View the full text of this document - Martindale.com

View the full text of this document - Martindale.com

View the full text of this document - Martindale.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

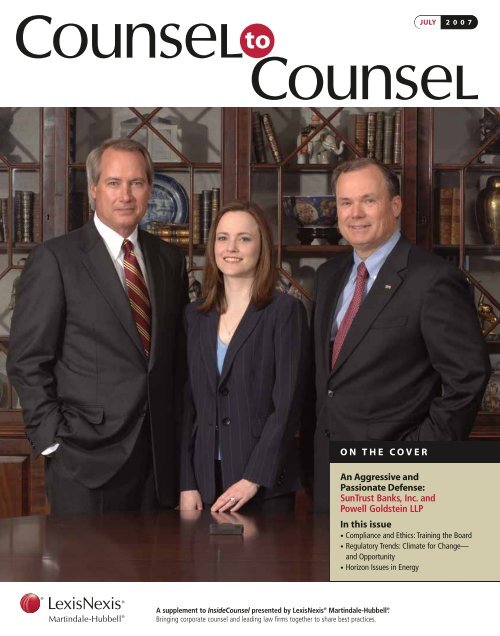

JULY 2 0 0 7<br />

ON THE COVER<br />

An Aggressive and<br />

Passionate Defense:<br />

SunTrust Banks, Inc. and<br />

Powell Goldstein LLP<br />

In <strong>this</strong> issue<br />

• Compliance and Ethics: Training <strong>the</strong> Board<br />

• Regulatory Trends: Climate for Change—<br />

and Opportunity<br />

• Horizon Issues in Energy<br />

A supplement to InsideCounsel presented by LexisNexis ® <strong>Martindale</strong>-Hubbell ® .<br />

Bringing corporate counsel and leading law firms toge<strong>the</strong>r to share best practices.

letter from<br />

martindale<br />

In <strong>this</strong> issue <strong>of</strong> Counsel to Counsel, we spotlight <strong>the</strong> many ways law<br />

firms partner with corporate clients to get out in front <strong>of</strong> <strong>the</strong> critical<br />

issues impacting <strong>the</strong>ir respective businesses and industries.<br />

contributor pr<strong>of</strong>iles<br />

Richard S. Cohen<br />

Managing Partner,<br />

Ford & Harrison LLP<br />

As <strong>the</strong> EEOC steps up its <strong>com</strong>mitment to<br />

systemic employment discrimination<br />

investigations and litigation, counsel<br />

should work with Human Resources and<br />

take aggressive steps to head <strong>of</strong>f<br />

potential lawsuits.<br />

Global climate change is a business reality that presents a number <strong>of</strong><br />

opportunities. “Climate for Change—and Opportunity” makes <strong>the</strong><br />

case for proactive corporations to get ahead <strong>of</strong> <strong>the</strong> curve on<br />

greenhouse gas emissions. Horizon Issues looks at <strong>the</strong> significant<br />

impacts to <strong>the</strong> hard-charging energy industry.<br />

The first <strong>of</strong> our Pr<strong>of</strong>iles in Partnership features SunTrust Banks, Inc.<br />

and Powell Goldstein LLP, and demonstrates <strong>the</strong> value <strong>of</strong> finding <strong>the</strong><br />

right litigation partner when <strong>the</strong> press is watching and it’s time to dig<br />

your heels in and stand your ground.<br />

The second Pr<strong>of</strong>ile examines a 7,000-acre master-planned<br />

<strong>com</strong>munity—essentially a small city—that generated a three-year<br />

regulatory review for Newland Communities and its counsel, Fowler<br />

White Boggs Banker, and involved some 19 state and federal agencies.<br />

We hope that you find <strong>this</strong> issue <strong>of</strong> Counsel to Counsel stimulating<br />

and informative. Please share your <strong>com</strong>ments with us at<br />

counseltocounselmag@martindale.<strong>com</strong>.<br />

Howard M. H<strong>of</strong>fmann<br />

Senior Trial Partner,<br />

Duane Morris LLP<br />

Richard L. Seabolt<br />

Partner/Litigator,<br />

Duane Morris LLP<br />

Stephen Martin<br />

General Counsel and<br />

Vice President, Strategy,<br />

Corpedia, Inc.<br />

A <strong>com</strong>prehensive <strong>com</strong>pliance and ethics training<br />

program for board members can help <strong>com</strong>panies<br />

avoid major liability issues.<br />

Isolated legal liability incidents can quickly<br />

be<strong>com</strong>e <strong>full</strong>-blown criminal investigations.<br />

Addressing legal liabilities right away can<br />

greatly reduce <strong>the</strong> impact <strong>of</strong> a crisis.<br />

Michael Walsh<br />

President and CEO<br />

On <strong>the</strong> cover: Pictured from left are L. Lin Wood and Nicole J. Wade, Powell Goldstein LLP; and<br />

Raymond D. Fortin, SunTrust Banks, Inc. Cover photo by Stanley Leary. Story on page 6.<br />

Robert J. Pugh<br />

Chief Counsel, Technology and<br />

Intellectual Property,<br />

The PNC Financial Services<br />

Group, Inc.<br />

Counsel need a simple way to identify<br />

corporate innovations that could be patentable<br />

and <strong>of</strong>fer additional benefits to <strong>the</strong> <strong>com</strong>pany<br />

when protected.<br />

InsideCounsel<br />

222 S. Riverside Plaza, Suite 620<br />

Chicago, IL 60606<br />

calfred@insidecounsel.<strong>com</strong><br />

312-651-0345<br />

LexisNexis ® <strong>Martindale</strong>-Hubbell ®<br />

121 Chanlon Road<br />

New Providence, NJ 07974<br />

counseltocounselmag@martindale.<strong>com</strong><br />

800-526-4902, ext. 2156<br />

Counsel to Counsel is published as a supplement to InsideCounsel, 222 S. Riverside Plaza, Suite 620, Chicago, IL 60606.<br />

Copyright 2007 by InsideCounsel and <strong>Martindale</strong>-Hubbell. All rights reserved. No reproduction <strong>of</strong> any portion <strong>of</strong> <strong>this</strong> supplement<br />

is allowed without written permission.<br />

LexisNexis, <strong>the</strong> Knowledge Burst logo, <strong>Martindale</strong>-Hubbell and martindale.<strong>com</strong> are registered trademarks <strong>of</strong> Reed Elsevier Properties<br />

Inc., used under license. © 2007 <strong>Martindale</strong>-Hubbell, a division <strong>of</strong> Reed Elsevier Inc. All rights reserved. The views expressed herein<br />

are <strong>the</strong> views <strong>of</strong> <strong>the</strong> author(s) and do not necessarily reflect those <strong>of</strong> <strong>Martindale</strong>-Hubbell.<br />

Sherrie L. Farrell<br />

Litigator and Member,<br />

Dykema<br />

Crafting an aggressive corporate defense against<br />

mass tort litigation is no easy task. Establishing<br />

an organizational structure and a detailed product<br />

time line will help you decide on <strong>the</strong> next step.

