Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

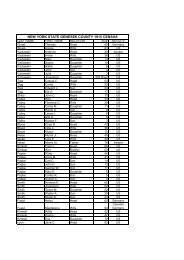

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> OWNERS NAME SEQUENCE<br />

SWIS - 183201 UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 2.-2-22 ********************<br />

1126 Ganson Ave<br />

2.-2-22 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Brown Ronald M Pembroke School 184202 10,500 VILLAGE TAXABLE VALUE 117,800<br />

1126 Ganson St Former Swis Code 183289 117,800 COUNTY TAXABLE VALUE 117,800<br />

Corfu, NY 14036 ACRES 0.70 TOWN TAXABLE VALUE 117,800<br />

EAST-0547445 NRTH-1076725 SCHOOL TAXABLE VALUE 87,800<br />

DEED BOOK 750 PG-29 FD008 <strong>Darien</strong> fire 117,800 TO<br />

FULL MARKET VALUE 117,800 WD009 Corfu Sewer 117,800 TO<br />

******************************************************************************************************* 2.-2-23.1 ******************<br />

9468 Allegany Rd<br />

2.-2-23.1 421 Restaurant VILLAGE TAXABLE VALUE 175,000<br />

Pizza Pantry Family Restaurant Pembroke School 184202 42,000 COUNTY TAXABLE VALUE 175,000<br />

100 E Main St Formerly In The <strong>Town</strong> Of 175,000 TOWN TAXABLE VALUE 175,000<br />

Corfu, NY 14036 <strong>Darien</strong>, Annexed Into The SCHOOL TAXABLE VALUE 175,000<br />

Village Of <strong>Darien</strong>/corfu FD008 <strong>Darien</strong> fire 175,000 TO<br />

ACRES 2.80 WD009 Corfu Sewer 175,000 TO<br />

EAST-0547590 NRTH-1076570 WD010 Corfu sewer 281.00 UN<br />

DEED BOOK 848 PG-534<br />

FULL MARKET VALUE 175,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> RPS150/V04/L015<br />

SWIS - 183201 CURRENT DATE 6/19/2012<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

R O L L S U B S E C T I O N - - T O T A L S<br />

*** S P E C I A L D I S T R I C T S U M M A R Y ***<br />

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE<br />

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE AMOUNT VALUE<br />

FD008 <strong>Darien</strong> fire 2 TOTAL 292,800 292,800<br />

WD009 Corfu Sewer 2 TOTAL 292,800 292,800<br />

WD010 Corfu sewer 1 UNITS 281.00 281.00<br />

*** S C H O O L D I S T R I C T S U M M A R Y ***<br />

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR<br />

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE<br />

184202 Pembroke School 2 52,500 292,800 292,800 30,000 262,800<br />

S U B - T O T A L 2 52,500 292,800 292,800 30,000 262,800<br />

T O T A L 2 52,500 292,800 292,800 30,000 262,800<br />

*** S Y S T E M C O D E S S U M M A R Y ***<br />

NO SYSTEM EXEMPTIONS AT THIS LEVEL<br />

*** E X E M P T I O N S U M M A R Y ***<br />

TOTAL<br />

CODE DESCRIPTION PARCELS VILLAGE COUNTY TOWN SCHOOL<br />

41854 STAR B 1 30,000<br />

T O T A L 1 30,000

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> RPS150/V04/L015<br />

SWIS - 183201 CURRENT DATE 6/19/2012<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

R O L L S U B S E C T I O N - - T O T A L S<br />

*** G R A N D T O T A L S ***<br />

ROLL TOTAL ASSESSED ASSESSED TAXABLE TAXABLE TAXABLE TAXABLE STAR<br />

SEC DESCRIPTION PARCELS LAND TOTAL VILLAGE COUNTY TOWN SCHOOL TAXABLE<br />

1 TAXABLE 2 52,500 292,800 292,800 292,800 292,800 292,800 262,800

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> RPS150/V04/L015<br />

SWIS - 183201 UNIFORM PERCENT OF VALUE IS 100.00 CURRENT DATE 6/19/2012<br />

R O L L S E C T I O N T O T A L S<br />

*** S P E C I A L D I S T R I C T S U M M A R Y ***<br />

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE<br />

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE AMOUNT VALUE<br />

FD008 <strong>Darien</strong> fire 2 TOTAL 292,800 292,800<br />

WD009 Corfu Sewer 2 TOTAL 292,800 292,800<br />

WD010 Corfu sewer 1 UNITS 281.00 281.00<br />

*** S C H O O L D I S T R I C T S U M M A R Y ***<br />

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR<br />

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE<br />

184202 Pembroke School 2 52,500 292,800 292,800 30,000 262,800<br />

S U B - T O T A L 2 52,500 292,800 292,800 30,000 262,800<br />

T O T A L 2 52,500 292,800 292,800 30,000 262,800<br />

*** S Y S T E M C O D E S S U M M A R Y ***<br />

NO SYSTEM EXEMPTIONS AT THIS LEVEL<br />

*** E X E M P T I O N S U M M A R Y ***<br />

TOTAL<br />

CODE DESCRIPTION PARCELS VILLAGE COUNTY TOWN SCHOOL<br />

41854 STAR B 1 30,000<br />

T O T A L 1 30,000

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> RPS150/V04/L015<br />

SWIS - 183201 UNIFORM PERCENT OF VALUE IS 100.00 CURRENT DATE 6/19/2012<br />

R O L L S E C T I O N T O T A L S<br />

*** G R A N D T O T A L S ***<br />

ROLL TOTAL ASSESSED ASSESSED TAXABLE TAXABLE TAXABLE TAXABLE STAR<br />

SEC DESCRIPTION PARCELS LAND TOTAL VILLAGE COUNTY TOWN SCHOOL TAXABLE<br />

1 TAXABLE 2 52,500 292,800 292,800 292,800 292,800 292,800 262,800

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - <strong>Genesee</strong> VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> S W I S T O T A L S RPS150/V04/L015<br />

SWIS - 183201 UNIFORM PERCENT OF VALUE IS 100.00 CURRENT DATE 6/19/2012<br />

*** S P E C I A L D I S T R I C T S U M M A R Y ***<br />

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE<br />

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE AMOUNT VALUE<br />

FD008 <strong>Darien</strong> fire 2 TOTAL 292,800 292,800<br />

WD009 Corfu Sewer 2 TOTAL 292,800 292,800<br />

WD010 Corfu sewer 1 UNITS 281.00 281.00<br />

*** S C H O O L D I S T R I C T S U M M A R Y ***<br />

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR<br />

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE<br />

184202 Pembroke School 2 52,500 292,800 292,800 30,000 262,800<br />

S U B - T O T A L 2 52,500 292,800 292,800 30,000 262,800<br />

T O T A L 2 52,500 292,800 292,800 30,000 262,800<br />

*** S Y S T E M C O D E S S U M M A R Y ***<br />

NO SYSTEM EXEMPTIONS AT THIS LEVEL<br />

*** E X E M P T I O N S U M M A R Y ***<br />

TOTAL<br />

CODE DESCRIPTION PARCELS VILLAGE COUNTY TOWN SCHOOL<br />

41854 STAR B 1 30,000<br />

T O T A L 1 30,000

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - <strong>Genesee</strong> VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2012<br />

VILLAGE - <strong>Darien</strong> S W I S T O T A L S RPS150/V04/L015<br />

SWIS - 183201 UNIFORM PERCENT OF VALUE IS 100.00 CURRENT DATE 6/19/2012<br />

*** G R A N D T O T A L S ***<br />

ROLL TOTAL ASSESSED ASSESSED TAXABLE TAXABLE TAXABLE TAXABLE STAR<br />

SEC DESCRIPTION PARCELS LAND TOTAL VILLAGE COUNTY TOWN SCHOOL TAXABLE<br />

1 TAXABLE 2 52,500 292,800 292,800 292,800 292,800 292,800 262,800<br />

* SUB TOTAL 2 52,500 292,800 292,800 292,800 292,800 292,800 262,800<br />

** GRAND TOTAL 2 52,500 292,800 292,800 292,800 292,800 292,800 262,800

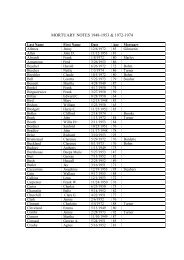

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 5.-1-15.2 ******************<br />

9997 Fargo Rd<br />

5.-1-15.2 240 Rural res COUNTY TAXABLE VALUE 154,100<br />

Abbarno Michael A Pembroke School 184202 37,700 TOWN TAXABLE VALUE 154,100<br />

Abbarno Terrie A ACRES 16.10 154,100 SCHOOL TAXABLE VALUE 154,100<br />

19 Pleasant St EAST-1187694 NRTH-1067327 AG001 Ag. District #1 .00 MT<br />

Cheektowaga, NY 14225 DEED BOOK 889 PG-239 FD008 <strong>Darien</strong> fire 154,100 TO<br />

