main street research project - Academic Technology Center ...

main street research project - Academic Technology Center ...

main street research project - Academic Technology Center ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

efforts must set businesses up for success, not overburden<br />

and stress them. As has already been stated, the<br />

focus of the City and local support organizations must be<br />

to attract unique and diverse small businesses to Main<br />

Street and the downtown area.<br />

Entrepreneurs face a daunting task when opening a new<br />

venture and the City must be sensitive to their needs.<br />

According to the Small Business Administration, 50% of<br />

all small businesses fail within the first five years. The<br />

City must strive to improve these odds by enacting<br />

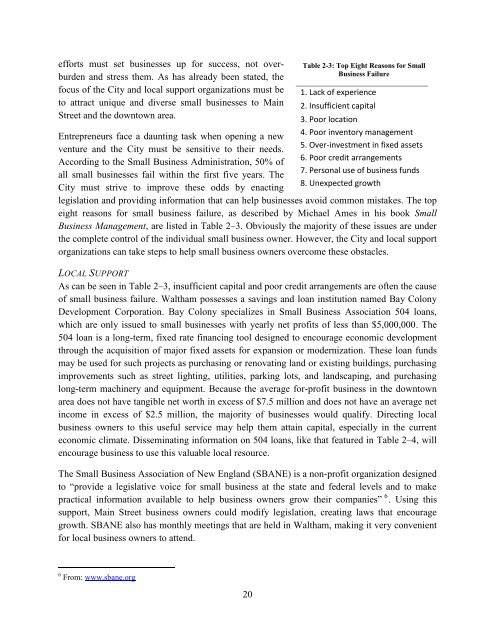

Table 2-3: Top Eight Reasons for Small<br />

Business Failure<br />

1. Lack of experience<br />

2. Insufficient capital<br />

3. Poor location<br />

4. Poor inventory management<br />

5. Over-investment in fixed assets<br />

6. Poor credit arrangements<br />

7. Personal use of business funds<br />

8. Unexpected growth<br />

legislation and providing information that can help businesses avoid common mistakes. The top<br />

eight reasons for small business failure, as described by Michael Ames in his book Small<br />

Business Management, are listed in Table 2–3. Obviously the majority of these issues are under<br />

the complete control of the individual small business owner. However, the City and local support<br />

organizations can take steps to help small business owners overcome these obstacles.<br />

LOCAL SUPPORT<br />

As can be seen in Table 2–3, insufficient capital and poor credit arrangements are often the cause<br />

of small business failure. Waltham possesses a savings and loan institution named Bay Colony<br />

Development Corporation. Bay Colony specializes in Small Business Association 504 loans,<br />

which are only issued to small businesses with yearly net profits of less than $5,000,000. The<br />

504 loan is a long-term, fixed rate financing tool designed to encourage economic development<br />

through the acquisition of major fixed assets for expansion or modernization. These loan funds<br />

may be used for such <strong>project</strong>s as purchasing or renovating land or existing buildings, purchasing<br />

improvements such as <strong>street</strong> lighting, utilities, parking lots, and landscaping, and purchasing<br />

long-term machinery and equipment. Because the average for-profit business in the downtown<br />

area does not have tangible net worth in excess of $7.5 million and does not have an average net<br />

income in excess of $2.5 million, the majority of businesses would qualify. Directing local<br />

business owners to this useful service may help them attain capital, especially in the current<br />

economic climate. Disseminating information on 504 loans, like that featured in Table 2–4, will<br />

encourage business to use this valuable local resource.<br />

The Small Business Association of New England (SBANE) is a non-profit organization designed<br />

to ―provide a legislative voice for small business at the state and federal levels and to make<br />

practical information available to help business owners grow their companies‖ 6 . Using this<br />

support, Main Street business owners could modify legislation, creating laws that encourage<br />

growth. SBANE also has monthly meetings that are held in Waltham, making it very convenient<br />

for local business owners to attend.<br />

6 From: www.sbane.org<br />

20

![4 little girls [videorecording] / an HBO documentary film - Academic ...](https://img.yumpu.com/34723141/1/190x245/4-little-girls-videorecording-an-hbo-documentary-film-academic-.jpg?quality=85)

![Abre los ojos [videorecording (DVD)] / Summit Entertainment y ...](https://img.yumpu.com/28051686/1/190x245/abre-los-ojos-videorecording-dvd-summit-entertainment-y-.jpg?quality=85)