<strong>Martindale</strong>-Hubbell<br />

President and CEO<br />

Michael Walsh<br />

Executive Editor/Editor in Chief<br />

Erin Martin<br />

Coordinator<br />

Laura Coppola<br />

Graphic Designer<br />

Holly Haugen<br />

InsideCounsel<br />

Publisher<br />

Brion Palmer<br />

Director <strong>of</strong> Custom Media<br />

Carol Alfred<br />

Editor<br />

Jay Becker<br />

Contributing Editors<br />

Scott M. Gawlicki<br />

18<br />

Barry Solomon, Esq.<br />

Amy I. Stickel<br />

John M. Toth<br />

© 2007 JupiterImages Corporation<br />

06<br />

09<br />

features<br />

pr<strong>of</strong>iles in partnership<br />

SunTrust Banks, Inc. and<br />

Powell Goldstein LLP<br />

best practices<br />

Preventing an EEOC<br />

Systemic Investigation<br />

Ford & Harrison LLP<br />

13<br />

14<br />

best practices<br />

Establishing <strong>the</strong><br />

Corporate Defense<br />

Dykema<br />

global perspectives<br />

M&A Regulation: Piecing<br />

Toge<strong>the</strong>r a New Paradigm<br />

26<br />

28<br />

in <strong>the</strong> spotlight<br />

Proactive Structuring<br />

<strong>of</strong> Investment Agreements<br />

in <strong>the</strong> spotlight<br />

Notice Provisions:<br />

Balancing Business Relationships<br />

With Insurance Claims<br />

10<br />

11<br />

12<br />

best practices<br />

Compliance and Ethics:<br />

Training <strong>the</strong> Board<br />

Corpedia, Inc.<br />

best practices<br />

Elements <strong>of</strong> Triage<br />

Duane Morris LLP<br />

best practices<br />

Surfacing Patentable<br />

Corporate Innovations<br />

The PNC Financial Services<br />

Group, Inc.<br />

16<br />

21<br />

24<br />

global perspectives<br />

Chemical Industry: Facing a Mix<br />

<strong>of</strong> Regulatory Challenges<br />

pr<strong>of</strong>iles in partnership<br />

Newland Communities and<br />

Fowler White Boggs Banker<br />

regulatory trends<br />

Climate for Change—<br />

and Opportunity<br />

02<br />

05<br />

18<br />

departments<br />

brief advice<br />

Dispute Resolution Methods<br />

decision point<br />

Offering In-House Counsel<br />

New Objective Data for<br />

Evaluating Law Firms<br />

horizon issues<br />

Energy<br />

JULY 2007 01

ief advice<br />

Weighing <strong>the</strong><br />

Pros and Cons<br />

<strong>Martindale</strong>-Hubbell posed<br />

<strong>the</strong> following question to<br />

provide a variety <strong>of</strong> views<br />

on <strong>this</strong> important topic:<br />

What should be my primary considerations in<br />

choosing a particular dispute resolution strategy?<br />

Cathleen M. Devlin<br />

Partner<br />

Saul Ewing LLP<br />

cdevlin@saul.<strong>com</strong><br />

Lori B. Wiese<br />

Partner<br />

Powers & Frost, LLP<br />

lwiese@powersfrost.<strong>com</strong><br />

Peer Review Rated<br />

Daniel F. Shank<br />

Director<br />

Coats Rose<br />

dshank@coatsrose.<strong>com</strong><br />

Peer Review Rated<br />

In resolving a business dispute, one<br />

key consideration is whe<strong>the</strong>r <strong>the</strong> parties<br />

seek to preserve an ongoing business<br />

relationship. If <strong>the</strong>y do, a more cooperative,<br />

informal and efficient dispute resolution<br />

strategy, enabling <strong>the</strong> parties to control<br />

<strong>the</strong>ir out<strong>com</strong>e by mutual agreement—such<br />

as direct negotiation or mediation—is<br />

usually <strong>the</strong> wiser course. Such methods<br />

maximize <strong>the</strong> chances <strong>of</strong> salvaging <strong>the</strong><br />

relationship in a way that <strong>the</strong> “winner and<br />

loser” out<strong>com</strong>e <strong>of</strong> more adversarial and<br />

protracted arbitration or litigation<br />

proceedings <strong>of</strong>ten cannot.<br />

Dispute resolution <strong>of</strong>ten isn’t considered<br />

early enough in <strong>the</strong> case-review process.<br />

Setting up an effective arbitration<br />

or mediation takes as much effort as a<br />

pretrial hearing—and in a dispute<br />

resolution, not every trial strategy should<br />

be disclosed to <strong>the</strong> o<strong>the</strong>r side, which adds<br />

ano<strong>the</strong>r element <strong>of</strong> <strong>com</strong>plexity. Crafting an<br />

organized strategy, bringing toge<strong>the</strong>r both<br />

parties, creating exhibits and <strong>com</strong>piling<br />

demonstrative evidence are essential to<br />

success. These efforts take time, but are<br />

<strong>of</strong>ten worth it; an experienced mediator<br />

or arbitrator is more informed and<br />

sophisticated than <strong>the</strong> average jury.<br />

• Mediation allows your client to hear <strong>the</strong><br />

o<strong>the</strong>r side’s position directly from <strong>the</strong><br />

o<strong>the</strong>r side. It is <strong>the</strong> best status report<br />

you can provide your client.<br />

• Arbitration is about replacing <strong>the</strong> legal<br />

system with a streamlined, sophisticated<br />

arbiter. Arbitration has its place in<br />

technical matters, but it can be just as<br />

expensive as traditional litigation.<br />

• Arbitration need not be administered<br />

between sophisticated parties. Instead,<br />

each party should select a mediator;<br />

<strong>the</strong> two disinterested mediators select a<br />

true neutral third; and <strong>the</strong>n, proceed<br />

using agreed rules.<br />

02 www.martindale.<strong>com</strong>

DISPUTE RESOLUTION METHODS<br />

Mediation and arbitration once represented exotic alternatives to litigation, revolutionary methods that could save feuding parties<br />

money, time and <strong>the</strong> unpredictability <strong>of</strong> a jury. As parties have grown more willing to embrace ADR, mediation and arbitration have<br />

be<strong>com</strong>e standard tools in a legal strategy. Since mediation, arbitration and litigation all have pros and cons, and no two cases are<br />

alike, <strong>the</strong>re are many factors to consider when choosing a particular option—or options.<br />

Illustrations by Holly Haugen<br />

Cheryl E. Diaz<br />

Partner<br />

Thompson & Knight LLP<br />

Cheryl.Diaz@tklaw.<strong>com</strong><br />

Peer Review Rated<br />

Michael J. Dewberry<br />

Shareholder<br />

Fowler White Boggs Banker<br />

mdewberry@fowlerwhite.<strong>com</strong><br />

Peer Review Rated<br />

John S. Barr<br />

Partner<br />

McGuireWoods LLP<br />

jbarr@mcguirewoods.<strong>com</strong><br />

Peer Review Rated<br />

If each party genuinely believes he or she<br />

will prevail, a nonbinding summary jury<br />

trial may be <strong>the</strong> tool to bring <strong>the</strong>m closer<br />

toge<strong>the</strong>r. In a summary jury trial, <strong>the</strong><br />

parties select 12 jurors from <strong>the</strong> applicable<br />

jury pool and retain a third-party neutral<br />

to serve as trial judge. The parties each<br />

present a condensed version <strong>of</strong> <strong>the</strong> case.<br />

The jurors <strong>the</strong>n deliberate and provide<br />

feedback. The perspective <strong>of</strong> <strong>the</strong> jurors can<br />

<strong>of</strong>ten lead a party to re-evaluate his or her<br />

position in order to facilitate a settlement.<br />

A sometimes-overlooked strategy is private<br />

judging. Although not available in every<br />

state, it provides <strong>the</strong> functional equivalent<br />

<strong>of</strong> a nonjury trial by a retired judge or<br />

qualified attorney, jointly selected by <strong>the</strong><br />

parties for his or her expertise. The<br />

process generally involves <strong>the</strong> streamlined<br />

application <strong>of</strong> procedural rules and more<br />

case management by <strong>the</strong> private judge.<br />

It is best suited to cases where an early<br />

decision or greater control over <strong>the</strong><br />

pretrial calendar is important, or where<br />

threshold legal issues require prompt<br />

rulings. In many states, some rights <strong>of</strong><br />

appeal are preserved.<br />

The primary consideration is “<strong>the</strong><br />

consequences <strong>of</strong> losing”; not just <strong>the</strong> case<br />

at hand, but <strong>the</strong> impact losing will<br />

have on future similar disputes, business<br />

operations, reputation and business<br />

strategy. Arbitrators tend to base decisions<br />

on concepts <strong>of</strong> equity, can be arbitrary and<br />

<strong>the</strong>re is no appeal. Litigation demands<br />

application <strong>of</strong> <strong>the</strong> rule <strong>of</strong> law and provides<br />

an opportunity to appeal a trial court<br />

disaster. Mediation allows for creative<br />

solutions, where litigation and arbitration<br />

serve up a number, <strong>of</strong>ten intolerable.<br />

Think through <strong>the</strong> end game before you<br />

pick your field <strong>of</strong> play.<br />

(Continued on next page)<br />

For more information about <strong>the</strong>se<br />

lawyers and <strong>the</strong>ir firms, please visit<br />

www.martindale.<strong>com</strong>.<br />

JULY 2007<br />

03

DISPUTE RESOLUTION METHODS<br />

What should be my primary considerations<br />

in choosing a particular dispute resolution strategy?<br />

Illustrations by Holly Haugen<br />

Mary Jane Stitt<br />

Partner<br />

Blake, Cassels & Graydon LLP<br />

maryjane.stitt@blakes.<strong>com</strong><br />

Peer Review Rated<br />

Michael W. Hawkins<br />

Partner<br />

Dinsmore & Shohl LLP<br />

michael.hawkins@dinslaw.<strong>com</strong><br />

Peer Review Rated<br />

John F. Mariani<br />

Shareholder<br />

Gunster, Yoakley & Stewart, P.A.<br />

jmariani@gunster.<strong>com</strong><br />

Peer Review Rated<br />

Private arbitration <strong>of</strong>fers several<br />

advantages over litigation, particularly<br />

when multinational organizations are<br />

involved. If <strong>the</strong> parties are located in more<br />

than one jurisdiction, <strong>the</strong>y can choose<br />

a neutral forum <strong>of</strong> convenience. There is<br />

also <strong>the</strong> ease <strong>of</strong> enforcement <strong>of</strong> <strong>the</strong><br />

arbitration award internationally without<br />

needing to re-litigate <strong>the</strong> issues. And<br />

arbitration <strong>of</strong>fers confidentiality <strong>of</strong> <strong>the</strong><br />

dispute and ultimate award; <strong>the</strong> opposing<br />

parties may not want <strong>the</strong> precedent <strong>of</strong> a<br />

court proceeding or all <strong>the</strong> world to know<br />

<strong>the</strong> details <strong>of</strong> <strong>the</strong> dispute.<br />

