Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Middle Market Update<br />

CLEVELAND ● COLUMBUS ● DALLAS<br />

www.wesrespartners.com<br />

Year-End | <strong>2012</strong><br />

Inside this issue:<br />

M&A <strong>Markets</strong><br />

Overview<br />

• Private Equity Activity<br />

• Strategic Activity<br />

• Bankruptcy Transactions<br />

<strong>Capital</strong> <strong>Markets</strong><br />

Overview<br />

• Equity & Debt Contributions<br />

• Senior Debt Trends<br />

• Subordinated Debt Trends<br />

Transaction in Focus<br />

• Recapitalization of The<br />

SpyGlass Group, Inc. by<br />

Crane Investment Company<br />

2<br />

3<br />

4<br />

<strong>Western</strong> <strong>Reserve</strong> provides M&A, capital<br />

raising and other financial advisory<br />

services to middle market companies<br />

across a focused set of industry<br />

verticals, including industrial, business<br />

services, consumer, healthcare,<br />

technology and real estate. With 35<br />

professionals in three offices (including<br />

affiliates), <strong>Western</strong> <strong>Reserve</strong> delivers<br />

thoughtful advice, keen market insight<br />

and superior execution to its clients,<br />

both nationally and internationally.<br />

<strong>Western</strong> <strong>Reserve</strong>’s managing directors<br />

average nearly 30 years of experience<br />

and have directly executed more than<br />

600 transactions throughout their<br />

careers.<br />

<strong>Western</strong> <strong>Reserve</strong> <strong>Partners</strong> <strong>LLC</strong> is a<br />

member of M&A International, the<br />

world’s largest alliance of investment<br />

banking firms, as well as World Services<br />

Group, a global consortium of middle<br />

market focused law firms and other<br />

advisors, which provides unparalleled<br />

access to global companies and<br />

investors. The firm is a FINRA-member<br />

broker / dealer and member of SIPC.<br />

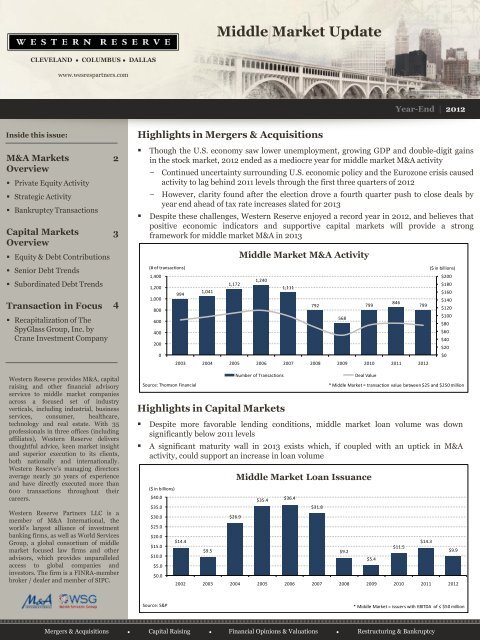

Highlights in Mergers & Acquisitions<br />

• Though the U.S. economy saw lower unemployment, growing GDP and double-digit gains<br />

in the stock market, <strong>2012</strong> ended as a mediocre year for middle market M&A activity<br />

− Continued uncertainty surrounding U.S. economic policy and the Eurozone crisis caused<br />

activity to lag behind 2011 levels through the first three quarters of <strong>2012</strong><br />

− However, clarity found after the election drove a fourth quarter push to close deals by<br />

year end ahead of tax rate increases slated for 2013<br />

• Despite these challenges, <strong>Western</strong> <strong>Reserve</strong> enjoyed a record year in <strong>2012</strong>, and believes that<br />

positive economic indicators and supportive capital markets will provide a strong<br />

framework for middle market M&A in 2013<br />

Highlights in <strong>Capital</strong> <strong>Markets</strong><br />

Middle Market M&A Activity<br />

(# of transactions) ($ in billions)<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