FULL MARKET VALUE 154,100<br />

******************************************************************************************************* 10.-1-59 *******************<br />

1336 Herkimer Rd<br />

10.-1-59 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Acquard Donald N Jr Alexander Schoo 182202 3,200 COUNTY TAXABLE VALUE 43,700<br />

1336 Herkimer Rd ACRES 0.15 BANKFAR0100 43,700 TOWN TAXABLE VALUE 43,700<br />

<strong>Darien</strong> Center, NY 14040 EAST-1200196 NRTH-1053962 SCHOOL TAXABLE VALUE 13,700<br />

DEED BOOK 828 PG-305 FD008 <strong>Darien</strong> fire 43,700 TO<br />

FULL MARKET VALUE 43,700 SD007 <strong>Darien</strong> sewer 1.00 UN<br />

WD001 Original 43,700 TO C<br />

******************************************************************************************************* 2.-1-25 ********************<br />

9510 Allegany Rd<br />

2.-1-25 210 1 Family Res VETS-CV-C 41132 0 25,000 0 0<br />

Acquard Jerome Pembroke School 184202 32,100 VETS-CV-T 41133 0 0 20,000 0<br />

Acquard Carol Ann ACRES 11.70 153,000 VETS-DV-C 41142 0 38,250 0 0<br />

9510 Alleghany Rd EAST-1196060 NRTH-1075743 VETS-DV-T 41143 0 0 38,250 0<br />

Corfu, NY 14036 DEED BOOK 311 PG-38 STAR EN 41834 0 0 0 62,200<br />

FULL MARKET VALUE 153,000 COUNTY TAXABLE VALUE 89,750<br />

TOWN TAXABLE VALUE 94,750<br />

SCHOOL TAXABLE VALUE 90,800<br />

AG001 Ag. District #1 .00 MT<br />

FD008 <strong>Darien</strong> fire 153,000 TO<br />

******************************************************************************************************* 7.-1-18.21 *****************<br />

9939 Colby Rd<br />

7.-1-18.21 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Acquard Kimberly Lee Pembroke School 184202 33,200 COUNTY TAXABLE VALUE 120,900<br />

9939 Colby Rd FRNT 375.00 DPTH 267.00 120,900 TOWN TAXABLE VALUE 120,900<br />

Corfu, NY 14036-9555 ACRES 13.10 SCHOOL TAXABLE VALUE 90,900<br />

EAST-1206429 NRTH-1068094 FD008 <strong>Darien</strong> fire 120,900 TO<br />

DEED BOOK 821 PG-216<br />

FULL MARKET VALUE 120,900<br />

******************************************************************************************************* 14.-1-56 *******************<br />

888 Mammot Rd<br />

14.-1-56 240 Rural res COUNTY TAXABLE VALUE 139,700<br />

Adkins Faye Attica Central 562201 22,400 TOWN TAXABLE VALUE 139,700<br />

1392 Northgate Ct ACRES 13.80 139,700 SCHOOL TAXABLE VALUE 139,700<br />

Denver, NC 28037 EAST-1192235 NRTH-1048127 FD008 <strong>Darien</strong> fire 139,700 TO<br />

DEED BOOK 640 PG-343<br />

FULL MARKET VALUE 139,700<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 10.-1-3 ********************<br />

951 Broadway Rd<br />

10.-1-3 210 1 Family Res COUNTY TAXABLE VALUE 266,750<br />

Alden State Bank Alden School 142001 25,900 TOWN TAXABLE VALUE 266,750<br />

13216 Broadway ACRES 7.60 266,750 SCHOOL TAXABLE VALUE 266,750<br />

Alden, NY 14004 EAST-1192823 NRTH-1057211 FD008 <strong>Darien</strong> fire 266,750 TO<br />

DEED BOOK 886 PG-817 WD003 Broadway Water Dist 266,750 TO<br />

FULL MARKET VALUE 266,750<br />

******************************************************************************************************* 10.-1-60.1 *****************<br />

10772 Allegany Rd<br />

10.-1-60.1 280 Res Multiple COUNTY TAXABLE VALUE 160,000<br />

Alden State Bank Alexander Schoo 182202 18,700 TOWN TAXABLE VALUE 160,000<br />

13216 Broadway Rd ACRES 1.30 160,000 SCHOOL TAXABLE VALUE 160,000<br />

Alden, NY 14004 EAST-1200198 NRTH-1053830 FD008 <strong>Darien</strong> fire 160,000 TO<br />

DEED BOOK 889 PG-258 SD007 <strong>Darien</strong> sewer 4.00 UN<br />

FULL MARKET VALUE 160,000 WD001 Original 160,000 TO C<br />

******************************************************************************************************* 15.-1-44 *******************<br />

11178 Tinkham Rd<br />

15.-1-44 240 Rural res VETS-WV-C 41122 0 15,000 0 0<br />

Aldinger Nelson Alexander Schoo 182202 24,800 VETS-WV-T 41123 0 0 12,000 0<br />

11178 Tinkham Rd ACRES 14.70 146,400 STAR EN 41834 0 0 0 62,200<br />

<strong>Darien</strong> Center, NY 14040 EAST-1205656 NRTH-1046981 COUNTY TAXABLE VALUE 131,400<br />

DEED BOOK 337 PG-166 TOWN TAXABLE VALUE 134,400<br />

FULL MARKET VALUE 146,400 SCHOOL TAXABLE VALUE 84,200<br />

FD008 <strong>Darien</strong> fire 146,400 TO<br />

******************************************************************************************************* 15.-1-14 *******************<br />

10981 Allegany Rd<br />

15.-1-14 240 Rural res STAR B 41854 0 0 0 30,000<br />

Aldrich Kevin G Alexander Schoo 182202 43,600 COUNTY TAXABLE VALUE 165,300<br />

Aldrich Chryl A ACRES 28.05 165,300 TOWN TAXABLE VALUE 165,300<br />

10981 Allegany Rd EAST-1201845 NRTH-1049591 SCHOOL TAXABLE VALUE 135,300<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 767 PG-224 FD008 <strong>Darien</strong> fire 165,300 TO<br />

FULL MARKET VALUE 165,300 WD001 Original 165,300 TO C<br />

******************************************************************************************************* 4.-1-49 ********************<br />

9741 Simonds Rd<br />

4.-1-49 210 1 Family Res AGED C 41802 0 21,900 0 0<br />

Alessi Francine M Pembroke School 184202 15,000 AGED S 41804 0 0 0 8,760<br />

Schlutz Donald ACRES 1.00 87,600 STAR EN 41834 0 0 0 62,200<br />

9741 Simonds Rd EAST-1213965 NRTH-1072051 COUNTY TAXABLE VALUE 65,700<br />

Corfu, NY 14036 DEED BOOK 868 PG-47 TOWN TAXABLE VALUE 87,600<br />

FULL MARKET VALUE 87,600 SCHOOL TAXABLE VALUE 16,640<br />

FD008 <strong>Darien</strong> fire 87,600 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 12.-1-75 *******************<br />

10604 Alex.-<strong>Darien</strong> <strong>Town</strong>line Rd<br />

12.-1-75 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Alfes Kenneth N Alexander Schoo 182202 21,000 COUNTY TAXABLE VALUE 175,600<br />

Alfes Nancy L 12-1-33.2 175,600 TOWN TAXABLE VALUE 175,600<br />

10604 <strong>Town</strong>line Rd ACRES 5.00 SCHOOL TAXABLE VALUE 145,600<br />

<strong>Darien</strong> Center, NY 14040 EAST-1221783 NRTH-1057219 FD008 <strong>Darien</strong> fire 175,600 TO<br />

DEED BOOK 697 PG-206<br />

FULL MARKET VALUE 175,600<br />

******************************************************************************************************* 7.-1-19.12 *****************<br />

9989 Colby Rd<br />

7.-1-19.12 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Allen Daniel T Alexander Schoo 182202 20,700 COUNTY TAXABLE VALUE 95,000<br />

9989 Colby Rd ACRES 4.80 95,000 TOWN TAXABLE VALUE 95,000<br />

Corfu, NY 14036 EAST-1206091 NRTH-1067663 SCHOOL TAXABLE VALUE 65,000<br />

DEED BOOK 673 PG-74 FD008 <strong>Darien</strong> fire 95,000 TO<br />

FULL MARKET VALUE 95,000<br />

******************************************************************************************************* 10.-1-6.11 *****************<br />

1081 Broadway Rd<br />

10.-1-6.11 311 Res vac land COUNTY TAXABLE VALUE 22,500<br />

Allison Diane L Alexander Schoo 182202 22,500 TOWN TAXABLE VALUE 22,500<br />

1081 Broadway Rd House Fire 2011 22,500 SCHOOL TAXABLE VALUE 22,500<br />

<strong>Darien</strong> Center, NY 14040 ACRES 7.20 FD008 <strong>Darien</strong> fire 22,500 TO<br />

