Registration Form - CCH Malaysia

Registration Form - CCH Malaysia

Registration Form - CCH Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WORKSHOP DETAILS<br />

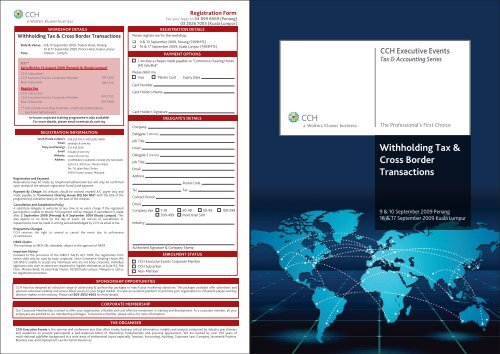

Withholding Tax & Cross Border Transactions<br />

Date & Venue : 9 & 10 September 2009, Traders Hotel, Penang<br />

16 & 17 September 2009, Prince Hotel, Kuala Lumpur<br />

Time : 9.00am - 5.00pm<br />

FEE**<br />

Early Bird by 14 August 2009 (Penang) & (Kuala Lumpur)<br />

<strong>CCH</strong> Subscriber/<br />

<strong>CCH</strong> Executive Events Corporate Member<br />

RM1,520<br />

Non-Subscriber<br />

RM1,710<br />

Regular Fee<br />

<strong>CCH</strong> Subscriber/<br />

<strong>CCH</strong> Executive Events Corporate Member<br />

RM1,710<br />

Non-Subscriber<br />

RM1,900<br />

** Fee includes workshop materials, certificate of attendance,<br />

lunch and refreshments<br />

In-house corporate training programme is also available!<br />

For more details, please email events@cch.com.my<br />

REGISTRATION INFORMATION<br />

Sarah (Kuala Lumpur)<br />

Email<br />

Mary Au (Penang)<br />

Email<br />

Website<br />

Address<br />

016.255.7013 / 603.2052.4608<br />

sarah@cch.com.my<br />

012.418.2616<br />

mau@cch.com.my<br />

www.cch.com.my<br />

COMMERCE CLEARING HOUSE (M) SDN BHD<br />

Suite 9.3, 9th Floor, Menara Weld,<br />

No. 76, Jalan Raja Chulan,<br />

50200 Kuala Lumpur, <strong>Malaysia</strong>.<br />

<strong>Registration</strong> and Payment<br />

Reservations may be made by telephone/telefax/email but will only be confirmed<br />

upon receipt of the relevant registration form(s) and payment.<br />

Payment By Cheque: All cheques should be crossed, marked A/C payee only and<br />

made payable to "Commerce Clearing House (M) Sdn Bhd" with the title of the<br />

programme(s) indicated clearly on the back of the cheques.<br />

Cancellation and Substitution Policy<br />

A substitute delegate is welcome at any time at no extra charge if the registered<br />

participant is unable to attend. Full payment will be charged if cancellation is made<br />

after 2 September 2009 (Penang) & 9 September 2009 (Kuala Lumpur). This<br />

also applies to no show on the day of event. All notices of cancellation or<br />

replacements must be made in writing and acknowledged by <strong>CCH</strong> via email or fax.<br />

Programme Changes<br />

<strong>CCH</strong> reserves the right to amend or cancel the event due to unforeseen<br />

circumstances.<br />

HRDF Claims<br />

This workshop is HRDF-SBL claimable, subject to the approval of HRDF.<br />

Important Notice<br />

Pursuant to the provisions of the DIRECT SALES ACT 1993, the registration form<br />

herein shall only be used by body corporate. Since Commerce Clearing House (M)<br />

Sdn Bhd is unable to accept any individuals who are not body corporate, individual<br />

applicants who wish to attend are requested to register themselves at Suite 9.3, 9th<br />

Floor, Menara Weld, 76 Jalan Raja Chulan, 50200 Kuala Lumpur, <strong>Malaysia</strong> or call us<br />

for registration procedure.<br />

<strong>Registration</strong> <strong>Form</strong><br />

Fax your reply to 04 899 8069 (Penang)<br />

03 2026 7003 (Kuala Lumpur)<br />

REGISTRATION DETAILS<br />

Please register me for the workshop,<br />

9 & 10 September 2009, Penang (1309MTE)<br />

16 & 17 September 2009, Kuala Lumpur (1409MTE)<br />

PAYMENT OPTIONS<br />

I enclose a cheque made payable to “Commerce Clearing House<br />

(M) Sdn Bhd”<br />

Please debit my<br />

Visa Master Card Expiry Date<br />

Card Number<br />

Card Holder’s Name<br />

Card Holder’s Signature<br />

DELEGATE’S DETAILS<br />

Company<br />

Delegate 1 (Mr/Ms)<br />

Job Title<br />

Email<br />

Delegate 2 (Mr/Ms)<br />

Job Title<br />

Email<br />

Address<br />

Tel<br />

Contact Person<br />

Email<br />

Postal Code<br />

Fax<br />

Company size 1-19 20-49 50-99 100-299<br />

300-499 more than 500<br />

Industry<br />

Authorised Signature & Company Stamp<br />

ENROLMENT STATUS<br />

<strong>CCH</strong> Executive Events Corporate Member<br />

<strong>CCH</strong> Subscriber<br />

Non-Member<br />

<strong>CCH</strong> Executive Events<br />

Tax & Accounting Series<br />

The Professional’s First Choice<br />

Withholding Tax &<br />

Cross Border<br />

Transactions<br />

9 & 10 September 2009 Penang<br />

16 & 17 September 2009 Kuala Lumpur<br />

SPONSORSHIP OPPORTUNITIES<br />

<strong>CCH</strong> Asia has designed an attractive range of advertising & sponsorship packages to match your marketing objectives. The packages available offer advertisers and<br />

sponsors extensive visibility and ensure direct access to your target market. It is also an excellent platform to promote your organisation to influential players and key<br />

decision-makers in the industry. Please call 603-2052 4603 for more details.<br />

