Report-Oregon-Property-Tax-Capitalization-FINAL

Report-Oregon-Property-Tax-Capitalization-FINAL

Report-Oregon-Property-Tax-Capitalization-FINAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24<br />

OREGON PROPERTY TAX CAPITALIZATION: EVIDENCE FROM PORTLAND<br />

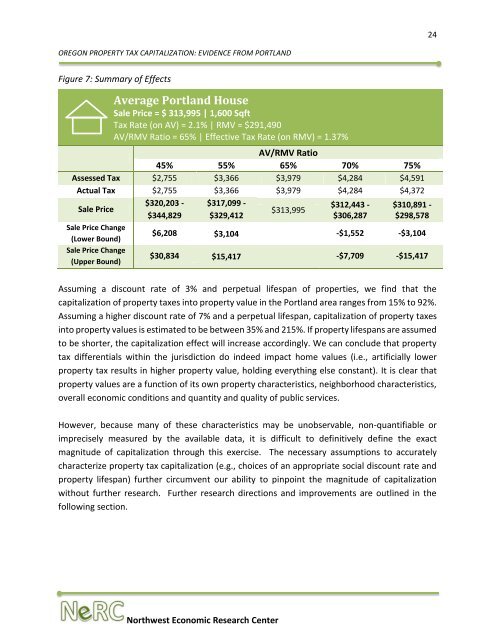

Figure 7: Summary of Effects<br />

Average Portland House<br />

Sale Price = $ 313,995 | 1,600 Sqft<br />

<strong>Tax</strong> Rate (on AV) = 2.1% | RMV = $291,490<br />

AV/RMV Ratio = 65% | Effective <strong>Tax</strong> Rate (on RMV) = 1.37%<br />

AV/RMV Ratio<br />

45% 55% 65% 70% 75%<br />

Assessed <strong>Tax</strong> $2,755 $3,366 $3,979 $4,284 $4,591<br />

Actual <strong>Tax</strong> $2,755 $3,366 $3,979 $4,284 $4,372<br />

Sale Price<br />

Sale Price Change<br />

(Lower Bound)<br />

Sale Price Change<br />

(Upper Bound)<br />

$320,203 -<br />

$344,829<br />

$317,099 -<br />

$329,412<br />

$313,995<br />

$312,443 -<br />

$306,287<br />

Assuming a discount rate of 3% and perpetual lifespan of properties, we find that the<br />

capitalization of property taxes into property value in the Portland area ranges from 15% to 92%.<br />

Assuming a higher discount rate of 7% and a perpetual lifespan, capitalization of property taxes<br />

into property values is estimated to be between 35% and 215%. If property lifespans are assumed<br />

to be shorter, the capitalization effect will increase accordingly. We can conclude that property<br />

tax differentials within the jurisdiction do indeed impact home values (i.e., artificially lower<br />

property tax results in higher property value, holding everything else constant). It is clear that<br />

property values are a function of its own property characteristics, neighborhood characteristics,<br />

overall economic conditions and quantity and quality of public services.<br />

<strong>Oregon</strong>’s Electric Vehicle Industry<br />

$310,891 -<br />

$298,578<br />

$6,208 $3,104 -$1,552 -$3,104<br />

$30,834 $15,417 -$7,709 -$15,417<br />

However, because many of these characteristics may be unobservable, non-quantifiable or<br />

imprecisely measured by the available data, it is difficult to definitively define the exact<br />

magnitude of capitalization through this exercise. The necessary assumptions to accurately<br />

characterize property tax capitalization (e.g., choices of an appropriate social discount rate and<br />

property lifespan) further circumvent our ability to pinpoint the magnitude of capitalization<br />

without further research. Further research directions and improvements are outlined in the<br />

following section.<br />

Northwest Economic Research Center