investments fin 4432 · f all semester 2012 · s - the Sorrell College of ...

investments fin 4432 · f all semester 2012 · s - the Sorrell College of ...

investments fin 4432 · f all semester 2012 · s - the Sorrell College of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

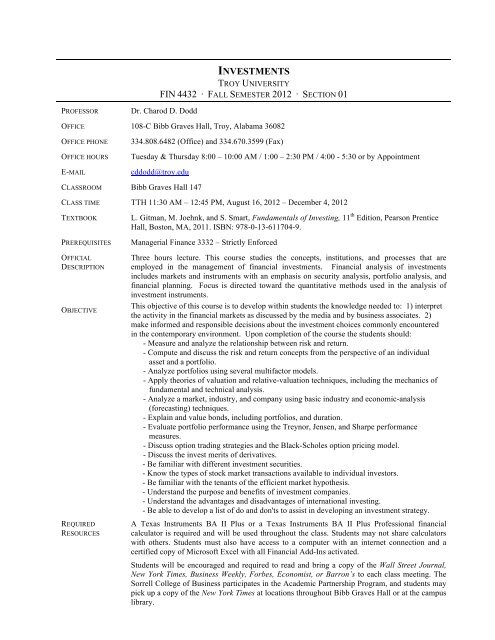

PROFESSOR<br />

INVESTMENTS<br />

TROY UNIVERSITY<br />

FIN <strong>4432</strong> <strong>·</strong> FALL SEMESTER <strong>2012</strong> <strong>·</strong> SECTION 01<br />

Dr. Charod D. Dodd<br />

OFFICE 108-C Bibb Graves H<strong>all</strong>, Troy, Alabama 36082<br />

OFFICE PHONE<br />

OFFICE HOURS<br />

E-MAIL<br />

334.808.6482 (Office) and 334.670.3599 (Fax)<br />

Tuesday & Thursday 8:00 – 10:00 AM / 1:00 – 2:30 PM / 4:00 - 5:30 or by Appointment<br />

cddodd@troy.edu<br />

CLASSROOM Bibb Graves H<strong>all</strong> 147<br />

CLASS TIME TTH 11:30 AM – 12:45 PM, August 16, <strong>2012</strong> – December 4, <strong>2012</strong><br />

TEXTBOOK<br />

PREREQUISITES<br />

OFFICIAL<br />

DESCRIPTION<br />

OBJECTIVE<br />

REQUIRED<br />

RESOURCES<br />

L. Gitman, M. Joehnk, and S. Smart, Fundamentals <strong>of</strong> Investing, 11 th Edition, Pearson Prentice<br />

H<strong>all</strong>, Boston, MA, 2011. ISBN: 978-0-13-611704-9.<br />

Managerial Finance 3332 – Strictly Enforced<br />

Three hours lecture. This course studies <strong>the</strong> concepts, institutions, and processes that are<br />

employed in <strong>the</strong> management <strong>of</strong> <strong>fin</strong>ancial <strong>investments</strong>. Financial analysis <strong>of</strong> <strong>investments</strong><br />

includes markets and instruments with an emphasis on security analysis, portfolio analysis, and<br />

<strong>fin</strong>ancial planning. Focus is directed toward <strong>the</strong> quantitative methods used in <strong>the</strong> analysis <strong>of</strong><br />

investment instruments.<br />

This objective <strong>of</strong> this course is to develop within students <strong>the</strong> knowledge needed to: 1) interpret<br />

<strong>the</strong> activity in <strong>the</strong> <strong>fin</strong>ancial markets as discussed by <strong>the</strong> media and by business associates. 2)<br />

make informed and responsible decisions about <strong>the</strong> investment choices commonly encountered<br />

in <strong>the</strong> contemporary environment. Upon completion <strong>of</strong> <strong>the</strong> course <strong>the</strong> students should:<br />

- Measure and analyze <strong>the</strong> relationship between risk and return.<br />

