You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

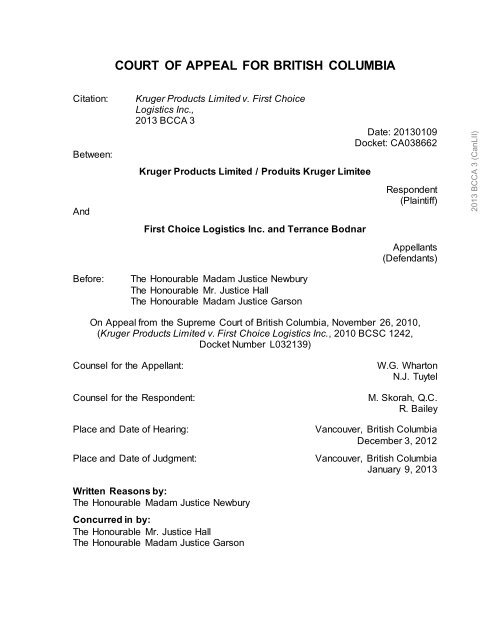

COURT OF APPEAL FOR BRITISH COLUMBIA<br />

Citation:<br />

Between:<br />

And<br />

Before:<br />

Kruger Products Limited v. First Choice<br />

Logistics Inc.,<br />

2013 BCCA 3<br />

Kruger Products Limited / Produits Kruger Limitee<br />

First Choice Logistics Inc. and Terrance Bodnar<br />

The Honourable Madam Justice Newbury<br />

The Honourable Mr. Justice Hall<br />

The Honourable Madam Justice Garson<br />

Date: 20130109<br />

Docket: CA038662<br />

Respondent<br />

(Plaintiff)<br />

Appellants<br />

(Defendants)<br />

2013 BCCA 3 (CanLII)<br />

On Appeal from the Supreme Court of British Columbia, November 26, 2010,<br />

(Kruger Products Limited v. First Choice Logistics Inc., 2010 BCSC 1242,<br />

Docket Number L032139)<br />

Counsel for the Appellant:<br />

Counsel for the Respondent:<br />

Place and Date of Hearing:<br />

Place and Date of Judgment:<br />

W.G. Wharton<br />

N.J. Tuytel<br />

M. Skorah, Q.C.<br />

R. Bailey<br />

Vancouver, British Columbia<br />

December 3, 2012<br />

Vancouver, British Columbia<br />

January 9, 2013<br />

Written Reasons by:<br />

The Honourable Madam Justice Newbury<br />

Concurred in by:<br />

The Honourable Mr. Justice Hall<br />

The Honourable Madam Justice Garson

Kruger Products Limited v. First Choice Logistics Inc. Page 2<br />

Reasons for Judgment of the Honourable Madam Justice Newbury:<br />

[1] On July 31, 2001, a fire broke out in a New Westminster warehouse in which<br />

the plaintiff Kruger Products Limited (formerly known as Scott Paper Ltd. and<br />

referred to herein as “Scott”) was storing large rolls of paper. The fire destroyed the<br />

entire building and its contents, including 3713 tonnes of “parent rolls” of<br />

unprocessed paper, approximately 236,000 cases of finished paper products, and<br />

other materials and supplies. At the time of the fire, the warehouse was being<br />

operated by the defendant First Choice Logistics Inc. (“FCL”) pursuant to the terms<br />

of a warehousing agreement with Scott.<br />

2013 BCCA 3 (CanLII)<br />

The Litigation<br />

[2] Scott commenced this action against FCL in July 2003, alleging FCL had<br />

breached express or implied terms of the warehousing agreement to maintain the<br />

warehouse in a condition “that met or exceeded professional warehousing<br />

management practices”, to operate all equipment safely and efficiently, and to<br />

operate the warehouse “so as to minimize the risk of damage to the Plaintiff’s<br />

inventory, including the risk of damage by fire.” Scott pleaded that FCL had<br />

breached its common law duty of care, its duty of care as a warehouser under the<br />

Warehouse Receipt Act, R.S.B.C. 1996, c. 481, and its duty of care as an occupier<br />

of the warehouse under the Occupiers Liability Act, R.S.B.C. 1996, c. 337.<br />

Paragraph 10 of the amended statement of claim stated in part:<br />

The Fire, and the Plaintiff’s ensuring loss and damage, were caused by the<br />

breach of contract, breach of statutory and common law duties of care, and<br />

gross negligence of the Defendant FCL, and by the breach of common law<br />

duties of care and gross negligence of its employee the Defendant Bodnar,<br />

and of other employees of FCL, for whose acts FCL is vicariously liable.<br />

Particulars of the fault of FCL and its employees include:<br />

(a)<br />

(b)<br />

(c)<br />

Operation of the Warehouse and the storage of goods therein in such<br />

a manner as to create excessive waste paper and paper debris;<br />

Failure to maintain the Warehouse and thereby allowing for the<br />

accumulation and presence of waste paper and paper debris within<br />

the Warehouse;<br />

Use of a type of lift truck in areas of the Warehouse where paper<br />

debris would be generated and would accumulate which FCL knew or

Kruger Products Limited v. First Choice Logistics Inc. Page 3<br />

(d)<br />

(e)<br />

(f)<br />

(g)<br />

...<br />

(i)<br />

...<br />

(l)<br />

ought to have known had a propensity to accumulate within its body<br />

paper and paper debris and knew or ought to have known of the risk<br />

that such paper would ignite;<br />

Failure to keep the body of the Lift Truck clean and clear of paper and<br />

paper debris;<br />

Failure to install or, alternatively, failure to instruct the dealer of the Lift<br />

Truck to install, safeguards against the ignition of paper and paper<br />

debris by the Lift Truck when FCL knew that such safeguards were<br />

readily available;<br />

Use of the Lift Truck when FCL knew or ought to have known that the<br />

Lift Truck incorporated no or insufficient safeguards to minimize the<br />

risk of ignition of accumulated paper and paper debris;<br />

Storage of goods within the Warehouse contrary to standard industry<br />

practices, in such a manner and configuration as to impair both the<br />

effective operation of fire suppression and firefighting equipment and<br />

personnel;<br />

Failure to exercise the care and diligence in regard to goods stored in<br />

the Warehouse as a careful and vigilant owner of similar goods would<br />

exercise in the custody of them in similar circumstances;<br />

Failure to warn the Plaintiff that the Lift Truck was operated in the<br />

Warehouse with no or insufficient safeguards to minimize the risk of<br />

paper debris ignition when FCL knew that such safeguards were<br />

readily available.<br />

2013 BCCA 3 (CanLII)<br />

[3] For its part, FCL denied the specific breaches of duty alleged in Scott’s<br />

pleading and stated that it had satisfied any duty of care owed to Scott. FCL<br />

pleaded that Scott itself had been negligent in certain respects, including:<br />

(a)<br />

(b)<br />

...<br />

(d)<br />

(e)<br />

failure to wrap the parent rolls in order to avoid paper sloughing off the<br />

rolls creating a housekeeping issue and fire hazard and to avoid the<br />

risk of ignition and/or fire transfer;<br />

instructing storage of parent rolls in such quantity and configuration at<br />

the Warehouse with the knowledge that such quantity and<br />

configuration created an increased fire hazard;<br />

demanding that the FCL Defendants utilize a Toyota Series 6 forklift<br />

at the Warehouse when they knew or ought to have known the<br />

dangers of using a Toyota Series 6 forklift;<br />

failing to warn the FCL Defendants about the risks inherent with the<br />

use of Toyota Series 6 forklift trucks including the Lift Truck ...<br />

[4] With respect to insurance, the warehouser also pleaded:

Kruger Products Limited v. First Choice Logistics Inc. Page 4<br />

6. The FCL Defendants state that the [warehousing agreement] includes<br />

provisions requiring the Plaintiff to obtain insurance including, inter<br />

alia, “insurance of its inventory and property within the Warehouse”<br />

and that such insurance should name the FCL Defendants as<br />

additional assureds and stand as primary coverage. As a<br />

consequence of these insurance provisions, the Plaintiff is barred by<br />

the terms of the [warehousing agreement] and is otherwise estopped<br />

from claiming against the FCL Defendants to the extent of the<br />

indemnity which would have been provided by such insurance if such<br />

insurance had been placed by the Plaintiff.<br />

7. The FCL Defendants state that it was an express or implied term of<br />

the [warehousing agreement] that the parties restrict recovery<br />

between them for any loss or damage to the amount of available<br />

insurance. The Plaintiff is therefore barred by the terms of the<br />

[warehousing agreement] and is otherwise estopped from claiming<br />

against the FCL Defendants in total or, in the alternative, to the extent<br />

of the indemnity that would have been provided by such insurance as<br />

the Plaintiff was obliged to obtain and maintain under the terms of the<br />

[warehousing agreement].<br />

2013 BCCA 3 (CanLII)<br />

[5] The action did not come on for trial until June 2008. By that time, the<br />

pleadings had been amended several times and assorted third parties had been<br />

joined by FCL, including various “Toyota” corporations alleged to have been involved<br />

in the design, manufacture, distribution or sale of the propane-powered lift truck (or<br />

forklift) allegedly involved in the starting of the fire, and Mason Forklift Ltd.<br />

