Notes to the income statement - comdirect bank AG

Notes to the income statement - comdirect bank AG

Notes to the income statement - comdirect bank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

130<br />

|<br />

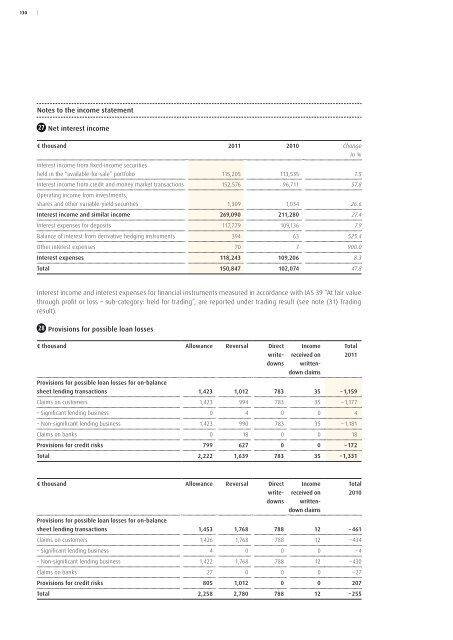

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>income</strong> <strong>statement</strong><br />

27 Net interest <strong>income</strong><br />

€ thousand 2011 2010 Change<br />

in %<br />

Interest <strong>income</strong> from fixed-<strong>income</strong> securities<br />

held in <strong>the</strong> “available-for-sale” portfolio 115,205 113,535 1.5<br />

Interest <strong>income</strong> from credit and money market transactions 152,576 96,711 57.8<br />

Operating <strong>income</strong> from investments,<br />

shares and o<strong>the</strong>r variable-yield securities 1,309 1,034 26.6<br />

Interest <strong>income</strong> and similar <strong>income</strong> 269,090 211,280 27.4<br />

Interest expenses for deposits 117,779 109,136 7.9<br />

Balance of interest from derivative hedging instruments 394 63 525.4<br />

O<strong>the</strong>r interest expenses 70 7 900.0<br />

Interest expenses 118,243 109,206 8.3<br />

Total 150,847 102,074 47.8<br />

Interest <strong>income</strong> and interest expenses for financial instruments measured in accordance with IAS 39 “At fair value<br />

through profit or loss – sub-category: held for trading”, are reported under trading result (see note (31) Trading<br />

result).<br />

28 Provisions for possible loan losses<br />

€ thousand Allowance Reversal Direct<br />

writedowns<br />

Provisions for possible loan losses for on-balance<br />

Income<br />

received on<br />

writtendown<br />

claims<br />

sheet lending transactions 1,423 1,012 783 35 – 1,159<br />

Claims on cus<strong>to</strong>mers 1,423 994 783 35 – 1,177<br />

– Significant lending business 0 4 0 0 4<br />

– Non-significant lending business 1,423 990 783 35 – 1,181<br />

Claims on <strong>bank</strong>s 0 18 0 0 18<br />

Provisions for credit risks 799 627 0 0 – 172<br />

Total 2,222 1,639 783 35 – 1,331<br />

Total<br />

2011<br />

€ thousand Allowance Reversal Direct<br />

writedowns<br />

Provisions for possible loan losses for on-balance<br />

Income<br />

received on<br />

writtendown<br />

claims<br />

sheet lending transactions 1,453 1,768 788 12 – 461<br />

Claims on cus<strong>to</strong>mers 1,426 1,768 788 12 – 434<br />

– Significant lending business 4 0 0 0 – 4<br />

– Non-significant lending business 1,422 1,768 788 12 – 430<br />

Claims on <strong>bank</strong>s 27 0 0 0 – 27<br />

Provisions for credit risks 805 1,012 0 0 207<br />

Total 2,258 2,780 788 12 – 255<br />

Total<br />

2010

| FOREWORD | THE BOARD OF MAN<strong>AG</strong>ING DIRECTORS | CORPORATE GOVERNANCE | GROUP MAN<strong>AG</strong>EMENT REPORT | CONSOLIDATED FINANCIAL STATEMENTS | 131<br />