CORPORATE MEMBERSHIP<br />

Our Corporate Membership is aimed to offer your organisation a flexible and cost effective investment in training and development. As a corporate member, all your<br />

employees are entitled to our membership privileges. To become a member, please call us for more information.<br />

THE ORGANISER<br />

<strong>CCH</strong> Executive Events is the seminar and conference arm that offers timely business critical information, insights and analysis conducted by industry practitioners<br />

and academics to provide participants a well-balanced blend of theoretical fundamentals and practical applications. We are backed by over 100 years of<br />

multi-national publisher background in a wide array of professional topics especially Taxation, Accounting, Auditing, Corporate Law, Company Secretarial Practice,<br />

Business Law, and Employment Law & Human Resources.

Withholding Tax & Cross Border Transactions<br />

Practical Issues & Planning Approaches Explained<br />

9 & 10 September 2009 • 9.00am – 5.00pm • Traders Hotel, Penang<br />

16 & 17 September 2009 • 9.00am – 5.00pm • Prince Hotel, Kuala Lumpur<br />

HRDF-SBL<br />

CLAIMABLE<br />

The tax issues connected to transactions on a cross<br />

border basis can be complicated and tedious.<br />

These range from withholding tax implications to<br />

tax treatment of “foreign source income” and the<br />

connected expenses as well as the consequences<br />

of sales of assets between controlled parties, to<br />

name a few. <strong>CCH</strong> Executive Events presents a<br />

2-day workshop to help you navigate through the<br />

maze of withholding tax and cross border<br />

transactions. It will also examine in detail<br />

important areas to be considered in order to<br />

ensure that the tax affairs of the relevant parties<br />

engaged in cross border transactions are<br />

adequately managed. Illustrated with numerous<br />

case studies, you will walk away with a sound<br />

understanding of key issues and learn how to apply<br />

the tax laws to practical scenarios in your business.<br />

Programme Outline<br />

HIGHLIGHTS<br />

Interactive Discussions<br />

Practical Examples<br />

Case Studies<br />

Who Should Attend<br />

Chief Executive Officers/Chief Financial<br />

Officers<br />

Regional Tax Directors/Managers<br />

Financial Controllers/Managers, Accountants<br />

Compliance Officers<br />

Workshop Leader<br />

Harvindar Singh,<br />

Managing Partner, Harvey & Associates<br />

Havinder has 15 years of experience in taxation<br />

gained at two of the largest accountancy firms in<br />

the world, PricewaterhouseCoopers and Ernst &<br />

Young. His professional experience ranges from<br />

advising on the tax implications of cross border<br />

transactions (inbound and outbound investments),<br />

international tax planning and structuring, tax<br />

audits and investigations, tax incentives<br />

applications, tax due diligence reviews, financing<br />

transactions including Islamic financing schemes,<br />

advising on transfer pricing issues, corporate and<br />

personal tax planning, Sarbanes-Oxley tax<br />

documentation review as well as tax compliance<br />

matters.<br />

<strong>CCH</strong> Reference Material<br />

Effective tax planning can be achieved by<br />

understanding the tax compliance<br />

environment including taxation laws, transfer<br />

pricing issues as well as tax planning<br />

strategies as a whole. <strong>CCH</strong> provides you an<br />

informative range of resources which help<br />

you and your organisations in making<br />

decisions in tax compliance issues.<br />

• Essential Tax Planning Strategies in<br />

<strong>Malaysia</strong><br />

• Asia Tax Planning and Compliance<br />

• Asia Transfer Pricing<br />

To find out more about these products and<br />

<strong>CCH</strong>’s resource offerings, kindly email you<br />

request to mktg@cch.com.my<br />

Day 1: Fundamentals Explained<br />

<br />

Income tax rules on withholding tax for payments made to<br />

Non-Residents<br />

<br />

<br />

The determination of tax residence status of companies and<br />

individuals<br />

Types of income subject to withholding tax<br />

Special classes of income under Section 4A of the Income Tax<br />

Act, 1967<br />

Interest payments<br />

Royalties<br />

Contract payments<br />

Payment of dividends by Real Estate Investment Trusts<br />

<br />

The application of Section 109B of the Income Tax Act, 1967<br />

vs Section 107A of the Income Tax Act, 1967 for payments<br />

made to Non-Residents by <strong>Malaysia</strong>n residents– the<br />

difference between the two and how it is applied in practice<br />

<br />

Derivation rules on various types of income – <strong>Malaysia</strong>n<br />

sourced vs foreign sourced income<br />

<br />

Cross Border investments<br />

Inbound investments<br />

Branch / incorporated companies<br />

Regulatory approvals<br />

Outbound investments<br />

Legal entity – branch / incorporated company<br />

Holding structures 2<br />

<br />

Determination of Permanent Establishments and the income<br />

tax implications Case studies<br />

Day 2: Advanced Aspects<br />

<br />

Withholding Tax and Permanent Establishments - A detailed<br />

discussion<br />

<br />

Double Tax Agreements and Bilateral Tax Credits / Double<br />

Taxation Relief<br />

<br />

Tax treatment for cross border sale / purchase of assets<br />

<br />

Offshore holding companies and tax optimum structures<br />

<br />

Transfer Pricing and cross border transactions<br />

<br />

Introduction of Advance Pricing Arrangements<br />

<br />

Withholding tax on Section 4(f) income - commissions,<br />

guarantee fees, loan arrangement fees<br />

<br />

Thin Capitalisation Rules<br />

<br />

Case studies