Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

Q4 2012 Capital Markets Newsletter - Western Reserve Partners LLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

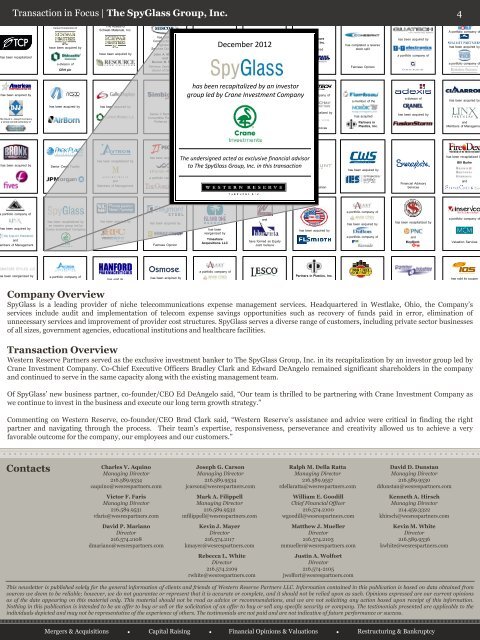

Transaction in Focus | The SpyGlass Group, Inc.<br />

4<br />

has been recapitalized<br />

The Ready-Mix Assets and Eastern<br />

Cement Corporation of<br />

have been acquired by<br />

a division of<br />

CRH plc<br />

The Assets of<br />

Schwab Materials, Inc.<br />

have been acquired by<br />

has sold its<br />

Construction and<br />

Engineering<br />

Services Division to<br />

John A. Martell<br />

and<br />

Bonnie M. Martell<br />

Fairness Opinion to the<br />

Board of Directors<br />

has been recapitalized<br />

December <strong>2012</strong><br />

has been acquired by<br />

Dan T. Moore<br />

Company, Inc.<br />

has acquired<br />

has completed a reverse<br />

stock split<br />

Fairness Opinion<br />

has been acquired by<br />

a portfolio company of<br />

A portfolio company of<br />

has been acquired by<br />

a portfolio company of<br />

has been acquired by<br />

he David J. Joseph Company<br />

a wholly owned subsidiary of<br />

has been acquired by<br />

has been acquired by<br />

Series C Redeemable<br />

Convertible Participating<br />

Preferred Stock<br />

has been recapitalized by an investor<br />

group led by Crane Investment Company<br />

Bankruptcy Estate of<br />

Driggs Farms of Indiana,<br />

Inc.<br />

a portfolio company of<br />

has been acquired by<br />

has been recapitalized by<br />

has been recapitalized by<br />

Land-O-Sun Dairies, <strong>LLC</strong><br />

an affiliate of Dean Foods<br />

Valuation Services<br />

a member of the<br />

has acquired<br />

<strong>Partners</strong> in<br />

Plastics, Inc.<br />

a division of<br />

has been acquired by<br />

has been acquired by<br />

and<br />

Members of Managemen<br />

has been acquired by<br />

Senior Credit Facility<br />

has been recapitalized by<br />

has been acquired by<br />

The undersigned acted as exclusive financial advisor<br />

to The has SpyGlass been acquired by Group, Inc. in this transaction<br />

has been acquired by<br />

has been recapitalized b<br />

Bill Burke<br />

and<br />

Members of Management<br />

a portfolio company of<br />

Fairness Opinion<br />

Financial Opinion<br />

Financial Advisory<br />

Services<br />

and<br />

portfolio company of<br />

has been acquired by<br />

and<br />

mbers of Management<br />

has been recapitalized by<br />

an investor group led by<br />

Crane Investment Company<br />

has been acquired by<br />

has been acquired by<br />

Fairness Opinion<br />

has been<br />

reorganized by<br />

Timeshare<br />

Acquisitions <strong>LLC</strong><br />

and<br />

have formed an Equity<br />

Joint Venture<br />

has been acquired by<br />

a portfolio company of<br />

has been acquired by<br />

a portfolio company of<br />

has been recapitalized by<br />

and<br />

a portfolio company of<br />

Valuation Services<br />

s been reorganized by<br />

Artemiss, <strong>LLC</strong><br />

an affiliate of<br />

a portfolio company of<br />

Company Overview<br />

has been acquired by<br />

has sold its<br />

Cephalosporin<br />

Finishing Facility to<br />

has been acquired by<br />

funds managed by<br />

Oaktree <strong>Capital</strong><br />

Management, L.P.<br />

a portfolio company of<br />

has been acquired by<br />

a portfolio company of<br />

has been acquired by<br />

<strong>Partners</strong> in Plastics, Inc.<br />

has been acquired by<br />

an Affiliate of<br />

has been acquired by<br />

has sold its coupon<br />

redemption operations t<br />

SpyGlass is a leading provider of niche telecommunications expense management services. Headquartered in Westlake, Ohio, the Company’s<br />

services include audit and implementation of telecom expense savings opportunities such as recovery of funds paid in error, elimination of<br />

unnecessary services and improvement of provider cost structures. SpyGlass serves a diverse range of customers, including private sector businesses<br />

of all sizes, government agencies, educational institutions and healthcare facilities.<br />

a portfolio company a portfolio of Marlin company<br />

Equity P<br />

of Marlin Equity Partner<br />

Transaction Overview<br />

<strong>Western</strong> <strong>Reserve</strong> <strong>Partners</strong> served as the exclusive investment banker to The SpyGlass Group, Inc. in its recapitalization by an investor group led by<br />

