yearbook 2009.indd - Ministry of Tourism Arts & Culture

yearbook 2009.indd - Ministry of Tourism Arts & Culture

yearbook 2009.indd - Ministry of Tourism Arts & Culture

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

T o u r i s m<br />

Yearbook<br />

2 0 0 9<br />

<strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> and <strong>Culture</strong><br />

Republic <strong>of</strong> Maldives

T o u r i s m<br />

Yearbook<br />

2 0 0 9<br />

<strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> and <strong>Culture</strong><br />

Republic <strong>of</strong> Maldives

© Copyright <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> and <strong>Culture</strong>, 2009<br />

<strong>Tourism</strong> Yearbook 2009<br />

ISBN 99915-95-45-7<br />

First Print: May 2009<br />

Produced and Published by<br />

Statistics & Research Section<br />

<strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong> <strong>Arts</strong> and <strong>Culture</strong><br />

6th Floor, ADK Tower<br />

Ameer Ahmed Magu<br />

Male’ 20094<br />

Republic <strong>of</strong> Maldives<br />

Tel: +960 330 4952<br />

Fax: +960 330 4951<br />

E-mail: stat@maldivestourism.gov.mv<br />

Website: www.tourism.gov.mv<br />

Data Compilation & Verification:<br />

Mariyam Sharmeela, Silma Ali, Aishath Yamna<br />

Concept:<br />

Mariyam Sharmeela, Aminath Fazla<br />

Layout & Design:<br />

Mariyam Sharmeela<br />

Editor:<br />

Moosa Zameer Hassan<br />

Cover Photos:<br />

Ahmed Shareef Nafees, Muhamed (Muha), Moosa Easa, Caroline Von Tuemplin, Mohamed Azmeel,<br />

Mohamed Musaaidh, Mohamed Siraj (Sidey)<br />

Inside Photos:<br />

Shazeen Abdul Samad, Andrea Pohlman, Caroline Von Tuemplin, Shaahina Ali<br />

Printed by:<br />

M7 Print Private Limited

Welcome to the <strong>Tourism</strong> Yearbook 2009! It is with great pleasure that I present to you this<br />

annual publication <strong>of</strong> <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> and <strong>Culture</strong>.<br />

Undoubtedly tourism is a very dynamic sector and timely dissemination <strong>of</strong> statistics is<br />

vital due to the significance <strong>of</strong> the industry. With this in mind, the <strong>Tourism</strong> Yearbook is<br />

published with the objective <strong>of</strong> providing comprehensive and latest statistical information<br />

on tourism industry, to the relevant Government authorities as well as private sector,<br />

institutions and individuals. This annual publication highlights key tourism indicators <strong>of</strong><br />

the Maldives for the past five years and provides information on the performance <strong>of</strong> the Maldives tourism<br />

industry in 2008.<br />

Year 2008 had been an eventful year for the Maldives, in terms <strong>of</strong> politics within the country as well as<br />

economic changes in the Maldives and around the world. While the Maldives welcomed a new administration<br />

<strong>of</strong> government, international tourism was being challenged by a deteriorating global economy. Growth in<br />

international tourist arrivals worldwide slowed down drastically during the last half <strong>of</strong> the year. Tourist<br />

arrivals to the Maldives increased by just about 1% showing that the Maldives tourism is highly dependent<br />

on the world economic situation. As the current troubled world economic scenario is expected to continue<br />

well into 2009 and beyond, international tourism is expected to stagnate.<br />

We have witnessed in the past that tourism, regardless <strong>of</strong> its vulnerability towards devastating crisis, manmade<br />

or natural, has shown overwhelming resilience and the ability to bounce back. Such resilience can<br />

be attributed to the determined efforts <strong>of</strong> the Government and the private sector. I am confident that with<br />

continued cooperation by the private sector and the Government, the Maldives tourism can recover and reach<br />

targeted growth levels from the current crisis.<br />

<strong>Tourism</strong> Yearbook 2009 is the result <strong>of</strong> combined efforts <strong>of</strong> many Government authorities, private sector<br />

organizations and the tourism industry <strong>of</strong> the Maldives. I acknowledge, with deep gratitude, the valuable<br />

contribution and support rendered by respective Government and private sector organizations.<br />

I do hope that the readers find this publication a useful source <strong>of</strong> information.<br />

Male’, May 2009<br />

i

Except where otherwise indicated, data used in this publication have been collected from relevant government<br />

agencies and the Maldives tourism industry.<br />

The <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> and <strong>Culture</strong> wishes to express its gratitude to the Department <strong>of</strong> National<br />

Planning, <strong>Ministry</strong> <strong>of</strong> Finance and Treasury, Department <strong>of</strong> Immigration and Emigration, Department <strong>of</strong><br />

Inland Revenue, Maldives Monetary Authority, Maldives Customs Services, Faculty <strong>of</strong> Hospitality and<br />

<strong>Tourism</strong> Studies, Maldives <strong>Tourism</strong> Promotion Board and the Maldives tourism industry for their continued<br />

cooperation and assistance in the compilation <strong>of</strong> this annual publication.<br />

ii

<strong>Tourism</strong> Yearbook 2009, has been produced and published by the Statistics Section <strong>of</strong> the <strong>Ministry</strong> <strong>of</strong><br />

<strong>Tourism</strong>, <strong>Arts</strong> and <strong>Culture</strong>. This publication briefly presents the overall performance <strong>of</strong> the tourism industry<br />

<strong>of</strong> the Maldives through 2004 to 2008. In addition to all the available national tourism statistics for the past<br />

five years (2004-2008), the publication contains major highlights <strong>of</strong> the tourism industry’s performance for<br />

2008.<br />

This publication is divided into 5 main sections<br />

1. Tourist Accommodation<br />

2. Tourist Arrival Trends<br />

3. Airlines Statistics<br />

4. Economic Indicators <strong>of</strong> <strong>Tourism</strong><br />

5. <strong>Tourism</strong> Highlights 2008<br />

Each section provides important data and information. Together, the sections provide a comprehensive picture<br />

<strong>of</strong> the tourism in the Maldives.<br />

iii

Foreword ......................................................................................................................................................... i<br />

Acknowledgements ........................................................................................................................................ ii<br />

Preface ............................................................................................................................................................ iii<br />

TOURIST ACCOMMODATION<br />

Tourist Accommodation in the Maldives ........................................................................................................ 1<br />

Table: 1 Number <strong>of</strong> Accommodation Establishments & their Bed Capacity, 2004 - 2008 ............................ 1<br />

Table: 2 Distribution <strong>of</strong> Resort Beds by Atolls, 2004 - 2008 ..........................................................................2<br />

Table: 3 Tourist Resorts by Type <strong>of</strong> Lease Holders, 2006 - 2008 ................................................................... 3<br />

Table: 4 Tourist Resorts by Type <strong>of</strong> Operators, 2006 - 2008 .......................................................................... 3<br />

Table: 5 Bed Nights, Occupancy Rate & Average Duration <strong>of</strong> Stay, 2004 - 2008.......................................... 4<br />

Table: 6 Monthly Average Occupancy Rates <strong>of</strong> Resorts & Hotels, 2004 - 2008 ............................................ 4<br />

TOURIST ARRIVAL TRENDS<br />

Global Arrival Trends ..................................................................................................................................... 7<br />

Table: 7 International Tourist Arrivals, 2007-2008 ........................................................................................ 7<br />

Tourist Arrivals to the Maldives ..................................................................................................................... 8<br />

Table: 8 Tourist Arrivals to the Maldives by Month, 2004 - 2008 ................................................................. 8<br />

Table: 9 Growth Trends <strong>of</strong> Tourist Arrivals by Month, 2004 - 2008 .............................................................. 8<br />

Major Markets ................................................................................................................................................. 9<br />

Figure: 1 Market Share by Regions, 2004 - 2008 ........................................................................................... 9<br />

Top Ten Markets <strong>of</strong> 2008 ...............................................................................................................................10<br />

Table: 10 Tourist Arrivals and Market Share <strong>of</strong> Top Ten Markets <strong>of</strong> 2008 ...................................................10<br />

Figure: 2 Arrival Growth and Market Share <strong>of</strong> UK Market, 2004 - 2008 .....................................................11<br />

Figure: 3 Monthly Tourist Arrival Trends <strong>of</strong> UK Market, 2004 - 2008 ........................................................ 11<br />

Figure: 4 Arrival Growth and Market Share <strong>of</strong> Italian Market, 2004 - 2008 ................................................12<br />

Figure: 5 Monthly Tourist Arrival Trends <strong>of</strong> Italian, 2004 - 2008 .................................................................12<br />

Figure: 6 Arrival Growth and Market Share <strong>of</strong> German Market, 2004 - 2008 ..............................................13<br />

Figure: 7 Monthly Tourist Arrival Trends <strong>of</strong> German, 2004 - 2008 ..............................................................13<br />

Figure: 8 Arrival Growth and Market Share <strong>of</strong> Russian Market, 2004 - 2008 ..............................................14<br />

Figure: 9 Monthly Tourist Arrival Trends <strong>of</strong> Russian, 2004 - 2008 ..............................................................14<br />

Figure: 10 Arrival Growth and Market Share <strong>of</strong> French Market, 2004 - 2008 ..............................................15<br />