(“Mason”), which had leased the forklift to FCL. These third parties in turn joined<br />

certain fourth parties. By the time of trial, however, the fourth party proceedings had<br />

been discontinued.<br />

[6] In an amendment to its statement of claim made pursuant to an order dated<br />

June 6, 2008, Scott expressly waived any right to recover from the defendants or<br />

any other party, any portion of its loss that might be attributable to the fault or breach<br />

of duty of any of the Toyota corporations or Mason and any other persons not<br />

named as defendants, for which the defendants might have been entitled to claim<br />

contribution, indemnity or apportionment.<br />

[7] Immediately before the trial commenced, the trial judge sitting in chambers<br />

ordered that the parties endorse an order dismissing the proceedings against Mason<br />

and the Toyota third parties, subject to the condition that the order would not be filed

Kruger Products Limited v. First Choice Logistics Inc. Page 5<br />

until the conclusion of the trial. On September 17, 2008, the Toyota proceedings<br />

were dismissed and on November 5, 2008 those against Mason were also<br />

dismissed, the latter without prejudice to certain possible defences.<br />

[8] The trial occupied 20 days beginning June 16, 2008. Even though no third or<br />

fourth party proceedings remained to be tried, there were many issues of fact and<br />

law to be resolved between the plaintiff and the defendants. Thus it is not surprising<br />

that the trial judge’s reasons ‒ indexed as 2010 BCSC 1242 ‒ are lengthy and<br />

detailed. I do not intend to review them as a whole, given that most of his factual<br />

findings are unchallenged on this appeal. I do note, however, that one of the difficult<br />

issues before the Court was to determine the exact terms of the agreement between<br />

Scott and FCL. Although the parties had discussed the terms of several drafts, they<br />

had never signed any written warehousing agreement. The trial judge ultimately<br />

found that their agreement (referred to as the “WMA”) consisted of a draft agreement<br />

and two appendices, “A” and “C”. Both parties had acted on the basis of these<br />

documents since early 2000. (Paras. 84-5.) No appeal is taken from that finding.<br />

2013 BCCA 3 (CanLII)<br />

[9] Another significant issue was the standard of care to which FCL was subject<br />

in operating the warehouse. Appendix A required FCL to maintain the facility in<br />

“food grade condition and cleanliness at all times”, and para. 7(a) of the agreement<br />

itself required FCL to perform its services in an “efficient, effective and professional<br />

manner, and properly, safely, efficiently and professionally ... all in accordance with<br />

the highest industry standards”. In addition, s. 2(4) of the Warehouse Receipt Act<br />

required that the warehouser exercise the care and diligence that a “careful and<br />

vigilant” owner of goods similar to those being stored would exercise in similar<br />

circumstances. (Para. 106.) The trial judge found that this standard of care was a<br />

higher one than that of reasonable care (para. 108), and again, no appeal is taken<br />

from that conclusion.<br />

[10] This appeal challenges only two substantive conclusions reached by the trial<br />

judge ‒ first, his finding of fact that Scott’s losses and damages were caused by<br />

negligence on the part of FCL; and second, his conclusion of law that Scott’s claim

Kruger Products Limited v. First Choice Logistics Inc. Page 6<br />

against FCL (which we are told is a subrogated claim) was not barred by the<br />

application of certain insurance provisions in the WMA. It is to those two issues that<br />

I now turn.<br />

The Cause of the Fire<br />

[11] The factual background of the outbreak of the fire was described by the trial<br />

judge at paras. 7-27 of his reasons. He began by describing the services provided<br />

by FCL to Scott at the warehouse, which included not only storage but space<br />

management and the co-ordination of shipping on Scott’s behalf. (Para. 8.) The<br />

“parent rolls” of paper being stored for Scott were very large rolls being stored until<br />

they could be processed for packaging into final products such as paper towels and<br />

toilet paper. Unlike the smaller processed rolls, these rolls were not wrapped in<br />

plastic or at all and were moved around in the warehouse primarily by means of a<br />

Toyota propane-powered forklift, the only forklift with a turning radius short enough<br />

to move the rolls. The defendant Mr. Bodnar, who operated the forklift in the storage<br />

area, described the debris created just by moving the rolls around:<br />

2013 BCCA 3 (CanLII)<br />

The unwrapped rolls, when they'd come into a truck, it depends where they<br />

came from at the other end. From Scott Paper they've ‒ they've already<br />

come unravelled. Depending on the size of the roll they were held by just<br />

like, it looked like masking tape, practically. And the operator at the other<br />

end, by squeezing them so hard, would force them to come unravelled.<br />

And some of the rolls were a fair size, so if a roll unravelled once around<br />

that could be anywhere from six to eight feet around a piece of paper that<br />

would come off. And just from the force of the machine would tear it right off<br />

when -- when we went to unload it, and it would fall on the floor.<br />

[12] Until about one week before the fire FCL employees had noticed that the<br />

propane forklift (the “Original Forklift”) was, in the trial judge’s words, overheating<br />

“due to paper debris being sucked up into the body of the vehicle by the operation of<br />

the radiator cooling fan.” The drivers could smell smouldering paper “within the<br />

machine as a result of contact with various hot elements associated with the engine<br />

and exhaust system.” (Para. 11.) Mr. Bodnar stated in discovery that the first time<br />

this happened, he “stopped, turned the machine off, opened the bonnet and the

Kruger Products Limited v. First Choice Logistics Inc. Page 7<br />

paper under there ‒ it wasn’t really on fire; it was smouldering. It was turning brown,<br />

kind of.” He was asked where the smouldering paper was located:<br />

A. That is the part I have difficulty with, is where the exhaust ‒ I can see<br />

part of the exhaust between the engine compartment and the radiator<br />

and there was a piece of paper like touching, but I think it was part of<br />

the exhaust.<br />

Q. Around the muffler? That far back?<br />

A. Yes. Yes.<br />

Q. That is on the opposite side of the radiator in the shaker screen, is it?<br />

A. It wasn’t the muffler, it was the exhaust pipe. If I remember ‒ like<br />

you’re saying the muffler was on the opposite side of the ‒ toward the<br />

back of the machine. I can’t recall what it looks like now.<br />

Q. But was it your experience that paper debris could get sucked up and<br />

get sucked through the shaker screen and the radiator into that back<br />

area where the tail pipe and the muffler were located?<br />

A. It has to come up past the exhaust pipe first to get to the shaker<br />

screen and the radiator. And being such a suction I guess since it’s<br />

happened earlier, no paper had ever gotten stuck by the exhaust pipe,<br />

it all went to the shaker screen. The radiator blocked the flow of the<br />

air and the machine overheated. It’s only a matter of time before it<br />

starts ‒ you know, before it got near the exhaust. Sooner or later it<br />

was bound to happen, which it did. That’s when I opened the bottom<br />

and it’s smouldering and there was a brown piece of paper there.<br />

2013 BCCA 3 (CanLII)<br />

[13] At trial, Mr. Bodnar testified:<br />

It would seem that the forklift would suck up paper like a vacuum cleaner, and<br />

doing so it would -- the paper would have packed itself in the exhaust pipe.<br />

And shortly after starting to operate the machine the -- I could smell -- I wasn't<br />

sure the first couple of times, but it was like a smouldering distinct paper<br />

smell. And the first time I had noticed this I lifted the bonnet and there was --<br />

there was paper wrapped around the exhaust. And I would try to reach my<br />

hand down there and tear it out as best I could and clean it out.<br />

Mr. Bodnar said he attempted to deal with the overheating problem by “blowing out”<br />

and cleaning the radiator and then adding water to it (using an outdoor hose) until<br />

the temperature gauge went down. (The Original Forklift had also been fitted with<br />

venting at the front and sides of the hood.)<br />

[14] At some point, FCL mentioned the overheating problem to Mason. It was<br />

decided that an air compressor would be used to “blow out” the Original Forklift and,

