Verification of Compliance - Morgan State University

Verification of Compliance - Morgan State University

Verification of Compliance - Morgan State University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

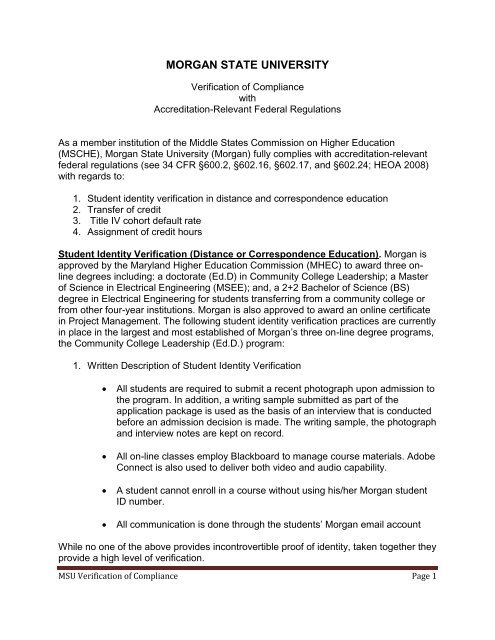

MORGAN STATE UNIVERSITY<br />

<strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong><br />

with<br />

Accreditation-Relevant Federal Regulations<br />

As a member institution <strong>of</strong> the Middle <strong>State</strong>s Commission on Higher Education<br />

(MSCHE), <strong>Morgan</strong> <strong>State</strong> <strong>University</strong> (<strong>Morgan</strong>) fully complies with accreditation-relevant<br />

federal regulations (see 34 CFR §600.2, §602.16, §602.17, and §602.24; HEOA 2008)<br />

with regards to:<br />

1. Student identity verification in distance and correspondence education<br />

2. Transfer <strong>of</strong> credit<br />

3. Title IV cohort default rate<br />

4. Assignment <strong>of</strong> credit hours<br />

Student Identity <strong>Verification</strong> (Distance or Correspondence Education). <strong>Morgan</strong> is<br />

approved by the Maryland Higher Education Commission (MHEC) to award three online<br />

degrees including: a doctorate (Ed.D) in Community College Leadership; a Master<br />

<strong>of</strong> Science in Electrical Engineering (MSEE); and, a 2+2 Bachelor <strong>of</strong> Science (BS)<br />

degree in Electrical Engineering for students transferring from a community college or<br />

from other four-year institutions. <strong>Morgan</strong> is also approved to award an online certificate<br />

in Project Management. The following student identity verification practices are currently<br />

in place in the largest and most established <strong>of</strong> <strong>Morgan</strong>’s three on-line degree programs,<br />

the Community College Leadership (Ed.D.) program:<br />

1. Written Description <strong>of</strong> Student Identity <strong>Verification</strong><br />

<br />

<br />

<br />

<br />

All students are required to submit a recent photograph upon admission to<br />

the program. In addition, a writing sample submitted as part <strong>of</strong> the<br />

application package is used as the basis <strong>of</strong> an interview that is conducted<br />

before an admission decision is made. The writing sample, the photograph<br />

and interview notes are kept on record.<br />

All on-line classes employ Blackboard to manage course materials. Adobe<br />

Connect is also used to deliver both video and audio capability.<br />

A student cannot enroll in a course without using his/her <strong>Morgan</strong> student<br />

ID number.<br />

All communication is done through the students’ <strong>Morgan</strong> email account<br />

While no one <strong>of</strong> the above provides incontrovertible pro<strong>of</strong> <strong>of</strong> identity, taken together they<br />

provide a high level <strong>of</strong> verification.<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 1

2. Written Procedure Regarding the Protection <strong>of</strong> Student Privacy<br />

<strong>Morgan</strong> <strong>State</strong> <strong>University</strong> adheres to the requirements <strong>of</strong> the Family Educational Rights<br />

and Privacy Act (FERPA) with regards to the implementation <strong>of</strong> the preceding methods<br />

<strong>of</strong> student identity verification as well as with the handling <strong>of</strong> students’ educational<br />

records. The FERPA policy and procedures as published in the undergraduate (pages<br />

XXXIX) and graduate catalog (pages 252 -253 1 .<br />

3. Written Procedure Regarding Projected Additional Charges<br />

Currently, there are no projected additional charges associated with the verification <strong>of</strong><br />

identity for students enrolled in online distance education courses. All current charges<br />

for tuition and fees for online courses are the same as for students enrolled in face-t<strong>of</strong>ace<br />

classroom courses. A charge differential for tuition and fees is based on students’<br />

classification as either in-state or out-<strong>of</strong>-state residents. <strong>Morgan</strong>’s Policy for Student<br />

Residency Classification for Admission, Tuition, & Charge-Differential Purposes is<br />

published on the Board <strong>of</strong> Regents’ website 2 and in the 2010 - 2013 online<br />

undergraduate and graduate catalogs.<br />

4. Responsibility for Application <strong>of</strong> Identity <strong>Verification</strong> Procedures<br />

The responsibility for the application <strong>of</strong> student identity verification procedures is shared<br />

by the Director <strong>of</strong> <strong>Morgan</strong> Online (http://www.morgan.edu/online.) and the faculty for the<br />

individual courses. As one <strong>of</strong> the administrative outcomes <strong>of</strong> the <strong>University</strong>’s ten (10)<br />

year strategic plan entitled, “Growing the Future, Leading the World: The Strategic<br />

Plan for <strong>Morgan</strong> <strong>State</strong> <strong>University</strong>, 2011 – 2021 3 ” <strong>Morgan</strong> Online is an administrative<br />

unit within the new Division <strong>of</strong> Academic Outreach and Engagement led by a Vice<br />

President. Advertisement for a fist time full-time Director <strong>of</strong> <strong>Morgan</strong> Online (job # 2013-<br />

025 DIRECTOR, MORGAN ONLINE) has been prepared, a search committee has been<br />

established, and applications are being received 4 . Ultimately, as in the case where<br />

students are enrolled in face-to-face classroom settings, verification <strong>of</strong> the identities <strong>of</strong><br />

students enrolled in the online courses rests with the faculty.<br />

Transfer <strong>of</strong> Credit. As outlined by the Maryland Higher Education Commission<br />

(MHEC), transfer <strong>of</strong> credit from community colleges in Maryland to four-year colleges<br />

and universities in the <strong>State</strong> is governed largely by the terms and provisions in<br />

ARTSYS 5 .<br />

1 http://www.morgan.edu/academics/academic_catalogs.html.<br />

2 Policy R-7 Residency: Procedures for Student Residency Classification for Admission, Tuition, and Charge-<br />

Differential Purposes (reference: Residency Policy) at morgancounsel.org/policies_procedures.html.<br />

3 www.morgan.edu/Documents/ABOUT/StrategicPlan/StrategicPlan2011-21_Final.pdf.<br />

4 www.morgan.edu/<strong>of</strong>fice_<strong>of</strong>_human_resources/employment/administrativestaff_positions.html.<br />

5 mhec.maryland.gov/preparing/stuguide.asp#ARTSYS.<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 2

1. Written Policies and Procedures for Making Decisions<br />

ARTSYS is a computerized data information system which informs students and<br />

advisors at a community college about the transferability <strong>of</strong> each community college<br />

course. It indicates whether the course is transferable and, if so, indicates the four-year<br />

institution's equivalent course number. It also indicates the general education area(s), at<br />

both the sending and receiving institution, applicable to the course. It is a system,<br />

developed and maintained by the <strong>University</strong> System <strong>of</strong> Maryland (USM)<br />

(http://artweb.usmd.edu) and is presently in use at all Maryland public institutions,<br />

including <strong>Morgan</strong>, and many independent colleges and universities. A copy <strong>of</strong><br />

ARTSYS’ published policies and procedures is found at Appendix 1. Additionally, the<br />

<strong>Morgan</strong> <strong>State</strong> <strong>University</strong> Transfer Student Policy is published online in the<br />

Undergraduate Catalog 6 .<br />

2. Public Disclosure <strong>of</strong> the Transfer Policy<br />

In addition to participating in the statewide USM ARTSYS transfer <strong>of</strong> credit programs,<br />

the <strong>Morgan</strong> <strong>State</strong> <strong>University</strong> Transfer Center 7 assists any student with the transfer <strong>of</strong><br />

credit process who has attended a two or four-year school and who applies for<br />

admission to <strong>Morgan</strong>. In general, once admitted to <strong>Morgan</strong>, the Office <strong>of</strong> Admissions<br />

forwards transcripts to the Transfer Center where an initial evaluation <strong>of</strong> the transfer<br />

student’s general education coursework is completed. The application <strong>of</strong> specific<br />

