AVANTHA POWER & INFRASTRUCTURE LIMITED - Cmlinks.com

AVANTHA POWER & INFRASTRUCTURE LIMITED - Cmlinks.com

AVANTHA POWER & INFRASTRUCTURE LIMITED - Cmlinks.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

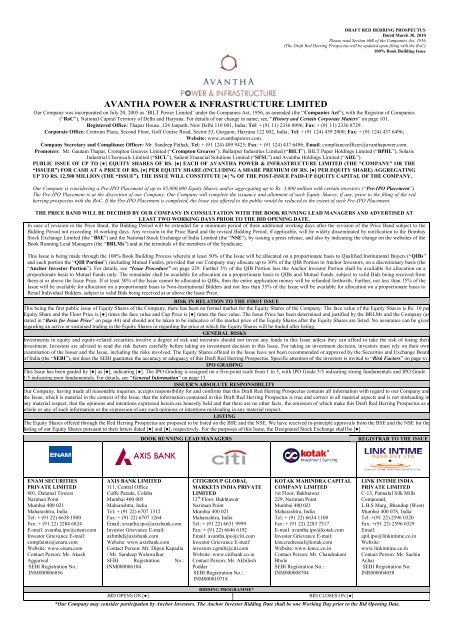

DRAFT RED HERRING PROSPECTUS<br />

Dated March 30, 2010<br />

Please read Section 60B of the Companies Act, 1956<br />

(The Draft Red Herring Prospectus will be updated upon filing with the RoC)<br />

100% Book Building Issue<br />

<strong>AVANTHA</strong> <strong>POWER</strong> & <strong>INFRASTRUCTURE</strong> <strong>LIMITED</strong><br />

Our Company was incorporated on July 20, 2005 as ‗BILT Power Limited‘ under the Companies Act, 1956, as amended (the ―Companies Act‖), with the Registrar of Companies<br />

(―RoC‖), National Capital Territory of Delhi and Haryana. For details of our change in name, see, ―History and Certain Corporate Matters‖ on page 101.<br />

Registered Office: Thapar House, 124 Janpath, New Delhi 110 001, India; Tel: + (91 11) 2336 8096; Fax: + (91 11) 2336 8729.<br />

Corporate Office: Centrum Plaza, Second Floor, Golf Course Road, Sector 53, Gurgaon, Haryana 122 002, India; Tel: + (91 124) 439 2000; Fax: + (91 124) 437 6496;<br />

Website: www.avanthapower.<strong>com</strong>.<br />

Company Secretary and Compliance Officer: Mr. Sandeep Pathak; Tel: + (91 124) 409 9425; Fax: + (91 124) 437 6496; Email: <strong>com</strong>plianceofficer@avanthapower.<strong>com</strong>.<br />

Promoters: Mr. Gautam Thapar, Crompton Greaves Limited (―Crompton Greaves‖), Ballarpur Industries Limited (―BILT‖), BILT Paper Holdings Limited (―BPHL‖), Solaris<br />

Industrial Chemicals Limited (―SICL‖), Salient Financial Solutions Limited (―SFSL‖) and Avantha Holdings Limited (―AHL‖).<br />

PUBLIC ISSUE OF UP TO [●] EQUITY SHARES OF RS. [●] EACH OF <strong>AVANTHA</strong> <strong>POWER</strong> & <strong>INFRASTRUCTURE</strong> <strong>LIMITED</strong> (THE “COMPANY” OR THE<br />

“ISSUER”) FOR CASH AT A PRICE OF RS. [] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF RS. [●] PER EQUITY SHARE) AGGREGATING<br />

UP TO RS. 12,500 MILLION (THE “ISSUE”). THE ISSUE WILL CONSTITUTE [●] % OF THE POST-ISSUE PAID-UP EQUITY CAPITAL OF THE COMPANY.<br />

Our Company is considering a Pre-IPO Placement of up to 65,000,000 Equity Shares and/or aggregating up to Rs. 3,000 million with certain investors (“Pre-IPO Placement”).<br />

The Pre-IPO Placement is at the discretion of our Company. Our Company will <strong>com</strong>plete the issuance and allotment of such Equity Shares, if any, prior to the filing of the red<br />

herring prospectus with the RoC. If the Pre-IPO Placement is <strong>com</strong>pleted, the Issue size offered to the public would be reduced to the extent of such Pre-IPO Placement.<br />