Kruger Products Limited v. First Choice Logistics Inc. Page 8<br />

in the trial judge’s words, that the exhaust pipe would be wrapped with fibreglass<br />

insulation “in order to shield paper and debris from the hot surface of the exhaust<br />

pipe”. These measures “greatly reduced”, but did not eliminate, the problems with<br />

smouldering paper. (Paras. 12-3.)<br />

[15] Unfortunately, the Original Forklift had to be taken out of operation due to an<br />

accident on July 20, 2001. Mason supplied a replacement of the same type and<br />

make which it delivered to the warehouse on July 26, fitted with a roll clamp so that it<br />

could handle the parent rolls. The exhaust pipes, however, were not wrapped, nor<br />

was the hood vented to reduce overheating. The replacement forklift (the “Forklift”)<br />

was put into service immediately.<br />

2013 BCCA 3 (CanLII)<br />

[16] On July 30, Mr. Bodnar returned from holiday. He noticed that the Forklift<br />

began overheating right away and had the same smouldering problems the Original<br />

Forklift had had. In his words, it “was right back to square one. Like smouldering,<br />

overheating, and just got [sic] to be really careful again.” (Para. 18.) The Forklift<br />

was blown out with compressed air about every ten or 15 minutes up to the time of<br />

the fire.<br />

[17] The trial judge found that on the morning of July 31, Mr. Bodnar was driving<br />

the Forklift, having picked up a roll. Mr. Bodnar testified that he did not notice any<br />

smell or detect any overheating, but a co-worker who was driving an electric forklift<br />

in the opposite direction saw something very concerning:<br />

Mr. Nijjar noticed a piece of paper approximately 2 to 3 feet long in the vicinity<br />

of the exhaust grill of the Forklift. The paper was on fire. Mr. Nijjar saw the<br />

paper drifting away from the back of the Forklift. The burning paper landed at<br />

the base of a stack of parent rolls. The burning paper immediately<br />

transferred flame to the stack of parent rolls.<br />

Mr. Nijjar made an attempt to stomp out the fire before running to get a<br />

nearby fire extinguisher. When Mr. Nijjar returned with a fire extinguisher, he<br />

felt the fire was already out of control so he left the area to report the Fire. [At<br />

paras. 23-4.]<br />

Mr. Bodnar testified that he immediately jumped off his machine, ran to the front of<br />

the Warehouse and yelled “9-1-1” to the office, ran back and tried to extinguish the

Kruger Products Limited v. First Choice Logistics Inc. Page 9<br />

fire with a fire hose. He had to give up very soon thereafter. Fire and emergency<br />

trucks were called, but the entire inventory in the warehouse was quickly destroyed.<br />

[18] The trial judge approached the issue of causation of the fire beginning at<br />

para. 107, noting the “but for” test enunciated by the Supreme Court of Canada in<br />

Resurfice Corp. v. Hanke 2007 SCC 7, [2007] 1 S.C.R. 333. After describing the<br />

high standard of care imposed by the Warehouse Receipt Act and the reverse onus<br />

applicable to a bailee, he found that:<br />

... [FCL] owed a duty of care to Scott not to allow paper debris to build up and<br />

to maintain the Warehouse as a “careful and vigilant owner”. A careful and<br />

vigilant owner would and should have foreseen that there was a risk of fire<br />

igniting due to smouldering paper debris coming into contact with various<br />

parts of a propane lift truck and if the Warehouse was not kept in a “foodgrade<br />

condition” so that paper debris was allowed to accumulate at the base<br />

of the stored parent rolls during each shift. A careful and vigilant<br />

warehouseman in the position of [FCL] would have taken steps to sweep up<br />

the paper debris not only in the aisles but also at the base of the stacked<br />

parent rolls on a regular basis and not just after each shift. I find that these<br />

failures amount to a breach of the duties owed by [FCL] to Scott. I am<br />

satisfied that Scott has demonstrated on a balance of probabilities that the<br />

damage which occurred would not have occurred but for the negligence of<br />

[FCL] in this regard. [FCL] has not shown that the duty that it owed to Scott<br />

has been discharged. As the standard of care if higher than merely not<br />

acting negligently, [FCL] has not met the onus of showing that the duty<br />

imposed upon it has been discharged. Scott has met the onus of showing<br />

that [FCL] did not discharge the duty that it owed to Scott. [At para. 116;<br />

emphasis added.]<br />

2013 BCCA 3 (CanLII)<br />

and further :<br />

I find that [FCL] did not act throughout as a careful and vigilant owner despite<br />

the fact that it had an obligation to do so pursuant to the obligations imposed<br />

at common law and under the Warehouse Receipt Act. Scott has met the<br />

burden of proving its losses and damages were caused through the<br />

negligence of [FCL]. [Para. 123.]<br />

[19] As to exactly how the fire had started, the trial judge found that:<br />

... it was paper debris coming into contact with the unwrapped exhaust<br />

system of the Forklift that caused the Fire. Burning tissue debris was seen by<br />

Mr. Nijjar to be trailing behind the Forklift. The fact that the burning paper<br />

was outside the Forklift, allows me to conclude that the paper had not been<br />

sucked up into the Forklift. This incident occurred only days after the Forklift<br />

had gone into service to replace the Original Forklift. This spatial and<br />

temporal proximity between the use of the Forklift with the unwrapped

Kruger Products Limited v. First Choice Logistics Inc. Page 10<br />

exhaust system and the burning paper is sufficient to allow me to come to the<br />

conclusion that the Fire was caused when paper came into contact with the<br />

unwrapped exhaust of the Forklift.<br />

An inspection of the Forklift following the Fire disclosed no evidence of fire<br />

within the Forklift. I find this to be further evidence that the Fire was caused<br />

by paper coming into contact with an external part of the Forklift. I find that<br />

the unprotected exhaust of the Forklift came into contact with paper debris,<br />

either in the location where Mr. Bodnar had deposited a parent roll or in the<br />

aisle as he moved the Forklift back to that part of the Warehouse where he<br />

was to pick up another parent roll. I find that the heat of the unprotected<br />

exhaust of the Forklift caused the paper which was in the aisle or which had<br />

been blown into the aisle from debris at the foot of a stack of parent rolls to<br />

ignite, the ignited paper landed at the base of a stack of parent rolls, the<br />

paper transferred the flame to the parent rolls, and the fire spread from there<br />

[At paras. 51-2; emphasis added.].<br />

2013 BCCA 3 (CanLII)<br />

The Court did not make any finding of gross negligence on the part of the<br />

defendants.<br />

[20] Beginning at para. 53, the Court also considered whether there were other<br />

possible causes of the fire. Most notably, FCL had adduced into evidence a report<br />

prepared by a professional engineer, Mr. West, of Baker Materials Engineering, who<br />

was instructed to assume inter alia that an examination of the Forklift did not reveal<br />

any possible source of ignition other than one “associated with the exhaust system.”<br />

He carried out certain tests on the overflow tube from the radiator reservoir of the<br />

Forklift. The tube was found charred and partly melted “where it passed adjacent to<br />

the exhaust pipe on the left side of the [Forklift].” The tests indicated that the<br />

temperature of the exhaust pipe in the Forklift during operation was “certainly<br />

sufficient to ignite paper” and that a molten or charred piece of the overflow tube<br />

could also have achieved temperatures sufficient to ignite paper. Mr. West<br />

concluded:<br />

We also understand that the fire started at approximately 10:30 a.m. and that<br />

forklift 1478 had operated as a replacement for FCL’s own unit for a period of<br />

four or five days before the fire occurred. The extended period of operation<br />

of the forklift before the fire indicates that either the overflow tube fell into<br />

contact with the exhaust pipe very shortly before the fire occurred, or the<br />

contact was intermittent over the time that the forklift was used before the fire.<br />