<strong>Morgan</strong> policies related to the transfer <strong>of</strong> credit is explained on the Transfer Center’s<br />

Transfer Students’ FAQ web page 8 .<br />

3. Indication <strong>of</strong> the Office(s) Responsible for Final Determination <strong>of</strong> Transfer Credit<br />

The procedures that indicate the <strong>of</strong>fice(s) responsible for the final determination <strong>of</strong> the<br />

acceptance or denial <strong>of</strong> transfer credit are published on the Transfer Center’s Transfer<br />

Students’ FAQ web page. The procedures are published as follows:<br />

What is the process for evaluating my earned credits?<br />

Once admitted to the <strong>University</strong>, Admissions will forward your transcripts to the<br />

Transfer Center. An initial evaluation <strong>of</strong> your general education coursework will<br />

be completed. At the end <strong>of</strong> this initial evaluation, the remainder <strong>of</strong> your<br />

coursework will appear online as free electives. Your transcripts are then<br />

forwarded to the Transfer Coordinator in the school in which your major is<br />

located. The free electives are then compared against <strong>Morgan</strong> <strong>State</strong> <strong>University</strong><br />

courses. The free electives are amended to show online the awarded <strong>Morgan</strong><br />

courses.<br />

6 http://www.morgan.edu/Documents/ACADEMICS/Academic_Catalog/undergrad/2010-<br />

2013/ucat_AcademicAffairs.pdf.<br />

7 www.morgan.edu/administration/academic_affairs/university_transfer_center.html.<br />

8 www.morgan.edu/administration/academic_affairs/university_transfer_center/transfer_student_faqs.html.<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 3

4. Published List <strong>of</strong> Institutions with which <strong>Morgan</strong> has Articulation Agreements<br />

The Transfer Center manages articulation agreements with as many as fourteen<br />

community colleges throughout Maryland and the region that govern transfer <strong>of</strong> credit<br />

into specific degree programs. A list <strong>of</strong> institutions with which <strong>Morgan</strong> has articulation<br />

agreements is found on the Transfer Center’s web site 9 and is included in Appendix 2.<br />

Title IV Cohort Default Rate. The Cohort Default Rate is the percentage <strong>of</strong> a school’s<br />

borrowers who enter repayment on certain Federal Family Education Loans (FFELs)<br />

and/or William D. Ford Federal Direct Loans (Direct Loans) during that fiscal year and<br />

who default (or fail to meet the other specified condition) within the cohort default<br />

period. Cohort default rates are based on federal fiscal years. Federal fiscal years<br />

begin October 1 st <strong>of</strong> a calendar year and end on September 30 th <strong>of</strong> the following<br />

calendar year.<br />

1. Department <strong>of</strong> Education’s Notice <strong>of</strong> <strong>Morgan</strong>’s Default Rate: 2009<br />

<strong>Morgan</strong>’s <strong>of</strong>ficial cohort default rate for FY 2008 was 9.2, for FY 2009 it was 11, and for<br />

2010 it was 14.2. 10 It is expected that the September 2013 notification from the U.S.<br />

Department <strong>of</strong> Education will provide the <strong>of</strong>ficial cohort default rate for FY 2011.<br />

2. External Audits <strong>of</strong> <strong>Morgan</strong>’s Federal Programs<br />

The external audits <strong>of</strong> federal programs (A-133) are found in the <strong>State</strong> <strong>of</strong> Maryland<br />

Single Audit Together with Reports <strong>of</strong> Independent Public Accountants 11 including<br />

financial aid audit reports and responses for the last three years (i.e., 2010, 2011,<br />

2012). The Financial Aid information is as follows:<br />

For FY 2010, pages 73-78 <strong>of</strong> the report cover <strong>Morgan</strong> <strong>State</strong> <strong>University</strong>.<br />

For FY 2011, pages 100-105 <strong>of</strong> the report cover <strong>Morgan</strong> <strong>State</strong> <strong>University</strong>.<br />

For FY 2012, the entire report covers <strong>Morgan</strong> <strong>State</strong> <strong>University</strong>.<br />

Assignment <strong>of</strong> Credit Hours. <strong>Morgan</strong> <strong>State</strong> <strong>University</strong> complies with federal, <strong>State</strong>,<br />

and its own institutional policies concerning credit hour assignment covering the variety<br />

<strong>of</strong> courses, disciplines, programs, degree levels, formats, and modalities <strong>of</strong> instructions.<br />

1. Written Policies and Procedures<br />

9 www.morgan.edu/administration/academic_affairs/university_transfer_center/articulation_agreements.html<br />

10 http://www.nslds.ed.gov/nslds_SA/defaultmanagement/cohortdetail.cfm?sno=0&ope_id=002083. Appendix 3<br />

11 Appendix 4 contains the <strong>State</strong>’s Single Audit Reports that include <strong>Morgan</strong> <strong>State</strong> <strong>University</strong><br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 4

The Academic Affairs Policy on the Assignment <strong>of</strong> Credit Hours (the Policy) at <strong>Morgan</strong><br />

<strong>State</strong> <strong>University</strong> is consistent with 13B.02.01.12 <strong>of</strong> the Code <strong>of</strong> Maryland Regulations<br />

(COMAR) 12 . In accordance with COMAR, <strong>Morgan</strong>’s Semester Credit Hours Policy<br />

provides<br />

A semester credit is defined as one 50-minute lecture class per week (or its<br />

equivalent) for one semester. A three-hour class may meet for three 50-<br />

minute periods per week, for two 75-minute periods per week, or for one 50-<br />

minute period and one 110-minute period per week, or for a combination <strong>of</strong><br />

these formats for one semester. Laboratory and studio classes normally<br />

require two to four hours in class per week as the equivalent <strong>of</strong> one semester<br />

hour. Internship and practicum courses normally require three or more<br />

contact hours per week as the equivalent <strong>of</strong> one semester hour (Pg. 53<br />

UGC).<br />

2. Evidence <strong>of</strong> Consistent Application <strong>of</strong> Policies and Procedures<br />

All academic programs <strong>of</strong>fered by <strong>Morgan</strong> <strong>State</strong> <strong>University</strong> (as well as all other public<br />

and private colleges and universities in Maryland) must be approved by MHEC which,<br />

among other programmatic aspects, verifies compliance with <strong>State</strong> higher education<br />

regulations and procedures including credit hour requirements. A checklist <strong>of</strong> MHEC<br />

program review fees and requirements is included in Appendix 5. Additionally,<br />

pursuant to <strong>Morgan</strong> <strong>State</strong> <strong>University</strong>’s Periodic Review <strong>of</strong> Programs: Policies and<br />

Procedures, every academic program, graduate as well as undergraduate is subject to<br />

a scheduled review <strong>of</strong> courses and credit <strong>of</strong>fered at the <strong>University</strong>. A copy <strong>of</strong> the<br />

schedule <strong>of</strong> program review is attached at Appendix 6.<br />

3. Description and Evidence <strong>of</strong> Processes for Institutional Review<br />

There are several levels <strong>of</strong> institutional review where academic credit for courses are<br />

assessed. Initially, every proposal for a new course and program is subject to review by<br />

departmental and/or school or college curriculum committee. Graduate courses are<br />

reviewed by a standing committee <strong>of</strong> the Graduate Council, the Curriculum Committee.<br />

If the courses reviewed by departmental, school, or college, including the Graduate<br />

Council’s Curriculum Committee, are part <strong>of</strong> a new degree or certificate program, the<br />

Academic Affairs Council which includes the Deans <strong>of</strong> each school/college and is<br />

chaired by the Vice President for Academic Affairs/Provost provides a second level <strong>of</strong><br />

review <strong>of</strong> courses and academic credit. Once approved by the Academic Affairs<br />

Council, new degree and certificate programs must be approved by the Present and<br />

<strong>Morgan</strong>’s Board <strong>of</strong> Regents prior to submission to the MHEC for assessment <strong>of</strong><br />

compliance with the <strong>State</strong> <strong>of</strong> Maryland’s academic regulations and procedures as<br />

outlined in COMAR. Among the documents outlining <strong>Morgan</strong>’s periodic application <strong>of</strong><br />

its policies and procedures for academic integrity, the assessment <strong>of</strong> student learning,<br />

