analysis and is not a required part <strong>of</strong> the basic<br />

financial statements. The Supplementary Information has been subjected to the auditing procedures<br />

applied in the audit <strong>of</strong> the basic financial statements and, in our opinion, is fairly stated in all material<br />

respects in relation to the basic financial statements taken as a whole. The Introductory and Statistical<br />

Sections have not been subjected to the auditing procedures applied in the audit <strong>of</strong> the basic financial<br />

statements and, accordingly, we express no opinion on them.<br />

Caporicci & Larson, Inc.<br />

A Subsidiary <strong>of</strong> Marcum LLP<br />

Certified Public Accountants<br />

Irvine, California<br />

December 2, 2010<br />

2

CITY OF CERRITOS, CALIFORNIA<br />

Management’s Discussion and Analysis<br />

Year Ended June 30, 2010<br />

As Management <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>, California (<strong>City</strong>), we <strong>of</strong>fer readers <strong>of</strong> the <strong>City</strong>’s financial<br />

statements this narrative overview and analysis <strong>of</strong> the financial activities <strong>of</strong> the <strong>City</strong> for the fiscal year<br />

ended June 30, 2010. We encourage readers to consider the information presented here in conjunction<br />

with the accompanying letter <strong>of</strong> transmittal at the front <strong>of</strong> this report, and the basic financial<br />

statements, which follow this section.<br />

FINANCIAL HIGHLIGHTS<br />

<br />

<br />

<br />

<br />

The <strong>City</strong>’s assets exceeded its liabilities at June 30, 2010 by $327.5 million. This amount is<br />

referred to as the net assets <strong>of</strong> the <strong>City</strong>. Of this amount, $169.7 million is invested in capital<br />

assets net <strong>of</strong> related debt, $31.6 million is restricted and $126.2 million is unrestricted. The<br />

unrestricted amount may be used to meet the <strong>City</strong>’s ongoing obligations to citizens and<br />

creditors.<br />

The <strong>City</strong>’s net assets decreased $16.1 million, expenses exceeding revenues by this amount.<br />

This decrease is attributable to the mandatory payment <strong>of</strong> $11.8 million to the State <strong>of</strong><br />

California for the <strong>City</strong>’s share <strong>of</strong> the Supplemental Educational Revenue Augmentation Fund<br />

(SERAF), Other Post Employment Benefits (OPEB) contribution <strong>of</strong> $2.0 million and general<br />

liability claims <strong>of</strong> $1.9 million.<br />

Governmental funds for the <strong>City</strong> reported combined fund balances <strong>of</strong> $148.6 million. Of this<br />

amount, $104.6 million is reserved while $44.0 million is unreserved, or available for spending<br />

at the <strong>City</strong>’s discretion.<br />

As <strong>of</strong> June 30, 2010, the unreserved fund balance <strong>of</strong> the General Fund, the <strong>City</strong>’s chief<br />

operating fund, was $80.5 million, or 141.5% <strong>of</strong> General Fund expenditures. This unreserved<br />

fund balance is available for future appropriation.<br />

OVERVIEW OF THE FINANCIAL STATEMENTS<br />

This discussion and analysis is intended to serve as an introduction to the <strong>City</strong>’s basic financial<br />

statements, which consist <strong>of</strong> three components: 1) government-wide financial statements, 2) fund<br />

financial statements and 3) notes to the basic financial statements. This report also contains<br />

supplementary information in addition to the basic financial statements.<br />

Government-wide <strong>Financial</strong> Statements<br />

The government-wide financial statements are designed to provide readers with a broad overview <strong>of</strong><br />

the <strong>City</strong>’s finances, in a manner similar to a private-sector business.<br />

The Statement <strong>of</strong> Net Assets presents information on all <strong>of</strong> the <strong>City</strong>’s assets and liabilities, with the<br />

difference between the two reported as net assets. Over time, increases or decreases in net assets may<br />

serve as a useful indicator <strong>of</strong> whether the financial position <strong>of</strong> the <strong>City</strong> is improving or deteriorating.<br />

3

OVERVIEW OF THE FINANCIAL STATEMENTS (CONTINUED)<br />

Government-wide <strong>Financial</strong> Statements (Continued)<br />

The Statement <strong>of</strong> Activities presents information on how the <strong>City</strong>’s net assets changed during the fiscal<br />

year. All changes in net assets are reported as soon as the underlying event giving rise to the change<br />

occurs, regardless <strong>of</strong> the timing <strong>of</strong> the related cash flows. Therefore, revenues and expenses are<br />

reported in this statement for some items that will only result in cash flows in future fiscal periods (for<br />

example, uncollected taxes and earned but unused employee leaves).<br />

Both <strong>of</strong> the government-wide financial statements distinguish functions <strong>of</strong> the <strong>City</strong> that are principally<br />

supported by taxes and intergovernmental revenues (governmental activities) from other functions that<br />

are intended to recover all or a significant portion <strong>of</strong> their costs through user fees and charges<br />

(business-type activities). The governmental activities <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> include legislative and<br />

administration, community development, public works, water and power, community and safety<br />

services, administrative services and the theater (<strong>Cerritos</strong> Center for the Performing Arts). The<br />

business-type activities <strong>of</strong> the <strong>City</strong> include water operations, reclaimed water, and electric utility.<br />

The government-wide financial statements include not only the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> itself (known as the<br />

primary government), but also the activities <strong>of</strong> the <strong>Cerritos</strong> Redevelopment Agency (Agency) and the<br />

<strong>Cerritos</strong> Public Financing Authority (Authority), a joint powers authority formed by the <strong>City</strong> and the<br />

