UPHS_Enrollment_Guide_FINAL

UPHS_Enrollment_Guide_FINAL

UPHS_Enrollment_Guide_FINAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>UPHS</strong>flex <strong>Enrollment</strong><br />

2010 Open <strong>Enrollment</strong> <strong>Guide</strong><br />

Click<br />

Here<br />

See What’s<br />

New for<br />

2010-2011!<br />

OPEN ENROLLMENT Monday, April 19, 2010 – Sunday, May 2, 2010

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Medical<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Account (FSA)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Open <strong>Enrollment</strong> <strong>Guide</strong><br />

<strong>UPHS</strong>flex Benefits<br />

It’s time to enroll in <strong>UPHS</strong>flex benefits for the benefits that will cover you and<br />

your family beginning July 1, 2010 through June 30, 2011. This enrollment guide<br />

provides a brief summary of your <strong>UPHS</strong>flex benefit options and an overview of<br />

the enrollment process.<br />

Use the navigation bars at the top and left of the page to access information<br />

about your benefits. You’ll also be able to download forms and additional<br />

information. To learn more about the benefits available to you:<br />

1. See What’s New in 2010-2011<br />

2. See the Cost of Coverage in 2010-2011<br />

3. Review the Plan Highlights<br />

4. Select your benefits on EnrollOne<br />

(If you are not currently logged on to EnrollOne, log on to<br />

www.enrollone.com/uphs.)<br />

When is Open<br />

<strong>Enrollment</strong>?<br />

Monday, April 19 –<br />

Sunday, May 2<br />

<strong>Enrollment</strong> Deadline:<br />

11:59 p.m., May 2, 2010<br />

All Open <strong>Enrollment</strong><br />

elections become effective<br />

on July 1, 2010

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > What’s New<br />

What’s New for 2010-2011<br />

New for 2010-2011<br />

<strong>UPHS</strong> continues to review the competitiveness of our benefit programs through<br />

market surveys of local and regional health care providers and we are pleased to<br />

say that the our benefits remain one of the most generous in the region. In<br />

addition, <strong>UPHS</strong> Corporate Benefits aggressively negotiates, on your behalf, with<br />

medical, dental, vision and life and disability insurance vendors to continue to<br />

give you the best available rates. As a result, we are pleased to announce the<br />

following for this upcoming plan year.<br />

Plan Designs<br />

Our medical, dental and vision plan designs will remain the same for the 2010-<br />

2011 plan year.<br />

Mental Health Parity<br />

There is a change in the Penn Behavioral Health Plan design due to the Mental<br />

Health Parity and Addiction Act of 2008. As a result of this change, all limits on<br />

mental health and substance abuse days and visits will be removed for inpatient<br />

and outpatient care. Also, all co-pays and co-insurance will be removed for PBH<br />

providers (except for emergency services) while the co-pays and co-insurance<br />

will match those of the out-of-network medical/surgical benefits. For more<br />

information about the new Act, please refer to these questions and answers, as<br />

well as the updated benefit chart.<br />

Prescription Drug Coverage<br />

Due to increasing utilization and the cost of prescription drugs, <strong>UPHS</strong> has<br />

increased some of the copays under the prescription drug plan. This is the first<br />

time <strong>UPHS</strong> has raised copays since the 2006-2007 plan year. Remember, you<br />

will always save money when you use an in-house <strong>UPHS</strong> pharmacy, along with<br />

generic drugs. For more information, please see the prescription drug section.<br />

More ><br />

Monday, April 19 –<br />

Sunday, May 2<br />

Please review your current<br />

benefit elections. If you want<br />

to continue with the same<br />

benefit elections and<br />

coverage levels, you do not<br />

have to re-enroll. However, if<br />

you participated in the<br />

Health Care FSA and/or<br />

Dependent Care FSA plans<br />

for the 2009-2010 plan<br />

year and you want to<br />

continue to participate for the<br />

2010-2011 plan year, you<br />

must re-enroll.<br />

You can enroll 24-hours a<br />

day during Open <strong>Enrollment</strong>.<br />

Any elections you make<br />

during Open <strong>Enrollment</strong> are<br />

effective July 1, 2010<br />

through June 30, 2011.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > What’s New<br />

Self- Injectable Drugs<br />

Beginning July 1, most self-injectable drug coverage will go through CVS<br />

Caremark instead of your medical plan. If you are currently taking a selfinjectable<br />

drug (delivered into the muscle or under the skin with a syringe and<br />

needle) and it’s being covered through your medical plan, you’ll receive<br />

information about the change from your medical plan carrier.<br />

Health Care Reform<br />

By now, you are aware that in late March President Obama signed into law the<br />

Patient Protection and Affordable Care Act of 2010. There is no immediate<br />

impact on either our programs or your coverage; however, there is one provision<br />

that is scheduled to take effect in 2011 that may impact you.<br />

• Health Care FSA – Over-the-counter medications will only be reimbursable<br />

until December 31, 2010 without a prescription. Beginning January 1, 2011,<br />

over-the-counter medications will no longer be reimbursable unless you have<br />

a prescription from your doctor.<br />

<strong>UPHS</strong> will continue to evaluate the new health care reform provisions and remain<br />

compliant with all mandatory regulations.<br />

Please note: The provision that states that all dependents must be covered until<br />

age 26, regardless of student status, is not required until July 1, 2011.<br />

Flexible Spending Accounts (FSA) Cards<br />

If you currently participate in the Health Care Flexible Spending Account (FSA)<br />

and the expiration date on your FSA card is 06/10; you will receive a new card in<br />

the mail if you re-enroll for the upcoming plan year (July 1, 2010-June 30, 2011).<br />

<br />

New Benefits Coming<br />

Adoption Policy<br />

<strong>UPHS</strong> is pleased to<br />

announce the new Adoption<br />

Policy that will go into effect<br />

July 01, 2010. This policy<br />

provides financial assistance<br />

for eligible adoption<br />

expenses for employees<br />

who are building their family<br />

through adoption. For more<br />

information, click here.<br />

Long-Term Care Coverage<br />

In the upcoming months,<br />

look for more information<br />

about the Long Term Care<br />

benefit that will be effective<br />

January 1, 2011.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > What’s New<br />