12 http://www.mhec.state.md.us/highered/COMAR/COMAR_CH_01_Web.pdf. (pg. 23)<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 5

including credit hour assignment, are the Periodic Review <strong>of</strong> Programs: Policies and<br />

Procedures 13 , and the 2008 MSU Comprehensive Assessment Plan (CAP) 14 .<br />

4. Courses that Do Not Conform to the “Credit Hour” Definition<br />

<strong>Morgan</strong>’s 2010 – 2013 Undergraduate Catalog (pg 43 section D) covers Nontraditional<br />

Credit. The policy provides that the assignment <strong>of</strong> credit for AP, CLEP, or other<br />

nationally recognized standardized examination scores as well as technical courses<br />

from career programs, course credit awarded through articulation agreements with other<br />

segments or agencies, credit awarded for clinical practice or cooperative education<br />

experiences, and credit awarded for life and work experiences shall be consistent with<br />

COMAR 13B.02.02 and shall be evaluated by <strong>Morgan</strong> on a course-by-course basis.<br />

<strong>Morgan</strong> <strong>State</strong> <strong>University</strong>’s Carnegie classification is Doctoral Research <strong>University</strong><br />

(DRU) Doc/Pr<strong>of</strong>: Doctoral pr<strong>of</strong>essional Dominant 15 . Consistent with its Carnegie<br />

classification the <strong>University</strong> inventory <strong>of</strong> undergraduate and graduate degree programs<br />

includes a number <strong>of</strong> independent study, clinical, and practicum courses. While the<br />

majority <strong>of</strong> the courses below have fixed credit and contact hour requirements, some<br />

have variable credit depending on the number <strong>of</strong> contact hours a student spends in the<br />

internship, clinic, field, and/or practicum. The course descriptions, contact hours, and<br />

assigned credit are found in the appropriate undergraduate or graduate catalog.<br />

Undergraduate Courses<br />

COMM 490 Internship I<br />

JOUR 491 Internship II<br />

BROA 491 Internship II<br />

BROA 492 Internship III<br />

JOUR 170 Freshman Spokesman Practicum I<br />

JOUR 171 Freshman Spokesman Practicum II<br />

JOUR 180 Freshman Promethean Practicum I<br />

SWAN 499 Independent Projects in Film and Digital Storytelling<br />

HIST 498 Senior Internship<br />

PHIL 498 Senior Internship<br />

POSC 498 Senior Internship<br />

PSYC 496 Senior Internship<br />

BUAD 486 Internship and Field Experience<br />

ENGL 498 Senior Internship<br />

INSS 495 Internship in Information Systems<br />

NURS 302 Practicum in Nursing Process and Health Assessment<br />

NURS 304 Practicum in Nursing Clinical Skills<br />

NURS 306 Clinical in Nursing Care <strong>of</strong> Adults<br />

13 Appendix 7<br />

14 Appendix 8<br />

15 http://classifications.carnegiefoundation.org/lookup_listings/institution.php.<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 6

NURS 402 Clinical in Nursing Care <strong>of</strong> Adults with Complex Health Problems<br />

NURS 406 Clinical in Parent-Child Nursing (Maternity)<br />

NURS 451 Senior Clinical Nursing Practicum<br />

BIOL 498 Senior Internship<br />

PHEC 499 Internship Practicum<br />

RECR 470 Practicum: Field Work Experience<br />

EDUC 480 Phase I Internship<br />

EDUC 489 Phase II Internship<br />

SCED 490 Observation and Student Teaching in the Secondary School<br />

EEGR 498 Independent Project<br />

SOWK 432-433 Field Education and Lab I and Lab II<br />

Graduate Courses<br />

EEGR 790: Independent Study<br />

IEGR 791: Independent Study in Industrial Engineering<br />

TRSP 790: Independent Study in Transportation<br />

ENGL 898: Independent Study I<br />

ENGL 899: Independent Study II<br />

HIST 880-881: Independent Study<br />

MUSE 522: Internship<br />

CREP 714: BES Internship for Planners<br />

LAAR 561: Landscape Architectural Practice<br />

PUBH 517: MPH Internship I<br />

PUBH 518: MPH Internship II<br />

PUBH 551: Doctoral Internship I<br />

PUBH 651: Doctoral Internship II<br />

EDAD 603: Clinical Studies/Internship: Administration and Social Policy<br />

EDAD 605: Clinical Studies/Internship: Educational Planning<br />

SOWK 811: Independent Study<br />

SOWK 503: Foundation Field Practicum I<br />

SOWK 504: Foundation Field Practicum II<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 7

APPENDICES<br />

1. Student Guide to Transfer Among Maryland Colleges and Universities<br />

2. List <strong>of</strong> Institutions with which <strong>Morgan</strong> has Articulation Agreements<br />

3. Table <strong>of</strong> MSU FY 2008, 2009, and 2010 Official Cohort Default Rates<br />

4. <strong>State</strong> <strong>of</strong> Maryland Single Audit Together with Reports <strong>of</strong> Independent Public<br />

Accountants: 2010, 2011, 2012<br />

5. Checklist <strong>of</strong> MHEC Program Review Fees and Requirements<br />

6. MSU Periodic Program Review Schedule<br />

7. Periodic Review <strong>of</strong> Programs: Policies and Procedures<br />

8. 2008 MSU Comprehensive Assessment Plan<br />

MSU <strong>Verification</strong> <strong>of</strong> <strong>Compliance</strong> Page 8

8<br />

Maryland liigher Education Commission <br />

Student Guide to Transfer#ARTSYS <br />

Academic Studies I Advisory Councils I Student Guide to Transfer<br />

Student Guide to Transfer<br />

STUDENT GUIDE TO TRANSFER <br />

AMONG MARYLAND COLLEGES AND UNIVERSITIES <br />

WHY SHOULD YOU READ THIS GUIDE?<br />

Students who enter higher education institutions in Maryland should have every opportunity to continue their learning<br />

throughout their lives. Some students will begin their college careers at a community college and transfer to a four-year<br />

college or university. Others will transfer between four-year institutions or from one community college to another. The<br />

purpose <strong>of</strong> this guide is to provide students with information to make the process <strong>of</strong> transferring from one college or<br />

university to another--not only from a community college to a four-year college, but from any college to any other in<br />

Maryland--an easier one. By following the advice in this guide, you can minimize (and hopefully avoid altogether) any<br />

loss <strong>of</strong> credit during transfer.<br />

The guide contains information on:<br />

Principles <strong>of</strong> Student Transfer in Marvland <br />

Steps to a Successful Transfer <br />

Elements <strong>of</strong> a College Degree <br />

Marv/and's General Education Program <br />

Transfer Programs and Career Programs <br />

ARTSYS: An Electronic Tool for Transfer Students <br />

Student Rights and Responsibilities <br />

What a Transfer Coordinator Can Do For You <br />

Contacting Your Transfer Coordinator <br />

Commonlv Asked Questions <br />

A Glossary <strong>of</strong> Terms Relating to Articulation and Transfer <br />

If, after reading this guide, you still have questions, you will find the phone numbers <strong>of</strong> knowledgeable transfer <br />

counselors in the section called Contacting Your Transfer Coordinator. Please call them. They are there to help you. <br />

PRINCIPLES OF STUDENT TRANSFER IN MARYLAND<br />

In Maryland, a student may be able to progress from one segment <strong>of</strong> the public higher education system to another<br />

without loss <strong>of</strong> time or duplication <strong>of</strong> courses. To help accomplish this, Maryland's public colleges and universities follow<br />

certain statewide policies. Several <strong>of</strong> the key policies are:<br />

• Maryland community college students who have completed the associate degree or students who have completed 56<br />

semester hours <strong>of</strong> credit with a cumulative grade point average (GPA) <strong>of</strong> 2.0 or higher on a scale <strong>of</strong> 4.0 shall not be denied<br />

direct transfer to a Maryland public four-year institution.<br />

• Courses taken at a Maryland community college as part <strong>of</strong> a recommended transfer program will ordinarily be applicable to<br />

related programs at a Maryland public institution granting the baccalaureate degree.<br />

• The General Education Program a student takes at one public college or university will transfer without further review to<br />

another public institution without the need for a course-to-course match. That is, courses that are designated as general<br />

education by a sending institution will transfer as general education even if the receiving institution does not <strong>of</strong>fer that<br />

specific course or has not designated that course as general education.<br />

• Courses designated as meeting the general education requirements at any Maryland public college shall be applicable to<br />

the general education requirements at any other Maryland public college or university.<br />

