download PDF - Robert Sterling Clark Foundation

download PDF - Robert Sterling Clark Foundation

download PDF - Robert Sterling Clark Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

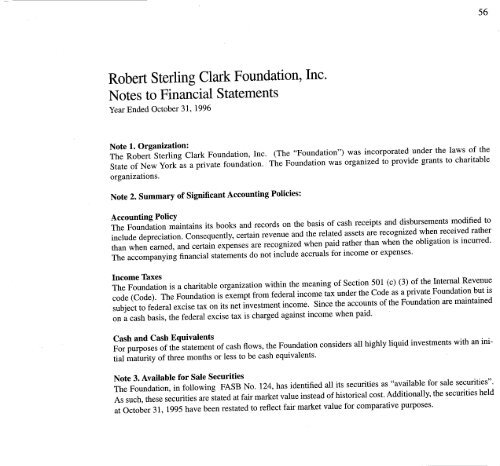

56<br />

<strong>Robert</strong> <strong>Sterling</strong> <strong>Clark</strong> <strong>Foundation</strong>, Inc.<br />

Notes to Financial Statements<br />

Year Ended October 31, 1996<br />

Note 1. Organization:<br />

The <strong>Robert</strong> <strong>Sterling</strong> <strong>Clark</strong> <strong>Foundation</strong>, Inc. (The "<strong>Foundation</strong>") was incorporated under the laws of the<br />

State of New York as a private foundation. The <strong>Foundation</strong> was organized to provide grants to charitable<br />

organizations.<br />

Note 2. Summary of Significant Accounting Policies:<br />

Accounting Policy<br />

The <strong>Foundation</strong> maintains its books and records on the basis of cash receipts and disbursements modified to<br />

include depreciation. Consequently, certain revenue and the related assets are recognized when received rather<br />

than when earned, and certain expenses are recognized when paid rather than when the obligation is incurred.<br />

The accompanying financial statements do not include accruals for income or expenses.<br />

Income Taxes<br />

The <strong>Foundation</strong> is a charitable organization within the meaning of Section 501 (c) (3) of the Internal Revenue<br />

code (Code). The <strong>Foundation</strong> is exempt from federal income tax under the Code as a private <strong>Foundation</strong> but is<br />

subject to federal excise tax on its net investment income. Since the accounts of the <strong>Foundation</strong> are maintained<br />

on a cash basis, the federal excise tax is charged against income when paid.<br />

Cash and Cash Equivalents<br />

For purposes of the statement of cash flows, the <strong>Foundation</strong> considers all highly liquid investments with an initial<br />

maturity of three months or less to be cash equivalents.<br />

Note 3. Available for Sale Securities<br />

The <strong>Foundation</strong>, in following FASB No. 124, has identified all its securities as "available for sale securities".<br />

As such, these securities are stated at fair market value instead of historical cost. Additionally, the securities held<br />

at October 31, 1995 have been restated to reflect fair market value for comparative purposes.