2004 TAC Annual Report - Transport Accident Commission

2004 TAC Annual Report - Transport Accident Commission

2004 TAC Annual Report - Transport Accident Commission

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

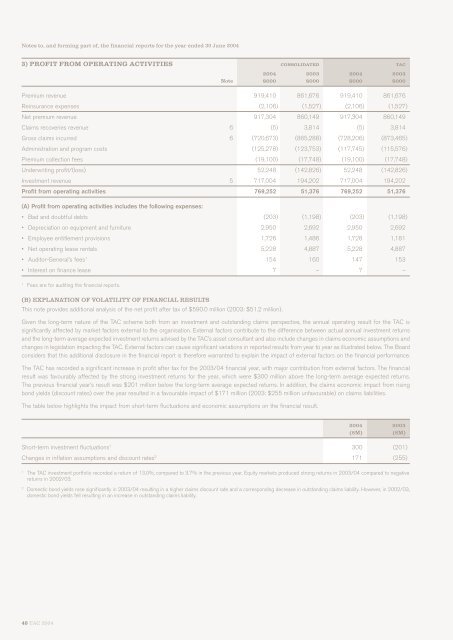

Notes to, and forming part of, the financial reports for the year ended 30 June <strong>2004</strong><br />

3) PROFIT FROM OPERATING ACTIVITIES CONSOLIDATED <strong>TAC</strong><br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Note $000 $000 $000 $000<br />

Premium revenue 919,410 861,676 919,410 861,676<br />

Reinsurance expenses (2,106) (1,527) (2,106) (1,527)<br />

Net premium revenue 917,304 860,149 917,304 860,149<br />

Claims recoveries revenue 6 (5) 3,814 (5) 3,814<br />

Gross claims incurred 6 (720,673) (865,288) (728,206) (873,465)<br />

Administration and program costs (125,278) (123,753) (117,745) (115,576)<br />

Premium collection fees (19,100) (17,748) (19,100) (17,748)<br />

Underwriting profit/(loss) 52,248 (142,826) 52,248 (142,826)<br />

Investment revenue 5 717,004 194,202 717,004 194,202<br />

Profit from operating activities 769,252 51,376 769,252 51,376<br />

(A) Profit from operating activities includes the following expenses:<br />

• Bad and doubtful debts (203) (1,198) (203) (1,198)<br />

• Depreciation on equipment and furniture 2,950 2,692 2,950 2,692<br />

• Employee entitlement provisions 1,726 1,486 1,728 1,181<br />

• Net operating lease rentals 5,228 4,887 5,228 4,887<br />

• Auditor-General’s fees 1 154 160 147 153<br />

• Interest on finance lease 7 – 7 –<br />

1<br />

Fees are for auditing the financial reports.<br />

(B) EXPLANATION OF VOLATILITY OF FINANCIAL RESULTS<br />

This note provides additional analysis of the net profit after tax of $590.0 million (2003: $51.2 million).<br />

Given the long-term nature of the <strong>TAC</strong> scheme both from an investment and outstanding claims perspective, the annual operating result for the <strong>TAC</strong> is<br />

significantly affected by market factors external to the organisation. External factors contribute to the difference between actual annual investment returns<br />

and the long-term average expected investment returns advised by the <strong>TAC</strong>’s asset consultant and also include changes in claims economic assumptions and<br />

changes in legislation impacting the <strong>TAC</strong>. External factors can cause significant variations in reported results from year to year as illustrated below. The Board<br />

considers that this additional disclosure in the financial report is therefore warranted to explain the impact of external factors on the financial performance.<br />

The <strong>TAC</strong> has recorded a significant increase in profit after tax for the 2003/04 financial year, with major contribution from external factors. The financial<br />

result was favourably affected by the strong investment returns for the year, which were $300 million above the long-term average expected returns.<br />

The previous financial year’s result was $201 million below the long-term average expected returns. In addition, the claims economic impact from rising<br />

bond yields (discount rates) over the year resulted in a favourable impact of $171 million (2003: $255 million unfavourable) on claims liabilities.<br />

The table below highlights the impact from short-term fluctuations and economic assumptions on the financial result.<br />

<strong>2004</strong> 2003<br />

($M)<br />

($M)<br />

Short-term investment fluctuations 1 300 (201)<br />

Changes in inflation assumptions and discount rates 2 171 (255)<br />

1<br />

The <strong>TAC</strong> investment portfolio recorded a return of 13.0%, compared to 3.7% in the previous year. Equity markets produced strong returns in 2003/04 compared to negative<br />

returns in 2002/03.<br />

2<br />

Domestic bond yields rose significantly in 2003/04 resulting in a higher claims discount rate and a corresponding decrease in outstanding claims liability. However, in 2002/03,<br />

domestic bond yields fell resulting in an increase in outstanding claims liability.<br />

40 <strong>TAC</strong> <strong>2004</strong>