• Credit earned in or transferred from an associate degree-granting institution shall be limited to approximately one-half the<br />

baccalaureate degree program requirement, not to exceed 70 credits, and to the first two years <strong>of</strong> the undergraduate<br />

educational experience.<br />

STEPS TO A SUCCESSFUL TRANSFER<br />

http:/ .gov/preparing/stuguide.asp 1/2312013

Seek advice on transfer from your academic advisor or campus transfer coordinator during your first semester or as soon<br />

as possible after earning 15 credits. (See "What A Transfer Coordinator Can Do For You!" )<br />

2. Choose as early as possible the institution to which you wish to transfer and your intended major program.<br />

3. Make use <strong>of</strong> ARTSYS, a computerized method <strong>of</strong> determining the transferability <strong>of</strong> your courses to your intended transfer<br />

institution. Check out the transferability <strong>of</strong> your courses before registration, not after. (See "ARTSYS, An Electronic Tool for<br />

Transfer Students" )<br />

4. Map out your course work in accord with the recommended transfer program you and your advisor find in ARTSYS or in<br />

other resources.<br />

5. Become familiar with Maryland's regulations on General Education and Transfer. These are printed in all college catalogs<br />

andlor student handbooks.<br />

6. Determine transfer application and admissions procedures and deadlines <strong>of</strong> your intended transfer institution. Each<br />

institution sets its own deadlines for application, admissions, housing, financial aid and scholarships. So, the sooner you<br />

apply, the greater your options will be.<br />

7. Be aware that courses and program requirements may change as colleges attempt to keep their programs current.<br />

Therefore, be sure to consult frequently with your advisor and transfer coordinator due to potential changes in courses and<br />

program requirements.<br />

ELEMENTS OF A COLLEGE DEGREE<br />

A college degree -- whether a two-year associate degree or a four-year bachelor's degree -- has three basic<br />

components: general education, major program requirements and electives. The distribution <strong>of</strong> courses among these<br />

three components varies from college to college, from major to major and from institution to institution.<br />

The Maryland general education program, as implemented by public colleges and universities, is designed to introduce<br />

undergraduates to the fundamental knowledge, skills and value'S that are essential to the study <strong>of</strong> academic disciplines,<br />

to encourage the pursuit <strong>of</strong> life-long learning and to foster the development <strong>of</strong> educated members <strong>of</strong> the community and<br />

the world.<br />

For students in public colleges and universities, the general education requirements are as presented in the following<br />

table. Independent colleges and universities each set their own general education requirements, and these can best be<br />

determined by consulting both the independent institution's catalog and academic advisers.<br />

NOTE: Students should be aware that they are responsible for the loss <strong>of</strong> credits due to changes in the individual's<br />

selection <strong>of</strong> the major program <strong>of</strong> study, the need for remedial course work or exceeding the limit <strong>of</strong> credits accepted in<br />

transfer as allowed by the Maryland Higher Education Commission. Students shall be held responsible for meeting all<br />

requirements <strong>of</strong> the academic program at the degree-granting institution. Please see an academic advisor for the course<br />

lists for each category and for specific general education information at your institution. The complete text <strong>of</strong> the<br />

regulations concerning general education appears in the catalog <strong>of</strong> each public college and university,<br />

Maryland's General Education Program<br />

Associate <strong>of</strong> Associate <strong>of</strong> Bachelor <strong>of</strong><br />

Applied Arts/ Arts I<br />

Distribution Areas<br />

Science Science Science<br />

degree degree degree<br />

(in credits) (in credits) (in credits)<br />

i! I II I<br />

I English Composition I! 3 minimum !I 3 minimum Ii 3 minimum I<br />

I Mathematics at or above the level <strong>of</strong> college algebra I 3 minimum \ i 3 minimum Ii 3 minimum \<br />

Arts & Humanities - one course from each <strong>of</strong> two<br />

disciplines, may include speech, foreign language or<br />

composition & literature courses<br />

6 minimum<br />

13 mioimum 1! i 6mioimum I<br />

I I II \I I<br />

http://mhec.maryland. stuguide.asp 1123/ 0-:'

Social & Behavioral Sciences one course from each <strong>of</strong> two <br />

disciplines 13 minimum 116 minimum<br />

iI<br />

E]<br />

Biological & Physical Sciences - two courses, including one<br />

i laboratory<br />

I<br />

I<br />

Interdisciplinary & Emerging Issues not required, will be<br />

transferred as part <strong>of</strong> General Education Program <br />

. 3 minimum<br />

Optional<br />

\ 6 minimum<br />

Optional<br />

(8 maximum) (8 maximum)<br />

Additional credits - may be assigned by each institution <br />

from English, Mathematics, Arts & Humanities, Social & <br />

Behavioral Sciences and Biological & Physical Sciences to 5-21 credits 0-12 credits<br />

complete the number <strong>of</strong> credits required for the General<br />

Education Program.<br />

I<br />

TOTAL CREDITS REQUIRED FOR GENERAL<br />

EDUCATION PROGRAM<br />

Ii<br />

II<br />

20-36 credits<br />

i<br />

30-36 credits<br />

116 minimum I<br />

116 minimum I<br />

I,<br />

Optional<br />

(8 maximum)<br />

8-22 credits<br />

I <br />

I <br />

40-46 credits<br />

\ ! \<br />

!!<br />

REMAINING GENERAL EDUCATION REQUIREMENTS<br />

FOR BACHELOR'S DEGREE AFTER COMPLETION OF<br />

ASSOCIATE'S DEGREE<br />

10-26 credits<br />

maximum<br />

10-16 credits<br />

maximum<br />

Not<br />

Applicable<br />

EXCEPTION: Since st. Mary's College <strong>of</strong> Maryland <strong>of</strong>fers a curriculum based on four-credit courses, the total credits<br />

required for general education at St. Mary's College will be 48 credits. Remaining general education requirements for<br />

the Bachelor's Degree after completion <strong>of</strong> the Associate <strong>of</strong> Applied Science Degree will be 10-28 credits maximum and<br />

after completion <strong>of</strong> the Associate <strong>of</strong> Arts/Science Degree will be 10-18 credits maximum.<br />

TRANSFER PROGRAMS AND CAREER PROGRAMS<br />

Maryland community colleges grant three associate-level degrees: the Associate <strong>of</strong> Arts (AA), the Associate <strong>of</strong> Science<br />

(AS) and the Associate <strong>of</strong> Applied Science (AAS).<br />

Transfer or Pre-baccalaureate degree programs (AA, AS) are aimed at meeting the needs <strong>of</strong> students who intend to<br />

earn a bachelor's degree from a four-year college or university. These programs are specifically designed so that all<br />

course work will transfer to a four-year institution. In fact. optional course <strong>of</strong>ferings are available to students taking<br />

transfer programs which can be tailored to the specific major fields students plan to pursue in their junior and senior<br />

years (and can also be tailored to the requirements <strong>of</strong> specific four-year colleges and universities). Students should<br />

consult ARTSYS as well as academic advisors or transfer counselors at both the sending and receiving institutions for<br />

current transfer information.<br />

Career degree programs (AAS) are designed for students intending to seek employment upon graduation from a<br />

community college. Many programs designated as AAS degrees are in fields which also <strong>of</strong>fer a baccalaureate degree.<br />

Some <strong>of</strong> these courses may transfer; students should consult ARTSYS as well as academic advisors at both the<br />

sending and receiving institutions for information. Other career programs include specific occupational courses not<br />

normally <strong>of</strong>fered by four-year institutions. These courses generally are not accepted as transfer credit by four-year<br />

institutions. However, all general education courses designated as such on the transcript will be accepted by receiving<br />

public four-year colleges and universities.<br />

ARTSYS<br />

http://mhec.ma 1st .asp 11 3/201

An Electronic Tool for Transfer Students<br />

ARTSYS is a computerized data information system which informs students and advisors at a community college about<br />

the transferability <strong>of</strong> each community college course. It indicates whether the course is transferable and, if so, indicates<br />

the four-year institution's equivalent course number. It also indicates the general education area(s), at both the sending<br />

and receiving institution, applicable to the course.<br />

It is a system, developed and maintained by the <strong>University</strong> <strong>of</strong> System <strong>of</strong> Maryland (USM), which is available both as a<br />

PC-based version on campuses and on the World Wide Web at http://artweb.usmd.edu.The system is presently in use<br />

at all Maryland public institutions and many independent colleges and universities.<br />

In addition to providing information on course transferability. the program provides, in community college course<br />

numbers, the recommended courses for transfer to specific programs <strong>of</strong> study at the participating four-year institutions.<br />

