OPI-Dick Gochnauer Interview - Ussco.com

OPI-Dick Gochnauer Interview - Ussco.com

OPI-Dick Gochnauer Interview - Ussco.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

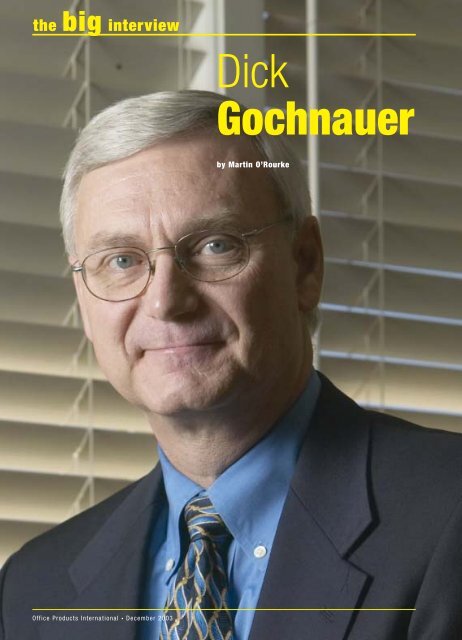

the big interview<br />

<strong>Dick</strong><br />

<strong>Gochnauer</strong><br />

by Martin O’Rourke<br />

Office Products International • December 2003

the big interview<br />

From McDonald’s to United Stationers, trust matters<br />

for CEO <strong>Dick</strong> <strong>Gochnauer</strong>. But can he help mend<br />

bridges in sometimes fraught OP relationships?<br />

<strong>OPI</strong>: <strong>Dick</strong>, if we can begin, it’s about 18 months since<br />

you joined the industry - do you still feel like the<br />

new kid on the block?<br />

DG: A little less so. But still, this is an industry with veterans<br />

who’ve been in it all of their lives, so I’ll probably<br />

always feel a bit like the new kid on the block.<br />

<strong>OPI</strong>: When you replaced Randy Larrimore as CEO did<br />

you have a radical vision, or was it fine tuning?<br />

DG: Fine tuning. United was a well run <strong>com</strong>pany, not a<br />

turnaround situation. Clearly, we had suffered like the<br />

industry but part was a self-inflicted wound because we’d<br />

moved off into a new 3PL venture that did not work.<br />

<strong>OPI</strong>: Have you found it very different from food?<br />

DG: I’ve been surprised at the parallels.The food industry<br />

had gone through a period of high growth, and so the focus<br />

was on how to service the customer. Then before this industry<br />

dip, it went into a period of very slow growth, particularly<br />

the fast food sector and costs and other factors became<br />

issues. The bar was raised, and those <strong>com</strong>panies that were<br />

able to step up survived - those that didn’t, didn’t.<br />

Both industries rely on the independent entrepreneur<br />

to serve the customer fairly extensively. In fast food it’s<br />

franchisees, in our industry it’s independent dealers.<br />

<strong>OPI</strong>: And the corporations?<br />

DG: Having both gives an industry some strength and some<br />

unique challenges. In McDonald’s case it has about 80% of<br />

its restaurants run by franchisees. It has tried different ratios<br />

and it keeps <strong>com</strong>ing back to something in that ballpark. Large<br />

corporations cannot service certain customer segments as<br />

well. They don’t run as good a restaurant. They’re not as<br />

clean. Customer satisfaction scores aren’t as good. The<br />

financial results and sales results aren’t as strong. That<br />

points to the spirit of free enterprise, of owning your own<br />

business and the kind of pride in ownership that goes with<br />

that. Ultimately, independent dealers and corporations have<br />

a role and it would be a shame if we lost that.<br />

<strong>OPI</strong>:What impression did you have of the industry<br />

before you came in? Was it black and white?<br />

DG: The less you know, the more it looks black and white<br />

and straightforward. As you get into it you realise how<br />

<strong>com</strong>plex it is, and the unique challenges it faces.<br />

<strong>OPI</strong>: Talking of the dealers, issues raised in <strong>OPI</strong><br />