Employee Contributions<br />

We are pleased to announce that employee contribution rates for the<br />

Supplemental Life and Dependent Life insurance plans will be reduced; however,<br />

please keep in mind that the premiums are based on your age and salary.<br />

Employee contribution rates for Short-Term Disability will remain the same, but<br />

may change due to a change in your age and/or salary.<br />

New employee contribution rates for medical, dental and vision can be found in<br />

the Cost of Coverage section.<br />

Social Security Numbers Updates for Eligible Dependents<br />

Open <strong>Enrollment</strong> is a good time for you to validate that the dependents you have<br />

listed on your benefits are eligible dependents as outlined in the <strong>UPHS</strong> Summary<br />

Plan Description. In addition, the Centers for Medicare & Medicaid Services<br />

(CMS) is requiring all medical carriers (IBC and Aetna) to obtain the Social<br />

Security information for covered dependents. Therefore, we’re encouraging you<br />

to make sure your covered dependents’ Social Security numbers are updated<br />

and correct in the system.<br />

Beneficiary Updates<br />

As we’re getting ready to go through Open <strong>Enrollment</strong>, now is the time to review<br />

your beneficiary information. Even if you are not making any changes, the<br />

Benefits Department is asking that everyone log on to www.enrollone.com/uphs<br />

to update their beneficiary information. Please keep in mind that you can<br />

update/change your beneficiary anytime throughout the year.<br />

< Back

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Cost of Coverage<br />

Cost for Coverage<br />

To see a chart with your 2010-2011 rates, please select from the two choices<br />

below:<br />

Full-Time Employees<br />

Part-Time Employees

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Making Changes During the Year<br />

Making Changes During the Year<br />

Confirmation Statement<br />

After Open <strong>Enrollment</strong>, you will receive a confirmation statement reflecting your<br />

benefit elections for the 2010-2011 plan year (July 1, 2010 – June 30, 2011). If<br />

any information on this confirmation statement is incorrect, you can access<br />

EnrollOne to make corrections by the deadline noted on your confirmation<br />

statement.<br />

Life Event Changes<br />

After the Open <strong>Enrollment</strong> correction deadline has passed, you may not make<br />

changes to your benefit elections until the next Open <strong>Enrollment</strong> — unless you<br />

experience a qualified Life Event during the year. A Life Event may include, but is<br />

not limited to:<br />

• Marriage or divorce,<br />

• Birth or adoption of a child, or<br />

• A change in your or your spouse’s employment resulting in the gain or loss of<br />

health care coverage.<br />

You have 30 days from the date of your Life Event to make a change by<br />

submitting a Life Event Change form (also available at your local Human<br />

Resources office or on the <strong>UPHS</strong> Human Resources Intranet site), along with<br />

any required documentation.<br />

Please remember you must notify the <strong>UPHS</strong> Benefits Office of any changes<br />

in family status that affect your covered dependents.<br />

Life Events Related to<br />

Medicaid or CHIP<br />

If your Life Event is related<br />

to Medicaid or CHIP, you<br />

have 60 days from the date<br />

of your Life Event to make a<br />

change to your coverage.<br />

Click here for more<br />

information.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Contact Information<br />

Benefit Plan Contact Information<br />

Plan Name Phone Number Website<br />

Medical Plans PENNCare PPO 215-241-2990 www.ibx.com<br />

800-841-1992<br />

Keystone Health Plan POS 215-241-2273 www.ibx.com<br />

800-227-3114<br />

Aetna QPOS 888-287-4296 www.aetna.com<br />

To make an appointment with a PENNCare provider, call 877-354-4999 or visit<br />

http://www.pennmedicine.org/penncarenetwork/.<br />

CVS Caremark Prescription<br />

Drug Program<br />

800-777-1023 www.caremark.com<br />

PENN Behavioral Health 888-321-4433 www.pennbehavioralhealth.org<br />

Program<br />

• Behavioral Health<br />

• EAP<br />

• Work/Life Program<br />

Health Program Carewise Health 800-615-0194<br />

Dental Plans PENN Faculty Practice (PFP) 215-898-4615 www.dental.upenn.edu/patients/pfp/pfp.<br />

html<br />

Delta Dental 800-932-0783 www.midatlanticdeltadental.com<br />

Aetna DMO 877-238-6200 www.aetna.com<br />

Vision Plans Davis Vision Standard Plans<br />

Davis Vision Premium Plans<br />

888-393-2583 www.davisvision.com<br />

Vision Benefits of America 800-432-4966 www.visionbenefits.com<br />

(VBA)<br />

FSA<br />

Administrator<br />

SHPS 800-678-6684 www.enrollone.com/uphs, click on “FSA<br />

Detail”<br />

TRIP WageWorks 877-924-3967 www.enrollone.com/uphs, click on<br />

“Transportation”

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Human Resources/Benefits Locations<br />

Human Resources/Benefits Locations<br />

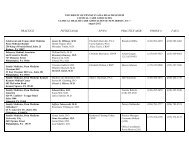

<strong>UPHS</strong> Entity Office Address Phone Number<br />

All <strong>UPHS</strong> Entities <strong>UPHS</strong> Benefits Office 3001 Market Street<br />

Suite 320<br />

Philadelphia, PA<br />

19104<br />

Clinical Care Associates<br />

(CCA), Clinical Health Care<br />

Associates of New Jersey<br />

(CHCANJ)<br />

Human Resources Office<br />

250 King of Prussia<br />

Road<br />

4th Floor<br />

Radnor, PA 19087<br />

Pennsylvania Hospital (PAH) Human Resources Office Harte Memorial<br />

Building<br />

723 Delancey Street<br />

Philadelphia, PA<br />

19107<br />

PENN Presbyterian<br />

Medical Center (PPMC)<br />

PENN Home Care and<br />

Hospice Services<br />

Human Resources Office<br />

Human Resources Office<br />

186 Wright-<br />

Saunders<br />

39th and Market<br />

Streets<br />

Philadelphia, PA<br />

19104<br />

150 Monument<br />

Road, Suite 300<br />

Bala Cynwyd, PA<br />

19004<br />

215-615-2675 or<br />

215-615-2277 and<br />

select the option<br />

for Benefits<br />

610-902-1710<br />

215-829-3341<br />

215-662-8450<br />

610-747-3431

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Plan Highlights<br />

Plan Highlights<br />

We continue to design our health plans to encourage employees to use <strong>UPHS</strong><br />

facilities and services so we all can receive the highest quality of care in a costeffective<br />

manner. Employees pay less out-of-pocket when using <strong>UPHS</strong> facilities.<br />