- Compute and discuss <strong>the</strong> risk and return concepts from <strong>the</strong> perspective <strong>of</strong> an individual<br />

asset and a portfolio.<br />

- Analyze portfolios using several multifactor models.<br />

- Apply <strong>the</strong>ories <strong>of</strong> valuation and relative-valuation techniques, including <strong>the</strong> mechanics <strong>of</strong><br />

fundamental and technical analysis.<br />

- Analyze a market, industry, and company using basic industry and economic-analysis<br />

(forecasting) techniques.<br />

- Explain and value bonds, including portfolios, and duration.<br />

- Evaluate portfolio performance using <strong>the</strong> Treynor, Jensen, and Sharpe performance<br />

measures.<br />

- Discuss option trading strategies and <strong>the</strong> Black-Scholes option pricing model.<br />

- Discuss <strong>the</strong> invest merits <strong>of</strong> derivatives.<br />

- Be familiar with different investment securities.<br />

- Know <strong>the</strong> types <strong>of</strong> stock market transactions available to individual investors.<br />

- Be familiar with <strong>the</strong> tenants <strong>of</strong> <strong>the</strong> efficient market hypo<strong>the</strong>sis.<br />

- Understand <strong>the</strong> purpose and benefits <strong>of</strong> investment companies.<br />

- Understand <strong>the</strong> advantages and disadvantages <strong>of</strong> international investing.<br />

- Be able to develop a list <strong>of</strong> do and don'ts to assist in developing an investment strategy.<br />

A Texas Instruments BA II Plus or a Texas Instruments BA II Plus Pr<strong>of</strong>essional <strong>fin</strong>ancial<br />

calculator is required and will be used throughout <strong>the</strong> class. Students may not share calculators<br />

with o<strong>the</strong>rs. Students must also have access to a computer with an internet connection and a<br />

certified copy <strong>of</strong> Micros<strong>of</strong>t Excel with <strong>all</strong> Financial Add-Ins activated.<br />

Students will be encouraged and required to read and bring a copy <strong>of</strong> <strong>the</strong> W<strong>all</strong> Street Journal,<br />

New York Times, Business Weekly, Forbes, Economist, or Barron’s to each class meeting. The<br />

<strong>Sorrell</strong> <strong>College</strong> <strong>of</strong> Business participates in <strong>the</strong> Academic Partnership Program, and students may<br />

pick up a copy <strong>of</strong> <strong>the</strong> New York Times at locations throughout Bibb Graves H<strong>all</strong> or at <strong>the</strong> campus<br />

library.

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

ACADEMIC<br />

INTEGRITY<br />

POLICY<br />

IMPORTANT<br />

DATES<br />

STUDENT<br />

ASSISTANCE<br />

EXAM<br />

POLICY<br />

ASSIGNMENT<br />

POLICY<br />

GRADING<br />

POLICY<br />

FINAL GRADE<br />

POLICY<br />

Academic dishonesty is not tolerated. All occurrences <strong>of</strong> academic misconduct will be addressed<br />

in accordance with guidelines and procedures outlined in <strong>the</strong> ORACLE: Student Handbook and<br />

Troy University approved Honor Code that applies to <strong>all</strong> students. The code is as follows:<br />

"As a Troy University student I will conduct myself with honor and integrity at <strong>all</strong> times. I will<br />

not lie, cheat, or steal, nor will I accept <strong>the</strong> actions <strong>of</strong> those who do."<br />

Upon accepting admission to Troy University, a student immediately assumes a commitment to<br />

uphold <strong>the</strong> Honor Code, to accept responsibility for learning, and to follow <strong>the</strong> philosophy and<br />

rules <strong>of</strong> <strong>the</strong> Honor Code. Students will be required to state <strong>the</strong>ir commitment on examinations,<br />

research papers, and o<strong>the</strong>r academic work. Ignorance <strong>of</strong> <strong>the</strong> rules does not exclude any member<br />

<strong>of</strong> <strong>the</strong> Troy University community from <strong>the</strong> requirements or <strong>the</strong> processes <strong>of</strong> <strong>the</strong> Honor Code.<br />