Figure: 11 Monthly Tourist Arrival Trends <strong>of</strong> French, 2004 - 2008 ..............................................................15<br />

Figure: 12 Arrival Growth and Market Share <strong>of</strong> Chinese Market, 2004 - 2008 ............................................16<br />

Figure: 13 Monthly Tourist Arrival Trends <strong>of</strong> Chinese, 2004 - 2008 ............................................................16<br />

Figure: 14 Arrival Growth and Market Share <strong>of</strong> Japanese Market, 2004 - 2008 ..........................................17<br />

Figure: 15 Monthly Tourist Arrival Trends <strong>of</strong> Japanese, 2004 - 2008 ...........................................................17<br />

Figure: 16 Arrival Growth and Market Share <strong>of</strong> Swiss Market, 2004 - 2008 ...............................................18<br />

Figure: 17 Monthly Tourist Arrival Trends <strong>of</strong> Swiss Market, 2004 - 2008 ...................................................18<br />

Figure: 18 Arrival Growth and Market Share <strong>of</strong> Korean Market, 2004 - 2008 .............................................19<br />

Figure: 19 Monthly Tourist Arrival Trends <strong>of</strong> Korean, 2004 - 2008 .............................................................19<br />

Figure: 20 Arrival Growth and Market Share <strong>of</strong> Indian Market, 2004 - 2008 ..............................................20<br />

Figure: 21 Monthly Tourist Arrival Trends <strong>of</strong> Indian Market, 2004 - 2008 ..................................................20<br />

AIRLINE STATISTICS<br />

Table: 11 Passenger Arrivals by Type <strong>of</strong> Carriers, 2004 - 2008 ....................................................................23<br />

Table: 12 Traffic by International Carriers at Male’ & Gan International Airport, 2004 - 2008 ...................23<br />

Table: 13 Traffic by Domestic Carriers at Male’ International Airport, 2004 - 2008 ....................................25

ECONOMIC INDICATORS<br />

<strong>Tourism</strong> and its Role in the Economy <strong>of</strong> the Maldives ..................................................................................29<br />

Table: 14 <strong>Tourism</strong> Contribution to Gross Domestic Product (GDP), 2004 - 2008 ........................................29<br />

Table: 15 <strong>Tourism</strong> Revenue and Tax, 2004 - 2008 ........................................................................................29<br />

Table: 16 Government Expenditure on <strong>Tourism</strong>, 2004 - 2008 ......................................................................30<br />

Table: 17 <strong>Tourism</strong> Receipts, 2004 - 2008 ......................................................................................................30<br />

ADDITIONAL TABLES<br />

Table: 18 Bed Capacity <strong>of</strong> Tourist Resorts, 2004 - 2008 ...............................................................................33<br />

Table: 19 New Islands Leased for Resort/Hotel Development ......................................................................36<br />

Table: 20 Graduates from Faculty <strong>of</strong> Hospitality & <strong>Tourism</strong> Industry, 2004 - 2008 .....................................38<br />

Table: 21 Inbound and Outbound Travel, 2004 - 2008 ..................................................................................38<br />

Table: 22 Seasonal Variation <strong>of</strong> Tourist Arrivals, 2004 - 2008 ......................................................................38<br />

Table: 23 Tourist Arrivals & Market Share by Major Markets, 2004 - 2008 ...............................................39<br />

Table: 24 Growth Trends <strong>of</strong> Major Markets, 2004 - 2008 .............................................................................40<br />

Table: 25 Tourist Arrivals by Nationality - end March 2009 .........................................................................42<br />

Table: 26 Major <strong>Tourism</strong> Indicators - end March 2009 .................................................................................44<br />

TOURISM HIGHLIGHTS 2008<br />

MAP OF THE MALDIVES - illustrating the tourism developments

TOURIST ACCOMMODATION

There are generally four types <strong>of</strong> tourist accommodation commodat<br />

od<br />

atio<br />

in the Maldives. Out <strong>of</strong> which, resorts are the mainly<br />

used form <strong>of</strong> accommodation in the Maldives and the rest include Safari Vessels, Hotels and Guest Houses.<br />

(Refer Table1)<br />

2004 2005 2006 2007 2008<br />

Type <strong>of</strong> Establishment No Beds No Beds No Beds No Beds No Beds<br />

Resorts 87 16,858 88 17,348 89 17,802 92 19,028 94 19,860<br />

Hotels 8 636 8 636 9 713 11 836 13 1,110<br />

Guest Houses 28 425 28 425 21 391 24 400 24 400<br />

Safari Vessels 113 1,676 121 1,789 116 1,599 133 1,923 143 2,094<br />

Total 236 19,595 245 20,198 235 20,505 260 22,187 274 23,464<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Tourist resorts, with its unique one island one resort concept, continue to be the most attractive type <strong>of</strong><br />

accommodation in the Maldives. Resorts consist over 85% <strong>of</strong> total bed capacity <strong>of</strong> the country. Over the last<br />

five years, resort bed capacity has been increasing at an average rate <strong>of</strong> 2.5% per year. Number <strong>of</strong> resorts<br />

increased from 87 in 2004 to 94 in 2008. The bed capacity <strong>of</strong> resorts increased from 16,858 in 2004 to 19,704<br />

in 2008.<br />

The second type <strong>of</strong> accommodation in the Maldives is the live-aboard safari vessels, which contribute over<br />

8% to total bed capacity <strong>of</strong> the Maldives. With the increasing popularity <strong>of</strong> this type <strong>of</strong> accommodation, the<br />

bed capacity increased from 1,676 in 2004 to 2,094 in 2008.<br />

Hotels and Guest Houses provide accommodation to tourists visiting Male’, the capital. By the end <strong>of</strong><br />

2008 there were 13 hotels and 24 guest houses with 1,110 beds and 400 beds respectively. Out <strong>of</strong> these 37<br />

establishments, all except two are located in Male’.<br />

1

Atoll<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Beds<br />

2004 2005 2006 2007 2008<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

Haa Alifu - - 50 0.3 90 0.5 390 2.0 432 2.2<br />

Noonu - - - - - - - - 400 2.0<br />

Raa 430 2.6 466 2.7 470 2.6 470 2.5 470 2.4<br />

Baa 1,034 6.1 1,034 6.0 1,240 7.0 1,240 6.5 1,240 6.2<br />

Lhaviyani 1,150 6.8 1,180 6.8 1,196 6.7 1,276 6.7 1,294 6.5<br />

Kaafu 8,038 47.7 8,316 47.9 8,450 47.5 8,724 45.8 8,914 44.9<br />

Alifu (North & South) 4,938 29.3 4,978 28.7 5,032 28.3 5,058 26.6 5,240 26.4<br />

Vaavu 294 1.7 350 2.0 350 2.0 350 1.8 350 1.8<br />

Meemu 400 2.4 400 2.3 400 2.2 400 2.1 400 2.0<br />

Faafu 250 1.5 250 1.4 250 1.4 250 1.3 250 1.3<br />

Dhaalu 324 1.9 324 1.9 324 1.8 324 1.7 324 1.6<br />

Seenu - - - - - - 546 2.9 546 2.7<br />

Total 16,858 100.0 17,348 100.0 17,802 100.0 19,028 100.0 19,860 100.0<br />

Beds<br />

%<br />

Share<br />

Since the commencement <strong>of</strong> tourism in the Maldives in 1972, the development <strong>of</strong> resorts concentrated close<br />

to the only international airport in the country. Due to this, most beds in the Maldives are located in Kaafu<br />

Atoll. The difficulty in transferring tourists to far away resorts has been the major reason for Kaafu Atoll<br />

being centralized for resort development. During the Second <strong>Tourism</strong> Master Plan period (1999 - 2006),<br />

Male’ Atoll and Ari Atoll was considered the main tourism zone and the focus <strong>of</strong> tourism development.<br />

However, today, under the new Third <strong>Tourism</strong> Master Plan, the target is to expand tourism to all the atolls<br />

in the Maldives. The Third <strong>Tourism</strong> Master Plan’s vision is to expand and strengthen the Maldives tourism<br />

as an instrument <strong>of</strong> economic and social development in a manner that benefits all Maldivians in all parts <strong>of</strong><br />

the country.<br />

In 2004, Kaafu Atoll resorts consisted 47.7% to the total bed capacity <strong>of</strong> the Maldives. However, by the end<br />

<strong>of</strong> 2008 this percentage dropped by nearly 4% to 44.9%. Under the tourism expansion plan, five new resorts<br />

started operation in 2007 and 2008, two in Haa Alifu Atoll, one in Seenu Atoll and two in Noonu Atoll. It is<br />

expected that by the end <strong>of</strong> 2009, there will be at least one tourist resort in every atoll.<br />

2

2006 2007 2008<br />

Nos<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

%<br />

Change<br />

Nos<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

%<br />

Change<br />

Nos<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

%<br />

Change<br />

Local 68 76.4 13,796 77.5 -0.2 70 76.1 14,716 77.3 6.7 74 78.7 15,882 80.0 7.9<br />

Foreign 7 7.9 922 5.2 28.8 8 8.7 1,122 5.9 21.7 8 8.5 1,086 5.5 -3.2<br />

Joint Venture<br />

(Local / Foreign)<br />

14 15.7 3,084 17.3 9.9 14 15.2 3,190 16.8 3.4 12 12.8 2,892 14.6 -9.3<br />

Total 89 100.0 17,802 100.0 2.6 92 100.0 19,028 100.0 6.9 94 100.0 19,860 100.0 4.4<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

