ethical equity fund - New Ireland Assurance

ethical equity fund - New Ireland Assurance

ethical equity fund - New Ireland Assurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Image description.<br />

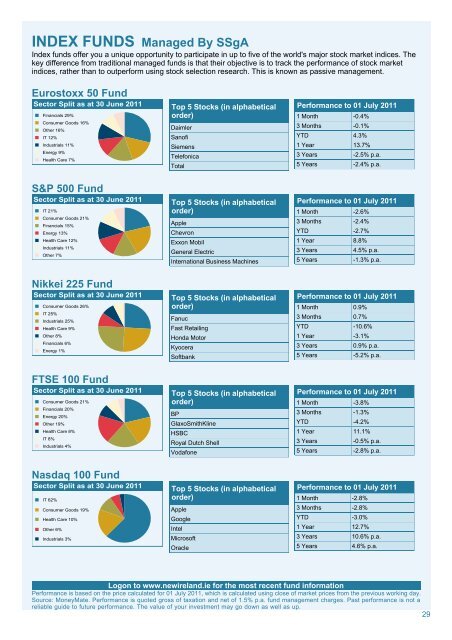

INDEX FUNDS Managed By SSgA<br />

Index <strong>fund</strong>s offer you a unique opportunity to participate in up to five of the world's major stock market indices. The<br />

key difference from traditional managed <strong>fund</strong>s is that their objective is to track the performance of stock market<br />

indices, rather than to outperform using stock selection research. This is known as passive management.<br />

Eurostoxx 50 Fund<br />

Sector Split as at 30 June 2011<br />

Sector Pie chart Split with as 7 at items. 30 June 2011<br />

1, 2, Financials Consumer 29% Goods 29.<br />

3, Other 16% 16. 16% 16.<br />

4, 5, IT Industrials 12% 12.<br />

6, Energy 9% 11% 9. 11.<br />

Item 7, Health Care 7% 7.<br />

End of image description.<br />

Financials 29%<br />

Consumer Goods 16%<br />

Other 16%<br />

IT 12%<br />

Industrials 11%<br />

Energy 9%<br />

Health Care 7%<br />

Top 5 Stocks (in alphabetical<br />

order)<br />

Daimler<br />

Sanofi<br />

Siemens<br />

Telefonica<br />

Total<br />

Performance to 01 July 2011<br />

1 Month -0.4%<br />

3 Months -0.1%<br />

YTD 4.3%<br />

1 Year 13.7%<br />

3 Years -2.5% p.a.<br />

5 Years -2.4% p.a.<br />

S&P 500 Fund<br />

Image description.<br />

Sector Pie chart Split with as 7 at items. 30 June 2011<br />

1, 2, IT Consumer 21% 21.<br />

3, Financials 15% Goods 15. 21% 21.<br />

4, 5, Energy Health Care 13% 12% 13.<br />

6, Industrials 11% 11. 12.<br />

Item 7, Other 7% 7.<br />

End of image description.<br />

Sector Split as at 30 June 2011<br />

IT 21%<br />

Consumer Goods 21%<br />

Financials 15%<br />

Energy 13%<br />

Health Care 12%<br />

Industrials 11%<br />

Other 7%<br />

Top 5 Stocks (in alphabetical<br />

order)<br />

Apple<br />

Chevron<br />

Exxon Mobil<br />

General Electric<br />

International Business Machines<br />

Performance to 01 July 2011<br />

1 Month -2.6%<br />

3 Months -2.4%<br />

YTD -2.7%<br />

1 Year 8.8%<br />

3 Years 4.5% p.a.<br />

5 Years -1.3% p.a.<br />

Nikkei 225 Fund<br />

Image description.<br />

Sector Pie chart Split with as 7 at items. 30 June 2011<br />

1, 2, Consumer IT 25% 25. Goods 26% 26.<br />

3, 4, Industrials Health Care 25% 9% 25.<br />

5, Other 8% 8. 9.<br />

Item 6, 7, Financials Energy 1% 6% 1. 6.<br />

End of image description.<br />

Sector Split as at 30 June 2011<br />

Consumer Goods 26%<br />

IT 25%<br />

Industrials 25%<br />

Health Care 9%<br />

Other 8%<br />

Financials 6%<br />

Energy 1%<br />

Top 5 Stocks (in alphabetical<br />

order)<br />

Fanuc<br />

Fast Retailing<br />

Honda Motor<br />

Kyocera<br />

Softbank<br />

Performance to 01 July 2011<br />

1 Month 0.9%<br />

3 Months 0.7%<br />

YTD -10.6%<br />

1 Year -3.1%<br />

3 Years 0.9% p.a.<br />

5 Years -5.2% p.a.<br />

FTSE 100 Fund<br />

Image description.<br />

Sector Pie chart Split with as 7 at items. 30 June 2011<br />

1, 2, Consumer Financials 20% Goods 20. 21% 21.<br />

3, 4, Energy Other 19% 20% 19. 20.<br />

5, 6, Health IT 8% 8. Care 8% 8.<br />

Item 7, Industrials 4% 4.<br />

End of image description.<br />

Sector Split as at 30 June 2011<br />

Consumer Goods 21%<br />

Financials 20%<br />

Energy 20%<br />

Other 19%<br />

Health Care 8%<br />

IT 8%<br />

Industrials 4%<br />

Top 5 Stocks (in alphabetical<br />

order)<br />

BP<br />

GlaxoSmithKline<br />

HSBC<br />

Royal Dutch Shell<br />

Vodafone<br />

Performance to 01 July 2011<br />

1 Month -3.8%<br />

3 Months -1.3%<br />

YTD -4.2%<br />

1 Year 11.1%<br />

3 Years -0.5% p.a.<br />

5 Years -2.8% p.a.<br />

Nasdaq 100 Fund<br />

Image description.<br />

Sector Pie chart Split with as 5 at items. 30 June 2011<br />

1, 2, IT Consumer 62% 62.<br />

3, Health Care Goods 10% 10. 19% 19.<br />

Item 4, 5, Other Industrials 6% 6. 3% 3.<br />

End of image description.<br />

Sector Split as at 30 June 2011<br />

IT 62%<br />

Consumer Goods 19%<br />

Health Care 10%<br />

Other 6%<br />

Industrials 3%<br />

Top 5 Stocks (in alphabetical<br />

order)<br />

Apple<br />

Google<br />

Intel<br />

Microsoft<br />

Oracle<br />

Performance to 01 July 2011<br />

1 Month -2.8%<br />

3 Months -2.8%<br />

YTD -3.0%<br />

1 Year 12.7%<br />

3 Years 10.6% p.a.<br />

5 Years 4.6% p.a.<br />

Logon to www.newireland.ie for the most recent <strong>fund</strong> information<br />

Performance is based on the price calculated for 01 July 2011, which is calculated using close of market prices from the previous working day.<br />

Source: MoneyMate. Performance is quoted gross of taxation and net of 1.5% p.a. <strong>fund</strong> management charges. Past performance is not a<br />

reliable guide to future performance. The value of your investment may go down as well as up.<br />

29