The ARTSYS program permits the student to enter his or her transcript into ARTSYS to determine the transferability <strong>of</strong><br />

courses he or she plans to take. ARTSYS also allows the analysis <strong>of</strong> the courses taken against a recommended transfer<br />

program. This may be done for a single program at a single institution or for multiple programs at several institutions.<br />

The ARTSYS program computes a transfer grade point average, a grade point average for a particular program, as well<br />

as an overall grade point average.<br />

For additional information, contact the transfer coordinator on your campus.<br />

STUDENT RIGHTS AND RESPONSIBILITIES<br />

A student is held accountable for the loss <strong>of</strong> credits that result from changes in the student's major program <strong>of</strong> study.<br />

were earned for remedial course work or exceed the total course credits allowable in transfer from a community college<br />

to a baccalaureate institution (e,g., one-half <strong>of</strong> the credits required for graduation at the receiving institution--generally<br />

60 credits for the bachelor's degree and in no case more than 70 credits).<br />

A student has the right to question any denial <strong>of</strong> transfer credit by a public college or university. The steps to appeal a<br />

denial <strong>of</strong> credit will be printed in the college's catalog and/or student handbook,<br />

There are time limits set on each step <strong>of</strong> the appeals process to protect the student by ensuring that an appeal is dealt<br />

with quickly. The steps in the process are summarized below. To receive a full description <strong>of</strong> the appeal process, see<br />

your college catalog, student handbook or the transfer coordinator on your campus,<br />

Steps in the Process<br />

1. The receiving institution notifies the student <strong>of</strong><br />

denial <strong>of</strong> transfer credit.<br />

Time limit<br />

Under normal conditions, notification must be made<br />

no later than mid-semester <strong>of</strong> the first semester <strong>of</strong><br />

enrollment<br />

2. Appeal to the receiving institution by the student. 20 working days (4 weeks)<br />

3. Response by the receiving institution. 10 working days (2 weeks)<br />

4. If transfer credit is still denied. the student may ask<br />

his/her sending institution to intervene on the student's<br />

behalf.<br />

5, The sending institution and the receiving institution<br />

consult. The sending institution informs the student <strong>of</strong><br />

the result.<br />

10 working days (2 weeks)<br />

15 working days (3 weeks)<br />

WHAT A TRANSFER COORDINATOR CAN DO FOR yOU<br />

Each Maryland public institution <strong>of</strong> higher education has a designated Transfer Coordinator. The Transfer Coordinator<br />

://mhec. .gov/prepa .asp 1/23/201.3

8<br />

interprets transfer policies for students, faculty and administrators.<br />

The Transfer Coordinator:<br />

• clarifies information for transfer students at either the sending or the receiving campus regarding course or<br />

program transfer.<br />

• works with transfer counselors and academic advisors to assist students in selecting courses which are<br />

transferable.<br />

• assists a transfer student who wishes to appeal a decision regarding the evaluation <strong>of</strong> transfer credit. Policies<br />

and procedures for appeals for students enrolled in public colleges and universities are stated in the Maryland<br />

Higher Education Commission's regulations concerning general education and transfer.<br />

You may contact the Transfer Coordinator at your college or on the campus to which you wish to transfer by calling the<br />

appropriate telephone number listed below.<br />

CONTACTING YOUR TRANSFER COORDINATOR<br />

Allegany (301) 724-7700<br />

www.allegany.edu<br />

Community Colleges<br />

Anne Arundel (410) 541-2634<br />

www.aacc.edu<br />

Baltimore City (410) 333-5905<br />

www.bccc.edu<br />

Carroll (410) 386-8435<br />

www.carrollcc.edu<br />

Cecil (410) 287-1000<br />

www.cecil.edu<br />

College <strong>of</strong> Southern MD (410) 870-3008<br />

www.csmd.edu<br />

Chesapeake (410) 822-5400<br />

www.chesapeake.edu<br />

CCBC Catonsville (410) 455-4728<br />

www.ccbcmd.edu<br />

CCBC Dundalk (410) 285-9815<br />

www.ccbcmd.edu<br />

CCBC Essex (410) 780-6457<br />

www.ccbcmd.edu<br />

Frederick (301) 846-2475<br />

www.frederick,edu<br />

Garrett (301) 387-3011<br />

www.garrettcolleqe.edu<br />

Hagerstown (301) 790-2800<br />

www.haqerstowncc.edu<br />

Harford (410) 836-4301<br />

www.harford,edu<br />

Participating 4-Year Institutions<br />

Bowie (301 ) 464-6089<br />

www.bowiestate.edu<br />

Coppin (410) 383-5990<br />

www.coppin.edu<br />

Frostburg (301) 687-4201<br />

www.frostburg.edu<br />

Salisbury (410) 543--6161<br />

www.salisburv.edu<br />

Towson (410) 830--2114<br />

www.towson.edu<br />

Univ. <strong>of</strong> Baltimore (410) 837-4806<br />

www.ubalt.edu<br />

Univ. <strong>of</strong> Maryland, Baltimore (410) 706--3171<br />

www.umaryland.edu<br />

UMBC (410) 455-3799<br />

www.umbc.edu<br />

Univ. <strong>of</strong> Maryland College Park (301) 314-8758<br />

www.umd.edu<br />

Univ, <strong>of</strong> Maryland Eastern Shore (410) 651-6411<br />

www.umes.edu<br />

UMUC (301) 985-7930<br />

www,umuc,edu<br />

<strong>Morgan</strong> <strong>State</strong> <strong>University</strong> (443) 885-3585<br />

www.morqan.edu<br />

St. Mary's College (301) 862-0336<br />

www.smcm,edu<br />

*College <strong>of</strong> Notre Dame <strong>of</strong> MD (410) 532-5330<br />

www.ndm.edu<br />

http://mhec.maryland.gov/preparing/ .asp 1/23/201

Howard (410) 992-4856<br />

www.howardcc.edu <br />

Montgomery Coil. Germantown (240) 567-7734<br />

VIWW· montgomerycollege .edu<br />

Montgomery College Rockville (240) 567-5063<br />

www.montgomervcollege.edu<br />

Montgomery Coil. Takoma Park (240) 567-1614<br />

www.montgomervcollege.edu<br />

Prince George's (301) 322-0834<br />

www.pgcc.edu<br />

'Hood College (301) 696-3500 <br />

www.hood.edu<br />

*Johns Hopkins <strong>University</strong> (410) 516-7186 <br />

www.jhu.edu <br />

*Stevenson <strong>University</strong> (410) 486--7001 <br />

www.stevenson.edu <br />

*Washington College (410) 778-7700 <br />

www.washcoll.edu <br />

*McDaniel College (800) 638--5005 <br />

www.mcdaniel.edu <br />

Wor-Wic (410) 334-2800 <br />

www.worwic.edu <br />

* Indicates an independent (not a public) institution.<br />

NOTE: For information regarding higher education institutions not listed, contact the Maryland Higher Education <br />

Commission for a Student Guide To Higher Education in Maryland. <br />

COMMONLY ASKED QUESTIONS<br />

Q: How do I get a transcript sent from one college or university to another?<br />

A: Make a written request to the Records/Registrar's <strong>of</strong>fice on your campus. There may be a fee required. All USM <br />

institutions, most community colleges and many other Maryland institutions have the ability to send and receive <br />

electronic transcripts from one another. <br />

Q: How can I know if the courses I am considering will transfer to the four-year campus I want to attend?<br />

A: ARTSYS indicates the transferability <strong>of</strong> courses from each community college to each participating four-year college.<br />

/( ARTSYS is available at your institution, consult your transfer coordinator about its use. If ARTSYS is not available at<br />

your institution, consult your academic advisor, transfer counselor or the transfer counselor at the four-year institution<br />

regarding the transferability <strong>of</strong> courses, or access ARTSYS on the Web at http://artweb.usmd.edu.<br />

Q: What courses should I take to major in my chosen field?<br />

A: Before registering for courses, you should consult your academic advisor or transfer counselor and/or ARTSYS to <br />

determine the transferability <strong>of</strong> courses you wish to take. The advisor may be able to provide a recommended transfer <br />

program for your major. <br />

Q: How do I access ARTSYS?<br />

A: Generally. ARTSYS is available both on pes at your institution as well as on the World \!Vide Web.<br />

Q: May I earn the associate degree at a community college while taking courses needed for transfer for a recommended<br />

transfer program at a specific four-year college?<br />

A: Yes. with adequate pre-planning in consultation with your academic advisor.<br />

