Certificate IV in Financial Services (Accounting) - TAFE NSW ...

Certificate IV in Financial Services (Accounting) - TAFE NSW ...

Certificate IV in Financial Services (Accounting) - TAFE NSW ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

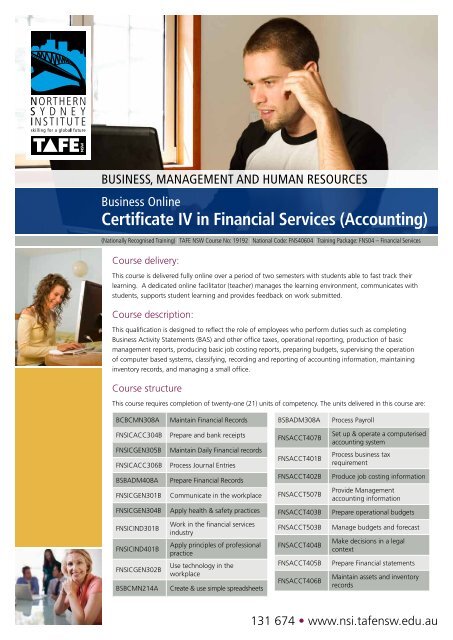

Bus<strong>in</strong>ess, Management and Human Resources<br />

Bus<strong>in</strong>ess Onl<strong>in</strong>e<br />

<strong>Certificate</strong> <strong>IV</strong> <strong>in</strong> F<strong>in</strong>ancial <strong>Services</strong> (Account<strong>in</strong>g)<br />

(Nationally Recognised Tra<strong>in</strong><strong>in</strong>g) | <strong>TAFE</strong> <strong>NSW</strong> Course No: 19192 | National Code: FNS40604 | Tra<strong>in</strong><strong>in</strong>g Package: FNS04 – F<strong>in</strong>ancial <strong>Services</strong><br />

Course delivery:<br />

This course is delivered fully onl<strong>in</strong>e over a period of two semesters with students able to fast track their<br />

learn<strong>in</strong>g. A dedicated onl<strong>in</strong>e facilitator (teacher) manages the learn<strong>in</strong>g environment, communicates with<br />

students, supports student learn<strong>in</strong>g and provides feedback on work submitted.<br />

Course description:<br />

This qualification is designed to reflect the role of employees who perform duties such as complet<strong>in</strong>g<br />

Bus<strong>in</strong>ess Activity Statements (BAS) and other office taxes, operational report<strong>in</strong>g, production of basic<br />

management reports, produc<strong>in</strong>g basic job cost<strong>in</strong>g reports, prepar<strong>in</strong>g budgets, supervis<strong>in</strong>g the operation<br />

of computer based systems, classify<strong>in</strong>g, record<strong>in</strong>g and report<strong>in</strong>g of account<strong>in</strong>g <strong>in</strong>formation, ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g<br />

<strong>in</strong>ventory records, and manag<strong>in</strong>g a small office.<br />

Course structure<br />

This course requires completion of twenty-one (21) units of competency. The units delivered <strong>in</strong> this course are:<br />

BCBCMN308A<br />

Ma<strong>in</strong>ta<strong>in</strong> F<strong>in</strong>ancial Records<br />

BSBADM308A<br />

Process Payroll<br />

FNSICACC304B<br />

FNSICGEN305B<br />

FNSICACC306B<br />

Prepare and bank receipts<br />

Ma<strong>in</strong>ta<strong>in</strong> Daily F<strong>in</strong>ancial records<br />

Process Journal Entries<br />

FNSACCT407B<br />

FNSACCT401B<br />

Set up & operate a computerised<br />

account<strong>in</strong>g system<br />

Process bus<strong>in</strong>ess tax<br />

requirement<br />

BSBADM408A<br />

FNSICGEN301B<br />

Prepare F<strong>in</strong>ancial Records<br />

Communicate <strong>in</strong> the workplace<br />

FNSACCT402B<br />

FNSACCT507B<br />

Produce job cost<strong>in</strong>g <strong>in</strong>formation<br />

Provide Management<br />

account<strong>in</strong>g <strong>in</strong>formation<br />

FNSICGEN304B<br />

Apply health & safety practices<br />

FNSACCT403B<br />

Prepare operational budgets<br />

FNSICIND301B<br />

FNSICIND401B<br />

FNSICGEN302B<br />

BSBCMN214A<br />

Work <strong>in</strong> the f<strong>in</strong>ancial services<br />

<strong>in</strong>dustry<br />

Apply pr<strong>in</strong>ciples of professional<br />

practice<br />

Use technology <strong>in</strong> the<br />

workplace<br />

Create & use simple spreadsheets<br />

FNSACCT503B<br />

FNSACCT404B<br />

FNSACCT405B<br />

FNSACCT406B<br />

Manage budgets and forecast<br />

Make decisions <strong>in</strong> a legal<br />

context<br />

Prepare F<strong>in</strong>ancial statements<br />

Ma<strong>in</strong>ta<strong>in</strong> assets and <strong>in</strong>ventory<br />

