ANNUAL REPORT 2012 - Wawasan TKH Holdings Berhad

ANNUAL REPORT 2012 - Wawasan TKH Holdings Berhad

ANNUAL REPORT 2012 - Wawasan TKH Holdings Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

094<br />

WAWASAN <strong>TKH</strong> HOLDINGS BERHAD (540218-A)<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2012</strong><br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER <strong>2012</strong> (cont’d)<br />

27. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (cont’d)<br />

(iv) Foreign currency risk<br />

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will<br />

fluctuate because of changes in foreign exchange rates.<br />

The Group is exposed to foreign exchange risk on sales and purchases that are denominated in<br />

currencies other than Ringgit Malaysia. The currencies giving rise to this risk are primarily US Dollar<br />

(‘USD’), Euro, Australian Dollar (‘AUD’) and Singapore Dollar (‘SGD’).<br />

Derivative financing instruments are used to reduce exposure to fluctuations in foreign exchange rates.<br />

The Group reviews, monitors and controls the hedging of transactions. USD and SGD bank accounts<br />

are being set up to facilitate natural hedging against any fluctuation in USD and SGD.<br />

The Group is also exposed to foreign currency risk in respect of the foreign subsidiary. The Group does<br />

not hedge this exposure with foreign currency borrowings.<br />

During the financial year, the Group entered into foreign currency forward contracts to manage exposures<br />

to currency risk for receivables, which are denominated in a currency other than the functional currencies<br />

of the Group.<br />

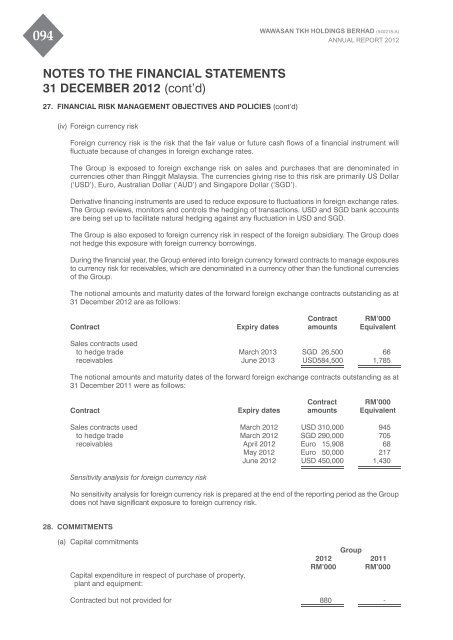

The notional amounts and maturity dates of the forward foreign exchange contracts outstanding as at<br />

31 December <strong>2012</strong> are as follows:<br />

Contract<br />

Sales contracts used<br />

to hedge trade<br />

receivables<br />

The notional amounts and maturity dates of the forward foreign exchange contracts outstanding as at<br />

31 December 2011 were as follows:<br />

Contract<br />

Sales contracts used<br />

to hedge trade<br />

receivables<br />

Sensitivity analysis for foreign currency risk<br />

No sensitivity analysis for foreign currency risk is prepared at the end of the reporting period as the Group<br />

does not have significant exposure to foreign currency risk.<br />

28. COMMITMENTS<br />

(a) Capital commitments<br />

Capital expenditure in respect of purchase of property,<br />

plant and equipment:<br />

Contracted but not provided for