994<br />

Source: Thomson Financial<br />

1,041<br />

1,172<br />

1,240<br />

1,111<br />

• Despite more favorable lending conditions, middle market loan volume was down<br />

significantly below 2011 levels<br />

• A significant maturity wall in 2013 exists which, if coupled with an uptick in M&A<br />

activity, could support an increase in loan volume<br />

($ in billions)<br />

$40.0<br />

$35.0<br />

$30.0<br />

$25.0<br />

$20.0<br />

$15.0<br />

$10.0<br />

$5.0<br />

$0.0<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

$14.4<br />

$9.5<br />

$26.9<br />

Number of Transactions<br />

792<br />

568<br />

Middle Market Loan Issuance<br />

$35.4<br />

$36.4<br />

$31.8<br />

799<br />

Deal Value<br />

846<br />

799<br />

$200<br />

$180<br />

$160<br />

$140<br />

$120<br />

$100<br />

$80<br />

$60<br />

$40<br />

$20<br />

* Middle Market = transaction value between $25 and $250 million<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

$9.2<br />

$5.4<br />

$11.5<br />

$14.3<br />

$0<br />

$9.9<br />

Source: S&P<br />

* Middle Market = issuers with EBITDA of ≤ $50 million<br />

Mergers & Acquisitions ● <strong>Capital</strong> Raising ● Financial Opinions & Valuations ● Restructuring & Bankruptcy

2<br />

M&A <strong>Markets</strong> Overview<br />

Private Equity Activity<br />

• Financial sponsor activity dipped slightly year-overyear<br />

in <strong>2012</strong>, with deal count and capital invested<br />

down 14% and 13%, respectively<br />

− <strong>2012</strong> add-on activity remained strong, at 48% of<br />

buyouts, though slightly off 2011’s 50% mark<br />

• With 641 deals, <strong>2012</strong> was a record year for exit<br />

volume, compared to the historical average of 395<br />

• More than 6,500 companies are currently held by<br />

financial sponsors, and nearly 70% have been held<br />

for three years or longer<br />

Add-On vs. Platform Activity<br />

(# of transactions) (% of total)<br />

3,000<br />

60%<br />

2,500<br />

50%<br />

48%<br />

44% 44%<br />

46%<br />

48%<br />

50%<br />

40% 41%<br />

2,000 35%<br />

37%<br />

1,102<br />

40%<br />

857<br />

1,500<br />

30%<br />

678<br />

775<br />

498<br />

679 794<br />

1,000<br />

677 20%<br />

500<br />

336<br />

1,240<br />

1,392<br />

486<br />

866<br />

1,015<br />

976<br />

632<br />

794 798 727<br />

529<br />

10%<br />

0<br />

0%<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

Add-Ons Platforms Add-Ons as a % of Total<br />

Source: Pitchbook<br />

Strategic Activity<br />

• Though strategic M&A activity slowed in <strong>2012</strong>,<br />

corporate buyers have continued to acquire growth<br />

in the absence of organic opportunities<br />

($ in billions)<br />

$2,500<br />

S&P 500 Cash Balances<br />

• S&P 500 cash balances remain at a ten-year high of<br />

nearly $2.0 trillion<br />

−<br />

Near zero interest rates and higher dividend<br />

taxation provide incentive for continued<br />

corporate reinvestment<br />

$2,000<br />

$1,500<br />

$1,000<br />

$989 $999<br />

$1,497<br />

$1,601<br />

$1,703<br />

$1,943<br />

• Multiples paid by strategic buyers in <strong>2012</strong> averaged<br />

7.4x, down from 8.0x in 2011<br />

$500<br />

$0<br />

2007 2008 2009 2010 2011 <strong>2012</strong><br />

Source: <strong>Capital</strong> IQ<br />

Bankruptcy Transactions<br />

• Bankruptcy activity continues to decline from<br />

recessionary highs seen in 2009, with associated<br />

deal volume falling in lockstep<br />

−<br />

As the lending market continues to strengthen<br />

and abundant financing sources remain<br />

available, many “would-be” bankruptcies have<br />

been prevented<br />

Bankruptcy Transactions<br />

(# of transactions) ($ in billions)<br />

400<br />

$400<br />

352<br />

350<br />

$350<br />

302<br />

300<br />

$300<br />

250<br />

$250<br />

200<br />

183<br />

166<br />

203<br />

189<br />

147<br />

$200<br />

150<br />

119<br />

$150<br />

100<br />

85 93<br />

$100<br />

50<br />

0<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 <strong>2012</strong><br />

$50<br />

$0<br />

Number of Transactions<br />

Deal Value<br />

Source: Thomson Financial<br />

CLEVELAND . COLUMBUS . DALLAS<br />

Mergers & Acquisitions ● <strong>Capital</strong> Raising ● Financial Opinions & Valuations ● Restructuring & Bankruptcy

