Texprocil News1 - Handloom Export Promotion Council

Texprocil News1 - Handloom Export Promotion Council

Texprocil News1 - Handloom Export Promotion Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

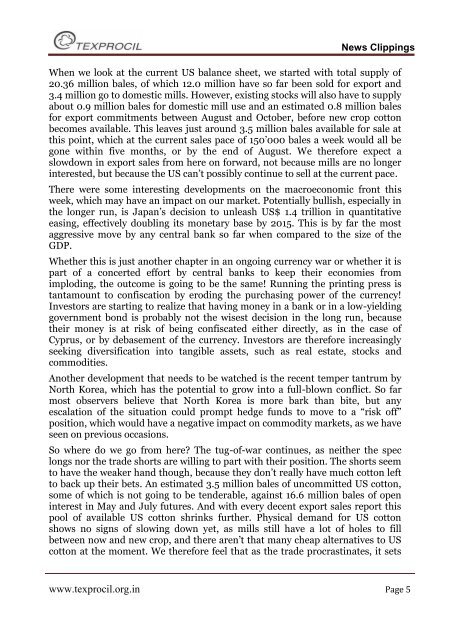

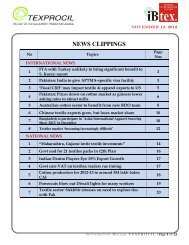

News Clippings<br />

When we look at the current US balance sheet, we started with total supply of<br />

20.36 million bales, of which 12.0 million have so far been sold for export and<br />

3.4 million go to domestic mills. However, existing stocks will also have to supply<br />

about 0.9 million bales for domestic mill use and an estimated 0.8 million bales<br />

for export commitments between August and October, before new crop cotton<br />

becomes available. This leaves just around 3.5 million bales available for sale at<br />

this point, which at the current sales pace of 150’000 bales a week would all be<br />

gone within five months, or by the end of August. We therefore expect a<br />

slowdown in export sales from here on forward, not because mills are no longer<br />

interested, but because the US can’t possibly continue to sell at the current pace.<br />

There were some interesting developments on the macroeconomic front this<br />

week, which may have an impact on our market. Potentially bullish, especially in<br />

the longer run, is Japan’s decision to unleash US$ 1.4 trillion in quantitative<br />

easing, effectively doubling its monetary base by 2015. This is by far the most<br />

aggressive move by any central bank so far when compared to the size of the<br />

GDP.<br />

Whether this is just another chapter in an ongoing currency war or whether it is<br />

part of a concerted effort by central banks to keep their economies from<br />

imploding, the outcome is going to be the same! Running the printing press is<br />

tantamount to confiscation by eroding the purchasing power of the currency!<br />

Investors are starting to realize that having money in a bank or in a low-yielding<br />

government bond is probably not the wisest decision in the long run, because<br />

their money is at risk of being confiscated either directly, as in the case of<br />

Cyprus, or by debasement of the currency. Investors are therefore increasingly<br />

seeking diversification into tangible assets, such as real estate, stocks and<br />

commodities.<br />

Another development that needs to be watched is the recent temper tantrum by<br />

North Korea, which has the potential to grow into a full-blown conflict. So far<br />

most observers believe that North Korea is more bark than bite, but any<br />

escalation of the situation could prompt hedge funds to move to a “risk off”<br />

position, which would have a negative impact on commodity markets, as we have<br />

seen on previous occasions.<br />

So where do we go from here? The tug-of-war continues, as neither the spec<br />

longs nor the trade shorts are willing to part with their position. The shorts seem<br />

to have the weaker hand though, because they don’t really have much cotton left<br />

to back up their bets. An estimated 3.5 million bales of uncommitted US cotton,<br />

some of which is not going to be tenderable, against 16.6 million bales of open<br />

interest in May and July futures. And with every decent export sales report this<br />

pool of available US cotton shrinks further. Physical demand for US cotton<br />

shows no signs of slowing down yet, as mills still have a lot of holes to fill<br />

between now and new crop, and there aren’t that many cheap alternatives to US<br />

cotton at the moment. We therefore feel that as the trade procrastinates, it sets<br />

www.texprocil.org.in Page 5