We all benefit when we use the health system for our health care.<br />

• Medical — Three choices of medical coverage are offered to provide you<br />

with broad health insurance options; all three plans include prescription drug<br />

coverage.<br />

• Vision — Three choices of coverage for your routine and enhanced vision<br />

care.<br />

• Dental — Three choices of coverage for many preventive, basic, and major<br />

dental treatments, including orthodontia.<br />

• Flexible Spending Accounts — Pay for eligible health care and/or dependent<br />

care expenses with tax-free money.<br />

• Life Insurance — <strong>UPHS</strong> provides you with Core Coverage. You may also<br />

purchase additional life insurance for yourself. In addition, you have life<br />

insurance options for your spouse and dependent children.<br />

• AD&D Coverage — You may purchase AD&D coverage for you and your<br />

family.<br />

• Disability Protection — Short-Term Disability (STD) and Long-Term Disability<br />

(LTD) coverage are provided based on your eligibility. STD has to be elected<br />

and paid for by the employee and full-time employees are eligible for LTD<br />

coverage after one full year of continuous service.<br />

The descriptions in this document are not intended to be complete statements<br />

about each benefit plan. There may be differences between these descriptions<br />

and the actual plan documents. Where details differ, the plan documents shall<br />

apply. Employees are advised that plans are amended from time-to-time. Itis the<br />

employee’s responsibility to inquire about the effect of such changes with their<br />

plan.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Carewise Health Programs<br />

Carewise Health Programs<br />

The decisions we make today can have a lasting effect on our health and<br />

happiness tomorrow. In today’s complex world, sometimes it’s hard to know what<br />

the right decisions are – not only for yourself, but for your loved ones as well.<br />

That’s where Carewise Health Personal Health Management can help. Carewise<br />

is a free program that helps you understand your benefits and make the best<br />

possible health choices – for today and tomorrow. No matter what your health<br />

concerns, or your current condition, Carewise can make a real difference.<br />

Through the program, you have access to specially trained registered nurses –<br />

experienced caregivers, who can provide all the in-depth, up-to-date medical<br />

information you need to make wise decisions and see those decisions through to<br />

successful conclusions.With Carewise, you don’t have to go it alone.<br />

The program includes:<br />

• 24 hour Nurse Line – A direct, toll-free, connection to real, live, registered nurses.<br />

• Health Notes – Postcards and newsletters with award-winning features on a variety<br />

of timely health and wellness topics.<br />

• Personal Health Programs – Custom-tailored services that enable those with chronic<br />

conditions (such as asthma, diabetes, coronary artery disease, etc.) to work one-onone<br />

with a personal Nurse Advocate.<br />

• High Risk Disease Management – A service that, in the event of accident, sudden<br />

illness, or ongoing health condition, provides a specially trained Nurse Advocate to<br />

help you navigate the health care system.<br />

• Maternity Management – A service designed to identify high-risk pregnancies,<br />

prevent pre-term deliveries and offer ongoing, support to expectant mothers and<br />

families during pregnancy.<br />

Maximize Your Benefits<br />

Carewise Health nurses can<br />

review your health<br />

insurance to answer<br />

questions about your<br />

coverage. They also can<br />

help you clarify careprovider<br />

and treatment<br />

options to make sure you<br />

are getting the best possible<br />

care you’re eligible to<br />

receive.<br />

To take advantage of these valuable resources, call Carewise Health at 800-615-0194.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

PENNCare PPO<br />

Keystone Point-of-<br />

Service (POS) Plan<br />

Aetna Quality<br />

Point-of-Service<br />

(QPOS) Plan<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Medical<br />

Medical Benefits<br />

You can elect the PENNCare PPO, Keystone Point-of-Service (KPOS) or the<br />

Aetna Quality Point-of-Service (QPOS) Plans. Your out-of-pocket expenses will<br />

be lower when you use a <strong>UPHS</strong> provider or facility, including CHOP. However,<br />

the PPO, KPOS and QPOS plans have large carrier networks.<br />

Keep in mind that in the KPOS and QPOS plans, your Primary Care Physician<br />

manages all of your in-network care, including referring you to specialists and<br />

network facilities (for example, laboratory testing).<br />

Click on the boxes to learn more about each plan:<br />

PENNCare PPO<br />

Plan<br />

Keystone Pointof-Service<br />

Plan<br />

Aetna Quality<br />

Point-of-Service<br />

Plan<br />

Provider Directory<br />

PENNCare provider<br />

directories and carrier<br />

network listings are<br />

available online. Click here<br />

to access the PENN<br />

Provider Directory.<br />

• PENNCare PPO<br />

• Keystone POS<br />

• Aetna QPOS

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

PENNCare PPO<br />

Keystone POS and<br />

Aetna QPOS<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Medical > PENNCare PPO<br />

PENNCare PPO<br />

Below is a summary of the PENNCare PPO plan. For a more detailed list of<br />

coverage, click here.<br />

How to Access Care<br />

PENNCare PPO<br />

PENNCare Network Personal Choice Out-of-Network<br />

Go to any PENNCare<br />

provider<br />

Go to any Personal<br />

Choice provider<br />

Referrals Needed No No No<br />

Annual Deductible and<br />

Coinsurance<br />

Outpatient Office Visit<br />

Hospital Inpatient<br />

For all plans, Pavilion is<br />

covered for an additional<br />

fee.<br />

Annual Out-of-Pocket<br />

Limit<br />

None None; 80%<br />

coinsurance for other<br />

services as noted<br />

$10 Primary Care or<br />

specialist visit<br />

Covered at 100%<br />

N/A<br />

$20 Primary Care or<br />

specialist visit<br />

Covered at 100% after<br />

copayment ($375<br />

maximum per<br />

admission)<br />

$2,000/person<br />

$4,000/family<br />

(coinsurance only)<br />

Go to any qualified<br />

provider<br />

$300/person<br />

$600/family<br />

Plan pays 70% UCR<br />

after deductible<br />

Deductibles and<br />

coinsurance apply<br />

Covered at 70% after<br />

deductible<br />

$2,500/person<br />

$5,000/family<br />

More Information<br />

Review the PENNCare PPO Chart<br />

Contact Provider<br />

PENNCare PPO at 215-241-2990 or 800-841-1992

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

PENNCare PPO<br />

Keystone POS and<br />

Aetna QPOS<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Medical > Keystone POS and Aetna QPOS<br />