<strong>Capital</strong> <strong>Markets</strong> Overview<br />

3<br />

Equity & Debt Contributions<br />

• In <strong>2012</strong>, average debt multiples held steady around<br />

3.5x EBITDA, demonstrating continued availability<br />

of leverage for middle market LBOs<br />

• Overall equity continues to comprise just below 50%<br />

of the average capital structure<br />

−<br />

Rising valuations in <strong>2012</strong> led to a slight increase<br />

in equity share over 2011 levels; however, this is<br />

still below the 50%+ equity contributions seen in<br />

2009 and 2010<br />

4.0x<br />

3.5x<br />

3.0x<br />

2.5x<br />

2.0x<br />

1.5x<br />

1.0x<br />

0.5x<br />

0.0x<br />

Middle Market* LBO Debt Multiples<br />

3.3x<br />

3.4x 3.4x<br />

3.0x<br />

2.8x<br />

1.0x<br />

1.0x 1.0x<br />

0.7x<br />

1.0x<br />

2.3x<br />

2.3x 2.4x 2.4x<br />

1.8x<br />

2008 2009 2010 2011 <strong>2012</strong><br />

Sub Debt<br />

Senior Debt<br />

Source: GF Data<br />

*Middle Market = transaction enterprise value between $10 and $250 million<br />

Senior Debt Trends<br />

• Senior debt comprised 37% of the average capital<br />

structure in <strong>2012</strong>, or 2.4x EBITDA<br />

• As of December 31, the 90-day LIBOR base rate was<br />

.31%, down from .36% on September 30<br />

• Senior debt spreads hovered between 5.3% and 5.6%<br />

throughout <strong>2012</strong><br />

8.0%<br />

7.5%<br />

7.0%<br />

6.5%<br />

6.0%<br />

5.5%<br />

5.0%<br />

4.5%<br />

4.0%<br />

3.5%<br />

3.0%<br />

Middle Market* LBO Senior Debt Pricing<br />

5.9%<br />

5.6%<br />

5.4% 5.3%<br />

5.6% 5.4%<br />

4.8%<br />

Q2'11 Q3'11 <strong>Q4</strong>'11 Q1'12 Q2'12 Q3'12 <strong>Q4</strong>'12<br />

Overall $10 - $25 million $25 - $50 million<br />

$50 - $100 million $100 - $250 million<br />

Source: GF Data<br />

*Middle Market = transaction enterprise value between $10 and $250 million<br />

Subordinated Debt Trends<br />

• Sub debt comprised 16% of the average capital<br />

structure in <strong>2012</strong>, or 1.0x EBITDA<br />

• In <strong>Q4</strong>’12, sub debt coupons remained relatively<br />

consistent with previous quarters, averaging 12.7%<br />

• Payment-in-kind (“PIK”) interest averages ranged<br />

from 2.4% to 4.5% throughout <strong>2012</strong><br />

−<br />

75% of deals with junior capital in <strong>Q4</strong>’12 featured<br />

PIK interest<br />

20.0%<br />

18.0%<br />

16.0%<br />

14.0%<br />

12.0%<br />

10.0%<br />

8.0%<br />

6.0%<br />

4.0%<br />

2.0%<br />

0.0%<br />

Middle Market* LBO Sub Debt Pricing<br />

17.3%<br />

17.3%<br />

16.1%<br />

14.8% 14.7%<br />

15.2%<br />

15.7%<br />

15.1%<br />

3.9%<br />

4.8%<br />

4.5%<br />

2.4% 2.2% 2.4%<br />

3.1% 2.4%<br />

12.2% 12.5% 12.4% 12.5% 12.8% 12.8% 12.6% 12.7%<br />

Q1'11 Q2'11 Q3'11 <strong>Q4</strong>'11 Q1'12 Q2'12 Q3'12 <strong>Q4</strong>'12<br />

PIK Interest<br />

Coupon Pricing<br />

Source: GF Data<br />

*Middle Market = transaction enterprise value between $10 and $250 million<br />

CLEVELAND . COLUMBUS . DALLAS<br />

Mergers & Acquisitions ● <strong>Capital</strong> Raising ● Financial Opinions & Valuations ● Restructuring & Bankruptcy