There were 74 resorts with a total bed capacity <strong>of</strong> 15,882 beds leased to local companies at the end <strong>of</strong> 2008.<br />

(Refer Table:3) While the bed capacity <strong>of</strong> resorts leased to joint venture companies declined by 9.3% over the<br />

year 2007, bed capacity in the resorts leased to foreign companies also declined by 3.2%. With 80% <strong>of</strong> the<br />

total bed capacity, beds in resorts operated by local companies increased by 7.9% in 2008 over 2007.<br />

2006 2007 2008<br />

Nos<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

%<br />

Change<br />

Nos<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

%<br />

Change<br />

Nos<br />

%<br />

Share<br />

Beds<br />

%<br />

Share<br />

%<br />

Change<br />

Local 42 47.2 9,442 53.0 -5.2 44 47.8 10,146 53.3 7.5 44 46.8 10,322 52.0 1.7<br />

Foreign 30 33.7 4,924 27.7 17.9 31 33.7 5,340 28.1 8.4 33 35.1 5,706 28.7 6.9<br />

Joint Venture<br />

(Local / Foreign)<br />

17 19.1 3,436 19.3 7.0 17 18.5 3,542 18.6 3.1 17 18.1 3,832 19.3 8.2<br />

Total 89 100.0 17,802 100.0 2.6 92 100.0 19,028 100.0 6.9 94 100.0 19,860 100.0 4.4<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

There were a total <strong>of</strong> 44 resorts, 10,322 beds, operated by local operators by the end <strong>of</strong> 2008, which is 52.0%<br />

<strong>of</strong> the total bed capacity <strong>of</strong> the Maldives (refer Table:4). While number <strong>of</strong> resorts operated by joint venture<br />

companies remained constant, resorts operated by foreign companies increased from 31 in 2007 to 33 in<br />

2008, consisting 28.7% <strong>of</strong> the total bed capacity.<br />

3

Year<br />

Tourist Bed Nights<br />

Bed night growth<br />

(%)<br />

Occupancy Rate (%)<br />

Average Duration <strong>of</strong><br />

Stay (days)<br />

2004 5,110,587 8.6 83.9 8.3<br />

2005 3,300,125 -35.4 64.4 8.3<br />

2006 4,826,372 * 46.2 81.4 8.0<br />

2007 5,293,224 9.7 82.8 8.5<br />

2008 5,451,164 3.0 78.0 8.8<br />

Note: * Revised<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

As shown in Table 5, tourist bed nights have been growing steadily over the years except for the year 2005.<br />

The huge decline <strong>of</strong> 35.4% in 2005 was the result <strong>of</strong> the Asian tsunami. The bed nights had recovered<br />

completely by the end <strong>of</strong> 2007 and surpassed pre-tsunami levels.<br />

Occupancy rate also showed the same pattern as that <strong>of</strong> bed nights. However, it still remains below pretsunami<br />

levels even at the end <strong>of</strong> 2008. The reason for the low occupancy rates maybe due to the increase<br />

in bed capacity over the past two years. The average duration <strong>of</strong> stay remained constant at 8.3 days, through<br />

2003 to 2005, showed a slight decline in 2006 and increased to 8.8 days at the end <strong>of</strong> 2008.<br />

Month 2004 2005 2006 2007 2008<br />

January 100.5 32.6 94.4 94.8 90.0<br />

February 100.8 64.9 96.8 100.1 95.9<br />

March 97.9 73.7 93.7 94.3 96.4<br />

April 90.6 61.9 92.2 92.6 88.2<br />

May 68.0 52.1 67.1 70.4 70.4<br />

June 57.4 46.3 56.7 58.9 54.2<br />

July 73.5 60.7 68.8 72.0 65.3<br />

August 92.3 77.5 86.1 84.4 76.0<br />

September 80.9 68.0 73.1 73.6 66.0<br />

October 83.8 75.3 81.4 81.2 76.2<br />

November 87.0 85.1 84.1 * 85.7 78.7<br />

December 74.5 74.5 82.5 * 85.1 79.1<br />

Annual Average 83.9 64.4 81.4 82.8 78.0<br />

Note: * Revised<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

4

TOURIST ARRIVAL TRENDS

According cord<br />

to the January<br />

2009 issue sue <strong>of</strong> the UNWTO World <strong>Tourism</strong> Barometer, international tourist arrivals<br />

totaled 924 million worldwide at the end <strong>of</strong> 2008 with an increase <strong>of</strong> 1.8% over 2007. It highlighted that<br />

arrivals had slowed drastically in 2008, under the influence <strong>of</strong> an extremely volatile and unfavorable global<br />

economy. According to the Barometer, after 5% increase in the first half <strong>of</strong> 2008, growth in international<br />

tourist arrivals moved into negative territory in the second half <strong>of</strong> the year with -1%. The UNWTO forecasts<br />

that international arrivals will be flat at best or a few percent down at worst by the end <strong>of</strong> 2009, as there are<br />

no signs that this downward trend will be reversed in the near future.<br />

Tourist Arrivals<br />

(in millions)<br />

2007 2008 * % Change % Share 2008 *<br />

Europe 488 489 0.1 52.9<br />

Asia & the Pacific 185 188 1.6 20.4<br />

Americas 143 148 3.6 16.0<br />

Africa 45 47 4.5 5.1<br />

Middle East 48 53 11.4 5.7<br />

World 908 924 1.8 100.0<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Table adapted from UNWTO World <strong>Tourism</strong> Barometer, January 2009 edition<br />

Note: * Data as collected by UNWTO, January 2009<br />

All the regions performed well in 2008 showing positive growth (refer Table 7). While Europe showed the<br />

lowest percentage <strong>of</strong> growth (+0.1%), highest growth occurred in the Middle East with 11%. Africa rose by<br />

5% and Americas by 4%. Asia and the Pacific recorded a 2% rise in arrivals in 2008.<br />

7

Over the last five years tourist arrivals als tothe the Maldives have been increasing ng constantly tly except for the year<br />

2005. The drop in 2005 was due to the impacts <strong>of</strong> the Asian tsunami which affected the whole region.<br />

Over the last five years, monthly arrival trends show similar patterns (refer Table 8). Arrivals to Maldives are<br />

recorded to be at its peak from October to April and the month <strong>of</strong> July is recorded to have the lowest count<br />

in tourist arrivals to the Maldives.<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 61,861 59,692 63,855 55,396 42,197 33,835 43,527 55,843 46,838 52,511 56,656 44,505 616,716<br />

2005 18,747 29,391 35,742 29,714 25,309 22,590 29,860 38,366 33,748 40,543 44,461 46,849 395,320<br />

2006 58,332 54,741 54,596 55,983 40,961 33,037 42,776 49,968 44,593 54,721 53,594 58,621 601,923<br />

2007 64,570 65,224 64,491 63,171 46,602 38,457 51,025 53,168 48,468 58,706 56,797 65,210 675,889<br />

2008 64,621 67,963 71,623 62,670 48,764 40,283 47,675 51,824 50,687 56,363 57,961 62,578 683,012<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Immigration & Emigration<br />

The Year 2007 ended as a record year for the Maldives in terms <strong>of</strong> tourist arrivals with 675,889 visitors.<br />

The growth rate <strong>of</strong> 12.3% for the year was 3.8% higher than expected growth for the year. With this record<br />

achievement, year 2008 started with high expectations and a projected growth for the year was 5.6%. In the<br />

first three months <strong>of</strong> the year, arrivals increased steadily (refer Table 9). However, by the month <strong>of</strong> April,<br />

arrivals started slowing down, reflecting the rise in oil prices and deterioration <strong>of</strong> global economy. In spite<br />

<strong>of</strong> these conditions, the year ended with a 1.1% increase due to excellent performances showed in the first 6<br />

months <strong>of</strong> the year.<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 13.5 5.3 13.1 13.7 35.6 25.7 14.3 15.3 4.2 8.6 10.9 -23.6 9.4<br />

2005 -69.7 -50.8 -44.0 -46.4 -40.0 -33.2 -31.4 -31.3 -27.9 -22.8 -21.5 5.3 -35.9<br />

2006 211.2 86.3 52.8 88.4 61.8 46.2 43.3 30.2 32.1 35.0 20.5 25.1 52.3<br />

2007 10.7 19.2 18.1 12.8 13.8 16.4 19.3 6.4 8.7 7.3 6.0 11.2 12.3<br />

2008 0.1 4.2 11.1 -0.8 4.6 4.7 -6.6 -2.5 4.6 -4.0 2.0 -4.0 1.1<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Immigration & Emigration<br />

8

Europe continues to be the leading generating market to the Maldives (refer Figure 1). Over the last five<br />

years, this region contributed, on an average more than 75% to the total arrivals to the Maldives. However,<br />

European market share has shown a drop from 78.6% in 2003 to 72.8% at the end <strong>of</strong> 2008. Major markets<br />

from this region include, the United Kingdom, Italy, Germany, Russia, France & Switzerland.<br />

Asia is the second leading generating market to the Maldives. With a total <strong>of</strong> 145,494 tourists in 2008, the<br />

region captured a market share <strong>of</strong> 21.3% that year. Over the years, Asia has been growing steadily. In 2003,<br />