Our tests showed that the tube melted and charred within minutes of contact<br />

with a hot exhaust pipe.<br />

If the contact had been intermittent, this could then present an opportunity for<br />

fragments of toilet paper product to attach to the melted portion of the tube

Kruger Products Limited v. First Choice Logistics Inc. Page 11<br />

after it separated or moved away from the exhaust pipe. When the tube next<br />

moved into contact with the exhaust pipe, these tissue fragments could be<br />

ignited as a result of contact with the exhaust pipe.<br />

Hence, contact between the overflow tube and the exhaust pipe also<br />

presents itself as a potential cause of ignition of the streamer observed by<br />

witness Nijjar. [Emphasis added.]]<br />

[21] The trial judge rejected this theory, however, noting that:<br />

There was no evidence as to when the overflow hose in the Forklift had been<br />

installed. I cannot conclude that the plastic radiator coolant overflow hose<br />

melted at the Warehouse where the Forklift had been used for less than a<br />

day and a half or that the alleged faulty installation caused or contributed to<br />

causing the Fire. No theory was presented how paper two to three feet long<br />

might have come in contact with the plastic radiator coolant overflow hose,<br />

been ignited, and then expelled from the Forklift in order that it would be<br />

streaming behind the Forklift. [At para. 53.]<br />

2013 BCCA 3 (CanLII)<br />

[22] The defendants also adduced evidence from an engineer, Dr. Colwell, who<br />

had conducted (and videotaped) certain tests in relation to the airflow characteristics<br />

of the Forklift. The purpose of the tests was “to evaluate whether ‘burning embers’<br />

of paper could pass through the radiator, past the fan, past the exit grill and then<br />

ignite a strip of paper or streamer caught on the exit grill.” He described the test and<br />

the results thereof in his report as follows:<br />

With the engine running at full rpm, the paper samples were placed at locations that<br />

provided the best opportunity for them to flow around the radiator and come into<br />

contact with the radiator grill at the rear of the lift truck. These locations included<br />

above and below the exhaust pipe as it passed the right side of the radiator (on the<br />

right side of the lift truck) and underneath the radiator near the fan drive belt.<br />

Results of the testing, summarized in Table 1, demonstrated that none of the<br />

tissue samples were able to get past the radiator intact. The only piece that<br />

made it past the radiator was manipulated such that a portion of the paper<br />

was pushed completely underneath the radiator and then released. It was<br />

drawn out of the engine compartment and chopped up by the fan such that<br />

only confetti-sized paper exited the lift truck. Samples released near the<br />

exhaust pipe which passes around the right side of the radiator were drawn<br />

forward, not rearward, and did not exit the engine compartment. [Emphasis<br />

added.]<br />

[23] In cross-examination, Dr. Colwell acknowledged that in one or two of his<br />

tests, the video showed a piece of paper being released, moving forward in the<br />

engine compartment, becoming entangled in a “structure” there and, after the

Kruger Products Limited v. First Choice Logistics Inc. Page 12<br />

camera had been shut off, being “sucked back onto the radiator screen.” He also<br />

confirmed that the cooling fan had been operating at maximum speed during the test<br />

and that accordingly, he had not made any observations “as to how burning paper<br />

debris and burning embers would move around in the engine compartment if the<br />

engine and the cooling fan were being operated at less than maximum speed.”<br />

Further, the engine had not been under load when the tests were carried out, nor<br />

had the Forklift been driven around “in piles of paper debris to see what would<br />

happen”. Significantly, the radiator had been cleaned out before each test. Counsel<br />

for the defendants successfully objected to counsel’s question to Dr. Colwell:<br />

I suggest to you, Doctor, that given these variables, you would have been<br />

surprised if you had seen fire propagate outside the lift truck?<br />

2013 BCCA 3 (CanLII)<br />

This witness, not having been called to provide expert evidence, was not asked to<br />

comment on the “exhaust pipe” theory ultimately adopted by the trial judge.<br />

[24] The trial judge said he accepted Dr. Colwell’s evidence. In his analysis:<br />

... I accept the evidence of Jeff Colwell, a professional engineer, that paper,<br />

once inside the body of a forklift, is drawn upwards towards the radiator with<br />

significant force so that the paper cannot get past the radiator and outside the<br />

vehicle unless manually forced past the radiator. I also take into account that<br />

there was no evidence of fire damage within the body of the Forklift after the<br />

Fire. I find that it would not have been possible for paper to be drawn into the<br />

Forklift, ignited and then expelled from the Forklift. [At para. 55; emphasis<br />

added.]<br />

For the same reason, he also rejected the defendants’ submission that the Toyota<br />

third parties were responsible for the fire ‒ although it was not necessary for the<br />

Court to decide the point. The judge rejected the notion that paper had been:<br />

... drawn into the body of the Forklift as a result of the negative air pressure<br />

created by the exhaust fan and that, after coming into contact with an<br />

exposed portion of the exhaust pipe, caught fire and escaped from the body<br />

of the Forklift. I am satisfied that this theory is disproven on the evidence due<br />

primarily to the inability of paper to escape once it has entered the body of<br />

the Forklift and the inability of ignited paper to move past the radiator fan to<br />

outside of the Forklift. [At para. 55; emphasis added.]

Kruger Products Limited v. First Choice Logistics Inc. Page 13<br />

On Appeal<br />

[25] On appeal, the defendants submit that the trial judge made a palpable and<br />

overriding error in finding that the fire occurred when paper debris came into contact<br />

with the unwrapped exhaust system of the Forklift, while at the same time finding<br />

that paper had not been “sucked up into the Forklift.” (Para. 51.) The defendants<br />

say these findings require that some part of the exhaust system (the part that was<br />

wrapped on the Original Forklift) must have been “external” to the Forklift. Citing the<br />

reports of Mr. West and Dr. Colwell, the defendants contend the entire exhaust<br />

system was inside the machine and that there was no evidence of any external<br />

portion that could cause paper to ignite. Further, they argue:<br />

2013 BCCA 3 (CanLII)<br />

... there was no evidence that anyone at [FCL], Scott, the manufacturer<br />

(Toyota) or supplier (Mason Lift), had ever seen or heard of paper being<br />

ignited by an external part of a forklift. On the evidence, therefore, ignition of<br />

paper by an external component of the forklift would not just be<br />

unforeseeable, but physically impossible.<br />

As the only parts of the exhaust system wrapped on the original forklift were<br />

internal to the machine, and there was no part of the exhaust system outside<br />

the body of the replacement Forklift, such fire could not have been caused by<br />

contact with the exhaust system. While the Forklift may conceivably have<br />

caused a fire, such fire would have been caused in a manner completely<br />

unknown to [FCL].<br />

It was also the uncontroverted evidence and finding of the Court that the<br />

Forklift had a propensity to vacuum up paper debris from the floor around the<br />

base of the machine while it was operating. Such paper would then be<br />

sucked up into the engine compartment, and would not exit the machine.<br />

[Emphasis added.]<br />

[26] With respect, I believe this argument takes an overly literal approach to the<br />

trial judge’s reference to “an external part” of the Forklift in his analysis of<br />

Dr. Colwell’s evidence. As Scott points out in its factum, no witness was asked<br />

directly whether the exhaust system was “internal” or “external”; and some of the<br />

photos of the Forklift in evidence show that the exhaust system is, in Scott’s words,<br />

“encased on the sides within an exterior housing”, that there is an open exhaust grill<br />

at the back, and that the underside of the machine was open. Arguably, the part of<br />

the exhaust system that travels from underneath the internal engine compartment to<br />

a location beside the radiator and then behind the radiator and up into the muffler is

Kruger Products Limited v. First Choice Logistics Inc. Page 14<br />

not “inside” or is external to the engine compartment itself. It seems to me that<br />

para. 56 of Scott’s factum aptly describes the reasoning adopted by the trial judge:<br />

Since the evidence at trial was clear that: (i) the actual strip of paper that<br />

caused the Fire was somehow attached to the exhaust grill; (ii) all other<br />

possible sources for the ignition of the Fire other than the [Forklift] were<br />

eliminated by the Appellant; (iii) the unwrapped exhaust pipes were known to<br />

be hot enough to start paper fires; and (iv) paper cannot escape from inside<br />

the engine compartment, it must be that the Fire started by paper touching<br />

that part of the exposed exhaust pipe near the muffler at the back of the<br />

[Forklift].<br />

[27] As Scott notes, this explanation is consistent with Mr. Bodnar’s experience<br />

with the Original Forklift described above. It is also consistent with the discovery<br />

evidence of Mr. Woykin, another FCL employee who worked in the warehouse. He<br />

recalled that before the exhaust system of the Original Forklift was “wrapped”, he<br />

had seen paper “smouldering” with smoke coming from a location under the driver’s<br />

seat of the machine, which was then being operated by a Mr. Bertie. By the time he<br />

and Mr. Bertie located an operating fire extinguisher, Mr. Woykin could see flames.<br />

2013 BCCA 3 (CanLII)<br />

[28] Significant evidence in this regard was also given by a Mr. Reinders, an<br />

employee of Toyota Canada Inc. He recalled “problems” experienced by Toyota<br />

early on in the production of its GM262 engines – the kind used in the Original<br />

Forklift and the Forklift. According to his testimony, these machines had a<br />

“propensity to suck up paper into the engine compartment and through into the<br />

radiator”, and to overheat. These problems were experienced where the units were<br />

“working extremely hard in the environment where there is significant debris on the<br />

floor that leads to plugging of the rads, and there is a ... very heavy use of the<br />

attachments that are on the truck.” The witness was referred to an internal Toyota<br />

memorandum to Toyota Canada describing overheating in pulp and paper<br />

applications of the machine. Toyota Canada recommended the following measures<br />

in response:<br />

1) Increase size of engine pipe diameter to allow for easier exhaust flow.<br />

2) Improved air flow around exhaust pipe to remove excess heat.<br />

3) Add fibreglass insulation wrap to engine pipe.<br />

4) Reduce hydraulic pressure, thus lowering hydraulic load on engine.