29 Net commission <strong>income</strong><br />

€ thousand 2011 2010 Change<br />

in %<br />

Securities transactions 165,975 158,104 5.0<br />

Payment transactions 9,600 7,957 20.6<br />

O<strong>the</strong>r commission 7,010 6,711 4.5<br />

Total 182,585 172,772 5.7<br />

30 Result from hedge accounting<br />

The results shown from underlying and hedging instruments only include measurement effects from effective fair<br />

value hedges.<br />

€ thousand 2011 2010 Change<br />

in %<br />

Results from hedging instruments – 2,493 100 – 2,593.0<br />

Results from hedged assets 2,542 – 122 – 2,183.6<br />

Total 49 – 22 – 322.7<br />

<strong>comdirect</strong> <strong>bank</strong> reports <strong>the</strong>se in line with <strong>the</strong> hedge accounting regulations under IAS 39. Individual bonds<br />

(hedged items) in <strong>the</strong> balance sheet line item “financial investments” are hedged against fluctuations in fair<br />

value due <strong>to</strong> changes in market rates using interest rate swaps (hedging instruments).<br />

31 Trading result<br />

€ thousand 2011 2010 Change<br />

in %<br />

Result from interest rate related transactions – 1,128 0 –<br />

Trading result – 1,128 0 –<br />

All financial instruments in <strong>the</strong> trading portfolio are measured at fair value. The trading result includes all interest<br />

<strong>income</strong>, interest expenses and measurement results for financial instruments measured in accordance with IAS<br />

39 in <strong>the</strong> category “At fair value through profit or loss – sub-category: held for trading”.

132<br />

|<br />

32 Result from financial investments<br />

The disposal results and gains and losses from impairments and recoveries in <strong>the</strong> “available-for-sale” securities<br />

portfolio and holdings in subsidiaries which have not been consolidated are shown in <strong>the</strong> result from financial<br />

investments.<br />

€ thousand 2011 2010 Change<br />

in %<br />

Disposal gains 3,415 14,453 – 76.4<br />

Disposal losses – 6,518 – 4,120 58.2<br />

Impairment – 2,886 – 414 597.1<br />

Total – 5,989 9,919 – 160.4<br />

Of impairments, €1,702 thousand (2010: €0) relates <strong>to</strong> bonds and o<strong>the</strong>r fixed-<strong>income</strong> securities and €1,184 thousand<br />

(2010: €414 thousand) <strong>to</strong> shares and o<strong>the</strong>r non-fixed <strong>income</strong> securities.<br />

33 Administrative expenses<br />

The <strong>comdirect</strong> group’s administrative expenses consist of personnel expenses, o<strong>the</strong>r administrative expenses and<br />

depreciation of office furniture and equipment as well as on intangible assets.<br />

Personnel expenses<br />

€ thousand 2011 2010 Change<br />

in %<br />

Wages and salaries 56,674 52,266 8.4<br />

Compulsory social security contributions 9,115 8,816 3.4<br />

Expenses for pensions and o<strong>the</strong>r employee benefits 1,676 1,481 13.2<br />

Total 67,465 62,563 7.8<br />

The item “wages and salaries” includes share-based payments (IFRS 2) <strong>to</strong>talling €2,013 thousand (2010: €1,521<br />

thousand).<br />

Breakdown of expenses for pensions and o<strong>the</strong>r employee benefits<br />

€ thousand 2011 2010 Change<br />

in %<br />

Company pension scheme 1,406 1,409 – 0.2<br />

Expenses for early retirement 248 52 376.9<br />

Contributions <strong>to</strong> Versicherungsverein<br />

des Bankgewerbes a.G. (BVV) 22 20 10.0<br />

Total 1,676 1,481 13.2

| FOREWORD | THE BOARD OF MAN<strong>AG</strong>ING DIRECTORS | CORPORATE GOVERNANCE | GROUP MAN<strong>AG</strong>EMENT REPORT | CONSOLIDATED FINANCIAL STATEMENTS | 133<br />

O<strong>the</strong>r administrative expenses<br />

€ thousand 2011 2010 Change<br />

in %<br />

Marketing expenses 57,208 53,021 7.9<br />

Communication expenses 6,450 4,353 48.2<br />

Consulting expenses 10,832 7,334 47.7<br />

Expenses for external services 36,467 30,258 20.5<br />

Sundry administrative expenses 36,920 38,438 – 3.9<br />

Total 147,877 133,404 10.8<br />

Sundry administrative expenses includes rental and lease payments for business premises as well as contributions<br />

