Vol 10, No 3 - Financial Planning Association of Malaysia

Vol 10, No 3 - Financial Planning Association of Malaysia

Vol 10, No 3 - Financial Planning Association of Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

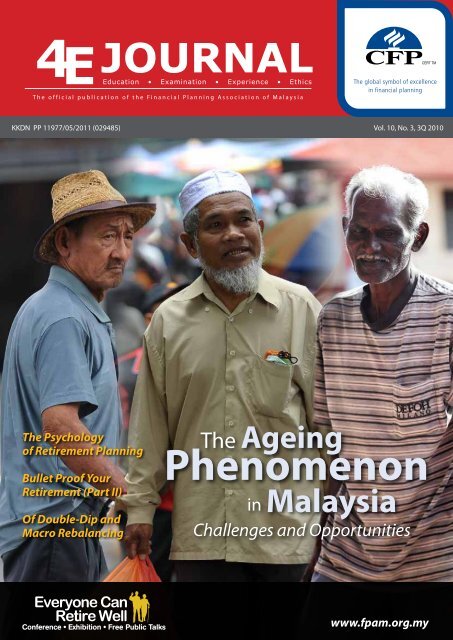

4E JOURNAL<br />

Education • Examination • Experience • Ethics<br />

The <strong>of</strong>ficial publication <strong>of</strong> the <strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong><br />

KKDN PP 11977/05/2011 (029485) <strong>Vol</strong>. <strong>10</strong>, <strong>No</strong>. 3, 3Q 20<strong>10</strong><br />

The Psychology<br />

<strong>of</strong> Retirement <strong>Planning</strong><br />

Bullet Pro<strong>of</strong> Your<br />

Retirement (Part II)<br />

Of Double-Dip and<br />

Macro Rebalancing<br />

The Ageing<br />

Phenomenon<br />

<strong>Malaysia</strong><br />

in<br />

Challenges and Opportunities<br />

Everyone Can<br />

Retire Well<br />

www.fpam.org.my

CONTENTS<br />

July - September 20<strong>10</strong><br />

In this Issue<br />

COVER STORY<br />

The Ageing Phenomenon<br />

in <strong>Malaysia</strong>:<br />

Challenges and Opportunities<br />

The ageing population in <strong>Malaysia</strong>, like many other Asian<br />

countries, is increasing rapidly and the rate <strong>of</strong> increase is<br />

faster than most Western countries. This phenomenon, whilst<br />

creating socio-economic challenges for the government, is at<br />

the same time creating new business opportunities.<br />

p 14<br />

Everyone Can<br />

Retire Well<br />

INDUSTRY<br />

<strong>Malaysia</strong>’s First Licensed Islamic Values<br />

Based <strong>Financial</strong> Adviser Firm FSA<br />

Commences Business<br />

Bullet Pro<strong>of</strong> Your Retirement (Part II)<br />

ISLAMIC FINANCE<br />

The Doctrine <strong>of</strong> ‘Aul and Its<br />

Impact on Estate <strong>Planning</strong><br />

BUSINESS MODEL<br />

Building a Pr<strong>of</strong>essional Business<br />

the MAAKL Way<br />

Building on the Right Platform<br />

ECONOMY<br />

Of Double-Dip and Macro Rebalancing<br />

NEWS IN BRIEF<br />

PINDOSF: For Investors<br />

with Aggressive Risk Appetite<br />

Empowering Investors<br />

with i*TradePro@CIMB<br />

CIMB Group Integrates<br />

Transaction Banking Regionally<br />

CHAPTER ACTIVITIES<br />

Constantly Educating the Public<br />

Upcoming Chapter Events<br />

CFP CERTIFICATION GLOBAL UPDATES<br />

CE COURSES<br />

p 26<br />

11<br />

34<br />

8<br />

44<br />

48<br />

5<br />

38<br />

39<br />

39<br />

37<br />

37<br />

40<br />

51<br />

, CERTIFIED FINANCIAL PLANNER® and are certification marks owned outside the U.S. by <strong>Financial</strong> <strong>Planning</strong> Standards Board Ltd. <strong>Financial</strong> <strong>Planning</strong><br />

<strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong> is the marks licensing authority for the CFP marks in <strong>Malaysia</strong>, through agreement with FPSB.<br />

Copyright 20<strong>10</strong> © <strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong>. All rights reserved. (KKDN PP 11977/05/2011) <strong>No</strong> part <strong>of</strong> this publication may be reproduced, stored in<br />

a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the written permission <strong>of</strong> the<br />

publisher. All information provided in this publication are for the purpose <strong>of</strong> education and keeping the members <strong>of</strong> the <strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong><br />

and the general public informed <strong>of</strong> news, developments and direction in the financial planning industry. <strong>No</strong> article published here is exhaustive on the respective<br />

subject it covers and is not intended to be a substitute for legal and financial advice or diminish any duty, statutory or otherwise imposed on persons by existing laws.

EDITORIAL<br />

Editorial Board<br />

Dear Members,<br />

Preparing<br />

for Retirement<br />

In the last edition <strong>of</strong> the 4E Journal, I mentioned briefly <strong>of</strong> our upcoming Everyone Can Retire Well<br />

Conference and Exhibition 20<strong>10</strong>. Well, this FPAM event <strong>of</strong> the year is only a few days away and I hope<br />

you are attending so as not to miss the many benefits it is <strong>of</strong>fering.<br />

The conference proper is a gathering for financial planning practitioners, policymakers, financial<br />

services and product providers, academics, and the pr<strong>of</strong>essionals who are in related sectors to come<br />

together to share their findings, challenges, proposals and viewpoints with one another to better<br />

address the issue <strong>of</strong> retirement in <strong>Malaysia</strong>. In this respect, we have invited several foreign and<br />

renowned local speakers to share their experiences and knowledge.<br />

Over the two days <strong>of</strong> the conference, there will also be public talks on the various components <strong>of</strong><br />

retirement planning including the financial, health, social and psychological aspects. These talks,<br />

together with an exhibition, will be free and open to the public. They aim to inform and educate<br />

the public on the options available to them to ensure that they enjoy their retirement years and<br />

contribute to society. I hope you invite your many clients and friends to attend these free talks.<br />

One feature, which I believe would be a hit with visitors is the EPF Mobile Team and booth. They<br />

will be at the conference to facilitate the public wishing to register for i-Akaun, obtain statements,<br />

withdrawal forms, nominate beneficiaries, make general enquiries or simply obtain brochures on<br />

EPF-related information.<br />

I would like to thank the co-chairmen <strong>of</strong> the conference, Tan Beng Wah and Badlisyah Abdul Ghani<br />

and their team for their untiring efforts in making this conference a success. Many thanks are also<br />

due to the staff <strong>of</strong> FPAM and volunteers without whom the endeavour <strong>of</strong> this magnitude would not<br />

be possible.<br />

Meanwhile, the <strong>Association</strong> will be moving to a new premise at Phileo Damansara. This move would<br />

cut our <strong>of</strong>fice rental by more than half while providing for a slightly bigger <strong>of</strong>fice space. The new<br />

address is: <strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong>, Unit 1<strong>10</strong>9, Block A, Phileo Damansara II, Jalan<br />

16/11, 46350 Petaling Jaya, Selangor Darul Ehsan.<br />

On September 28, FPAM commenced a job analysis survey. The objective <strong>of</strong> the survey is to<br />

determine which financial planning competencies, skills and areas <strong>of</strong> knowledge are important,<br />

and which ones are actually being used. A detailed questionnaire was developed for the survey.<br />

The results <strong>of</strong> the survey will be used to determine the content <strong>of</strong> the final examination for CFP<br />

candidates and the weighting <strong>of</strong> the various topics. I hope all <strong>of</strong> you will spare the time to answer<br />

the survey questions should you be selected as one <strong>of</strong> the respondents.<br />

We have also just concluded a networking event themed “China Nite 20<strong>10</strong>.” Members had the<br />

opportunity to listen to two speakers on Global Market Outlook and Investing in China. And on<br />