Asia shared 17.4%, at the end <strong>of</strong> 2008 it rose by 4%. Main markets from Asia include, China, Japan, Korea<br />

and India.<br />

In 2008, since more than 94% <strong>of</strong> the tourists arrivals to the Maldives was generated from Europe and Asia,<br />

the rest <strong>of</strong> the world contributed just about 6% <strong>of</strong> the arrivals to the Maldives. Market share from the African<br />

region remained almost constant through 2003 to 2008, with the highest recorded share being 0.9% in 2004<br />

and 2005. In 2007 and 2008, market share from Americas stood at 2.1%. This region had shown a steady<br />

increase in its share since 2003, from 1.4% in 2003 to 2.1% at the end <strong>of</strong> 2008. The market share from Oceania<br />

varied between 1.3% and 1.5% through 2003 to 2008. With a total <strong>of</strong> 10,661 tourists, the highest recorded<br />

share from Oceania was 1.6% in 2007. The Middle East, which is considered to be a rapidly growing region<br />

to the Maldives with high potential, captured a market share <strong>of</strong> 1.3% at the end <strong>of</strong> 2008. Arrivals from this<br />

region had been increasing steadily over the years, except for the year 2005, which was the Asian tsunami<br />

year.<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

Middle East<br />

Oceania<br />

Americas<br />

Africa<br />

Asia<br />

Europe<br />

20%<br />

10%<br />

0%<br />

2004 2005 2006 2007 2008<br />

9

The top ten leading markets to the Maldives during the year 2008 were United Kingdom with a market share<br />

<strong>of</strong> 17.1%, Italy (15.2%), Germany (10.1%), Russia (7.2%), France (7.0%), China (6.1%), Japan (5.6%),<br />

Switzerland (4.0%), Korea (3.1%) and India (2.4%). While Russia made its way to the 4th position in 2008,<br />

Japan, which was the fifth market in 2007, dropped to the 7th position (refer Table 10).<br />

Rank<br />

2008 Country Arrivals<br />

2008 2007<br />

Market<br />

Share (%)<br />

Arrivals<br />

Market<br />

Share (%)<br />

1 United Kingdom 116,821 17.1 125,158 18.5 1<br />

2 Italy 103,824 15.2 117,246 17.3 2<br />

3 Germany 69,240 10.1 72,269 10.7 3<br />

4 Russia 48,978 7.2 31,845 4.7 7<br />

5 France 48,100 7.0 45,301 6.7 4<br />

6 China 41,511 6.1 35,976 5.3 6<br />

7 Japan 38,193 5.6 41,121 6.1 5<br />

8 Switzerland 26,983 4.0 26,183 3.9 8<br />

9 Korea 20,934 3.1 20,976 3.1 9<br />

10 India 16,663 2.4 17,327 2.6 10<br />

Global Total 683,012 675,889<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Immigration & Emigration<br />

Rank<br />

2007<br />

10

With a total <strong>of</strong> 116,821 tourists and a market share <strong>of</strong> 17.1% the United Kingdom was the number one leading<br />

market to the Maldives in 2008.<br />

30.0<br />

21.3<br />

23.8<br />

20.0<br />

15.9<br />

10.0<br />

18.5<br />

22.1<br />

17.9 18.5 17.1<br />

Percent (%)<br />

0.0<br />

-10.0<br />

2004 2005 2006 2007 2008<br />

-6.7<br />

-20.0<br />

-30.0<br />

-23.4<br />

Market Share<br />

Arrival Growth<br />

Over the last five years, the U.K. market has performed well with the market share varying between 17.1%<br />

and 18.5% (refer Figure 2). In the year 2005, this market showed its lowest decline <strong>of</strong> -23.4% due to Asian<br />

tsunami <strong>of</strong> December 2004. The U.K. market also captured its highest market share <strong>of</strong> 22.1% and became the<br />

number one leading market to the Maldives in 2005. In 2006 its market share dropped to 17.9%. However, in<br />

2007 it regained its market position. Though the market performed with a negative growth <strong>of</strong> 6.7% in 2008,<br />

it still remained as the number one leading market to the Maldives, at the end <strong>of</strong> 2008.<br />

As shown in Figure 3, the monthly performance shows irregular patterns over the last five years. While<br />

arrivals is at its peak in March, its lowest performance is observed in June.<br />

20,000<br />

18,000<br />

16,000<br />

14,000<br />

ival numbers<br />

Arri<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 9,083 10,746 12,016 10,254 7,642 7,020 8,863 10,983 9,382 9,300 11,322 7,380 113,991<br />

2005 4,470 6,861 7,364 6,339 6,368 6,470 6,952 9,022 7,488 8,811 9,039 8,080 87,264<br />

2006 8,531 9,354 8,659 9,000 8,390 6,648 8,972 9,976 8,739 10,576 9,701 9,449 107,995<br />

2007 10,952 11,913 10,787 10,912 8,599 8,109 11,272 10,783 10,092 11,332 9,719 10,688 125,158<br />

2008 9,638 11,238 12,544 11,150 7,972 8,037 9,136 9,789 10,448 9,541 8,470 8,858 116,821<br />

11

At the end <strong>of</strong> 2008, the Italian market captured a market share <strong>of</strong> 15.2% making it the second most popular<br />

tourist generating market to the Maldives.<br />

30.0<br />

27.0<br />

20.0<br />

Percent (%)<br />

10.0<br />

0.0<br />

-10.0<br />

3.1<br />

11.8 14.1<br />

11.8 10.7 10.11<br />

2004 2005 2006<br />

2.0<br />

2007 2008<br />

-4.2<br />

-20.0<br />

-23.6<br />

Market Share<br />

Arrival Growth<br />

-30.0<br />

The Italian market is one <strong>of</strong> the well established traditional markets to the Maldives. Since 2002, Italian<br />

inbound travel to the Maldives has been stagnant and declined considerably in 2004, and in 2005 arrivals<br />

dropped to an all-time low due to the Asian tsunami. There is a decline in arrivals from Italy for the past 5<br />

years. With an annual average <strong>of</strong> 8.2% from 2003-2008, from over 140,000 in 2003 to less than 104,000 in<br />

2008. Similarly, Italian market share dropped from 25.1% in 2002 to 15.2% in 2008, with an annual average<br />

rate <strong>of</strong> -9.1% from 2003 to 2008.<br />

Unlike U.K., monthly arrivals from Italy show similar patterns over the last five years. The month <strong>of</strong> March<br />

is considered as the peak month and June records the lowest numbers <strong>of</strong> arrivals.<br />

20,000<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

numbers<br />

Arrival n<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 15,478 16,181 17,540 12,843 6,536 6,242 6,702 13,714 8,279 8,765 9,833 8,931 131,044<br />

2005 3,039 6,882 8,392 5,602 2,444 2,738 4,175 8,903 4,751 5,649 7,339 10,201 70,115<br />

2006 14,703 12,977 13,866 13,293 5,683 5,020 6,733 11,106 6,718 8,368 8,168 12,294 118,929<br />

2007 15,507 14,323 13,872 13,488 5,455 5,027 6,925 9,555 5,896 7,912 7,034 12,252 117,246<br />

2008 13,473 13,630 14,865 11,246 4,212 3,683 5,432 8,305 5,972 5,579 6,711 10,715 103,824<br />

12

With a total <strong>of</strong> 69,240 tourists, the German market captured a market share <strong>of</strong> 10.1% and remained in the<br />

third position at the end <strong>of</strong> 2008.<br />

80.0<br />

60.0<br />

69.6<br />

40.0<br />

(%)<br />

Percent (<br />

20.0<br />

0.0<br />

-20.0<br />

21.2 17.7 19.8 17.3 15.2<br />

-1.4<br />

2004 -6.6<br />

2005 2006 2007 2008<br />

-11.4<br />

-40.0<br />

-60.0<br />

-46.5<br />

Market Share<br />

Arrival Growth<br />

Though Germany is a well established and leading market to the Maldives, its market share has been on<br />

the decline since 1992. Over the last five years, the market captured a market share <strong>of</strong> 11.7% on an average<br />

(refer Figure 6). The biggest decline <strong>of</strong> over 23% occurred due to the 2005 tsunami, the German market also<br />

showed a decline <strong>of</strong> 4.2% in 2008.<br />

As seen in figure 7, monthly performance <strong>of</strong> this market shows very similar patterns over the last five years.<br />

It increased from January to March, and slows in April and it increases in May, drops to its lowest in June and<br />

from June till November the market grows steadily. In December the German market again starts to decline.<br />

9,000 9000<br />

8,000<br />

7,000<br />

6,000<br />

rivals numbers<br />

Arr<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 5,869 6,446 7,143 6,195 6,788 3,905 4,806 5,791 6,273 7,898 7,181 4,672 72,967<br />

2005 2,373 4,030 5,582 4,329 5,204 3,032 3,665 4,218 5,065 6,251 7,011 5,022 55,782<br />

2006 6,044 6,032 7,170 6,591 6,133 4,293 4,191 5,135 6,026 6,991 6,829 5,395 70,830<br />

2007 5,911 6,186 6,982 6,718 6,930 4,288 4,629 4,790 5,850 7,450 6,829 5,706 72,269<br />