EAST-1194839 NRTH-1057240 WD003 Broadway Water Dist 22,500 TO<br />

DEED BOOK 841 PG-442<br />

FULL MARKET VALUE 22,500<br />

******************************************************************************************************* 16.-1-20 *******************<br />

Attica Rd<br />

16.-1-20 312 Vac w/imprv COUNTY TAXABLE VALUE 30,700<br />

Almeter Thomas J Alexander Schoo 182202 12,000 TOWN TAXABLE VALUE 30,700<br />

105 East Ave ACRES 10.00 30,700 SCHOOL TAXABLE VALUE 30,700<br />

Attica, NY 14011 EAST-1217206 NRTH-1050234 AG007 Ag. District #7 .00 MT<br />

DEED BOOK 839 PG-991 FD008 <strong>Darien</strong> fire 30,700 TO<br />

FULL MARKET VALUE 30,700<br />

******************************************************************************************************* 5.-1-26.1 ******************<br />

10294 Harlow Rd<br />

5.-1-26.1 240 Rural res STAR B 41854 0 0 0 30,000<br />

Alonzo Paul J Pembroke School 184202 55,900 COUNTY TAXABLE VALUE 174,700<br />

Alonzo Connie L F/p/o 5-1-26 174,700 TOWN TAXABLE VALUE 174,700<br />

10294 Harlow Rd ACRES 22.00 SCHOOL TAXABLE VALUE 144,700<br />

<strong>Darien</strong> Center, NY 14040 EAST-1188028 NRTH-1061254 AG001 Ag. District #1 .00 MT<br />

DEED BOOK 673 PG-268 FD008 <strong>Darien</strong> fire 174,700 TO<br />

FULL MARKET VALUE 174,700 WD003 Broadway Water Dist 174,700 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 9.-1-29.115 ****************<br />

204 Broadway Rd<br />

9.-1-29.115 442 MiniWhseSelf BUS >1997 47612 0 43,200 0 0<br />

Alvord David R Alden School 142001 22,500 COUNTY TAXABLE VALUE 78,300<br />

1162 Broadway Rd F\p\o 9-1-29.114 121,500 TOWN TAXABLE VALUE 121,500<br />

<strong>Darien</strong> Center, NY 14040 FRNT 330.00 DPTH SCHOOL TAXABLE VALUE 121,500<br />

ACRES 5.98 AG001 Ag. District #1 .00 MT<br />

EAST-1180857 NRTH-1056241 FD008 <strong>Darien</strong> fire 121,500 TO<br />

DEED BOOK 838 PG-552<br />

FULL MARKET VALUE 121,500<br />

******************************************************************************************************* 10.-1-100.2 ****************<br />

1162 Broadway Rd<br />

10.-1-100.2 240 Rural res STAR B 41854 0 0 0 30,000<br />

Alvord David R Alexander Schoo 182202 46,900 COUNTY TAXABLE VALUE 241,300<br />

Alvord Kimberly A 10-1-100.11 241,300 TOWN TAXABLE VALUE 241,300<br />

1162 Broadway Rd FRNT 323.50 DPTH SCHOOL TAXABLE VALUE 211,300<br />

<strong>Darien</strong> Center, NY 14040 ACRES 21.60 FD008 <strong>Darien</strong> fire 241,300 TO<br />

EAST-1196538 NRTH-1056309 WD003 Broadway Water Dist 241,300 TO<br />

DEED BOOK 546 PG-00107<br />

FULL MARKET VALUE 241,300<br />

******************************************************************************************************* 10.-1-100.12 ***************<br />

1140 Broadway Rd<br />

10.-1-100.12 483 Converted Re COUNTY TAXABLE VALUE 155,000<br />

Alvord Kimberly A Alexander Schoo 182202 16,000 TOWN TAXABLE VALUE 155,000<br />

Lang Shelly A F/p/o 10-1-100.1 155,000 SCHOOL TAXABLE VALUE 155,000<br />

1140 Broadway Rd FRNT 324.00 DPTH AG001 Ag. District #1 .00 MT<br />

<strong>Darien</strong> Center, NY 14040 ACRES 2.00 FD008 <strong>Darien</strong> fire 155,000 TO<br />

EAST-1196199 NRTH-1056841 WD003 Broadway Water Dist 155,000 TO<br />

DEED BOOK 665 PG-334<br />

FULL MARKET VALUE 155,000<br />

******************************************************************************************************* 12.-1-33.113 ***************<br />

10797 Alex.-<strong>Darien</strong> <strong>Town</strong>line Rd<br />

12.-1-33.113 240 Rural res STAR EN 41834 0 0 0 62,200<br />

Amedick Elaine L Alexander Schoo 182202 81,200 COUNTY TAXABLE VALUE 288,100<br />

10797 <strong>Town</strong>line Rd F\p\o 12-1-33.111 288,100 TOWN TAXABLE VALUE 288,100<br />

<strong>Darien</strong> Center, NY 14040 ACRES 85.10 SCHOOL TAXABLE VALUE 225,900<br />

EAST-1221051 NRTH-1055667 AG007 Ag. District #7 .00 MT<br />

DEED BOOK 766 PG-195 FD008 <strong>Darien</strong> fire 288,100 TO<br />

FULL MARKET VALUE 288,100<br />

******************************************************************************************************* 11.-2-63.1 *****************<br />

1568 Broadway Rd<br />

11.-2-63.1 210 1 Family Res AGED C 41802 0 47,900 0 0<br />

Amend Alois H Alexander Schoo 182202 17,500 AGED S 41804 0 0 0 43,110<br />

1568 Broadway 11-2-63.2 95,800 STAR EN 41834 0 0 0 52,690<br />

<strong>Darien</strong> Center, NY 14040 F/p/o #11-2-63 COUNTY TAXABLE VALUE 47,900<br />

ACRES 1.98 TOWN TAXABLE VALUE 95,800<br />

EAST-1204322 NRTH-1057146 SCHOOL TAXABLE VALUE 0<br />

DEED BOOK 391 PG-417 FD008 <strong>Darien</strong> fire 95,800 TO<br />

FULL MARKET VALUE 95,800 WD001 Original 95,800 TO C<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 16.-1-16.2 *****************<br />

2238 Attica Rd<br />

16.-1-16.2 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Amend Karl E Alexander Schoo 182202 18,100 COUNTY TAXABLE VALUE 174,400<br />

Amend Roxanne M ACRES 5.14 174,400 TOWN TAXABLE VALUE 174,400<br />

2238 Route 238 EAST-1215512 NRTH-1051768 SCHOOL TAXABLE VALUE 144,400<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 468 PG-00041 FD008 <strong>Darien</strong> fire 174,400 TO<br />

FULL MARKET VALUE 174,400<br />

******************************************************************************************************* 11.-2-69 *******************<br />

1839 Sharrick Rd 3009<br />

11.-2-69 210 1 Family Res AGED C 41802 0 30,590 0 0<br />

Amey Lois A Alexander Schoo 182202 10,800 AGED S 41804 0 0 0 17,480<br />

Amey Steven F FRNT 150.00 DPTH 200.00 87,400 STAR EN 41834 0 0 0 62,200<br />

1839 Sharrick Rd ACRES 0.60 COUNTY TAXABLE VALUE 56,810<br />

<strong>Darien</strong> Center, NY 14040 EAST-1208999 NRTH-1059915 TOWN TAXABLE VALUE 87,400<br />

DEED BOOK 891 PG-854 SCHOOL TAXABLE VALUE 7,720<br />

PRIOR OWNER ON 3/01/2012 FULL MARKET VALUE 87,400 FD008 <strong>Darien</strong> fire 87,400 TO<br />

Amey Lois A<br />

******************************************************************************************************* 11.-2-70 *******************<br />

Sharrick Rd<br />

11.-2-70 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 7.-1-38.2 ******************<br />

10254 Colby Rd<br />

7.-1-38.2 240 Rural res STAR B 41854 0 0 0 30,000<br />

Andrzejewski Jeffrey L Alexander Schoo 182202 35,600 COUNTY TAXABLE VALUE 168,200<br />

Williams Stacy M ACRES 14.70 BANKWFR0100 168,200 TOWN TAXABLE VALUE 168,200<br />

10254 Colby Rd EAST-1205102 NRTH-1062760 SCHOOL TAXABLE VALUE 138,200<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 888 PG-985 AG001 Ag. District #1 .00 MT<br />

FULL MARKET VALUE 168,200 FD008 <strong>Darien</strong> fire 168,200 TO<br />

******************************************************************************************************* 3.-1-23.11 *****************<br />

1883 Richley Rd<br />

3.-1-23.11 311 Res vac land COUNTY TAXABLE VALUE 12,700<br />

Annis Alvin R Pembroke School 184202 12,700 TOWN TAXABLE VALUE 12,700<br />

1861 Richley Rd 3-1-23.22 12,700 SCHOOL TAXABLE VALUE 12,700<br />

Corfu, NY 14036 ACRES 22.50 FD008 <strong>Darien</strong> fire 12,700 TO<br />

EAST-1208552 NRTH-1073768<br />

DEED BOOK 866 PG-192<br />

FULL MARKET VALUE 12,700<br />

******************************************************************************************************* 3.-1-23.21 *****************<br />