October 19, FPAM in collaboration with Smart Investor and Mazda will be jointly hosting a networking<br />

gathering at the new Tropicana City Mall in Petaling Jaya. I hope members will take advantage <strong>of</strong> this<br />

event to make new friends and build your business network. As usual, further details are available at<br />

our website at: www.fpam.org.my.<br />

Publisher<br />

<strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong><br />

Editor<br />

Dennis Tan<br />

Managing Editor<br />

Steven K C Poh<br />

Advisor<br />

Steve L H Teoh<br />

Editorial Panel<br />

Tan Beng Wah<br />

K P Bose Dasan<br />

Kong Kim Heng<br />

Maznita Mokhtar<br />

Administration & Advertising<br />

V. Murugiah<br />

Consulting Producer<br />

i2Media Sdn Bhd (493346-K)<br />

Suite <strong>10</strong>-01, <strong>10</strong>th Floor, Block A,<br />

Damansara Intan,<br />

<strong>No</strong>.1, Jalan SS20/27,<br />

47400 Petaling Jaya,<br />

Selangor Darul Ehsan.<br />

Printer<br />

Mr Print Sdn Bhd (577080-H)<br />

Lot 21, Jalan 4/32A, Off Batu 6 1/2,<br />

Mukim Batu, Jalan Kepong,<br />

52<strong>10</strong>0 Kuala Lumpur.<br />

The 4E Journal is published quarterly by the<br />

<strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong>.<br />

Opinions and views expressed in the 4E Journal<br />

are solely the writers’ and do not necessarily<br />

reflect those <strong>of</strong> the <strong>Financial</strong> <strong>Planning</strong><br />

<strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong>. The publisher accepts<br />

no responsibility for unsolicited manuscripts,<br />

illustrations or photographs. All manuscripts<br />

and enquiries should be addressed to:<br />

The Editor, 4E Journal,<br />

c/o <strong>Financial</strong> <strong>Planning</strong> <strong>Association</strong> <strong>of</strong> <strong>Malaysia</strong>,<br />

Lot 16.02, 16 th Floor, Block B, HP Towers,<br />

Jalan Gelenggang, Bukit Damansara,<br />

50490 Kuala Lumpur.<br />

Phone: +60-3-2095 7713<br />

Fax: +60-3-2095 7719<br />

On behalf <strong>of</strong> FPAM, I would like to take this opportunity to thank all the sponsors for their continued<br />

and generous support in all our functions and events.<br />

See you all at the conference!<br />

Wong Boon Choy,<br />

President<br />

president@fpam.org.my<br />

www.fpam.org.my

ECONOMY<br />

July - September 20<strong>10</strong><br />

Of Double-Dip and Macro Rebalancing<br />

By Anthony Dass<br />

Brewing risk <strong>of</strong> a potential<br />

double-dip<br />

The worst <strong>of</strong> the global economy from<br />

the economic crisis viewpoint has been<br />

avoided as a result <strong>of</strong> prompt and massive<br />

worldwide stimulus policy. Global growth<br />

for 1H20<strong>10</strong> was in a firmer footing,<br />

resulting in the upgrading <strong>of</strong> global<br />

growth by the International Monetary<br />

Fund (IMF) to 4.2 percent from its earlier<br />

projection <strong>of</strong> 3.9 percent (-0.6 percent in<br />

2009).<br />

Even so, new fears have started to emerge<br />

as we draw closer to 4Q20<strong>10</strong>. First, it has<br />

become more glaring that neither the<br />

European sovereign debt crisis nor the<br />

banking sector crisis has been resolved<br />

as both mutually reinforced each other.<br />

While the authorities needed to backstop<br />

banks, the banks themselves owned large<br />

amounts <strong>of</strong> peripheral government bonds.<br />

Clearly, the obstacles to a real solution for<br />

the banking and sovereign crisis were<br />

formidable.<br />

The brief breather from the stress test<br />

in July was perceived to be the circuitbreaker<br />

which provided transparency<br />

on the banks’ exposures and served<br />

as a catalyst for consolidating and<br />

recapitalising the banking system.<br />

Investors, however, are doubtful about<br />

the stringency and relevance <strong>of</strong> the<br />

test. As such, buyers <strong>of</strong> the Greece<br />

government bonds still revolved around<br />

the European Central Bank (ECB). Also<br />

investors are still wary <strong>of</strong> Ireland’s<br />

government bonds in view <strong>of</strong> the state <strong>of</strong><br />

their banks, which are still in substantial<br />

difficulties. Portugal’s government bonds<br />

are trading at their widest spreads over<br />

Bunds (German bonds); and many<br />

European banks are still depending on<br />

ECB for liquidity support.<br />

The U.S. economy, meanwhile, has<br />

entered into a rough patch, but analysts<br />

believe it will only be temporary. Still,<br />

downside risks are evident for the near<br />

term. Hence, the U.S. Federal Reserve has<br />

shifted its focus from an exiting strategy<br />

to the possibility <strong>of</strong> doing more by: (1)<br />

buying more securities;<br />

(2) committing to lower<br />

policy rates for a longer<br />

period; and (3) reducing<br />

the interest rate on bank<br />

reserves.<br />

This simply means its exit<br />

strategy mode would<br />

most likely be in 2011. But<br />

the risk <strong>of</strong> a double-dip<br />

recession is flaring, with the<br />

odds rising quickly. The U.S.<br />

1H20<strong>10</strong> real gross domestic<br />

product (GDP) was below<br />

trend, with expectation <strong>of</strong><br />

a much slower growth in<br />

2H20<strong>10</strong>. And even if the<br />

economy technically avoids<br />

a double-dip, we believe<br />

poor job creation; rising<br />

unemployment; larger<br />

cyclical budget deficits; a<br />

further fall in home prices;<br />

and banks’ larger losses<br />

on mortgages, consumer<br />

credit and other loans<br />

would create the uneasy<br />

recession feeling.<br />

China’s policy tightening<br />

to deal with its economic<br />

overheating and the rise in goods and<br />

asset inflation are showing signs <strong>of</strong><br />

slowing down growth. Also, the growth<br />

slowdown <strong>of</strong> advanced economies and<br />

the weakening <strong>of</strong> the euro will further<br />

dent Chinese growth in 2H 20<strong>10</strong>. Simply,<br />

this means the world’s leading growth<br />

locomotive would slow down its growth<br />

from above 11 percent to 7 percent rate<br />

by end-20<strong>10</strong>. Such a scenario would be<br />

bad news for export growth for Asia as<br />

well as other commodity exporters who<br />

have been relying on China’s imports.<br />

An important victim from a slower Chinese<br />

economic growth will be Japan. Domestic<br />

demand remains weak as real income<br />

growth is anemic. Japan is seen to be<br />

relying heavily on exports to China for its<br />

economic growth. That’s not all. Japan is<br />

also expected to suffer from low potential<br />

growth as a result <strong>of</strong> the lack <strong>of</strong> structural<br />

