UPHS_Enrollment_Guide_FINAL

UPHS_Enrollment_Guide_FINAL

UPHS_Enrollment_Guide_FINAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

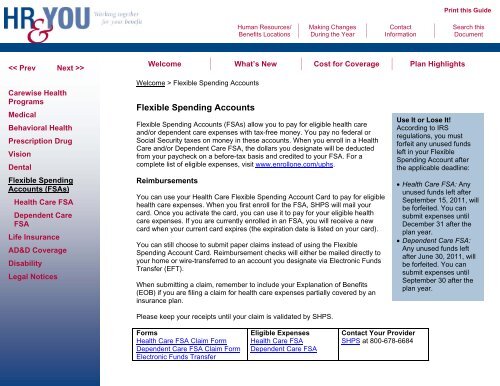

Print this <strong>Guide</strong><br />

Human Resources/<br />

Benefits Locations<br />

Making Changes<br />

During the Year<br />

Contact<br />

Information<br />

Search this<br />

Document<br />

><br />

Welcome What’s New Cost for Coverage Plan Highlights<br />

Carewise Health<br />

Programs<br />

Medical<br />

Behavioral Health<br />

Prescription Drug<br />

Vision<br />

Dental<br />

Flexible Spending<br />

Accounts (FSAs)<br />

Health Care FSA<br />

Dependent Care<br />

FSA<br />

Life Insurance<br />

AD&D Coverage<br />

Disability<br />

Legal Notices<br />

Welcome > Flexible Spending Accounts<br />

Flexible Spending Accounts<br />

Flexible Spending Accounts (FSAs) allow you to pay for eligible health care<br />

and/or dependent care expenses with tax-free money. You pay no federal or<br />

Social Security taxes on money in these accounts. When you enroll in a Health<br />

Care and/or Dependent Care FSA, the dollars you designate will be deducted<br />

from your paycheck on a before-tax basis and credited to your FSA. For a<br />

complete list of eligible expenses, visit www.enrollone.com/uphs.<br />

Reimbursements<br />

You can use your Health Care Flexible Spending Account Card to pay for eligible<br />

health care expenses. When you first enroll for the FSA, SHPS will mail your<br />

card. Once you activate the card, you can use it to pay for your eligible health<br />

care expenses. If you are currently enrolled in an FSA, you will receive a new<br />

card when your current card expires (the expiration date is listed on your card).<br />

You can still choose to submit paper claims instead of using the Flexible<br />

Spending Account Card. Reimbursement checks will either be mailed directly to<br />

your home or wire-transferred to an account you designate via Electronic Funds<br />

Transfer (EFT).<br />

When submitting a claim, remember to include your Explanation of Benefits<br />

(EOB) if you are filing a claim for health care expenses partially covered by an<br />

insurance plan.<br />

Please keep your receipts until your claim is validated by SHPS.<br />

Use It or Lose It!<br />

According to IRS<br />

regulations, you must<br />

forfeit any unused funds<br />

left in your Flexible<br />

Spending Account after<br />

the applicable deadline:<br />

• Health Care FSA: Any<br />

unused funds left after<br />

September 15, 2011, will<br />

be forfeited. You can<br />

submit expenses until<br />

December 31 after the<br />

plan year.<br />

• Dependent Care FSA:<br />

Any unused funds left<br />

after June 30, 2011, will<br />

be forfeited. You can<br />

submit expenses until<br />

September 30 after the<br />

plan year.<br />

Forms<br />

Health Care FSA Claim Form<br />

Dependent Care FSA Claim Form<br />

Electronic Funds Transfer<br />

Eligible Expenses<br />

Health Care FSA<br />

Dependent Care FSA<br />

Contact Your Provider<br />

SHPS at 800-678-6684