records<br />

131 674 • www.nsi.tafensw.edu.au

Assessments<br />

A range of assessment methods are used <strong>in</strong> this course. These <strong>in</strong>clude practical exercises, case studies,<br />

quizzes and reports.<br />

Career opportunities:<br />

A range of positions <strong>in</strong> various <strong>in</strong>dustries that either support and/or have responsibility for basic account<strong>in</strong>g,<br />

<strong>in</strong>clud<strong>in</strong>g Bus<strong>in</strong>ess Activity Statements (BAS) and other office taxes, operational report<strong>in</strong>g, production<br />

of basic management reports, produc<strong>in</strong>g basic job cost<strong>in</strong>g reports, prepar<strong>in</strong>g budgets, supervis<strong>in</strong>g the<br />

operation of computer based systems, classify<strong>in</strong>g, record<strong>in</strong>g and report<strong>in</strong>g of account<strong>in</strong>g <strong>in</strong>formation,<br />

ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g <strong>in</strong>ventory records, and manag<strong>in</strong>g a small office.<br />

Entry requirement:<br />

<strong>NSW</strong> School <strong>Certificate</strong> or equivalent.<br />

Career pathways:<br />

Graduates of this qualification may wish to study the Diploma of Account<strong>in</strong>g followed by the Advanced<br />

Diploma <strong>in</strong> Account<strong>in</strong>g. Graduates of the Diploma and Advanced Diploma may apply to a range of<br />

Australian universities for articulation and/or advanced stand<strong>in</strong>g.<br />

<strong>TAFE</strong> <strong>NSW</strong> fee:<br />

When you enrol, you will need to pay a <strong>TAFE</strong> <strong>NSW</strong> fee, unless you qualify for a fee exemption or your<br />

course is exempt from payment of the <strong>TAFE</strong> <strong>NSW</strong> fee. The 2010 <strong>TAFE</strong> <strong>NSW</strong> fee for this course is $934<br />

annual fee or $467 for enrolments of one semester or less. CASH IS NOT ACCEPTED. Accepted forms of<br />

payment are EFTPOS, VISA CARD, MASTERCARD, MONEY ORDER or CHEQUE (payable to <strong>TAFE</strong> <strong>NSW</strong> –<br />

Northern Sydney Institute).<br />

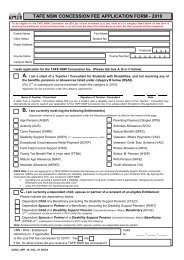

Aborig<strong>in</strong>al or Torres Strait Islander students are exempt from pay<strong>in</strong>g the <strong>TAFE</strong> <strong>NSW</strong> fee. Students <strong>in</strong> receipt<br />

of a Disability Support Pension and students with a disability (clients of a <strong>TAFE</strong> Disability Consultant) are<br />

entitled to one full fee exemption for one <strong>TAFE</strong> <strong>NSW</strong> course per year and are eligible for the $51 concession<br />

fee for subsequent enrolments <strong>in</strong> that year.<br />

How to enrol<br />

For further <strong>in</strong>formation on register<strong>in</strong>g and enroll<strong>in</strong>g <strong>in</strong> the course go to the NSI Internet site: www.nsi.<br />

tafensw.edu.au/studyonl<strong>in</strong>e or contact 131 674 or email: NSI.Study@tafensw.edu.au<br />

Recognition of Prior Learn<strong>in</strong>g:<br />

<strong>TAFE</strong> <strong>NSW</strong> recognises the skills and knowledge you have ga<strong>in</strong>ed <strong>in</strong> other courses, life experience, work or<br />

tra<strong>in</strong><strong>in</strong>g provided at work. You may be able to have your prior learn<strong>in</strong>g recognised and credited aga<strong>in</strong>st a<br />

course of study. For further <strong>in</strong>formation call 131 674 or go to www.nsi.tafensw.edu.au.<br />

<strong>TAFE</strong> <strong>NSW</strong> courses commence only if there are sufficient resources and demand.<br />

131 674 • www.nsi.tafensw.edu.au