Keystone POS and Aetna QPOS<br />

Below is a summary of the POS plans. For a more detailed list of coverage, click here.<br />

Point-of-Service Plan (Keystone POS and Aetna QPOS)<br />

PENNCare Network<br />

Carrier Network Out-of-Network/Self-<br />

(Keystone or Aetna) Referred<br />

How to Access Care Select a <strong>UPHS</strong> Primary<br />

Care provider<br />

Select a carrier network<br />

Primary Care provider<br />

Go to any qualified<br />

provider<br />

Referrals Needed Yes Yes No<br />

Annual Deductible and<br />

Coinsurance<br />

None None $300/person<br />

$600/family<br />

Outpatient Office Visit<br />

Hospital Inpatient<br />

For all plans, Pavilion is<br />

covered for an additional<br />

fee.<br />

Annual Out-of-Pocket<br />

Limit<br />

$10 Primary Care or<br />

specialist visit<br />

Covered at 100%<br />

N/A<br />

$15 Primary Care or<br />

$20 specialist visit<br />

Covered at 100% after<br />

$120 copayment per<br />

admission<br />

Keystone only<br />

$1,500/person<br />

$3,000/family<br />

Plan pays 70% UCR<br />

after deductible<br />

Deductibles and<br />

coinsurance apply<br />

Covered at 70% after<br />

deductible<br />

$2,500/person<br />

$5,000/family<br />

More Information<br />

Review the POS Chart<br />

Contact Provider<br />

• Keystone POS at 215-241-2273 or 800-227-3114<br />

• Aetna QPOS at 888-287-4296

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Medical > Behavioral Health<br />

Behavioral Health Coverage<br />

The University of Pennsylvania Health System Mental Health and Chemical<br />

Dependency Benefits have changed in response to the Mental Health Parity and<br />

Addiction Equity Act of 2008. To learn more about Parity and how it may affect<br />

your coverage, please click here.<br />

Behavioral health coverage for all of the medical plans is provided by PENN<br />

Behavioral Health. They can be reached by at 888-321-4433.<br />

More Information<br />

Review the Behavioral Health Chart.<br />

Contact Provider<br />

PENN Behavioral Health at<br />

888-321-4433

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Using a <strong>UPHS</strong><br />

Pharmacy<br />

Retail/Mail-Order<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Prescription Drug<br />

Prescription Drug<br />

All employees enrolled in any of the <strong>UPHS</strong>flex medical options are automatically<br />

enrolled in prescription drug coverage through CVS Caremark.<br />

Three-Tier Prescription Drug Approach<br />

When you have a prescription to fill, you have a choice among:<br />

• Generic (copay is the lowest)<br />

• Preferred (copay is higher than for generic drugs, but less than for nonpreferred<br />

drugs)<br />

• Non-preferred (highest copay)<br />

If you must have a particular medication that is not on the preferred list, out of<br />

preference or necessity, you will pay the highest copay.<br />

Remember, your out-of-pocket costs will be lower if you use an in-house<br />

<strong>UPHS</strong> pharmacy.<br />

Copays<br />

<strong>UPHS</strong><br />

(30-Day<br />

Supply)<br />

Retail<br />

Pharmacy<br />

(30-Day<br />

Supply)<br />

PENN<br />

Medicine<br />

at Radnor<br />

(90-Day<br />

Supply)*<br />

CVS Caremark<br />

Mail-Order<br />

Program<br />

(90-Day<br />

Supply)<br />

Generic $5 $15 $10 $30<br />

Preferred $15 $30 $30 $60<br />

Non-Preferred $25 $45 $60 $90<br />

* You may access a 90-day supply through the outpatient pharmacies at <strong>UPHS</strong><br />

locations.<br />

Contact Provider<br />

Contact CVS Caremark at<br />

800-777-1023<br />

Prescription Drug Card<br />

You will receive a separate<br />

prescription drug card for<br />

your benefits. Your medical<br />

card is not your prescription<br />

drug card. Contact CVS<br />

Caremark at 800-777-1023<br />

if you need a replacement<br />

card.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Using a <strong>UPHS</strong><br />

Pharmacy<br />

Retail/Mail-Order<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Prescription Drug > Using a <strong>UPHS</strong> Pharmacy<br />

Using a <strong>UPHS</strong> Pharmacy<br />

This is the most cost-effective way for you to fill your prescriptions.<br />

You can fill any of your prescriptions for a 30-day or 90-day supply at any of the<br />

<strong>UPHS</strong> pharmacies for a lower copay.<br />

Filling a 30-day or 90-day supply is very convenient — drop off your prescription<br />

on your way to work and pick up your medication the next day.<br />

Have prescriptions filled for you and your family members at the following inhouse<br />

<strong>UPHS</strong> pharmacies:<br />

Hospital of the<br />

University of<br />

Pennsylvania<br />

3400 Spruce Street<br />

1 Ravdin<br />

215-662-2920<br />

Pennsylvania<br />

Hospital<br />

Outpatient<br />

Pharmacy<br />

800 Spruce Street<br />

Spruce Building<br />

First Floor<br />

215-829-5873<br />

PENN<br />

Presbyterian<br />

Medical Center<br />

Outpatient<br />

Pharmacy<br />

39th & Market<br />

Streets<br />

Medical Office<br />

Building (MOB)<br />

215-662-9494<br />

PENN Medicine<br />

at Radnor<br />

Outpatient<br />

Pharmacy and<br />

Mail Order<br />

Services<br />

250 King of<br />

Prussia Road<br />

2nd Floor<br />

Radnor<br />

610-902-1700

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Using a <strong>UPHS</strong><br />