recently by independent dealers, such as Al<br />

Lynden’s ‘trojan horse’ letter (see <strong>OPI</strong> September<br />

2003, page 11) must have struck a chord with you.<br />

DG: It’s clearly a topic that needs to be on the agenda so<br />

that there is some clarity as to what is and isn’t happening,<br />

what the intentions are, and where people are going.<br />

<strong>OPI</strong>: Do you see more consolidation of the dealer base?<br />

DG: Well, we are seeing the bigger dealers get bigger. We<br />

hope dealers of all sizes remain viable and healthy, and<br />

Office Products International • December 2003

the big interview<br />

that is our expectation. And, of course, the independent<br />

dealer represents by far the largest share of our business,<br />

so it’s an important part of our customer base.<br />

<strong>OPI</strong>: Let’s move on to the US wholesale industry.<br />

Were you surprised at Daisytek’s fall from grace?<br />

DG: Not too surprised. It was a virtual rather than an<br />

asset-rich <strong>com</strong>pany. Once you lose your funding, can’t pay<br />

suppliers and don’t have inventory, it doesn’t take long<br />

for customers to switch. And so the flight was very rapid.<br />

“Companies who have drifted off<br />

purely in pursuit of greed, have got<br />

into big trouble, reinforcing the<br />

position that it’s dangerous territory”<br />

<strong>OPI</strong>: A flawed business model?<br />

DG: Clearly. What was not fully appreciated was the difficulty<br />

and the amount of capital required to enter into the<br />

full line supply of office products. This industry is built on<br />

speed, and the only way you’re going to get speed and low<br />

cost is to have inventory in local markets. That requires<br />

huge investments in physical facilities and inventory. A<br />

slightly lower price while giving up on service, is not a<br />

proposition that will sell, so it was an underestimation of<br />

what it required to get into that segment of the business.<br />

<strong>OPI</strong>: Ostensibly, that leaves you and SP Richards. Is<br />

that a good thing?<br />

DG: It was SP Richards and United before Daisytek as well,<br />

because it was not a full line supplier. It’s when it tried to<br />

be<strong>com</strong>e a full line supplier that it exacerbated its problems.<br />