Q: Is it better to get the associate degree or to transfer early?<br />

A: In general, it is preferable to have a completed degree program on your academic record and on your resume.<br />

Q: How many credits will transfer?<br />

http://mhec.<br />

Istuguide.asp<br />

1/23/2013

A: Transfer credits from a community college normally are limited to half the baccalaureate degree program <br />

requirement, not to exceed 70 credits. <br />

Q: How many requirements for graduation at my chosen four-year college willi have met when I receive my associate's<br />

degree?<br />

A: In order to answer this question, you must consult an academic advisor or transfer coordinator at the four-year <br />

college? <br />

Q: How long will it take to complete a degree after I transfer?<br />

A: This will depend on your personal circumstances. For example, will you be a part-time or full-time student? If you <br />

change majors, it could well take longer than if you do not change. <br />

Q: What class standing will I have?<br />

A: This will be based on the credits accepted in transfer. Consult the receiving col/ege's catalog for specific definitions <strong>of</strong><br />

class standing,<br />

Q: Will the college to which I am transferring do an evaluation <strong>of</strong> my transfer credit before I enroll at that college?<br />

A: Many institutions provide an un<strong>of</strong>ficial evaluation <strong>of</strong> transfer credits prior to enrollment. Your advisor, using ARTSYS,<br />

should be able to provide a clear indication <strong>of</strong> the transfer credits you will receive.<br />

Q: Will I get an advisor at the college to which I am transferring?<br />

A: Yes, An advisor will be assigned to you after you have enrolled,<br />

Q: Will grades <strong>of</strong> "0" be accepted in transfer?<br />

A: "D" grades will be accepted in transfer if the college to which you are applying also accepts a "D" for native students.<br />

A "D" grade earned in a general education course that meets a general education requirement at a sending institution,<br />

which has deSignated that course as meeting a general education requirement, will transfer and meet a general<br />

education requirement at the receiving institution.<br />

Q: Which institutions have the major I want?<br />

A: Consult ARTSYS and your academic advisor or transfer counselor, or access individual campus home pages or the<br />

Maryland Higher Education Commission web site at http://www.mhec.state.md.us. Under the "Colleges and<br />

Universities" section, the "list <strong>of</strong> higher education institutions" links to each available campus home page (see the<br />

"Contacting Your Transfer Counselor" section for campus web site addresses). The "academic programs" link lists<br />

campuses and approved programs <strong>of</strong>fered by institution; programs can also be found under "Publications",<br />

GLOSSARY<br />

Credit hour - One semester hour <strong>of</strong> credit is awarded for a minimum <strong>of</strong> 15 hours (50 minutes each) <strong>of</strong> actual class time;<br />

for 30 hours <strong>of</strong> laboratory time; or for 45 hours <strong>of</strong> instructional situations such as a practicum, internships and<br />

cooperative education placements. (For example, a 3-credit lecture course meets for 45 hours - usually three times per<br />

week for 15 weeks.)<br />

Native student - A student whose initial college enrollment was at a given institution <strong>of</strong> higher education and who has<br />

not transferred to another institution since that initial enrollment.<br />

Receiving institution - The institution <strong>of</strong> higher education at which a transfer student currently desires to enroll or has<br />

enrolled.<br />

Recommended transfer program - A planned program <strong>of</strong> courses, including both general education and courses in the<br />

major, taken at a community college which is applicable to a baccalaureate program at a receiving institution; ordinarily<br />

http://mhec.maryland. /stuguide.asp 1/23/2013

8<br />

the first two years <strong>of</strong> a baccalaureate degree.<br />

Sending institution The institution <strong>of</strong> higher education <strong>of</strong> most recent previous enrollment by a transfer student at<br />

which transferable academic credit was earned.<br />

Transfer student - A student entering an institution for the first time with academic credit earned at another institution<br />

which is applicable for credit at the institution the student is entering.<br />

IMPORTANT NUMBERS AND ADDRESSES <br />

Maryland Higher Education Commission <br />

6 N. Liberty Street, 10th Floor, Baltimore, MD 21201 <br />

410-767-3301 <br />

800-974-0203 <br />

Visitors who are hard <strong>of</strong> hearing, deaf or speech-disabled and who use a TTY or text telephone can contact MHEC via <br />

Maryland Relay (Dial 7-1-1 or 800-735-2258). <br />

http://www.mhec.state.md.us <br />

http://rnhec.rnary1and.gov/preparing/stuguide.asp 1/23/2013

MORGAN STATE UNIVERSITY<br />

Current Articulation Agreements*<br />

Anne Arundel Community College<br />

Architectural and Interior Design<br />

Baltimore City Community College<br />

Actuarial Science<br />

Business<br />

Medical Technology<br />

Nursing (RTP - Recommended Transfer Plan)<br />

Psychology<br />

Social Work<br />

Sociology and Anthropology<br />

Carroll Community College<br />

Social Work<br />

Cecil Community College<br />

Electrical Engineering<br />

Community College <strong>of</strong> Baltimore County<br />

Biology<br />

Computer Science<br />

English (Creative Writing)<br />

Nursing (RTP - Recommended Transfer Plan)<br />

Social Work<br />

College <strong>of</strong> Southern Maryland<br />

Computer Science<br />

Engineering<br />

1

Frederick Community College<br />

Architecture<br />

Harford Community College<br />

Business<br />

Electrical Engineering<br />

Harrisburg Area Community College, Pennsylvania<br />

Architecture<br />

Highline Community College, Des Moines, WA<br />

General Education all Majors<br />

Howard Community College<br />

Hospitality Management<br />

Lansing Community College, Michigan<br />

<strong>State</strong>ment <strong>of</strong> Cooperation<br />

Monroe Community College, New York<br />

2+2 Degree Audit Sheets 2012-2013<br />

BU49 B.S. Business Administration<br />

CI33 B.S. Computer Information Systems<br />

CM39 B.S. Communication Studies<br />

CS38 B.S. Computer Science<br />

EN38 B.S. Engineering Science<br />

FA32 B.A. Fine Arts<br />

HS33 B.S. Health Administration<br />

LH30 B.A./B.S. Liberal Arts & Sciences - Humanities and Social Sciences<br />

LS30 B.A./B.S. Liberal Arts & Sciences - Science<br />

2

Montgomery College<br />

Architectural Design<br />

Social Work<br />

Teacher Education Program<br />

Westchester Community College, New York<br />

English & Language Arts<br />

*Published at:<br />

www.morgan.edu/administration/academic_affairs/university_transfer_center/articulation_agreements.html.<br />

3

STATE OF MARYLAND<br />

Single Audit<br />

Together with<br />

Reports <strong>of</strong> Independent Public Accountants<br />

Year Ended June 30, 2010

TABLE OF CONTENTS<br />

Report <strong>of</strong> Independent Public Accountants 1<br />

Report <strong>of</strong> Independent Public Accountants on Internal Control Over Financial<br />

Reporting and on <strong>Compliance</strong> and Other Matters Based on an Audit <strong>of</strong> the<br />

Financial <strong>State</strong>ments in Accordance with Government Auditing Standards 6<br />

Report <strong>of</strong> Independent Public Accountants on <strong>Compliance</strong> with Requirements<br />

that Could Have a Direct and Material Effect on Each Major Program and<br />

on Internal Control over <strong>Compliance</strong> in Accordance with OMB Circular A-133 10<br />

Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal Awards 15<br />

Notes to the Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal Awards 33<br />

Schedule <strong>of</strong> Findings and Questioned Costs<br />

Section I – Summary <strong>of</strong> Independent Public Accountant’s Results 42<br />

Section II – Financial <strong>State</strong>ment Findings 44<br />

Section III – Federal Award Findings and Questioned Costs 46<br />

Section IV – Summary Schedule <strong>of</strong> Prior Year Audit Findings 88<br />

Page

The Honorable Peter Franchot<br />

Comptroller <strong>of</strong> Maryland<br />

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS<br />

We have audited the financial statements <strong>of</strong> the governmental activities, the business-type activities, the<br />

aggregate discretely presented component units, each major fund, and the aggregate remaining fund<br />

information <strong>of</strong> the <strong>State</strong> <strong>of</strong> Maryland (the <strong>State</strong>), as <strong>of</strong> and for the year ended June 30, 2010, which<br />

collectively comprise the <strong>State</strong>’s basic financial statements as listed in the table <strong>of</strong> contents. These<br />

financial statements, schedules and supplementary information are the responsibility <strong>of</strong> the <strong>State</strong>’s<br />

management. Our responsibility is to express an opinion on these financial statements based on our audit.<br />