2008 6,000 6,182 7,949 6,015 6,983 3,964 4,163 4,103 5,292 6,647 6,880 5,062 69,240<br />

13

In 2008, the Russian market captured a market share <strong>of</strong> 7.2% and became the 4th leading market to the<br />

Maldives.<br />

60.0<br />

50.0<br />

49.3<br />

50.6<br />

53.8<br />

40.0<br />

45.0<br />

30.0<br />

Percent(%)<br />

20.0<br />

10.0<br />

0.0<br />

-10.0<br />

2.9 3.7 3.6 4.7 7.2<br />

2004 2005 2006 2007 2008<br />

-20.0<br />

-19.3<br />

Market Share<br />

Arrival Growth<br />

-30.0<br />

In 2008, the most significant growth was performed by the Russian market with 53.8%. Russia is considered<br />

to be one <strong>of</strong> the potential and was the fastest growing markets to the Maldives in 2008. Over the last five<br />

years, excluding the tsunami year 2005, the Russian market has performed with an average <strong>of</strong> nearly 52%<br />

growth. The market share increased from 2.1% in 2003 to 7.2% in 2008.<br />

One <strong>of</strong> the factors that contributed to the increase in Russian arrivals to the Maldives was the start <strong>of</strong> charter<br />

flights from Moscow to Male’. The Kras Air which stopped its operation in 2006, restarted in 2007 and<br />

increased its flight movements in 2008. A new airline named Atlant Soyuz also began its charter flights from<br />

Moscow in 2008.<br />

The monthly arrivals from Russia show similar patterns over the last five years. June is recorded to have the<br />

lowest count in arrivals from Russia, while January records the highest number <strong>of</strong> arrivals.<br />

7,000<br />

6,000<br />

5,000<br />

rival numbers<br />

Arr<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 2,357 1,136 1,217 1,840 1,485 688 1,024 1,115 1,127 1,784 2,343 1,959 18,075<br />

2005 1,223 828 1,186 1,121 1,002 768 849 1,233 1,160 1,329 2,052 1,831 14,582<br />

2006 2,812 1,553 1,779 2,157 1,348 932 1,431 1,543 1,174 1,889 2,386 2,951 21,955<br />

2007 4,401 2,205 2,696 2,958 1,791 1,257 1,654 2,239 1,932 2,793 3,855 4,064 31,845<br />

2008 5,507 3,339 4,730 4,313 3,345 2,225 2,691 3,511 2,834 3,997 6,397 6,089 48,978<br />

14

The French market captured a market share <strong>of</strong> 7% to and was the 5th top tourist generating market to the<br />

Maldives in 2008.<br />

120.0<br />

100.0<br />

101.6<br />

80.0<br />

60.0<br />

Percent (% %)<br />

40.0<br />

20.0<br />

0.0<br />

-20.0<br />

12.4<br />

3.8 6.2<br />

5.5<br />

7.5<br />

7.2<br />

6.7 7.0<br />

2004 2005 2006 2007 2008<br />

-40.0<br />

-60.0<br />

-53.1<br />

Market Share<br />

Arrival Growth<br />

-80.0<br />

At the end <strong>of</strong> 2008, over 48 thousand tourists visited the Maldives from France with an annual growth rate <strong>of</strong><br />

6.2%. The market share increased from 6.7% in 2007 to 7% in 2008. Even though the French market share<br />

increased in 2008, it lost its 4th position to Russia in that year.<br />

The French market captured a market share <strong>of</strong> 7.3% in 2003, increased by 0.2% in 2004, it declined by 2% in<br />

2005, recovered to 2003 level in 2006, declined again in 2007 but increased its share to 7.0% in 2008 (refer<br />

Figure 10).<br />

Monthly performance <strong>of</strong> the French market shows that its best performance occurs from November to April<br />

(refer Figure 11). Arrivals start to decline in May and records the lowest in June.<br />

8000 8,000<br />

7,000<br />

6,000<br />

rival numbers<br />

Ar<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 5,661 6,193 6,324 5,076 2,277 1,258 2,089 2,718 1,864 3,124 5,170 4,402 46,156<br />

2005 870 2,229 2,170 2,002 1,013 554 982 1,395 1,140 1,932 3,343 4,010 21,640<br />

2006 5,712 6,690 5,605 5,145 2,366 1,069 1,735 2,594 1,927 2,662 3,703 4,419 43,627<br />

2007 6,010 6,678 6,761 4,742 2,076 1,048 1,485 1,977 1,411 2,865 5,030 5,218 45,301<br />

2008 6,784 7,163 6,019 5,801 2,437 1,096 1,455 2,393 1,674 3,295 4,565 5,418 48,100<br />

15

)<br />

The sixth leading market to the Maldives in 2008 was China with a total arrival <strong>of</strong> 61,511 and a market share<br />

<strong>of</strong> 6.1%. The Chinese market was the 6th leading market to the Maldives in 2007 as well. It grew by 15.4%<br />

in 2008 over 2007 and the market share increased from 5.3% in 2007 to 6.1% in 2008 (refer Figure 12).<br />

140.0<br />

120.0<br />

127.4<br />

100.0<br />

80.0<br />

Percent (%)<br />

60.0<br />

40.0<br />

20.0<br />

0.0<br />

-20.0<br />

37.1<br />

36.3<br />

15.4<br />

3.3 2.9 4.4 5.3 6.1<br />

2004 2005 2006 2007 2008<br />

-40.0<br />

-60.0<br />

-43.6<br />

Market Share<br />

Arrival Growth<br />

Apart from Russia, China is also considered to be a market with great potential. It has been increasing on an<br />

average rate <strong>of</strong> 48% over the last five years excluding 2005. It’s market share has been increasing steadily<br />

over the last five years. In 2003, it captured a market share <strong>of</strong> 2.7%, and at the end <strong>of</strong> 2008 it’s share rose to<br />

6.1%. As shown in Figure 13, the months <strong>of</strong> Dec, March and April show low performance throughout the<br />

period 2004-2008.<br />

6,000<br />

5,000<br />

rival numbers<br />

Ar<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 4,297 829 913 1,278 2,638 1,037 1,830 1,663 1,490 2,430 1,099 1,095 20,599<br />

2005 146 202 438 631 754 726 1,515 1,482 1,450 1,824 1,071 1,370 11,609<br />

2006 2,852 1,985 1,376 1,479 2,406 1,595 2,230 2,244 2,262 3,090 2,382 2,495 26,396<br />

2007 1,855 4,591 1,647 1,981 3,505 2,722 3,159 3,996 3,450 4,097 2,671 2,302 35,976<br />

2008 2,569 5,638 2,065 2,408 3,631 3,133 3,903 3,440 4,724 4,286 3,101 2,613 41,511<br />

16

)<br />

Japan, which used to be the 4th leading market to Maldives and the largest tourist generating market in Asia,<br />

lost its market position and dropped to the 7th position capturing a market share <strong>of</strong> 5.6% at the end <strong>of</strong> 2008.<br />

80.0<br />

60.0<br />

69.9<br />

40.0<br />

Percent (%)<br />

20.00<br />

0.0<br />

11.5<br />

4.0<br />

7.6 5.9 6.6<br />

6.1<br />

5.6<br />

2004 2005 2006 2007 2008-7.1<br />

-20.0<br />

-40.0<br />

-60.0<br />

-50.4<br />

Market Share<br />

Arrival Growth<br />

The Japanese market declined considerably over the years. In 2004 it captured a market share <strong>of</strong> 7.6% making<br />

it the 4th major market to Maldives. Since then its share has been declining (refer Figure 14). In 2006, Japan<br />

lost its market position to France and fell to the 5th position. In 2008, the Japanese market recorded a decline<br />

<strong>of</strong> more than 7%. The Japanese market performance is at its best during the month <strong>of</strong> August and lowest is<br />

in the month <strong>of</strong> May.<br />

7,000<br />

6,000<br />

5,000<br />

rival numbers<br />

Arr<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 3,553 3,206 3,471 3,513 3,040 3,182 4,462 6,031 5,178 3,931 4,377 2,995 46,939<br />

2005 622 1,025 1,472 1,519 1,011 1,385 2,256 2,962 3,037 2,668 2,498 2,814 23,269<br />

2006 2,918 2,238 2,820 2,573 2,167 2,696 3,950 4,003 4,269 4,094 4,225 3,575 39,528<br />

2007 2,586 3,293 3,623 3,173 2,057 2,822 3,554 4,322 4,714 3,913 3,477 3,587 41,121<br />

2008 2,269 2,985 3,088 2,832 2,305 3,062 3,746 3,966 4,288 3,413 3,178 3,061 38,193<br />

17

)<br />

With a market share <strong>of</strong> 4% in 2008, the Swiss market stood at the number 8th position.<br />

40.0<br />

35.9<br />

30.0<br />

20.0<br />

Percent (%)<br />

10.0<br />

0.0<br />

-10.0<br />

3.1<br />

4.7 4.9 4.4 3.9<br />

4.0<br />

-0.3<br />

2004 2005 2006 2007<br />

-5.0<br />

2008<br />

-20.0<br />

-30.0<br />

-40.0<br />

-33.9<br />

Market Share<br />

Arrival Growth<br />

The Swiss market was the sixth leading market to the Maldives in 2005. In 2006 it dropped to the 7th position<br />

with a decline <strong>of</strong> 0.5%. Its market share declined even further in 2007 and fell to the 8th position at the end<br />

