BDO Mozambique July 2012 Newsletter - MCLI

BDO Mozambique July 2012 Newsletter - MCLI

BDO Mozambique July 2012 Newsletter - MCLI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWSLETTER<br />

SEPTEMBER <strong>2012</strong>

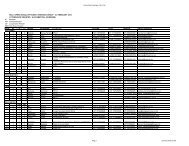

MONTHLY TAX OBLIGATIONS<br />

DATE OBLIGATION DESCRIPTION LEGAL BASIS<br />

10 SEP<br />

<strong>2012</strong><br />

Social Security<br />

Payment of employees Social security contribution from salaries of<br />

August <strong>2012</strong>.<br />

Art.43 of<br />

Ministerial<br />

Order no.<br />

45/90, of 9<br />

May<br />

20 SEP<br />

<strong>2012</strong><br />

Stamp Tax<br />

Payment of taxes related to bills of exchange and promissory notes<br />

resulting from the use of credit in financial transactions and insurance<br />

polices which fiscal obligations were incurred in August <strong>2012</strong>.<br />

Art.16, no.1<br />

of Decree no.<br />

6/2004<br />

20 SEP<br />

<strong>2012</strong><br />

IRPS (Personal<br />

Income Tax)<br />

Payment of withheld taxes from Personal Income Tax Code (includes<br />

PAYE)<br />

Art.65 CIRPS<br />

20 SEP<br />

<strong>2012</strong><br />

IRPC<br />

(Company Income<br />

Tax)<br />

Payment of Corporate Tax<br />

No.5, Art.67<br />

CIRPC<br />

20 SEP<br />

<strong>2012</strong><br />

Specific Tax<br />

on Oil Production<br />

Payment of Oil production taxes for August <strong>2012</strong>.<br />

Art.10 of Decree<br />

no.<br />

4/2008<br />

20 SEP<br />

<strong>2012</strong><br />

Mining Production<br />

Tax<br />

Payment of mineral extraction taxes for August <strong>2012</strong>.<br />

Art.10 of Decree<br />

no.<br />

5/2008<br />

Normal Regime<br />

30 SEP<br />

<strong>2012</strong><br />

VAT<br />

Submission to relevant Tax Authority the periodic statement of August<br />

<strong>2012</strong> with respective payment. Taxpayers who did not perform<br />

any taxable transaction are also required to submit periodic statement.<br />

Isolated acts<br />

Taxable persons who performed independently a single taxable<br />

Art.25, point<br />

c), no.1, Art.<br />

32 of CIVA<br />

Art.33 of<br />

CIVA<br />

transaction should submit the respective statement (Model E)

CORPORATE TAX<br />

Companies with organized accounting will have to pay the third instalment of the Advancement of Company Income<br />

Tax. Companies with different tax period of December 31, must pay the Advancement of Company Income Tax on<br />

the 5th, 7th and 9th month of the tax calendar.<br />

Note that the Advanced Payment is 80% of collection paid in the previous year divided into three equal instalments<br />

rounded up (paragraph 2 of article 28. CIRPC of regulation).<br />

In the case of last instalment should be noted that if the taxpayer check that the amount of the advance payment<br />

already made is equal to or greater than the tax that is due based on taxable income for the year, can no longer<br />

make new payment, but must remit to the tax authority a declaration of limitation payment due until the expiry of<br />

the deadline for payment.<br />

CODE OF CORPORATE INCOME TAX AND ITS REGULATION<br />

We provide on our site www.bdo.co.mz, an updated version of Law number 32/2007 of December 31 - VAT Code,<br />

as amended by Law 3/<strong>2012</strong> of 23 January and its Regulation approved by Decree 7/2008 of 16 April, as amended<br />