Kruger Products Limited v. First Choice Logistics Inc. Page 15<br />

[29] A couple of years later, in 1998, another Toyota customer complained about<br />

overheating of the exhaust pipe – to over 400 degrees F. “very rapidly”. The writer<br />

of the memo stated:<br />

If this customer for some reason rotates the clamp attachment on a regular<br />

basis in this application (short travel distances) the hydraulic oil has no time<br />

to cool and will keep the temperature rising until something fails. Further to<br />

this the engine is being loaded during rotation causing the exhaust pipe to<br />

drastically increase in temperature. When these units deliver damaged rolls<br />

to the recycling area (loose paper on floor) the possibility of paper igniting can<br />

happen if the exhaust temperature is extremely high. [Emphasis added.]<br />

The solution suggested by Toyota Canada Inc. was to install a “flow regulator” in the<br />

rotating circuit. In 2001, it also recommended inter alia that suppliers install vents in<br />

the hood, and “exhaust wrap”.<br />

2013 BCCA 3 (CanLII)<br />

[30] In late 2000, a paper recycling plant in Washington state reported continuing<br />

difficulties to Toyota, having had two small fires start “from the exhaust manifold<br />

downpipes and trapped paper”. The fires were small and resolved quickly. Again,<br />

Toyota recommended using, inter alia, a “heat wrap on the exhaust pipe”, and hood<br />

vents. There were similar reports from other customers of “excessive amounts of<br />

paper sucking up underneath the engine compartment and clogging the radiator”<br />

and “paper sucked up into the engine bay”, threatening to ignite on the exhaust<br />

manifold.<br />

[31] All of this in my view supports the trial judge’s findings as to how the fire<br />

started, although he was apparently under the impression that because the third<br />

party proceedings against the Toyota corporations had been discontinued, it was not<br />

open to him to consider Mr. Reinders’ testimony. (Para. 125.) Even without the<br />

benefit of the reverse onus imposed by the Warehouse Receipt Act, there was<br />

substantial evidence that the fire began, as fires or near-fires had on previous<br />

occasions known to Toyota, when paper came into contact with the extremely hot<br />

exhaust system of the Forklift. Whether one sees this as ‘internal’ or ‘external’ to the<br />

engine is not in my view material. FCL was of course also aware of this problem<br />

which, in combination with the fact that paper debris was all around the warehouse,<br />

created a ‘perfect storm’ of dangerous conditions.

Kruger Products Limited v. First Choice Logistics Inc. Page 16<br />

[32] I would dismiss FCL’s appeal on the question of causation.<br />

Was the Subrogated Claim Barred?<br />

[33] Paragraph 17 of the WMA contained covenants on the part of both parties<br />

with respect to insurance. Paragraph 17 stated:<br />

INSURANCE<br />

A. Liability Insurance<br />

The Contractor [FCL] will maintain, throughout the Term of this Agreement,<br />

and any Extension Term, comprehensive general liability insurance and<br />

industry standard warehouseman’s legal liability insurance. Scott will<br />

maintain general liability insurance, tenant’s legal liability insurance, and<br />

insurance of its inventory and property within the warehouse.<br />

All insurance shall name Scott or the Contractor as applicable as an<br />

additional insured against all liability for bodily and/or personal injury and<br />

property damage, arsing from the insured’s fault or negligence, or the fault or<br />

negligence of any of its or their shareholders, directors, officers, employees,<br />

servants and agents, its and their affiliated, related, parent and subsidiary<br />

companies, and its and their appointees, successors and assigns, in<br />

connection with the Management Services hereunder.<br />

If the comprehensive general liability policy contains a general aggregate,<br />

that aggregate limit shall apply separately, per location, so that the<br />

Warehouse will have its own aggregate limit. All insurance policies<br />

contemplated hereunder shall constitute and respond as primary coverage to<br />

any insurance otherwise available Scott and any of its shareholders,<br />

directors, officers, employees, servants and agents, its affiliated, related,<br />

parent and subsidiary companies, or its and their appointees, successors and<br />

assigns.<br />

. . .<br />

B. Insurance on Building Contents<br />

Scott shall, at its own costs and expense, insure and keep insured any of its<br />

own property in, on or about the Warehouse, in which Scott itself has an<br />

insurable interest, including, without limitation, Scott’[s] inventory, furniture,<br />

fixtures, and equipment.<br />

D. Warehouseman’s Legal Liability Insurance<br />

The Contractor shall obtain and maintain industry standard Warehouseman’s<br />

Legal Liability Insurance that covers against risk of loss of inventory and<br />

property belonging to Scott or its divisions, subsidiaries, affiliated or related<br />

corporations, and arising from or relating to the Contractor’s gross<br />

negligence, which insurance shall be in the amount of (Cdn.) five million<br />

dollars. Damaged or lost inventory and products insured hereunder will be<br />

valued at Scott’[s] selling price to the trade.<br />

2013 BCCA 3 (CanLII)

Kruger Products Limited v. First Choice Logistics Inc. Page 17<br />

The Contractor will add both the Landlord and Scott as additional insureds.<br />

The Contractor will obtain and pay the premiums for such insurance coverage<br />

as an Allowable Operating Expense.<br />

E. Notice of Loss or Damage to Goods<br />

The Contractor agrees to notify Scott promptly in writing of any loss or<br />

damage of any kind to any product or goods stored or handled under the<br />

terms of this Agreement. [Emphasis added.]<br />

(Paragraph 17 contained no section “C”.)<br />

[34] As mentioned earlier, we were told this action is a subrogated action, i.e., one<br />

brought by Scott’s insurer, which (presumably) paid Scott out in respect of its losses<br />

due to the fire. As also noted, FCL’s statement of defence at least suggested that<br />

Scott failed to name FCL as an additional insured under the “primary coverage”<br />

referred to in para. 17A. However, we were not referred to any evidence on this<br />

point, and the trial judge did not refer to any. In any event, this question of fact<br />

would seem irrelevant to the “covenant to insure” (also called “tort immunity”)<br />

defence raised by FCL as a bar to Scott’s subrogated claim. That defence depends<br />

entirely on the terms of the contract between Scott and FCL, whether they were<br />

performed or not: see Greenwood Shopping Plaza Ltd. v. Beattie [1980] 2 S.C.R.<br />

228.<br />

2013 BCCA 3 (CanLII)<br />

[35] The starting point on the question of whether a subrogated claim may be<br />

pursued against FCL in the circumstances of this case is the Supreme Court of<br />

Canada’s “trilogy” of cases, Agnew-Surpass Shoe Stores Ltd. v. Cummer-Yonge<br />

Investments Ltd. [1976] 2 S.C.R. 221, Ross Southward Tire Ltd. v. Pyrotech<br />

Products Ltd. [1976] 2 S.C.R. 35, and T. Eaton Co. v. Smith [1978] 2 S.C.R. 749.<br />

Each involved landlord-tenant insurance arrangements and damage by fire, but each<br />

involved slightly different contractual provisions. In Agnew-Surpass, the lease<br />

required the landlord to insure its shopping centre “against all risk of loss or damage<br />

caused by or resulting from fire.” In Ross Southward, the lease required the tenant<br />

to pay all “insurance rates”. The landlord regularly charged the tenant for, inter alia,<br />

its share of the cost of fire insurance. In T. Eaton, two landlords covenanted to<br />

insure the leased premises against fire; the tenant on the other hand promised to<br />

repair on notice, damage by fire excepted. In each instance, a fire was caused by

Kruger Products Limited v. First Choice Logistics Inc. Page 18<br />

negligence attributed to the tenant. Subrogation was barred partly in Agnew-<br />