Plagiarism, cheating, or dishonesty will cause a student to get a course grade <strong>of</strong> “F” and may<br />

result in suspension from <strong>the</strong> university for a specific or inde<strong>fin</strong>ite period <strong>of</strong> time.<br />

Monday, August 20, <strong>2012</strong> – Last day to drop, add a class, or withdraw without <strong>fin</strong>ancial penalty.<br />

Friday, October 19, <strong>2012</strong> – Last day to drop a course or withdraw without academic penalty.<br />

Tuesday, December 11, <strong>2012</strong> – Final Exam, 147 Bibb Graves H<strong>all</strong>, 2:00 PM – 4:00 PM.<br />

Students can meet with me during scheduled <strong>of</strong>fice hours listed above or arrange an appointment<br />

via e-mail. I will gener<strong>all</strong>y respond to e-mail messages within 24 hours. Please be specific when<br />

asking questions via e-mail.<br />

There will be three exams and a cumulative <strong>fin</strong>al exam administered during <strong>the</strong> course. All<br />

exams will be held during regular class hours or exam dates noted in <strong>the</strong> class schedule. Exam<br />

dates are fixed and will not be changed unless <strong>the</strong> University is closed.<br />

Each student is expected to adjust his or her schedule to fit <strong>the</strong>se exam times. A missed exam<br />

will result in a zero for <strong>the</strong> exam unless <strong>the</strong> student presents a legitimate, university approved<br />

excuse at least 24 hours prior to <strong>the</strong> scheduled exam. If <strong>the</strong> excuse is verifiable and f<strong>all</strong>s under<br />

<strong>the</strong> university’s policy, <strong>the</strong> cumulative <strong>fin</strong>al exam will substitute for <strong>the</strong> missed exam.<br />

Homework assignments, quizzes, discussion, and an Investment Project will be administered<br />

during <strong>the</strong> <strong>semester</strong>. Assignment may require that <strong>the</strong> student read <strong>the</strong> textbook in advance to <strong>the</strong><br />

material being covered in class. Moreover, each assignment may cover textbook material which<br />

will not be presented in class. Each assignment will be graded for accuracy. Additional details<br />

will be provided on <strong>the</strong> first day <strong>of</strong> class.<br />

There are 600 total points in <strong>the</strong> course. Four exams account for 100 points each. Quizzes <strong>all</strong>ow<br />

for 105 points, discussion topics <strong>all</strong>ow for 40, and <strong>the</strong> Investment Project <strong>all</strong>ows for 55 points.<br />

Letter grades are assigned by <strong>the</strong> total points earned, not percentages: 540+ is an A, 480–539 is a<br />

B, 420–479 is a C, 360–419 is a D, and below 359 is an F.<br />

Please note that <strong>all</strong> <strong>fin</strong>al grades are calculated on a cumulative point system, not a percentage<br />

system. That is, <strong>the</strong>re are 600 available points in <strong>the</strong> course. If a student has accumulated a total<br />

<strong>of</strong> 539 points (89.83 percent) at <strong>the</strong> end <strong>of</strong> <strong>the</strong> course, <strong>the</strong> <strong>fin</strong>al grade will be recorded as a B.<br />

Unless <strong>the</strong>re is an error in your <strong>fin</strong>al grade calculation, do not contact me after <strong>the</strong> <strong>fin</strong>al exam to<br />

request that your letter grade be changed. I will not give an extra assignment or change grades<br />

for any reason except in cases where <strong>the</strong>re is an error in <strong>the</strong> calculation <strong>of</strong> <strong>the</strong> <strong>fin</strong>al grade. No<br />

exceptions. Students who ignore this policy will forfeit one letter grade.<br />

PAGE 2 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

ADDITIONAL<br />

REQUIREMENTS<br />

AND POLICIES<br />

CELL PHONE<br />

POLICY<br />

ADA<br />

POLICY<br />

DISCLAIMER<br />

A business-like demeanor is expected <strong>of</strong> <strong>all</strong> students in <strong>all</strong> aspects <strong>of</strong> <strong>the</strong> course, e.g., attendance,<br />

tardiness, preparation, class discussion, assignments, examinations.<br />

Students are not permitted to use a recording device (audio or video) in class.<br />