<strong>to</strong> <strong>the</strong> Deposit Protection Fund of €13,607 thousand.<br />

Depreciation of office furniture and equipment and intangible assets<br />

€ thousand 2011 2010 Change<br />

in %<br />

Office furniture and equipment 4,050 4,669 – 13.3<br />

Intangible assets 12,682 9,392 35.0<br />

Total 16,732 14,061 19.0<br />

The depreciation on intangible assets includes an unexpected depreciation of €2,076 thousand.<br />

34 O<strong>the</strong>r operating result<br />

€ thousand 2011 2010 Change<br />

in %<br />

O<strong>the</strong>r operating <strong>income</strong> 20,910 14,217 47.1<br />

Interest from tax refunds 9,232 0 –<br />

Income from writing-back of provisions and accruals 4,079 4,619 – 11.7<br />

Income from service level agreements 3,060 5,345 – 42.8<br />

Project grants 1,267 1,899 – 33.3<br />

Insurance payments 660 0 –<br />

Income from o<strong>the</strong>r accounting period 892 830 7.5<br />

Income from recoverable input taxes 581 195 197.9<br />

Sundry <strong>income</strong> items 1,139 1,329 – 14.3<br />

O<strong>the</strong>r operating expenses 5,793 7,803 – 25.8<br />

Goodwill payments and price differences in security<br />

transactions 709 933 – 24.0<br />

Non-<strong>income</strong>-related taxes including interest from<br />

previous years 664 493 34.7<br />

Losses on <strong>the</strong> disposal of fixed assets 0 109 – 100.0<br />

Loan loss provisions and write-downs outside retail lending 682 99 588.9<br />

Sundry expense items 3,738 6,169 – 39.4<br />

Total 15,117 6,414 135.7<br />

Due <strong>to</strong> a detailed presentation, <strong>the</strong> previous figures were adjusted accordingly.

134<br />

|<br />

35 Taxes on <strong>income</strong><br />

€ thousand 2011 2010 Change<br />

in %<br />

Current taxes on <strong>income</strong> current year 30,641 21,031 45.7<br />

Current taxes on <strong>income</strong> from previous years – 31,703 – 496 6,291.7<br />

Deferred taxes – 2,625 705 – 472.3<br />

Total – 3,687 21,240 – 117.4<br />

Reconciliation of taxes on <strong>income</strong><br />

€ thousand 2011 2010<br />

Profit from ordinary activities of <strong>comdirect</strong> <strong>bank</strong> <strong>AG</strong> and ebase GmbH 108,076 80,874<br />

multiplied by <strong>the</strong> respective <strong>income</strong> tax rate for <strong>the</strong> company<br />

= Calculated <strong>income</strong> tax paid in financial year 28,223 21,180<br />

Effect of tax-free <strong>income</strong> from financial investments – 78 – 38<br />

Effect of losses from financial investments; not tax deductible 750 308<br />

Effect of taxes from previous years recognised in <strong>the</strong> financial year – 32,875 – 342<br />

O<strong>the</strong>r effects 293 132<br />

Total – 3,687 21,240<br />

The tax <strong>income</strong> from previous years results from a positive ruling in appeal proceedings upheld with regard <strong>to</strong> <strong>the</strong><br />

recognition of write-downs <strong>to</strong> <strong>the</strong> going concern value of shares in foreign subsidiaries in financial year 2001.<br />

The <strong>income</strong> tax rate selected as a basis for <strong>the</strong> reconciliation is composed of <strong>the</strong> corporation <strong>income</strong> tax rate of<br />

15.0% applicable in Germany, plus a solidarity surcharge of 5.5% and a rate for trade earnings tax of 10.15% for<br />

<strong>comdirect</strong> <strong>bank</strong> <strong>AG</strong> (Quickborn location) and 12.25% for ebase GmbH (Aschheim location).<br />

As in <strong>the</strong> previous year, this produces an <strong>income</strong> tax rate of around 25.98% for <strong>comdirect</strong> <strong>bank</strong> <strong>AG</strong> and around<br />

27.73% for ebase GmbH.