Agency to issue bonds for the construction <strong>of</strong> major capital facilities. The <strong>City</strong> is financially<br />

accountable for both <strong>of</strong> these legally separate entities, which are referred to as blended component<br />

units. The Agency and Authority function for all practical purposes as departments <strong>of</strong> the <strong>City</strong>, and<br />

therefore, these blended component units have been included in these financial statements as an<br />

integral part <strong>of</strong> the primary government.<br />

Fund <strong>Financial</strong> Statements<br />

A fund is a grouping <strong>of</strong> related accounts that is used to maintain control over resources that have been<br />

segregated for specific activities or objectives. The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>, like other state and local<br />

governments, uses fund accounting to ensure and demonstrate compliance with finance-related legal<br />

requirements. All <strong>of</strong> the funds <strong>of</strong> the <strong>City</strong> can be divided into two categories: governmental funds and<br />

proprietary funds.<br />

<br />

Governmental Funds<br />

Governmental funds are used to account for essentially the same functions reported as<br />

governmental activities in the government-wide financial statements. However, unlike the<br />

government-wide financial statements, governmental fund financial statements focus on<br />

near-term inflows and outflows <strong>of</strong> spendable resources, as well as on balances <strong>of</strong> spendable<br />

resources available at the end <strong>of</strong> the fiscal year. Such information may be useful in evaluating<br />

the <strong>City</strong>’s near-term financing requirements.<br />

Because the focus <strong>of</strong> governmental funds is narrower than that <strong>of</strong> the government-wide<br />

financial statements, it is useful to compare the information presented for governmental funds<br />

with similar information presented for governmental activities in the government-wide<br />

financial statements. By doing so, readers may better understand the long-term impact <strong>of</strong> the<br />

<strong>City</strong>’s near-term financing decisions. Both the governmental fund balance sheet and the<br />

governmental fund statement <strong>of</strong> revenues, expenditures and changes in fund balances provide a<br />

reconciliation to facilitate this comparison between governmental funds and governmental<br />

activities.<br />

4

OVERVIEW OF THE FINANCIAL STATEMENTS (CONTINUED)<br />

Fund <strong>Financial</strong> Statements (Continued)<br />

<br />

Governmental Funds (Continued)<br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> maintains nineteen individual governmental funds. Information is<br />

presented separately in the governmental fund balance sheet and in the governmental fund<br />

statement <strong>of</strong> revenues, expenditures and changes in fund balances for the General Fund,<br />

Redevelopment Agency Debt Service Fund and Redevelopment Agency Capital Projects Fund,<br />

each <strong>of</strong> which are considered to be major funds. Data from the other sixteen governmental<br />

funds are combined into a single, aggregated presentation. Individual fund data for each <strong>of</strong><br />

these nonmajor governmental funds is provided in the form <strong>of</strong> combining statements elsewhere<br />

in this report.<br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> adopts an annual appropriated budget for the General Fund and all Special<br />

Revenue Funds. A budgetary comparison statement has been provided for each <strong>of</strong> these funds<br />

to demonstrate compliance with these budgets.<br />

<br />

Proprietary Funds<br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> maintains two different types <strong>of</strong> proprietary funds. Enterprise funds are<br />

used to report the same functions presented as business-type activities in the government-wide<br />

financial statements. The <strong>City</strong> uses enterprise funds to account for its water, reclaimed water<br />

and electric utility activities. Internal service funds are accounting devices used to accumulate<br />

and allocate costs internally among the <strong>City</strong>’s various functions. The <strong>City</strong> uses an internal<br />

service fund to account for its equipment maintenance and replacement activities. Because the<br />

internal service fund provides services that predominantly benefit governmental rather than<br />

business-type functions, it has been included within governmental activities in the governmentwide<br />

financial statements.<br />

Proprietary funds provide the same type <strong>of</strong> information as the government-wide financial<br />

statements, only in more detail. The proprietary fund financial statements provide separate<br />

information for the Water Fund, Reclaimed Water Fund and Electric Utility Fund, which are<br />

considered major funds <strong>of</strong> the <strong>City</strong>. Conversely, the internal service fund is shown as a<br />

separate reporting category on the Proprietary Funds reports and in the Supplementary<br />

Information section <strong>of</strong> this report.<br />

Notes to the Basic <strong>Financial</strong> Statements<br />

The notes to the basic financial statements provide additional information that is essential to a full<br />

understanding <strong>of</strong> the data provided in the government-wide and fund financial statements.<br />

Other Information<br />

The combining statements, referred to earlier in connection with other governmental funds and the<br />

internal service fund, are presented in Supplementary Information.<br />

5

GOVERNMENT-WIDE FINANCIAL ANALYSIS<br />

The following table summarizes the Statement <strong>of</strong> Net Assets for fiscal years ending June 30, 2010 and<br />

June 30, 2009.<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> Net Assets<br />

(in millions)<br />

Governmental Activities Business-Type Activities Total<br />

2010 2009 2010 2009 2010 2009<br />

Cash and investments $ 157.2 $ 182.6 $ 4.1 $ 5.4 $ 161.3 $ 188.0<br />

Other Assets 20.8 20.1 (4.1) (2.9) 16.7 17.2<br />

Capital Assets 298.1 291.4 40.4 41.9 338.5 333.3<br />

Total Assets 476.1 494.1 40.4 44.4 516.5 538.5<br />

Other Liabilities 11.5 15.0 1.1 0.3 12.6 15.3<br />

Long term liabilities outstanding 176.2 179.6 0.2 - 176.4 179.6<br />

Total Liabilities 187.7 194.6 1.3 0.3 189.0 194.9<br />

Net Assets<br />

Invested in capital assets,<br />

net <strong>of</strong> related debt 129.3 108.3 40.4 41.9 169.7 150.2<br />

Restricted 31.6 32.9 - - 31.6 32.9<br />

Unrestricted 127.5 158.3 (1.3) 2.2 126.2 160.5<br />

Total net assets $ 288.4 $ 299.5 $ 39.1 $ 44.1 $ 327.5 $ 343.6<br />

As noted earlier, net assets may serve over time as a useful indicator <strong>of</strong> a government’s financial<br />

position. In the case <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>, net assets were $327.5 million as <strong>of</strong> June 30, 2010. Net<br />

assets decreased $16.1 million, or 4.7%, during fiscal year 2009-10. Assets decreased 4.1% and<br />

liabilities decreased 3.0% when compared to June 30, 2009.<br />

The largest portion <strong>of</strong> the <strong>City</strong>’s net assets at June 30, 2010 ($169.7 million, or 51.8% <strong>of</strong> total net<br />

assets) reflects its investment in capital assets (e.g., land, infrastructure, buildings, machinery and<br />

equipment) less any related debt used to acquire those assets that is still outstanding. The <strong>City</strong> uses<br />

these capital assets to provide services to citizens; consequently, these assets are not available for<br />

future spending. Although the <strong>City</strong>’s investment in its capital assets is reported net <strong>of</strong> related debt, it<br />

should be noted that the resources needed to repay this debt must be provided from other sources, since<br />

the capital assets themselves cannot be used to liquidate these liabilities.<br />

