Capital calculation methods

Capital calculation methods

Capital calculation methods

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

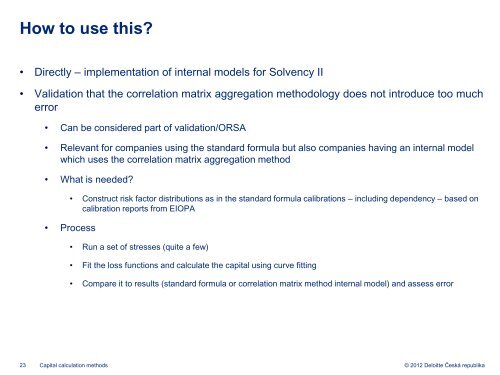

How to use this<br />

• Directly – implementation of internal models for Solvency II<br />

• Validation that the correlation matrix aggregation methodology does not introduce too much<br />

error<br />

• Can be considered part of validation/ORSA<br />

• Relevant for companies using the standard formula but also companies having an internal model<br />

which uses the correlation matrix aggregation method<br />

• What is needed<br />

• Construct risk factor distributions as in the standard formula calibrations – including dependency – based on<br />

calibration reports from EIOPA<br />

• Process<br />

• Run a set of stresses (quite a few)<br />

• Fit the loss functions and calculate the capital using curve fitting<br />

• Compare it to results (standard formula or correlation matrix method internal model) and assess error<br />

23 <strong>Capital</strong> <strong>calculation</strong> <strong>methods</strong><br />

© 2012 Deloitte Česká republika