1861 Richley Rd<br />

3.-1-23.21 210 1 Family Res VETS-WV-C 41122 0 15,000 0 0<br />

Annis Alvin R Pembroke School 184202 16,500 VETS-WV-T 41123 0 0 12,000 0<br />

1861 Richley Rd FRNT 300.00 DPTH 290.40 129,300 STAR B 41854 0 0 0 30,000<br />

Corfu, NY 14036 ACRES 2.00 BANKFAR0100 COUNTY TAXABLE VALUE 114,300<br />

EAST-1208215 NRTH-1073521 TOWN TAXABLE VALUE 117,300<br />

DEED BOOK 669 PG-391 SCHOOL TAXABLE VALUE 99,300<br />

FULL MARKET VALUE 129,300 FD008 <strong>Darien</strong> fire 129,300 TO<br />

******************************************************************************************************* 14.-1-19.121 ***************<br />

Allegany Rd<br />

14.-1-19.121 323 Vacant rural COUNTY TAXABLE VALUE 3,600<br />

Ansbrow James Est Attica Central 562201 3,600 TOWN TAXABLE VALUE 3,600<br />

Ansbrow Joan D Landlocked 3,600 SCHOOL TAXABLE VALUE 3,600<br />

10902 Allegany Rd ACRES 7.10 FD008 <strong>Darien</strong> fire 3,600 TO<br />

<strong>Darien</strong> Center, NY 14040 EAST-1196189 NRTH-1050756<br />

DEED BOOK 443 PG-874<br />

FULL MARKET VALUE 3,600<br />

******************************************************************************************************* 14.-1-27.2 *****************<br />

10902 Allegany Rd 65 PCT OF VALUE USED FOR EXEMPTION PURPOSES<br />

14.-1-27.2 240 Rural res VETS-CV-C 41132 0 25,000 0 0<br />

Ansbrow Joan D Alexander Schoo 182202 84,200 VETS-CV-T 41133 0 0 20,000 0<br />

Ansbrow James Est ACRES 72.60 292,800 STAR B 41854 0 0 0 30,000<br />

10902 Allegany Rd EAST-1198686 NRTH-1051147 COUNTY TAXABLE VALUE 267,800<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 443 PG-00874 TOWN TAXABLE VALUE 272,800<br />

FULL MARKET VALUE 292,800 SCHOOL TAXABLE VALUE 262,800<br />

FD008 <strong>Darien</strong> fire 292,800 TO<br />

WD001 Original 292,800 TO C<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 14.-1-3.2 ******************<br />

10883 Harlow Rd<br />

14.-1-3.2 210 1 Family Res COUNTY TAXABLE VALUE 206,000<br />

Anthony Ryan Alden School 142001 15,300 TOWN TAXABLE VALUE 206,000<br />

Anthony Crystal ACRES 1.20 BANKWFR0100 206,000 SCHOOL TAXABLE VALUE 206,000<br />

10883 Harlow Rd EAST-1188838 NRTH-1051910 FD008 <strong>Darien</strong> fire 206,000 TO<br />

<strong>Darien</strong>, NY 14040 DEED BOOK 888 PG-399<br />

FULL MARKET VALUE 206,000<br />

******************************************************************************************************* 11.-2-51 *******************<br />

10634 Tinkham Rd<br />

11.-2-51 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Antonucci Vincent D Alexander Schoo 182202 13,000 COUNTY TAXABLE VALUE 127,700<br />

1704 Greco Ln ACRES 0.70 127,700 TOWN TAXABLE VALUE 127,700<br />

<strong>Darien</strong> Center, NY 14040 EAST-1206012 NRTH-1056349 SCHOOL TAXABLE VALUE 97,700<br />

DEED BOOK 693 PG-170 FD008 <strong>Darien</strong> fire 127,700 TO<br />

FULL MARKET VALUE 127,700 WD001 Original 127,700 TO C<br />

******************************************************************************************************* 8.-1-31.21 *****************<br />

2457 Walker Rd<br />

8.-1-31.21 240 Rural res STAR B 41854 0 0 0 30,000<br />

Apps Richard T Alexander Schoo 182202 36,800 COUNTY TAXABLE VALUE 181,300<br />

Apps Mary R FRNT 496.32 DPTH 181,300 TOWN TAXABLE VALUE 181,300<br />

2457 Walker Rd ACRES 15.50 SCHOOL TAXABLE VALUE 151,300<br />

Alexander, NY 14005 EAST-1219675 NRTH-1064881 AG001 Ag. District #1 .00 MT<br />

DEED BOOK 463 PG-00264 FD008 <strong>Darien</strong> fire 181,300 TO<br />

FULL MARKET VALUE 181,300<br />

******************************************************************************************************* 14.-1-28.2 *****************<br />

10950 Allegany Rd<br />

14.-1-28.2 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Arcangel Patrick M Alexander Schoo 182202 19,800 COUNTY TAXABLE VALUE 168,600<br />

Zulewski Charlene M ACRES 3.50 BANKFAR0100 168,600 TOWN TAXABLE VALUE 168,600<br />

10950 Allegany Rd EAST-1200377 NRTH-1050407 SCHOOL TAXABLE VALUE 138,600<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 841 PG-462 FD008 <strong>Darien</strong> fire 168,600 TO<br />

FULL MARKET VALUE 168,600 WD001 Original 168,600 TO C<br />

******************************************************************************************************* 14.-1-49 *******************<br />

Harlow Rd<br />

14.-1-49 321 Abandoned ag COUNTY TAXABLE VALUE 24,100<br />

Arcese Gary Attica Central 562201 24,100 TOWN TAXABLE VALUE 24,100<br />

1048 Getman Rd Landlocked 24,100 SCHOOL TAXABLE VALUE 24,100<br />

Alden, NY 14004 ACRES 19.10 FD008 <strong>Darien</strong> fire 24,100 TO<br />

EAST-1191526 NRTH-1045262<br />

DEED BOOK 529 PG-00032<br />

FULL MARKET VALUE 24,100<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 6.-1-40 ********************<br />

781 Sumner Rd<br />

6.-1-40 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Arcese Louis J Jr Pembroke School 184202 9,300 COUNTY TAXABLE VALUE 127,000<br />

Arcese Jackie M ACRES 0.50 127,000 TOWN TAXABLE VALUE 127,000<br />

781 Sumner Rd EAST-1189893 NRTH-1064957 SCHOOL TAXABLE VALUE 97,000<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 437 PG-00764 FD008 <strong>Darien</strong> fire 127,000 TO<br />

FULL MARKET VALUE 127,000<br />

******************************************************************************************************* 16.-1-22 *******************<br />

10862 Alex.-<strong>Darien</strong> <strong>Town</strong>line Rd<br />

16.-1-22 240 Rural res STAR B 41854 0 0 0 30,000<br />

Ashworth Brian J Alexander Schoo 182202 55,100 COUNTY TAXABLE VALUE 250,700<br />

Ashworth Katherine R ACRES 79.10 250,700 TOWN TAXABLE VALUE 250,700<br />

10862 <strong>Town</strong> Line Rd EAST-1221195 NRTH-1052764 SCHOOL TAXABLE VALUE 220,700<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 495 PG-00215 FD008 <strong>Darien</strong> fire 250,700 TO<br />

FULL MARKET VALUE 250,700<br />

******************************************************************************************************* 11.-2-52.2 *****************<br />

1632 Broadway Rd<br />

11.-2-52.2 432 Gas station COUNTY TAXABLE VALUE 210,000<br />

Athaudage Palitha Alexander Schoo 182202 35,000 TOWN TAXABLE VALUE 210,000<br />

4675 Hedgewood Dr ACRES 5.00 210,000 SCHOOL TAXABLE VALUE 210,000<br />

Clarence, NY 14221 EAST-1205334 NRTH-1057072 FD008 <strong>Darien</strong> fire 210,000 TO<br />

DEED BOOK 885 PG-127 WD001 Original 210,000 TO C<br />

FULL MARKET VALUE 210,000<br />

******************************************************************************************************* 14.-1-1 ********************<br />

Harlow Rd<br />

14.-1-1 321 Abandoned ag COUNTY TAXABLE VALUE 120,800<br />

Attea Karen Alden School 142001 120,800 TOWN TAXABLE VALUE 120,800<br />

Attea Elias H 14-1-2 120,800 SCHOOL TAXABLE VALUE 120,800<br />

715 Williamston <strong>County</strong> Line Rd 14-1-3.11 AG001 Ag. District #1 .00 MT<br />

Fairview, TN 37062 14-1-4.1 FD008 <strong>Darien</strong> fire 120,800 TO<br />

ACRES 185.90<br />

EAST-1188780 NRTH-1050080<br />

DEED BOOK 883 PG-271<br />

FULL MARKET VALUE 120,800<br />

******************************************************************************************************* 14.-1-4.2 ******************<br />