Pharmacy<br />

Retail/Mail-Order<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Prescription Drug > Retail/Mail-Order<br />

Using a Retail Pharmacy<br />

You can also fill a 30-day supply of your prescription at any of the CVS<br />

Caremark national network pharmacies. To find a pharmacy near you, visit<br />

www.caremark.com or call CVS Caremark at 800-777-1023.<br />

Using the Mail-Order Program<br />

The mail-order benefit plan allows you to receive a 90-day supply of your<br />

maintenance medication for one copay. Your prescription is mailed to the<br />

address of your choice.<br />

Mail-order is available through CVS Caremark and PENN Medicine at Radnor.<br />

Contact your local HR Office or call <strong>UPHS</strong> Benefits at 215-615-2277 for more<br />

information.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

IBC Davis Vision<br />

Premium Plan<br />

IBC Davis Vision<br />

Standard Plan<br />

Vision Benefits of<br />

America (VBA)<br />

Plan<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Vision<br />

Vision<br />

The <strong>UPHS</strong>flex vision benefit options are:<br />

• IBC Davis Vision Premium Plan<br />

• IBC Davis Vision Standard Plan<br />

• Vision Benefits of America (VBA) Plan<br />

Scheie Eye is a participating provider with both IBC Vision Plans and VBA for<br />

your routine vision care. However, if you elect the IBC Davis Vision Premium<br />

Plan and use Scheie providers, you will receive some enhanced vision care<br />

benefits at a reduced cost for services.<br />

All vision services are covered once every contract year (July 1 through<br />

June 30).<br />

You will save money if you receive eye care from these <strong>UPHS</strong> Eye Care Centers:<br />

PENN<br />

Presbyterian<br />

Medical Center<br />

Scheie Eye<br />

Institute<br />

51 N. 39th Street<br />

Philadelphia, PA<br />

19104<br />

Hospital of the<br />

University of<br />

Pennsylvania<br />

2 Gates<br />

3400 Spruce<br />

Street<br />

Philadelphia, PA<br />

19104<br />

PENN Medicine<br />

at Radnor<br />

250 King of<br />

Prussia Road<br />

Radnor, PA<br />

19087<br />

Mercy Fitzgerald<br />

Medical Office<br />

Building<br />

Suite 2058<br />

1501 Lansdowne<br />

Avenue<br />

Darby, PA 19023<br />

Call 215-662-8100 or 800-789-PENN to make an appointment at any location.<br />

PENN Eye Care<br />

at Media<br />

601 West<br />

State Street<br />

Media, PA 19063<br />

Contact Providers<br />

• Davis Vision at<br />

888-393-2583<br />

• Vision Benefits of<br />

America at<br />

800-432-4966<br />

Low Vision<br />

Research and<br />

Rehabilitation<br />

Center at<br />

Ralston House<br />

3615 Chestnut<br />

Street<br />

Philadelphia, PA<br />

19104

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

IBC Davis Vision<br />

Premium Plan<br />

IBC Davis Vision<br />

Standard Plan<br />

Vision Benefits of<br />

America (VBA)<br />

Plan<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Vision > IBC Davis Vision Premium Plan<br />

IBC Davis Vision Premium Plan<br />

IBC Davis Vision Premium Plan<br />

How to Access Care Scheie Provider All Other Participating<br />

Providers<br />

Non-Participating<br />

Providers<br />

Eye Exam (once per Covered at 100% Covered after $10 copay Reimbursement of up to $32<br />

contract year)<br />

Standard Lenses<br />

(once per contract<br />

year)<br />

Covered at 100% for all<br />

ranges of prescriptions<br />

Covered at 100% for all<br />

ranges of prescriptions<br />

Reimbursement of up to:<br />

• Single vision: $30<br />

• Bifocal: $36<br />

• Trifocal: $50<br />

• Lenticular: $72<br />

Frames<br />

Medically necessary<br />

contact lenses (in lieu<br />

of eyeglasses) and<br />

evaluation and fitting,<br />

with prior approval<br />

Contact lenses (in lieu<br />

of eyeglasses)<br />

including standard,<br />

specialty and<br />

disposable lenses<br />

Participating provider's<br />

frame collection:<br />

• $100 allowance<br />

OR<br />

• Davis' Fashion selection:<br />

100%<br />

• Designer selection:<br />

100%<br />

• Premier selection: $20<br />

Participating provider's<br />

frame collection:<br />

• $65 allowance<br />

OR<br />

• Davis' Fashion<br />

selection: 100%<br />

• Designer selection:<br />

100%<br />

• Premier selection: $20<br />

Reimbursement of up to $30<br />

Covered up to $200 Covered up to $200 Reimbursement of up to<br />

$200<br />

Allowance of up to:<br />

• Standard/Specialty:<br />

$110<br />

• Disposable: $80<br />

Allowance of up to $75<br />

Reimbursement of up to:<br />

• Standard/Specialty: $60<br />

• Disposable: $75<br />

This chart does not provide a complete description of the plans. For more details,<br />

please contact the <strong>UPHS</strong> Benefits Office at 215-615-2277.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

IBC Davis Vision<br />

Premium Plan<br />

IBC Davis Vision<br />

Standard Plan<br />

Vision Benefits of<br />

America (VBA)<br />

Plan<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Vision > IBC Davis Vision Standard Plan<br />

IBC Davis Vision Standard Plan<br />

IBC Davis Vision Standard Plan<br />

How to Access Care Participating Providers Non-Participating Providers<br />

Eye Exam (once per contract year) Covered after $10 copay Reimbursement of up to $30<br />