The increase in governmental activities investment in capital assets is attributable to the <strong>City</strong> acquiring<br />

land and the completion <strong>of</strong> an expansion to the Sheriff’s station. The decrease in business-type<br />

activities was due to normal depreciation <strong>of</strong> existing capital assets with no significant purchases. The<br />

restricted portion <strong>of</strong> the <strong>City</strong>’s net assets 9.6%) represents resources that are subject to external<br />

restrictions on how they may be used. These restricted net assets decreased $1.3 million due to<br />

amounts that were spent related to capital projects. The remaining balance <strong>of</strong> unrestricted net assets <strong>of</strong><br />

$126.2 million may be used to meet the government’s ongoing obligations to citizens and creditors.<br />

Cash and investments decreased 14.2%, or $26.7 million when compared to the previous fiscal year.<br />

This decrease is directly linked to the State <strong>of</strong> California mandated payment <strong>of</strong> $11.8 million for the<br />

<strong>City</strong>’s share <strong>of</strong> the Supplemental Educational Revenue Augmentation Fund (SERAF), the <strong>City</strong>’s share<br />

<strong>of</strong> improvements to the <strong>Cerritos</strong> Mall in the amount <strong>of</strong> $4.0 million and the purchase <strong>of</strong> land in the<br />

amount <strong>of</strong> $7.0 million, which resulted in the increase to the <strong>City</strong>’s investment in capital assets, as<br />

previously described.<br />

6

GOVERNMENT-WIDE FINANCIAL ANALYSIS (CONTINUED)<br />

As noted in the following table, the <strong>City</strong>’s net assets declined by $16.1 million during the current fiscal<br />

year. The fiscal year 2009-10 decline in net assets compares to the fiscal year 2008-09 decrease <strong>of</strong><br />

$16.0 million.<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> Change in Net Assets<br />

(in millions)<br />

Governmental Activities Business-type activities Total<br />

2010 2009 2010 2009 2010 2009<br />

Revenues<br />

Program revenues:<br />

Charges for services $ 12.1 $ 12.5 $ 12.4 $ 15.3 $ 24.5 $ 27.8<br />

Operating grants and contributions 11.3 10.0 - - 11.3 10.0<br />

Capital grants and contributions 0.6 0.2 0.1 0.1 0.7 0.3<br />

General revenues:<br />

Taxes 58.5 63.6 - - 58.5 63.6<br />

Investment income 20.6 18.3 0.1 0.1 20.7 18.4<br />

Miscellaneous 1.1 0.2 - - 1.1 0.2<br />

Total revenues 104.2 104.8 12.6 15.5 116.8 120.3<br />

Expenses:<br />

Legislative and administration 24.0 12.2 - - 24.0 12.2<br />

Community development 9.6 7.5 - - 9.6 7.5<br />

Public works 17.6 24.0 - - 17.6 24.0<br />

Water and power 0.5 1.5 - - 0.5 1.5<br />

Community and safety services 23.2 24.7 - - 23.2 24.7<br />

Administrative services 12.4 16.5 - - 12.4 16.5<br />

<strong>Cerritos</strong> Center for the Performing Arts 10.8 12.6 - - 10.8 12.6<br />

Unallocated infrastructure depreciation 1.1 1.0 - - 1.1 1.0<br />

Interest expense 16.1 16.8 - - 16.1 16.8<br />

Water - - 9.7 9.0 9.7 9.0<br />

Reclaimed water - - 1.4 1.3 1.4 1.3<br />

Electric Utility - - 6.5 9.2 6.5 9.2<br />

Total expenses 115.3 116.8 17.6 19.5 132.9 136.3<br />

Change in net assets<br />

before transfers (11.1) (12.0) (5.0) (4.0) (16.1) (16.0)<br />

Transfers - 4.2 - (4.2) - -<br />

Change in net assets (11.1) (7.8) (5.0) (8.2) (16.1) (16.0)<br />

Net assets, beginning <strong>of</strong> year 299.5 307.3 44.1 52.3 343.6 359.6<br />

Net assets, end <strong>of</strong> year $ 288.4 $ 299.5 $ 39.1 $ 44.1 $ 327.5 $ 343.6<br />

The <strong>City</strong>’s total revenues were $116.8 million in FY 2009-10, while the total cost <strong>of</strong> all programs and<br />

services was $132.9 million. Revenues decreased by $3.5 million, or 2.9%, from the prior year levels<br />

and expenses decreased $3.4 million, or 2.5% when compared to FY 2008-09.<br />

Approximately 50.1% <strong>of</strong> all revenues this past year came from some form <strong>of</strong> tax (down from 52.9% in<br />

FY 2008-09).<br />

7

GOVERNMENT-WIDE FINANCIAL ANALYSIS (CONTINUED)<br />

Governmental Activities<br />

Revenues associated with governmental activities<br />

decreased $0.6 million compared to FY 2008-09 primarily<br />

due to the economic recession. Although tax revenues<br />

declined, specifically in the areas <strong>of</strong> sales taxes and tax<br />

increment revenues ($5.0 million), other revenue sources<br />

increased when compared to one year ago. The increases<br />

in operating and capital grant revenues included police<br />

grants, library grants, and $0.5 million in American<br />

Recovery and Reinvestment Act (ARRA) grant funds for a<br />

major street improvement project.<br />

Expenses associated with governmental activities<br />

decreased $1.5 million compared to one year earlier. With<br />

the economic downturn and declines in the <strong>City</strong>’s core<br />

revenue sources, all <strong>City</strong> departments were charged with<br />

reducing operating expenses to maintain a balanced<br />

budget. The only areas which show increases are<br />

legislative and administration, detailing the mandatory<br />

SERAF payment to the State <strong>of</strong> California, and<br />

community development.<br />

Motor vehicle<br />

taxes<br />

4%<br />

Franchise<br />

taxes<br />

1%<br />

Sales taxes<br />

17%<br />

Property<br />

taxes<br />

33%<br />

Unallocated<br />

infrastructure<br />

depreciation<br />

1%<br />

<strong>Cerritos</strong><br />

Center for the<br />

Performing<br />

Arts<br />

10%<br />

Administrative<br />

Services<br />

11%<br />

Revenue Sources<br />

Fiscal Year Ended June 30, 2010<br />

Capital grants<br />

and<br />

contributions<br />

1%<br />

Charges for<br />

services<br />

12%<br />

Transient<br />

occupancy<br />

taxes<br />

FINANCIAL ANALYSIS OF THE CITY’S FUNDS<br />

As noted earlier, the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> uses fund accounting to ensure and demonstrate compliance with<br />