Buyers <strong>of</strong> the Greece government bonds still revolved<br />

around the European Central Bank (ECB).<br />

reforms as well as ineffective government,<br />

reflected by the frequent change <strong>of</strong> Prime<br />

Ministers (four Prime Ministers in four<br />

years and compounded by large public<br />

debt, ageing demographics and the<br />

strengthening yen.<br />

Clearly, the fear <strong>of</strong> double-dip is<br />

accelerating. Should the U.S. economy<br />

expand at a mediocre 1.5 percent, while<br />

both Europe and Japan grow closer to<br />

zero than 1 percent, and China sees a<br />

slower growth <strong>of</strong> below 8 percent, it will<br />

create a strong feeling <strong>of</strong> a double-dip.<br />

Any additional shock would then push<br />

the fragile global economy’s growth<br />

close to stall speed and into a full-fledged<br />

double-dip. Should this happen, we can<br />

expect the sovereign problems in Europe<br />

to deteriorate further, thus leading<br />

into another round <strong>of</strong> risky asset-price<br />

correction, while global risk aversion and<br />

The 4E Journal 5

volatility will hurt the region and the<br />

world.<br />

A vicious circle <strong>of</strong> asset-price correction<br />

leading to weaker growth and in turn<br />

downside surprises to growth, which<br />

are not currently priced by markets and<br />

causing further asset prices to fall would<br />

tip the global economy into a global<br />

recession like what happened in 2008-<br />

2009. Also, the risk <strong>of</strong> a possible war in the<br />

Middle East between Israel and Iran could<br />

send oil prices skyrocketing. Should this<br />

happen, it will drag the global economy<br />

into a recession.<br />

Policymakers are also bankrupt <strong>of</strong> ideas.<br />

Should the risk <strong>of</strong> a double-dip arise,<br />

additional quantitative easing may not<br />

mean much. And room for further fiscal<br />

stimulus by most advanced economies<br />

is limited. The big bailout <strong>of</strong> financial<br />

systems is also limited by the fiscal strains<br />

<strong>of</strong> many sovereigns.<br />

The ‘V-shaped’ recovery illusion has<br />

vanished. We are now looking at best<br />

a ‘U’ shaped growth for the advanced<br />

economies, with Europe and Japan<br />

possibly stretching into ‘L-shaped’ near<br />

depression. The advance economies are<br />

expected to struggle in order to avoid<br />

a ‘W-shaped’ double-dip recession. This<br />

means, even the ‘V-shaped’ recovery<br />

from the stronger emerging markets are<br />

expected to be dented by their strong<br />

dependence on the advance economies<br />

whose economic growth is expected to<br />

be weak.<br />

Increasing need for macro<br />

rebalancing <strong>of</strong> ASEAN<br />

economies<br />

The 2008 financial crisis in the developed<br />

world had some resemblance to the ASEAN<br />

financial crisis <strong>of</strong> 1997/98. Among them:<br />

• the large current account deficit due<br />

to overinvestment by corporations<br />

triggered the ASEAN crisis, while<br />

the 2008 crisis saw excessive<br />

consumption by households in U.S.<br />

• the surge in liquidity into ASEAN prior<br />

to the 1997/98 crisis as a result <strong>of</strong><br />

global capital market development<br />

and short-term capital inflows<br />

took advantage <strong>of</strong> the managed<br />

exchange rate policy and incomplete<br />

sterilisation, while in the U.S. the<br />

consumption was largely funded<br />

by excess liquidity which fuelled<br />

economic growth<br />

• a combination <strong>of</strong> financial institutions,<br />

moral hazard and regulatory<br />

frameworks spurred liquidity into<br />

ASEAN and the U.S., which in turn led<br />

to misallocation <strong>of</strong> resources, credit<br />

and debt as well as asset bubbles.<br />

Today, advanced economies remain<br />

weary about issues like: (1) consumer<br />

deleveraging in the U.S.; (2) contagion<br />

effects <strong>of</strong> sovereign debt in Europe; and<br />

(3) the weak Japanese economic recovery.<br />

On the other hand, ASEAN policymakers<br />

are focusing on their healthy macro<br />

balance sheets which were restored<br />

following the 1997/98 financial crisis.<br />

While it is great for ASEAN to have<br />

deleveraged, the situation remains a<br />

cause <strong>of</strong> concern when looking forward.<br />

After having addressed the issue <strong>of</strong> excess<br />

demand prior to the Asian financial crisis,<br />

ASEAN’s growth now hinges heavily<br />

on exports in the post 1997/98 crisis. It<br />

has corrected the excesses in the nonhousehold<br />

private sector by deleveraging:<br />

• bank credit as a percentage <strong>of</strong> GDP<br />

shrank between 1997 and 1Q20<strong>10</strong><br />

(Indonesia: 47.5 percent <strong>of</strong> GDP in<br />

1997 to 12.8 percent in 1Q20<strong>10</strong>;<br />

<strong>Malaysia</strong>: <strong>10</strong>1.2 percent in 1997 to 51<br />

percent in 1Q20<strong>10</strong>; Singapore: 68.9<br />

percent in 1998 to 55.3 percent in<br />

1Q20<strong>10</strong>; and Thailand: 142.2 percent<br />

<strong>of</strong> GDP in 1997 to 67.4 percent in<br />

1Q20<strong>10</strong>)<br />

• decline in private external debt<br />

(Indonesia: 86.3 percent <strong>of</strong> GDP in<br />

1998 to 12 percent <strong>of</strong> GDP in 1Q20<strong>10</strong>;<br />

<strong>Malaysia</strong>: 53.9 percent in 1997 to<br />

29.1 percent in 1Q20<strong>10</strong>; Thailand:<br />

65.6 percent in 1998 to 20 percent<br />

in 1Q20<strong>10</strong>). But with the risk <strong>of</strong> a<br />

potential global double-dip flaring,<br />

coupled with the recent relaxation <strong>of</strong><br />

the Chinese Renminbi, the possibility<br />

for ASEAN’s structural exports to<br />

dampen remains high. This means<br />

ASEAN will have to move away from<br />

their over-reliance on exports, going<br />

forward.<br />

Although the scenario <strong>of</strong> a double-dip is<br />

not our base case, we believe ASEAN would<br />

need to rebalance. And it should come<br />

through investment as its trade surpluses<br />

did not come from poor consumption but<br />

rather weak capital expenditure (capex).<br />

For instance, <strong>Malaysia</strong>’s private investment<br />

capex was at <strong>10</strong>.9 percent <strong>of</strong> GDP in 2004-<br />

2007 versus 30.5 percent in 1994-1997,<br />

while Thailand’s private investment capex<br />

stood at 16.1 percent <strong>of</strong> GDP in 2004-<br />

2007 against 18 percent in 1994-1997.<br />

With capex in 2004-2007 being below<br />

the pre-1998 levels, it denotes that macro<br />

rebalancing via investment will be carried<br />

out through more productive and nonspeculative<br />

investment, going forward.<br />

“The risk <strong>of</strong> a possible<br />

war in the Middle East<br />

between Israel and Iran<br />

could send oil prices<br />

skyrocketing. Should<br />

this happen, it will drag<br />

the global economy into<br />

a recession.”<br />

6 The 4E Journal

three times, each by 25 basis points (bps)<br />

to the current 2.75 percent. While some<br />

quarters expect another 25 bps hike in<br />

2H<strong>10</strong>, we believe the central bank has<br />

ended its monetary tightening for 20<strong>10</strong>.<br />

Whether Bank Negara decides to raise<br />

the OPR by another 25 bps or leave it<br />

unchanged at 2.75 percent for the rest <strong>of</strong><br />

2H20<strong>10</strong>, we believe the overall monetary<br />

policy remains accommodative and will<br />

stay below the ‘natural’ level <strong>of</strong> 3.5 percent.<br />

The government would also need to rationalise the subsidy system which has impeded the country’s progress on the<br />