THE PRICE BAND WILL BE DECIDED BY OUR COMPANY IN CONSULTATION WITH THE BOOK RUNNING LEAD MANAGERS AND ADVERTISED AT<br />

LEAST TWO WORKING DAYS PRIOR TO THE BID OPENING DATE.<br />

In case of revision in the Price Band, the Bidding Period will be extended for a minimum period of three additional working days after the revision of the Price Band subject to the<br />

Bidding Period not exceeding 10 working days. Any revision in the Price Band and the revised Bidding Period, if applicable, will be widely disseminated by notification to the Bombay<br />

Stock Exchange Limited (the ―BSE‖) and the National Stock Exchange of India Limited (the ―NSE‖), by issuing a press release, and also by indicating the change on the websites of the<br />

Book Running Lead Managers (the ―BRLMs‖) and at the terminals of the members of the Syndicate.<br />

This Issue is being made through the 100% Book Building Process wherein at least 50% of the Issue will be allocated on a proportionate basis to Qualified Institutional Buyers (―QIBs‖<br />

and such portion the ―QIB Portion‖) (including Mutual Funds), provided that our Company may allocate up to 30% of the QIB Portion to Anchor Investors, on a discretionary basis (the<br />

―Anchor Investor Portion‖). For details, see ―Issue Procedure‖ on page 229. Further 5% of the QIB Portion less the Anchor Investor Portion shall be available for allocation on a<br />

proportionate basis to Mutual Funds only. The remainder shall be available for allocation on a proportionate basis to QIBs and Mutual Funds, subject to valid Bids being received from<br />

them at or above the Issue Price. If at least 50% of the Issue cannot be allocated to QIBs, then the entire application money will be refunded forthwith. Further, not less than 15% of the<br />

Issue will be available for allocation on a proportionate basis to Non-Institutional Bidders and not less than 35% of the Issue will be available for allocation on a proportionate basis to<br />

Retail Individual Bidders, subject to valid Bids being received at or above the Issue Price.<br />

RISK IN RELATION TO THE FIRST ISSUE<br />

This being the first public issue of Equity Shares of the Company, there has been no formal market for the Equity Shares of the Company. The face value of the Equity Shares is Rs. 10 per<br />

Equity Share and the Floor Price is [●] times the face value and Cap Price is [●] times the face value. The Issue Price has been determined and justified by the BRLMs and the Company (as<br />

stated in ―Basis for Issue Price‖ on page 44) and should not be taken to be indicative of the market price of the Equity Shares after the Equity Shares are listed. No assurance can be given<br />

regarding an active or sustained trading in the Equity Shares or regarding the price at which the Equity Shares will be traded after listing.<br />

GENERAL RISKS<br />

Investments in equity and equity-related securities involve a degree of risk and investors should not invest any funds in this Issue unless they can afford to take the risk of losing their<br />

investment. Investors are advised to read the risk factors carefully before taking an investment decision in this Issue. For taking an investment decision, investors must rely on their own<br />

examination of the Issuer and the Issue, including the risks involved. The Equity Shares offered in the Issue have not been re<strong>com</strong>mended or approved by the Securities and Exchange Board<br />

of India (the ―SEBI‖), nor does the SEBI guarantee the accuracy or adequacy of this Draft Red Herring Prospectus. Specific attention of the investors is invited to ―Risk Factors‖ on page xv.<br />

IPO GRADING<br />

This Issue has been graded by [●] as [●], indicating [●]. The IPO Grading is assigned on a five-point scale from 1 to 5, with IPO Grade 5/5 indicating strong fundamentals and IPO Grade<br />

1/5 indicating poor fundamentals. For details, see ―General Information‖ on page 13.<br />

ISSUER‟S ABSOLUTE RESPONSIBILITY<br />

Our Company, having made all reasonable inquiries, accepts responsibility for and confirms that this Draft Red Herring Prospectus contains all information with regard to our Company and<br />

the Issue, which is material in the context of the Issue, that the information contained in this Draft Red Herring Prospectus is true and correct in all material aspects and is not misleading in<br />

any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other facts, the omission of which make this Draft Red Herring Prospectus as a<br />

whole or any of such information or the expression of any such opinions or intentions misleading in any material respect.<br />