We did not audit the financial statements <strong>of</strong> (1) certain Economic Development Loan Programs; (2) the<br />

Maryland <strong>State</strong> Lottery Agency; (3) the Maryland Transportation Authority; (4) the Economic<br />

Development Insurance Programs; (5) certain foundations included in the higher education component<br />

units; (6) the Maryland Food Center Authority; (7) the Maryland Technology Development Corporation;<br />

and (8) the Investment Trust Fund, which represent the percentages <strong>of</strong> the total assets, total net assets, and<br />

total operating revenues or additions included in the financial statements.<br />

Total<br />

Assets<br />

Percentage <strong>of</strong> Opinion Unit<br />

Total Net<br />

Assets<br />

Total<br />

Operating<br />

Revenues<br />

Business-Type Activities<br />

Major -<br />

Certain Economic Development Loan Programs 30.7 % 8.7 % 4.3 %<br />

Maryland <strong>State</strong> Lottery Agency 2.1 0.4 49.3<br />

Maryland Transportation Authority 46.0 48.1 15.0<br />

Non-Major -<br />

Economic Development Insurance Programs 0.9 1.7 0.1<br />

Total percentage <strong>of</strong> business-type activities 79.7 % 58.9 % 68.7 %<br />

Component Units<br />

Major -<br />

Certain foundations included in the higher education 12.8 % 15.5 % 13.5 %<br />

component units<br />

Non-Major -<br />

Maryland Food Center Authority 0.3 0.4 0.4<br />

Maryland Technology Development Corporation 0.3 0.1 1.7<br />

Total percentage <strong>of</strong> component units 13.4 % 16.0 % 15.6 %<br />

Fiduciary Funds<br />

Investment Trust Fund 5.8 % 6.9 % 75.4 %<br />

200 International Circle • Suite 5500 • Hunt Valley • Maryland 21030 • P 410-584-0060 • F 410-584-0061

Those financial statements were audited by other auditors whose reports thereon have been furnished to<br />

us, and our opinion, ins<strong>of</strong>ar as it relates to the amounts included for the above-mentioned funds and<br />

component units, is based on the reports <strong>of</strong> the other auditors.<br />

We conducted our audit in accordance with auditing standards generally accepted in the United <strong>State</strong>s <strong>of</strong><br />

America and the standards applicable to financial audits contained in Government Auditing Standards,<br />

issued by the Comptroller General <strong>of</strong> the United <strong>State</strong>s. Those standards require that we plan and perform<br />

the audit to obtain reasonable assurance about whether the financial statements are free <strong>of</strong> material<br />

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and<br />

disclosures in the financial statements. An audit also includes assessing the accounting principles used<br />

and significant estimates made by management, as well as evaluating the overall financial statement<br />

presentation. We believe that our audit and the reports <strong>of</strong> the other auditors provide a reasonable basis for<br />

our opinion.<br />

In our opinion, based on our audit and the reports <strong>of</strong> the other auditors, the financial statements referred to<br />

above present fairly, in all material respects, the respective financial position <strong>of</strong> the governmental<br />

activities, the business-type activities, the aggregate discretely presented component units, each major<br />

fund, and the aggregate remaining fund information <strong>of</strong> the <strong>State</strong>, as <strong>of</strong> June 30, 2010, and the respective<br />

changes in financial position and cash flows, where applicable, there<strong>of</strong> for the year then ended in<br />

conformity with accounting principles generally accepted in the United <strong>State</strong>s <strong>of</strong> America.<br />

In accordance with Government Auditing Standards, we have also issued our report dated December 10,<br />

2010, on our consideration <strong>of</strong> the <strong>State</strong>’s internal control over financial reporting and our tests <strong>of</strong> its<br />

compliance with certain provisions <strong>of</strong> laws, regulations, contracts, and grant agreements and other<br />

matters. The purpose <strong>of</strong> that report is to describe the scope <strong>of</strong> our testing <strong>of</strong> internal control over financial<br />

reporting and compliance and the results <strong>of</strong> that testing and not to provide an opinion on the internal<br />

control over financial reporting or on compliance. That report is an integral part <strong>of</strong> an audit performed in<br />

accordance with Government Auditing Standards and should be considered in assessing the results <strong>of</strong> our<br />

audit.<br />

The accompanying Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal awards is presented for purposes <strong>of</strong> additional<br />

analysis as required by the United <strong>State</strong>s Office <strong>of</strong> Management and Budget (OMB) Circular A-133,<br />

Audits <strong>of</strong> <strong>State</strong>s, Local Governments, and Non-Pr<strong>of</strong>it Organizations, and is not a required part <strong>of</strong> the basic<br />

financial statements. The Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal awards is prepared on the basis <strong>of</strong><br />

accounting described in Note 2 to the Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal awards and excludes the<br />

expenditures associated with the Federal financial assistance programs for the Maryland Water Quality<br />

Financing Administration, an administration <strong>of</strong> the Maryland Department <strong>of</strong> the Environment; the<br />

Maryland Transportation Authority, an enterprise fund <strong>of</strong> the <strong>State</strong>; the Maryland Technology<br />

Development Corporation, a component unit <strong>of</strong> the <strong>State</strong>, and the Maryland Health Insurance program,<br />

part <strong>of</strong> the general fund <strong>of</strong> the <strong>State</strong>, that had separate OMB Circular A-133 audits. The information in<br />

the Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal awards has been subject to the auditing procedures applied in the<br />

audit <strong>of</strong> the basic financial statements and, in our opinion, based on our audit, is fairly stated, in all<br />

material respects, in relation to the basic financial statements taken as a whole.<br />

The management’s discussion and analysis; required supplemental schedules <strong>of</strong> funding progress and<br />

employer contributions for the Maryland Pension and Retirement System, the Maryland Transit<br />

Administration Pension Plan, and Other Post-employment Benefits Plan; and the respective budgetary<br />

2

comparison for the budgetary general, special and Federal funds as listed in the table <strong>of</strong> contents are not a<br />

required part <strong>of</strong> the basic financial statements but are supplementary information required by the<br />

accounting principles generally accepted in the United <strong>State</strong>s <strong>of</strong> America. We and the other auditors have<br />

applied certain limited procedures, which consisted principally <strong>of</strong> inquiries <strong>of</strong> management regarding the<br />

methods <strong>of</strong> measurement and presentation <strong>of</strong> the required supplementary information. However, we did<br />

not audit the information and express no opinion on it.<br />

Our audit was conducted for the purpose <strong>of</strong> forming an opinion on the financial statements that<br />

collectively comprise the <strong>State</strong>’s basic financial statements. The combining financial statements,<br />

schedules, introductory and statistical sections, and financial schedules required by law, as listed in the<br />

table <strong>of</strong> contents, are presented for purposes <strong>of</strong> additional analysis and are not a required part <strong>of</strong> the basic<br />

financial statements. The combining financial statements and schedules have been subjected to the<br />

auditing procedures applied by us and the other auditors in the audit <strong>of</strong> the basic financial statements and,<br />

in our opinion, based on our audit and the reports <strong>of</strong> the other auditors, are fairly stated in all material<br />

respects in relation to the basic financial statements taken as a whole. The introductory and statistical<br />

sections <strong>of</strong> this report and the financial schedules required by law have not been subjected to the auditing<br />

procedures applied by us or the other auditors in the audit <strong>of</strong> the basic financial statements and,<br />

accordingly, we express no opinion on them.<br />

Hunt Valley, Maryland<br />

December 10, 2010<br />

3

THIS PAGE INTENTIONALLY LEFT BLANK

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS ON INTERNAL<br />

CONTROL OVER FINANCIAL REPORTING AND ON COMPLIANCE AND<br />

OTHER MATTERS BASED ON AN AUDIT OF THE FINANCIAL STATEMENTS<br />

IN ACCORDANCE WITH GOVERNMENT AUDITING STANDARDS

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS ON INTERNAL<br />

CONTROL OVER FINANCIAL REPORTING AND ON COMPLIANCE AND<br />

OTHER MATTERS BASED ON AN AUDIT OF THE FINANCIAL STATEMENTS<br />

IN ACCORDANCE WITH GOVERNMENT AUDITING STANDARDS<br />

The Honorable Peter Franchot<br />

Comptroller <strong>of</strong> Maryland<br />

We have audited the basic financial statements <strong>of</strong> the <strong>State</strong> <strong>of</strong> Maryland (the <strong>State</strong>), as <strong>of</strong> and for the year<br />

ended June 30, 2010, and have issued our report thereon dated December 10, 2010. We conducted our<br />

audit in accordance with auditing standards generally accepted in the United <strong>State</strong>s <strong>of</strong> America and the<br />

standards applicable to financial audits contained in Government Auditing Standards, issued by the<br />

