Annual Report Hunter Douglas

Annual Report Hunter Douglas

Annual Report Hunter Douglas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to consolidated financial statements<br />

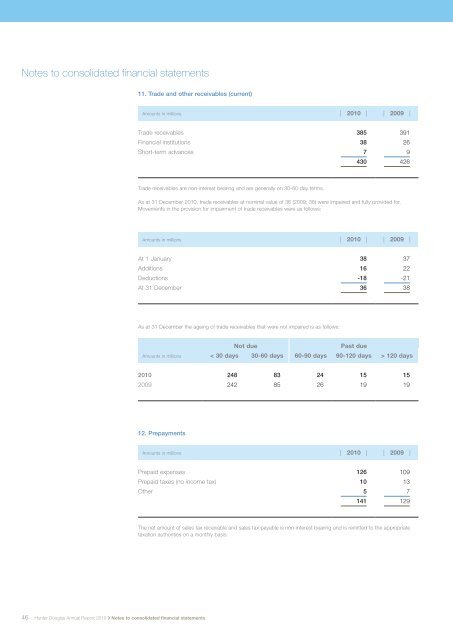

11. Trade and other receivables (current)<br />

Amounts in millions | 2010 | | 2009 |<br />

Trade receivables 385 391<br />

Financial institutions 38 26<br />

Short-term advances 7 9<br />

430 426<br />

Trade receivables are non-interest bearing and are generally on 30-60 day terms.<br />

As at 31 December 2010, trade receivables at nominal value of 36 (2009: 38) were impaired and fully provided for.<br />

Movements in the provision for impairment of trade receivables were as follows:<br />

Amounts in millions | 2010 | | 2009 |<br />

At 1 January 38 37<br />

Additions 16 22<br />

Deductions -18 -21<br />

At 31 December 36 38<br />

As at 31 December the ageing of trade receivables that were not impaired is as follows:<br />

Not due<br />

Past due<br />

Amounts in millions < 30 days 30-60 days 60-90 days 90-120 days > 120 days<br />

2010 248 83 24 15 15<br />

2009 242 85 26 19 19<br />

12. Prepayments<br />

Amounts in millions | 2010 | | 2009 |<br />

Prepaid expenses 126 109<br />

Prepaid taxes (no income tax) 10 13<br />

Other 5 7<br />

141 129<br />

The net amount of sales tax receivable and sales tax payable is non-interest bearing and is remitted to the appropriate<br />

taxation authorities on a monthly basis.<br />

46<br />

<strong>Hunter</strong> <strong>Douglas</strong> <strong>Annual</strong> <strong>Report</strong> 2010 Notes to consolidated financial statements