competitiveness front.<br />

Also, the weak capex was also a result<br />

<strong>of</strong> savings being channeled abroad and<br />

not into domestic investment, although<br />

ASEAN enjoys high domestic savings.<br />

Comparing ASEAN economies’ savings visà-vis<br />

other economies <strong>of</strong> similar income,<br />

ASEAN’s gross domestic savings rates are<br />

much higher – suggesting a good scope<br />

for consumption as a rebalancing tool.<br />

We feel the scope is bigger for Singapore<br />

which is already a high-income economy<br />

when compared to economies like<br />

<strong>Malaysia</strong>, Indonesia and Thailand. Since<br />

savings has a positive relationship to the<br />

economy’s income level, it clearly suggests<br />

why the lower-income economies suffer<br />

from the dilemma <strong>of</strong> needing investment<br />

to ‘take <strong>of</strong>f’ but lacks savings to finance it.<br />

On that premise, as opposed to increasing<br />

consumption, countries like <strong>Malaysia</strong>,<br />

Indonesia and Thailand would be in a<br />

better footing to tap on their high savings<br />

to increase investment and potential<br />

growth.<br />

But the macro rebalancing is expected<br />

to differ amongst the ASEAN economies.<br />

Economies like Indonesia and Thailand<br />

will need to have a greater rebalance<br />

and move towards a stronger domestic<br />

demand base in view <strong>of</strong> their large<br />

economic structure and population size<br />

when compared to <strong>Malaysia</strong>. On that note,<br />

we believe rebalancing via investment<br />

as opposed to consumption would be a<br />

more viable strategy.<br />

Singapore, on the other hand, will be able<br />

to rely on exports as its strategy in view<br />

<strong>of</strong> its small economic size and population.<br />

While they could focus on consumption,<br />

it will be less effective in view <strong>of</strong> its<br />

small domestic demand. So, instead <strong>of</strong><br />

rebalancing from exports to domestic<br />

demand, they should focus on moving<br />

away from traditional export markets in<br />

the developed economies to new export<br />

markets in the developing world.<br />

Looking at the rebalancing strategy,<br />

Indonesia and Singapore are ahead<br />

<strong>of</strong> Thailand and <strong>Malaysia</strong>. The reason:<br />

Indonesia is enjoying smaller current<br />

account surplus, while its gross fixed<br />

capex in the period 4Q2009-1Q20<strong>10</strong> rose<br />

to 31.6 percent <strong>of</strong> GDP from 23.8 percent<br />

in 2004-2007 as a result <strong>of</strong> the structural<br />

decline in the cost <strong>of</strong> capital. Singapore<br />

has already started to focus on new export<br />

areas. But Thailand’s fixed capex ratios fell<br />

further to 23.8 percent <strong>of</strong> GDP in 4Q2009-<br />

1Q20<strong>10</strong> from 27.3 percent in 2004-2007. It<br />

could be attributed to its political climate,<br />

which if it improves would spur further<br />

investment. As for <strong>Malaysia</strong>, it fell to 18.6<br />

percent from 20.9 percent.<br />

Much will depend on the policymakers’<br />

will power to execute their plans, like<br />

shifting their focus from physical to nonphysical<br />

infrastructure like education<br />

to create a quality labour force for the<br />

country to unleash its potential growth<br />

and drive its economic transformation.<br />

The government would also need to<br />

rationalise the subsidy system which<br />

has impeded the country’s progress on<br />

the competitiveness front. This would<br />

help jumpstart the private investment<br />

momentum from both local and foreign<br />

investors.<br />

Cyclical recovery for <strong>Malaysia</strong><br />

Economic consolidation for the <strong>Malaysia</strong>n<br />

economy is underway, now that the<br />

economy is clearly out <strong>of</strong> the woods.<br />

Bank Negara <strong>Malaysia</strong> (BNM) started to<br />

normalise its monetary condition by<br />

raising the overnight policy rate (OPR)<br />

Meanwhile, the consolidation <strong>of</strong> public<br />

economy is progressing at a gradual<br />

pace in 20<strong>10</strong> with budget deficit/GDP<br />

projected to ease to 5.3 percent in 20<strong>10</strong><br />

and 4.9 percent in 2011 from 7.4 percent in<br />

2009. The modest consolidation <strong>of</strong> budget<br />

deficit/GDP, in our view, is partly due to the<br />

slower than expected rationalisation <strong>of</strong><br />

subsidies. Just like the goods and services<br />

tax (GST) which has been temporarily<br />

shelved, the removal <strong>of</strong> subsidies could<br />

also follow the same direction. We found<br />

that for every 1 percent reduction in<br />

subsidy, the budget deficit would drop by<br />

approximately 0.2 percent.<br />

The risk for real disposable income to<br />

erode, following the removal <strong>of</strong> subsidies,<br />

remains high, and could have a strong<br />

backlash for the authorities. Such risk<br />

is not surprising given that fuel and<br />

food make up 32 percent and 4 percent<br />

respectively <strong>of</strong> the RM74 billion total<br />

subsidy in 2009 are the target areas. Other<br />

areas <strong>of</strong> subsidy like welfare, education<br />

and healthcare account for 58 percent <strong>of</strong><br />

the total subsidy bill in 2009. The subsidy<br />

for infrastructure (6 percent) will continue.<br />

We believe the economic growth drivers<br />

in 20<strong>10</strong> and 2011 will come from cyclical<br />

factors – manufactured exports, private<br />

expenditure and positive terms <strong>of</strong><br />

trade from elevated commodity prices<br />

– and they are expected to spearhead<br />

domestic demand in 20<strong>10</strong> and 2011.<br />

Complementing the cyclical drivers will<br />

be the modest fiscal consolidation. Hence,<br />

our real GDP projection for 20<strong>10</strong> and 2011<br />

is 6.7 percent and 6.3 percent respectively.<br />

While acknowledging a cyclical recovery,<br />

our concern remains with structural issues<br />

that could undermine medium- and longterm<br />

growth. Underpinned by an uneven<br />

track record for reform, our main concern<br />

is policy execution. Without fully executing<br />

the blueprints <strong>of</strong> the <strong>10</strong>th <strong>Malaysia</strong> Plan,<br />