Students may not wear headgear <strong>of</strong> any kind during an exam. Students who must wear headgear<br />

for medical reasons are exempt from this policy upon written documentation <strong>of</strong> medical<br />

necessity from a qualified medical physician.<br />

Students who miss a class, for whatever reason, should obtain <strong>all</strong> notes and assignments from a<br />

fellow classmate. I do not give out my lecture notes to anyone for any reason. In addition, I do<br />

not support cramming, thus I will not answer questions about homework on <strong>the</strong> day it is due. I<br />

also require evidence <strong>of</strong> your work on an assignment before providing direction or advice.<br />

Unless you have prior approval for a specific class day, please turn <strong>of</strong>f <strong>all</strong> cell phones when you<br />

enter <strong>the</strong> classroom. Violations <strong>of</strong> this policy will not be tolerated. If a student’s cell phone rings<br />

during a lecture he or she will be excused from class for <strong>the</strong> remainder <strong>of</strong> <strong>the</strong> class day.<br />

Cell phones and Bluetooth devices should not be visible during an exam. If <strong>the</strong> instructor sees or<br />

hears a student’s cell phone during an exam <strong>the</strong> student will be excused from <strong>the</strong> exam with a zero.<br />

Students who have special needs as addressed by <strong>the</strong> Americans with Disabilities Act should<br />

speak with <strong>the</strong> instructor, contact <strong>the</strong> Office <strong>of</strong> Adaptive Needs Program (Wright H<strong>all</strong> 226), or<br />

c<strong>all</strong> 334.670.3220/3221. Various accommodations are available through <strong>the</strong> Adaptive Needs<br />

Program.<br />

The faculty in <strong>the</strong> School <strong>of</strong> Business makes every effort to accommodate unique and special<br />

needs <strong>of</strong> students with respect to speech, hearing, vision, seating, or o<strong>the</strong>r possible disabling<br />

conditions. Please notify <strong>the</strong> instructor as soon as possible <strong>of</strong> requested accommodations or<br />

ways to help.<br />

The instructor reserves <strong>the</strong> right to modify this syllabus as necessary.<br />

PAGE 3 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

MODULE 1: PREPARING TO INVEST & IMPORTANT CONCEPTUAL TOOLS<br />

Thursday August 16 Introduction Course Introduction<br />

Tuesday August 21 Chapter 1 The Investment Environment I<br />

Thursday August 23 Chapter 1 The Investment Environment II<br />

Tuesday August 28 Chapter 2 Securities Markets and Transactions I<br />

Thursday August 30 Chapter 2 Securities Markets and Transactions II<br />

Tuesday September 4 Chapter 3 Investment Information and Securities Transactions I<br />

Thursday September 6 Chapter 3 Investment Information and Securities Transactions II<br />