11047 Harlow Rd<br />

14.-1-4.2 240 Rural res COUNTY TAXABLE VALUE 300,200<br />

Attea Karen Alden School 142001 87,600 TOWN TAXABLE VALUE 300,200<br />

Attea Elias H ACRES 49.40 300,200 SCHOOL TAXABLE VALUE 300,200<br />

715 Williamson <strong>County</strong> Line Rd EAST-1189962 NRTH-1049387 AG001 Ag. District #1 .00 MT<br />

Fairview, TN 37062 DEED BOOK 883 PG-268 FD008 <strong>Darien</strong> fire 300,200 TO<br />

FULL MARKET VALUE 300,200<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 4.-1-42 ********************<br />

9712 Ridge Rd<br />

4.-1-42 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Audsley Wessbrook Pembroke School 184202 19,100 COUNTY TAXABLE VALUE 137,500<br />

Dibble Joann ACRES 3.70 137,500 TOWN TAXABLE VALUE 137,500<br />

9712 Ridge Rd EAST-1219028 NRTH-1072819 SCHOOL TAXABLE VALUE 107,500<br />

Corfu, NY 14036 DEED BOOK 814 PG-23 FD008 <strong>Darien</strong> fire 137,500 TO<br />

FULL MARKET VALUE 137,500<br />

******************************************************************************************************* 2.-1-54.21 *****************<br />

Allegany Rd<br />

2.-1-54.21 311 Res vac land COUNTY TAXABLE VALUE 6,500<br />

Augustyn Timothy J Pembroke School 184202 6,500 TOWN TAXABLE VALUE 6,500<br />

9806 Allegany Rd Formerly Part Of 6,500 SCHOOL TAXABLE VALUE 6,500<br />

Corfu, NY 14036 Parcel 2-1-54.2 FD008 <strong>Darien</strong> fire 6,500 TO<br />

ACRES 4.32 BANKFAR0100<br />

EAST-1198067 NRTH-1070650<br />

DEED BOOK 769 PG-1<br />

FULL MARKET VALUE 6,500<br />

******************************************************************************************************* 2.-1-54.22 *****************<br />

9806 Allegany Rd<br />

2.-1-54.22 283 Res w/Comuse STAR B 41854 0 0 0 30,000<br />

Augustyn Timothy J Pembroke School 184202 20,500 COUNTY TAXABLE VALUE 168,100<br />

9806 Allegany Rd Formerly Part Of 168,100 TOWN TAXABLE VALUE 168,100<br />

Corfu, NY 14036 Parcel 2-1-54.2 SCHOOL TAXABLE VALUE 138,100<br />

ACRES 3.98 BANKFAR0100 FD008 <strong>Darien</strong> fire 168,100 TO<br />

EAST-1198304 NRTH-1070634<br />

DEED BOOK 769 PG-1<br />

FULL MARKET VALUE 168,100<br />

******************************************************************************************************* 12.-1-20.1 *****************<br />

2049 Broadway Rd<br />

12.-1-20.1 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Augustyn Timothy J Jr Alexander Schoo 182202 17,500 COUNTY TAXABLE VALUE 94,700<br />

2049 Broadway Rd ACRES 2.00 BANKWFB0100 94,700 TOWN TAXABLE VALUE 94,700<br />

<strong>Darien</strong>, NY 14040 EAST-1212435 NRTH-1057698 SCHOOL TAXABLE VALUE 64,700<br />

DEED BOOK 877 PG-29 FD008 <strong>Darien</strong> fire 94,700 TO<br />

FULL MARKET VALUE 94,700 WD001 Original 94,700 TO C<br />

******************************************************************************************************* 1.-1-42 ********************<br />

9742 Fargo Rd<br />

1.-1-42 210 1 Family Res VETS-CV-C 41132 0 25,000 0 0<br />

Austin Merelle M Pembroke School 184202 20,900 VETS-CV-T 41133 0 0 20,000 0<br />

Austin Donna J ACRES 4.90 110,000 VETS-DV-C 41142 0 16,500 0 0<br />

9742 Fargo Rd EAST-1186134 NRTH-1071632 VETS-DV-T 41143 0 0 16,500 0<br />

Corfu, NY 14036 DEED BOOK 410 PG-393 STAR EN 41834 0 0 0 62,200<br />

FULL MARKET VALUE 110,000 COUNTY TAXABLE VALUE 68,500<br />

TOWN TAXABLE VALUE 73,500<br />

SCHOOL TAXABLE VALUE 47,800<br />

FD008 <strong>Darien</strong> fire 110,000 TO<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 11.-1-103 ******************<br />

1500 Erie Rd<br />

11.-1-103 210 1 Family Res CW_10_VET/ 41152 0 6,000 0 0<br />

Babcock Morris J Alexander Schoo 182202 27,000 STAR EN 41834 0 0 0 62,200<br />

Babcock Susan Ann ACRES 9.00 201,800 COUNTY TAXABLE VALUE 195,800<br />

1500 Erie Rd EAST-1202668 NRTH-1053841 TOWN TAXABLE VALUE 201,800<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 826 PG-205 SCHOOL TAXABLE VALUE 139,600<br />

FULL MARKET VALUE 201,800 FD008 <strong>Darien</strong> fire 201,800 TO<br />

******************************************************************************************************* 11.-1-104 ******************<br />

Erie Rd<br />

11.-1-104 323 Vacant rural COUNTY TAXABLE VALUE 3,900<br />

Babcock Morris J Alexander Schoo 182202 3,900 TOWN TAXABLE VALUE 3,900<br />

Babcock Susan Ann Landlocked 3,900 SCHOOL TAXABLE VALUE 3,900<br />

1500 Erie Rd ACRES 2.60 FD008 <strong>Darien</strong> fire 3,900 TO<br />

<strong>Darien</strong> Center, NY 14040 EAST-1202708 NRTH-1053359<br />

DEED BOOK 826 PG-208<br />

FULL MARKET VALUE 3,900<br />

******************************************************************************************************* 5.-1-47 ********************<br />

2369 <strong>County</strong> Line Rd<br />

5.-1-47 210 1 Family Res VETS-WV-C 41122 0 15,000 0 0<br />

Bak Joseph J Alden School 142001 28,000 VETS-WV-T 41123 0 0 12,000 0<br />

Bak Jean E F\p\o 5-1-37.12 287,500 STAR B 41854 0 0 0 30,000<br />

2369 <strong>County</strong>line Rd FRNT 300.00 DPTH 550.00 COUNTY TAXABLE VALUE 272,500<br />

Alden, NY 14004 ACRES 3.70 TOWN TAXABLE VALUE 275,500<br />

EAST-1180578 NRTH-1063616 SCHOOL TAXABLE VALUE 257,500<br />

DEED BOOK 814 PG-67 AG001 Ag. District #1 .00 MT<br />

FULL MARKET VALUE 287,500 FD008 <strong>Darien</strong> fire 287,500 TO<br />

WD006 Alden Water Dist 1.00 UN<br />

******************************************************************************************************* 12.-1-51.2 *****************<br />

10700 Griswold Rd<br />

12.-1-51.2 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Baker Linda J Alexander Schoo 182202 16,800 COUNTY TAXABLE VALUE 69,300<br />

10700 Griswold Rd ACRES 1.50 BANKFAR0100 69,300 TOWN TAXABLE VALUE 69,300<br />

<strong>Darien</strong> Center, NY 14040 EAST-1211465 NRTH-1055544 SCHOOL TAXABLE VALUE 39,300<br />

DEED BOOK 650 PG-43 FD008 <strong>Darien</strong> fire 69,300 TO<br />

FULL MARKET VALUE 69,300 WD001 Original 69,300 TO C<br />

******************************************************************************************************* 11.-2-26 *******************<br />

10532 Harper Rd<br />

11.-2-26 210 1 Family Res VETS-WV-C 41122 0 13,335 0 0<br />

Bala Lawrence H Alexander Schoo 182202 11,500 VETS-WV-T 41123 0 0 12,000 0<br />

Bala Sandra A ACRES 0.60 88,900 STAR B 41854 0 0 0 30,000<br />

10532 Harper Rd EAST-1209823 NRTH-1058068 COUNTY TAXABLE VALUE 75,565<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 478 PG-203 TOWN TAXABLE VALUE 76,900<br />

FULL MARKET VALUE 88,900 SCHOOL TAXABLE VALUE 58,900<br />

FD008 <strong>Darien</strong> fire 88,900 TO<br />

WD001 Original 88,900 TO C<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 11.-2-27.2 *****************<br />

Harper Rd<br />

11.-2-27.2 311 Res vac land COUNTY TAXABLE VALUE 1,000<br />

Bala Lawrence H Alexander Schoo 182202 1,000 TOWN TAXABLE VALUE 1,000<br />

Bala Sandra A ACRES 0.24 1,000 SCHOOL TAXABLE VALUE 1,000<br />

10532 Harper Rd EAST-1209780 NRTH-1058002 FD008 <strong>Darien</strong> fire 1,000 TO<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 650 PG-272 WD001 Original 1,000 TO C<br />