Transaction in Focus | The SpyGlass Group, Inc.<br />

4<br />

has been recapitalized<br />

The Ready-Mix Assets and Eastern<br />

Cement Corporation of<br />

have been acquired by<br />

a division of<br />

CRH plc<br />

The Assets of<br />

Schwab Materials, Inc.<br />

have been acquired by<br />

has sold its<br />

Construction and<br />

Engineering<br />

Services Division to<br />

John A. Martell<br />

and<br />

Bonnie M. Martell<br />

Fairness Opinion to the<br />

Board of Directors<br />

has been recapitalized<br />

December <strong>2012</strong><br />

has been acquired by<br />

Dan T. Moore<br />

Company, Inc.<br />

has acquired<br />

has completed a reverse<br />

stock split<br />

Fairness Opinion<br />

has been acquired by<br />

a portfolio company of<br />

A portfolio company of<br />

has been acquired by<br />

a portfolio company of<br />

has been acquired by<br />

he David J. Joseph Company<br />

a wholly owned subsidiary of<br />

has been acquired by<br />

has been acquired by<br />

Series C Redeemable<br />

Convertible Participating<br />

Preferred Stock<br />

has been recapitalized by an investor<br />

group led by Crane Investment Company<br />

Bankruptcy Estate of<br />

Driggs Farms of Indiana,<br />

Inc.<br />

a portfolio company of<br />

has been acquired by<br />

has been recapitalized by<br />

has been recapitalized by<br />

Land-O-Sun Dairies, <strong>LLC</strong><br />

an affiliate of Dean Foods<br />

Valuation Services<br />

a member of the<br />

has acquired<br />

<strong>Partners</strong> in<br />

Plastics, Inc.<br />

a division of<br />

has been acquired by<br />

has been acquired by<br />

and<br />

Members of Managemen<br />

has been acquired by<br />

Senior Credit Facility<br />

has been recapitalized by<br />

has been acquired by<br />

The undersigned acted as exclusive financial advisor<br />

to The has SpyGlass been acquired by Group, Inc. in this transaction<br />

has been acquired by<br />

has been recapitalized b<br />

Bill Burke<br />

and<br />

Members of Management<br />

a portfolio company of<br />

Fairness Opinion<br />

Financial Opinion<br />

Financial Advisory<br />

Services<br />

and<br />

portfolio company of<br />

has been acquired by<br />

and<br />

mbers of Management<br />

has been recapitalized by<br />

an investor group led by<br />

Crane Investment Company<br />

has been acquired by<br />

has been acquired by<br />

Fairness Opinion<br />

has been<br />

reorganized by<br />

Timeshare<br />

Acquisitions <strong>LLC</strong><br />

and<br />

have formed an Equity<br />

Joint Venture<br />

has been acquired by<br />

a portfolio company of<br />

has been acquired by<br />

a portfolio company of<br />

has been recapitalized by<br />

and<br />

a portfolio company of<br />

Valuation Services<br />

s been reorganized by<br />

Artemiss, <strong>LLC</strong><br />

an affiliate of<br />

a portfolio company of<br />

Company Overview<br />

has been acquired by<br />

has sold its<br />

Cephalosporin<br />

Finishing Facility to<br />

has been acquired by<br />

funds managed by<br />

Oaktree <strong>Capital</strong><br />

Management, L.P.<br />

a portfolio company of<br />

has been acquired by<br />

a portfolio company of<br />

has been acquired by<br />

<strong>Partners</strong> in Plastics, Inc.<br />

has been acquired by<br />

an Affiliate of<br />

has been acquired by<br />

has sold its coupon<br />

redemption operations t<br />

SpyGlass is a leading provider of niche telecommunications expense management services. Headquartered in Westlake, Ohio, the Company’s<br />

services include audit and implementation of telecom expense savings opportunities such as recovery of funds paid in error, elimination of<br />

unnecessary services and improvement of provider cost structures. SpyGlass serves a diverse range of customers, including private sector businesses<br />

of all sizes, government agencies, educational institutions and healthcare facilities.<br />

a portfolio company a portfolio of Marlin company<br />

Equity P<br />

of Marlin Equity Partner<br />

Transaction Overview<br />

<strong>Western</strong> <strong>Reserve</strong> <strong>Partners</strong> served as the exclusive investment banker to The SpyGlass Group, Inc. in its recapitalization by an investor group led by<br />