LISTING<br />

The Equity Shares offered through the Red Herring Prospectus are proposed to be listed on the BSE and the NSE. We have received in-principle approvals from the BSE and the NSE for the<br />

listing of our Equity Shares pursuant to their letters dated [●] and [●], respectively. For the purposes of this Issue, the Designated Stock Exchange shall be [●].<br />

BOOK RUNNING LEAD MANAGERS<br />

REGISTRAR TO THE ISSUE<br />

ENAM SECURITIES<br />

PRIVATE <strong>LIMITED</strong><br />

801, Dalamal Towers<br />

Nariman Point<br />

Mumbai 400 021<br />

Maharashtra, India<br />

Tel: + (91 22) 6638 1800<br />

Fax: + (91 22) 2284 6824<br />

E-mail: avantha.ipo@enam.<strong>com</strong><br />

Investor Grievance E-mail:<br />

<strong>com</strong>plaints@enam.<strong>com</strong><br />

Website: www.enam.<strong>com</strong><br />

Contact Person: Mr. Akash<br />

Aggarwal<br />

SEBI Registration No.:<br />

INM000006856<br />

AXIS BANK <strong>LIMITED</strong><br />

111, Central Office<br />

Cuffe Parade, Colaba<br />

Mumbai 400 005<br />

Maharashtra, India<br />

Tel: + (91 22) 6707 1312<br />

Fax: + (91 22) 6707 1264<br />

Email: avantha.ipo@axisbank.<strong>com</strong><br />

Investor Grievance E-mail:<br />

axbmbd@axisbank.<strong>com</strong><br />

Website: www.axisbank.<strong>com</strong><br />

Contact Person: Mr. Dipen Kapadia<br />

/ Mr. Sandeep Walawalkar<br />

SEBI Registration No.:<br />

INM000006104<br />

CITIGROUP GLOBAL<br />

MARKETS INDIA PRIVATE<br />

<strong>LIMITED</strong><br />

12 th Floor, Bakhtawar<br />

Nariman Point<br />

Mumbai 400 021<br />

Maharashtra, India<br />

Tel: + (91 22) 6631 9999<br />

Fax: + (91 22) 6646 6192<br />

Email: avantha.ipo@citi.<strong>com</strong><br />

Investor Grievance E-mail:<br />

investors.cgmib@citi.<strong>com</strong><br />

Website: www.citibank.co.in<br />

Contact Person: Mr. Akhilesh<br />

Poddar<br />

SEBI Registration No.:<br />

INM000010718<br />

KOTAK MAHINDRA CAPITAL<br />

COMPANY <strong>LIMITED</strong><br />

1st Floor, Bakhtawar<br />

229, Nariman Point<br />

Mumbai 400 021<br />

Maharashtra, India<br />

Tel: + (91 22) 6634 1100<br />

Fax: + (91 22) 2283 7517<br />

E-mail: avantha.ipo@kotak.<strong>com</strong><br />

Investor Grievance E-mail:<br />

kmccredressal@kotak.<strong>com</strong><br />

Website: www.kmcc.co.in<br />

Contact Person: Mr. Chandrakant<br />

Bhole<br />

SEBI Registration No.:<br />

INM000008704<br />

LINK INTIME INDIA<br />

PRIVATE <strong>LIMITED</strong><br />

C-13, Pannalal Silk Mills<br />

Compound,<br />

L.B.S Marg, Bhandup (West)<br />

Mumbai 400 078, India<br />

Tel: +(91 22) 2596 0320<br />

Fax: +(91 22) 2596 0329<br />

Email:<br />

apil.ipo@linkintime.co.in<br />

Website:<br />

www.linkintime.co.in<br />

Contact Person: Mr. Sachin<br />

Achar<br />

SEBI Registration No:<br />

INR000004058<br />

BIDDING PROGRAMME*<br />

BID OPENS ON [●]<br />

BID CLOSES ON [●]<br />

*Our Company may consider participation by Anchor Investors. The Anchor Investor Bidding Date shall be one Working Day prior to the Bid Opening Date.