Surpass, where the Court was split, and was barred completely in the latter two<br />

cases.<br />

[36] The three cases are well-known to insurance practitioners and I do not intend<br />

to rehearse their legal reasoning in detail. It is fair to say that Chief Justice Laskin’s<br />

minority position in Agnew-Surpass evolved into the majority position in the other<br />

two cases, such that by the time T. Eaton was decided, the landlords’ covenant to<br />

insure their tenant’s premises was regarded as a “supervening covenant” that<br />

prevailed even where the tenant’s negligence had caused the loss. The Chief<br />

Justice characterized the issue in T. Eaton thus:<br />

2013 BCCA 3 (CanLII)<br />

... It is whether, in circumstances where, by the lease, the tenant is under an<br />

obligation to repair, and where its obligation to repair does not extend to<br />

repairing damage from accidental (as contrasted with negligent) fires, it is<br />

entitled, as between it and the landlord, to claim the benefit of a fire insurance<br />

policy (providing indemnity for loss arising from fires negligently caused),<br />

which the landlord had covenanted with the tenant to provide.<br />

... This is not a case where one has to consider whether there is some<br />

provision exonerating one contracting party from liability to the other for the<br />

former's negligence. Rather is it a case where a supervening covenant has<br />

been given and taken to cover by an insurance policy the risk of loss from a<br />

fire caused by negligence. An insurer could not refuse to pay a claim for loss<br />

by fire merely because the fire arose from the insured's negligence. I can see<br />

no reason why its position can be any better against a tenant, whose<br />

negligence caused loss by fire, if the lease with the landlord makes it clear<br />

that a policy was to be taken out by the landlord to cover such fires, and a<br />

policy is written which does so. In short, the insurer can claim only by<br />

subrogation under the lease. [At 755-6; emphasis added.]<br />

[37] A helpful summary of the evolution of the trilogy was provided in Madison<br />

Developments Ltd. v. Plan Electric Co. (1997) 36 O.R. (3d) 80 (Ont. C.A.), where<br />

Carthy J.A. stated:<br />

... The law is now clear that in a landlord-tenant relationship, where the<br />

landlord covenants to obtain insurance against the damage to the premises<br />

by fire, the landlord cannot sue the tenant for a loss by fire caused by the<br />

tenant's negligence. A contractual undertaking by the one party to secure<br />

property insurance operates in effect as an assumption by that party of the<br />

risk of loss or damage caused by the peril to be insured against. This is so<br />

notwithstanding a covenant by the tenant to repair which, without the<br />

landlord's covenant to insure, would obligate the tenant to indemnify for such<br />

a loss. This is a matter of contractual law, not insurance law, but, of course,

Kruger Products Limited v. First Choice Logistics Inc. Page 19<br />

the insurer can be in no better position than the landlord on a subrogated<br />

claim. The rationale for this conclusion is that the covenant to insure is a<br />

contractual benefit accorded to the tenant, which, on its face, covers fires with<br />

or without negligence by any person. There would be no benefit to the tenant<br />

from the covenant if it did not apply to a fire caused by the tenant's<br />

negligence. [At 84; emphasis added.]<br />

(See also 1044589 Ontario Inc. (Nantucket Business Centre) v. AB Autorama Ltd.<br />

2009 ONCA 654.)<br />

[38] The Court in Madison echoed the reasoning in Ross Southward that the<br />

tenant had paid for “an expected benefit” as between itself and its landlord ‒<br />

insurance coverage via the landlord’s policy. Carthy J.A. extended this reasoning<br />

beyond landlord-tenant relationships to complex construction cases, emphasizing<br />

the “anticipation” that subcontractors would “contribute their efforts to the overall<br />

project and ... that if a fire occurred it would most likely be caused by the negligence<br />

of one of those subcontractors.” In the Court’s analysis, it would make no business<br />

sense for each subcontractor to pay premiums to duplicate the comprehensive fire<br />

coverage to be obtained by the contractor and there would be no purpose for a<br />

covenant on the latter’s part to obtain such insurance if it were not to protect the<br />

subcontractors from claims caused by their own negligence. (At 85.) The<br />

subcontractor’s employees were also held to be entitled to be protected from liability:<br />

see 92. (See also Tony & Jim’s Holdings Ltd. v. Silva (1999) 43 O.R. (3d) 633<br />

(C.A.); Orange Julius Canada Ltd. v. Surrey 2000 BCCA 467; London Drugs Ltd.<br />

v. Kuehne & Nagel International Ltd. [1992] 3 S.C.R. 299; and Madison, supra, at<br />

88-92.)<br />

2013 BCCA 3 (CanLII)<br />

[39] The trilogy was also applied by this court in North Newton Warehouses Ltd.<br />

v. Alliance Woodcraft Manufacturing Inc. 2005 BCCA 309, lve to app. refused [2005]<br />

S.C.C.A. No. 375. Mr. Justice Hall for the majority held that a subrogated claim<br />

brought by the insurer of a landlord against a tenant whose employees had<br />

negligently caused a fire was barred. The landlord had covenanted in the lease to<br />

take out and maintain insurance against “all risks” of loss or damage to the building<br />

and to repair the premises in the event of damage by “fire or other casualty not

Kruger Products Limited v. First Choice Logistics Inc. Page 20<br />

caused by the negligence of the Tenant”; the tenant had agreed to reimburse the<br />

landlord for its insurance premiums as a component of “additional rent”. Adopting<br />

the “benefit” reasoning of Ross Southward, Hall J.A. stated:<br />

Here the tenant Alliance has paid the landlord an amount for the insurance<br />

obtained by North Newton covering fire damage to the building. It seems to<br />

me that, as Laskin C.J.C. observed in the Ross Southward case at 39, a<br />

tenant who has paid for an expected advantage as between itself and its<br />

landlord should benefit from those payments, and loss issues thereafter are<br />

between the landlord and its insurer. In such circumstances, to allow the<br />

insurer of North Newton to pursue its subrogated action against Alliance<br />

would render nugatory benefits accruing to the tenant under the covenant of<br />

the landlord to insure. [At para. 42; emphasis added.]<br />

2013 BCCA 3 (CanLII)<br />

and further:<br />

Ultimately, the policy rule underpinning the proposition that the insurer cannot<br />

pursue a tenant for damages in circumstances such as those present in the<br />

instant case is based on the proposition that it makes little business sense for<br />

a landlord to covenant to insure and for a tenant to pay the premiums if the<br />

tenant is not to derive some benefit from the insurance. One might properly<br />

say that there is something approaching a presumption in favour of a tenant<br />

benefiting from a landlord's covenant to insure. That is the legal principle that<br />

I take to be established from the trilogy of cases decided by the Supreme<br />

Court of Canada. [At para. 45; emphasis added.]<br />

(See also Orange Julius, supra, at para. 22.)<br />

[40] Finally, reference may be made to Commonwealth Construction Co. Ltd.<br />

v. Imperial Oil Ltd. [1978] 1 S.C.R. 317. Like Madison, it involved a contract entered<br />

into by a general contractor with an owner, Imperial Oil, for the construction of a<br />

fertilizer plant. A subcontractor, Commonwealth, had been engaged to install piping<br />

and had caused a fire to break out, causing damage not only to its own property but<br />

to other parts of the project. Imperial Oil had taken out property insurance that<br />

named not only its own subsidiaries, but their contractors and subcontractors as<br />

insureds. The entire amount of damage was claimed by and paid to Imperial Oil by<br />

its insurer, which then purported to bring a subrogated action against<br />

Commonwealth. The Alberta Appellate Division ruled that the policy insured<br />

Commonwealth only to the extent of its portion of the work performed under the<br />

subcontract, and therefore permitted the subrogated action to proceed.