Standard Lenses (once per<br />

contract year)<br />

Frames<br />

Medically necessary contact<br />

lenses (in lieu of eyeglasses) and<br />

evaluation and fitting, with prior<br />

approval<br />

Contact lenses (in lieu of<br />

eyeglasses) including standard,<br />

specialty and disposable lenses<br />

Covered at 100% for all ranges of<br />

prescriptions<br />

Participating provider's frame<br />

collection:<br />

• Single vision: $20<br />

• Bifocal: $20<br />

• Trifocal: $30<br />

• Lenticular: $50<br />

Participating provider's frame collection: Reimbursement of up to $15<br />

• $15 allowance<br />

OR<br />

• Davis' Fashion selection: 100%<br />

• Designer selection: $16<br />

• Premier selection: $35<br />

Allowance of up to $100 Reimbursement of up to $200<br />

Not Covered<br />

This chart does not provide a complete description of the plans. For more details,<br />

please contact the <strong>UPHS</strong> Benefits Office at 215-615-2277.<br />

Not Covered

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

IBC Davis Vision<br />

Premium Plan<br />

IBC Davis Vision<br />

Standard Plan<br />

Vision Benefits of<br />

America (VBA)<br />

Plan<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Vision > Vision Benefits of Amercia (VBA) Plan<br />

Vision Benefits of America (VBA) Plan<br />

Vision Benefits of America (VBA) Plan<br />

How to Access Care VBA Provider Non-VBA Provider<br />

Eye Exam (once per contract Covered at 100% Reimbursed up to $40<br />

year)<br />

Standard Lenses (once per Covered at 100% Reimbursed up to $30-$80<br />

contract year)<br />

Frames Reimbursed up to $100 Reimbursed up to $30<br />

Medically necessary contact Based on UCR Reimbursed up to $200<br />

lenses (in lieu of eyeglasses)<br />

and evaluation and fitting,<br />

with prior approval<br />

Contact lenses (in lieu of<br />

eyeglasses) including<br />

standard, specialty and<br />

disposable lenses<br />

$140 max paid in lieu of<br />

exam and glasses<br />

$140 max paid in lieu of exam<br />

and glasses<br />

This chart does not provide a complete description of the plans. For more details,<br />

please contact the <strong>UPHS</strong> Benefits Office at 215-615-2277.<br />

Receiving Benefits<br />

You must request a claim form before your appointment. The claim is good for<br />

60 days. To obtain a claim form, please contact VBA at 800-432-4966 or log on<br />

to their website at www.visionbenefits.com. Along with the claim form, you will<br />

also receive a list of participating providers in your area.<br />

Please note: There is no vision card associated with this plan.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Penn Faculty<br />

Practice<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Dental<br />

Dental<br />

PENN Faculty Practice<br />

(PFP)*<br />

Delta Dental*<br />

Aetna DMO<br />

How to Access Care Go to any PFP network<br />

provider<br />

Go to any dental care<br />

provider (benefits may be<br />

greater with a Delta<br />

Care must be coordinated<br />

by your Primary Care<br />

dentist<br />

Dental provider)<br />

Referrals Needed No No Yes<br />

Annual Deductible $50/person, $150/family (on<br />

basic, major and ortho)<br />

$50/person, $150/family<br />

(on basic, major and<br />

None<br />

Coinsurance<br />

• Preventive<br />

• Basic<br />

• Major<br />

• Orthodontic<br />

Plan pays:<br />

• 100%<br />

• 80%<br />

• 50%<br />

• 50% up to $2,000 lifetime<br />

orthodontic maximum (for<br />

dependent children to age<br />

19 only)<br />

ortho)<br />

Plan pays:<br />

• 100% of Delta’s<br />

allowance<br />

• 80% of Delta’s<br />

allowance<br />

• 50% of Delta’s<br />

allowance<br />

• 50% of Delta’s<br />

allowance up to<br />

$1,500 lifetime<br />

orthodontic maximum<br />

(for dependent<br />

children to age 19<br />

only)<br />

Plan pays:<br />

• 100%<br />

• 100%<br />

• 50%<br />

• 50% (for adults and<br />

dependent children); no<br />

lifetime orthodontic<br />

maximum<br />

Annual Maximum $3,000/person<br />

Premier – $1,500/person None<br />

Benefit<br />

PPO – $2,000/person<br />

*The Dental Plan contains a provision that coordinates the benefits it pays on behalf of an individual with<br />

payments that may be made under other plans covering the individual, so that the total benefits available will not<br />

exceed 100% of the allowable expenses. Please see your Summary Plan Description for more information.<br />

This chart does not provide a complete description of the plans. For more details, please contact the<br />

<strong>UPHS</strong> Benefits Office at 215-615-2277.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Penn Faculty<br />

Practice<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Dental > Penn Faculty Practice<br />

Penn Faculty Practice<br />

There are three Penn Faculty Plan locations you can go to for dental services.<br />

The Dental Care<br />

Center<br />

4003 Locust Street<br />

Philadelphia<br />

215-898-4615<br />

PENN Dental<br />

3401 Market Street<br />

Philadelphia<br />

215-573-8400<br />

Please note: There is no dental card associated with this plan.<br />

PENN Dental Center At Bryn<br />

Mawr<br />

711 Lancaster Avenue<br />

Bryn Mawr<br />

610-520-4600<br />

Contact Providers<br />

• PENN Faculty Practice<br />

at 215-898-4615<br />

• Delta Dental at<br />

800-932-0783<br />

• Aetna DMO at<br />

877-238-6200

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Health Care FSA<br />

Dependent Care<br />

FSA<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Flexible Spending Accounts<br />

Flexible Spending Accounts<br />

Flexible Spending Accounts (FSAs) allow you to pay for eligible health care<br />

and/or dependent care expenses with tax-free money. You pay no federal or<br />

Social Security taxes on money in these accounts. When you enroll in a Health<br />

Care and/or Dependent Care FSA, the dollars you designate will be deducted<br />

from your paycheck on a before-tax basis and credited to your FSA. For a<br />

complete list of eligible expenses, visit www.enrollone.com/uphs.<br />

Reimbursements<br />

You can use your Health Care Flexible Spending Account Card to pay for eligible<br />

health care expenses. When you first enroll for the FSA, SHPS will mail your<br />

card. Once you activate the card, you can use it to pay for your eligible health<br />

care expenses. If you are currently enrolled in an FSA, you will receive a new<br />

card when your current card expires (the expiration date is listed on your card).<br />

You can still choose to submit paper claims instead of using the Flexible<br />

Spending Account Card. Reimbursement checks will either be mailed directly to<br />

your home or wire-transferred to an account you designate via Electronic Funds<br />