we fear it will remain a mere ‘plan.’ But if<br />

well executed, we believe the long-term<br />

structural issues will improve, mitigating<br />

the short-term growth impact.<br />

Anthony Dass is the Research Advisor <strong>of</strong><br />

Inter-Pacific Research Sdn Bhd.<br />

The 4E Journal 7

ISLAMIC FINANCE<br />

July - September 20<strong>10</strong><br />

The Doctrine <strong>of</strong> ‘Aul and<br />

Its Impact on Estate <strong>Planning</strong><br />

By Azman Ismail<br />

“A particular aspect<br />

that has attracted<br />

attention among<br />

financial planners is<br />

the one related to the<br />

distribution <strong>of</strong> estate in<br />

Islam. This is especially<br />

true among those who<br />

specialise in estate<br />

planning.”<br />

The awareness and interest in Islamic<br />

financial planning has grown<br />

steadily and there are now many<br />

financial planners who have attended<br />

the Islamic <strong>Financial</strong> <strong>Planning</strong> courses.<br />

A particular aspect that has attracted<br />

attention among financial planners is<br />

the one related to the distribution <strong>of</strong><br />

estate in Islam. This is especially true<br />

among those who specialise in estate<br />

planning. However, there are only a few<br />

financial planners who are involved in,<br />

more so who understand, the various<br />

components <strong>of</strong> Islamic estate planning<br />

especially the one related to the Islamic<br />

law on distribution <strong>of</strong> estate. (For an initial<br />

understanding <strong>of</strong> the subject see author’s<br />

article, ‘Faraid – The Missing Link’, Personal<br />

Money, February 2003)<br />

One aspect <strong>of</strong> the Islamic law <strong>of</strong><br />

distribution that will have an impact on<br />

estate planning relates to the distribution<br />

<strong>of</strong> estate; where when the shares <strong>of</strong> the<br />

Quranic heirs (i.e. heirs that are determined<br />

by the Quran) are added together, the<br />

sum equals to more than one. To solve<br />

this problem, Muslim scholars resort to<br />

the doctrine <strong>of</strong> ‘aul. ‘Aul literally means<br />

“increase” and the doctrine <strong>of</strong> ‘aul states that<br />

when the shares allocated by the Quran<br />

to the various heirs when added together<br />

amounts to more than one, their shares are<br />

subjected to a proportionate abatement<br />

by increasing the common denominator.<br />

What this means is that the shares <strong>of</strong> the<br />

Quranic heirs are proportionately reduced<br />

so that each heir now gets less than what is<br />

mentioned in the Quran.<br />

8 The 4E Journal

The doctrine <strong>of</strong> ‘aul was conceived possibly<br />

in the sixty-fourth decade, several years<br />

after the death <strong>of</strong> the Prophet Muhammad.<br />

It was reported that during the reign <strong>of</strong><br />

Umar the second Caliph, he was asked to<br />

judge on the distribution <strong>of</strong> the deceased’s<br />

estate. The deceased left a husband and<br />

two full sisters (i.e. sisters <strong>of</strong> the deceased<br />

with the same mother and same father).<br />

According to the Quran, the husband is<br />

entitled to a half <strong>of</strong> the estate whilst the<br />

two sisters are entitled to two-thirds <strong>of</strong><br />

the estate. The Quran says, ‘And unto you<br />

belongeth a half <strong>of</strong> that which your wives<br />

leave, if they have no child ….’ (Chapter<br />

4, Verse 12) and ‘They ask thee for a<br />

pronouncement. Say: God hath pronounced<br />

for you concerning distant kindred. If a man<br />

dies childless and he has a sister, hers is half<br />

the heritage, and he would have inherited<br />

from her had she died childless. And if there<br />

be two sisters, then theirs are two-thirds <strong>of</strong><br />

the heritage…(Chapter 4, Verse 176)<br />

“The doctrine <strong>of</strong> ‘aul was<br />

conceived possibly in<br />

the sixty-fourth decade,<br />

several years after the<br />

death <strong>of</strong> the Prophet<br />

Muhammad.”<br />

<strong>No</strong>w when we add the fractions together,<br />

it is obvious that the total sum is sevensixth<br />

(7/6). Caliph Umar, being a pious<br />

man, did not want to take a decision that<br />

seems to contradict the Quran and since<br />

the law <strong>of</strong> estate distribution is a very<br />

important matter, he consulted several<br />

<strong>of</strong> the Prophet’s companions in line with<br />

the Quranic verse, “Those who hearken<br />

to their Lord, and establish regular prayer;<br />

and who (conduct) their affairs by mutual<br />

consultation…” (Quran, 42 : 28).<br />

At that time Umar wondered whether he<br />

should give to the husband his share first<br />

and then give the balance equally to the<br />

sisters; or should he give to the sisters their<br />

share first and then give the balance to<br />

the husband? If he were to implement the<br />

former method, then the husband will get<br />

a half <strong>of</strong> the estate and the sisters will get a<br />

quarter each. On the other hand, if he were<br />

to implement the latter method, the heirs<br />

will get one-third each. Either way, each<br />

<strong>of</strong> the heirs will not get his or her share<br />

according to the Quran. Umar had possibly<br />

wanted to proportionately divide the<br />

estate but he needed other companions to<br />

confirm this thought. He put forward the<br />

issue by saying that he did not know which<br />

<strong>of</strong> them God has preferred over the other.<br />

Among the companions who attended the<br />

meeting was Abbas bin Abdul Mutalib the<br />

Prophet’s uncle, Saidina Ali the fourth Caliph<br />

and Zaid bin Thabit the faraid expert. One <strong>of</strong><br />

the companions suggested that each share<br />

be proportionately reduced and argued<br />

that this does not go against the spirit <strong>of</strong> the<br />

Quran. It was suggested in a hypothetical<br />

proposition that if a man died leaving six<br />

dirhams, and suppose that there were two<br />

people claiming their debt from the estate<br />

where one <strong>of</strong> them claims three dirhams<br />

and the other claims four dirhams, what<br />

would we have done? We would apply the<br />

rule <strong>of</strong> bankruptcy and divide the dirhams<br />

proportionately between the two. All the<br />

companions present at that meeting agreed<br />

and thus the doctrine <strong>of</strong> ‘aul was born. The<br />

doctrine <strong>of</strong> ‘aul says that in the event where<br />

there are several Quranic heirs surviving the<br />

deceased and their fractional shares when<br />

added together amount to more than one,<br />

the solution is to proportionately decrease<br />

the shares <strong>of</strong> each heir. This proportionate<br />

decrease is done through the following<br />

steps:<br />

1. Get the lowest common multiple<br />

(LCM) <strong>of</strong> the denominators <strong>of</strong><br />

the original fractional Quranic<br />

shares. In this case, the LCM <strong>of</strong> the<br />

denominators is 6 being a multiple<br />

<strong>of</strong> 2 (the denominator for half, the<br />

husband’s Quranic share) and 3 (the<br />

denominator for two-thirds, the<br />

Quranic share <strong>of</strong> the sisters.<br />

2. Add the sum <strong>of</strong> the numerators. Since<br />

the numerators are now 3 (1/2 = 3/6)<br />

and 4 (2/3 = 4/6), the sum is 7.<br />

3. Increase the denominator so that<br />

it will equal to the sum <strong>of</strong> the<br />

numerators. The denominator is<br />

now 7.<br />

4. Allow the numerators to remain.<br />

5. The shares <strong>of</strong> the heirs are now the<br />

new numerators (after the LCM<br />

process) over the new denominator<br />

i.e. 3/7 and 4/7.<br />

In the above example, the husband would<br />

get 3/7 instead <strong>of</strong> half and the sisters<br />

would get 2/7 each instead <strong>of</strong> 1/3 each.<br />

This doctrine has now been accepted by<br />

almost all the Islamic schools <strong>of</strong> thought<br />

including that <strong>of</strong> <strong>Malaysia</strong>. Therefore<br />

Islamic financial planners in <strong>Malaysia</strong> and<br />

elsewhere, and their clients, should take<br />

into consideration this doctrine when<br />

developing an estate plan for their Muslim<br />

client. Otherwise, the actual amount that<br />

the heirs will obtain will be less than the<br />

amount required.<br />

Let us take another example. Suppose<br />

a man has a wife, parents and two<br />

daughters. If the man were to pass away,<br />

the wife would get one-eighth, the<br />

parents one-sixth each and the daughters<br />

get one-third each. These apportionment<br />

are based on verses 11 and 12 <strong>of</strong> chapter<br />

4 <strong>of</strong> the Quran. In verse 11, the Quran says,<br />

‘…and if there be daughters more than two,<br />

then theirs is two-thirds <strong>of</strong> the inheritance<br />

and if there be one (only) then a half. And to<br />

his parents a sixth <strong>of</strong> the inheritance…’. In<br />

verse 12, the Quran says, ‘And unto them<br />

belongeth the fourth <strong>of</strong> that which ye leave<br />

if ye have no child, but if ye have a child then<br />

the eighth <strong>of</strong> that which ye leave…’<br />

Before applying the doctrine <strong>of</strong> ‘aul, the<br />

sum <strong>of</strong> the Quranic shares is 27/24 i.e.<br />

Father’s share + mother’s share + wife’s<br />

share + two daughters’ share<br />

xx<br />

1/6 + 1/6 + 1/8 + 2/3<br />

xx<br />

4/24 + 4/24 + 3/24 + 16/24 = 27/24<br />

When the doctrine <strong>of</strong> ‘aul is applied to the<br />

above case, the shares <strong>of</strong> the various heirs<br />

are as follows :<br />

xx<br />

4/27 + 4/27 + 3/27 + 16/27 = 27/27<br />

The following table represents the shares<br />

<strong>of</strong> the Quranic heirs before and after the<br />

doctrine <strong>of</strong> ‘aul.<br />

Quranic Heir<br />

Father<br />

Mother<br />

Wife<br />

Two Daughters<br />

Share<br />

Before<br />

‘Aul<br />

1/6<br />

1/6<br />

1/8<br />

2/3<br />

Share<br />

After<br />

‘Aul<br />

4/27<br />

4/27<br />

3/27 = 1/9<br />

16/27<br />

Let us suppose that before applying the<br />

doctrine <strong>of</strong> ‘aul, a client, in consultation<br />

with an Islamic financial planner, has<br />

determined that he ought to leave<br />

RM180,000 for his family. Suppose he came<br />

up with this figure with the assumption<br />

that his two daughters will get twothirds<br />

<strong>of</strong> his estate should he pass away.<br />

Suppose also that his nest egg has already<br />

accumulated RM <strong>10</strong>0,000 and he needs<br />

another RM80,000 in insurance or takaful<br />

cover. However, since he leaves behind a<br />

wife, parents and two daughters, he now<br />

needs an additional insurance or takaful<br />

coverage <strong>of</strong> RM30,000 to fulfill the needs <strong>of</strong><br />

his family after his death. Confused? Don’t<br />

be. Contact your Islamic financial planner.<br />

(More cases <strong>of</strong> ‘aul can be found in the<br />

book, “Perancangan Perwarisan Islam”<br />

written by the author and published by<br />

Amanah Raya Bhd.)<br />

The author is the managing director <strong>of</strong> IIFIN<br />

Consulting Sdn Bhd, a one-stop specialist<br />

consultancy in Islamic finance and insurance.<br />

The 4E Journal 9

Make Prudent <strong>Financial</strong><br />

Management a Way <strong>of</strong> Life<br />

<strong>Financial</strong> Education<br />

Get knowledgeable about<br />

managing your finances<br />

smartly.<br />

<strong>Financial</strong> Counselling<br />

Learn to put into action<br />

your financial knowledge by<br />

practising positive financial<br />

habits daily.<br />

Debt Management<br />

Enjoy financial freedom<br />

through your determination<br />

and discipline.<br />

<strong>10</strong> The 4E Journal<br />

www.akpk.org.my<br />

1800-88-2575

<strong>Malaysia</strong>’s First<br />

Licensed Islamic Values Based<br />

<strong>Financial</strong> Adviser Firm FSA<br />

Commences Business<br />

INDUSTRY<br />

July - September 20<strong>10</strong><br />

First Sovereign Advisory Sdn Bhd (FSA),<br />

the first Islamic values based financial<br />

adviser firm licensed by Bank Negara<br />

<strong>Malaysia</strong> and the Securities Commission<br />

in <strong>Malaysia</strong>, opens its business operations<br />

on September 17, 20<strong>10</strong> with the aim <strong>of</strong><br />

making financial freedom a reality for all<br />

its clients through prudent and effective<br />

financial planning.<br />

A bumiputera controlled company, FSA’s<br />

business model is based on a fair sharing<br />

formula between FSA (the financial<br />

adviser (FA) firm) and the financial adviser<br />

representative (FAR) and/or licensed<br />

capital markets services representative<br />

(CMSRL). “It is a ‘win-win’ formula, proven<br />

worldwide in bringing financial planning<br />

to the community,” its chief executive<br />

<strong>of</strong>ficer, Anuar Shuib said.<br />

“FSA’s primary role is to provide an efficient<br />

and effective platform for its FARs and<br />

CMSRLs to practise financial planning by<br />

providing a plethora <strong>of</strong> unique financial<br />

products and services via strategic<br />

partnerships with selected financial<br />

institutions,” Anuar added. “That’s not all.<br />

Our infrastructure also includes a topnotch<br />

support system, IT system, client<br />

data management system, continuous<br />

knowledge and skills training, backroom<br />

facilities, research and development and<br />

strict compliance with regulators.”<br />

“<strong>Financial</strong> planning is the heart and soul<br />

<strong>of</strong> FSA,” Anuar pointed out. “We <strong>of</strong>fer<br />

prudent financial planning with an array<br />

<strong>of</strong> other related services like portfolio<br />

management and tax planning to our<br />

clients. We also leverage our expertise<br />

and resources with strategic alliances<br />

that specialise in their respective areas<br />

<strong>of</strong> expertise to give our clients the best<br />

and most effective financial planning<br />

services to get the intended results and<br />

achieve their personal financial objectives,<br />

and in the process, really a total financial<br />

planning experience.<br />

“At the retail level, we believe inflation,<br />

interest rate and the economy will have a<br />

direct impact on our clients’ financial future<br />

and lifestyle,” Anuar said. “And as financial<br />

advisors, we are entrusted with the<br />

The FSA team with strategic partners and guest <strong>of</strong> honour Tun Dr Mahathir Mohamed.<br />