As a general dispute resolution principle, it<br />

is critical to know your goals and know <strong>the</strong><br />

o<strong>the</strong>r party. The key is to understand your<br />

interests and <strong>the</strong>ir interests. Particularly<br />

in mediations, <strong>the</strong> most effective results<br />

<strong>com</strong>e from avoiding excessive posturing,<br />

and, instead, identifying <strong>the</strong> interests<br />

<strong>of</strong> <strong>the</strong> o<strong>the</strong>r side and proposing mutually<br />

agreeable solutions. Making reasonable<br />

proposals that can be backed up by<br />

objective and legitimate standards will<br />

go far in bringing <strong>the</strong> o<strong>the</strong>r side in line<br />

with your perspective.<br />

Mandatory arbitration, once viewed<br />

as <strong>the</strong> be-all, can be straightforward<br />

and definitive but is not necessarily as<br />

streamlined as it once was, and<br />

possibilities <strong>of</strong> appeal are practically nil.<br />

Mediation tends to work best as a<br />

precursor to arbitration or trial, giving<br />

both sides a glimpse <strong>of</strong> things to <strong>com</strong>e and<br />

an objective outsider urging peace in place<br />

<strong>of</strong> war. Trial, while certainly <strong>the</strong> most<br />

involved, at least allows <strong>the</strong> check and<br />

balance <strong>of</strong> meaningful appellate review.<br />

Which to use? Focus on <strong>the</strong> level <strong>of</strong><br />

<strong>com</strong>plexity <strong>of</strong> <strong>the</strong> dispute; <strong>the</strong>n, match a<br />

resolution methodology to that.<br />

For more information about <strong>the</strong>se<br />

lawyers and <strong>the</strong>ir firms, please visit<br />

www.martindale.<strong>com</strong>.<br />

04 www.martindale.<strong>com</strong>

Offering In-House Counsel New<br />

Objective Data for Evaluating Law Firms<br />

decision point<br />

Jacob Wackerhausen/iStockphoto<br />

Corporate counsel and o<strong>the</strong>r buyers <strong>of</strong> legal services frequently<br />

express <strong>the</strong>ir need for a robust and independent resource that can<br />

help <strong>the</strong>m identify, evaluate and select law firms. They can learn<br />

about law firms from <strong>the</strong>ir Web sites, consult online directories to<br />

evaluate <strong>the</strong>ir credentials and review legal publications to read<br />

about <strong>the</strong>ir specific ac<strong>com</strong>plishments. What is missing, though, is<br />

objective data in a standardized format that enables true apples-toapples<br />

<strong>com</strong>parisons <strong>of</strong> law firms. In-house counsel are asking for<br />

<strong>this</strong> type <strong>of</strong> reliable, objective data as a foundation on which <strong>the</strong>y<br />

can build <strong>the</strong>ir buying decisions.<br />

A<br />

t LexisNexis <strong>Martindale</strong>-Hubbell,<br />

we have conducted extensive<br />

interviews with in-house counsel<br />

around <strong>the</strong> world, asking <strong>the</strong>m<br />

what resources would be most useful<br />

to <strong>the</strong>m in <strong>the</strong> outside counsel selection<br />

process. This research has highlighted<br />

a critical need for reliable data based on<br />

feedback from o<strong>the</strong>r buyers <strong>of</strong> legal services<br />

regarding <strong>the</strong>ir outside counsel. After all,<br />

<strong>the</strong> first resource that virtually any corporate<br />

counsel uses when looking to hire a law<br />

firm is <strong>the</strong> old-fashioned referral from one<br />

<strong>of</strong> <strong>the</strong>ir peers.<br />

For example, some <strong>of</strong> <strong>the</strong> tasks that buyers<br />

<strong>of</strong> legal services told us <strong>the</strong>y would hope to<br />

ac<strong>com</strong>plish with <strong>this</strong> elusive objective data<br />

about law firms include:<br />

■ Select outside counsel with confidence,<br />

using qualitative information from peers<br />

on key criteria for evaluating law firms;<br />

■ Identify and evaluate <strong>the</strong> credentials <strong>of</strong> a<br />

law firm about which little is known,<br />

such as a firm in a remote jurisdiction;<br />

■ Receive a true sense <strong>of</strong> a law firm’s<br />

demonstrated expertise by considering<br />

<strong>the</strong> feedback from o<strong>the</strong>r in-house counsel<br />

as additional data to supplement an<br />

evaluation <strong>of</strong> law firm pr<strong>of</strong>ile data,<br />

LexisNexis <strong>Martindale</strong>-Hubbell Peer<br />

Review Ratings and o<strong>the</strong>r information;<br />

■ Save time with <strong>the</strong> law firm evaluation<br />

process; and<br />

■ Justify <strong>the</strong> selection <strong>of</strong> outside counsel<br />

to <strong>the</strong> CEO, board <strong>of</strong> directors and<br />

o<strong>the</strong>r key executives with an objective<br />

indicator <strong>of</strong> <strong>the</strong> firm’s experience and<br />

credentials.<br />

We took <strong>this</strong> feedback to heart and<br />

partnered with in-house counsel to develop<br />

a new information resource that would<br />

help meet <strong>the</strong>se stated needs. LexisNexis<br />

<strong>Martindale</strong>-Hubbell Client Review is a<br />

new product that is based on confidential<br />

surveys <strong>com</strong>pleted by current and former<br />

clients <strong>of</strong> law firms that provide client<br />

re<strong>com</strong>mendations <strong>of</strong> a law firm’s quality <strong>of</strong><br />

legal representation, client service and value<br />

for <strong>the</strong> money. Developed in collaboration<br />

with in-house counsel worldwide, Client<br />

Review also includes re<strong>com</strong>mendations by<br />

practice area and industry.<br />

Just like our Peer Review Ratings, Client<br />

Review is a service to <strong>the</strong> legal pr<strong>of</strong>ession<br />

facilitated by <strong>Martindale</strong>-Hubbell. All<br />

survey responses are anonymous and not<br />

attributable to specific respondents.<br />

We view Client Review as part <strong>of</strong> <strong>the</strong><br />

next generation <strong>of</strong> decision support data<br />

from <strong>Martindale</strong>-Hubbell. These reviews<br />

aggregate feedback from law firm clients on<br />

a wide range <strong>of</strong> critical factors that buyers<br />

<strong>of</strong> legal services have told us are <strong>the</strong> key<br />

items that shape <strong>the</strong>ir selection <strong>of</strong> outside<br />

counsel. This is <strong>the</strong> kind <strong>of</strong> objective data<br />

that informs in-house counsel’s evaluation<br />

<strong>of</strong> those qualitative aspects <strong>of</strong> a law firm<br />

on which only <strong>the</strong>ir in-house counsel peers<br />

can <strong>com</strong>ment.<br />

Client Review was developed from a broad<br />

spectrum <strong>of</strong> corporate counsel input and is<br />

prominently featured on www.martindale.<strong>com</strong>.<br />

No o<strong>the</strong>r <strong>com</strong>parable client review tool<br />

exists.<br />

To make <strong>this</strong> <strong>of</strong>fering as useful as possible<br />

to in-house counsel, we need your help.<br />

Participation <strong>of</strong> in-house counsel as active<br />

reviewers <strong>of</strong> law firms is essential as we<br />

build <strong>this</strong> new pr<strong>of</strong>essional resource that<br />

will be widely available to buyers <strong>of</strong><br />

legal services on www.martindale.<strong>com</strong>, our<br />

industry-leading Web site for information<br />

about lawyers and law firms. Your continued<br />

participation in <strong>the</strong> process will provide<br />

you and your peers with a credible source<br />

<strong>of</strong> objective and anonymous input that<br />

you can rely upon as you evaluate, <strong>com</strong>pare<br />

and ultimately select outside counsel.<br />

To help us continue building a useful<br />

and objective information resource<br />

to aid you in your evaluation <strong>of</strong> prospective<br />

outside counsel, please contact us at<br />

http://www.martindale.<strong>com</strong>/clientreview/<br />

reviewer/ and learn how you can submit a<br />

Client Review <strong>of</strong> a law firm.<br />

Barry Solomon, Esq., is vice president<br />

and general manager, LexisNexis<br />

<strong>Martindale</strong>-Hubbell. He can be reached<br />

at barry.solomon@lexisnexis.<strong>com</strong>.<br />

JULY 2007<br />

05

pr<strong>of</strong>iles in partnership<br />

An Aggressive<br />

and<br />

Passionate Defense<br />

SunTrust Banks, Inc. and Powell Goldstein LLP<br />

By Scott M. Gawlicki<br />

Sometimes you just have to dig your<br />

heels in and fight.<br />

Such was <strong>the</strong> case in 2005 when two heirs<br />

<strong>of</strong> a prominent Atlanta family sued SunTrust<br />

Banks, Inc. for a staggering $165 million,<br />

claiming <strong>the</strong> bank lost <strong>the</strong>m millions <strong>of</strong><br />