Tuesday September 11 Chapter 4 Return and Risk I<br />

Thursday September 13 Chapter 4 Return and Risk II<br />

Tuesday September 18 Chapter 5 Modern Portfolio Concepts I<br />

Thursday September 20 Chapter 5 Modern Portfolio Concepts II<br />

Tuesday September 25 Exam I Exam I: 11:30 AM – 12:45 PM<br />

MODULE 2: INVESTING IN COMMON STOCK & INVESTING IN FIXED-INCOME SECURITIES<br />

Thursday September 27 Chapter 6 Common Stocks I<br />

Tuesday October 2 Chapter 6 Common Stocks II<br />

Thursday October 4 Chapter 7 Analyzing Common Stocks I<br />

Tuesday October 9 Chapter 7 Analyzing Common Stocks II<br />

Thursday October 11 Chapter 8 Stock Valuation I<br />

Tuesday October 16 Chapter 8 Stock Valuation II<br />

Thursday October 18 Group Project Group Project Work Day<br />

Tuesday October 23 Chapter 10 Fixed-Income Securities I & II<br />

Thursday October 25 Chapter 11 Bond Valuation I<br />

Tuesday October 30 Chapter 11 Bond Valuation II<br />

Thursday November 1 Exam II Exam II: 11:30 AM – 12:45 PM<br />

MODULE 3: PORTFOLIO MANAGEMENT & DERIVATIVE SECURITIES<br />

Tuesday November 6 Chapter 12 Mutual Funds: Pr<strong>of</strong>ession<strong>all</strong>y Managed Portfolios<br />

Thursday November 8 Chapter 13 Managing Your Own Portfolio<br />

Tuesday<br />

Thursday<br />

November 13<br />

November 15<br />

Chapter 14<br />

Chapter 14<br />

Tuesday November 20 Troy Campus F<strong>all</strong> Break<br />

Thursday<br />

Tuesday<br />

November 22<br />

November 27<br />

Holiday<br />

Project<br />

Options: Puts and C<strong>all</strong>s I<br />

Options: Puts and C<strong>all</strong>s II<br />

Thanksgiving<br />

Project Deadline<br />

Tuesday November 27 Chapter 15 Commodities and Financial Futures<br />

Thursday November 29 Exam III Exam III: 11:30 AM – 12:45 PM<br />

MODULE 4: COMPREHENSIVE FINAL EXAM<br />

Tuesday December 4 Review Final Exam Review<br />

Tuesday December 11 Exam IV Comprehensive Exam IV: 2:00 PM – 4:00 PM<br />

END OF COURSE<br />

PAGE 4 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

THIS PAGE WAS INTENTIONALLY LEFT BLANK<br />

PAGE 5 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

PROJECT<br />

OVERVIEW<br />

ADDITIONAL<br />

POLICIES<br />

DEADLINES<br />

COMPENSATION<br />

SCHEME<br />

INVESTMENT CONSULTING PROJECT<br />

TROY UNIVERSITY<br />

REAL ESTATE <strong>4432</strong> – FALL SEMESTER <strong>2012</strong> – SECTION 01<br />

Congratulations, you have just completed your degree at Troy University and you have accepted a<br />

position as a research analyst in <strong>the</strong> equities division <strong>of</strong> Dodd Financial, a regional <strong>fin</strong>ancial<br />

services firm providing <strong>fin</strong>ancial consulting services to investors in <strong>the</strong> sou<strong>the</strong>astern United States.<br />

A national equities investment company recently approached Dodd Financial seeking to make a<br />

sizeable investment in Alabama. While our client is a major equities and fixed income securities<br />

investor for pension funds, your analysis should be based on <strong>the</strong> attractiveness <strong>of</strong> <strong>the</strong> stock as a<br />

stand-alone asset. That is, ignore any portfolio or corporate objective issues. The client faces a<br />

28% marginal tax rate, prefers more wealth to less, is risk averse, and has no passive income.<br />

As research analysts in <strong>the</strong> equities division you will identify three suitable stocks. Each student<br />

sh<strong>all</strong> select a stock according to <strong>the</strong> first letter <strong>of</strong> <strong>the</strong>ir last name. You will <strong>the</strong>n conduct a detailed<br />

analysis <strong>of</strong> <strong>the</strong> stock and make a recommendation to our client in <strong>the</strong> form <strong>of</strong> a written, formal<br />

report. The ultimate question to be answered by your analysis is as follows: Under <strong>the</strong> current<br />

market conditions we strongly recommend our client to purchase <strong>the</strong> securities?<br />

The essay part <strong>of</strong> <strong>the</strong> project must be typed and double-spaced using word processor (Micros<strong>of</strong>t<br />