So really the industry has been served for sometime by two<br />

national wholesalers. All customers need at least two<br />

choices. Whether you need three or four remains to be<br />

seen. Here you’ve got two good options - both well run,<br />

well financed and healthy. So each dealer has a choice.<br />

<strong>OPI</strong>: Do you expect the likes of Tech Data, Synnex,<br />

Ingram Micro to try and move into the market or<br />

will they stay niche orientated?<br />

DG: It would be a whole different<br />

service proposition for<br />

them and requires a different<br />

business model. I think<br />

they’ll continue to be active<br />

players in the segment that<br />

makes sense for them.<br />

<strong>OPI</strong>: You bought<br />

Daisytek Inc for a<br />

knock down price of $1<br />

million. What does it<br />

offer you?<br />

DG: We were interested in<br />

the intellectual property. It<br />

has some software capabilities<br />

too and clearly we<br />

get the customer lists and<br />

suppliers and there is<br />

some information that I’m<br />

sure will be new to us. It<br />

had a software engine that<br />

allows you to do some<br />

product <strong>com</strong>parisons and<br />

which the industry had<br />

been using. We wanted to<br />

make sure the industry<br />

didn’t lose this, so we’ll<br />

try to keep that available.<br />

<strong>OPI</strong>: So some of the<br />

things Daisytek did<br />

were very impressive.<br />

DG: Yes. It didn’t get<br />

where it got to without<br />

delivering some good<br />

products and service to<br />

the industry.<br />

<strong>OPI</strong>: Will you keep that<br />

name - Daisytek Inc?<br />

DG: I don’t know - it wasn’t<br />

our primary focus. I don’t<br />

snapshot<br />

age: 53<br />

job title: CEO and president of<br />

United Stationers<br />

lives: Winnetka, Illinois<br />

favourite food: hamburgers!<br />

favourite restaurant: McDonald’s<br />

favourite drink: iced tea<br />

loves: The City of Hope<br />

hates: dysfunction<br />

education: under graduate degree<br />

in engineering from North<br />

Western, and MBA from Harvard<br />

alternative career: in the nonprofit<br />

world<br />

favourite past time:<br />

volunteering<br />

holiday destination: Colorado<br />

skiing<br />

biggest fear: Not responding<br />

fast enough to customers<br />

biggest hope: the industry<br />

learns to collaborate better<br />

nickname: none<br />

know whether or not there is some future use for that name.<br />

<strong>OPI</strong>: We’ll move onto your results over the period<br />

you’ve been there. Sales of $923 million for Q4 2002;<br />

$970 million for Q1 2003; and $955 million for Q2<br />

2003. Why the fluctuation?<br />

DG: That’s normal. January is a big month, so you get some<br />

extra pop in the first quarter. People cut off purchases but<br />

January is the new budget period so they’re replenishing<br />

inventories. Our sales for the first half of 2003 were up<br />

about 4%, heavily driven by growth on the <strong>com</strong>puter consumables<br />

side. The good news is that furniture has gone<br />

from big negatives to closer to flat, so that’s moving in the<br />

right direction, but certainly not driving any sales growth.<br />

<strong>OPI</strong>: Are you happy with sales overall?<br />

DG: I’m concerned about the more traditional office products<br />

segment, because that hasn’t picked up. The brakes are still<br />

on in large <strong>com</strong>panies in terms of spending, and the control<br />

of spending, even to the point where <strong>com</strong>panies talk<br />

about how you get a choice of one pen or one pencil and if<br />

Office Products International • December 2003

the big interview<br />

you want a different brand, you buy your own. So that kind<br />

of thinking towards office products will keep the lid on until<br />

staff numbers grow. But I’m hopeful that as times get better<br />

and <strong>com</strong>panies are more confident, they’ll take a broader<br />

view and a more realistic view of their office supply purchases,<br />

and recognise that actually this is an area where we<br />

can add value.<br />

<strong>OPI</strong>: Do you feel the economy has bottomed out?<br />

DG: We’re not anticipating it turning the industry around,<br />

so we’ve got to take control of our own destiny and do<br />

what we need to do to make things happen. And if<br />

things do work out as a lot of people are forecasting and<br />

predicting, then that’s great. I hope it does, obviously.<br />

“The best endorsement is manufacturers<br />

sourcing in China and putting their<br />

brand there. You wouldn’t do that if you<br />

didn’t have confidence in the quality”<br />

<strong>OPI</strong>: You don’t feel bullish?<br />

DG: I do, but over the long term - it’s just a question of<br />

when. The concern that we have is that although things are<br />

starting to bounce back, <strong>com</strong>panies have learned how to operate<br />