Kruger Products Limited v. First Choice Logistics Inc. Page 21<br />

[41] Commonwealth appealed successfully on the basis that it had had an<br />

insurable interest in the entire “works”. De Grandpré J., speaking for the Supreme<br />

Court, began his analysis by referring to the “basic principle” that subrogation cannot<br />

be obtained against the insured himself. This was also true, he said, in cases of<br />

“true joint insurance” and in cases of several insurance “if the different interests are<br />

pervasive and if each relates to the entire property, albeit from different angles”. (At<br />

321.) As to whether Commonwealth had a “pervasive” interest in the entire project,<br />

he drew an analogy to longstanding law in the field of bailment.<br />

The question is: in the context of the construction contracts, did the various<br />

trades have, prior to the loss, such a relationship with the entire works that<br />

their potential liability therefor constituted an insurable interest in the whole?<br />

In certain fields of mercantile law, e.g. bailment in the widest sense, full<br />

insurable interest has for a long time been held to exist in others than the<br />

owner because of their special relationship with the property entailing<br />

possibility of liability.<br />

It is sufficient to refer to the now classic decisions of Waters v. Monarch Fire<br />

and Life Assurance Co. [[1843-60] All E.R. Rep. 654] and London and North<br />

Western Railway Co. v. Glyn [(1859), 1 El. & El. 652], applied by the House<br />

of Lords as recently as 1966 in Hepburn v. A. Tomlinson (Hauliers), Ltd.<br />

[[1966] All E.R. 418.] These two classic decisions were also referred to with<br />

approval by the Supreme Court of the United States in Phoenix Insurance<br />

Co. v. Erie and Western Transportation Co. [(1886), 117 U.S. 312], which<br />

was followed in Wager v. Providence Insurance Co. [(1893), 150 U.S. 99].<br />

The decisions of the Canadian Courts applying this doctrine are numerous<br />

and I will only refer to Smith v. Stevenson [[1942] 1 D.L.R. 681, [1942] O.R.<br />

79], a judgment of the Ontario Court of Appeal. Although these judgments<br />

were pronounced on policies issued to the bailee and not to the owner and all<br />

other interested parties, as in the case at bar, I do not see that circumstance<br />

making any difference when it comes to determining the existence or nonexistence<br />

of an insurable interest in a person who is not the owner of the<br />

property.<br />

In all these cases, there existed an underlying contract whereby the owner of<br />

the goods had given possession thereof to the party claiming full insurable<br />

interest in them based on a special relationship therewith. [At 322-23;<br />

emphasis added.]<br />

2013 BCCA 3 (CanLII)<br />

[42] The Court went on to observe that by recognizing an insurable interest in all<br />

tradesmen based on the ‘possibility’ of damage, the courts would “apply to the<br />

construction field the principle expressed so long ago in the area of bailment.” Doing<br />

so would allow all parties engaged on one construction project to be “spared the<br />

necessity of fighting between themselves should an accident occur involving the

Kruger Products Limited v. First Choice Logistics Inc. Page 22<br />

possible responsibility of one of them.” (At 324.) In the result, Commonwealth was<br />

held to be “an insured whose insurable interest extended to the entire works”. The<br />

subrogated claim brought by Imperial Oil was disallowed.<br />

The Trial Judge’s Reasons<br />

[43] Most if not all of the Canadian authorities described above were cited to the<br />

trial judge in the case at bar. As he noted at para. 202, Scott took the position that<br />

the “covenant to insure” defence did not apply in this instance because FCL had not<br />

paid (nor been required by the WMA to pay) any of Scott’s insurance costs and<br />

because:<br />

2013 BCCA 3 (CanLII)<br />

(a) there is no language in the Warehouse Management Agreement which<br />

suggests an intent that the property insurance policy of Scott should benefit<br />

[FCL]; (b) there is a valid commercial reason for the parties to a warehousing<br />

agreement to stipulate that it is incumbent upon the bailor to insure its<br />

property against loss; (c) there is a critical distinction between leases and<br />

construction contracts on the one hand and contracts of bailment on the other<br />

hand regarding the insurable interest of the parties in the bailed property; and<br />

(d) barring a claim against a bailee in respect of losses arising from a breach<br />

of its duty of care because of an insurance provision would effectively<br />

extinguish the rights of a bailor in entirety and such an interpretation of an<br />

insurance clause would contravene the common law obligations of a<br />

warehouseman and would make meaningless the requirement that [FCL] act<br />

as a careful and vigilant owner<br />

[44] In considering these arguments, the trial judge turned his attention not to<br />

para. 17A of the WMA, but to a provision in Appendix C, the form of warehouse<br />

receipt attached to the WMA. It provided that all goods were stored at the owner’s<br />

risk. (The WMA provided that in the event of a conflict between the receipt and the<br />

agreement itself, the latter would prevail.) The trial judge reasoned that contractual<br />

language of this kind simply means that the bailee does not accept risk of loss to<br />

goods which may arise other than as a result of its own fault, citing Rose v. Borisko<br />

Brothers Ltd. (1981) 33 O.R. (2d) 685, aff’d (1983) 41 O.R (2d) 606 (Ont. C.A.)<br />

[45] The facts of Rose v. Borisko were very different from those in the case at bar:<br />

there was no indication in the agreement between owner and warehouser or in their<br />

correspondence that the owners would obtain insurance for the warehouser’s

Kruger Products Limited v. First Choice Logistics Inc. Page 23<br />

benefit. Indeed, before entering into the bailment agreement, the warehouser had<br />

assured the owners that it would provide “maximum” insurance coverage and would<br />

take other precautions for the safety and protection of the owners’ goods. It failed to<br />

do so and the goods were destroyed by a fire caused by unknown third parties.<br />

[46] The owners’ insurance covered part of their loss and the insurer relied on<br />

Commonwealth to argue that because part of the owners’ loss had been covered,<br />

the action should be barred. The trial judge held, however, that:<br />

... before an insurance policy will bar subrogation there must exist some<br />

special relationship between the insurer and the person against whom<br />

subrogation is sought. In general terms, the cases stand for the proposition<br />

that an insurer cannot assert against a third party any rights which the<br />

insured has, by contract, put beyond his own reach. In this case, I find neither<br />

any special relationship that should preclude subrogation nor any contractual<br />

terms that would prevent subrogation in this case. [At 691; emphasis added.]<br />

2013 BCCA 3 (CanLII)<br />

The Court went on to rule (arguably as the ratio of the case) that the storage<br />

contract had been fundamentally breached by the defendant and that the plaintiffs<br />

had been “grossly misled” as to the type of facility to be used. Judgment was<br />

entered for the plaintiffs.<br />

[47] The Ontario Court of Appeal agreed with the trial judge’s comments regarding<br />

the absence of any special relationship that would preclude the insurer’s right of<br />

subrogation. Presumably, a “special relationship” (a phrase used in Commonwealth)<br />

would have existed if the owners had covenanted to obtain insurance for the<br />

warehouser’s benefit as well as their own. (See also Lafarge Canada Inc. v. JJM<br />

Construction Ltd. 2011 BCCA 453.)<br />

[48] The trial judge in the case at bar did not comment further on Rose v. Borisko,<br />

but noted that FCL had (at para. 8 of the WMA) expressly disclaimed any “right, title<br />

or interest” in the goods stored for Scott, other than a possible lien under the<br />

Warehouse Receipt Act. He went on to distinguish bailment cases from landlordtenant<br />

and complex construction cases in terms of insurable interest. In his<br />

analysis:

Kruger Products Limited v. First Choice Logistics Inc. Page 24<br />

I am satisfied that the landlord-tenant and construction project cases that<br />

have found a bar to subrogation can be distinguished from cases involving<br />

bailor and bailee. A warehouser does not have a generalized property<br />

interest in the goods which it stores. On the other hand, tenants have an<br />

insurable interest in the continuing existence and availability for use of<br />

demised premises. Similarly, the insurable interest of all trades and<br />

subtrades in a construction project is obvious and was recognized in<br />

Commonwealth Construction Co. v. Imperial Oil Ltd., [1976] 1 S.C.R. 317.<br />

[At para. 205; emphasis added.]<br />

[49] On a policy level, the trial judge was also of the view that barring the<br />

subrogated action would impair the duty of care owned by FCL to Scott, contrary to<br />

s. 2(4)(b) of the Warehouse Receipt Act. He noted that there were no Canadian<br />

cases on point, but that in two American decisions, Brown v. Sloan’s Moving &<br />

Storage Co., 296 SW2d 20 (S.C. Mo., 1956) and Kimberley-<strong>Clark</strong> Corporation<br />

v. Lake Erie Warehouse, Division of Lake Erie Rolling Mill Inc. 375 NYS2d 918, 49<br />

A 2d 492 (S.C., App. Div.), the courts had declined to give effect to clauses requiring<br />

a bailor to obtain its own insurance, on the basis that the bailee should not be<br />

exempted from its contractual or statutory duties of care. As well, the trial judge<br />

said, disallowing the subrogated claim in this instance would “make meaningless”<br />

the indemnification provisions at para. 12 of the WMA, under which each of Scott<br />

and FCL had covenanted to hold the other harmless from all losses and claims<br />

arising, inter alia, from property damage ‘related to’ the negligence of the other.<br />