FULL MARKET VALUE 1,000<br />

******************************************************************************************************* 7.-1-24.112 ****************<br />

10030 Harper Rd<br />

7.-1-24.112 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Balduf Daniel Alexander Schoo 182202 16,100 COUNTY TAXABLE VALUE 164,800<br />

10030 Harper Rd F\p\o 7-1-24.11 164,800 TOWN TAXABLE VALUE 164,800<br />

PO Box 10 FRNT 300.00 DPTH 267.00 SCHOOL TAXABLE VALUE 134,800<br />

Corfu, NY 14036 ACRES 1.70 BANKFAR0100 FD008 <strong>Darien</strong> fire 164,800 TO<br />

EAST-1209533 NRTH-1066339<br />

DEED BOOK 873 PG-206<br />

FULL MARKET VALUE 164,800<br />

******************************************************************************************************* 7.-1-66 ********************<br />

Harper Rd<br />

7.-1-66 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 12.-1-34.112 ***************<br />

Broadway Rd<br />

12.-1-34.112 105 Vac farmland AG DIST-CO 41720 0 37,444 37,444 37,444<br />

Baldwin Matthew W Alexander Schoo 182202 67,800 COUNTY TAXABLE VALUE 30,356<br />

2378 Broadway Rd ACRES 95.00 67,800 TOWN TAXABLE VALUE 30,356<br />

<strong>Darien</strong> Center, NY 14040 EAST-1219916 NRTH-1056077 SCHOOL TAXABLE VALUE 30,356<br />

DEED BOOK 821 PG-669 AG001 Ag. District #1 .00 MT<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 67,800 FD008 <strong>Darien</strong> fire 67,800 TO<br />

UNDER AGDIST LAW TIL 2016<br />

******************************************************************************************************* 12.-1-36 *******************<br />

2378 Broadway Rd<br />

12.-1-36 112 Dairy farm AG DIST-CO 41720 0 39,868 39,868 39,868<br />

Baldwin Matthew W Alexander Schoo 182202 80,100 STAR B 41854 0 0 0 30,000<br />

2378 Broadway Rd ACRES 72.40 254,000 COUNTY TAXABLE VALUE 214,132<br />

<strong>Darien</strong> Center, NY 14040 EAST-1218565 NRTH-1056229 TOWN TAXABLE VALUE 214,132<br />

DEED BOOK 821 PG-669 SCHOOL TAXABLE VALUE 184,132<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 254,000 AG001 Ag. District #1 .00 MT<br />

UNDER AGDIST LAW TIL 2016 FD008 <strong>Darien</strong> fire 254,000 TO<br />

******************************************************************************************************* 11.-2-24 *******************<br />

1918 Sharrick Rd<br />

11.-2-24 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Ball Gary L Alexander Schoo 182202 9,900 COUNTY TAXABLE VALUE 94,900<br />

1918 Sharrick Rd ACRES 0.50 BANKFAR0100 94,900 TOWN TAXABLE VALUE 94,900<br />

<strong>Darien</strong> Center, NY 14040 EAST-1209794 NRTH-1058260 SCHOOL TAXABLE VALUE 64,900<br />

DEED BOOK 825 PG-725 FD008 <strong>Darien</strong> fire 94,900 TO<br />

FULL MARKET VALUE 94,900 WD001 Original 94,900 TO C<br />

******************************************************************************************************* 5.-1-53 ********************<br />

569 Sumner Rd<br />

5.-1-53 210 1 Family Res VETS-CV-C 41132 0 25,000 0 0<br />

Balon Anthony F Pembroke School 184202 27,300 VETS-CV-T 41133 0 0 20,000 0<br />

Balon Joyce L F\P\O 5.-1-11.116 223,800 VETS-DV-C 41142 0 50,000 0 0<br />

569 Sumner Rd FRNT 300.00 DPTH VETS-DV-T 41143 0 0 40,000 0<br />

Corfu, NY 14036 ACRES 9.20 BANKFAR0100 STAR B 41854 0 0 0 30,000<br />

EAST-1186197 NRTH-1065417 COUNTY TAXABLE VALUE 148,800<br />

DEED BOOK 810 PG-172 TOWN TAXABLE VALUE 163,800<br />

FULL MARKET VALUE 223,800 SCHOOL TAXABLE VALUE 193,800<br />

AG001 Ag. District #1 .00 MT<br />

FD008 <strong>Darien</strong> fire 223,800 TO<br />

******************************************************************************************************* 5.-1-11.12 *****************<br />

10070 Fargo Rd<br />

5.-1-11.12 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Balsano Debora L Pembroke School 184202 16,400 COUNTY TAXABLE VALUE 90,500<br />

10070 Fargo Rd F\p\o 5-1-11.1 90,500 TOWN TAXABLE VALUE 90,500<br />

Corfu, NY 14036 FRNT 300.00 DPTH 300.00 SCHOOL TAXABLE VALUE 60,500<br />

ACRES 1.90 AG001 Ag. District #1 .00 MT<br />

EAST-1187774 NRTH-1065654 FD008 <strong>Darien</strong> fire 90,500 TO<br />

DEED BOOK 751 PG-243<br />

FULL MARKET VALUE 90,500<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 7.-1-59 ********************<br />

10201 Colby Rd<br />

7.-1-59 210 1 Family Res VETS-CV-C 41132 0 25,000 0 0<br />

Bank Michael W Jr Alexander Schoo 182202 23,300 VETS-CV-T 41133 0 0 20,000 0<br />

Bank Kimberly M F/p/o 7-1-34.111 178,200 STAR B 41854 0 0 0 30,000<br />

10201 Colby Rd ACRES 6.50 BANKFAR0100 COUNTY TAXABLE VALUE 153,200<br />

<strong>Darien</strong> Center, NY 14040 EAST-1206155 NRTH-1063918 TOWN TAXABLE VALUE 158,200<br />

DEED BOOK 622 PG-251 SCHOOL TAXABLE VALUE 148,200<br />

FULL MARKET VALUE 178,200 FD008 <strong>Darien</strong> fire 178,200 TO<br />

******************************************************************************************************* 5.-1-51 ********************<br />

547 Sumner Rd<br />

5.-1-51 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Barillari Michael J Pembroke School 184202 27,000 COUNTY TAXABLE VALUE 223,400<br />

547 Sumner Rd FRNT 300.00 DPTH 223,400 TOWN TAXABLE VALUE 223,400<br />

Corfu, NY 14036 ACRES 9.00 SCHOOL TAXABLE VALUE 193,400<br />

EAST-1185906 NRTH-1065411 AG001 Ag. District #1 .00 MT<br />

DEED BOOK 874 PG-822 FD008 <strong>Darien</strong> fire 223,400 TO<br />

FULL MARKET VALUE 223,400<br />

******************************************************************************************************* 11.-1-59 *******************<br />

1386 Erie Rd<br />

11.-1-59 220 2 Family Res COUNTY TAXABLE VALUE 86,130<br />

Barrett James E Jr Alexander Schoo 182202 1,800 TOWN TAXABLE VALUE 86,130<br />

26 Walnut St FRNT 63.50 DPTH 74.25 86,130 SCHOOL TAXABLE VALUE 86,130<br />

Attica, NY 14011 ACRES 0.11 FD008 <strong>Darien</strong> fire 86,130 TO<br />

EAST-1200624 NRTH-1054032 SD007 <strong>Darien</strong> sewer 2.00 UN<br />

DEED BOOK 855 PG-373 WD001 Original 86,130 TO C<br />

FULL MARKET VALUE 86,130<br />

******************************************************************************************************* 11.-1-48.111 ***************<br />

1441 Broadway Rd<br />

11.-1-48.111 411 Apartment COUNTY TAXABLE VALUE 233,600<br />

Barsuk David Alexander Schoo 182202 30,600 TOWN TAXABLE VALUE 233,600<br />

PO Box 258 11.-1-48.11+11-1-47.112=4 233,600 SCHOOL TAXABLE VALUE 233,600<br />

East Pembroke, NY 14056 ACRES 3.60 FD008 <strong>Darien</strong> fire 233,600 TO<br />

EAST-1201519 NRTH-1057367 SD007 <strong>Darien</strong> sewer 6.00 UN<br />

DEED BOOK 829 PG-745 WD001 Original 233,600 TO C<br />

FULL MARKET VALUE 233,600<br />

******************************************************************************************************* 4.-1-32 ********************<br />

2524 Richley Rd<br />

4.-1-32 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Bartholomew Dale A Pembroke School 184202 18,500 COUNTY TAXABLE VALUE 208,200<br />

Bartholomew Valerie R FRNT 238.00 DPTH 208,200 TOWN TAXABLE VALUE 208,200<br />

2524 Richley Rd ACRES 3.30 SCHOOL TAXABLE VALUE 178,200<br />

Corfu, NY 14036 EAST-1220413 NRTH-1074593 FD008 <strong>Darien</strong> fire 208,200 TO<br />