more efficiently with fewer people, and they’ve also been<br />

forced to outsource more things from overseas particularly.<br />

<strong>OPI</strong>: Your share price is looking good. What would<br />

you attribute that to?<br />

DG: Part of it is an expectation that the economy is going<br />

to improve and that we will benefit from that. Wall<br />

Street knows how high a fixed cost wholesalers face, and<br />

so it’s witnessed the impact of lower sales in 2002 on<br />

profitability and the expectation is that as sales start<br />

turning around, earnings will follow suit. We’ve been<br />

doing a lot of talking about how we improve efficiencies<br />

and how we drive waste out for the whole supply chain<br />

and Wall Street has seen some good signs <strong>com</strong>ing out of<br />

some of the other public <strong>com</strong>panies in our industry.<br />

<strong>OPI</strong>: You seem to be holistic in<br />

your approach to business. How<br />

do you stand on issues like CSR?<br />

DG: All <strong>com</strong>panies must be good<br />

<strong>com</strong>munity citizens. We’ve an obligation<br />

beyond just making a<br />

profit for our shareholders, or<br />

providing employment for our<br />

associates. It’s not just right from<br />

a moral point of view, but also<br />

from a <strong>com</strong>pany view. Staff want<br />

to know their <strong>com</strong>pany cares, and<br />

there are lots of ways to show<br />

that. Research shows <strong>com</strong>panies<br />

with a very strong value system<br />

outperform those without it. And,<br />

clearly, <strong>com</strong>panies who have drifted<br />

off purely in the pursuit of<br />

greed, have got into big trouble,<br />

reinforcing the position<br />

that it’s dangerous territory.<br />

<strong>OPI</strong>: Is that something<br />

McDonald’s embodied?<br />

DG: McDonald’s did, very<br />

strongly. They run Ronald<br />

McDonald houses and they are really quite phenomenal.<br />

I’d hold them up as an outstanding example of understanding<br />

the importance of being more than just a <strong>com</strong>pany<br />

that makes a profit.<br />

<strong>OPI</strong>: Have you got links with China?<br />

DG: We have an office there and links with sources there.<br />

These days Asia Pacific is increasingly the manufacturing<br />

location of choice for office products, for the obvious reasons.<br />

We’re struggling with how to deliver consumers greater<br />

value, and obviously keeping the quality up and lowering<br />

the cost. Second is that we’re importing more. I can’t imagine<br />

why we wouldn’t continue to have an office there.<br />

<strong>OPI</strong>: Is the quality of goods out of China up to scratch?<br />

DG: As long as the manufacturers have clear quality specs<br />

and that process is managed right, there is good quality<br />

product. The best endorsement is manufacturers sourcing<br />

there and putting their brand there - you wouldn’t do<br />

that if you didn’t have confidence in the quality.<br />

<strong>OPI</strong>: You talked of trust (see <strong>OPI</strong> November 2003,<br />

‘food for thought’, page 68) as a culture within the<br />

business. How do you manage the inevitable conflicts<br />

between dealers, resellers and manufacturers?<br />

DG: You’ve got to keep the end goal in mind, which is how<br />

to best serve our customers. The independent dealers have<br />

the wholesaler relationship, the relationship with a provider<br />

of systems - IT, back office systems - and they may or may<br />

not have a relationship with a buying group and most do.<br />

A dealer said to me: “I depend on these three groups,<br />

and what scares me is that they don’t work well together,<br />

and view each other to some extent as <strong>com</strong>petition. And<br />

yet I need to depend on all three of them and collaborate<br />

with them, and integrate what they do into my business.”<br />

Office Products International • December 2003

the big interview<br />

He’s absolutely right of course. We’ve<br />

got to focus on how to service dealers<br />

and make them successful so that the<br />

end user sees that there is a seamless<br />

integration of all these groups behind<br />

the scenes so the customer has a very<br />

pleasant and a low cost experience.<br />

<strong>OPI</strong>: In other words classic <strong>com</strong>promise<br />

and negotiation - give a<br />

little, take a little.<br />

DG: Yes, and focusing on if your customer<br />

is healthy and successful - contribute to that and<br />

you’ll be healthy.<br />

<strong>OPI</strong>: Last year, I attended the OPMA meeting where<br />

Jim Fahey (SVP merchandising) and John Kreidel spoke<br />

from is.group and there was some friendly banter in<br />

terms of their relationships with the dealers. How are<br />

your relations with the dealer groups?<br />

DG: Well, they’re not where they should be and we’re trying<br />

to reach out and say “let’s see if we can’t put the past<br />

behind us”. And so I would say we’re at the very start of<br />

trying to build trust with dealer groups, and it doesn’t<br />

happen without a lot of effort - it’s going to take a lot of<br />

willingness on both sides. I really don’t know the history<br />

of how we got to this point and I actually don’t spend a<br />

whole lot of time trying to figure it out. I’d rather spend<br />

time focusing on where we could help each other.<br />

“We’re at the very start of trying to build<br />

trust with dealer groups, and it doesn’t<br />

happen without a lot of effort - it’s going<br />

to take a lot of will on both sides”<br />

<strong>OPI</strong>: You said quite recently, since Daisytek went, that<br />

a lot of the business you picked up is low margin <strong>com</strong>puter<br />