Crane Investment Company. Co-Chief Executive Officers Bradley Clark and Edward DeAngelo remained significant shareholders in the company<br />

and continued to serve in the same capacity along with the existing management team.<br />

Of SpyGlass’ new business partner, co-founder/CEO Ed DeAngelo said, “Our team is thrilled to be partnering with Crane Investment Company as<br />

we continue to invest in the business and execute our long term growth strategy.”<br />

Commenting on <strong>Western</strong> <strong>Reserve</strong>, co-founder/CEO Brad Clark said, “<strong>Western</strong> <strong>Reserve</strong>’s assistance and advice were critical in finding the right<br />

partner and navigating through the process. Their team’s expertise, responsiveness, perseverance and creativity allowed us to achieve a very<br />

favorable outcome for the company, our employees and our customers.”<br />

has been<br />

recapitalized by<br />

Contacts<br />

Charles V. Aquino<br />

Managing Director<br />

216.589.9534<br />

caquino@wesrespartners.com<br />

Victor F. Faris<br />

Managing Director<br />

216.589.9531<br />

vfaris@wesrespartners.com<br />

David P. Mariano<br />

Director<br />

216.574.2108<br />

dmariano@wesrespartners.com<br />

This story<br />

Joseph<br />

can fit<br />

G.<br />

75-125<br />

Carson<br />

words. Managing Director<br />

216.589.9534<br />

jcarson@wesrespartners.com<br />

Selecting pictures or<br />

graphics is Mark an important<br />

A. Filippell<br />

part of adding<br />

Managing<br />

content<br />

Director<br />

to<br />

216.589.9532<br />

your newsletter.<br />

mfilippell@wesrespartners.com<br />

Think about Kevin your J. Mayer article and<br />

Director<br />

ask yourself<br />

216.574.2117<br />

if the picture<br />

supports kmayer@wesrespartners.com<br />

or enhances the<br />

message you’re Rebecca trying L. White to<br />

Director<br />

convey. Avoid selecting<br />

216.574.2109<br />

images that rwhite@wesrespartners.com<br />

appear to be out<br />

of context.<br />

thousands<br />

Ralph M. Della<br />

of clip<br />

Ratta<br />

art images<br />

from Managing which Director you can choose<br />

216.589.9557<br />

rdellaratta@wesrespartners.com<br />

and import into your<br />

newsletter. There are also<br />

William E. Goodill<br />

several Chief Financial tools you Officer can use to<br />

216.574.2100<br />

draw shapes and symbols.<br />

wgoodill@wesrespartners.com<br />

Once Matthew you have J. Mueller chosen an<br />

image, place Director it close to the<br />

216.574.2103<br />

mmueller@wesrespartners.com<br />

article. Be sure to place the<br />

caption<br />

Justin<br />

of<br />

A.<br />

the<br />

Wolfort<br />

image near<br />

the image. Director<br />

216.574-2105<br />

jwolfort@wesrespartners.com<br />

David D. Dunstan<br />

Managing Director<br />

216.589.9530<br />

ddunstan@wesrespartners.com<br />

Kenneth A. Hirsch<br />

Managing Director<br />

214.459.3322<br />

khirsch@wesrespartners.com<br />

Kevin M. White<br />

Director<br />

216.589.9536<br />

kwhite@wesrespartners.com<br />

This newsletter is published solely for the general information of clients and friends of <strong>Western</strong> <strong>Reserve</strong> <strong>Partners</strong> <strong>LLC</strong>. Information contained in this publication is based on data obtained from<br />

sources we deem to be reliable; however, we do not guarantee or represent that it accurate or complete, and it should not be relied upon as such. Opinions expressed are our current opinions<br />

Microsoft Publisher includes<br />

as of the date appearing on this material only. This material should not be read as advice or recommendations, and we are not soliciting any action based upon receipt of this information.<br />

Nothing in this publication is intended to be an offer to buy or sell or the solicitation of an offer to buy or sell any specific security or company. The testimonials presented are applicable to the<br />

individuals depicted and may not be representative of the experience of others. The testimonials are not paid and are not indicative of future performance or success.<br />

Mergers & Acquisitions ● <strong>Capital</strong> Raising ● Financial Opinions & Valuations ● Restructuring & Bankruptcy