Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

M&A <strong>Markets</strong> Overview<br />

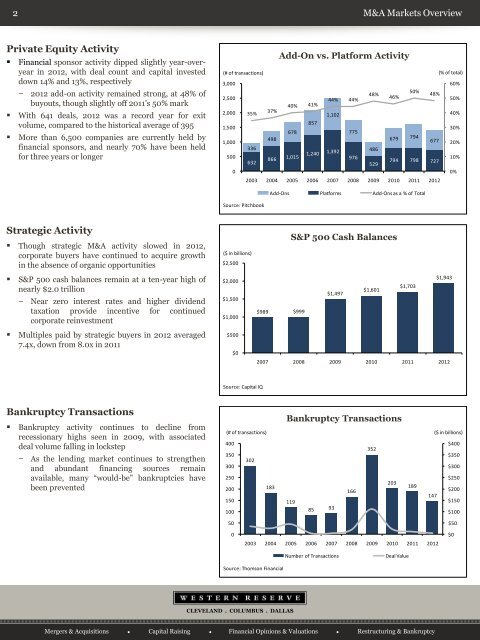

Private Equity Activity<br />

• Financial sponsor activity dipped slightly year-overyear<br />

in <strong>2012</strong>, with deal count and capital invested<br />

down 14% and 13%, respectively<br />

− <strong>2012</strong> add-on activity remained strong, at 48% of<br />

buyouts, though slightly off 2011’s 50% mark<br />

• With 641 deals, <strong>2012</strong> was a record year for exit<br />

volume, compared to the historical average of 395<br />

• More than 6,500 companies are currently held by<br />

financial sponsors, and nearly 70% have been held<br />

for three years or longer<br />

Add-On vs. Platform Activity<br />

(# of transactions) (% of total)<br />

3,000<br />

60%<br />

2,500<br />

50%<br />

48%<br />

44% 44%<br />

46%<br />

48%<br />

50%<br />

40% 41%<br />

2,000 35%<br />

37%<br />

1,102<br />

40%<br />

857<br />

1,500<br />

30%<br />

678<br />

775<br />

498<br />

679 794<br />

1,000<br />

677 20%<br />

500<br />

336<br />

1,240<br />

1,392<br />

486<br />

866<br />

1,015<br />

976<br />

632<br />

794 798 727<br />

529<br />

10%<br />

0<br />

0%<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

Add-Ons Platforms Add-Ons as a % of Total<br />

Source: Pitchbook<br />

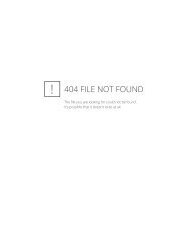

Strategic Activity<br />

• Though strategic M&A activity slowed in <strong>2012</strong>,<br />

corporate buyers have continued to acquire growth<br />

in the absence of organic opportunities<br />

($ in billions)<br />

$2,500<br />

S&P 500 Cash Balances<br />

• S&P 500 cash balances remain at a ten-year high of<br />

nearly $2.0 trillion<br />

−<br />

Near zero interest rates and higher dividend<br />

taxation provide incentive for continued<br />

corporate reinvestment<br />

$2,000<br />

$1,500<br />

$1,000<br />

$989 $999<br />

$1,497<br />

$1,601<br />

$1,703<br />

$1,943<br />

• Multiples paid by strategic buyers in <strong>2012</strong> averaged<br />

7.4x, down from 8.0x in 2011<br />

$500<br />

$0<br />

2007 2008 2009 2010 2011 <strong>2012</strong><br />

Source: <strong>Capital</strong> IQ<br />

Bankruptcy Transactions<br />

• Bankruptcy activity continues to decline from<br />

recessionary highs seen in 2009, with associated<br />

deal volume falling in lockstep<br />

−<br />

As the lending market continues to strengthen<br />

and abundant financing sources remain<br />

available, many “would-be” bankruptcies have<br />

been prevented<br />

Bankruptcy Transactions<br />

(# of transactions) ($ in billions)<br />

400<br />

$400<br />

352<br />

350<br />

$350<br />

302<br />

300<br />

$300<br />

250<br />

$250<br />

200<br />

183<br />

166<br />

203<br />

189<br />

147<br />

$200<br />

150<br />

119<br />

$150<br />

100<br />

85 93<br />

$100<br />

50<br />

0<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

$50<br />

$0<br />

Number of Transactions<br />

Deal Value<br />

Source: Thomson Financial<br />

CLEVELAND . COLUMBUS . DALLAS<br />

Mergers & Acquisitions ● <strong>Capital</strong> Raising ● Financial Opinions & Valuations ● Restructuring & Bankruptcy