DEED BOOK 712 PG-260<br />

FULL MARKET VALUE 208,200<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 21<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 3.-1-36.1 ******************<br />

1494 Mc Vean Rd<br />

3.-1-36.1 240 Rural res STAR B 41854 0 0 0 30,000<br />

Bartlett Charles S Pembroke School 184202 36,800 COUNTY TAXABLE VALUE 125,200<br />

1494 Mc Vean Rd ACRES 21.30 125,200 TOWN TAXABLE VALUE 125,200<br />

Corfu, NY 14036 EAST-1201929 NRTH-1070573 SCHOOL TAXABLE VALUE 95,200<br />

DEED BOOK 838 PG-965 AG001 Ag. District #1 .00 MT<br />

FULL MARKET VALUE 125,200 FD008 <strong>Darien</strong> fire 125,200 TO<br />

******************************************************************************************************* 14.-1-33.12 ****************<br />

O'Conner Rd<br />

14.-1-33.12 322 Rural vac>10 COUNTY TAXABLE VALUE 35,000<br />

Bartoszek Joseph S Jr Attica Central 562201 35,000 TOWN TAXABLE VALUE 35,000<br />

63 Foxhunt Rd ACRES 13.70 35,000 SCHOOL TAXABLE VALUE 35,000<br />

Lancaster, NY 14086 EAST-1200273 NRTH-1045639 FD008 <strong>Darien</strong> fire 35,000 TO<br />

DEED BOOK 446 PG-498<br />

FULL MARKET VALUE 35,000<br />

******************************************************************************************************* 14.-1-36 *******************<br />

11243 Warner Rd<br />

14.-1-36 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Baskerville Michael T Attica Central 562201 15,200 COUNTY TAXABLE VALUE 115,400<br />

11243 Warner Rd ACRES 1.10 115,400 TOWN TAXABLE VALUE 115,400<br />

<strong>Darien</strong> Center, NY 14040 EAST-1194939 NRTH-1045178 SCHOOL TAXABLE VALUE 85,400<br />

DEED BOOK 878 PG-639 FD008 <strong>Darien</strong> fire 115,400 TO<br />

FULL MARKET VALUE 115,400<br />

******************************************************************************************************* 11.-1-84 *******************<br />

10625 Allegany Rd<br />

11.-1-84 411 Apartment COUNTY TAXABLE VALUE 120,000<br />

Bates Alexander J Alexander Schoo 182202 4,800 TOWN TAXABLE VALUE 120,000<br />

9629 Allegany Rd ACRES 0.30 BANKBAC0100 120,000 SCHOOL TAXABLE VALUE 120,000<br />

Corfu, NY 14036 EAST-1200533 NRTH-1056525 FD008 <strong>Darien</strong> fire 120,000 TO<br />

DEED BOOK 876 PG-594 SD007 <strong>Darien</strong> sewer 4.00 UN<br />

FULL MARKET VALUE 120,000 WD001 Original 120,000 TO C<br />

******************************************************************************************************* 2.-1-34.11 *****************<br />

9629 Allegany Rd<br />

2.-1-34.11 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Bates Donald A Pembroke School 184202 19,200 COUNTY TAXABLE VALUE 127,800<br />

Bates Jacqueline A ACRES 3.10 127,800 TOWN TAXABLE VALUE 127,800<br />

9629 Allegany Rd EAST-1197326 NRTH-1074013 SCHOOL TAXABLE VALUE 97,800<br />

Corfu, NY 14036 DEED BOOK 866 PG-822 FD008 <strong>Darien</strong> fire 127,800 TO<br />

FULL MARKET VALUE 127,800<br />

******************************************************************************************************* 4.-1-59.2 ******************<br />

2018 Richley Rd<br />

4.-1-59.2 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Bates Mark D Pembroke School 184202 17,000 COUNTY TAXABLE VALUE 173,200<br />

Bates Sue Ellen FRNT 250.00 DPTH 373.25 173,200 TOWN TAXABLE VALUE 173,200<br />

2018 Richley Rd ACRES 2.30 SCHOOL TAXABLE VALUE 143,200<br />

Corfu, NY 14036 EAST-1211211 NRTH-1073205 FD008 <strong>Darien</strong> fire 173,200 TO<br />

DEED BOOK 491 PG-00145<br />

FULL MARKET VALUE 173,200<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 22<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 2.-1-29 ********************<br />

9509 Allegany Rd<br />

2.-1-29 210 1 Family Res VETS-CV-C 41132 0 25,000 0 0<br />

Bates Ralph Pembroke School 184202 17,800 VETS-CV-T 41133 0 0 20,000 0<br />

Bates Mary ACRES 2.20 103,600 STAR EN 41834 0 0 0 62,200<br />

PO Box 154 EAST-1196606 NRTH-1076113 COUNTY TAXABLE VALUE 78,600<br />

Corfu, NY 14036-0154 DEED BOOK 348 PG-13 TOWN TAXABLE VALUE 83,600<br />

FULL MARKET VALUE 103,600 SCHOOL TAXABLE VALUE 41,400<br />

FD008 <strong>Darien</strong> fire 103,600 TO<br />

******************************************************************************************************* 5.-1-15.112 ****************<br />

9921 Fargo Rd<br />

5.-1-15.112 312 Vac w/imprv COUNTY TAXABLE VALUE 51,200<br />

Bauer Brandon Pembroke School 184202 49,200 TOWN TAXABLE VALUE 51,200<br />

842 Main St F\p\o 5-1-15 51,200 SCHOOL TAXABLE VALUE 51,200<br />

West Seneca, NY 14224 ACRES 23.80 AG001 Ag. District #1 .00 MT<br />

EAST-1187494 NRTH-1068410 FD008 <strong>Darien</strong> fire 51,200 TO<br />

DEED BOOK 980 PG-56<br />

FULL MARKET VALUE 51,200<br />

******************************************************************************************************* 13.-1-4 ********************<br />

803 <strong>County</strong> Line Rd<br />

13.-1-4 240 Rural res COUNTY TAXABLE VALUE 77,300<br />

Baun Laura Alden School 142001 29,300 TOWN TAXABLE VALUE 77,300<br />

11864 E Lakeshore Rd ACRES 11.50 77,300 SCHOOL TAXABLE VALUE 77,300<br />

Lyndonville, NY 14098 EAST-1180700 NRTH-1051279 FD008 <strong>Darien</strong> fire 77,300 TO<br />

DEED BOOK 892 PG-378 WD006 Alden Water Dist 1.00 UN<br />

PRIOR OWNER ON 3/01/2012 FULL MARKET VALUE 77,300<br />

Gminski Raymond L<br />

******************************************************************************************************* 14.-1-9.112 ****************<br />

Warner Rd<br />

14.-1-9.112 260 Seasonal res COUNTY TAXABLE VALUE 29,600<br />

Bea Clifford Attica Central 562201 11,500 TOWN TAXABLE VALUE 29,600<br />

Attn: Dean Anthony ACRES 9.00 29,600 SCHOOL TAXABLE VALUE 29,600<br />

3288 Buffalo St EAST-1192719 NRTH-1051610 FD008 <strong>Darien</strong> fire 29,600 TO<br />

Alexander, NY 14005 DEED BOOK 416 PG-359<br />

FULL MARKET VALUE 29,600<br />

******************************************************************************************************* 14.-1-61 *******************<br />

Warner Rd<br />

14.-1-61 314 Rural vac

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 23<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 10.-1-79.2 *****************<br />

10738 Warner Rd<br />

10.-1-79.2 240 Rural res STAR B 41854 0 0 0 30,000<br />

Beal Daniel T Alexander Schoo 182202 38,400 COUNTY TAXABLE VALUE 157,800<br />

Nutty Denise FRNT 862.00 DPTH 157,800 TOWN TAXABLE VALUE 157,800<br />

10738 Warner Rd ACRES 16.58 SCHOOL TAXABLE VALUE 127,800<br />

<strong>Darien</strong> Center, NY 14040 EAST-1194753 NRTH-1054106 AG001 Ag. District #1 .00 MT<br />

DEED BOOK 752 PG-341 FD008 <strong>Darien</strong> fire 157,800 TO<br />

FULL MARKET VALUE 157,800<br />

******************************************************************************************************* 10.-1-77.112 ***************<br />

Warner Rd<br />

10.-1-77.112 322 Rural vac>10 COUNTY TAXABLE VALUE 9,800<br />

Beal Richard Alexander Schoo 182202 9,800 TOWN TAXABLE VALUE 9,800<br />

1060 Broadway FRNT 397.00 DPTH 9,800 SCHOOL TAXABLE VALUE 9,800<br />

<strong>Darien</strong> Center, NY 14040 ACRES 11.56 AG001 Ag. District #1 .00 MT<br />

EAST-1195785 NRTH-1055048 FD008 <strong>Darien</strong> fire 9,800 TO<br />

DEED BOOK 550 PG-00280<br />

FULL MARKET VALUE 9,800<br />

******************************************************************************************************* 10.-1-79.1 *****************<br />

