Annual report - Putnam Investments

Annual report - Putnam Investments

Annual report - Putnam Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

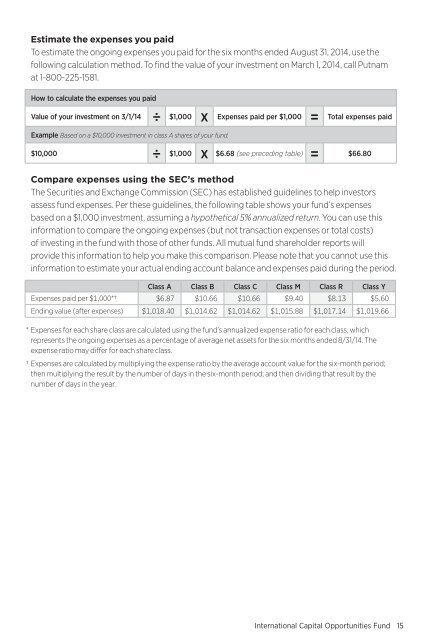

Estimate the expenses you paid<br />

To estimate the ongoing expenses you paid for the six months ended August 31, 2014, use the<br />

following calculation method. To find the value of your investment on March 1, 2014, call <strong>Putnam</strong><br />

at 1-800-225-1581.<br />

How to calculate the expenses you paid<br />

Value of your investment on 3/1/14<br />

÷ $1,000 x Expenses paid per $1,000 =<br />

Total expenses paid<br />

Example Based on a $10,000 investment in class A shares of your fund.<br />

$10,000<br />

÷ $1,000 x $6.68 (see preceding table) =<br />

$66.80<br />

Compare expenses using the SEC’s method<br />

The Securities and Exchange Commission (SEC) has established guidelines to help investors<br />

assess fund expenses. Per these guidelines, the following table shows your fund’s expenses<br />

based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this<br />

information to compare the ongoing expenses (but not transaction expenses or total costs)<br />

of investing in the fund with those of other funds. All mutual fund shareholder <strong>report</strong>s will<br />

provide this information to help you make this comparison. Please note that you cannot use this<br />

information to estimate your actual ending account balance and expenses paid during the period.<br />

Class A Class B Class C Class M Class R Class Y<br />

Expenses paid per $1,000*† $6.87 $10.66 $10.66 $9.40 $8.13 $5.60<br />

Ending value (after expenses) $1,018.40 $1,014.62 $1,014.62 $1,015.88 $1,017.14 $1,019.66<br />

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which<br />

represents the ongoing expenses as a percentage of average net assets for the six months ended 8/31/14. The<br />

expense ratio may differ for each share class.<br />

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period;<br />

then multiplying the result by the number of days in the six-month period; and then dividing that result by the<br />

number of days in the year.<br />

International Capital Opportunities Fund 15