Transfer (EFT).<br />

When submitting a claim, remember to include your Explanation of Benefits<br />

(EOB) if you are filing a claim for health care expenses partially covered by an<br />

insurance plan.<br />

Please keep your receipts until your claim is validated by SHPS.<br />

Use It or Lose It!<br />

According to IRS<br />

regulations, you must<br />

forfeit any unused funds<br />

left in your Flexible<br />

Spending Account after<br />

the applicable deadline:<br />

• Health Care FSA: Any<br />

unused funds left after<br />

September 15, 2011, will<br />

be forfeited. You can<br />

submit expenses until<br />

December 31 after the<br />

plan year.<br />

• Dependent Care FSA:<br />

Any unused funds left<br />

after June 30, 2011, will<br />

be forfeited. You can<br />

submit expenses until<br />

September 30 after the<br />

plan year.<br />

Forms<br />

Health Care FSA Claim Form<br />

Dependent Care FSA Claim Form<br />

Electronic Funds Transfer<br />

Eligible Expenses<br />

Health Care FSA<br />

Dependent Care FSA<br />

Contact Your Provider<br />

SHPS at 800-678-6684

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Health Care FSA<br />

Dependent Care<br />

FSA<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Flexible Spending Accounts > Health Care FSA<br />

Health Care FSA<br />

You can use this account to pay for certain health care expenses not covered by<br />

your benefit plans. For the 2010 – 2011 plan year, you can contribute from $60<br />

up to $3,000 to a Health Care FSA.<br />

Expenses that are reimbursable<br />

• Medical and dental deductibles and<br />

copays;<br />

• Out-of-pocket costs for hospital or<br />

physician care;<br />

• Non-reimbursed prescriptions and<br />

copays;<br />

• Over-the-counter medications and<br />

drugs (such as pain relievers,<br />

antacids and allergy and cold<br />

medicines);<br />

• Dental care, including orthodontia;<br />

• Vision care, including exams,<br />

eyeglasses and contact lenses;<br />

• Hearing aids; and<br />

• Other expenses considered eligible<br />

by the IRS.<br />

Expenses that are NOT reimbursable<br />

• Health insurance contributions;<br />

• Health insurance premiums under your<br />

spouse’s plan;<br />

• Most cosmetic surgery procedures;<br />

and<br />

• Dietary supplements/vitamins,<br />

cosmetics, toiletries and sundry items.<br />

Over-the-counter medications will only be reimbursable without a<br />

prescription until December 31, 2010. Beginning January 1, 2011, over-thecounter<br />

medications will no longer be reimbursable unless you have a<br />

prescription from your doctor.<br />

You must re-enroll for the Health Care FSA if you would like to<br />

participate in the plan for the 2010-2011 plan year.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Health Care FSA<br />

Dependent Care<br />

FSA<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Flexible Spending Accounts > Dependent Care FSA<br />

Dependent Care FSA<br />

You can use this account to pay for some of the expenses you incur for certain<br />

dependent care services. Dependent care may also include costs you incur for<br />

child care for dependent children under age 13 and/or an adult living with you<br />

whom you claim as a tax dependent and who is physically or mentally incapable<br />

of self-care (e.g., disabled spouse, elderly parent).<br />

For the 2010 – 2011 plan year, you can contribute from $260 up to $5,000 to a<br />

Dependent Care FSA. For the Dependent Care FSA, pre-paid expenses are not<br />

eligible for reimbursement until the service is actually received.<br />

If you are married and filing a joint tax return, your contributions combined with<br />

your spouse’s contributions to a Dependent Care FSA, cannot exceed $5,000 for<br />

the calendar year (January 1 through December 31), regardless of your or your<br />

spouse’s plan year.<br />

Remember, your Dependent Care FSA election is reported on your W-2 form for<br />

the current calendar year (January 1 through December 31); however, your<br />

election is on a fiscal year basis (July 1 through June 30). As such, be mindful of<br />

the amount you elect for the Dependent Care FSA.<br />

You must re-enroll for the Dependent Care FSA if you would like<br />

to participate in the plan for the 2010-2011 plan year.<br />

Eligible Dependent Care<br />

Expenses<br />

Please note, this benefit is<br />

not for health care<br />

expenses such as copays,<br />

braces, eyeglasses, and<br />

prescriptions. For<br />

information on health care<br />

expenses, click here.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

Dependent Life<br />

Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Life Insurance<br />

Life Insurance<br />

The cost for life insurance is based on your coverage option, base pay and your<br />

age. If you leave <strong>UPHS</strong>, you may convert your coverage to an individual policy<br />

within 30 days of your termination date.<br />

Your Coverage Options:<br />

Core Coverage<br />

• All benefit-eligible employees may elect <strong>UPHS</strong>-provided Core Coverage of 1x<br />

your base pay at no cost to employees.<br />

• You can elect to opt out of Core Coverage.<br />

Supplemental Coverage<br />

• You can also choose employee-paid Supplemental Coverage of 1x, 2x, or 3x<br />

your base pay. However, you must elect Core Coverage to elect<br />

Supplemental Coverage.<br />

• Premiums for Supplemental Coverage will be deducted from your paycheck<br />

on an after-tax basis.<br />

Combined maximum employee life insurance coverage amount (<strong>UPHS</strong>-provided<br />

Core Coverage plus Supplemental Coverage) is $1,000,000.<br />

Imputed Income for<br />

Core Coverage<br />

Under IRS rules, you must<br />

pay taxes on the premium<br />

value of <strong>UPHS</strong>-paid Core<br />

Coverage over $50,000.<br />

This is called imputed<br />

income and will be shown<br />

on your pay stub. The IRS<br />

determines the amount of<br />

this tax. Note that imputed<br />

income rules do not apply<br />

to AD&D, supplemental<br />

and dependent life<br />

insurance benefits.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

Dependent Life<br />

Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Life Insurance > Dependent Life Insurance<br />

Dependent Life Insurance<br />

Dependent life insurance provides benefits to you, as the beneficiary, in the<br />

event of the death of your spouse/partner and/or child(ren). If you choose any of<br />

the dependent life insurance options, your deductions for the coverage are made<br />

with after-tax dollars.<br />

Remember, a dependent must meet the requirements under the dependent<br />

eligibility section as defined in the Summary Plan Description (SPD).<br />

Dependent life insurance options for all <strong>UPHS</strong> employees are as follows:<br />