finance-related legal requirements.<br />

Governmental Funds<br />

The focus <strong>of</strong> the <strong>City</strong>’s governmental funds is to provide information on near-term inflows, outflows,<br />

and balances <strong>of</strong> spendable resources. Such information is useful in assessing the <strong>City</strong>’s financing<br />

requirements. In particular, unreserved fund balance may serve as a useful measure <strong>of</strong> a government’s<br />

net resources available for spending at the end <strong>of</strong> the fiscal year.<br />

At the end <strong>of</strong> the current fiscal year, the <strong>City</strong>’s governmental funds reported combined ending fund<br />

balances <strong>of</strong> $148.6 million, a decrease <strong>of</strong> $22.6 million from the prior year. Approximately $44.0<br />

million constitutes unreserved fund balance, which is available for spending at the <strong>City</strong>’s discretion.<br />

The remainder <strong>of</strong> fund balance is reserved to indicate that it is not available for new spending because<br />

it has already been committed 1) for long-term receivables ($101.8 million) from the <strong>Cerritos</strong><br />

Redevelopment Agency and the Electric Utility Fund, 2) for inventories and deposits ($0.8 million),<br />

and 3) for land held for resale ($2.0 million).<br />

The General Fund is the main operating fund <strong>of</strong> the <strong>City</strong>. At the end <strong>of</strong> the current fiscal year,<br />

unreserved fund balance <strong>of</strong> the General Fund was $80.5 million, which represents 141.5% <strong>of</strong> General<br />

Fund expenditures, excluding transfers. Reserved amounts include $101.8 million for long-term<br />

receivables and $0.8 million for inventories and deposits. Unreserved fund balance includes<br />

designations for Arts Center programs ($10.0 million), asset replacement ($0.7 million), and self<br />

insurance ($1.0 million).<br />

The <strong>City</strong>’s General Fund balance increased $1.7 million during the fiscal year compared to a budgeted<br />

increase <strong>of</strong> $0.3 million. Although revenues (including transfers in) completed the fiscal year $1.9<br />

million less than the adjusted budget, departmental expenditures (including transfers out) were under<br />

budget by $3.3 million, resulting in the $1.4 million variance from budgeted to actual fund balance.<br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> has two other governmental funds that qualify as major funds. The<br />

Redevelopment Agency Debt Service Fund ended the fiscal year with a deficit fund balance <strong>of</strong> $66.1<br />

million. The deficit fund balance increased $22.9 million during the fiscal year due to the mandatory<br />

SERAF payment to the State <strong>of</strong> California ($11.8 million) and the increased transfer to the Capital<br />

Projects Fund ($11.7 million). The Redevelopment Agency Capital Projects Fund completed fiscal<br />

year 2009-10 with an ending fund balance <strong>of</strong> $25.3 million. Of this ending fund balance, $2.0 million<br />

is reserved for land held for resale. The remaining fund balance <strong>of</strong> $23.3 million is unreserved. The<br />

increase <strong>of</strong> $0.3 million in fund balance from the previous fiscal year is due to the increase in the<br />

transfer from the Debt Service Fund.<br />

Proprietary Funds<br />

The <strong>City</strong>’s proprietary funds provide the same type <strong>of</strong> information found in the government-wide<br />

financial statements, but in more detail.<br />

The <strong>City</strong>’s major proprietary funds are the Water, Reclaimed Water and Electric Utility Funds. Net<br />

assets <strong>of</strong> the Water, Reclaimed Water, and Electric Utility Funds at the end <strong>of</strong> the fiscal year amounted<br />

to $25.4 million, $7.5 million, and $6.1 million, respectively. The total change in net assets <strong>of</strong> these<br />

9

FINANCIAL ANALYSIS OF THE CITY’S FUNDS (CONTINUED)<br />

Proprietary Funds (Continued)<br />

funds was ($2.6) million, ($0.5) million, and ($1.9) million. In total, net assets for all major funds<br />

decreased $5.0 million from the previous year.<br />

Operating expenses exceeded operating revenues in each <strong>of</strong> the major proprietary funds resulted in a<br />

decline in net assets. The <strong>City</strong> has not implemented a rate increase in the past four years, calling upon<br />

existing net assets to subsidize operations.<br />

GENERAL FUND BUDGETARY HIGHLIGHTS<br />

During the fiscal year, there was a $1.3 million decrease in appropriations between the original and<br />

final amended budget. <strong>City</strong> management mandated budget reductions within all departmental budgets<br />

due to the effects <strong>of</strong> the economic recession on the <strong>City</strong>’s major revenue streams. All line items were<br />

reviewed with special emphasis on necessary expenditures, while items such as travel, training, and<br />

supplies were reduced.<br />

As stated above, the decrease in appropriations was necessary because <strong>of</strong> the decline in the <strong>City</strong>’s<br />

major revenue sources, primarily sales tax revenue declining $3.4 million, or 16.7% from the prior<br />

fiscal year.<br />

CAPITAL ASSET AND DEBT ADMINISTRATION<br />

Capital Assets<br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>’ investment in capital assets for its governmental and business-type activities as <strong>of</strong><br />

June 30, 2010, amounts to $338.5 million (net <strong>of</strong> accumulated depreciation) an increase <strong>of</strong> $5.2 million<br />

from the prior fiscal year. This investment in capital assets includes land, streets, water, sewer and<br />

storm drain systems, buildings and improvements, machinery and equipment, vehicles, public works <strong>of</strong><br />

art, parking structures, and electric rights.<br />

The following table presents the capital assets <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> at June 30, 2010.<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> Capital Assets<br />