Word or Pages) and consists <strong>of</strong> <strong>the</strong> name <strong>of</strong> <strong>the</strong> stock, <strong>the</strong> ticker symbol, industry, and <strong>the</strong> stock<br />

market where <strong>the</strong> stock is traded. The following four sections should make up <strong>the</strong> body <strong>of</strong> <strong>the</strong><br />

report: SECTION IV: An Overview, SECTION V: Competition, SECTION VI: Financial<br />

Characteristics and Pr<strong>of</strong>itability, SECTION VII: Future Prospect<br />

The results <strong>of</strong> your analysis must be presented in a formal feasibility report using <strong>the</strong> outline<br />

provided on <strong>the</strong> following page. Analysts are expected to make full use <strong>of</strong> <strong>the</strong> tools and techniques<br />

discussed in typical Finance principles and Investments courses, as well as your own creative and<br />

analytical abilities.<br />

Each research analyst is expected to make this a pr<strong>of</strong>essional document <strong>of</strong> <strong>the</strong> highest standard,<br />

and plagiarism will result in dismissal from <strong>the</strong> firm. Using double-spaced typed pages, figures,<br />

and tables, please contain your remarks to 5–10 pages exclusive <strong>of</strong> <strong>the</strong> cover page, table <strong>of</strong><br />

contents, and executive summary.<br />

Remember that <strong>the</strong> company places a priority on accuracy <strong>of</strong> your analysis but we also reward<br />

creativity, pr<strong>of</strong>essionalism, and insightful analysis. The compensation you receive will be<br />

determined by how well you meet <strong>the</strong>se expectations. A copy <strong>of</strong> your report will be provided to <strong>the</strong><br />

listing agent and owners <strong>of</strong> <strong>the</strong> property you evaluate. You may legitimately access any<br />

pr<strong>of</strong>essional sources willing to assist you.<br />

Hastily-prepared reports, plagiarized reports, reports with excessive grammatical errors, and<br />

reports without <strong>all</strong> <strong>of</strong> <strong>the</strong> required components will not be accepted.<br />

Final drafts <strong>of</strong> <strong>the</strong> reports are due on Tuesday, November 27, <strong>2012</strong> by 11:30 AM. Submit a printed<br />

and bound copy <strong>of</strong> your <strong>fin</strong>al report in a sealed envelope addressed to Dr. Dodd using <strong>the</strong> contact<br />

information at <strong>the</strong> top <strong>of</strong> this syllabus.<br />

Creativity and Pr<strong>of</strong>essionalism:<br />

Content Accuracy:<br />

Analysis and Application:<br />

Total Points Available:<br />

15 Points<br />

15 Points<br />

25 Points<br />

55 Points<br />

PAGE 6 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

All investment research reports for Dodd Financial contain <strong>the</strong> following sections:<br />

I. Cover Page<br />

II. Table <strong>of</strong> Contents for All Report Sections, Tables, and Figures, References<br />

III. Executive Summary <strong>of</strong> Important Facts and Conclusions<br />

IV.<br />

Brief history<br />

V. Analysis<br />

1. Economic Analysis<br />

The economic analysis is <strong>the</strong> first step in <strong>the</strong> traditional analysis.<br />

The following economic factor effects on each stock chosen, should be discussed<br />

here:<br />

Business cycle<br />

GDP<br />

Industrial production<br />

Over<strong>all</strong> Savings Vs. Consumption<br />

Taxes<br />

Government Spending<br />

Debt Management<br />

Money Supply<br />

Interest Rates<br />

Inflation<br />

Consumer Spending<br />

Business Investments<br />

Foreign Trade and Foreign Exchange rates<br />

Refer to textbook pages 250 – 254.<br />

PAGE 7 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

2. Industry Analysis<br />

The first step in <strong>the</strong> industry analysis is to establish <strong>the</strong> competitive position <strong>of</strong> a particular<br />

industry in relation to o<strong>the</strong>rs. Then, identify companies within <strong>the</strong> industry that hold<br />

particular promise.<br />

The following are discussion question that you would want to discuss in this section:<br />

a. Financial makeup, basic characteristics, <strong>fin</strong>ancial ratios about performance<br />