1060 Broadway Rd<br />

10.-1-79.1 112 Dairy farm AG DIST-CO 41720 0 51,684 51,684 51,684<br />

Beal Richard D Alexander Schoo 182202 114,000 STAR EN 41834 0 0 0 62,200<br />

Beal Barbara F F\p\o 10-1-79 276,400 SILO C/T/S 42100 0 12,000 12,000 12,000<br />

1060 Broadway Rd ACRES 96.80 COUNTY TAXABLE VALUE 212,716<br />

<strong>Darien</strong> Center, NY 14040 EAST-1194296 NRTH-1055846 TOWN TAXABLE VALUE 212,716<br />

DEED BOOK 465 PG-00715 SCHOOL TAXABLE VALUE 150,516<br />

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 276,400 AG001 Ag. District #1 .00 MT<br />

UNDER AGDIST LAW TIL 2016 FD008 <strong>Darien</strong> fire 264,400 TO<br />

12,000 EX<br />

WD003 Broadway Water Dist 264,400 TO<br />

12,000 EX<br />

******************************************************************************************************* 14.-1-11.1 *****************<br />

Warner Rd<br />

14.-1-11.1 322 Rural vac>10 COUNTY TAXABLE VALUE 29,000<br />

Bechtold Timothy Alexander Schoo 182202 29,000 TOWN TAXABLE VALUE 29,000<br />

10840 Warner Rd 10-1-78 29,000 SCHOOL TAXABLE VALUE 29,000<br />

<strong>Darien</strong>, NY 14040 ACRES 36.80 BANKFAR0100 AG001 Ag. District #1 .00 MT<br />

EAST-1193855 NRTH-1052568 FD008 <strong>Darien</strong> fire 29,000 TO<br />

DEED BOOK 882 PG-128<br />

FULL MARKET VALUE 29,000<br />

******************************************************************************************************* 14.-1-13 *******************<br />

10840 Warner Rd<br />

14.-1-13 240 Rural res COUNTY TAXABLE VALUE 201,000<br />

Bechtold Timothy Alexander Schoo 182202 44,600 TOWN TAXABLE VALUE 201,000<br />

10840 Warner Rd 14-1-11.2 201,000 SCHOOL TAXABLE VALUE 201,000<br />

<strong>Darien</strong>, NY 14040 ACRES 15.80 BANKFAR0100 AG001 Ag. District #1 .00 MT<br />

EAST-1194926 NRTH-1052592 FD008 <strong>Darien</strong> fire 201,000 TO<br />

DEED BOOK 882 PG-128<br />

FULL MARKET VALUE 201,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 24<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 12.-1-48.2 *****************<br />

10778 Griswold Rd<br />

12.-1-48.2 240 Rural res COUNTY TAXABLE VALUE 197,000<br />

Beck Karen C Alexander Schoo 182202 28,700 TOWN TAXABLE VALUE 197,000<br />

10778 Griswold Rd ACRES 16.50 197,000 SCHOOL TAXABLE VALUE 197,000<br />

<strong>Darien</strong> Center, NY 14040 EAST-1211409 NRTH-1053930 AG001 Ag. District #1 .00 MT<br />

DEED BOOK 689 PG-296 FD008 <strong>Darien</strong> fire 197,000 TO<br />

FULL MARKET VALUE 197,000<br />

******************************************************************************************************* 15.-1-52.12 ****************<br />

11060 Tinkham Rd<br />

15.-1-52.12 240 Rural res COUNTY TAXABLE VALUE 171,100<br />

Becker Richard A Alexander Schoo 182202 47,400 TOWN TAXABLE VALUE 171,100<br />

John Zoladz Executor F\p\o 15-1-52.1 171,100 SCHOOL TAXABLE VALUE 171,100<br />

521 Broadway Rd ACRES 22.60 FD008 <strong>Darien</strong> fire 171,100 TO<br />

<strong>Darien</strong> Center, NY 14040 EAST-1205004 NRTH-1048820<br />

DEED BOOK 712 PG-1<br />

FULL MARKET VALUE 171,100<br />

******************************************************************************************************* 11.-1-15 *******************<br />

10546 Bonnie Brae Dr<br />

11.-1-15 210 1 Family Res VETS-WV-C 41122 0 13,470 0 0<br />

Beers James J Alexander Schoo 182202 15,800 VETS-WV-T 41123 0 0 12,000 0<br />

Beers Anna M ACRES 0.90 89,800 STAR EN 41834 0 0 0 62,200<br />

10546 Bonnie Brae Dr EAST-1201072 NRTH-1057831 COUNTY TAXABLE VALUE 76,330<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 409 PG-933 TOWN TAXABLE VALUE 77,800<br />

FULL MARKET VALUE 89,800 SCHOOL TAXABLE VALUE 27,600<br />

FD008 <strong>Darien</strong> fire 89,800 TO<br />

SD007 <strong>Darien</strong> sewer 1.00 UN<br />

WD001 Original 89,800 TO C<br />

******************************************************************************************************* 11.-1-40 *******************<br />

10517 Bonnie Brae Dr<br />

11.-1-40 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Begiers Jason M Alexander Schoo 182202 10,700 COUNTY TAXABLE VALUE 100,000<br />

Begiers Amanda M FRNT 100.00 DPTH 235.00 100,000 TOWN TAXABLE VALUE 100,000<br />

10517 Bonnie Brae Dr ACRES 0.54 SCHOOL TAXABLE VALUE 70,000<br />

<strong>Darien</strong> Center, NY 14040 EAST-1201054 NRTH-1058478 FD008 <strong>Darien</strong> fire 100,000 TO<br />

DEED BOOK 857 PG-878 SD007 <strong>Darien</strong> sewer 1.00 UN<br />

FULL MARKET VALUE 100,000 WD001 Original 100,000 TO C<br />

******************************************************************************************************* 1.-1-33 ********************<br />

652 <strong>Genesee</strong> Rd<br />

1.-1-33 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Begiers Michael Pembroke School 184202 28,000 COUNTY TAXABLE VALUE 39,000<br />

Dabb Patricia FRNT 150.00 DPTH 511.00 39,000 TOWN TAXABLE VALUE 39,000<br />

652 <strong>Genesee</strong> Rd ACRES 1.76 SCHOOL TAXABLE VALUE 9,000<br />

Corfu, NY 14036 EAST-1187619 NRTH-1075773 FD008 <strong>Darien</strong> fire 39,000 TO<br />

DEED BOOK 860 PG-28<br />

FULL MARKET VALUE 39,000<br />

************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 25<br />

COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011<br />

TOWN - <strong>Darien</strong> TAXABLE STATUS DATE-MAR 01, 2012<br />

SWIS - 183289 OWNERS NAME SEQUENCE<br />

UNIFORM PERCENT OF VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 14.-1-44.2 *****************<br />

962 Mammot Rd<br />

14.-1-44.2 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Behrend Mark R Attica Central 562201 23,300 COUNTY TAXABLE VALUE 202,000<br />

962 Mammot Rd FRNT 316.20 DPTH 898.80 202,000 TOWN TAXABLE VALUE 202,000<br />

Alden, NY 14004 ACRES 6.52 BANKFAR0100 SCHOOL TAXABLE VALUE 172,000<br />

EAST-1193936 NRTH-1048298 FD008 <strong>Darien</strong> fire 202,000 TO<br />

DEED BOOK 831 PG-727<br />

FULL MARKET VALUE 202,000<br />

******************************************************************************************************* 12.-1-76 *******************<br />

10760 Alex.-<strong>Darien</strong> <strong>Town</strong>line Rd<br />

12.-1-76 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Beideck Gary Alexander Schoo 182202 21,000 COUNTY TAXABLE VALUE 183,000<br />

Beideck Karen ACRES 5.00 183,000 TOWN TAXABLE VALUE 183,000<br />

10760 <strong>Town</strong>line Rd EAST-1221837 NRTH-1054802 SCHOOL TAXABLE VALUE 153,000<br />

<strong>Darien</strong> Center, NY 14040 DEED BOOK 551 PG-00301 FD008 <strong>Darien</strong> fire 183,000 TO<br />

FULL MARKET VALUE 183,000<br />

******************************************************************************************************* 9.-1-19 ********************<br />

680 Broadway Rd<br />

9.-1-19 210 1 Family Res STAR B 41854 0 0 0 30,000<br />

Belz Shiloh E Alden School 142001 14,000 COUNTY TAXABLE VALUE 133,000<br />

680 Broadway Rd ACRES 0.77 BANKBAC0100 133,000 TOWN TAXABLE VALUE 133,000<br />

<strong>Darien</strong> Center, NY 14040 EAST-1187942 NRTH-1056669 SCHOOL TAXABLE VALUE 103,000<br />

DEED BOOK 874 PG-527 FD008 <strong>Darien</strong> fire 133,000 TO<br />

FULL MARKET VALUE 133,000 WD003 Broadway Water Dist 133,000 TO<br />