dollars by mismanaging trust funds established<br />

by <strong>the</strong>ir late grandfa<strong>the</strong>r.<br />

The lawsuit generated plenty <strong>of</strong> headlines<br />

and brought <strong>the</strong> bank more than its share <strong>of</strong><br />

negative publicity. But SunTrust was not<br />

about to be intimidated.<br />

“We believed <strong>the</strong> plaintiffs made a variety<br />

<strong>of</strong> reckless allegations—unsupported by<br />

facts—that attacked our integrity,” says<br />

SunTrust Executive Vice President and<br />

General Counsel Raymond D. Fortin. “We<br />

made a fundamental decision to defend<br />

ourselves because we knew we didn’t do<br />

anything wrong.”<br />

Faced with what looked to be a long,<br />

drawn-out battle, SunTrust turned to Powell<br />

Goldstein LLP partners and litigators L. Lin<br />

Wood and Nicole J. Wade. Wood, who would<br />

serve as lead counsel and trial lawyer, had<br />

a lot <strong>of</strong> experience with high-pr<strong>of</strong>ile cases,<br />

including representation <strong>of</strong> Richard Jewell<br />

in connection with <strong>the</strong> 1996 bombing <strong>of</strong><br />

Centennial Olympic Park in Atlanta.<br />

“SunTrust was <strong>the</strong> victim <strong>of</strong> false accusations<br />

that went to <strong>the</strong> core <strong>of</strong> its reputation<br />

and integrity,” Wood says. “The bank<br />

wanted an aggressive and passionate<br />

defense. My reputation is that I play by<br />

<strong>the</strong> rules but that I’m aggressive and<br />

passionate in defending my clients. So it<br />

was a very good fit.”<br />

Opening Salvos<br />

The lawsuit was brought by Thomas Shaw<br />

and his half bro<strong>the</strong>r, Alexander Hitz, after<br />

SunTrust filed to resign as <strong>the</strong>ir trustee. The<br />

plaintiffs accused SunTrust <strong>of</strong> breaching its<br />

“We made a fundamental<br />

decision to defend<br />

ourselves because we<br />

knew we didn’t do<br />

anything wrong.”<br />

fiduciary duty in managing trusts<br />

established by <strong>the</strong>ir late grandfa<strong>the</strong>r and<br />

Atlanta physician, H. Cliff Sauls. Key to<br />

<strong>the</strong>ir argument was <strong>the</strong> bank’s longstanding<br />

relationship with The Coca-Cola Co., and<br />

its substantial holdings <strong>of</strong> Coca-Cola stock.<br />

Raymond D. Fortin, SunTrust Banks, Inc.<br />

Shaw and Hitz claimed SunTrust refused<br />

to act on numerous requests to diversify<br />

<strong>the</strong>ir stock portfolios—which were heavily<br />

invested in Coca-Cola stock—because it<br />

would negatively affect its own holdings.<br />

That refusal, <strong>the</strong>y argued, resulted in <strong>the</strong><br />

value <strong>of</strong> <strong>the</strong>ir trusts declining by more than<br />

50 percent after Coke stock hit a peak <strong>of</strong><br />

nearly $89 in 1998 and <strong>the</strong>n dropped to<br />

roughly $44 at <strong>the</strong> time <strong>of</strong> <strong>the</strong> lawsuit.<br />

SunTrust, on <strong>the</strong> o<strong>the</strong>r hand, argued it<br />

had made every effort to <strong>com</strong>ply. In 2000,<br />

it subdivided <strong>the</strong> original trust into<br />

multiple trusts representing Shaw and Hitz<br />

and two o<strong>the</strong>r beneficiaries, an aunt and<br />

Emory University. That increased each half<br />

bro<strong>the</strong>r’s annual distribution from about<br />

$75,000 to more than $230,000. But when<br />

<strong>the</strong> wrangling continued, <strong>the</strong> bank opted<br />

to resign as trustee.<br />

Photography by Stanley Leary<br />

L. Lin Wood, Powell Goldstein LLP<br />

06 www.martindale.<strong>com</strong>

partnership<br />

at a glance<br />

SunTrust Banks, Inc.<br />

L. Lin Wood (left), and Nicole J. Wade, Powell Goldstein LLP;<br />

Raymond D. Fortin, SunTrust Banks, Inc.<br />

SunTrust Banks, Inc., headquartered<br />

in Atlanta, is one <strong>of</strong> <strong>the</strong> nation’s<br />

largest banking organizations,<br />

serving a broad range <strong>of</strong> consumer,<br />

<strong>com</strong>mercial, corporate and<br />

institutional clients. As <strong>of</strong> March 31,<br />

2007, SunTrust had total assets<br />

<strong>of</strong> $186.4 billion and total deposits<br />

<strong>of</strong> $123.4 billion. The <strong>com</strong>pany<br />

operates an extensive branch and<br />

ATM network throughout <strong>the</strong><br />

high-growth Sou<strong>the</strong>ast and mid-<br />

Atlantic states.<br />

“There were efforts to diversify <strong>the</strong>ir<br />

holdings as well, but we needed <strong>the</strong> consent<br />

<strong>of</strong> <strong>the</strong> plaintiffs and <strong>the</strong>y didn’t consent,”<br />

Fortin says. “Over time, it became apparent<br />

to us that <strong>the</strong>y might be more interested in<br />

litigation than anything else. They were very<br />

difficult to deal with.”<br />

“SunTrust hired Powell Goldstein in 2004<br />

after it received a demand letter from<br />

plaintiffs’ counsel,” Wade explains. “After a<br />

thorough assessment, including extensive<br />

witness interviews and <strong>document</strong> review, we<br />

agreed with <strong>the</strong> bank that its actions were<br />

proper and it should aggressively defend <strong>the</strong><br />

case.” Beating <strong>the</strong> plaintiffs to <strong>the</strong><br />

“SunTrust had nothing to hide,<br />

so we said, ‘Let’s get into<br />

court and get <strong>this</strong> resolved.’<br />

The plaintiffs were very<br />

surprised by that strategy.”<br />

courthouse, SunTrust filed suit to resign as<br />

trustee in early 2005. Wade continues,<br />

“SunTrust had nothing to hide, so we said,<br />

‘Let’s get into court and get <strong>this</strong> resolved.’<br />

The plaintiffs were very surprised by that<br />

strategy.”<br />

Indeed. Shaw and Hitz quickly filed a<br />

countersuit, arguing <strong>the</strong> bank’s failure to<br />

diversify <strong>the</strong>ir trusts resulted in <strong>the</strong>ir value<br />

declining from $14 million to $6 million.<br />

Claiming <strong>the</strong>y lost $15 million—$8 million<br />

in market value, as well as <strong>the</strong> value <strong>of</strong> lost<br />

in<strong>com</strong>e and investment opportunities—<br />

<strong>the</strong> half bro<strong>the</strong>rs asked for punitive<br />

damages 10 times <strong>the</strong> $15 million figure,<br />

plus fees paid to SunTrust, or more than<br />

$165 million.<br />

Building a Defense<br />

SunTrust and Powell Goldstein began <strong>the</strong><br />

defense process by sifting through nearly<br />

30,000 pages <strong>of</strong> <strong>document</strong>s, many stored on<br />

micr<strong>of</strong>iche and dating back to <strong>the</strong> original<br />

trust’s opening in 1950. The <strong>document</strong>s<br />

were placed in an electronic database<br />

accessible to both SunTrust and Powell<br />

Goldstein attorneys.<br />

“We didn’t just hand <strong>the</strong> case over; we had<br />

regular strategy sessions with a lot <strong>of</strong><br />

dialogue and interaction,” Fortin explains.<br />

“I had to assess <strong>the</strong> goals and sensitivities<br />

<strong>of</strong> our business people and convey that to<br />

Lin and Nicole. There were o<strong>the</strong>r trusts<br />

with Coke stock, so <strong>the</strong>re was a precedent<br />

<strong>com</strong>ponent to <strong>the</strong> case.”<br />

In one analysis, <strong>the</strong> team examined all<br />

potential gains and losses that would have<br />

been realized if SunTrust had diversified<br />

<strong>the</strong> trusts at any time o<strong>the</strong>r than 1998, when<br />

