The Nigerian Accountant 2012 - The Institute of Chartered ...

The Nigerian Accountant 2012 - The Institute of Chartered ...

The Nigerian Accountant 2012 - The Institute of Chartered ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Reporting<br />

Governments. This option guarantees<br />

adequate funding <strong>of</strong> Local Government<br />

Projects, and thereby enables them to<br />

discharge their statutory functions.<br />

METHODS OF RAISING FINANCE<br />

IN THE CAPITAL MARKET<br />

Before embarking on sourcing for<br />

funds from the capital market, the local<br />

government must first identify a project<br />

and then prepare a feasibility report. A<br />

feasibility report is essential to ensure<br />

that the project is economically, financially<br />

and technically viable. From the feasibility<br />

report, the financial structure will determine<br />

the most prudent methods <strong>of</strong> funding the<br />

project in terms <strong>of</strong> costs. If part <strong>of</strong> the<br />

funds will be provided by way <strong>of</strong> equity, it<br />

will be funded through debt instruments<br />

in which case a bond or loan stock may<br />

be issued. <strong>The</strong> project may also require<br />

the issuance <strong>of</strong> a combination <strong>of</strong> debt<br />

and equity.<br />

To enhance the marketability <strong>of</strong><br />

the bond/loan stock, the government<br />

concerned might be required to guarantee<br />

the stock by the issuance <strong>of</strong> standing<br />

payment order on their statutory Revenue<br />

Allocation Account with the CBN in addition<br />

to the mortgages/security provided. This is<br />

necessary since the project has no past<br />

financial records on which investors can<br />

analyse and access the risk. Investors<br />

therefore, need to be adequately<br />

protected although they will rely more<br />

on the earnings from the project and the<br />

willingness <strong>of</strong> the local government to<br />

meet her obligations.<br />

BENEFITS OF RAISING FUNDS<br />

THROUGH THE CAPITAL MARKET<br />

Capital market is a medium whereby<br />

eligible government can source for funds<br />

through <strong>of</strong>fer <strong>of</strong> equity to the public as<br />

well as raise debt instrument known as<br />

debenture stock. <strong>The</strong>re are a number <strong>of</strong><br />

benefits which accrue to local government<br />

to embark upon more projects and to<br />

complete such projects within the tenure<br />

<strong>of</strong> <strong>of</strong>fice <strong>of</strong> the government:<br />

1. Capital market enables local<br />

government to borrow long-term finance<br />

via the sale <strong>of</strong> loan stock or debenture/<br />

bonds. This process enables a government<br />

to embark upon more projects and to<br />

complete such projects within the tenure<br />

<strong>of</strong> <strong>of</strong>fice <strong>of</strong> the government.<br />

2. <strong>The</strong> capital market provides<br />

cheap and long-term funds for project<br />

developments by the local government.<br />

3. <strong>The</strong>re will be better accountability<br />

for use <strong>of</strong> the funds and the regulatory<br />

agencies including the stock exchange<br />

will normally request for financial reporting<br />

on such projects to be financed which will<br />

reduce some <strong>of</strong> the leakages in the local<br />

government accounting.<br />

4. Capital market financing breeds<br />

discipline among government to evaluate<br />

its performance on a continuing basis with<br />

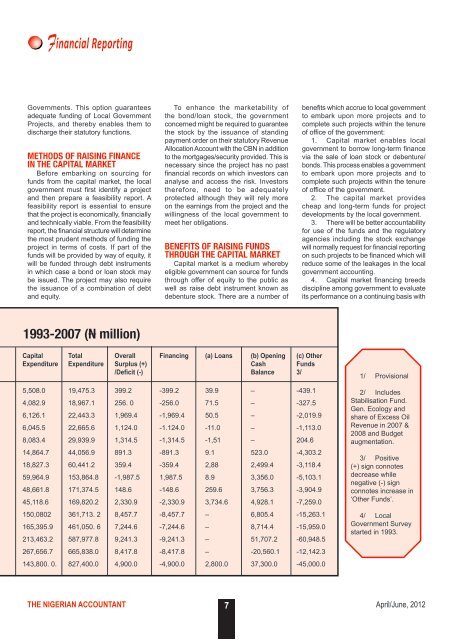

1993-2007 (N million)<br />

Capital Total Overall Financing (a) Loans (b) Opening (c) Other<br />

Expenditure Expenditure Surplus (+) Cash Funds<br />

/Deficit (-) Balance 3/<br />

5,508.0 19,475.3 399.2 -399.2 39.9 – -439.1<br />

4,082.9 18,967.1 256. 0 -256.0 71.5 – -327.5<br />

6,126.1 22,443.3 1,969.4 -1,969.4 50.5 – -2,019.9<br />

6,045.5 22,665.6 1,124.0 -1.124.0 -11.0 – -1,113.0<br />

8,083.4 29,939.9 1,314.5 -1,314.5 -1,51 – 204.6<br />

14,864.7 44,056.9 891.3 -891.3 9.1 523.0 -4,303.2<br />

18,827.3 60,441.2 359.4 -359.4 2,88 2,499.4 -3,118.4<br />

59,964.9 153,864.8 -1,987.5 1,987.5 8.9 3,356.0 -5,103.1<br />

48,661.8 171,374.5 148.6 -148.6 259.6 3,756.3 -3,904.9<br />

45,118.6 169,820.2 2,330.9 -2,330.9 3,734.6 4,928.1 -7,259.0<br />

150,0802 361,713. 2 8,457.7 -8,457.7 – 6,805.4 -15,263.1<br />

165,395.9 461,050. 6 7,244.6 -7,244.6 – 8,714.4 -15,959.0<br />

213,463.2 587,977.8 9,241.3 -9,241.3 – 51,707.2 -60,948.5<br />

267,656.7 665,838.0 8,417.8 -8,417.8 – -20,560.1 -12,142.3<br />

143,800. 0. 827,400.0 4,900.0 -4,900.0 2,800.0 37,300.0 -45,000.0<br />

1/ Provisional<br />

2/ Includes<br />

Stabilisation Fund.<br />

Gen. Ecology and<br />

share <strong>of</strong> Excess Oil<br />

Revenue in 2007 &<br />

2008 and Budget<br />

augmentation.<br />

3/ Positive<br />

(+) sign connotes<br />

decrease while<br />

negative (-) sign<br />

connotes increase in<br />

‘Other Funds’.<br />

4/ Local<br />

Government Survey<br />

started in 1993.<br />

THE NIGERIAN ACCOUNTANT 7<br />

April/June, <strong>2012</strong>