Cannon Equity Fund Factsheet - Cannon Asset Managers

Cannon Equity Fund Factsheet - Cannon Asset Managers

Cannon Equity Fund Factsheet - Cannon Asset Managers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CANNON EQUITY FUND<br />

FEBRUARY 2011<br />

CONTACT: Doug Turvey & Bella Shongwe +27-11-463-3140 unittrusts@cannonassets.co.za<br />

INVESTMENT OBJECTIVES<br />

The <strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong> aims to deliver sustainable growth in capital<br />

through exposure to listed equities over a three-to-five year investment<br />

horizon. Recognising the relatively long-term horizon, we endeavour to<br />

outperform the JSE’s All Share Index (ALSI) on a rolling basis and, in so<br />

doing, deliver returns that ensure real growth in investors’ wealth. The<br />

portfolio manager does not make use of gearing or derivative instruments to<br />

achieve the investment objective. <strong>Asset</strong> class risk must be managed by<br />

investors outside of the fund.<br />

INVESTMENT COMMENT<br />

With the first month of the new year out of the way, volumes picked up over<br />

the course of February and the FTSE-JSE All Share Index made up for the lost<br />

ground over January by returning 2.8 percent. The <strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong><br />

returned 2.6 percent. This slight underperformance is largely attributable to<br />

our overweight exposure to the construction sector, where we continue to see<br />

deep value in this unloved sector, especially amongst some of the higher<br />

quality businesses, including Aveng and Group 5. The political unrest in the<br />

Middle East and North African regions proved to be a positive influence on<br />

portfolio performance as the oil and gas sector was the top performing sector<br />

over February. This was driven chiefly by Sasol, which has a high weight in<br />

our investment portfolio and which returned 9.8 percent over the month.<br />

As the market continues in this upward trend a frequent question that is<br />

currently been raised is whether local equities remain the most prudent asset<br />

class to invest in?<br />

There are numerous methods for assessing the current valuation of a market.<br />

One such commonly used method is the price earnings (PE) ratio. A problem<br />

with the simple PE ratio, however, is that it is overly reliant on near term<br />

events, such as the current phase of the economic cycle, because the E part is<br />

determined only by recent earnings. For this reason we use a cyclically<br />

adjusted PE ratio which inflates earnings over the past 5 to 10 years to<br />

today’s prices, giving a cyclically adjusted earnings figure in the calculation<br />

of the PE ratio. Based on this valuation method, we are of the view that the<br />

local market is fairly valued, and hence opportunities for the active stock<br />