Coke’s stock price peaked. By including<br />

capital gains taxes and o<strong>the</strong>r costs, <strong>the</strong><br />

analysis revealed <strong>the</strong> trusts would be worth<br />

millions less.<br />

“We basically re-created everything that<br />

happened from day one,” Wade explains.<br />

“Dozens <strong>of</strong> depositions were taken,<br />

including those <strong>of</strong> <strong>the</strong> plaintiffs and <strong>the</strong>ir<br />

advisers, SunTrust management and<br />

management at Coke. Over <strong>the</strong> time period,<br />

SunTrust unquestionably made <strong>the</strong> right<br />

decisions for <strong>the</strong> trust, and <strong>the</strong> plaintiffs<br />

As SunTrust’s general counsel,<br />

Raymond D. Fortin is responsible for<br />

<strong>the</strong> <strong>com</strong>pany’s legal and regulatory<br />

affairs, and oversees corporate<br />

<strong>com</strong>pliance, regulatory liaison and<br />

federal legislative affairs. He joined<br />

SunTrust in 1989 and also serves as<br />

corporate secretary and a member<br />

<strong>of</strong> <strong>the</strong> Management Committee.<br />

Prior to joining SunTrust, he served<br />

for eight years as staff counsel at<br />

<strong>the</strong> Citizens and Sou<strong>the</strong>rn Georgia<br />

Corporation. Contact Raymond at<br />

raymond.fortin@suntrust.<strong>com</strong>.<br />

pr<strong>of</strong>ited greatly from those decisions. As a<br />

trustee, SunTrust should not have been<br />

held responsible for failing to sell <strong>the</strong> stock<br />

at <strong>the</strong> one moment in history when it briefly<br />

reached an all-time high.”<br />

In 2006, Powell Goldstein moved for partial<br />

summary judgment, arguing that because<br />

<strong>the</strong> plaintiffs signed <strong>the</strong> new distribution<br />

agreement in 2000, <strong>the</strong>y effectively waived<br />

any claim that <strong>the</strong> in<strong>com</strong>e paid from <strong>the</strong><br />

trusts was insufficient.<br />

Fur<strong>the</strong>r, <strong>the</strong> firm asked that expert witness<br />

and financial analyst Candace L. Preston,<br />

whom <strong>the</strong> plaintiffs brought in to assess <strong>the</strong><br />

alleged financial damages, be disqualified<br />

because she had no experience in trusts. At<br />

<strong>the</strong> same time, Wood and Wade persuaded<br />

SunTrust not to introduce any expert witnesses<br />

<strong>of</strong> its own.<br />

JULY 2007<br />

07

partnership<br />

at a glance<br />

Powell Goldstein LLP<br />

Powell Goldstein's litigation team<br />

includes attorneys with a wealth <strong>of</strong><br />

experience in handling and minimizing<br />

<strong>the</strong> impact <strong>of</strong> controversies on a wide<br />

range <strong>of</strong> industries including manufacturing,<br />

banking, healthcare, technology<br />

and tele<strong>com</strong>munications. The firm<br />

regularly handles cases in both state<br />

and federal court for individuals and<br />

for institutional fiduciaries, including<br />

four <strong>of</strong> <strong>the</strong> largest national banks in<br />

<strong>the</strong> country.<br />

L. Lin Wood has 30 years’ experience<br />

as a trial lawyer focusing on civil<br />

litigation, representing individuals and<br />

corporations as plaintiffs or defendants<br />

in tort and business cases involving<br />

claims <strong>of</strong> significant damage. He has<br />

extensive experience in First Amendment<br />

litigation and management <strong>of</strong> <strong>the</strong><br />

media in high-pr<strong>of</strong>ile cases, including<br />

representation <strong>of</strong> Richard Jewell,<br />

Howard K. Stern (individually and as<br />

executor <strong>of</strong> <strong>the</strong> estate <strong>of</strong> Anna Nicole<br />

Smith), John and Patsy Ramsey, <strong>the</strong><br />

victim in <strong>the</strong> Kobe Bryant case and<br />

former U.S. Congressman Gary Condit.<br />

Lin is Peer Review Rated. Contact him at<br />

llwood@pogolaw.<strong>com</strong>.<br />

Nicole J. Wade practices civil litigation,<br />

with an emphasis on fiduciary litigation,<br />

trust and estate litigation and general<br />

<strong>com</strong>mercial litigation. She represents<br />

financial institutions and individuals<br />

in a wide range <strong>of</strong> fiduciary litigation,<br />

including breach <strong>of</strong> fiduciary duty<br />

actions, fraud claims, will caveats, will<br />

and trust construction cases, <strong>com</strong>petency<br />

claims, actions for removal <strong>of</strong> trustees<br />

and executors, and contested<br />

guardianship hearings. Contact Nicole<br />

at nwade@pogolaw.<strong>com</strong>.<br />

“What’s interesting is that a<br />

fiduciary case can sometimes<br />

be similar to a tort case.<br />

You’re talking about a<br />

standard <strong>of</strong> care that’s<br />

very fact-specific. So it’s a<br />

battle <strong>of</strong> experts. In <strong>this</strong><br />

case <strong>the</strong> o<strong>the</strong>r side failed to<br />

produce a qualified expert<br />

and we exploited it.”<br />

“You open up <strong>the</strong> defense lawyer’s handbook<br />

and under ‘strategy’ it will advise you to<br />

prepare your own experts. We did that and<br />

had excellent experts ready to testify for<br />

<strong>the</strong> bank,” Wood explains. “But if we had<br />

identified those experts, it would have<br />

given plaintiffs additional time to designate<br />

new rebuttal experts and remedy what we<br />

believed to be a fatal deficiency in <strong>the</strong>ir<br />

case, among o<strong>the</strong>rs. Without identifying<br />

our experts, plaintiffs were stuck with<br />

Candace Preston.”<br />

In January 2007, Fulton County Superior<br />

Court Judge Jerry W. Baxter ruled <strong>the</strong> two<br />

half bro<strong>the</strong>rs could not sue <strong>the</strong> bank for lost<br />

or insufficient in<strong>com</strong>e from <strong>the</strong> trust. He<br />

also disqualified Preston, saying she did not<br />

have <strong>the</strong> “appropriate level <strong>of</strong> knowledge,<br />

skill, experience, training, or education, in<br />

<strong>the</strong> area or specialty in which her opinion is<br />

to be given.”<br />

“My hat’s <strong>of</strong>f to Lin and Nicole; that was a<br />

gutsy move,” Fortin says. “What’s interesting<br />

is that a fiduciary case can sometimes be<br />

similar to a tort case. You’re talking about a<br />

standard <strong>of</strong> care that’s very fact-specific. So<br />

it’s a battle <strong>of</strong> experts. In <strong>this</strong> case <strong>the</strong> o<strong>the</strong>r<br />

side failed to produce a qualified expert and<br />

we exploited it.”<br />

Baxter’s decision represented a major<br />

win for <strong>the</strong> bank. In March, Shaw dropped<br />

out <strong>of</strong> <strong>the</strong> lawsuit and agreed to retain<br />

SunTrust as his trustee. SunTrust, in turn,<br />

agreed not to pursue <strong>the</strong> reimbursement<br />

<strong>of</strong> its attorneys’ fees and expenses. With<br />

Hitz’s response still pending, Fortin could<br />

not be happier with both <strong>the</strong> result and<br />

Powell Goldstein’s performance.<br />

“At <strong>the</strong> start, I told upper management we<br />

were going to be aggressive and try to set <strong>the</strong><br />

tempo <strong>of</strong> <strong>the</strong> case. To do that, we needed<br />

litigators with both <strong>the</strong> passion and ability to<br />

explain our side <strong>of</strong> <strong>the</strong> story,” he says. “We<br />

liked <strong>the</strong> fact that with Lin, Powell Goldstein<br />

brought a real trial lawyer to <strong>the</strong> case. He<br />

and Nicole were focused, creative partners,<br />

and <strong>the</strong>y put on a superb defense.”<br />

08 www.martindale.<strong>com</strong>

FORD & HARRISON LLP<br />

Preventing an EEOC<br />

Systemic Investigation<br />

best practices<br />

A longstanding female employee—who did not<br />

situation<br />

<strong>com</strong>plain internally—files gender discrimination<br />

charges with <strong>the</strong> Equal Employment Opportunity<br />

Commission (EEOC) alleging that she has been repeatedly passed over<br />

for promotion in favor <strong>of</strong> less qualified men. Regardless <strong>of</strong> <strong>the</strong> merit<br />

<strong>of</strong> her charge, Human Resources (HR) is concerned about a possible<br />