responsibility to assist our clients in their<br />

personal financial planning journey to<br />

ensure they arrive safely at their intended<br />

financial ‘destination.’ We do this by <strong>of</strong>fering<br />

them a comprehensive range <strong>of</strong> financial<br />

solutions via our expert advisors as well<br />

as designing tailor-made financial plans<br />

to meet their unique needs. As an Islamic<br />

values based financial adviser, we also give<br />

our Muslim clients financial advice from<br />

a Shariah perspective, which is an FSA<br />

unique selling proposition. This includes<br />

zakat planning as well as planning for the<br />

hereafter as encouraged in the Quran.<br />

Anuar: <strong>Financial</strong> planning is the heart and soul <strong>of</strong> FSA.<br />

“As financial planners, I believe we also act<br />

as a personal finance coach to our clients,<br />

and collectively, I believe we have a nationbuilding<br />

role to play as well. We are inevitably<br />

and indirectly ‘entrusted’ with the role <strong>of</strong><br />

constructing the wealth management<br />

blueprint for <strong>Malaysia</strong>ns,” Anuar said.<br />

At the corporate level, Anuar said there is<br />

now a renewed focus on the importance<br />

<strong>of</strong> company financial planning. “There<br />

are lessons to be learned from the recent<br />

global financial crisis and companies are<br />

now more aware <strong>of</strong> the need to be prudent<br />

in their financial management as a way<br />

to shield themselves from or minimise<br />

economic damages,” he pointed out.<br />

“Corporations now realise that there is more<br />

to be achieved when practising sound<br />

financial planning rather than avoiding it,”<br />

he added. “The notion that corporations<br />

can have consistent pr<strong>of</strong>itability without<br />

proper risk management and investment<br />

planning is now no longer relevant.<br />

Corporations must understand that it is<br />

their responsibility to exercise effective<br />

corporate financial planning as it is the<br />

key towards financial sustainability and<br />

pr<strong>of</strong>itability. This is where FSA again<br />

plays its role, and we believe we have the<br />

necessary expertise to assist our corporate<br />

clients in this endeavour.”<br />

The 4E Journal 11

INDUSTRY<br />

July - September 20<strong>10</strong><br />

Bullet Pro<strong>of</strong> Your<br />

Retirement Plan (Part II)<br />

We have established in the<br />

previous article that investing<br />

is for the medium- to longterm<br />

and what is key to accumulate your<br />

retirement fund is to be discipline and<br />

consistent. Through this approach and<br />

cost averaging you will be able to lower<br />

your total cost <strong>of</strong> investing. Make this<br />

habit your second nature because you<br />

stand to benefit!<br />

So now that you know the recommended<br />

approach to take in accumulating your<br />

retirement pool, consider the next few<br />

questions: How much is enough? How<br />

best to determine what you need?<br />

Through proper planning you will be<br />

able to determine how much you actually<br />

need and whether your current wealth<br />

accumulation method is effective. Four<br />

simple steps have been outlined below<br />

for you to follow when planning your<br />

retirement:<br />

Step 1:<br />

Set realistic goals on the retirement<br />

lifestyle you are aiming for<br />

• By setting clear goals and having a<br />

plan to help you achieve your goals,<br />

you will be able to start making<br />

progress, in big or small consistent<br />

steps, towards your retirement goal<br />

and financial independence.<br />

• Apply a strategy and stick with it.<br />

• Make adjustments along the way.<br />

Step 2:<br />

Determine your financial requirements<br />

based on your desired retirement lifestyle<br />

• Make allowances for your daily<br />

expenses, foreign vacations and big<br />

item purchases or expenses.<br />

• You should also take into<br />

consideration the effects <strong>of</strong> inflation<br />

on the value <strong>of</strong> your money, children’s<br />

education, clearing your debts,<br />

miscellaneous expenses such as<br />

health and living costs, or expenses<br />

related to unforeseen incidences.<br />

Step 3:<br />

Make an inventory <strong>of</strong> all your financial<br />

assets and liabilities<br />

debts like housing loans, car loans,<br />

personal loans, credit card debt, etc.<br />

• Get a clear picture <strong>of</strong> your financial<br />

status which will determine the kind<br />

<strong>of</strong> financial plan needed to secure<br />

your future. Be honest!<br />

Step 4:<br />

Determine the amounts for cash savings,<br />

investments and the rate <strong>of</strong> return you are<br />

comfortable with.<br />

• This will help you choose the type<br />

<strong>of</strong> investments that will help you<br />

achieve your goals.<br />

• Start early, reinvest your gains and<br />

benefit from the compounded rate<br />

<strong>of</strong> return. You will be amazed at how<br />

a small amount <strong>of</strong> capital invested on<br />

a monthly basis over a period <strong>of</strong> time<br />

will enable you to live your dream<br />

retirement life!<br />

• Use the rule <strong>of</strong> 72 to determine how<br />

many years it will take to double the<br />

value <strong>of</strong> your investment, assuming all<br />

gains are reinvested. Take 72 divided<br />

by the returns you are receiving per<br />

annum. The answer indicates the<br />

number <strong>of</strong> years it takes to double<br />

your investment. Better still, through<br />

smart investing plans, you can<br />

possibly enjoy an early retirement!<br />

<strong>No</strong>w, let us apply the four steps to<br />

retirement planning to Jacob’s case and<br />

evaluate whether his retirement plans are<br />

achievable. If not then, how to rectify the<br />

situation?<br />

Jacob - 33 years old and is the sole breadwinner <strong>of</strong> the family <strong>of</strong> four. He<br />

has two children, a one-year-old and three-year-old and is just starting<br />

to plan for both his retirement and his wife’s retirement.<br />

Current Situation<br />

• Current household income: RM<strong>10</strong>,000 monthly / RM120,000 annually<br />

• Current Retirement Saving: RM150,000<br />

• Current investment type and return: Regular saving / investments amounting<br />

to RM1,000 monthly with an average return <strong>of</strong> <strong>10</strong> percent per annum<br />

• Expected Increase in household Income annually: 4 percent<br />

• Expected rate <strong>of</strong> Inflation annually: 3 percent<br />

Retirement Plans<br />

• Goal: To retire at the age <strong>of</strong> 55 (22 years to retirement)<br />

• Estimated life expectancy after retirement: 22 years<br />

• Desired lifestyle during retirement: <strong>No</strong>t have to work and to go for overseas<br />

holidays yearly<br />

• Estimated annual cost <strong>of</strong> living post-retirement: 90 percent <strong>of</strong> current expenses<br />

equivalent to RM9,000 monthly/ RM<strong>10</strong>8,000 annually<br />

• <strong>Financial</strong> and economic challenges: Inflation and family commitments<br />