picker remain.<br />

PERFORMANCE METRICS<br />

<strong>Fund</strong> Benchmark<br />

Return Since Inception (% cumulative)<br />

Return Since Inception (% annualised)<br />

144.05<br />

17.06<br />

163.18<br />

18.59<br />

High Water Mark (cpu) 246.73 269.82<br />

Low Water Mark (cpu) 98.78 100.00<br />

% of Positive Months 64.18 62.69<br />

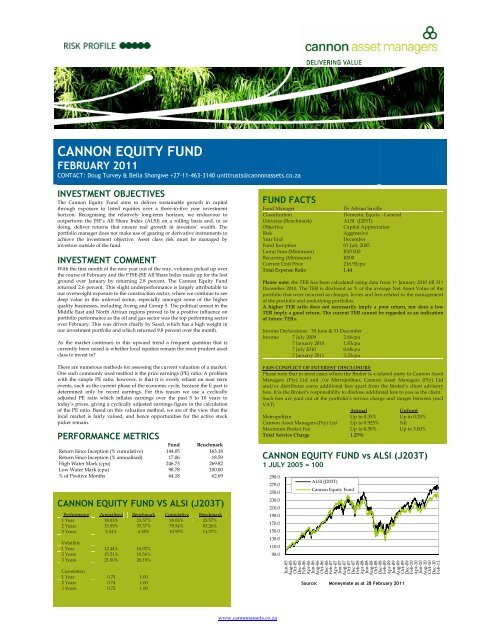

CANNON EQUITY FUND VS ALSI (J203T)<br />

Performance Annualised Benchmark Cumulative Benchmark<br />

1 Year 18.03% 23.57% 18.03% 23.57%<br />

2 Years<br />

3 Years<br />

33.99%<br />

3.54%<br />

35.37%<br />

4.58%<br />

79.54%<br />

10.99%<br />

83.26%<br />

14.37%<br />

Volatility<br />

1 Year 12.44% 16.92%<br />

2 Years<br />

3 Years<br />

15.51%<br />

21.00%<br />

19.36%<br />

26.19%<br />

Correlation<br />

1 Year 0.75 1.00<br />

2 Years<br />

3 Years<br />

0.74<br />

0.72<br />

1.00<br />

1.00<br />

FUND FACTS<br />

<strong>Fund</strong> Manager<br />

Dr Adrian Saville<br />

Classification<br />

Domestic <strong>Equity</strong> - General<br />

Universe (Benchmark)<br />

ALSI (J203T)<br />

Objective<br />

Capital Appreciation<br />

Risk<br />

Aggressive<br />

Year End<br />

December<br />

<strong>Fund</strong> Inception 01 July 2005<br />

Lump Sum (Minimum) R10 000<br />

Recurring (Minimum)<br />

R500<br />

Current Unit Price<br />

216.92cpu<br />

Total Expense Ratio 1.44<br />

Please note: the TER has been calculated using data from 1 st January 2010 till 31 st<br />

December 2010. The TER is disclosed as % of the average Net <strong>Asset</strong> Value of the<br />

portfolio that were incurred as charges, levies and fees related to the management<br />

of the portfolio and underlying portfolios.<br />

A higher TER ratio does not necessarily imply a poor return, nor does a low<br />

TER imply a good return. The current TER cannot be regarded as an indication<br />

of future TERs.<br />

Income Declarations 30 June & 31 December<br />

Income 7 July 2009 2.66cpu<br />

7 January 2010 1.83cpu<br />

7 July 2010 0.68cpu<br />

7 January 2011 2.25cpu<br />

FAIS CONFLICT OF INTEREST DISCLOSURE<br />

Please note that in most cases where the Broker is a related party to <strong>Cannon</strong> <strong>Asset</strong><br />

<strong>Managers</strong> (Pty) Ltd and /or Metropolitan, <strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong> (Pty) Ltd<br />

and/or distributor earns additional fees apart from the Broker’s client advisory<br />

fees. It is the Broker’s responsibility to disclose additional fees to you as the client.<br />

Such fees are paid out of the portfolio’s service charge and ranges between (excl<br />

VAT)<br />

Annual<br />

Upfront<br />

Metropolitan Up to 0.35% Up to 0.25%<br />

<strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong> (Pty) Ltd Up to 0.925% Nil<br />

Maximum Broker Fee Up to 0.50% Up to 3.00%<br />

Total Service Charge 1.25%<br />

CANNON EQUITY FUND vs ALSI (J203T)<br />

1 JULY 2005 = 100<br />

290.0<br />

270.0<br />

250.0<br />

230.0<br />

210.0<br />

190.0<br />

170.0<br />

150.0<br />

130.0<br />

110.0<br />

90.0<br />

ALSI (J203T)<br />

<strong>Cannon</strong> <strong>Equity</strong> <strong>Fund</strong><br />

Jun-05<br />

Aug-05<br />

Oct-05<br />

Dec-05<br />

Feb-06<br />

Apr-06<br />

Jun-06<br />

Aug-06<br />

Oct-06<br />

Dec-06<br />

Feb-07<br />

Apr-07<br />

Jun-07<br />

Aug-07<br />

Oct-07<br />

Dec-07<br />

Feb-08<br />

Apr-08<br />

Jun-08<br />

Aug-08<br />

Oct-08<br />

Dec-08<br />

Feb-09<br />

Apr-09<br />

Jun-09<br />

Aug-09<br />

Oct-09<br />

Dec-09<br />

Feb-10<br />

Apr-10<br />

Jun-10<br />

Aug-10<br />

Oct-10<br />

Dec-10<br />

Feb-11<br />

Source: Moneymate as at 28 February 2011<br />

www.cannonassets.co.za

CANNON EQUITY FUND<br />

FEBRUARY 2011<br />

CONTACT: Doug Turvey & Bella Shongwe +27-11-463-3140 unittrusts@cannonassets.co.za<br />