Comptroller General <strong>of</strong> the United <strong>State</strong>s. Our report on the basic financial statements included<br />

disclosures regarding our references to the reports <strong>of</strong> other auditors.<br />

Internal Control over Financial Reporting<br />

In planning and performing our audit, we considered the <strong>State</strong>’s internal control over financial reporting<br />

as a basis for designing our auditing procedures for the purpose <strong>of</strong> expressing our opinion on the financial<br />

statements, but not for the purpose <strong>of</strong> expressing an opinion on the effectiveness <strong>of</strong> the <strong>State</strong>’s internal<br />

control over financial reporting. Accordingly, we do not express an opinion on the effectiveness <strong>of</strong> the<br />

<strong>State</strong>’s internal control over financial reporting.<br />

A deficiency in internal control exists when the design or operation <strong>of</strong> a control does not allow<br />

management or employees, in the normal course <strong>of</strong> performing their assigned functions, to prevent, or<br />

detect and correct misstatements on a timely basis. A material weakness is a deficiency, or combination<br />

<strong>of</strong> deficiencies, in internal controls, such that there is a reasonable possibility that a material misstatement<br />

<strong>of</strong> the financial statements will not be prevented, or detected and corrected on a timely basis.<br />

Our consideration <strong>of</strong> the internal control over financial reporting was for the limited purpose described in<br />

the first paragraph <strong>of</strong> this section and was not designed to identify all deficiencies in internal control over<br />

financial reporting that might be deficiencies, or material weaknesses. We and the other auditors did not<br />

identify any deficiencies in internal control over financial reporting that we consider to be material<br />

weaknesses, as defined above.<br />

200 International Circle • Suite 5500 • Hunt Valley • Maryland 21030 • P 410-584-0060 • F 410-584-0061

<strong>Compliance</strong> and Other Matters<br />

As part <strong>of</strong> obtaining reasonable assurance about whether the <strong>State</strong>’s financial statements are free <strong>of</strong><br />

material misstatement, we performed tests <strong>of</strong> its compliance with certain provisions <strong>of</strong> laws, regulations,<br />

contracts, and grant agreements, noncompliance with which could have a direct and material effect on the<br />

determination <strong>of</strong> financial statement amounts. However, providing an opinion on compliance with those<br />

provisions was not an objective <strong>of</strong> our audit, and accordingly, we do not express such an opinion. The<br />

results <strong>of</strong> our tests and those <strong>of</strong> other auditors disclosed no instances <strong>of</strong> noncompliance or other matters<br />

that are required to be reported under Government Auditing Standards.<br />

We noted other matters involving the internal control over financial reporting, which we have reported to<br />

the management <strong>of</strong> the <strong>University</strong> System <strong>of</strong> Maryland, and Baltimore City Community College in<br />

separate letters dated November 2, 2010, and November 10, 2010, respectively.<br />

This report is intended solely for the information and use <strong>of</strong> the <strong>State</strong>’s management, the U.S. Department<br />

<strong>of</strong> Health and Human Services (cognizant agency), Federal awarding agencies, and pass-through entities<br />

and is not intended to be and should not be used by anyone other than these specified parties.<br />

Hunt Valley, Maryland<br />

December 10, 2010<br />

7

THIS PAGE INTENTIONALLY LEFT BLANK

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS ON COMPLIANCE<br />

WITH REQUIREMENTS THAT COULD HAVE A DIRECT AND<br />

MATERIAL EFFECT ON EACH MAJOR PROGRAM AND ON<br />

INTERNAL CONTROL OVER COMPLIANCE IN ACCORDANCE<br />

WITH OMB CIRCULAR A-133

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS REPORT ON<br />

COMPLIANCE WITH REQUIREMENTS THAT COULD HAVE A DIRECT<br />

AND MATERIAL EFFECT ON EACH MAJOR PROGRAM AND ON INTERNAL<br />

CONTROL OVER COMPLIANCE IN ACCORDANCE WITH OMB CIRCULAR A-133<br />

The Honorable Peter Franchot<br />

Comptroller <strong>of</strong> Maryland<br />

<strong>Compliance</strong><br />

We have audited the <strong>State</strong> <strong>of</strong> Maryland’s (the <strong>State</strong>) compliance with the types <strong>of</strong> compliance<br />

requirements described in the OMB Circular A-133 <strong>Compliance</strong> Supplement that could have a direct and<br />

material effect on each <strong>of</strong> its major Federal programs for the year ended June 30, 2010. The <strong>State</strong>’s major<br />

Federal programs are identified in the Summary <strong>of</strong> Independent Public Accountant’s Results section <strong>of</strong><br />

the accompanying Schedule <strong>of</strong> Findings and Questioned Costs. <strong>Compliance</strong> with the requirements <strong>of</strong><br />

laws, regulations, contracts, and grants applicable to each <strong>of</strong> its major Federal programs is the<br />

responsibility <strong>of</strong> the <strong>State</strong>’s management. Our responsibility is to express an opinion on the <strong>State</strong>’s<br />

compliance based on our audit.<br />

The <strong>State</strong>’s basic financial statements include the operations <strong>of</strong> the Maryland Water Quality Financing<br />

Administration, an administration <strong>of</strong> the Maryland Department <strong>of</strong> the Environment; the Maryland<br />

Transportation Authority, an enterprise fund <strong>of</strong> the <strong>State</strong>; the Maryland Technology Development<br />

Corporation, a component unit <strong>of</strong> the <strong>State</strong>; and the Maryland Health Insurance Program, part <strong>of</strong> the<br />

general fund <strong>of</strong> the <strong>State</strong>, which received Federal awards that are not included in the accompanying<br />

Schedule <strong>of</strong> Expenditures <strong>of</strong> Federal Awards. Our audit, described below, did not include the operations<br />

<strong>of</strong> these entities because the <strong>State</strong> engaged other auditors to perform a separate audit in accordance with<br />

OMB Circular A-133.<br />

We conducted our audit <strong>of</strong> compliance in accordance with auditing standards generally accepted in the<br />

United <strong>State</strong>s <strong>of</strong> America; the standards applicable to financial audits contained in Government Auditing<br />

Standards, issued by the Comptroller General <strong>of</strong> the United <strong>State</strong>s; and OMB Circular A-133, Audits <strong>of</strong><br />

<strong>State</strong>s, Local Governments, and Non-Pr<strong>of</strong>it Organizations. Those standards and OMB Circular A-133<br />

require that we plan and perform the audit to obtain reasonable assurance about whether noncompliance<br />

with the types <strong>of</strong> compliance requirements referred to above that could have a direct and material effect<br />

on a major Federal program occurred. An audit includes examining, on a test basis, evidence about the<br />

<strong>State</strong>’s compliance with those requirements and performing such other procedures, as we considered<br />

necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.<br />

Our audit does not provide a legal determination on the <strong>State</strong>’s compliance with those requirements.<br />

200 International Circle • Suite 5500 • Hunt Valley • Maryland 21030 • P 410-584-0060 • F 410-584-0061

In our opinion, the <strong>State</strong> complied, in all material respects, with the compliance requirements referred to<br />

above that could have a direct and material effect on each <strong>of</strong> its major Federal programs for the year<br />

ended June 30, 2010. However, the results <strong>of</strong> our audit procedures disclosed other instances <strong>of</strong><br />

noncompliance with those requirements, which are required to be reported in accordance with OMB<br />

Circular A-133 and which are described in the accompanying Schedule <strong>of</strong> Findings and Questioned Costs<br />

as items 2010-1, 2010-2, 2010-3, 2010-4, 2010-5, 2010-6, 2010-8, 2010-9, 2010-10, 2010-11, 2010-12,<br />

2010-13, 2010-14, 2010-15, 2010-16, 2010-17 and 2010-18.<br />

Internal Control over <strong>Compliance</strong><br />

Management <strong>of</strong> the <strong>State</strong> is responsible for establishing and maintaining effective internal control over<br />

compliance with the requirements <strong>of</strong> laws, regulations, contracts, and grants applicable to Federal<br />

programs. In planning and performing our audit, we considered the <strong>State</strong>’s internal control over<br />

compliance with the requirements that could have a direct and material effect on a major Federal program<br />

to determine the auditing procedures for the purpose <strong>of</strong> expressing our opinion on compliance and to test<br />