(in millions)<br />

Governmental activities Business-type activities Total<br />

2010 2009 2010 2009 2010 2009<br />

Land $ 84.0 $ 77.0 $ - $ - $ 84.0 $ 77.0<br />

Parking structure rights 3.8 3.8 - - 3.8 3.8<br />

Right-<strong>of</strong>-way 49.2 49.2 - - 49.2 49.2<br />

Public art 4.4 4.4 - - 4.4 4.4<br />

Trees 1.4 1.4 - - 1.4 1.4<br />

Construction in progress 0.2 2.4 - 1.0 0.2 3.4<br />

Buildings and structures 126.0 124.2 3.2 3.3 129.2 127.5<br />

Improvements other<br />

than buildings 4.3 4.4 - - 4.3 4.4<br />

Infrastructure/water mains<br />

and lines 21.7 21.2 22.3 22.1 44.0 43.3<br />

Water rights - - 1.8 1.9 1.8 1.9<br />

Electric Rights - - 11.8 12.2 11.8 12.2<br />

Furniture and equipment 3.1 3.4 1.3 1.4 4.4 4.8<br />

Total $ 298.1 $ 291.4 $ 40.4 $ 41.9 $ 338.5 $ 333.3<br />

10

CAPITAL ASSET AND DEBT ADMINISTRATION (CONTINUED)<br />

Capital Assets (Continued)<br />

Major capital asset events during the fiscal year included the following:<br />

<br />

<br />

<br />

Purchase <strong>of</strong> property located on the Northwest corner <strong>of</strong> Studebaker Road and 183 rd Street in<br />

the amount <strong>of</strong> $7.0 million;<br />

Completion <strong>of</strong> the Sheriff Station expansion amounting to $6.5 million;<br />

The Bloomfield Avenue resurfacing project was completed in the amount <strong>of</strong> $1.1 million.<br />

Besides utilizing highway users’ tax revenues to complete this project, the <strong>City</strong> received $0.5<br />

million in ARRA funding for the completion <strong>of</strong> this resurfacing.<br />

Detailed information relating to capital assets can be found in Note 7 to the basic financial statements.<br />

Long-term debt<br />

At the end <strong>of</strong> the current fiscal year, the <strong>City</strong> had total debt outstanding <strong>of</strong> $176.2 million. The<br />

majority <strong>of</strong> this debt is Redevelopment Agency revenue bonds ($168.8 million). Additions to the<br />

<strong>City</strong>’s long-term debt included $2.0 million <strong>of</strong> OPEB obligation and $1.9 million in general liability<br />

claims payable.<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> Long-Term Debt<br />

(in millions)<br />

2010 2009<br />

Los <strong>Cerritos</strong>-Revenue Bonds $ 39.8 $ 42.3<br />

Los Coyotes-Revenue Bonds 127.4 132.1<br />

Add Deferred Amounts 1.6 1.7<br />

Subtotal – Revenue Bonds 168.8 176.1<br />

Note Payable 1.0 1.0<br />

Compensated Absences 2.5 2.5<br />

Net OPEB Obligation 2.0 -<br />

Claims Payable-General Liability 1.9 -<br />

Total Long-Term Debt $ 176.2 $ 179.6<br />

Detailed information relating to long-term debt can be found in Note 9 to the basic financial<br />

statements.<br />

ECONOMIC FACTORS AND NEXT YEAR’S BUDGET<br />

S<strong>of</strong>tness in the real estate market along with a tightening in the credit market continues to have an<br />

adverse effect on the local Southern California economy. Key sectors <strong>of</strong> the economy that continue to<br />

be affected include technology, entertainment and certain durable goods. Rising costs <strong>of</strong> raw materials<br />

along with unemployment concerns has slowed remodeling and reconstruction <strong>of</strong> housing within the<br />

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>.<br />

The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> has been able to maintain its levels <strong>of</strong> service to the community by positioning<br />

itself to withstand fluctuations in the economic environment. The combined tax revenues, particularly<br />

sales tax and income from investments and ground leases have made it possible to progress with the<br />

planned level <strong>of</strong> development while maintaining a high degree <strong>of</strong> financial stability.<br />

11

ECONOMIC FACTORS AND NEXT YEAR’S BUDGET (CONTINUED)<br />

The <strong>City</strong>’s ability to maintain a positive business climate was evidenced with the completion <strong>of</strong> the<br />

new Nordstrom Department store along with a new Kia dealership at the <strong>Cerritos</strong> Auto Square. These<br />

accomplishments are strong examples <strong>of</strong> the <strong>City</strong>’s continued ability to generate significant ground<br />

rent, sales tax and tax increment revenues.<br />

Despite the challenging economic environment, careful management <strong>of</strong> expenditures will enable the<br />

<strong>City</strong> to maintain its ability to fund current levels <strong>of</strong> services to its residents without the need to use its<br />

reserves. The <strong>City</strong> has, in the past, used unreserved fund balance for specific capital projects, but<br />

continues to take a cautious approach to spending in light <strong>of</strong> the ongoing California budget crisis.<br />

Management is confident that the <strong>City</strong> can sustain and build upon its current reserves while satisfying<br />

the funding needs <strong>of</strong> future capital projects and operations. Future planned capital projects include the<br />

installation <strong>of</strong> photovoltaic solar panels at the Corporate Yard and ongoing street improvement<br />

projects.<br />

The recent fluctuations in revenues, continuing demand for the <strong>City</strong>’s service levels, and potential<br />

revenue reductions from the State’s actions to eliminate the State budget deficit continue to be taken<br />

into account by the <strong>City</strong> in budgeting its expenses for the upcoming year. The <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

continues to adopt a budget that not only serves as a financial plan, but also a communication device,<br />

policy tool and operations guide for the <strong>City</strong> Council and the citizens <strong>of</strong> <strong>Cerritos</strong>.<br />

REQUESTS FOR INFORMATION<br />

This financial report is designed to provide the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong> citizens, taxpayers, customers,<br />

investors, and creditors with a general overview <strong>of</strong> the <strong>City</strong>’s finances and to illustrate the <strong>City</strong>’s<br />

accountability for the money it receives. If you have questions about this report or need additional<br />

financial information, contact the <strong>City</strong>’s Administrative Services Department at the <strong>City</strong> <strong>of</strong> <strong>Cerritos</strong>,<br />