<strong>of</strong> <strong>the</strong> company as compared to <strong>the</strong> industry<br />

b. What is <strong>the</strong> nature <strong>of</strong> <strong>the</strong> industry? Is it monopolistic, or are <strong>the</strong>re many<br />

competitors? Do a few set <strong>the</strong> trend for <strong>the</strong> rest, and if so, who are those<br />

few?<br />

c. To what extent is <strong>the</strong> industry regulated? If so, how “friendly” are <strong>the</strong><br />

regulatory bodies?<br />

d. What role does labor play in <strong>the</strong> industry? How important are labor<br />

unions? Are <strong>the</strong>re good labor relations within <strong>the</strong> industry? When is <strong>the</strong><br />

next round <strong>of</strong> contract talks?<br />

e. How important are technological developments? Are any new<br />

developments taking place? What impact are potential breakthroughs<br />

likely to have?<br />

f. Which economic forces are especi<strong>all</strong>y important to <strong>the</strong> industry? Is<br />

demand for <strong>the</strong> industry’s goods and services related to key economic<br />

variables? If so, what is <strong>the</strong> outlook for those variables? How important<br />

is foreign competition to <strong>the</strong> health <strong>of</strong> <strong>the</strong> industry?<br />

g. What are <strong>the</strong> important <strong>fin</strong>ancial and operating considerations? Is <strong>the</strong>re an<br />

adequate supply <strong>of</strong> labor, material, and capital? What are <strong>the</strong> capital<br />

spending plans and needs <strong>of</strong> <strong>the</strong> industry?<br />

Refer to textbook pages 254-258.<br />

PAGE 8 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

3. Fundamental Analysis<br />

Fundamental analysis is <strong>the</strong> study <strong>of</strong> <strong>the</strong> <strong>fin</strong>ancial affairs <strong>of</strong> a business for <strong>the</strong> purpose <strong>of</strong><br />

better understanding <strong>the</strong> company that issued <strong>the</strong> common stock. In <strong>the</strong> fundamental analysis<br />

<strong>the</strong> value <strong>of</strong> <strong>the</strong> stock is influenced by <strong>the</strong> performance <strong>of</strong> <strong>the</strong> company that issued <strong>the</strong> stock.<br />

The following should be discussed in this section:<br />

a. <strong>the</strong> competitive position <strong>of</strong> <strong>the</strong> company.<br />

b. Its composition and growth in sales.<br />

c. Pr<strong>of</strong>it margins and <strong>the</strong> dynamics <strong>of</strong> company earnings.<br />

d. The composition and liquidity <strong>of</strong> corporate resources (<strong>the</strong> company’s asset<br />

mix).<br />

e. The capital structure <strong>of</strong> <strong>the</strong> company.<br />

f. Financial statements<br />

g. Financial ratios<br />

a. Liquidity Measures<br />

b. Activity Measures<br />

c. Leverage Measures<br />

d. Pr<strong>of</strong>itability Measures<br />

e. Common Stock Measures<br />

Refer to textbook pages 258-276<br />

Recommendation<br />

VI.<br />

VII.<br />

VIII.<br />

Future Prospect<br />

Discussion <strong>of</strong> new goods, services or products, managements direction, and your pr<strong>of</strong>essional opinion about <strong>the</strong><br />

growth or lack <strong>the</strong>re <strong>of</strong> in <strong>the</strong> firm. Discuss a forecast <strong>of</strong> future cash flows, EPS, dividends, and stock price.<br />

Discuss any international opportunities for growth.<br />

Summary <strong>of</strong> Conclusions and Final Recommendation<br />

References<br />

PAGE 9 OF 10

DR. CHAROD D. DODD<br />

INVESTMENTS<br />

PROFESSOR OF FINANCE FIN <strong>4432</strong> – SECTION 01<br />

SORRELL COLLEGE OF BUSINESS FALL SEMESTER <strong>2012</strong><br />

THIS PAGE WAS INTENTIONALLY LEFT BLANK<br />

PAGE 10 OF 10