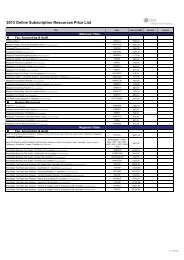

Registration Form - CCH Malaysia

Registration Form - CCH Malaysia

Registration Form - CCH Malaysia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

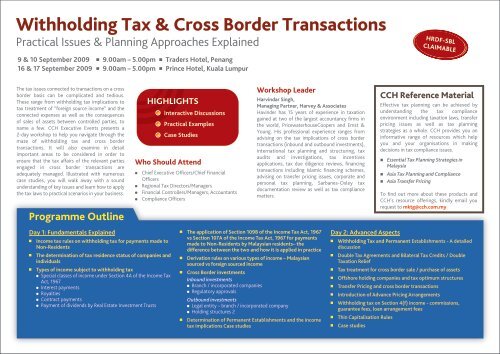

Withholding Tax & Cross Border Transactions<br />

Practical Issues & Planning Approaches Explained<br />

9 & 10 September 2009 • 9.00am – 5.00pm • Traders Hotel, Penang<br />

16 & 17 September 2009 • 9.00am – 5.00pm • Prince Hotel, Kuala Lumpur<br />

HRDF-SBL<br />

CLAIMABLE<br />

The tax issues connected to transactions on a cross<br />

border basis can be complicated and tedious.<br />

These range from withholding tax implications to<br />

tax treatment of “foreign source income” and the<br />

connected expenses as well as the consequences<br />

of sales of assets between controlled parties, to<br />

name a few. <strong>CCH</strong> Executive Events presents a<br />

2-day workshop to help you navigate through the<br />

maze of withholding tax and cross border<br />

transactions. It will also examine in detail<br />

important areas to be considered in order to<br />

ensure that the tax affairs of the relevant parties<br />

engaged in cross border transactions are<br />

adequately managed. Illustrated with numerous<br />

case studies, you will walk away with a sound<br />

understanding of key issues and learn how to apply<br />

the tax laws to practical scenarios in your business.<br />

Programme Outline<br />

HIGHLIGHTS<br />

Interactive Discussions<br />

Practical Examples<br />

Case Studies<br />

Who Should Attend<br />

Chief Executive Officers/Chief Financial<br />

Officers<br />

Regional Tax Directors/Managers<br />

Financial Controllers/Managers, Accountants<br />

Compliance Officers<br />

Workshop Leader<br />

Harvindar Singh,<br />

Managing Partner, Harvey & Associates<br />

Havinder has 15 years of experience in taxation<br />

gained at two of the largest accountancy firms in<br />

the world, PricewaterhouseCoopers and Ernst &<br />

Young. His professional experience ranges from<br />

advising on the tax implications of cross border<br />

transactions (inbound and outbound investments),<br />

international tax planning and structuring, tax<br />

audits and investigations, tax incentives<br />

applications, tax due diligence reviews, financing<br />

transactions including Islamic financing schemes,<br />

advising on transfer pricing issues, corporate and<br />

personal tax planning, Sarbanes-Oxley tax<br />

documentation review as well as tax compliance<br />

matters.<br />

<strong>CCH</strong> Reference Material<br />

Effective tax planning can be achieved by<br />

understanding the tax compliance<br />

environment including taxation laws, transfer<br />

pricing issues as well as tax planning<br />

strategies as a whole. <strong>CCH</strong> provides you an<br />

informative range of resources which help<br />

you and your organisations in making<br />

decisions in tax compliance issues.<br />

• Essential Tax Planning Strategies in<br />

<strong>Malaysia</strong><br />

• Asia Tax Planning and Compliance<br />

• Asia Transfer Pricing<br />

To find out more about these products and<br />

<strong>CCH</strong>’s resource offerings, kindly email you<br />

request to mktg@cch.com.my<br />

Day 1: Fundamentals Explained<br />

<br />

Income tax rules on withholding tax for payments made to<br />

Non-Residents<br />

<br />

<br />

The determination of tax residence status of companies and<br />

individuals<br />

Types of income subject to withholding tax<br />

Special classes of income under Section 4A of the Income Tax<br />

Act, 1967<br />

Interest payments<br />

Royalties<br />

Contract payments<br />

Payment of dividends by Real Estate Investment Trusts<br />

<br />

The application of Section 109B of the Income Tax Act, 1967<br />

vs Section 107A of the Income Tax Act, 1967 for payments<br />

made to Non-Residents by <strong>Malaysia</strong>n residents– the<br />

difference between the two and how it is applied in practice<br />

<br />

Derivation rules on various types of income – <strong>Malaysia</strong>n<br />

sourced vs foreign sourced income<br />

<br />

Cross Border investments<br />

Inbound investments<br />

Branch / incorporated companies<br />

Regulatory approvals<br />

Outbound investments<br />

Legal entity – branch / incorporated company<br />

Holding structures 2<br />

<br />

Determination of Permanent Establishments and the income<br />

tax implications Case studies<br />

Day 2: Advanced Aspects<br />

<br />

Withholding Tax and Permanent Establishments - A detailed<br />

discussion<br />

<br />

Double Tax Agreements and Bilateral Tax Credits / Double<br />

Taxation Relief<br />

<br />

Tax treatment for cross border sale / purchase of assets<br />

<br />

Offshore holding companies and tax optimum structures<br />

<br />

Transfer Pricing and cross border transactions<br />

<br />

Introduction of Advance Pricing Arrangements<br />

<br />

Withholding tax on Section 4(f) income - commissions,<br />

guarantee fees, loan arrangement fees<br />

<br />

Thin Capitalisation Rules<br />

<br />

Case studies