18125 Bloomfield Avenue, <strong>Cerritos</strong>, CA 90703, or call (562) 860-0311 or visit our website at<br />

www.ci.cerritos.us.<br />

12

BASIC FINANCIAL STATEMENTS<br />

13

This page intentionally left blank.<br />

14

GOVERNMENT-WIDE FINANCIAL STATEMENTS<br />

15

This page intentionally left blank.<br />

16

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Statement <strong>of</strong> Net Assets<br />

June 30, 2010<br />

ASSETS<br />

Governmental Business-Type<br />

Activities Activities Total<br />

Cash and investments $ 130,461,058 $ 4,133,401 $ 134,594,459<br />

Restricted assets:<br />

Cash 9,959,056 - 9,959,056<br />

Investments with fiscal agents 16,826,527 - 16,826,527<br />

Accounts receivable 6,117,358 1,640,279 7,757,637<br />

Interest receivable 328,090 9,593 337,683<br />

Internal balances 8,316,367 (8,316,367) -<br />

Other receivables 1,791,336 - 1,791,336<br />

Prepaid expenses 814,865 2,581,274 3,396,139<br />

Inventories 23,883 - 23,883<br />

Land held for resale or lease 1,953,330 - 1,953,330<br />

Unamortized bond issue costs 1,407,931 - 1,407,931<br />

Capital assets:<br />

Nondepreciable 142,944,636 - 142,944,636<br />

Depreciable, net 155,114,206 40,406,258 195,520,464<br />

Total Assets 476,058,643 40,454,438 516,513,081<br />

LIABILITIES<br />

Accounts payable and accrued liabilities 4,722,875 979,909 5,702,784<br />

Accrued salaries and benefits 1,579,966 73,440 1,653,406<br />

Interest payable 1,718,465 - 1,718,465<br />

Unearned revenue 2,223,836 - 2,223,836<br />

Due to other agencies 776,000 - 776,000<br />

Deposits payable 399,716 56,632 456,348<br />

Noncurrent liabilities:<br />

Due within one year 8,340,500 64,484 8,404,984<br />

Due in more than one year 167,870,465 193,453 168,063,918<br />

Total Liabilities 187,631,823 1,367,918 188,999,741<br />

NET ASSETS<br />

Invested in capital assets, net <strong>of</strong> related debt 129,318,648 40,406,258 169,724,906<br />

Restricted for:<br />

Street and sewer related purposes 4,423,142 - 4,423,142<br />

Transportation related purposes 1,254,083 - 1,254,083<br />

Assessment districts 105,662 - 105,662<br />

Miscellaneous grants 492,474 - 492,474<br />

Asset replacement 25,275,197 - 25,275,197<br />

Unrestricted 127,557,614 (1,319,738) 126,237,876<br />

Total Net Assets $ 288,426,820 $ 39,086,520 $ 327,513,340<br />

See accompanying Notes to Basic <strong>Financial</strong> Statements.<br />

17

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Statement <strong>of</strong> Activities<br />

For the Year Ended June 30, 2010<br />

Program Revenues<br />

Operating<br />

Capital<br />

Charges for Grants and Grants and<br />

Functions/Programs Expenses Services Contributions Contributions<br />

Governmental Activities:<br />

Legislative and Administration $ 24,023,012 $ 8,990 $ 4,355,058 $<br />

-<br />

Community Development 9,634,162 1,472,210 1,696,862 -<br />

Public Works 17,574,871 924,062 2,943,244 -<br />

Water and Power 503,095 8,200 - -<br />

Community and Safety Services 23,219,777 3,724,638 265,931 367,744<br />

Administrative Services 12,431,539 1,313,723 2,020,775 -<br />

<strong>Cerritos</strong> Center for the Performing Arts 10,795,353 4,620,793 16,000 246,046<br />

Unallocated infrastructure depreciation 1,051,981 - - -<br />

Interest and fiscal charges 16,114,428 - - -<br />

Total Governmental Activities 115,348,218 12,072,616 11,297,870 613,790<br />

Business-Type Activities:<br />

Water 9,690,959 7,032,634 - 109,677<br />

Reclaimed Water 1,351,283 698,021 - -<br />

Electric Utility 6,524,284 4,637,710 - -<br />

Total Business-Type Activities 17,566,526 12,368,365 - 109,677<br />

Total $ 132,914,744 $ 24,440,981 $ 11,297,870 $ 723,467<br />

General Revenues:<br />

Taxes:<br />

Sales taxes<br />

Property taxes<br />

Motor vehicle taxes<br />

Franchise taxes<br />

Transient occupancy taxes<br />

Other taxes<br />

Investment and rental income<br />

Miscellaneous<br />

Total General Revenues<br />

Changes in Net Assets<br />

Net Assets - Beginning <strong>of</strong> Year<br />

Net Assets - End <strong>of</strong> Year<br />

See accompanying Notes to Basic <strong>Financial</strong> Statements.<br />

18

Net (Expense) Revenue and<br />

Changes in Net Assets<br />

Governmental Business-Type<br />

Activities Activities Total<br />

$ (19,658,964) $ - $ (19,658,964)<br />

(6,465,090) - (6,465,090)<br />

(13,707,565) - (13,707,565)<br />

(494,895) - (494,895)<br />

(18,861,464) - (18,861,464)<br />

(9,097,041) - (9,097,041)<br />

(5,912,514) - (5,912,514)<br />

(1,051,981) - (1,051,981)<br />

(16,114,428) - (16,114,428)<br />

(91,363,942) - (91,363,942)<br />

- (2,548,648) (2,548,648)<br />

- (653,262) (653,262)<br />

- (1,886,574) (1,886,574)<br />

- (5,088,484) (5,088,484)<br />

$ (91,363,942) $ (5,088,484) $ (96,452,426)<br />

17,166,138 - 17,166,138<br />

34,842,837 - 34,842,837<br />

4,382,067 - 4,382,067<br />

1,498,545 - 1,498,545<br />

356,119 - 356,119<br />

286,895 - 286,895<br />

20,581,624 97,855 20,679,479<br />

1,132,936 - 1,132,936<br />

80,247,161 97,855 80,345,016<br />

(11,116,781) (4,990,629) (16,107,410)<br />

299,543,601 44,077,149 343,620,750<br />

$ 288,426,820 $ 39,086,520 $ 327,513,340<br />

19

This page intentionally left blank.<br />

20

FUND FINANCIAL STATEMENTS<br />

21

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Balance Sheet<br />

Governmental Funds<br />

June 30, 2010<br />

Redevelopment Redevelopment<br />

Agency Agency Nonmajor Total<br />

Debt Service Capital Projects Governmental Governmental<br />

General Fund Fund Funds Funds<br />

ASSETS<br />

Cash and investments $ 71,311,235 $ 23,269,018 $ 13,952,937 $ 6,426,461 $ 114,959,651<br />

