View the full text of this document - Martindale.com

View the full text of this document - Martindale.com

View the full text of this document - Martindale.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

pr<strong>of</strong>iles in partnership<br />

An Aggressive<br />

and<br />

Passionate Defense<br />

SunTrust Banks, Inc. and Powell Goldstein LLP<br />

By Scott M. Gawlicki<br />

Sometimes you just have to dig your<br />

heels in and fight.<br />

Such was <strong>the</strong> case in 2005 when two heirs<br />

<strong>of</strong> a prominent Atlanta family sued SunTrust<br />

Banks, Inc. for a staggering $165 million,<br />

claiming <strong>the</strong> bank lost <strong>the</strong>m millions <strong>of</strong><br />

dollars by mismanaging trust funds established<br />

by <strong>the</strong>ir late grandfa<strong>the</strong>r.<br />

The lawsuit generated plenty <strong>of</strong> headlines<br />

and brought <strong>the</strong> bank more than its share <strong>of</strong><br />

negative publicity. But SunTrust was not<br />

about to be intimidated.<br />

“We believed <strong>the</strong> plaintiffs made a variety<br />

<strong>of</strong> reckless allegations—unsupported by<br />

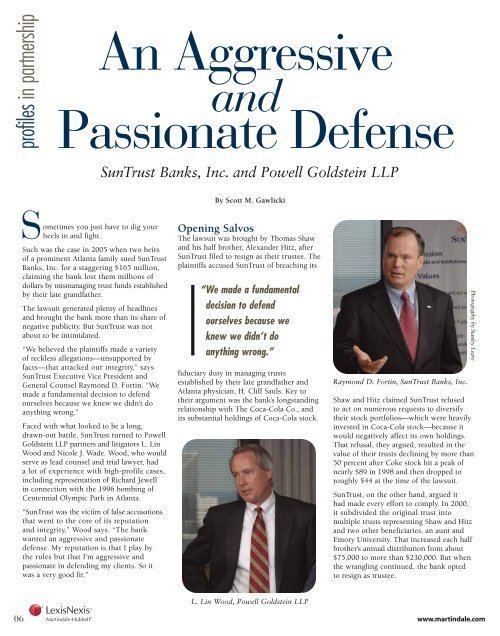

facts—that attacked our integrity,” says<br />

SunTrust Executive Vice President and<br />

General Counsel Raymond D. Fortin. “We<br />

made a fundamental decision to defend<br />

ourselves because we knew we didn’t do<br />

anything wrong.”<br />

Faced with what looked to be a long,<br />

drawn-out battle, SunTrust turned to Powell<br />

Goldstein LLP partners and litigators L. Lin<br />

Wood and Nicole J. Wade. Wood, who would<br />

serve as lead counsel and trial lawyer, had<br />

a lot <strong>of</strong> experience with high-pr<strong>of</strong>ile cases,<br />

including representation <strong>of</strong> Richard Jewell<br />

in connection with <strong>the</strong> 1996 bombing <strong>of</strong><br />

Centennial Olympic Park in Atlanta.<br />

“SunTrust was <strong>the</strong> victim <strong>of</strong> false accusations<br />

that went to <strong>the</strong> core <strong>of</strong> its reputation<br />

and integrity,” Wood says. “The bank<br />

wanted an aggressive and passionate<br />

defense. My reputation is that I play by<br />

<strong>the</strong> rules but that I’m aggressive and<br />

passionate in defending my clients. So it<br />

was a very good fit.”<br />

Opening Salvos<br />

The lawsuit was brought by Thomas Shaw<br />

and his half bro<strong>the</strong>r, Alexander Hitz, after<br />

SunTrust filed to resign as <strong>the</strong>ir trustee. The<br />

plaintiffs accused SunTrust <strong>of</strong> breaching its<br />

“We made a fundamental<br />

decision to defend<br />

ourselves because we<br />

knew we didn’t do<br />

anything wrong.”<br />

fiduciary duty in managing trusts<br />

established by <strong>the</strong>ir late grandfa<strong>the</strong>r and<br />

Atlanta physician, H. Cliff Sauls. Key to<br />

<strong>the</strong>ir argument was <strong>the</strong> bank’s longstanding<br />

relationship with The Coca-Cola Co., and<br />

its substantial holdings <strong>of</strong> Coca-Cola stock.<br />

Raymond D. Fortin, SunTrust Banks, Inc.<br />

Shaw and Hitz claimed SunTrust refused<br />

to act on numerous requests to diversify<br />

<strong>the</strong>ir stock portfolios—which were heavily<br />

invested in Coca-Cola stock—because it<br />

would negatively affect its own holdings.<br />

That refusal, <strong>the</strong>y argued, resulted in <strong>the</strong><br />

value <strong>of</strong> <strong>the</strong>ir trusts declining by more than<br />

50 percent after Coke stock hit a peak <strong>of</strong><br />

nearly $89 in 1998 and <strong>the</strong>n dropped to<br />

roughly $44 at <strong>the</strong> time <strong>of</strong> <strong>the</strong> lawsuit.<br />

SunTrust, on <strong>the</strong> o<strong>the</strong>r hand, argued it<br />

had made every effort to <strong>com</strong>ply. In 2000,<br />

it subdivided <strong>the</strong> original trust into<br />

multiple trusts representing Shaw and Hitz<br />

and two o<strong>the</strong>r beneficiaries, an aunt and<br />

Emory University. That increased each half<br />

bro<strong>the</strong>r’s annual distribution from about<br />

$75,000 to more than $230,000. But when<br />

<strong>the</strong> wrangling continued, <strong>the</strong> bank opted<br />

to resign as trustee.<br />

Photography by Stanley Leary<br />

L. Lin Wood, Powell Goldstein LLP<br />

06 www.martindale.<strong>com</strong>