TOTAL INVESTMENT VALUE at 55 Years Old: RM2,175,305.72<br />

Retirement Fund (RM)<br />

2,500,000<br />

2,000,000<br />

1,500,000<br />

1,000,000<br />

500,000<br />

Balance<br />

Retirement Fund<br />

• Do a simple exercise <strong>of</strong> summarising<br />

all your income sources, investments,<br />

insurance coverage and deduct your<br />

0<br />

34<br />

39 44 49 54 55 60 65 70 75<br />

Age<br />

12 The 4E Journal

Results<br />

Recommendations and Conclusion<br />

• Jacob needs to save more because<br />

his retirement funds will only last<br />

14 years post retirement or till he<br />

reaches 69 years-old as illustrated<br />

in the graph above.<br />

• Within these 14 years, Jacob can<br />

enjoy more <strong>of</strong> less 90 percent <strong>of</strong><br />

his current lifestyle but will be left<br />

with nothing for the remaining 8<br />

years till the age <strong>of</strong> 77-years old.<br />

• The bottomline here is that for Jacob<br />

to achieve his retirement goals, he has<br />

to generate additional income sources<br />

either through higher investment<br />

returns or additional income streams<br />

such as side business.<br />

• We recommend an investment<br />

vehicle which is able to yield a higher<br />

return than current i.e. <strong>10</strong> percent.<br />

• It will also help if Jacob reconsiders<br />

his current lifestyle and expenses<br />

to channel more money into<br />

investments.<br />

• Jacob can also consider investing in<br />

more aggressive growth unit trust<br />

funds which are targeted to yield<br />

approximately <strong>10</strong> to 12 percent<br />

returns per annum. This can be<br />

achieved through a small capital<br />

outlay with consistent regular savings.<br />

“Through proper<br />

planning you will be<br />

able to determine how<br />

much you actually<br />

need and whether<br />

your current wealth<br />

accumulation method<br />

is effective.”<br />

From Jacob’s case, we can see that proper<br />

planning is essential. The more time you<br />

have the better but the trick is to put the<br />

plan into action immediately. Having<br />

the buffer also allows you to cover the<br />

unforeseen circumstances and make the<br />

necessary lifestyle changes in time for you<br />

to still achieve your retirement goals.<br />

The earlier you start, the earlier you can<br />

identify the areas which need more<br />

attention and work. So, start taking action<br />

NOW!<br />

Disclaimer:<br />

This has been prepared by HwangDBS Investment<br />

Management Bhd (429786-T) for information only<br />

and is not, and should not be construed as an <strong>of</strong>fer<br />

document or an <strong>of</strong>fer or solicitation to buy or sell<br />

any investments. <strong>No</strong> representation or warranty,<br />

expressed or implied, is made that such information<br />

or opinions are accurate, complete or verified and<br />

it should not be relied upon as such. Information<br />

and opinions presented are published for the<br />

recipient’s reference only, and are not to be relied<br />

upon as authoritative or without the recipient’s<br />

own independent verification <strong>of</strong> in substitution for<br />

the exercise <strong>of</strong> judgment by any recipient, and are<br />

subject to change without notice.

COVER STORY<br />

July - September 20<strong>10</strong><br />

The Ageing<br />

Phenomenon<br />

in <strong>Malaysia</strong>:<br />

Challenges and Opportunities<br />

By Richard Lim<br />

The Ageing Phenomenon<br />

The ageing population in <strong>Malaysia</strong>, like<br />

many other Asian countries (see following<br />

tables), is increasing rapidly and the rate<br />

<strong>of</strong> increase is faster than most Western<br />

countries.<br />

<strong>Malaysia</strong> will be a matured society by<br />

2020 with 9.5 percent <strong>of</strong> its population<br />

aged 60 and above. If the government<br />

does not start now to actively address<br />

issues arising from its ageing population,<br />

the issues today will become big social<br />

problems in the years to come.<br />

This phenomenon, whilst creating socioeconomic<br />

challenges for the government,<br />

is at the same time creating new business<br />

opportunities in the following areas:<br />

• Demand for innovative financial<br />

planning services for retirees that<br />

help them to create a level <strong>of</strong><br />

income that maintain the lifestyles<br />

they are accustomed to during<br />

their retirement years. The planning<br />

services to include counselling that<br />

prepares the clients “mentally ready”<br />

for retirement.<br />

• Demand for suitable housing<br />

alternative that meet the needs <strong>of</strong><br />

the elderly who are active and want<br />

to live independently,<br />

• Demand for a viable, cost-efficient<br />

and high standard aged care system<br />

(nursing homes) that caters for the<br />

long-term care needs <strong>of</strong> frail senior<br />

citizens.<br />

• Demand for mental health and other<br />

allied health services by the elderly,<br />

especially those with depression and<br />

dementia.<br />

The Origin <strong>of</strong> the Retirement<br />

Concept<br />

When <strong>Malaysia</strong>ns say that they are old,<br />

they normally benchmark it against a lifechanging<br />

event. Usually it is the day they<br />

<strong>of</strong>ficially retire at the age <strong>of</strong> 56.<br />

The idea or concept <strong>of</strong> retirement had<br />

its origin in 1884, when the German<br />

Chancellor implemented a mandatory<br />

retirement age <strong>of</strong> 65 to remove “living<br />

fossils” from their desks. At that point in<br />

history, the average life expectancy was<br />

only 37.<br />

If <strong>Malaysia</strong>ns were to adjust that figure<br />

basing on a life expectancy <strong>of</strong> 73<br />

(World Health Organisation’s average <strong>of</strong><br />

<strong>Malaysia</strong>n life expectancy in 2008) for the<br />

21st Century, the equivalent retirement<br />

age would be around 127 years!<br />

Governments around the world have<br />

since been using retirement as the door to<br />

usher older people out <strong>of</strong> the work force<br />

to make way for the young. The downward<br />

shift in the statutory retirement aged<br />

happened during the 1970s and 1980s<br />

in the developed countries. We are now<br />

starting to see developed countries<br />

increasing the statutory retirement age as<br />

a means <strong>of</strong> <strong>of</strong>fsetting the fiscal pressures<br />

<strong>of</strong> the ageing population.<br />

The idea <strong>of</strong> a comfortable and enjoyable<br />

retirement years is only a very recent<br />

phenomenon, which came after the Great<br />

Depression.<br />

14 The 4E Journal

In the developed economies, retirement<br />

in the 1940s and the 1950s was a period <strong>of</strong><br />

rest after years <strong>of</strong> toiling in the factories or<br />

in the fields. In the 1970s, retirement was<br />

a reward for the years <strong>of</strong> hard work, and in<br />

the 1980s it was a period <strong>of</strong> funded leisure<br />

that came as the result <strong>of</strong> globalisation<br />

and increasing personal wealth.<br />

<strong>No</strong>w the emerging retirement trend in the<br />

industrialised world is that retirement is a<br />

period <strong>of</strong> new opportunity and continued<br />

activity (work, education and leisure)<br />

rather than rest and relaxation.<br />

In a developing economy like <strong>Malaysia</strong>, a<br />

lot <strong>of</strong> retirees look at retirement as a period<br />

<strong>of</strong> rest and relaxation. However, there is<br />

an emergence <strong>of</strong> a group trend-setting<br />

retirees who are looking forward to an<br />

active old age. These retirees who live<br />

mainly in urban areas and who work in the<br />

services sector or other modern areas <strong>of</strong> the<br />

economy as well as more exposed to work<br />

practices <strong>of</strong> developed economies, appear<br />

to be leapfrogging the idea <strong>of</strong> retirement<br />

as a period <strong>of</strong> rest and relaxation. They<br />

go straight for the new model <strong>of</strong> “active<br />

contributory” retirement and they have the<br />

financial means to do so.<br />

The role <strong>of</strong> the extended Asian/<strong>Malaysia</strong>n<br />

family is also changing. The notion <strong>of</strong> the<br />

elderly moving in with their children and<br />

expecting their children to care for them<br />

is quickly diminishing. Future generations<br />

<strong>of</strong> older Asian/ <strong>Malaysia</strong>n people may not<br />

receive the care and financial support<br />

they expect from their families.<br />

Sufficiency <strong>of</strong> Income and<br />

“Preparedness” for Retirement<br />

In an Employees Provident Fund (EPF)’s<br />

report in May 2007, the average EPF<br />

contributor has approximately RM<strong>10</strong>6,000<br />

in his/her EPF account on retirement and<br />

99.9 percent <strong>of</strong> them withdrew their<br />

savings in one lump sum. And that lump<br />

sum would be used up within <strong>10</strong> years <strong>of</strong><br />

retirement.<br />

Given that the average life expectancy <strong>of</strong> a<br />

<strong>Malaysia</strong>n is 73, the question is how does<br />

an average <strong>Malaysia</strong>n (EPF contributor)<br />

sustain the remaining eight years <strong>of</strong> his/<br />

her retirement?<br />

This income sufficiency issue is further<br />

compounded by the fact that an average<br />

<strong>Malaysia</strong>n needs nine years <strong>of</strong> nursing<br />

care <strong>of</strong> some form. Where does he or she<br />

get the additional funds to cover those<br />

medical and hospital expenses and the<br />

cost <strong>of</strong> staying in a reasonable standard<br />

nursing home?<br />

Hong Kong<br />

1,118<br />

Another issue is how well is a retiree<br />

prepared “mentally” for retirement?<br />

Retirees have become accustomed to<br />

work and everything associated with it.<br />

Once the novelty <strong>of</strong> retirement is over,<br />

reality sets in with feelings <strong>of</strong> loss <strong>of</strong><br />

3,577<br />

Japan<br />

34,751 46,748<br />

27<br />

42<br />

Indonesia<br />

19,049 Over 60 Years (’000) 67,355 As % 8<strong>of</strong> Total Population 24<br />