<strong>of</strong> 2007 and remained at that position at the end <strong>of</strong> 2008. Though its position remained same the market share<br />

showed a slight increase <strong>of</strong> 0.1%.<br />

While most <strong>of</strong> the major markets showed double digit increase in the year 2004, the Swiss market showed<br />

a decline <strong>of</strong> 5% in that year. After the impact <strong>of</strong> tsunami, it recovered with a 35.9% growth in 2006, with a<br />

slight decline <strong>of</strong> 0.3% in 2007, and showed an increase <strong>of</strong> 3.1% at the end <strong>of</strong> 2008. October till April remain<br />

the best performance period as shown in Figure 17.<br />

4,000<br />

3,500<br />

3,000<br />

rival numbers<br />

Arr<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 2,861 3,329 3,023 3,402 1,857 1,141 1,697 1,343 1,940 3,134 3,430 2,095 29,252<br />

2005 1,176 1,624 2,076 1,729 1,263 804 1,386 1,213 1,474 2,340 2,321 1,915 19,321<br />

2006 2,758 2,438 2,395 3,169 1,766 866 1,768 973 1,741 2,893 2,801 2,683 26,251<br />

2007 2,551 2,581 2,702 3,731 1,478 956 1,817 904 1,726 2,221 2,792 2,724 26,183<br />

2008 2,815 2,883 3,265 2,933 1,465 1,214 1,459 1,099 1,665 2,544 3,080 2,561 26,983<br />

18

)<br />

Korea is the third market among the Asian markets which made its way to the top ten major market list <strong>of</strong><br />

Maldives. With a market share <strong>of</strong> 3.1% it stayed at the 9th position at the end <strong>of</strong> 2008.<br />

160.0<br />

140.0<br />

146.9<br />

120.0<br />

100.0<br />

80.0<br />

Percent (%)<br />

60.0<br />

40.0<br />

20.0<br />

0.0<br />

-20.0<br />

-40.0<br />

-60.0<br />

14.9<br />

1.6 1.7 2.7 3.1 3.1<br />

-0.2<br />

2004 2005 2006 2007 2008<br />

-32.4<br />

Market Share<br />

29.8<br />

Arrival Growth<br />

The Korean market made its way to the top ten list in 2006 and since then maintained its market position over<br />

the last three years. It’s market share rose from 1.6% in 2004 to 3.1% at the end <strong>of</strong> 2008.<br />

Even though it showed a negative growth <strong>of</strong> 0.2% in 2008, Korea is considered to be one <strong>of</strong> the potential<br />

markets to the Maldives and have been growing steadily over the years.<br />

As shown in Figure 19, the peak month for this market remained same over the years, the lowest performing<br />

months have been varying. From 2004 to 2006, the month <strong>of</strong> January was recorded to have the lowest count<br />

in tourist arrivals from Korea. However, this has changed over the last two years. In 2007, the lowest number<br />

<strong>of</strong> arrivals was in February while in 2008 it was July.<br />

3,500 3500<br />

3,000<br />

2,500<br />

rrival numbers<br />

Ar<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 402 763 856 597 1,351 638 588 466 713 1,351 1,241 706 9,672<br />

2005 79 205 199 398 521 435 575 396 501 1,312 1,105 817 6,543<br />

2006 489 694 760 1,260 1,745 1,248 866 729 1,513 2,207 2,511 2,135 16,157<br />

2007 1,492 862 1,344 1,749 2,484 1,496 1,454 947 1,574 3,019 2,472 2,083 20,976<br />

2008 1,438 1,164 1,632 2,103 2,705 2,001 898 911 1,610 2,879 2,353 1,240 20,934<br />

19

With a total arrivals <strong>of</strong> 16,663 and a market share <strong>of</strong> 2.4%, the Indian market remained at the 10th position<br />

in the top ten market list <strong>of</strong> 2008.<br />

50.0<br />

43.5<br />

40.0<br />

30.0<br />

Market Share<br />

Arrival Growth<br />

Percent (%)<br />

)<br />

20.0<br />

17.7<br />

10.0<br />

0.0<br />

-10.0<br />

1.8 2.6 2.0 2.6 2.4<br />

2004 2005 2006 2007 2008<br />

-3.8<br />

-4.4<br />

-6.7<br />

Arrivals from India increased significantly from 2004 to 2008. It’s market share increased from 1.8% in 2004<br />

to 2.4% at the end <strong>of</strong> 2008.<br />

Indian arrivals to the Maldives have been increasing at an average rate <strong>of</strong> 9% over the last five years. The<br />

highest growth was recorded in 2007 with +43.5%. Arrivals from India is at its peak during the month <strong>of</strong> May<br />

and December and performs steadily in other months.<br />

2,500<br />

2,000<br />

rival numbers<br />

Arr<br />

1,500<br />

1,000<br />

500<br />

0<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total<br />

2004 994 786 788 871 1,318 925 971 818 875 775 782 1,096 10,999<br />

2005 807 733 843 746 891 821 853 653 840 949 861 1,263 10,260<br />

2006 1,104 889 915 1,089 1,231 901 817 809 816 906 923 1,671 12,071<br />

2007 1,578 1,184 1,156 1,592 2,051 1,275 1,237 1,099 1,159 1,278 1,634 2,084 17,327<br />

2008 1,436 1,313 1,467 1,337 2,001 1,425 1,147 1,231 1,036 1,425 1,037 1,808 16,663<br />

20

AIRLINE STATISTICS

2004 2005 2006 2007 2008<br />

Type <strong>of</strong> Carrier<br />

Arrivals % Share Arrivals % Share Arrivals % Share Arrivals % Share Arrivals % Share<br />

Scheduled 578,147 81.3 419,271 81.6 592,971 80.7 669,219 80.3 694,718 80.8<br />

Charter 133,241 18.7 94,525 18.4 141,762 19.3 164,217 19.7 164,587 19.2<br />

Total 711,388 100.0 513,796 100.0 734,733 100.0 833,436 100.0 859,305 100.0<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Civil Aviation<br />

In 2008, 859,305 passengers arrived the Maldives by schedule and charter flights. This is a 3.1% increase<br />

compared to the 833,436 passengers that arrived in the year 2007. While more than 80% <strong>of</strong> the passengers<br />

arrived by Schedule flights, Charter flight passengers accounted for 19.2% <strong>of</strong> the total arrivals. As seen in<br />

Table 11, the charter flight passengers has been increasing steadily over the last five years, from 133,241<br />

passengers in 2004 to 164,587 passengers by the end <strong>of</strong> 2008.<br />

Operator<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

2004 2005 2006 2007 2008<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

International Schedule 9,074 578,147 7,400 419,271 8,114 592,971 9,414 669,219 9,993 694,718<br />

Aer<strong>of</strong>lot 54 3,320 - - 4 585 - - 26 2,492<br />

Air Europe -Italy 400 48,491 - - - - - - - -<br />

Air Seychelles 384 5,343 44 785 - - - - - -<br />

Air Sahara 66 1,680 264 8,575 - -<br />

Austrian Airlines 206 11,379 130 7,368 158 11,482 110 7,827 42 3,342<br />

Bangkok Airways 50 1,333 26 359 18 741 224 9,142 256 8,872<br />

China Eastern Airlines 280 7,075 217 7,690<br />

Condor 228 25,695 220 23,060 260 27,431 258 28,512 252 27,949<br />

Czech Airlines 4 19 28 147 - - - - - -<br />

Emirates 1,656 99,045 1,390 74,411 1,336 103,911 1,242 109,713 1,234 128,053<br />

Eur<strong>of</strong>ly 446 52,974 372 39,317 444 50,049 487 50,476 522 52,787<br />

Island Aviation Corporation - - - - - - - - 991 25,028<br />

Indian Airlines 734 42,036 736 45,678 820 52,433 1,258 68,425 1,326 63,836<br />

Krasair - - 12 772 - - - - - -<br />

Jazeera Airways 38 641 30 498<br />

L. T. U 340 39,858 306 29,068 310 38,206 314 37,859 258 29,896<br />

Lauda Air - Italy / Livingston 98 9,365 98 10,700 190 23,268 190 23,219 138 13,209<br />

Lauda Air - Vienna - - - - - - - - - -<br />

Malaysia Airlines 208 14,090 288 16,822 312 21,984 333 15,297 422 27,162<br />

Martin Air - - 18 802 152 4,616 56 1,229 - -<br />

Mihin Lanka - - - - - - 208 10,229 116 4,603<br />

Qatar Airways 740 31,409 722 31,768 734 52,202 736 65,891 732 62,263<br />

Singapore Airlines 540 62,699 404 35,916 540 63,893 730 90,472 735 83,569<br />

Srilankan Airlines 2,500 131,091 2,176 102,298 2,184 140,276 1,893 132,406 2,252 153,469<br />

Viva Macau - - - - 6 214 70 2,231 - -<br />

Srilankan Airlines (Cargo) 296 0 350 0 388 0 186 0 4 0<br />

Expo Aviation (Cargo) 190 0 80 0 192 0 537 0 440 0<br />

23

2004 2005 2006 2007 2008<br />

Operator<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements Passenger<br />