by Decree 4/<strong>2012</strong> of 24 February.<br />

DECISIONS TAKEN BY THE COUNCIL OF MINISTERS IN AUGUST<br />

Approved:<br />

• Balance of economic and social<br />

plan in the first half of <strong>2012</strong>.<br />

• Decree authorizing the Minister<br />

of Finance to obtain internal<br />

amortizable loan called Treasury<br />

Bonds-<strong>2012</strong>, until the total<br />

amount of 3,150,112.40 million<br />

MT.<br />

• Decree establishing a Committee<br />

for Africa Liberation Movements<br />

(CPMLA) Heritage Preservation<br />

Programme and approves its articles<br />

of association.<br />

• Balance of the Global Strategy<br />

for Public Sector Reform -2001-<br />

2011 and approach of public sector<br />

reform following the end of<br />

the implementation of the global<br />

strategy of public sector reform<br />

from 2001 to 2011.<br />

• Decree authorizing the company<br />

Manica Chinhamapare Investments,<br />

SA, (SOMACHIL, SA) to<br />

create the “Instituto Sperior”<br />

with headquarters in Manica,<br />

Manica province.<br />

• Decree authorizing Prometra-<br />

Agro Ltd, to create the “Instituto<br />

Superior de Estudos de Desenvolvimento”<br />

Local, referred to as<br />

ISEDEL, at nation level, with<br />

headquarters in the administrative<br />

post of Maluana, district of<br />

Manhiça, Maputo province.<br />

• Resolutions authorizing the Company<br />

Sunslots <strong>Mozambique</strong>, SA,<br />

to operate games of chance, in<br />

the cities of Matola and Tete,<br />

respectively.<br />

• Integrated Management Strategy<br />

for Solid Waste.<br />

<strong>BDO</strong> NEWS<br />

<strong>BDO</strong> won the Global Outsourcing Award in category of “Outsourcing Service Provider of the Year”, organized by the<br />

European Outsourcing Industry.<br />

This award recognizes the strategic investment that <strong>BDO</strong> has focused on developing F&A services for the very biggest<br />

and the very smallest clients across almost every country in Europe.

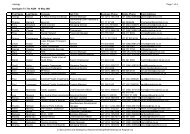

LEGISLATION PUBLISHED IN AUGUST<br />

ASSEMBLY OF THE REPUBLIC<br />

• Resolution no. 10/<strong>2012</strong><br />

Approves the Parliament Report and Annual Account for the financial year 2011.<br />

COUNCIL OF MINISTERS<br />

• Decree no. 30/<strong>2012</strong><br />

Defines the requirements for forest exploration under a simple license and under the terms, conditions and incentives<br />

for the establishment of forest plantations and revokes sections 16, 18 and 20 of the Regulation of Forestry and<br />

Wildlife Law, approved by Decree no. 12 / 2002 of June 6.<br />

TOP 100 SME AWARD<br />

The Top 100 SME Award of <strong>Mozambique</strong> is a joint initiative between the Ministry of Industry and Trade - IPEME and<br />

Group Soico that has the support of SNV, BCI and <strong>BDO</strong>, which aims to publicly recognize good business practices,<br />

establish a research instrument and inducer of policy measures, establish a mechanism to standardize the classification<br />

of Micro, Small and Medium Enterprises, promote the development of Mozambican entrepreneurship, encourage<br />

the inclusion of poor communities and/or individuals in companies value chain and distinguish the Top 100<br />

Small and Medium size companies in <strong>Mozambique</strong>.<br />

A unique initiative in <strong>Mozambique</strong> that aims to innovate and mark the national economic agenda through positive<br />

communication that encourages the creation and development of small and medium size companies.<br />

To apply for this event, Small and Medium Size Enterprises in <strong>Mozambique</strong> you must complete the entry form, attach<br />

the required documents set forth in the Regulation and consult the website www.100melhorespme.co.mz in<br />

order to confirm your participation.<br />

IFRS NEWS<br />

21AUG12<br />

IFRS at a Glance (IAAG) has been compiled to assist in gaining a high level overview of International<br />

Financial Reporting Standards (IFRSs), including International Accounting Standards and Interpretations.<br />

The update includes all IFRSs in issue as at 30 June <strong>2012</strong>. The update features minor amendments to<br />

IFRS 1 First-time adoption of International Financial Reporting Standards and IFRS 7 Financial Instru-<br />

09AUG12<br />

The IFRS Formula Linkbase <strong>2012</strong> is now available for download from the IASB website. It is an updated<br />

version of the formula prototype which was released in October 2011. The <strong>2012</strong> formulae are designed<br />

to work with the IFRS Taxonomy <strong>2012</strong>.<br />

07AUG12<br />

EFRAG and the Italian standard setter Organismo Italiano di Contabilita (OIC) have issued a questionnaire<br />

on impairment requirements for goodwill. Respondents are invited to complete the questionnaire<br />

by 30 September <strong>2012</strong>.<br />

EFRAG and OIC expect that the IASB will initiate its post-implementation review of IFRS 3 Business<br />

Combinations in 2013.<br />

07AUG12<br />

The trustees of the IFRS Foundation, responsible for the governance and oversight of the International<br />

Accounting Standards Board (IASB), published for public comment a drafting review of the IFRS Foundation<br />

Constitution.<br />

The review incorporates changes to the Constitution to reflect the separation of the role of Chairman<br />

of the IASB and Chief Executive Officer of the IFRS Foundation. This change is in line with the conclusions<br />

of the Monitoring Board Governance Review.

