ENERFLEX SYSTEMS LTD. ANNUAL INFORMATION FORM For the ...

ENERFLEX SYSTEMS LTD. ANNUAL INFORMATION FORM For the ...

ENERFLEX SYSTEMS LTD. ANNUAL INFORMATION FORM For the ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ENERFLEX</strong> <strong>SYSTEMS</strong> <strong>LTD</strong>. – <strong>ANNUAL</strong> <strong>IN<strong>FORM</strong>ATION</strong> <strong>FORM</strong><br />

<strong>For</strong>eign currency exchange<br />

Enerflex, a Canadian company, is exposed to foreign exchange risk when it buys or sells goods or services in foreign<br />

currencies. As <strong>the</strong>se foreign currencies depreciate against <strong>the</strong> Canadian dollar, it makes <strong>the</strong> Company’s products<br />

exported from Canada more expensive in <strong>the</strong> foreign currency, while reducing <strong>the</strong> relative cost of inputs purchased<br />

in <strong>the</strong> same currency.<br />

The Company manages most of this inherent risk through a variety of contractual means, but currency risk cannot be<br />

eliminated entirely. Enerflex has foreign subsidiaries in Australia, Indonesia, <strong>the</strong> Ne<strong>the</strong>rlands and <strong>the</strong> United States,<br />

and interests in joint ventures in Pakistan and Germany. These expose <strong>the</strong> Company to changes in <strong>the</strong> exchange<br />

rates for <strong>the</strong> currencies of each country in addition to changes in <strong>the</strong> Canadian and U.S. dollar.<br />

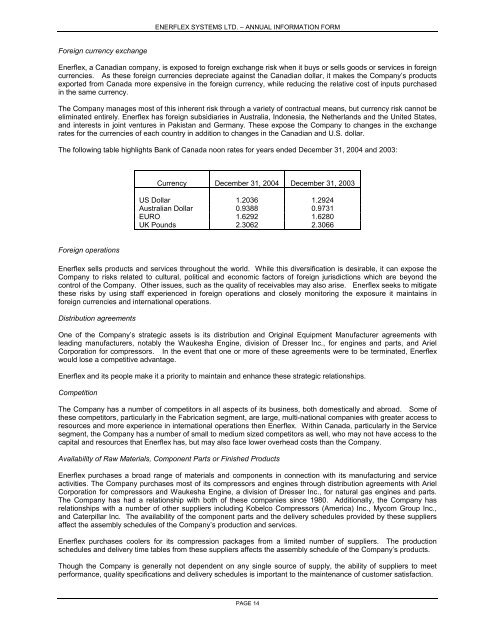

The following table highlights Bank of Canada noon rates for years ended December 31, 2004 and 2003:<br />

Currency December 31, 2004 December 31, 2003<br />

US Dollar 1.2036 1.2924<br />

Australian Dollar 0.9388 0.9731<br />

EURO 1.6292 1.6280<br />

UK Pounds 2.3062 2.3066<br />

<strong>For</strong>eign operations<br />

Enerflex sells products and services throughout <strong>the</strong> world. While this diversification is desirable, it can expose <strong>the</strong><br />

Company to risks related to cultural, political and economic factors of foreign jurisdictions which are beyond <strong>the</strong><br />

control of <strong>the</strong> Company. O<strong>the</strong>r issues, such as <strong>the</strong> quality of receivables may also arise. Enerflex seeks to mitigate<br />

<strong>the</strong>se risks by using staff experienced in foreign operations and closely monitoring <strong>the</strong> exposure it maintains in<br />

foreign currencies and international operations.<br />

Distribution agreements<br />

One of <strong>the</strong> Company’s strategic assets is its distribution and Original Equipment Manufacturer agreements with<br />

leading manufacturers, notably <strong>the</strong> Waukesha Engine, division of Dresser Inc., for engines and parts, and Ariel<br />

Corporation for compressors. In <strong>the</strong> event that one or more of <strong>the</strong>se agreements were to be terminated, Enerflex<br />

would lose a competitive advantage.<br />

Enerflex and its people make it a priority to maintain and enhance <strong>the</strong>se strategic relationships.<br />

Competition<br />

The Company has a number of competitors in all aspects of its business, both domestically and abroad. Some of<br />

<strong>the</strong>se competitors, particularly in <strong>the</strong> Fabrication segment, are large, multi-national companies with greater access to<br />

resources and more experience in international operations <strong>the</strong>n Enerflex. Within Canada, particularly in <strong>the</strong> Service<br />

segment, <strong>the</strong> Company has a number of small to medium sized competitors as well, who may not have access to <strong>the</strong><br />

capital and resources that Enerflex has, but may also face lower overhead costs than <strong>the</strong> Company.<br />

Availability of Raw Materials, Component Parts or Finished Products<br />

Enerflex purchases a broad range of materials and components in connection with its manufacturing and service<br />

activities. The Company purchases most of its compressors and engines through distribution agreements with Ariel<br />

Corporation for compressors and Waukesha Engine, a division of Dresser Inc., for natural gas engines and parts.<br />

The Company has had a relationship with both of <strong>the</strong>se companies since 1980. Additionally, <strong>the</strong> Company has<br />

relationships with a number of o<strong>the</strong>r suppliers including Kobelco Compressors (America) Inc., Mycom Group Inc.,<br />

and Caterpillar Inc. The availability of <strong>the</strong> component parts and <strong>the</strong> delivery schedules provided by <strong>the</strong>se suppliers<br />

affect <strong>the</strong> assembly schedules of <strong>the</strong> Company’s production and services.<br />

Enerflex purchases coolers for its compression packages from a limited number of suppliers. The production<br />

schedules and delivery time tables from <strong>the</strong>se suppliers affects <strong>the</strong> assembly schedule of <strong>the</strong> Company’s products.<br />

Though <strong>the</strong> Company is generally not dependent on any single source of supply, <strong>the</strong> ability of suppliers to meet<br />

performance, quality specifications and delivery schedules is important to <strong>the</strong> maintenance of customer satisfaction.<br />

PAGE 14