Creditor Protection for Life Insurance and Annuities

Creditor Protection for Life Insurance and Annuities

Creditor Protection for Life Insurance and Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

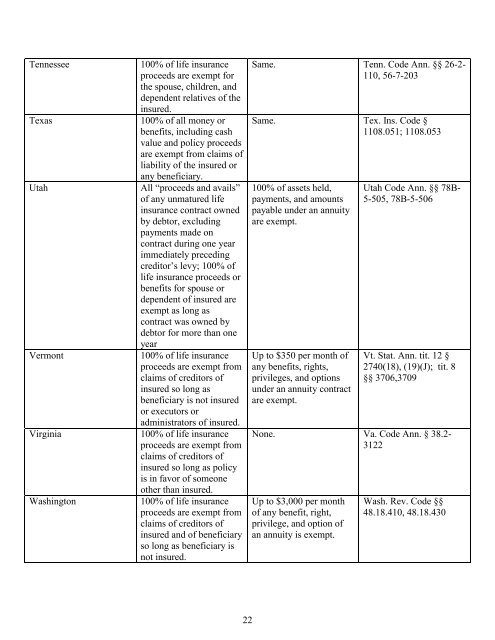

Tennessee<br />

Texas<br />

Utah<br />

Vermont<br />

Virginia<br />

Washington<br />

100% of life insurance<br />

proceeds are exempt <strong>for</strong><br />

the spouse, children, <strong>and</strong><br />

dependent relatives of the<br />

insured.<br />

100% of all money or<br />

benefits, including cash<br />

value <strong>and</strong> policy proceeds<br />

are exempt from claims of<br />

liability of the insured or<br />

any beneficiary.<br />

All “proceeds <strong>and</strong> avails”<br />

of any unmatured life<br />

insurance contract owned<br />

by debtor, excluding<br />

payments made on<br />

contract during one year<br />

immediately preceding<br />

creditor’s levy; 100% of<br />

life insurance proceeds or<br />

benefits <strong>for</strong> spouse or<br />

dependent of insured are<br />

exempt as long as<br />

contract was owned by<br />

debtor <strong>for</strong> more than one<br />

year<br />

100% of life insurance<br />

proceeds are exempt from<br />

claims of creditors of<br />

insured so long as<br />

beneficiary is not insured<br />

or executors or<br />

administrators of insured.<br />

100% of life insurance<br />

proceeds are exempt from<br />

claims of creditors of<br />

insured so long as policy<br />

is in favor of someone<br />

other than insured.<br />

100% of life insurance<br />

proceeds are exempt from<br />

claims of creditors of<br />

insured <strong>and</strong> of beneficiary<br />

so long as beneficiary is<br />

not insured.<br />

Same. Tenn. Code Ann. §§ 26-2-<br />

110, 56-7-203<br />

Same. Tex. Ins. Code §<br />

1108.051; 1108.053<br />

100% of assets held,<br />

payments, <strong>and</strong> amounts<br />

payable under an annuity<br />

are exempt.<br />

Up to $350 per month of<br />

any benefits, rights,<br />

privileges, <strong>and</strong> options<br />

under an annuity contract<br />

are exempt.<br />

Utah Code Ann. §§ 78B-<br />

5-505, 78B-5-506<br />

Vt. Stat. Ann. tit. 12 §<br />

2740(18), (19)(J); tit. 8<br />

§§ 3706,3709<br />

None. Va. Code Ann. § 38.2-<br />

3122<br />

Up to $3,000 per month<br />

of any benefit, right,<br />

privilege, <strong>and</strong> option of<br />

an annuity is exempt.<br />

Wash. Rev. Code §§<br />

48.18.410, 48.18.430<br />

22