TABLE OF CONTENTS<br />

SECTION I – GENERAL ..................................................................................................................................... i<br />

DEFINITIONS AND ABBREVIATIONS ...................................................................................................... i<br />

PRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATA .............................................. x<br />

NOTICE TO INVESTORS ........................................................................................................................... xii<br />

FORWARD-LOOKING STATEMENTS .................................................................................................. xiii<br />

SECTION II – RISK FACTORS ...................................................................................................................... xv<br />

SECTION III - INTRODUCTION ..................................................................................................................... 1<br />

SUMMARY OF INDUSTRY .......................................................................................................................... 1<br />

SUMMARY OF OUR BUSINESS .................................................................................................................. 3<br />

SUMMARY OF FINANCIAL INFORMATION.......................................................................................... 6<br />

THE ISSUE .................................................................................................................................................... 12<br />

GENERAL INFORMATION ....................................................................................................................... 13<br />

CAPITAL STRUCTURE .............................................................................................................................. 23<br />

OBJECTS OF THE ISSUE ........................................................................................................................... 35<br />

BASIS FOR ISSUE PRICE ........................................................................................................................... 44<br />

STATEMENT OF TAX BENEFITS ............................................................................................................ 47<br />

SECTION IV- ABOUT THE COMPANY ....................................................................................................... 52<br />

INDUSTRY .................................................................................................................................................... 52<br />

OUR BUSINESS ............................................................................................................................................ 67<br />

REGULATIONS AND POLICIES IN INDIA ............................................................................................ 88<br />

HISTORY AND CERTAIN CORPORATE MATTERS ......................................................................... 101<br />

OUR MANAGEMENT ............................................................................................................................... 116<br />

OUR PROMOTERS AND GROUP ENTITIES ....................................................................................... 130<br />

DIVIDEND POLICY .................................................................................................................................. 153<br />

SECTION V – FINANCIAL INFORMATION .............................................................................................. F 1<br />

FINANCIAL STATEMENTS ...................................................................................................................... F 1<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS<br />

OF OPERATIONS ...................................................................................................................................... 154<br />

FINANCIAL INDEBTEDNESS ................................................................................................................. 176<br />

SECTION VI – LEGAL AND OTHER INFORMATION ........................................................................... 182<br />

OUTSTANDING LITIGATION AND MATERIAL DEVELOPMENTS ............................................. 182<br />

GOVERNMENT AND OTHER APPROVALS ........................................................................................ 206<br />

OTHER REGULATORY AND STATUTORY DISCLOSURES ........................................................... 213<br />

SECTION VII – ISSUE RELATED INFORMATION ................................................................................. 222<br />

ISSUE STRUCTURE .................................................................................................................................. 222<br />

TERMS OF THE ISSUE ............................................................................................................................. 226<br />

ISSUE PROCEDURE .................................................................................................................................. 229<br />

SECTION VIII - MAIN PROVISIONS OF ARTICLES OF ASSOCIATION OF THE COMPANY ..... 258<br />

SECTION IX: OTHER INFORMATION...................................................................................................... 268<br />

MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION ................................................ 268<br />

DECLARATION ......................................................................................................................................... 271

SECTION I – GENERAL<br />

DEFINITIONS AND ABBREVIATIONS<br />

Unless the context otherwise indicates or implies, the following terms have the following meanings in this Draft<br />

Red Herring Prospectus, and references to any statute, regulation or policy shall include amendments notified<br />

thereto, from time to time.<br />

Company-Related Terms<br />

Term<br />

―APIL‖, ―the Issuer‖, ―the<br />

Company‖ or ―our<br />

Company‖<br />

―we‖, ―us‖ or ―our‖<br />

AHL<br />

AoA /Articles of Association<br />

APR Sacks<br />

Arizona Printers<br />

Asia Aviation<br />

ASA Agencies<br />

Audit Committee<br />

Auditor<br />

Avantha Group<br />

Avantha Realty<br />

Axis Bank<br />

Ballarpur Unit<br />

BBEL<br />

BGPPL<br />

Bhigwan Unit<br />

BILT<br />

BILT Packaging<br />

Board/ Board of Directors<br />

Blue Horizon<br />

BPHL<br />

BTTL<br />

Brand Agreement<br />

Brook Crompton<br />

Captive Power Units<br />

CG Actaris<br />

CG Americas<br />

CG Electric Hungary<br />

CG Holdings Belgium<br />

CG Hungary<br />

CG Ireland<br />

CG Lucy<br />

CG PPI<br />

CG Power Belgium<br />

CG Power Canada<br />

CG Power Ireland<br />

CG Power USA<br />

CG Sales France<br />

Chhattisgarh Power Project<br />

Chhattisgarh Power Project<br />

Phase I<br />

Description<br />

Avantha Power & Infrastructure Limited, a public limited <strong>com</strong>pany incorporated under<br />