consumables. Why exactly is it low margin?<br />

DG: Partly because there are fewer manufacturers to choose<br />

from and it’s treated more like a <strong>com</strong>modity product. And<br />

it’s sold less on service and more on price differentiation.<br />

It’s just a very <strong>com</strong>petitive side of the business. It’s not too<br />

dissimilar from paper products.<br />

<strong>OPI</strong>: Can it be changed or is it a fundamental mind shift?<br />

DG: I don’t know. I think it could if the manufacturers<br />

worked to support a change. Such low margins on some<br />

of these products are actually not healthy for the manufacturers<br />

either, because they’ve got a salesforce out there<br />

selling their products and the more they sell, the more<br />

trouble they are in financially.<br />

<strong>OPI</strong>: You also said product mix is a challenging issue.<br />

Why is that?<br />

DG: When the economy is tight, people cut discretionary<br />

spends. Instead of buying the more expensive pen or pencil<br />

we’ll buy a cheaper pencil. And so the industry shifts to<br />

lower margin products and away from some of the higher<br />

margin more discretionary items. Our<br />

industry lives on selling a mix and<br />

you have to have the right mix. The<br />

challenge is that the higher margin<br />

products and the discretionary products<br />

haven’t been purchased as they<br />

have in the past.<br />

The second trend is that <strong>com</strong>puter<br />

products are driving a higher percentage<br />

of sales, and I don’t see that<br />

trend changing. You’ve got those<br />

two trends. So obviously a healthier economy in tandem<br />

with the hope that offices begin to purchase more discretionary<br />

items again will benefit everyone in our industry.<br />

<strong>OPI</strong>: When it <strong>com</strong>es to cost-cutting, how do you do it?<br />

DG: I purposefully labelled ours a war on waste, because the<br />

first thing people think is, “OK, we’re going to cut people”.<br />

In reality, our industry has a great deal of waste. That<br />

would probably be one of the deltas between this industry<br />

and food. It has been much more cost conscious for a much<br />

longer period of time, and so a lot of the waste has already<br />

been removed. For example, we put over $20 million a<br />

year of product on distress trailers. That doesn’t include the<br />

cost of shipping, picking the order, wrapping it, shipping<br />

it to a dealer, shipping it to the customer, the paperwork of<br />

getting it back from the customer and back to us. We lose<br />

a lot of money on that.<br />

<strong>OPI</strong>: What scope is there for you or SP Richards to<br />

expand the international network?<br />

DG: Well, United is in both Mexico and Canada. For us,<br />

it’s via the Azerty businesses. But in Canada for example,<br />

we are now offering office supplies as well as the <strong>com</strong>puter<br />

product lines that Azerty has. So North America makes<br />

some sense. We haven’t been able to determine the value<br />

we could create by going to Europe or Asia.<br />

<strong>OPI</strong>: Would you pick up Daisytek’s Australia baton?<br />

DG: We’re not sure. Logistics and marketing skill sets are<br />

unique to some extent by market. You have to learn those.<br />

If we don’t think we can <strong>com</strong>e with any unique business<br />

proposition or anything that we could do that will benefit<br />

the industry, then it doesn’t make sense for us to go.<br />

<strong>OPI</strong>: <strong>Dick</strong>, on that note, thank you. Your time has<br />

been much appreciated.<br />

Office Products International • December 2003<br />

Reprinted with kind permission from <strong>OPI</strong>