Country<br />

<strong>Malaysia</strong><br />

2006 1,847<br />

2050 8,405<br />

2006 7<br />

2050 2<br />

Singapore China<br />

Hong Thailand Kong<br />

Australia Japan<br />

147,799 561<br />

6,945 1,118<br />

34,751 3,602<br />

431,532 1,983<br />

20,702 3,577<br />

46,748 8,356<br />

11 13<br />

16 11<br />

27 18<br />

31 38<br />

39 28<br />

42 30<br />

Source: Indonesia<br />

United Nations World Population 19,049 Over Data 60 Years (’000) 67,355 As % 8<strong>of</strong> Total Population 24<br />

Country<br />

<strong>Malaysia</strong><br />

2006 1,847<br />

2050 8,405<br />

2006 7<br />

2050 2<br />

Singapore China<br />

Hong Thailand Kong<br />

Australia Japan<br />

147,799 561<br />

6,945 1,118<br />

34,751 3,602<br />

431,532 1,983<br />

20,702 3,577<br />

46,748 8,356<br />

11 13<br />

16 11<br />

27 18<br />

31 38<br />

39 28<br />

42 30<br />

Source: Indonesia<br />

United Nations World Population 19,049 Data 67,355<br />

8<br />

24<br />

<strong>Malaysia</strong><br />

1,847<br />

8,405<br />

7<br />

2<br />

Singapore<br />

Thailand Country<br />

561Population 1,983<br />

aged 65+<br />

6,945 increasing from 20,702 7% to 14%<br />

13<br />

11<br />

38<br />

<strong>No</strong>. <strong>of</strong> Years 28<br />

Australia France 3,602 1865 - 1980 8,356<br />

18 115 30<br />

Source: United Sweden Nations World Population Data 1890 - 1975 85<br />

Australia 1938 - 2011 73<br />

U.S.<br />

Country Canada<br />

Population 1944 - 2013 aged 65+<br />

increasing 1944 from - 2009 7% to 14%<br />

69<br />

<strong>No</strong>. <strong>of</strong> 65Years<br />

France Britain 1930 1865 - 1975 1980 115 45<br />

Sweden Spain 1947 1890 - 1992 1975 45 85<br />

Australia Japan 1970 1938 - 1996 2011 26 73<br />

China U.S. Population 2000 1944 - 2026 2013 aged 65+<br />

26 69<br />

Sri Country Canada Lanka increasing 1944 2002 from --2026 2009 7% to 14%<br />

<strong>No</strong>. <strong>of</strong> 24 65Years<br />

Thailand France Britain 2002 1930 1865 - 2024 1975 1980 115 22 45<br />

Singapore Sweden Spain 2000 1947 1890 - 2019 1992 1975 19 45 85<br />

<strong>Malaysia</strong>* Australia Japan 2019 1970 1938 -- 2050* 1996 2011 31* 26 73<br />

China U.S. 2000 1944 - 2026 2013 26 69<br />

(* estimate by the author based on U.S. Census Bureau “An Aging World 2001 publication)<br />

Sri Canada Lanka 1944 2002 --2026 2009 24<br />

Source: Kinsella & Gist 1995 and U.S. Census Bureau, International Data Base 2008<br />

65<br />

Thailand Britain 2002 1930 - 2024 1975 22 45<br />

Singapore Spain 2000 1947 - 2019 1992 19 45<br />

<strong>Malaysia</strong>* Japan 2019 1970 - 2050* 1996 31* 26<br />

China 2000 - 2026 26<br />

(* estimate by the author based on U.S. Census Bureau “An Aging World 2001 publication)<br />

Source: Kinsella Sri Lanka & Gist 1995 and U.S. Census Bureau, 2002 International -2026 Data Base 2008<br />

24<br />

Thailand 2002 - 2024 22<br />

Singapore 2000 - 2019 19<br />

Percentage Increase in Population<br />

<strong>Malaysia</strong>* aged 65 & over 2008 2019 to 2040 - 2050* Developing Countries 31*<br />

(* estimate Singapore<br />

by the author based on U.S. Census 316 Bureau “An Aging World France 2001 publication) 69<br />

Source: Kinsella & Gist 1995 and U.S. Census Bureau, International Data Base 2008<br />

<strong>Malaysia</strong><br />

269<br />

Japan<br />

30<br />

Indonesia<br />

223<br />

Australia<br />

<strong>10</strong>5<br />

Thailand<br />

China<br />

Percentage 179 Increase in Population Canada<br />

aged 65 & over 209 2008 to 2040 Developing U.S. Countries<br />

114<br />

<strong>10</strong>7<br />

Singapore Sri Lanka<br />

South <strong>Malaysia</strong> Korea<br />

316 182<br />

269 216<br />

Sweden France<br />

Denmark Japan<br />

69 43<br />

30 65<br />

Source: U.S. Indonesia Census Bureau “An Aging World 2232008”<br />

Australia<br />

<strong>10</strong>5<br />

Thailand<br />

China<br />

Percentage 179 Increase in Population Canada<br />

aged 65 & over 209 2008 to 2040 Developing U.S. Countries<br />

114<br />

<strong>10</strong>7<br />

Given the<br />

Singapore Sri above Lanka scenario, it is imperative<br />

316 182 purpose, Sweden France<br />

sense <strong>of</strong> belonging,<br />

69 43fulfilment<br />

for <strong>Malaysia</strong>ns to start planning early for and usefulness.<br />

South <strong>Malaysia</strong> Korea<br />

269 216<br />

Denmark Japan<br />

30 65<br />

their retirement. It is more so for retirees<br />

to Source: implement U.S. Indonesia Census innovative Bureau “An Aging financial World 2232008”<br />

plans In developed Australia countries like <strong>10</strong>5 U.S., Britain,<br />

so that Thailand their cumulative savings 179 are<br />

sufficient China to sustain the lifestyles 209 they<br />

Switzerland, CanadaAustralia, Japan 114 and even<br />

Singapore, U.S. there is a surge in <strong>10</strong>7 depression<br />

wish to maintain Sri Lankaafter retirement, 182 without and the Sweden suicide rates in males and 43to a lesser<br />

the need to ask for financial help from the degree in females in the post-retirement<br />

South Korea<br />

216<br />

Denmark<br />

65<br />

children.<br />

age group. Suicide rates generally increase<br />

Source: U.S. Census Bureau “An Aging World 2008” with age among men and are highest at<br />

aged 75 and over. For women, it also tends<br />

to rise with age but peak before age 75.<br />

16<br />

39<br />

Also, the phenomenon <strong>of</strong> a man dying<br />

within years <strong>of</strong> retirement is not a myth. It<br />

happens all too <strong>of</strong>ten.<br />

The 4E Journal 15

Traditional Family Practice <strong>of</strong><br />

Filial Piety Evolving<br />

Traditionally, the elderly in Asia expect<br />

their children to look after them during<br />

old age and more <strong>of</strong>ten than not stay with<br />

their children.<br />

The children, whilst realising the many<br />

practical issues and challenges <strong>of</strong> keeping<br />

their parents in their homes, are reluctant<br />

to accept the concept <strong>of</strong> retirement living<br />

as a better living alternative for their<br />

parents.<br />

This reluctance is due to the perception<br />

<strong>of</strong> their filial duty to their ageing parents.<br />

Allowing them to live in retirement<br />

villages is <strong>of</strong>ten seen as a neglect <strong>of</strong> their<br />

filial duty and hence a loss <strong>of</strong> face.<br />

However, this traditional practice is fast<br />

evolving with changing global conditions<br />

as revealed by one inter-generational<br />

study undertaken in Asia recently. This<br />

study revealed that children are starting<br />

to appreciate and accept living in<br />

retirement villages/nursing homes as a<br />

socially acceptable alternative for their<br />

parents. They are starting to appreciate<br />

and embrace the reality that by allowing<br />

and encouraging their parents to live in<br />

retirement villages/nursing homes is in fact<br />

an act <strong>of</strong> filial piety without any loss <strong>of</strong> face.<br />

The various research undertaken over<br />

the last few years suggest that more and<br />

more elderly <strong>Malaysia</strong>ns prefer to live<br />

independently. Retirement villages could<br />

provide the alternative lifestyle choice<br />

they are looking for.<br />

What is a Retirement Village?<br />

The idea <strong>of</strong> the retirement village has<br />

developed from the need to provide an<br />

alternative lifestyle choice for members<br />

<strong>of</strong> the community who have reached<br />

retirement age. The aim is to create a<br />

secure environment where people can<br />

socialise and mix with those <strong>of</strong> their own<br />

age, thus helping to remove some <strong>of</strong> the<br />

loneliness and boredom <strong>of</strong>ten associated<br />

with growing old.<br />