the Companies Act<br />

Avantha Power & Infrastructure Limited and our Subsidiaries on a consolidated basis<br />

Avantha Holdings Limited<br />

Articles of Association of our Company, as amended<br />

APR Sacks Limited<br />

Arizona Printers & Packers Private Limited<br />

Asia Aviation Limited<br />

ASA Agencies Private Limited<br />

The <strong>com</strong>mittee of the Board of Directors constituted as our Company‘s Audit<br />

Committee in accordance with Clause 49 of the Listing Agreement to be entered into<br />

with the Stock Exchanges<br />

The statutory auditors of our Company, K.K.Mankeshwar & Company, Chartered<br />

Accountants<br />

Group of <strong>com</strong>panies which are controlled by Mr. Gautam Thapar<br />

Avantha Realty Limited<br />

Axis Bank Limited<br />

Our 67.50 MW captive power plant located at Ballarpur, Maharashtra<br />

Biltech Building Elements Limited<br />

BILT Graphic Paper Products Limited<br />

Our 60 MW captive power plant located at Bhigwan, Maharashtra<br />

Ballarpur Industries Limited<br />

BILT Industrial Packaging Company Limited<br />

The board of directors of our Company, or a duly constituted <strong>com</strong>mittee thereof<br />

Blue Horizon Investments Limited<br />

BILT Paper Holdings Limited<br />

BILT Tree Tech Limited<br />

Brand equity and business promotion agreement dated October 20, 2009 between our<br />

Company and AHL, one of our Promoters, as described in ―History and Certain<br />

Corporate Matters-Material Agreements‖ on page 106.<br />

Brook Crompton Greaves Limited<br />

Our captive power plants of 67.50 MW located at Ballarpur, Maharashtra, 60 MW<br />

located at Bhigwan, Maharashtra, 24.50 MW located at Yamuna Nagar, Haryana and<br />

13 MW located at Sewa, Orissa<br />

CG Actaris Electricity Management Private Limited<br />

CG Sales Networks Americas Inc<br />

CG Electric Systems Hungary Zrt.<br />

CG Holdings Belgium NV<br />

CG Holdings Hungary Kft<br />

CG Power Holdings Ireland Limited<br />

CG Lucy Switchgear Limited<br />

CG PPI Adhesive Products Limited<br />

CG Power Systems Belgium NV<br />

CG Power Systems Canada Inc.<br />

CG Power Systems, Ireland<br />

CG Power Systems USA Inc<br />

CG Sales Network France S.A.<br />

Collectively, Chhattisgarh Power Project Phase I and Chhattisgarh Power Project Phase<br />

II<br />

The first unit of a coal based thermal power plant with a planned power generation<br />

capacity of 600 MW, located in Raigarh in the State of Chhattisgarh<br />

i

Term<br />

Chhattisgarh Power Project<br />

Phase II<br />

Corporate Office<br />

Crompton Greaves<br />

Directors<br />

ESOP 2010<br />

Global Green<br />

Gyanodaya<br />

Grant Date<br />

Group Entities<br />

Gujarat Power Project<br />

ICIL<br />

IDFCL<br />

Intergarden India<br />

Intergarden NV<br />

JPIPL<br />

JPL<br />

KCTBL<br />

Key Management Personnel<br />

Krebs & CIE<br />

KWPCL<br />

Leading Line<br />

Madhya Pradesh Power<br />

Project<br />

Madhya Pradesh Power<br />

Project Phase I<br />

Madhya Pradesh Power<br />

Project Phase II<br />

Malanpur Power Plant<br />

MoA / Memorandum of<br />

Association<br />

MCPL<br />

NewQuest<br />

Paperbase<br />

Pauwels Trafo<br />

Phase I<br />

Phase II<br />

Pioneer<br />

Promoters<br />

Promoter Group<br />

Registered Office<br />

Sabah<br />

Salient Business<br />

Description<br />

The second unit of a coal based thermal power plant with a planned power generation<br />

capacity of 600 MW, located in Raigarh in the State of Chhattisgarh<br />

The corporate office of our Company located at Centrum Plaza, Second Floor, Golf<br />