<strong>BDO</strong> IN MOÇAMBIQUE<br />

• At <strong>BDO</strong> we believe that the success of our customers is our own success.<br />

• <strong>BDO</strong> <strong>Mozambique</strong> was founded in 1999 already has a portfolio of more than 200<br />

customers and more than 100 highly skilled consultants.<br />

• <strong>BDO</strong> <strong>Mozambique</strong> is the Audit and Consulting company with higher growth in<br />

<strong>Mozambique</strong> in recent years.<br />

• <strong>BDO</strong> provides flexibility, expertise, direct contact with customer and personalized<br />

services of a local firm, combining these features to a global network of<br />

knowledge and experts.<br />

• <strong>BDO</strong> is distinguished by its ability to offer the best of both worlds<br />

HOW CAN WE HELP YOU?<br />

Services with the quality that your company deserves in<br />

<strong>Mozambique</strong> and the world.<br />

• Audit: independence, competence and credibility to help<br />

our customers thrive in both national and international<br />

markets.<br />

• Accounting: Outsourcing of accounting function and advice<br />

of professionals with large experience<br />

• Consulting: development of methodology and strategic<br />

solutions for companies to obtain the best position in the<br />

market.<br />

• Tax : Tax support to companies and organizations.<br />

AUDIT<br />

In addition to validating financial information of companies<br />

and institutions, we analyze not only the correct application<br />

of standards and legislation, but also the internal control<br />

system and continuity of operations.<br />

Our professional intervention in this area includes, in particular:<br />

• Complete audit the financial statements;<br />

• Review internal control;<br />

• Limited review financial statements;<br />

• Examination of prospective financial information;<br />

• Specific audits (incentives, due diligence, accounting,<br />

research, statistics);<br />

• Internal audit, management, information technology,<br />

taxation and others.<br />

ACCOUNTING<br />

<strong>BDO</strong> is the largest provider of accounting services in the<br />

country, with more than 30 technicians and dozens of devoted<br />

customers.<br />

We present the ideal solution for the businessmen or institution<br />

wishing to focus on their core business leaving highly<br />

risky specialized administrative tasks to professionals and<br />

experts.<br />

The main services we provide are the following:<br />

• Transition and implementation of IFRS;<br />

• Accounting Service;<br />

• Accounting Outsourcing;<br />

• Payroll Services;<br />

• Consolidation of accounts;<br />

• Training.<br />

ADVISORY<br />

<strong>BDO</strong> Advisory has qualified advisors to support solutions that<br />

generate added value for companies and other entities increasingly<br />

look for our services. The large experience of<br />

<strong>BDO</strong> allows companies to benefit from functional and practical<br />

solutions designed by our team of advisors with the use<br />

of advanced technological tools and always taking into account<br />

the particularities of each business.<br />

In this context, we provide the following services:<br />

• Evaluation of companies;<br />

• Feasibility studies;<br />

• Investment and Financing;<br />

• Restructuring of companies and organizations;<br />

• Strategic plans and business plans;<br />

• Information systems advisory, with particular emphasis<br />

to the implementation of integrated systems and developments;<br />

• Advice on Human Resources;<br />

• Specific training.<br />

TAX<br />

<strong>BDO</strong> Tax monitors the compliance with the obligations of<br />

the companies, institutions and individuals, and shall review<br />

tax strategies with the aim of optimizing tax solutions and<br />

minimize tax risk.<br />

Our services include:<br />

• Monitoring of compliance with tax obligations and charges;<br />

• Mergers and Acquisitions;<br />

• Process of insolvency;<br />

• Full tax situations diagnosis;<br />

• Tax planning and prevention;<br />

• Studies of fiscal framework;<br />

• Taxation of expatriates;<br />

• Collection of tax incentives;<br />

• Support expatriates;<br />

• Support transfer of capital.

CONTACTS<br />

25 de Setembro Avenue, 1230,<br />

3th Floor Block 5 CP 4200<br />

Maputo<br />

Republic of <strong>Mozambique</strong><br />

Tel.: +258 21 300720<br />

Email: eferreira@bdo.co.mz<br />

www.bdo.co.mz<br />

This information has been carefully prepared, but it has been written in general terms and should be seen<br />

as broad guidance only. The information cannot be relied upon to cover specific situations and you should<br />

not act, or refrain from acting, upon the information contained therein without obtaining specific professional<br />

advice. Please contact <strong>BDO</strong> Lda. to discuss these matters in the context of your particular circumstances.<br />

<strong>BDO</strong> Lda., its partners, employees and agents do not accept or assume any liability or duty of care<br />

for any loss arising from any action taken or not taken by anyone in reliance on this information or for any<br />

decision based on it.<br />

<strong>BDO</strong> Lda., a Mozambican limited company, is a member of <strong>BDO</strong> International Limited, a UK company limited<br />

by guarantee, and forms part of the international <strong>BDO</strong> network of independent member firms.<br />

<strong>BDO</strong> is the brand name for the <strong>BDO</strong> network and for each of the <strong>BDO</strong> Member Firms<br />

Legal authorization to work in Audit and Certification of Accounts by order of 27/10/99 Vice-Minister of<br />

Planning and Finance<br />

Copyright © <strong>BDO</strong> Lda. All rights reserved.<br />

. Please consider the environment before printing this document.