eq-2014-12

eq-2014-12

eq-2014-12

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

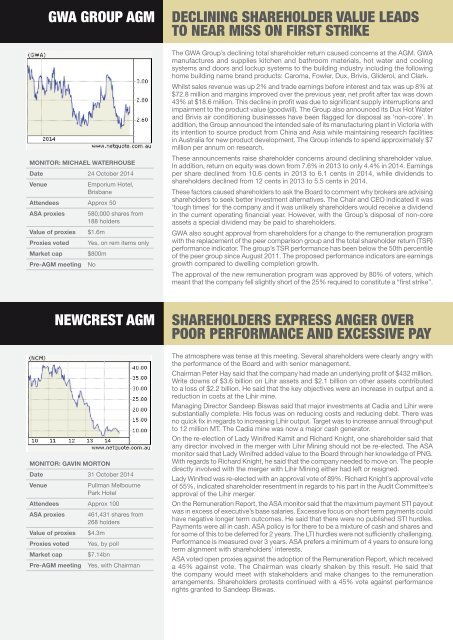

MONITOR: MICHAEL WATERHOUSE<br />

Date 24 October <strong>2014</strong><br />

Venue<br />

Emporium Hotel,<br />

Brisbane<br />

Attendees Approx 50<br />

ASA proxies<br />

GWA GROUP AGM<br />

Value of proxies<br />

Proxies voted<br />

580,000 shares from<br />

188 holders<br />

$1.6m<br />

Market cap $800m<br />

Pre-AGM meeting<br />

Yes, on rem items only<br />

No<br />

DECLINING SHAREHOLDER VALUE LEADS<br />

TO NEAR MISS ON FIRST STRIKE<br />

The GWA Group’s declining total shareholder return caused concerns at the AGM. GWA<br />

manufactures and supplies kitchen and bathroom materials, hot water and cooling<br />

systems and doors and lockup systems to the building industry including the following<br />

home building name brand products: Caroma, Fowler, Dux, Brivis, Gliderol, and Clark.<br />

Whilst sales revenue was up 2% and trade earnings before interest and tax was up 8% at<br />

$72.8 million and margins improved over the previous year, net profit after tax was down<br />

43% at $18.6 million. This decline in profit was due to significant supply interruptions and<br />

impairment to the product value (goodwill). The Group also announced its Dux Hot Water<br />

and Brivis air conditioning businesses have been flagged for disposal as ‘non-core’. In<br />

addition, the Group announced the intended sale of its manufacturing plant in Victoria with<br />

its intention to source product from China and Asia while maintaining research facilities<br />

in Australia for new product development. The Group intends to spend approximately $7<br />

million per annum on research.<br />

These announcements raise shareholder concerns around declining shareholder value.<br />

In addition, return on <strong>eq</strong>uity was down from 7.6% in 2013 to only 4.4% in <strong>2014</strong>. Earnings<br />

per share declined from 10.6 cents in 2013 to 6.1 cents in <strong>2014</strong>, while dividends to<br />

shareholders declined from <strong>12</strong> cents in 2013 to 5.5 cents in <strong>2014</strong>.<br />

These factors caused shareholders to ask the Board to comment why brokers are advising<br />

shareholders to seek better investment alternatives. The Chair and CEO indicated it was<br />

‘tough times’ for the company and it was unlikely shareholders would receive a dividend<br />

in the current operating financial year. However, with the Group’s disposal of non-core<br />

assets a special dividend may be paid to shareholders.<br />

GWA also sought approval from shareholders for a change to the remuneration program<br />

with the replacement of the peer comparison group and the total shareholder return (TSR)<br />

performance indicator. The group’s TSR performance has been below the 50th percentile<br />

of the peer group since August 2011. The proposed performance indicators are earnings<br />

growth compared to dwelling completion growth.<br />

The approval of the new remuneration program was approved by 80% of voters, which<br />

meant that the company fell slightly short of the 25% r<strong>eq</strong>uired to constitute a “first strike”.<br />

MONITOR: GAVIN MORTON<br />

Date 31 October <strong>2014</strong><br />

Venue<br />

Pullman Melbourne<br />

Park Hotel<br />

Attendees Approx 100<br />

ASA proxies<br />

Value of proxies<br />

Proxies voted<br />

Market cap<br />

NEWCREST AGM<br />

Pre-AGM meeting<br />

461,431 shares from<br />

268 holders<br />

$4.3m<br />

Yes, by poll<br />

$7.14bn<br />

Yes, with Chairman<br />

SHAREHOLDERS EXPRESS ANGER OVER<br />

POOR PERFORMANCE AND EXCESSIVE PAY<br />

The atmosphere was tense at this meeting. Several shareholders were clearly angry with<br />

the performance of the Board and with senior management.<br />

Chairman Peter Hay said that the company had made an underlying profit of $432 million.<br />

Write downs of $3.6 billion on Lihir assets and $2.1 billion on other assets contributed<br />

to a loss of $2.2 billion. He said that the key objectives were an increase in output and a<br />

reduction in costs at the Lihir mine.<br />

Managing Director Sandeep Biswas said that major investments at Cadia and Lihir were<br />

substantially complete. His focus was on reducing costs and reducing debt. There was<br />

no quick fix in regards to increasing Lihir output. Target was to increase annual throughput<br />

to <strong>12</strong> million MT. The Cadia mine was now a major cash generator.<br />

On the re-election of Lady Winifred Kamit and Richard Knight, one shareholder said that<br />

any director involved in the merger with Lihir Mining should not be re-elected. The ASA<br />

monitor said that Lady Winifred added value to the Board through her knowledge of PNG.<br />

With regards to Richard Knight, he said that the company needed to move on. The people<br />

directly involved with the merger with Lihir Mining either had left or resigned.<br />

Lady Winifred was re-elected with an approval vote of 89%. Richard Knight`s approval vote<br />

of 55%, indicated shareholder resentment in regards to his part in the Audit Committee’s<br />

approval of the Lihir merger.<br />

On the Remuneration Report, the ASA monitor said that the maximum payment STI payout<br />

was in excess of executive’s base salaries. Excessive focus on short term payments could<br />

have negative longer term outcomes. He said that there were no published STI hurdles.<br />

Payments were all in cash. ASA policy is for there to be a mixture of cash and shares and<br />

for some of this to be deferred for 2 years. The LTI hurdles were not sufficiently challenging.<br />

Performance is measured over 3 years. ASA prefers a minimum of 4 years to ensure long<br />

term alignment with shareholders’ interests.<br />

ASA voted open proxies against the adoption of the Remuneration Report, which received<br />

a 45% against vote. The Chairman was clearly shaken by this result. He said that<br />

the company would meet with stakeholders and make changes to the remuneration<br />

arrangements. Shareholders protests continued with a 45% vote against performance<br />

rights granted to Sandeep Biswas.