(Take <strong>of</strong>f / In<br />

Landing)<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

International Charter 1,972 133,241 1,725 94,525 2,356 141,762 3,231 164,217 3,508 164,587<br />

Air 2000/First Choice<br />

Airways<br />

58 7,168 62 7,053 169 19,502 - - - -<br />

Air Italy - - 2 212 38 3,263 72 7,723 8 925<br />

Air Luxor 2 0 - - - - - - - -<br />

Air Plus Comet 36 3,130 - - - - - - - -<br />

Air Slovakia 46 1,455 - - - - - - - -<br />

Atlant Soyuz - - - - - - - - 34 2,927<br />

Belair 52 5,269 24 1,662 20 1,509 52 4,430 78 5,899<br />

Blue Panorama Airlines 38 3,555 12 733 98 9,186 84 9,317 96 9,339<br />

Britannia Airways/<br />

Thomson Fly<br />

50 6,358 50 6,528 34 4,913 18 2,001 76 9,106<br />

Cathay Pacific 14 1,126 - - - - - - - -<br />

Condor - - - - - - - - 24 781<br />

Corse Air International 40 4,850 20 3,194 38 8,543 - - - -<br />

Domodedovo Airlines 12 530 4 234 - - - - - -<br />

Eagle Aviation 14 729 - - - - - - - -<br />

Edelweiss 166 19,779 122 14,447 158 20,403 156 18,194 158 18,956<br />

First Choice - - - - - - 210 25,172 180 21,406<br />

Kras Air 51 1,225 20 535 - - 40 3,575 131 13,463<br />

Malev - Hungarian<br />

Airlines<br />

12 798 4 139 20 1,376 18 937 - -<br />

Monarch Airlines 264 41,523 214 35,945 158 27,433 226 33,728 190 30,243<br />

My Travel Airways 52 7,957 16 2,139 38 4,194 72 8,558 - -<br />

Neos Spa 6 225 96 10,732 162 18,600 78 7,950 82 9,099<br />

Star Airlines/XL Airways 56 9,179 4 623 56 7,431 110 16,651 110 16,000<br />

Transaero Airlines 122 10,019 92 8,531 80 11,262 140 14,746 122 15,406<br />

Travel Services 32 1,044 - - - - 2 45 8 410<br />

Tuifly Nordic - - - - - - - - 10 1,394<br />

Vaso Airlines - - - - - - 7 303 - -<br />

Volare - - - - 4 189 40 3,785 60 4,070<br />

Other Internationals 849 7,322 983 1,818 1,283 3,958 1,906 7,102 2,141 5,163<br />

Total 11,046 711,388 9,125 513,796 10,470 734,733 12,645 833,436 13,501 859,305<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Civil Aviation<br />

At the end <strong>of</strong> 2008, international scheduled flight movements increased by 6.2% and charter flights increased<br />

by 8.6%. Aer<strong>of</strong>lot restarted its scheduled flights in 2008. Three Airliners, namely, Air Sahara, Martin Air and<br />

Viva Macau stopped its scheduled flights in 2008.<br />

The major highlight for the year 2008 was the beginning <strong>of</strong> charter flights from Atlant Soyuz, a Russian<br />

Airliner. With a total flight movements <strong>of</strong> 34, it brought in 2,927 passengers to the Maldives in 2008. The<br />

Condor flight, also operated charter flights to the Gan International Airport, the second international airport<br />

opened in the Maldives in 2007.<br />

24

2004 2005 2006 2007 2008<br />

Operator<br />

No. <strong>of</strong><br />

Movements Passenger<br />

(Take <strong>of</strong>f / In<br />

Landing)<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements<br />

(Take <strong>of</strong>f /<br />

Landing)<br />

Passenger<br />

In<br />

No. <strong>of</strong><br />

Movements Passenger<br />

(Take <strong>of</strong>f / In<br />

Landing)<br />

Domestic<br />

Air Equator 256 3,076 175 2,263 - - - - - -<br />

Island Aviation<br />

Services<br />

Maldivian Air<br />

Taxi<br />

Trans Maldivian<br />

Airways (Scheduled)<br />

Trans Maldivian<br />

Airways<br />

Other Domestic<br />

*<br />

4,535 45,754 5,470 55,694 7,378 72,272 9,139 93,244 9,311 90,557<br />

34,762 163,048 25,150 136,569 35,859 186,522 38,959 195,361 39,570 204,413<br />

- - - - - - - - 1,538 21,408<br />

21,186 109,144 14,753 63,950 22,152 96,221 26,798 109,825 25,856 101,624<br />

1,347 0 1,443 0 2,028 0 - - - -<br />

Total 62,086 321,022 46,991 258,476 67,417 355,015 74,896 398,430 76,275 418,002<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Civil Aviation<br />

Even though there has not been any major increase in domestic flight movements, the passenger arrivals from<br />

domestic carriers showed nearly a 5% growth over 2007. While the Maldivian Air Taxi and Trans Maldivian<br />

Airways, mainly cater to the tourism sector <strong>of</strong> the Maldives, flight movements as well as passenger traffic,<br />

increased in 2008, Island Aviation Services showed a decline in passenger movements in 2008 compared to<br />

2007.<br />

25

ECONOMIC INDICATORS

Economic growth <strong>of</strong> the Maldives has been largely driven by the tourism sector. <strong>Tourism</strong> is the leading<br />

industry and a range <strong>of</strong> tertiary activities have grown to support tourism.<br />

Year GDP GDP Growth % <strong>Tourism</strong> Contribution<br />

% Share <strong>of</strong> <strong>Tourism</strong><br />

Contribution<br />

2004 8,312.30 9.5 2,688.80 32.3<br />

2005 7,927.50 -4.6 1,798.50 22.7<br />

2006 9,442.60 19.1 2,559.70 _/ 27.4 _/<br />

2007 10,067.40 6.6 2,816.60 27.9<br />

2008 10,607.30 5.4 2,884.95 27.2<br />

Note: _/ Revised fi gures<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> National Planning<br />

From mid 80’s till early 2000’s tourism has contributed over 30% to the GDP <strong>of</strong> the Maldives. Though<br />

the percentage contribution nearly dropped by 10%, after the impact <strong>of</strong> Asian Tsunami <strong>of</strong> 2004, it started<br />

recovering in 2006. In 2007, tourism contribution stood at 27.9% and 2008 it showed a slight decline -0.7%.<br />

The decline in 2008 was due to the slow down in tourist arrivals in 2008 as a result <strong>of</strong> world economic<br />

recession.<br />

Year<br />

Government<br />

Revenue<br />

<strong>Tourism</strong> Revenue<br />

% Share <strong>of</strong> <strong>Tourism</strong><br />

Revenue<br />

<strong>Tourism</strong> Tax<br />

% Share <strong>of</strong><br />

<strong>Tourism</strong> Tax to<br />

<strong>Tourism</strong> Revenue<br />

2004 3,351.80 921.47 27.5 409.50 44.4<br />

2005 3,788.30 911.80 24.1 346.50 _/ 37.8<br />

2006 5,286.70 1,776.90 33.6 495.70 27.9<br />

2007 _// 6,669.40 2,525.07 37.9 544.25 21.7<br />

2008 7,054.43 1,969.72 27.9 566.55 28.8<br />

Note: _/ Revised fi gures, _// Provisional estimates<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Department <strong>of</strong> Inland Revenue<br />

Over the last five years, tourism contribution to the government revenue has been increasing steadily. In 2004<br />

tourism contributed about 28% to the government revenue. In 2008, total Government Revenue was 7,054.43<br />

million Rufiyaa out <strong>of</strong> which 1,969.72 million came from tourism. The percentage share <strong>of</strong> tourism revenue<br />

to the total government revenue in 2008 was 27.9%.<br />

29

Year Government Expenditure <strong>Tourism</strong> Expenditure<br />

% Share <strong>of</strong><br />

<strong>Tourism</strong> Expenditure<br />

2004 3,779.10 56.30 1.5<br />

2005 5,775.40 57.40 1.0<br />

2006 _/ 7,066.20 100.80 1.4<br />

2007 9,036.30 111.80 1.2<br />

2008 10,801.76 170.80 1.6<br />

Note: _/ Revised fi gures,<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: <strong>Ministry</strong> <strong>of</strong> Finance & Treasury<br />

Even though the tourism revenue has been increasing at a steady rate over the years, the share <strong>of</strong> government<br />

expenditure on tourism is very low (refer Table 16). From 2005 to 2006 tourism expenditure almost doubled<br />

as a result <strong>of</strong> the extra activities that had to be carried out to recover from the impacts <strong>of</strong> Asian tsunami <strong>of</strong><br />

2004.<br />

In 2008, a total <strong>of</strong> 170.80 million Rufiyaa were spent on tourism, which is 1.6 <strong>of</strong> total government<br />

expenditure.<br />

Year<br />

<strong>Tourism</strong> Receipts Growth Rate (%) Exports, FOB Imports, CIF<br />

2004 470.87 17.27 122.40 639.30<br />

2005 286.64 -39.13 103.80 742.00<br />

2006 512.45 _/ 78.78 135.07 922.92<br />

2007 602.37 17.55 107.80 1,092.02<br />

2008 696.30 * 15.59 125.87 1,382.11<br />

Note: _/ Revised fi gures, * Provisional estimates<br />

Source: <strong>Ministry</strong> <strong>of</strong> <strong>Tourism</strong>, <strong>Arts</strong> & <strong>Culture</strong><br />