SECTOR ALLOCATION<br />

TOP TEN HOLDINGS<br />

Basic Materials<br />

Financials<br />

Industrials<br />

Oil & Gas<br />

Consumer Goods<br />

Technology<br />

Consumer Services<br />

Telecommunications<br />

15.07<br />

10.22<br />

8.32<br />

6.72<br />

3.26<br />

2.05<br />

22.48<br />

31.21<br />

Anglo American Plc 12.62<br />

Sasol Ltd 10.22<br />

Old Mutual Plc 5.67<br />

Steinhoff Int Hld Ltd 4.97<br />

ArcelorMittal SA Ltd 4.25<br />

AECI Limited 4.10<br />

Grindrod Limited 3.57<br />

Aveng Limited 3.47<br />

Assore Limited 3.42<br />

Lewis Group Limited 3.25<br />

TOTAL 55.55<br />

Cash<br />

0.67<br />

ADMINISTRATION<br />

If your complaint has not been resolved to your<br />

satisfaction, kindly contact our Complaints<br />

Resolution Committee: Tel: (021) 940 5880,<br />

Fax:(021) 940 6205<br />

Email: emoruck@metropolitan.co.za or metunit@metropolitan.co.za<br />

Custodian: Standard Executors & Trustees: Tel (021) 401-2286. Metropolitan Collective<br />

Investments Limited PO Box 925 Bellville 7535 Tel (021) 940-5981 Fax (021) 940-5885 Call<br />

Centre, Tel: 0860 100 279 Registration No 1991/03741/06<br />

Collective Investments are generally medium to long term investments. The<br />

value of participating interests may go down as well as up and past<br />

performance is not necessarily a guide to the future. Collective Investments are<br />

traded at ruling prices and can engage in scrip lending. Forward pricing is<br />

used. A schedule of fees and charges and maximum commissions is available<br />

on request from <strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong>. Commission and incentives may be<br />

paid and if so, are included in the overall cost. This fund may be closed to new<br />

investors. Graphs and performance figures are sourced from MoneyMate for<br />

lump sum investments including income distribution, at NAV to NAV basis<br />

and do not take any initial fees into account. Income is reinvested on the exdividend<br />

date. Actual investment performance will differ based on the initial<br />

fees applicable, the actual investment date and the date of reinvestment of<br />

income. Collective Investment prices are calculated on a net asset value basis<br />

and auditor’s fees, bank charges and trustee fees are levied against the<br />

portfolio. The portfolio manager may borrow up to 10% of portfolio NAV to<br />

bridge insufficient liquidity. The performance fee FAQ document is kept as a<br />

public document at Metropolitan Head office. The FSP holds professional<br />

indemnity cover and fidelity insurance cover. Metropolitan Collective<br />

Investments Ltd is an authorised Financial Services Provider and a Full<br />

member of the Association for Savings & Investments SA (ASISA).<br />

FURTHER CONTACT DETAILS<br />

<strong>Cannon</strong> <strong>Asset</strong> <strong>Managers</strong> (Pty) Ltd<br />

First Floor, Building B,<br />

Bryanston Corner,<br />

18 Ealing Crescent<br />

Bryanston, 2194.<br />

PO Box 70997,<br />

Bryanston, 2021<br />

Unit 2 Rydall Vale Crescent,<br />

Rydall Vale Park,<br />

La Lucia Ridge, 4019.<br />

PO Box 5200,<br />

Rydall Vale Park, 4019.<br />

Authorised Financial Services Provider #736.<br />

www.cannonassets.co.za