EEOC investigation which would extend beyond <strong>the</strong> individual charging<br />

party’s situation.<br />

in-house counsel<br />

challenge<br />

The EEOC has recently stepped up its<br />

<strong>com</strong>mitment to systemic discrimination<br />

investigations and litigation. Therefore, it’s<br />

inside counsel’s task to work with HR to resolve <strong>the</strong> issue quickly<br />

and head <strong>of</strong>f an EEOC investigation before it expands into a pattern<br />

and practice lawsuit.<br />

approach<br />

adopted<br />

In <strong>this</strong> scenario, which is based on an actual<br />

case, inside counsel and HR began <strong>the</strong><br />

investigation by meeting with <strong>the</strong> department<br />

head to get a detailed explanation as to why <strong>the</strong> department head<br />

selected <strong>the</strong> male employee. The department’s statistical evidence was<br />

also examined—including direct hires, promotions, resignations,<br />

terminations and exit interviews—for any evidence <strong>of</strong> discrimination.<br />

Even though <strong>the</strong> department head’s reasoning was deemed solid,<br />

<strong>the</strong> department’s past performance was troubling. O<strong>the</strong>r female<br />

employees had suggested during exit interviews that a previous<br />

department head—not <strong>the</strong> current manager—had not given women<br />

quality assignments.<br />

In <strong>this</strong> case, legal and HR opted to establish a new job opportunity<br />

which would represent a promotion for <strong>the</strong> charging party. HR worked<br />

with <strong>the</strong> new department head—who was assured <strong>the</strong> solution was<br />

not based on <strong>the</strong> belief that he had done anything wrong—to assess<br />

<strong>the</strong> woman’s skills. At <strong>the</strong> same time, legal prepared a joint letter that<br />

would go to <strong>the</strong> EEOC from HR and <strong>the</strong> charging party.<br />

HR <strong>the</strong>n met with <strong>the</strong> charging party and told her <strong>the</strong> situation had been<br />

reviewed. Without discussing <strong>the</strong> merits <strong>of</strong> her charge, HR emphasized<br />

her value as an employee and explained <strong>the</strong> last thing ei<strong>the</strong>r wanted<br />

was a dispute.<br />

A new position with more responsibility and higher salary was <strong>of</strong>fered.<br />

In addition, HR <strong>of</strong>fered, at <strong>the</strong> <strong>com</strong>pany’s expense, a training seminar<br />

on supervisory skills and advised her that, because <strong>of</strong> <strong>the</strong> <strong>com</strong>pany’s<br />

<strong>com</strong>mitment to equal opportunity, an EEO training program for all<br />

managers and supervisors within <strong>the</strong> department had been organized.<br />

implementation steps<br />

• If a discrimination allegation occurs, conduct internal interviews<br />

and take immediate action.<br />

• To prevent allegations and/or problematic EEOC systemic<br />

investigations in <strong>the</strong> future, establish a system to regularly monitor<br />

statistical employment evidence, including direct hires, promotions,<br />

resignations and terminations, for evidence <strong>of</strong> discrimination.<br />

• Establish a similar process to monitor and follow up on exit<br />

interview results.<br />

measuring<br />

success<br />

Short term: The female employee was happy<br />

with <strong>the</strong> promotion opportunity and that<br />

HR had moved so quickly and positively on<br />

her <strong>com</strong>plaint. She signed <strong>the</strong> letter for <strong>the</strong> EEOC, which <strong>the</strong>n<br />

dismissed <strong>the</strong> charge without ever conducting any investigation or<br />

even obtaining a position statement. Hence, <strong>the</strong> <strong>com</strong>pany avoided<br />

what easily could have turned into a pattern type investigation.<br />

Long term: The training did take place and <strong>the</strong> turnover rate for<br />

female employees in that department was reduced dramatically.<br />

future issues<br />

to consider<br />

In light <strong>of</strong> <strong>the</strong> EEOC’s renewed focus on systemic<br />

investigations and litigation, inside counsel must<br />

ensure that statistical employment evidence and exit<br />

interview results are being monitored regularly to<br />

uncover and resolve potential discrimination<br />

problems early on.<br />

Richard S. Cohen is managing partner in <strong>the</strong><br />

Phoenix <strong>of</strong>fice <strong>of</strong> Ford & Harrison LLP. His<br />

primary practice area is employment law, with<br />

an emphasis on employment discrimination.<br />

Richard is Peer Review Rated. He can be<br />

reached at rcohen@fordharrison.<strong>com</strong>.<br />

JULY 2007<br />

09

est practices<br />

COMPLIANCE AND ETHICS:<br />

Training <strong>the</strong> Board<br />

STEPHEN MARTIN | CORPEDIA, INC.<br />

Stephen Martin is general counsel and vice president, strategy, at Phoenix-based Corpedia, Inc., an ethics and <strong>com</strong>pliance<br />

consulting <strong>com</strong>pany, and a clinical pr<strong>of</strong>essor at <strong>the</strong> University <strong>of</strong> Denver. He was a recent Counsel to Counsel forum co-chair.<br />

Contact him at smartin@corpedia.<strong>com</strong>.<br />

implementation steps<br />

Personal liability for <strong>com</strong>pliance and corporate<br />

situation<br />

ethics failures for board members is at its peak.<br />

Yet, despite recent amendments to <strong>the</strong> Federal<br />

Sentencing Guidelines—and corporate financial scandals that have held<br />

board members personally liable for millions <strong>of</strong> dollars—many <strong>com</strong>panies<br />

still do not provide board members with <strong>com</strong>pliance and ethics training.<br />

in-house counsel<br />

challenge<br />

Companies must address FSG board member oversight<br />

requirements <strong>of</strong> <strong>the</strong> organization’s <strong>com</strong>pliance and<br />

ethics programs and <strong>com</strong>pany responsibility for<br />

<strong>com</strong>municating program standards and procedures by “conducting effective<br />

training programs and o<strong>the</strong>rwise disseminating information appropriate to<br />

<strong>the</strong> [board <strong>of</strong> directors’] roles and responsibilities.” Although directors want<br />

such guidance, most <strong>com</strong>panies do not have formal board training programs.<br />

In-house counsel must explain <strong>the</strong> expanding liability issues, both to <strong>the</strong><br />

<strong>com</strong>pany and <strong>the</strong> board, and establish a <strong>com</strong>prehensive training program.<br />

approach<br />

adopted<br />

Meet with management and explain <strong>the</strong> impact <strong>of</strong><br />

<strong>the</strong> recent amendments to <strong>the</strong> Guidelines. Impress<br />

upon <strong>the</strong>m <strong>the</strong> necessity <strong>of</strong> training <strong>the</strong> <strong>com</strong>pany’s<br />

board to protect <strong>the</strong> <strong>com</strong>pany and individual directors.<br />

Then, meet with <strong>the</strong> board, underscore <strong>the</strong> importance <strong>of</strong> <strong>the</strong> training and<br />

assess each member’s desired training topics. Popular and key training<br />

topics include: data protection/customer privacy; gifts/entertainment;<br />

recent rule changes by <strong>the</strong> National Association <strong>of</strong> Securities Dealers and<br />

<strong>the</strong> Securities and Exchange Commission; appropriate board oversight <strong>of</strong> a<br />

<strong>com</strong>pliance program under <strong>the</strong> Guidelines; D&O liability and proactively<br />

addressing risk; and what ethical leadership by directors means today.<br />

Once needs are assessed, determine how to deploy <strong>the</strong> training. Will<br />

internal or external experts conduct it? Will you employ electronic<br />

tutorials, classroom sessions or workshops with break-out groups? Ensure<br />

quality and effectiveness while maximizing board time. A typical agenda<br />

might include:<br />

• Overview <strong>of</strong> Board Oversight Responsibilities.<br />

• Substantive Discussion. Includes interactive scenario-based situations,<br />

best practices workshops and Q&A.<br />

• Demonstrate to senior management <strong>the</strong> need for board training.<br />

Cite supporting information, e.g., <strong>the</strong> amended Federal Sentencing<br />

Guidelines, corporate and personal liability issues revealed by<br />

recent scandals and/or examples <strong>of</strong> best practices.<br />

• Assess <strong>the</strong> board’s training needs. Check with peers to see how<br />

o<strong>the</strong>rs handle training. Determine who will conduct <strong>the</strong> training<br />

and establish <strong>the</strong> format.<br />

• Conduct <strong>the</strong> training and canvass <strong>the</strong> board to gauge<br />

effectiveness. Compare results with those <strong>of</strong> peers or consultants.<br />

Use <strong>the</strong> feedback to refine all aspects <strong>of</strong> future training.<br />

• Consider informing stakeholders, customers and employees that<br />

your training has occurred. This could be great positive internal<br />

and external press.<br />

• Ethical Frameworks and Values-Based Leadership. Includes driving<br />

long-term focus, pr<strong>of</strong>it and sustainability as an enterprise, including<br />

handling ethical dilemmas.<br />

A day <strong>of</strong> formal training, separate from <strong>the</strong> board’s normal duties, is<br />

ideal. Discuss with management <strong>the</strong> available (and appropriate)<br />

amount <strong>of</strong> time that can be dedicated.<br />

Provide written reference materials and ask <strong>the</strong> board to evaluate<br />

training effectiveness. Compare your findings with those <strong>of</strong> peers or<br />

third parties. Use <strong>the</strong> feedback to refine future board training.<br />

measuring<br />

success<br />

Providing <strong>com</strong>pliance and ethics board<br />

training <strong>com</strong>plies with <strong>the</strong> Federal Sentencing<br />