Spouse/Partner<br />

Child(ren)<br />

$2,000 for your spouse/partner $1,000 for your child(ren)<br />

$5,000 for your spouse/partner $2,000 for your child(ren)<br />

$10,000 for your spouse/partner $5,000 for your child(ren)<br />

Please Note: If your spouse works for <strong>UPHS</strong>, only one of you can elect<br />

dependent life insurance.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > AD&D Coverage<br />

Accidental Death & Dismemberment (AD&D) Coverage<br />

AD&D coverage pays benefits — in addition to any life insurance benefits you<br />

receive — if you die or are dismembered as the result of an accident. You may<br />

also elect family coverage for your spouse/partner and any eligible dependent<br />

children. If you choose any of the family coverage options, your deductions for<br />

the coverage are made with after-tax dollars.<br />

Employee-Paid AD&D Coverage<br />

• Your choices for employee-paid AD&D coverage are 1x, 2x, 3x, 4x base pay,<br />

or no coverage.<br />

• The maximum available AD&D coverage amount is $500,000.<br />

• Required premiums for election amounts will be deducted pre-tax from your<br />

paycheck.<br />

Family AD&D Coverage<br />

• Your spouse’s coverage will equal 50% of the amount you choose for<br />

yourself.<br />

• Coverage for each dependent child will equal 15% of the amount you choose<br />

to a maximum of $25,000.<br />

• If you elect family AD&D coverage, you are automatically the beneficiary for<br />

any benefits that may be payable.<br />

Please Note: A dependent must meet the requirements under the dependent<br />

eligibility section as defined in the Summary Plan Description (SPD). If your<br />

spouse works for <strong>UPHS</strong>, only one of you can elect family AD&D coverage.<br />

Naming a Beneficiary<br />

• Name a beneficiary<br />

when you first become<br />

insured.<br />

• You may change your<br />

beneficiary at any<br />

time.<br />

• For your life insurance<br />

or AD&D coverage,<br />

you may name anyone<br />

as your beneficiary;<br />

however, minors will<br />

not be entitled to<br />

benefits until they<br />

reach legal adult age.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Disability<br />

Short-Term Disability (STD)<br />

• Provides you with income if you are not able to work due to a non-workrelated<br />

illness or injury.<br />

• For most of the Health System, the waiting period for STD is 30 days or the<br />

end of your accrued sick time, whichever is greater. For CCA, the waiting<br />

period is 14 days.<br />

• The voluntary plan provides 60% of your base pay to a maximum of $1,000<br />

per week for up to 180 days following the start of your disability payments.<br />

• The cost of STD coverage is based on your age and base pay.<br />

Employees who work in New Jersey can elect coverage through the <strong>UPHS</strong>flex<br />

STD option. However, this coverage will be offset by any STD benefit you receive<br />

from the New Jersey state plan.<br />

You can file a short-term disability claim over the phone by calling<br />

UnumProvident, at which time a representative will begin the claim process. You<br />

will be asked to sign an authorization allowing UnumProvident to obtain<br />

information directly from your medical provider. For more information, call the<br />

Disability Management Office at 215-615-2360.<br />

Long-Term Disability (LTD)<br />

• A non-flex benefit and will not appear as an option for enrollment on the<br />

EnrollOne website.<br />

• Provides you with income if you are not able to work due to a non-workrelated<br />

illness or injury that extends beyond the later of 26 weeks or the<br />

exhaustion of your STD benefit.<br />

• Provides a <strong>UPHS</strong>-paid core benefit of 60% of base pay to a maximum of<br />

$10,000 per month.<br />

• Full-time employees that have worked one continuous year are eligible for<br />

LTD benefits.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Legal Notices<br />

Legal Notices<br />

The following legal notices are included in this guide to inform you of your rights<br />

under federal law. The chart includes brief descriptions of each notice. You can<br />

click on a notice to learn more.<br />

Notice<br />

Mastectomy Services<br />

Michelle’s Law<br />

Notice of Privacy Practices<br />

Employees Eligible for Medicare<br />

Medicaid and Children’s Health<br />

Insurance (CHIP) Participants<br />

Medicaid CHIP Notice: States<br />

This Notice Describes …<br />

Your right to receive coverage for breast reconstruction and<br />

related services.<br />

Information about Extended dependent coverage for students on<br />

medical leave.<br />

How medical information about you may be used and disclosed<br />

and how you may get access to your medical information.<br />

Information about your current prescription drug coverage with<br />

<strong>UPHS</strong> and prescription drug coverage if you are enrolled in or<br />

Medicare eligible. It also explains the options you have under<br />

Medicare prescription drug coverage and can help you decide<br />

whether or not you want to enroll.<br />

How to request a special enrollment if you or your family<br />

member(s) lose Medicaid or CHIP coverage.<br />

A list of Medicaid and/or CHIP programs available by state.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Welcome > Legal Notices<br />

Women’s Health and Cancer Rights Act Notice<br />

The Women’s Health and Cancer Rights Act of 1998 requires that all <strong>UPHS</strong><br />

medical plans cover the following medical services in connection with coverage<br />

for a mastectomy: reconstruction of the breast on which the mastectomy has<br />

been performed; surgery and reconstruction of the other breast to produce a<br />

symmetrical appearance; and prostheses and physical complications in all<br />

stages of mastectomy, including lymphedemas.<br />

These services shall be provided in a manner determined in consultation with the<br />

attending physician and the patient. Coverage for these medical services are<br />

subject to applicable deductibles and coinsurance amounts.<br />

Michelle’s Law<br />

Effective January 1, 2010, if your child loses his or her status as a full-time<br />

student (for example, takes a leave of absence or changes to part-time status)<br />

because of a serious illness or injury, he or she may continue to be covered<br />

under the <strong>UPHS</strong> health care plans. Coverage can continue for up to 12 months<br />

from the date of the change in student status, unless your child loses eligibility for<br />

another reason, such as reaching the plan’s age limit.