ADVIS Financial Strategies - Woodlynde School

ADVIS Financial Strategies - Woodlynde School

ADVIS Financial Strategies - Woodlynde School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

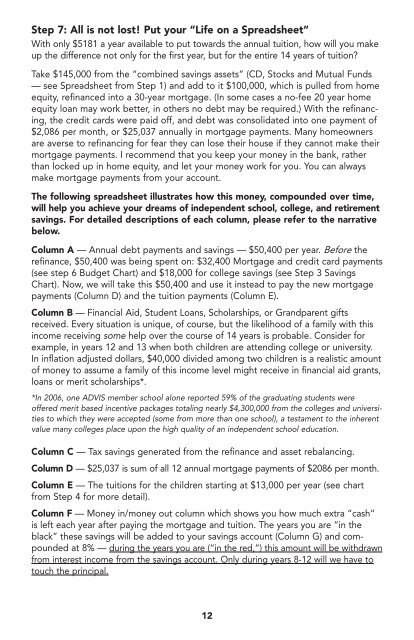

Step 7: All is not lost! Put your “Life on a Spreadsheet”<br />

With only $5181 a year available to put towards the annual tuition, how will you make<br />

up the difference not only for the first year, but for the entire 14 years of tuition?<br />

Take $145,000 from the “combined savings assets” (CD, Stocks and Mutual Funds<br />

— see Spreadsheet from Step 1) and add to it $100,000, which is pulled from home<br />

equity, refinanced into a 30-year mortgage. (In some cases a no-fee 20 year home<br />

equity loan may work better, in others no debt may be required.) With the refinancing,<br />

the credit cards were paid off, and debt was consolidated into one payment of<br />

$2,086 per month, or $25,037 annually in mortgage payments. Many homeowners<br />

are averse to refinancing for fear they can lose their house if they cannot make their<br />

mortgage payments. I recommend that you keep your money in the bank, rather<br />

than locked up in home equity, and let your money work for you. You can always<br />

make mortgage payments from your account.<br />

The following spreadsheet illustrates how this money, compounded over time,<br />

will help you achieve your dreams of independent school, college, and retirement<br />

savings. For detailed descriptions of each column, please refer to the narrative<br />

below.<br />

Column A — Annual debt payments and savings — $50,400 per year. Before the<br />

refinance, $50,400 was being spent on: $32,400 Mortgage and credit card payments<br />

(see step 6 Budget Chart) and $18,000 for college savings (see Step 3 Savings<br />

Chart). Now, we will take this $50,400 and use it instead to pay the new mortgage<br />

payments (Column D) and the tuition payments (Column E).<br />

Column B — <strong>Financial</strong> Aid, Student Loans, Scholarships, or Grandparent gifts<br />

received. Every situation is unique, of course, but the likelihood of a family with this<br />

income receiving some help over the course of 14 years is probable. Consider for<br />

example, in years 12 and 13 when both children are attending college or university.<br />

In inflation adjusted dollars, $40,000 divided among two children is a realistic amount<br />

of money to assume a family of this income level might receive in financial aid grants,<br />

loans or merit scholarships*.<br />

*In 2006, one <strong>ADVIS</strong> member school alone reported 59% of the graduating students were<br />

offered merit based incentive packages totaling nearly $4,300,000 from the colleges and universities<br />

to which they were accepted (some from more than one school), a testament to the inherent<br />

value many colleges place upon the high quality of an independent school education.<br />

Column C — Tax savings generated from the refinance and asset rebalancing.<br />

Column D — $25,037 is sum of all 12 annual mortgage payments of $2086 per month.<br />

Column E — The tuitions for the children starting at $13,000 per year (see chart<br />

from Step 4 for more detail).<br />

Column F — Money in/money out column which shows you how much extra “cash”<br />

is left each year after paying the mortgage and tuition. The years you are “in the<br />

black” these savings will be added to your savings account (Column G) and compounded<br />

at 8% — during the years you are (“in the red,”) this amount will be withdrawn<br />

from interest income from the savings account. Only during years 8-12 will we have to<br />

touch the principal.<br />

12