Guidelines, fulfills board oversight duties,<br />

protects <strong>the</strong> <strong>com</strong>pany and individual directors and helps <strong>the</strong> <strong>com</strong>pany’s<br />

drive toward increased long-term pr<strong>of</strong>itability and corporate sustainability.<br />

future issues<br />

to consider<br />

Consider approaches for retraining, onboarding new<br />

members and avoiding <strong>com</strong>placency. Keep things fresh<br />

with continued <strong>com</strong>munications and training that<br />

share best practices and updates.<br />

10 www.martindale.<strong>com</strong>

DUANE MORRIS LLP<br />

Elements <strong>of</strong> Triage<br />

best practices<br />

The recent E. coli outbreak linked to spinach, which<br />

situation<br />

began as an agricultural processing accident,<br />

demonstrates that what appears to be an isolated<br />

product liability incident can quickly morph into a <strong>full</strong>-blown criminal<br />

investigation. Establishing and addressing legal liabilities at <strong>the</strong> outset—a form<br />

<strong>of</strong> legal triage—can greatly reduce <strong>the</strong> impact <strong>of</strong> a crisis on any organization.<br />

in-house counsel<br />

challenge<br />

minimizes potential legal risks.<br />

As <strong>the</strong> <strong>com</strong>pany’s legal steward, inside counsel<br />

must play a leadership role in developing and<br />

executing a crisis response strategy that averts or<br />

approach<br />

Ga<strong>the</strong>r your crisis team immediately. Prosecutors<br />

adopted always look at how quickly a <strong>com</strong>pany reacts, so<br />

don’t let anything fester, even for an hour. Identify<br />

<strong>the</strong> legal risks and risk sources and list <strong>the</strong>m in order <strong>of</strong> importance.<br />

Begin by identifying <strong>the</strong> core problem and <strong>the</strong> potential for continued<br />

injury, death and/or financial loss, and <strong>the</strong>n take remedial action. If you’re<br />

a food, toy or drug supplier, will you need to issue recalls? Should you<br />

temporarily stop buying from your suppliers?<br />

A factory explosion that injures workers may have been caused by leaks<br />

in aging piping. What must be done to prevent fur<strong>the</strong>r harm at <strong>this</strong><br />

facility or o<strong>the</strong>rs like it? Can <strong>the</strong> problem be isolated, or will <strong>the</strong> entire<br />

plant have to be shut down? Retaining outside consultants—for<br />

example, a firm specializing in evaluating and replacing piping—will<br />

obviously affect your response and enhance your image with regulators.<br />

At <strong>the</strong> same time, institute internal measures to prevent a cover-up. Take<br />

steps as soon as possible to prevent employees from destroying and/or<br />

falsifying operating logs or o<strong>the</strong>r records.<br />

Once <strong>the</strong> problem is identified and remedial measures are in place, develop a<br />

verifiable message that addresses internal and external audience concerns.<br />

Appoint one spokesperson to ensure consistency. If an investigation is<br />

under way and you have no information to release right now, say so.<br />

Reach out to state and federal enforcement and regulatory agencies. If<br />

you enlist regulators as your colleagues, <strong>the</strong>y will be less likely to bring<br />

charges against you.<br />

Have Sales contact key customers. Explain <strong>the</strong> situation and how you’re<br />

reacting. Send updates by fax, email or both to keep customers in <strong>the</strong> loop.<br />

If appropriate, consider reaching out to your <strong>com</strong>petitors. They’ve<br />

probably been through similar crises and may be willing to sell overnight<br />

production time—or even <strong>the</strong> product itself—to help you continue to sell<br />

under your own name.<br />

implementation steps<br />

• Assemble <strong>the</strong> crisis team as soon as possible.<br />

• Identify <strong>the</strong> root cause <strong>of</strong> <strong>the</strong> problem.<br />

• Establish and implement corrective measures.<br />

• Secure all internal records.<br />

• Craft a public message/response.<br />

• Reach out to regulators and customers.<br />

• Conduct post-crisis analysis.<br />

Finally, your primary outside counsel should be part <strong>of</strong> <strong>the</strong> crisis team. They<br />

know your business well and <strong>of</strong>ten bring experience from o<strong>the</strong>r crises.<br />

measuring<br />

success<br />

Effective crisis management will prevent,<br />

defuse or win private lawsuits and<br />

indictments. Fur<strong>the</strong>r, it will protect businesscritical<br />

licenses and registrations; reimbursements and grants from<br />

local, state and federal agencies; and long-term relationships with<br />

customers, insurers, lenders and o<strong>the</strong>r business partners.<br />

future issues<br />

to consider<br />

If you haven’t already done so, identify and schedule<br />

your first meeting with an internal, go-to crisis<br />

management team.<br />

Howard M. H<strong>of</strong>fmann, former chief <strong>of</strong> <strong>the</strong><br />

criminal division and deputy U.S. attorney for<br />

<strong>the</strong> U.S. Attorney’s <strong>of</strong>fice in Chicago, is a senior<br />

trial and appellate partner with Duane Morris<br />

LLP. Howard is Peer Review Rated. He can be<br />

reached at hmh<strong>of</strong>fmann@duanemorris.<strong>com</strong>.<br />

Richard L. Seabolt is a Duane Morris<br />

partner/litigator, focusing on <strong>com</strong>plex trials<br />

and appeals arising from <strong>com</strong>mercial<br />

disputes, including those involving technology,<br />

construction and insurance. Richard is<br />

Peer Review Rated and can be reached at<br />

rlseabolt@duanemorris.<strong>com</strong>.<br />

JULY 2007<br />

11

est practices<br />

Surfacing Patentable<br />

Corporate Innovations<br />

ROBERT J. PUGH | THE PNC FINANCIAL SERVICES GROUP, INC.<br />

Robert J. Pugh is chief counsel, Technology and Intellectual Property, at The PNC Financial Services Group, Inc.<br />

in Pittsburgh. Robert recently co-chaired Counsel to Counsel forums on <strong>this</strong> subject. He can be reached at<br />

robert.pugh@pnc.<strong>com</strong>.<br />

implementation steps<br />

Most <strong>com</strong>panies recognize <strong>the</strong> value and<br />

situation<br />

importance <strong>of</strong> patenting corporate innovations.<br />

For some industries, such as <strong>the</strong> financial services<br />

industry, <strong>the</strong>se protectable innovations include processes, generally<br />

implemented by <strong>com</strong>puters, involved in operating a business or that<br />

define a service <strong>of</strong>fering (sometimes referred to as “business methods”).<br />

However, many <strong>com</strong>panies in <strong>the</strong>se same industries do not have a long<br />

history <strong>of</strong> or established culture surrounding patenting such innovations.<br />

in-house counsel<br />

challenge<br />

Corporate counsel must establish a simple way<br />

to identify new technology-based systems<br />

and processes that may be candidates for patent<br />

protection. This can be especially difficult in industries where <strong>the</strong>re’s<br />

little history <strong>of</strong> seeking such patents.<br />

approach<br />

adopted<br />

Begin with an internal education program.<br />

Develop and broadly distribute informational<br />

materials explaining <strong>the</strong> types <strong>of</strong> methods<br />

and systems that are patentable and why patent protection is<br />

important. Include any examples <strong>of</strong> innovations your <strong>com</strong>pany has<br />

already sought to patent. Target for more focused <strong>com</strong>munications<br />

those areas within <strong>the</strong> <strong>com</strong>pany that are most likely to develop<br />

patentable innovations, such as departments responsible for product or<br />

application development. Establish points <strong>of</strong> contact for those seeking<br />

more information.<br />

Try to leverage existing databases and systems within <strong>the</strong> <strong>com</strong>pany to<br />

help identify patentable innovations. For example, check with your<br />

IT department to see if your <strong>com</strong>pany currently employs one or more<br />

databases to track technology-based projects. PNC, for example,<br />

maintains a “Technology Initiatives” database. When new technologybased<br />

initiatives are launched, <strong>the</strong>y are entered into and tracked within<br />

<strong>this</strong> database. The project managers enter information concerning <strong>the</strong><br />

initiatives into <strong>the</strong> database, including <strong>the</strong>ir name, department, contact<br />

information and detailed descriptions <strong>of</strong> <strong>the</strong> initiative.<br />

• Spearhead a campaign that explains what is patentable and why<br />

patent protection is important.<br />

• If possible, provide examples <strong>of</strong> systems and methods your<br />

