The Pharmaceutical Price Regulation Scheme - Office of Fair Trading

The Pharmaceutical Price Regulation Scheme - Office of Fair Trading

The Pharmaceutical Price Regulation Scheme - Office of Fair Trading

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

February 2007<br />

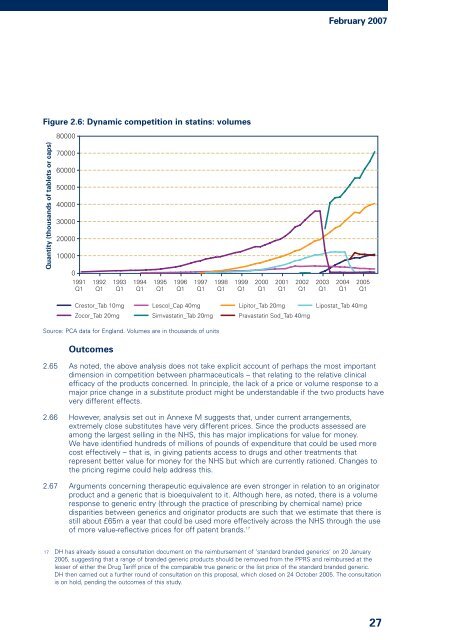

Figure 2.6: Dynamic competition in statins: volumes<br />

80000<br />

Quantity (thousands <strong>of</strong> tablets or caps)<br />

70000<br />

60000<br />

50000<br />

40000<br />

30000<br />

20000<br />

10000<br />

0<br />

1991<br />

Q1<br />

1992<br />

Q1<br />

1993<br />

Q1<br />

1994<br />

Q1<br />

1995<br />

Q1<br />

1996<br />

Q1<br />

1997<br />

Q1<br />

1998<br />

Q1<br />

1999<br />

Q1<br />

2000<br />

Q1<br />

2001<br />

Q1<br />

2002<br />

Q1<br />

2003<br />

Q1<br />

2004<br />

Q1<br />

2005<br />

Q1<br />

Crestor_Tab 10mg<br />

Zocor_Tab 20mg<br />

Lescol_Cap 40mg<br />

Simvastatin_Tab 20mg<br />

Lipostat_Tab 40mg<br />

Lipitor_Tab 20mg<br />

Pravastatin Sod_Tab 40mg<br />

Source: PCA data for England. Volumes are in thousands <strong>of</strong> units<br />

Outcomes<br />

2.65 As noted, the above analysis does not take explicit account <strong>of</strong> perhaps the most important<br />

dimension in competition between pharmaceuticals – that relating to the relative clinical<br />

efficacy <strong>of</strong> the products concerned. In principle, the lack <strong>of</strong> a price or volume response to a<br />

major price change in a substitute product might be understandable if the two products have<br />

very different effects.<br />

2.66 However, analysis set out in Annexe M suggests that, under current arrangements,<br />

extremely close substitutes have very different prices. Since the products assessed are<br />

among the largest selling in the NHS, this has major implications for value for money.<br />

We have identified hundreds <strong>of</strong> millions <strong>of</strong> pounds <strong>of</strong> expenditure that could be used more<br />

cost effectively – that is, in giving patients access to drugs and other treatments that<br />

represent better value for money for the NHS but which are currently rationed. Changes to<br />

the pricing regime could help address this.<br />

2.67 Arguments concerning therapeutic equivalence are even stronger in relation to an originator<br />

product and a generic that is bioequivalent to it. Although here, as noted, there is a volume<br />

response to generic entry (through the practice <strong>of</strong> prescribing by chemical name) price<br />

disparities between generics and originator products are such that we estimate that there is<br />

still about £65m a year that could be used more effectively across the NHS through the use<br />

<strong>of</strong> more value-reflective prices for <strong>of</strong>f patent brands. 17 27<br />

17 DH has already issued a consultation document on the reimbursement <strong>of</strong> ‘standard branded generics’ on 20 January<br />

2005, suggesting that a range <strong>of</strong> branded generic products should be removed from the PPRS and reimbursed at the<br />

lesser <strong>of</strong> either the Drug Tariff price <strong>of</strong> the comparable true generic or the list price <strong>of</strong> the standard branded generic.<br />

DH then carried out a further round <strong>of</strong> consultation on this proposal, which closed on 24 October 2005. <strong>The</strong> consultation<br />

is on hold, pending the outcomes <strong>of</strong> this study.