Restricted assets:<br />

Cash 9,959,056 - - - 9,959,056<br />

Investments with fiscal agents - 16,826,527 - - 16,826,527<br />

Receivables:<br />

Accounts 4,736,415 - 189,836 1,191,107 6,117,358<br />

Notes - - 2,395,506 - 2,395,506<br />

Interest 197,273 54,702 25,222 14,915 292,112<br />

Other 1,945 1,781,338 - 8,053 1,791,336<br />

Due from other funds 3,691,630 - - - 3,691,630<br />

Prepaid expenses 814,315 - - 550 814,865<br />

Inventories 23,883 - - - 23,883<br />

Land held for resale or lease - - 1,953,330 - 1,953,330<br />

Advances to other funds 101,784,752 - 11,812,007 - 113,596,759<br />

Total Assets $ 192,520,504 $ 41,931,585 $ 30,328,838 $ 7,641,086 $ 272,422,013<br />

LIABILITIES AND<br />

FUND BALANCES<br />

Liabilities:<br />

Accounts payable and accrued liabilities $ 3,310,931 $ - $ 649,891 $ 717,983 $ 4,678,805<br />

Accrued salaries and benefits 1,527,806 - - 52,160 1,579,966<br />

Deferred revenue 4,222,810 - 2,628,772 565,475 7,417,057<br />

Deposits payable 358,883 - 40,833 - 399,716<br />

Due to other funds - 1,796,734 1,734,145 29,136 3,560,015<br />

Due to other agencies - 776,000 - - 776,000<br />

Advances from other funds - 105,412,007 - - 105,412,007<br />

Total Liabilities 9,420,430 107,984,741 5,053,641 1,364,754 123,823,566<br />

Fund Balances:<br />

Reserved:<br />

General fund 102,622,950 - - - 102,622,950<br />

Land held for resale or lease - - 1,953,330 - 1,953,330<br />

Unreserved, designated for, reported in:<br />

General fund 11,659,056 - - - 11,659,056<br />

Special revenue funds - - - 6,275,361 6,275,361<br />

Capital projects funds - - 23,321,867 971 23,322,838<br />

Unreserved, undesignated 68,818,068 (66,053,156) - - 2,764,912<br />

Total Fund Balances 183,100,074 (66,053,156) 25,275,197 6,276,332 148,598,447<br />

Total Liabilities and<br />

Fund Balances $ 192,520,504 $ 41,931,585 $ 30,328,838 $ 7,641,086 $ 272,422,013<br />

See accompanying Notes to Basic <strong>Financial</strong> Statements.<br />

22

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Reconciliation <strong>of</strong> the Governmental Funds Balance Sheet<br />

to the Government-Wide Statement <strong>of</strong> Net Assets<br />

June 30, 2010<br />

Total Fund Balances - Total Governmental Funds $ 148,598,447<br />

Amounts reported for governmental activities in the statement <strong>of</strong> net assets are different because:<br />

Capital assets used in governmental activities are not financial resources and therefore are not<br />

reported in governmental funds.<br />

Cost $ 405,086,194<br />

Less: Accumulated depreciation (107,027,352)<br />

298,058,842<br />

Revenue earned but not available to pay for current period expenditures for governmental funds<br />

is deferred.<br />

2,797,715<br />

Internal service funds are used by management to charge the costs <strong>of</strong> various city activities to<br />

individual government. The assets and liabilities <strong>of</strong> the internal service funds are included in<br />

the statement <strong>of</strong> net assets.<br />

15,493,315<br />

Long-term liabilities applicable to the <strong>City</strong> governmental activities are not due and payable in<br />

the current period and accordingly are not reported as fund liabilities. All liabilities, both<br />

current and long-term, are reported in the Statement <strong>of</strong> Net Assets:<br />

Tax allocation bonds payable $ (167,152,500)<br />

Note payable (1,025,000)<br />

Compensated absences payable (2,512,435)<br />

Claims payable (1,917,561)<br />

OPEB liabilities (2,015,775)<br />

Unamortized bond premium (4,293,775)<br />

Unamortized deferred charge on refunding <strong>of</strong> bonds 1,843,196<br />

Unamortized bond discount 862,885<br />

Unamortized issuance cost 1,407,931<br />

(174,803,034)<br />

Accrued interest payable for the interest due on long-term liabilities has not been reported in the<br />

governmental funds.<br />

(1,718,465)<br />

Net Assets <strong>of</strong> Governmental Activities $ 288,426,820<br />

See accompanying Notes to Basic <strong>Financial</strong> Statements.<br />

23

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Statement <strong>of</strong> Revenues, Expenditures and Changes in Fund Balances<br />

Governmental Funds<br />

For the Year Ended June 30, 2010<br />

REVENUES:<br />

Redevelopment Redevelopment<br />

Agency Agency Nonmajor Total<br />

Debt Service Capital Projects Governmental Governmental<br />

General Fund Fund Funds Funds<br />

Property, sales, and other taxes $ 20,507,251 $ 32,144,708 $ - $ - $ 52,651,959<br />

Licenses and permits 1,913,968 - - - 1,913,968<br />

Fines and forfeitures 1,103,441 - - - 1,103,441<br />

Investment and rental income 16,468,213 580,417 2,583,324 136,365 19,768,319<br />

Revenues from other agencies 10,976,983 - - 5,637,027 16,614,010<br />

Current fees and services 6,932,698 - - 157,320 7,090,018<br />

Franchises 1,498,545 - - 6,307 1,504,852<br />

Other revenues 1,706,500 - 32,392 109,183 1,848,075<br />

Total Revenues 61,107,599 32,725,125 2,615,716 6,046,202 102,494,642<br />

EXPENDITURES:<br />

Current:<br />

Legislative and Administration 2,707,891 13,656,362 4,982,491 11,140 21,357,884<br />