Data provided by: Maldives Monetary Authority<br />

Maldives Customs Services<br />

<strong>Tourism</strong> Receipts, which is calculated in United States Dollars, has been increasing over the years (refer<br />

Table 17). In 2004 a total <strong>of</strong> 470.87 million US Dollars was received as tourism receipts. In 2008 tourism<br />

receipts totalled 692.32 million dollars. This was an increase <strong>of</strong> 15% over 2007.<br />

30

ADDITIONAL TABLES

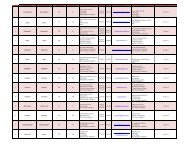

Name <strong>of</strong> the Resort<br />

Atoll & Island Name<br />

Airport<br />

Distance<br />

(Km)<br />

Year <strong>of</strong> Initial Initial Bed<br />

Operation Capacity<br />

2004 2005 2006 2007 2008<br />

1Adhaaran Club Bathala A.A. Bathala 48.3 1983 20 90 90 90 90 90<br />

2Adhaaran Club Rannaalhi K. Rannalhi 2.0 1978 34 232 232 232 232 256<br />

3Adhaaran Select Hudhuranfushi K. Lhohifushi 22.5 1979 40 274 274 274 354 354<br />

4Adhaaran Select Meedhupparu R. Meedhupparu 130.3 2000 430 430 466 470 470 470<br />

5Alimatha Aquatic Resort V. Alimatha 48.0 1975 20 204 260 260 260 260<br />

6Anantara Resort & Spa Maldives K. Dhigufinolhu 40.0 1980 24 200 200 220 220 220<br />

7Angaaga Island Resort and Spa A.Dh. Angaga 85.0 1989 100 140 140 140 140 140<br />

8Angsana Resort & Spa Maldives, Ihuru K. Ihuru 17.0 1978 20 90 90 90 90 90<br />

9Angsana Resort and Spa Maldives - Velavaru Dh. Velavaru 125.0 1998 50 168 168 168 168 168<br />

10Asdhu Sun Island K. Asdhu 32.0 1981 36 60 60 60 60 60<br />

11Athurugau Island Resort A.Dh. Athurugau 90.0 1990 79 98 98 98 98 98<br />

12Bandos Island Resort and Spa K. Bandos 8.0 1972 220 450 450 450 450 450<br />

13Banyan Tree Maldives Vabbinfaru K. Vabbinfaru 12.0 1977 24 96 96 96 96 96<br />

14Baros Holiday Resort K. Baros 16.0 1973 56 150 150 150 150 150<br />

15Biyaadhu Island Resort K. Biyaadhoo 18.0 1982 192 192 192 192 192 192<br />

16Chaaya Lagoon Hakuraa Huraa M. Hakuraa Huraa 128.7 1999 72 160 160 160 160 160<br />

17Cinnamon Island Alidhoo H.A. Alidhoo 300.0 2007 66 - - - 200 200<br />

18Club Faru, Farukolhufushi K. Farukolhufushi 2.0 1973 112 304 304 304 304 304<br />

19Club Med Kanifinolhu K. Kanifinolhu 19.3 1978 18 378 378 444 444 444<br />

20Coco Palm Boduhithi K. Boduhithi 29.0 1979 50 206 206 206 206 206<br />

21Coco Palm Dhunikolhu B. Dhunikolhu 124.0 1998 192 200 200 200 200 200<br />

22Coco Palm Kudahithi K. Kudahithi 27.4 1984 12 14 14 14 14 14<br />

23Cocoa Island K. Makunufushi 30.0 1981 12 60 70 70 70 70<br />

24Conrad Maldives Rangali Island A.Dh. Rangalifinolhu 96.6 1992 80 304 304 304 304 304<br />

25Diva Maldives A.Dh. Dhidhdhufinolhu 104.0 1988 180 282 282 282 282 394<br />

26Dhiggiri Tourist Resort V. Dhiggiri 32.0 1982 50 90 90 90 90 90<br />

27Chaaya Island Dhonveli K. Kanuoiy Huraa 13.0 1981 20 92 128 176 292 292<br />

28Dream Island Maldives K. Villivaru 29.0 1981 120 120 120 120 120 120<br />

29Ellaidhu Tourist Resort A.A., Ellaidhoo 54.0 1985 32 156 156 156 176 224<br />

30Emboodhu Village K. Emboodhu 8.0 1979 44 236 236 236 236 236<br />

31Eriyadhu Island Resort K. Eriyadhu 40.0 1982 40 114 114 114 114 114<br />

32Fihalhohi Island Resort K. Fihaalhohi 28.0 1981 90 300 300 300 300 300<br />

33Filitheyo Island Resort F. Filitheyo 120.7 1999 250 250 250 250 250 250<br />

34Four Seasons Resort Maldives at Kuda Huraa K. Kuda Huraa 12.9 1977 32 212 212 212 212 212<br />

35Four Seasons Resort Maldives at Landaa Giraavaru B. Landaa Giraavaru 120.0 2006 206 - - 206 206 206<br />

36Full Moon Beach Resort K. Furanafushi 5.6 1973 112 312 312 312 312 312<br />

33

Name <strong>of</strong> the Resort<br />

Atoll & Island Name<br />

Airport<br />

Distance<br />

(Km)<br />

Year <strong>of</strong> Initial<br />

Operation<br />

Initial Bed<br />

Capacity<br />

2004 2005 2006 2007 2008<br />

37Fun Island Resort K. Bodufinolhu 38.0 1980 44 200 200 200 200 200<br />

38Gangehi Island Resort A.A. Gangehi 77.2 1987 50 50 50 50 50 72<br />

39Gasfinolhu Island Resort K. Gasfinolhu 23.0 1980 18 80 80 80 80 80<br />

40Giraavaru Tourist Resort K. Giraavaru 11.3 1980 40 132 132 132 132 132<br />

41Halaveli Holiday Village A.A. Halaveli 36.0 1982 30 112 112 112 112 112<br />

42Helengeli Island Resort K. Helengeli 46.7 1979 20 100 100 100 100 100<br />

43Handhufushi S. Herethere 480.0 2007 106 - - - 546 546<br />

44Holiday Island A.Dh. Dhiffushi 93.0 1994 284 284 284 284 284 284<br />

45Huvafenfushi K. Nakatchafushi 25.7 1979 80 102 102 102 102 102<br />

46Irufushi Beach and Spa Resort N. Medhafushi 238.0 2008 200 - - - - 300<br />

Island Hideaway at Dhonakulhi<br />

47 H.A. Dhonakulhi 250.0 2005 50 - 50 90 90 90<br />

Maldives, Spa Resort & Marina<br />

48Island <strong>of</strong> Bolifushi K. Bolifushi 12.0 1982 64 110 110 110 110 110<br />

49Kandooma Tourist Resort K. Kandoomafushi 27.4 1985 98 204 204 204 204 322<br />

50Kihaadhuffaru Resort B. Kihaadhuffaru 104.6 1999 200 200 200 200 200 200<br />

51Komandoo Maldive Island Resort Lh. Komandoo 128.7 1998 90 90 120 120 120 120<br />

52Kudarah Island Resort A.Dh. Kudarah 88.5 1991 50 60 60 60 60 60<br />

53Kuramathi Tourist Resort A.A. Kuramathi 56.3 1977 48 580 580 580 580 580<br />

54Kuredhdhu Island Resort Lh. Kuredhdhu 128.7 1978 18 660 660 660 740 746<br />

55Kurumba Maldives K. Vihamanaafushi 3.2 1972 60 362 362 362 362 362<br />

56Laguna Maldives K. Velassaru 11.3 1974 90 258 258 258 258 258<br />

57Lily Beach Resort A.Dh. Huvahendhoo 85.0 1994 168 170 170 170 170 170<br />

58Maayafushi Tourist Resort A.A. Maayafushi 63.0 1983 48 134 150 150 150 150<br />

59Machchafushi Island Resort A.Dh. Machchafushi 95.0 1992 96 128 128 128 128 128<br />

60Madoogali Resort A.A. Madoogali 77.2 1989 70 112 112 112 112 112<br />

61Makunudhoo Island K. Makunudhu 38.6 1983 58 74 74 74 74 74<br />

62Medhufushi Island Resort M. Medhufushi 128.7 2000 240 240 240 240 240 240<br />

63Meeru Island Resort K. Meerufenfushi 37.0 1978 128 454 518 518 570 570<br />

64Mirihi Island Resort A.Dh. Mirihi 112.6 1989 36 72 72 72 72 72<br />

65Mo<strong>of</strong>ushi Island Resort A.Dh. Mo<strong>of</strong>ushi 80.0 1990 84 120 124 124 124 124<br />

66Naladhu K. Veligandu Huraa 27.0 1986 32 112 112 112 138 138<br />

67Nika Island Resort A.A. Kudafolhudhu 69.2 1983 30 56 76 76 76 76<br />

68Olhuveli Beach & Spa Resort K. Olhuveli 51.5 1979 36 250 268 268 268 268<br />

69One & Only Kanuhura, Maldives Lh. Kanuhuraa 125.5 1999 200 200 200 200 200 200<br />

70One & Only Reethi Rah, Maldives K. Medhufinolhu 64.4 1979 24 120 264 264 264 264<br />