Crane Investment Company. Co-Chief Executive Officers Bradley Clark and Edward DeAngelo remained significant shareholders in the company<br />

and continued to serve in the same capacity along with the existing management team.<br />

Of SpyGlass’ new business partner, co-founder/CEO Ed DeAngelo said, “Our team is thrilled to be partnering with Crane Investment Company as<br />

we continue to invest in the business and execute our long term growth strategy.”<br />

Commenting on <strong>Western</strong> <strong>Reserve</strong>, co-founder/CEO Brad Clark said, “<strong>Western</strong> <strong>Reserve</strong>’s assistance and advice were critical in finding the right<br />

partner and navigating through the process. Their team’s expertise, responsiveness, perseverance and creativity allowed us to achieve a very<br />

favorable outcome for the company, our employees and our customers.”<br />

has been<br />

recapitalized by<br />

Contacts<br />

Charles V. Aquino<br />

Managing Director<br />

216.589.9534<br />

caquino@wesrespartners.com<br />

Victor F. Faris<br />

Managing Director<br />

216.589.9531<br />

vfaris@wesrespartners.com<br />

David P. Mariano<br />

Director<br />

216.574.2108<br />

dmariano@wesrespartners.com<br />

This story<br />

Joseph<br />

can fit<br />

G.<br />

75-125<br />

Carson<br />

words. Managing Director<br />

216.589.9534<br />

jcarson@wesrespartners.com<br />

Selecting pictures or<br />

graphics is Mark an important<br />

A. Filippell<br />

part of adding<br />

Managing<br />

content<br />

Director<br />

to<br />

216.589.9532<br />

your newsletter.<br />

mfilippell@wesrespartners.com<br />

Think about Kevin your J. Mayer article and<br />

Director<br />

ask yourself<br />

216.574.2117<br />

if the picture<br />

supports kmayer@wesrespartners.com<br />

or enhances the<br />

message you’re Rebecca trying L. White to<br />

Director<br />

convey. Avoid selecting<br />

216.574.2109<br />

images that rwhite@wesrespartners.com<br />

appear to be out<br />

of context.<br />

thousands<br />

Ralph M. Della<br />

of clip<br />

Ratta<br />

art images<br />

from Managing which Director you can choose<br />

216.589.9557<br />

rdellaratta@wesrespartners.com<br />

and import into your<br />

newsletter. There are also<br />

William E. Goodill<br />

several Chief Financial tools you Officer can use to<br />

216.574.2100<br />

draw shapes and symbols.<br />

wgoodill@wesrespartners.com<br />

Once Matthew you have J. Mueller chosen an<br />

image, place Director it close to the<br />

216.574.2103<br />

mmueller@wesrespartners.com<br />

article. Be sure to place the<br />

caption<br />

Justin<br />

of<br />

A.<br />

the<br />

Wolfort<br />

image near<br />

the image. Director<br />

216.574-2105<br />

jwolfort@wesrespartners.com<br />

David D. Dunstan<br />

Managing Director<br />

216.589.9530<br />

ddunstan@wesrespartners.com<br />

Kenneth A. Hirsch<br />

Managing Director<br />

214.459.3322<br />

khirsch@wesrespartners.com<br />

Kevin M. White<br />

Director<br />

216.589.9536<br />

kwhite@wesrespartners.com<br />

This newsletter is published solely for the general information of clients and friends of <strong>Western</strong> <strong>Reserve</strong> <strong>Partners</strong> <strong>LLC</strong>. Information contained in this publication is based on data obtained from<br />

sources we deem to be reliable; however, we do not guarantee or represent that it accurate or complete, and it should not be relied upon as such. Opinions expressed are our current opinions<br />

Microsoft Publisher includes<br />

as of the date appearing on this material only. This material should not be read as advice or recommendations, and we are not soliciting any action based upon receipt of this information.<br />

Nothing in this publication is intended to be an offer to buy or sell or the solicitation of an offer to buy or sell any specific security or company. The testimonials presented are applicable to the<br />

individuals depicted and may not be representative of the experience of others. The testimonials are not paid and are not indicative of future performance or success.<br />

Mergers & Acquisitions ● <strong>Capital</strong> Raising ● Financial Opinions & Valuations ● Restructuring & Bankruptcy