Given the policy implications of barring a party from enforcing its rights to indemnity,<br />

he suggested that very clear and specific language would be required for that<br />

purpose.<br />

2013 BCCA 3 (CanLII)<br />

[50] In the result, he held that there was no bar to the subrogated claim against<br />

FCL. The claim was allowed as against both defendants, with damages to be<br />

assessed at a later date.<br />

On Appeal<br />

[51] In this court, the defendants submit that the trial judge erred in declining to<br />

apply the “covenant to insure” principle established by the trilogy and in particular, in<br />

distinguishing bailment situations from the landlord-tenant and complex construction

Kruger Products Limited v. First Choice Logistics Inc. Page 25<br />

situations discussed in the authorities. In the defendants’ submission, the trial<br />

judge’s concern regarding the “impairment” of the warehouser’s standard of care is<br />

based on a misapprehension of both the immunity defence and the intent of the<br />

Warehouse Receipt Act. It is said that Scott’s covenant to insure and to name FCL<br />

as an insured in respect of the primary coverage for liability and property damage<br />

must be construed “in effect as an assumption by that party [here, Scott] of the risk<br />

of loss or damage caused by the peril to be insured against”. (Madison, at 85.) The<br />

defendants say that para. 17A of the WMA was, like the subject clause in Ross<br />

Southward, intended to benefit FCL, and that FCL did have an insurable interest in<br />

the contents of the warehouse, contrary to the trial judge’s holding. I will attempt to<br />

deal with each of these arguments below.<br />

2013 BCCA 3 (CanLII)<br />

Does a Warehouser have an Insurable Interest in the Stored Goods?<br />

[52] It seems to me that this question was answered by the Supreme Court of<br />

Canada in Commonwealth. As seen above, de Grandpré J. for the Court observed<br />

that in the field of bailment “in the widest sense”, persons other than the owner have<br />

been held to have insurable interests in the subject property “because of their<br />

special relationship with the property entailing [the] possibility of liability.” (At 322-<br />

23.) His Lordship cited various English and Canadian cases but found it necessary<br />

to refer only to Smith v. Stevenson [1942] 1 D.L.R. 681 (Ont. C.A.). I repeat here for<br />

convenience the observations of de Grandpré J.:<br />

... Although these judgments were pronounced on policies issued to the<br />

bailee and not to the owner and all other interested parties, as in the case at<br />

bar, I do not see that circumstance making any difference when it comes to<br />

determining the existence or non-existence of an insurable interest in a<br />

person who is not the owner of a property.<br />

In all these cases, there existed an underlying contract whereby the owner of<br />

the goods had given possession thereof to the party claiming full insurable<br />

interest in them based on a special relationship therewith. ... By recognizing<br />

in all tradesmen an insurable interest based on that very real possibility [of<br />

damage by one tradesman to the property of another], which itself has its<br />

source in the contractual arrangements opening the doors of the job site to<br />

the tradesmen, the courts would apply to the construction field the principle<br />

expressed so long ago in the area of bailment. [At 323-24; emphasis added.]

Kruger Products Limited v. First Choice Logistics Inc. Page 26<br />

[53] These comments are consistent with many venerable English and American<br />

cases. The locus classicus is Waters et al. v. Monarch Fire and Life Assurance Co.<br />

[1843-60] All E.R. Rep 654 (Q.B.), where it was held that two insurance policies<br />

taken out by the plaintiff warehousers were not limited to the amount of their charges<br />

(for which they had a lien on the goods) but extended to the “whole amount of the<br />

loss.” The majority relied on an analogy to trust, given that the goods had been<br />

‘entrusted’ to the bailee. Waters was adopted by the U.S. Supreme Court in<br />

Phoenix Insurance Co. v. Eerie and Western Transportation Co. 117 U.S. 873<br />

(1886). More recently, the principle was affirmed in England in Hepburn<br />

v. A. Tomlinson (Hauliers) Ltd. [1966] 1 All E.R. 418 (H.L.), at 421 and in Petrofina<br />

(U.K.) Ltd. v. Magnaload Ltd. [1983] 3 All E.R. 35 (Q.B.), at 40-3, where the Court<br />

cited and agreed with Commonwealth. See also Nicholas Legh-Jones, John Birds,<br />

David C. Owen, eds., MacGillivray On Insurance Law, (10th ed., 2003) at §1-137;<br />

Norman Palmer, Palmer on Bailment (3d ed., 2009) at §1-060 and ch. 39 generally;<br />

and ch. 4 of N. Palmer and E. McKendrick, Interests in Goods (2 nd ed., 1998), by<br />

John Birds.<br />

2013 BCCA 3 (CanLII)<br />

[54] Obviously in this case, the warehouser was subject to the “possibility of<br />

liability” under the WMA. I conclude that the trial judge erred in ruling that FCL did<br />

not or could not be said to have an insurable interest in the property that was<br />

destroyed by the fire.<br />

[55] Even if it were otherwise, this court has already held that the absence of an<br />

insurable interest given to a tenant under the landlord’s insurance policy is not<br />

determinative of the question of tort immunity. In North Newton, the lease in<br />

question provided expressly that no insurable interest would be conferred on the<br />

tenant under the policies of insurance to be carried by the landlord, and further that<br />

the landlord’s insurance would not cover any of the tenant’s property. Hall J.A. for<br />

the Court stated:<br />

In my opinion, the fact that no insurable interest is given to the tenant under<br />

the landlord's policy is not determinative. That issue was considered in the<br />

case of Amexon Realty Inc. v. Comcheq Services Ltd. (1998), 37 O.R. (3d)<br />

573, 155 D.L.R. (4th) 661 (C.A.). That was a case in which, as in the case at<br />

bar, the landlord was required to insure and the tenant was obliged to

Kruger Products Limited v. First Choice Logistics Inc. Page 27<br />

contribute to the premiums. The Ontario Court of Appeal held that the insurer<br />

could not pursue a subrogated claim against the tenant. Reference was<br />

made to the Supreme Court of Canada trilogy. On the question of insurable<br />

interest, Goudge J.A. said this at 576:<br />

It is true that the lease provides that the tenant has no<br />

insurable interest under the landlord's policy. While this<br />

provision would presumably preclude the tenant from asserting<br />

a claim for his own loss under that policy, it does not speak to<br />

the claim asserted by the appellant in this case. It is the<br />

bargain I have referred to rather than the tenant having an<br />

insurable interest under the landlord's policy that is the basis<br />

upon which this action is precluded.<br />

I agree with this reasoning.<br />

It does not appear to me that the clause stating the insurance of the landlord<br />

is not to cover property of the tenant has much relevance in the<br />

circumstances of this case. This case is concerned with damage to the<br />

building. [At paras. 36-7; emphasis added.]<br />

2013 BCCA 3 (CanLII)<br />

I know of no reason in principle why similar reasoning would not extend to the<br />

bailment context or to the case at bar.<br />

Impairment of Standard of Care?<br />

[56] With respect to the trial judge’s policy concerns regarding the warehouser’s<br />

obligation to indemnify Scott for negligent acts, I must also, with the greatest of<br />

respect, disagree. First, I do not see any conflict between a general covenant to<br />

indemnify given by a warehouser (in this case, by FCL at para. 12 of the WMA), and<br />

insurance provisions such as para. 17A. Indeed one may see insurance covenants<br />

as a means of strengthening indemnification obligations, which alone are only as<br />

strong as the indemnifier’s particular financial circumstances. Furthermore, the<br />

obligation of a negligent warehouser to indemnify its bailor for breaches of its duty of<br />

care arises even without a provision such as para. 12. It would make no commercial<br />

sense to permit an indemnity provision to overwhelm or supersede an insurance<br />

provision such as para. 17A ‒ the “supervening covenant” discussed in T. Eaton. As<br />

was stated in Economical Mutual Insurance Co. v. 1072871 Ontario Ltd. [1998] 20<br />

R.P.R. (3d) 154 (Ont. Ct. J. (Gen. Div.)), aff’d (1999) 9 C.C.L.I. (3d) 224:<br />

Counsel for the plaintiff further seeks to distinguish the T. Eaton case on the<br />

basis that para. 8(1) of the lease before me contains a provision requiring the

Kruger Products Limited v. First Choice Logistics Inc. Page 28<br />

tenant to keep the Landlord indemnified with respect to any damage to the<br />

premises occasioned by the negligence of the tenant ... whereas there is no<br />

such provision in the leases in the T. Eaton case.<br />

I do not accept this submission. In my view para. 8(2) does not impose upon<br />

the tenant any greater liability for fire caused by its negligence than exists in<br />

the absence of such a provision ...<br />

...<br />