Community Development 2,864,679 - - 1,793,123 4,657,802<br />

Public Works 10,908,071 - - 5,219,166 16,127,237<br />

Water and Power 73,683 - - 32,140 105,823<br />

Community and Safety Services 21,217,358 - - 134,604 21,351,962<br />

Administrative Services 10,317,186 - - 329,302 10,646,488<br />

<strong>Cerritos</strong> Center for the Performing Arts 8,781,832 - - - 8,781,832<br />

Capital outlay - - 15,753,370 2,780,479 18,533,849<br />

Debt service:<br />

Principal retirement - 7,260,000 - - 7,260,000<br />

Interest - 16,261,275 - - 16,261,275<br />

Total Expenditures 56,870,700 37,177,637 20,735,861 10,299,954 125,084,152<br />

REVENUES OVER<br />

(UNDER) EXPENDITURES 4,236,899 (4,452,512) (18,120,145) (4,253,752) (22,589,510)<br />

OTHER FINANCING SOURCES (USES):<br />

Transfers in 2,000,000 - 18,428,942 5,130,074 25,559,016<br />

Transfers out (4,581,877) (18,428,942) - (2,548,197) (25,559,016)<br />

Total Other Financing Sources (Uses) (2,581,877) (18,428,942) 18,428,942 2,581,877 -<br />

Net Change in Fund Balances 1,655,022 (22,881,454) 308,797 (1,671,875) (22,589,510)<br />

FUND BALANCES:<br />

Beginning <strong>of</strong> Year 181,445,052 (43,171,702) 24,966,400 7,948,207 171,187,957<br />

End <strong>of</strong> Year $ 183,100,074 $ (66,053,156) $ 25,275,197 $ 6,276,332 $ 148,598,447<br />

See accompanying Notes to Basic <strong>Financial</strong> Statements.<br />

24

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Reconciliation <strong>of</strong> the Governmental Funds Statement <strong>of</strong> Revenues, Expenditures and Changes<br />

in Fund Balances to the Government-Wide Statement <strong>of</strong> Activities<br />

For the Year Ended June 30, 2010<br />

Net Change in Fund Balance - Total Governmental Funds: $ (22,589,510)<br />

Amounts reported for governmental activities in the Statement <strong>of</strong> Activities are different because:<br />

Governmental funds report capital outlays as expenditures. However, in the Statement <strong>of</strong> Activities the cost<br />

<strong>of</strong> these assets is allocated over their estimated useful lives and reported as depreciation expense.<br />

Capital outlays $ 18,533,849<br />

Less: Capital outlay related to repair and maintenance (5,180,543)<br />

Disposition <strong>of</strong> capital assets (23,067)<br />

Depreciation expense (6,651,779)<br />

6,678,460<br />

Revenue in the Statement <strong>of</strong> Activities that does not provide current financial resources is not reported as<br />

revenue in governmental funds.<br />

1,736,795<br />

Internal service funds are used by management to charge the costs <strong>of</strong> certain activities, such as equipment<br />

replacement and inventory usage fees to individual funds. The change in net assets <strong>of</strong> internal service funds<br />

is reported within governmental activities.<br />

(400,950)<br />

The issuance <strong>of</strong> long-term liabilities provides current financial resources to governmental funds, while the<br />

repayment <strong>of</strong> the principal <strong>of</strong> long-term liabilities consumes the current financial resources <strong>of</strong> governmental<br />

funds. Neither transaction, however, has any effect on net assets. Also, governmental funds report the effect<br />

<strong>of</strong> issuance costs, premiums, discounts, and similar items when debt is first issued, whereas these amounts<br />

are deferred and amortized in the statement <strong>of</strong> activities. This amount is the net effect <strong>of</strong> these differences in<br />

the treatment <strong>of</strong> long-term liabilities and related items.<br />

Debt issued or incurred:<br />

Principal payments $ 7,260,000<br />

Change in compensated absences payable (15,087)<br />

Change in claim payable (1,917,561)<br />

Change in OPEB liabilities (2,015,775) 3,311,577<br />

Some expenses reported in the Statement <strong>of</strong> Activities do not require the use <strong>of</strong> current financial resources<br />

and therefore are not reported as expenditures in the governmental funds.<br />

Accrued interest 144,135<br />

Amortization <strong>of</strong> bond premium 306,699<br />

Amortization <strong>of</strong> deferred charge on refunding (141,785)<br />

Amortization <strong>of</strong> bond discount (61,635)<br />

Amortization <strong>of</strong> issuance costs (100,567) 146,847<br />

Change in Net Assets <strong>of</strong> Governmental Activities $ (11,116,781)<br />

See accompanying Notes to Basic <strong>Financial</strong> Statements.<br />

25

This page intentionally left blank.<br />

26

PROPRIETARY FUND FINANCIAL STATEMENTS<br />

27

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Statement <strong>of</strong> Net Assets<br />

Proprietary Funds<br />

June 30, 2010<br />

Governmental<br />

Business-Type Activities - Enterprise Funds<br />

Activities -<br />

Water Reclaimed Electric Total Enterprise Internal<br />

Fund Water Utility Funds Service Funds<br />

ASSETS<br />

Current Assets:<br />

Cash and investments $ 4,107,021 $ - $ 26,380 $ 4,133,401 $ 15,501,407<br />

Accounts receivable 1,015,256 143,755 481,268 1,640,279 -<br />

Interest receivable 9,532 - 61 9,593 35,978<br />

Prepaid expenses 38,580 3,930 2,538,764 2,581,274 -<br />

Total Current Assets 5,170,389 147,685 3,046,473 8,364,547 15,537,385<br />

Noncurrent Assets:<br />

Capital assets:<br />

Construction in progress - - - - -<br />

Building and structures 4,947,697 1,315,000 - 6,262,697 -<br />

Water mains and lines 27,788,342 13,068,932 - 40,857,274 -<br />

Equipment 4,023,715 120,278 - 4,143,993 -<br />

Water rights acquired 2,259,378 - - 2,259,378 -<br />

Electric utility rights acquired - - 14,105,000 14,105,000 -<br />

Accumulated depreciation (17,921,130) (6,950,121) (2,350,833) (27,222,084) -<br />

Total Noncurrent Assets 21,098,002 7,554,089 11,754,167 40,406,258 -<br />