Lion Brewery (Ceylon) PLC Annual Report 2011 - Carson and ...

Lion Brewery (Ceylon) PLC Annual Report 2011 - Carson and ...

Lion Brewery (Ceylon) PLC Annual Report 2011 - Carson and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> of the Board of Directors on the affairs of the<br />

Company Contd.<br />

19<br />

<strong>Lion</strong> <strong>Brewery</strong> (<strong>Ceylon</strong>) <strong>PLC</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

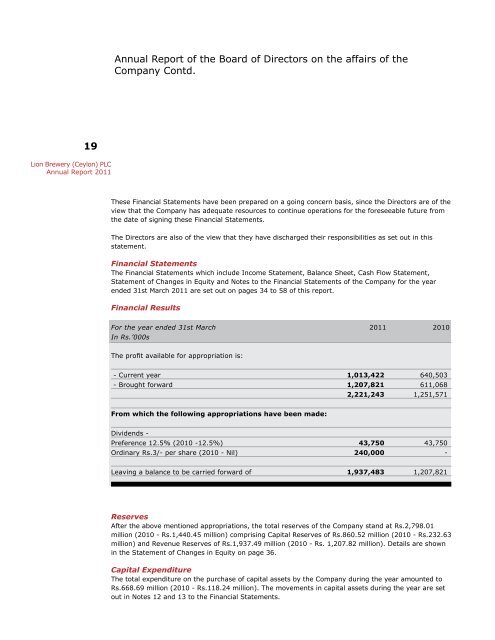

These Financial Statements have been prepared on a going concern basis, since the Directors are of the<br />

view that the Company has adequate resources to continue operations for the foreseeable future from<br />

the date of signing these Financial Statements.<br />

The Directors are also of the view that they have discharged their responsibilities as set out in this<br />

statement.<br />

Financial Statements<br />

The Financial Statements which include Income Statement, Balance Sheet, Cash Flow Statement,<br />

Statement of Changes in Equity <strong>and</strong> Notes to the Financial Statements of the Company for the year<br />

ended 31st March <strong>2011</strong> are set out on pages 34 to 58 of this report.<br />

Financial Results<br />

For the year ended 31st March <strong>2011</strong> 2010<br />

In Rs.’000s<br />

The profit available for appropriation is:<br />

- Current year 1,013,422 640,503<br />

- Brought forward 1,207,821 611,068<br />

2,221,243 1,251,571<br />

From which the following appropriations have been made:<br />

Dividends -<br />

Preference 12.5% (2010 -12.5%) 43,750 43,750<br />

Ordinary Rs.3/- per share (2010 - Nil) 240,000 -<br />

Leaving a balance to be carried forward of 1,937,483 1,207,821<br />

Reserves<br />

After the above mentioned appropriations, the total reserves of the Company st<strong>and</strong> at Rs.2,798.01<br />

million (2010 - Rs.1,440.45 million) comprising Capital Reserves of Rs.860.52 million (2010 - Rs.232.63<br />

million) <strong>and</strong> Revenue Reserves of Rs.1,937.49 million (2010 - Rs. 1,207.82 million). Details are shown<br />

in the Statement of Changes in Equity on page 36.<br />

Capital Expenditure<br />

The total expenditure on the purchase of capital assets by the Company during the year amounted to<br />

Rs.668.69 million (2010 - Rs.118.24 million). The movements in capital assets during the year are set<br />

out in Notes 12 <strong>and</strong> 13 to the Financial Statements.