UPHS_Enrollment_Guide_FINAL

UPHS_Enrollment_Guide_FINAL

UPHS_Enrollment_Guide_FINAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Life Insurance<br />

Dependent Life<br />

Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

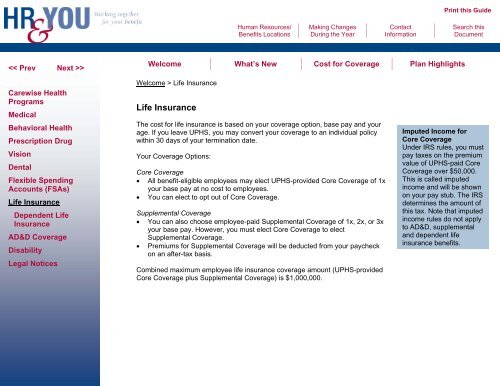

Welcome > Life Insurance<br />

Life Insurance<br />

The cost for life insurance is based on your coverage option, base pay and your<br />

age. If you leave <strong>UPHS</strong>, you may convert your coverage to an individual policy<br />

within 30 days of your termination date.<br />

Your Coverage Options:<br />

Core Coverage<br />

• All benefit-eligible employees may elect <strong>UPHS</strong>-provided Core Coverage of 1x<br />

your base pay at no cost to employees.<br />

• You can elect to opt out of Core Coverage.<br />

Supplemental Coverage<br />

• You can also choose employee-paid Supplemental Coverage of 1x, 2x, or 3x<br />

your base pay. However, you must elect Core Coverage to elect<br />

Supplemental Coverage.<br />

• Premiums for Supplemental Coverage will be deducted from your paycheck<br />

on an after-tax basis.<br />

Combined maximum employee life insurance coverage amount (<strong>UPHS</strong>-provided<br />

Core Coverage plus Supplemental Coverage) is $1,000,000.<br />

Imputed Income for<br />

Core Coverage<br />

Under IRS rules, you must<br />

pay taxes on the premium<br />

value of <strong>UPHS</strong>-paid Core<br />

Coverage over $50,000.<br />

This is called imputed<br />

income and will be shown<br />

on your pay stub. The IRS<br />

determines the amount of<br />

this tax. Note that imputed<br />

income rules do not apply<br />

to AD&D, supplemental<br />

and dependent life<br />

insurance benefits.