<strong>com</strong>pany has already sought to patent.<br />

• Provide extra focus to those areas <strong>of</strong> <strong>the</strong> <strong>com</strong>pany most likely to<br />

develop patentable methods or systems, such as <strong>the</strong> product or<br />

application development departments.<br />

• Check with IT to see whe<strong>the</strong>r a database already exists for<br />

tracking new technology-based initiatives.<br />

• Leverage that database to obtain leads on potentially patentable<br />

technology-based systems and methods.<br />

To leverage <strong>the</strong> database, <strong>the</strong> Legal department added a simple yet<br />

effective step—embedding a short series <strong>of</strong> “yes” or ”no” questions<br />

concerning <strong>the</strong> initiative into <strong>the</strong> database and requiring each project<br />

manager to answer <strong>the</strong>m. Examples <strong>of</strong> <strong>the</strong>se questions include:<br />

“Does your initiative involve a system or process that is not currently<br />

available from a vendor?” and “Are <strong>com</strong>petitors using similar systems<br />

or processes?” The questions take less than a minute to answer,<br />

and, if certain responses are given, an electronic <strong>com</strong>munication is<br />

automatically forwarded to Legal identifying <strong>the</strong> initiative as one<br />

meriting fur<strong>the</strong>r investigation. Often, <strong>the</strong>se types <strong>of</strong> project tracking<br />

databases already include codes to identify <strong>the</strong> type <strong>of</strong> initiative. You<br />

can set up <strong>the</strong> questions so that when certain codes are selected (such<br />

as routine building maintenance) <strong>the</strong> questions are not presented,<br />

since <strong>the</strong>se types <strong>of</strong> initiatives are unlikely to involve patentable<br />

innovation.<br />

measuring<br />

success<br />

The electronic tool described here has<br />

helped bridge <strong>the</strong> gap between <strong>the</strong> PNC<br />

Legal department and those who develop<br />

new business methods and systems, accumulating numerous<br />

leads on potentially patentable developments. As a result, PNC<br />

is building a solid portfolio <strong>of</strong> pending patent applications.<br />

12 www.martindale.<strong>com</strong>

DYKEMA<br />

Establishing <strong>the</strong><br />

Corporate Defense<br />

best practices<br />

The pace and breadth <strong>of</strong> mass tort litigation<br />

situation<br />

continues to expand. As a result, in-house<br />

counsel at large national or multinational<br />

corporations are increasingly faced with <strong>com</strong>plex, voluminous,<br />

multidistrict product liability lawsuits involving personal injury, property<br />

damage and/or economic loss.<br />

in-house counsel<br />

challenge<br />

Crafting an aggressive corporate defense,<br />

whe<strong>the</strong>r it’s a relatively isolated matter or a<br />

bet-<strong>the</strong>-<strong>com</strong>pany case, requires identifying<br />

and ga<strong>the</strong>ring case-specific facts, <strong>document</strong>s and input from witnesses<br />

and expert witnesses; and ensuring that highly technical issues are<br />

translated into concepts that are easy for a jury to understand.<br />

implementation steps<br />

• Identify affected divisions/business units.<br />

• Create a product time line that identifies important facts,<br />

witnesses and <strong>document</strong>s.<br />

• Interview key internal contacts and opposing witnesses.<br />

• Review transcripts for testimony that supports your case.<br />

• Ga<strong>the</strong>r case-related <strong>document</strong>s.<br />

• Test and refine your story.<br />

• Choose/prepare expert witnesses.<br />

approach<br />

adopted<br />

The defense process starts by assessing <strong>the</strong><br />

<strong>com</strong>pany’s current standing in terms <strong>of</strong> facts,<br />

product history, witnesses and internal <strong>document</strong>s.<br />

Begin by identifying <strong>the</strong> affected division or divisions and retrieving<br />

all applicable organization charts. This will help you 1) determine<br />

how <strong>the</strong> organization was structured when <strong>the</strong> product was developed,<br />

2) identify key players who may ultimately serve as witnesses and<br />

3) identify where important <strong>document</strong>s are stored. If product<br />

development dates back 10 or more years, chances are <strong>the</strong> organization<br />

has changed—perhaps dramatically.<br />

Then, build a product time line, which will help establish and prioritize<br />

<strong>the</strong> facts <strong>of</strong> <strong>the</strong> case. The goal is to create a fact chronology. How<br />

did <strong>the</strong> product design play out? What departments and individuals<br />

were involved? Were <strong>the</strong>re any early issues or problems? And if so,<br />

how were <strong>the</strong>y resolved?<br />

Include disputed facts and previous litigation, if <strong>the</strong>re are any. Make <strong>the</strong><br />

time line as detailed as possible because you will refer back to it <strong>of</strong>ten.<br />

Does <strong>the</strong> past or current litigation involve <strong>the</strong> same product or issue?<br />

Are <strong>the</strong>re similarities in <strong>the</strong> plaintiffs? Which firms are bringing <strong>the</strong>se<br />

cases? The time line will bring all <strong>the</strong>se issues out into <strong>the</strong> open.<br />

The process will also help identify key internal players, develop a<br />

potential defense strategy and hone your discovery objectives. Once<br />

you arrive at a defense strategy, it’s far easier to get internal people<br />

to talk to you. Then you can review deposition transcripts—including<br />

opposing witnesses—to uncover testimony that supports your strategy.<br />

Apply <strong>the</strong> same approach to e-discovery. You want and need <strong>the</strong><br />

discovery and discovery response to be strategic. Considering <strong>the</strong> cost,<br />

you need to know what you’re looking for, versus mass <strong>document</strong><br />

retrieval. Use <strong>the</strong> time line and plan your discovery and response<br />

accordingly.<br />

Draft <strong>the</strong> corporate story and test it. Start at <strong>the</strong> trial stage and work<br />

backward. Ask, “Do we have enough pieces to put toge<strong>the</strong>r our story<br />

for <strong>this</strong> trial? Or are <strong>the</strong>re still holes in <strong>the</strong> time line?” Continue to<br />

massage <strong>the</strong> story until it is simple enough for any jury to understand.<br />

Once <strong>the</strong> defense is established, review your expert witness list. If<br />

you’ve done your homework, you’ll know which experts are a good<br />

fit. Then coach <strong>the</strong>m to ensure <strong>the</strong>y will address <strong>the</strong>ir topics exactly<br />

<strong>the</strong> same way every time, regardless <strong>of</strong> where <strong>the</strong> case is tried.<br />

measuring<br />

success<br />

Creating <strong>the</strong> corporate story requires a<br />

<strong>com</strong>prehensive review <strong>of</strong> all product-related<br />

<strong>document</strong>s, witness interviews and caserelated<br />

facts, both good and bad. This legal “audit” is <strong>the</strong> road map<br />

that will help inside counsel ascertain <strong>the</strong> strength (or weakness) <strong>of</strong><br />

<strong>the</strong> <strong>com</strong>pany’s position and craft its defense strategy accordingly.<br />

Sherrie L. Farrell, a litigator and member<br />

in Dykema’s Detroit <strong>of</strong>fice, coordinates<br />

and provides discovery strategies for<br />

<strong>com</strong>panies involved in multidistrict<br />

litigation and mass tort claims. She can<br />

be reached at sfarrell@dykema.<strong>com</strong>.<br />

JULY 2007<br />

13

global perspectives<br />

M&A REGULATION:<br />

Piecing Toge<strong>the</strong>r a<br />

Slava Gutsko/iStockphoto<br />

New Paradigm<br />

By John M. Toth<br />

In a decision with far-reaching implications,<br />

Canada’s Competition Tribunal ruled in<br />

March 2007 that <strong>the</strong> country’s Competition<br />

Bureau could not delay <strong>the</strong> closing <strong>of</strong> Labatt<br />

Brewing Co. Ltd.’s proposed $201.4 million<br />

CAD takeover <strong>of</strong> Lakeport Brewing In<strong>com</strong>e<br />

Fund. The decision by <strong>the</strong> Tribunal, a<br />

specialized court that decides controversies<br />

under Canada’s Competition Act, paves<br />

<strong>the</strong> way for faster <strong>com</strong>pletion <strong>of</strong> Canadian<br />

<strong>com</strong>pany acquisitions—a significant<br />

advantage in <strong>the</strong> current active M&A<br />

market. It also reverses a nearly 30-year<br />

global trend toward <strong>com</strong>plex and timeconsuming<br />

regulatory scrutiny <strong>of</strong> M&A<br />

transactions. Central to <strong>this</strong> paradigm shift<br />

was a well-conceived, high-stakes plan by<br />

Labatt and Blake, Cassels & Graydon LLP,<br />

<strong>the</strong> <strong>com</strong>pany’s outside counsel, to force<br />

closing <strong>the</strong> Lakeport acquisition within <strong>the</strong><br />

statutory period defined for Competition<br />

Bureau review, regardless <strong>of</strong> any delay<br />