ANNUAL REPORT 2012 - Wawasan TKH Holdings Berhad

ANNUAL REPORT 2012 - Wawasan TKH Holdings Berhad

ANNUAL REPORT 2012 - Wawasan TKH Holdings Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

090<br />

WAWASAN <strong>TKH</strong> HOLDINGS BERHAD (540218-A)<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2012</strong><br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER <strong>2012</strong> (cont’d)<br />

27. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (cont’d)<br />

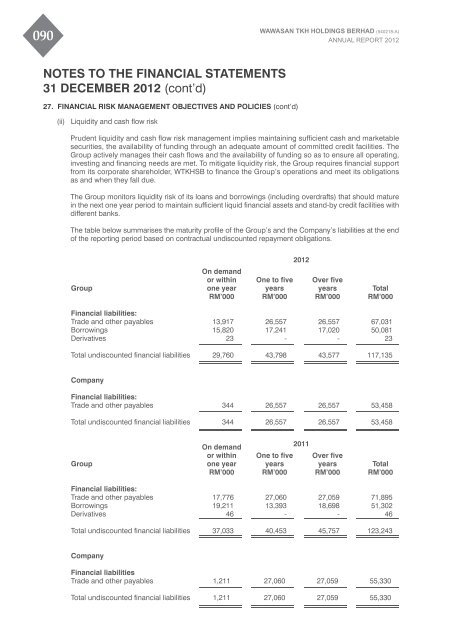

(ii) Liquidity and cash flow risk<br />

Prudent liquidity and cash flow risk management implies maintaining sufficient cash and marketable<br />

securities, the availability of funding through an adequate amount of committed credit facilities. The<br />

Group actively manages their cash flows and the availability of funding so as to ensure all operating,<br />

investing and financing needs are met. To mitigate liquidity risk, the Group requires financial support<br />

from its corporate shareholder, W<strong>TKH</strong>SB to finance the Group’s operations and meet its obligations<br />

as and when they fall due.<br />

The Group monitors liquidity risk of its loans and borrowings (including overdrafts) that should mature<br />

in the next one year period to maintain sufficient liquid financial assets and stand-by credit facilities with<br />

different banks.<br />

The table below summarises the maturity profile of the Group’s and the Company’s liabilities at the end<br />

of the reporting period based on contractual undiscounted repayment obligations.<br />

<strong>2012</strong><br />

Group<br />

On demand<br />

or within<br />

one year<br />

RM’000<br />

One to five<br />

years<br />

RM’000<br />

Over five<br />

years<br />

RM’000<br />

Total<br />

RM’000<br />

Financial liabilities:<br />

Trade and other payables<br />

Borrowings<br />

Derivatives<br />

13,917<br />

15,820<br />

23<br />

26,557<br />

17,241<br />

-<br />

26,557<br />

17,020<br />

-<br />

67,031<br />

50,081<br />

23<br />

Total undiscounted financial liabilities<br />

29,760<br />

43,798<br />

43,577<br />

117,135<br />

Company<br />

Financial liabilities:<br />

Trade and other payables<br />

344<br />

26,557<br />

26,557<br />

53,458<br />

Total undiscounted financial liabilities<br />

344<br />

26,557<br />

26,557<br />

53,458<br />

Group<br />

On demand<br />

or within<br />

one year<br />

RM’000<br />

2011<br />

One to five<br />

years<br />

RM’000<br />

Over five<br />

years<br />

RM’000<br />

Total<br />

RM’000<br />

Financial liabilities:<br />

Trade and other payables<br />

Borrowings<br />

Derivatives<br />

17,776<br />

19,211<br />

46<br />

27,060<br />

13,393<br />

-<br />

27,059<br />

18,698<br />

-<br />

71,895<br />

51,302<br />

46<br />

Total undiscounted financial liabilities<br />

37,033<br />

40,453<br />

45,757<br />

123,243<br />

Company<br />

Financial liabilities<br />

Trade and other payables<br />

1,211<br />

27,060<br />

27,059<br />

55,330<br />

Total undiscounted financial liabilities<br />

1,211<br />

27,060<br />

27,059<br />

55,330