Course Road, Sector 53, Gurgaon, Haryana 122 002, India<br />

Crompton Greaves Limited<br />

Directors of our Company<br />

Employee Stock Option Plan, 2010 of our Company as approved by our shareholders<br />

on February 2, 2010<br />

Global Green Company Limited<br />

Gyanodaya Prakashan Private Limited<br />

The date on which the options are granted to an eligible employee ( as such term is<br />

defined under ESOP 2010) by the Compensation & Remuneration Committee of our<br />

Board<br />

The <strong>com</strong>panies and entities mentioned in ―Our Promoter and Group Entities‖ on page<br />

130, promoted by our Promoters, irrespective of whether such entities are covered<br />

under Section 370(1)(B) of the Companies Act<br />

Our project to build a coal based thermal power plant with a planned power generation<br />

capacity of 1,320 MW (<strong>com</strong>prising two units of 660 MW each) located in Amreli, in<br />

the State of Gujarat<br />

International Components India Limited<br />

Infrastructure Development Finance Company Limited<br />

Intergarden (India) Private Limited<br />

Intergarden NV, Aaist, Belgium<br />

Jhabua Power Investments Private Limited<br />

Jhabua Power Limited<br />

Karam Chand Thapar & Bros. Limited<br />

Officers vested with executive powers and officers at the level immediately below the<br />

Board of Directors, including any other person whom our Company may declare as key<br />

management personnel. See ―Our Management – Key Management Personnel‖ on<br />

page 126.<br />

Krebs & CIE (India) Limited<br />

Korba West Power Company Limited<br />

Leading Line Merchant Traders Private Limited<br />

Collectively, Madhya Pradesh Power Project Phase I and Madhya Pradesh Power<br />

Project Phase II<br />

The first unit of a coal based thermal power plant with a planned power generation<br />

capacity of 600 MW, located in Seoni in the State of Madhya Pradesh<br />

The second unit of a coal based thermal power plant with a planned power generation<br />

capacity of 600 MW, located in Seoni in the State of Madhya Pradesh<br />

The gas-fired power plant of an installed capacity of 26.19 MW located in Malanpur,<br />

District Bhind, Madhya Pradesh, operated by Malanpur Captive Power Limited<br />

Memorandum of Association of our Company, as amended<br />

Malanpur Captive Power Limited<br />

NewQuest Services Private Limited<br />

T H E Paperbase Company Limited<br />

Pauwels Trafo Gent N.V.<br />

The first unit of a coal based thermal power plant with a planned power generation<br />

capacity of 600 MW<br />

The second unit of a coal based thermal power plant with a planned power generation<br />

capacity of 600 MW<br />

The Pioneer Limited<br />

Mr. Gautam Thapar, Crompton Greaves Limited, Ballarpur Industries Limited, BILT<br />

Paper Holdings Limited, Solaris Industrial Chemicals Limited, Salient Financial<br />

Solutions Limited and AHL<br />

Includes such persons and entities constituting our promoter group pursuant to Regulation<br />

2(1)(zb) of the Securities and Exchange Board of India (Issue of Capital and Disclosure<br />

Requirements) Regulations, 2009, as amended, other than Ms. Shalini Waney, Mr. Karan<br />

Thapar and Ms. Renate Hempal<br />

The registered office of our Company located at Thapar House, 124 Janpath, New<br />

Delhi 110 001, India<br />

Sabah Forest Industries Sendirian Berhad<br />

Salient Business Solutions Limited<br />

ii

Term<br />

Scheme of Demerger<br />

Sewa Unit<br />

SFSL<br />

SHL<br />

Solaris Chemtech<br />

Yamuna Nagar Unit<br />

SECL<br />

SICL<br />

Subsidiary(ies)<br />

Toscana Footwear<br />

Toscana Lasts<br />

TKS<br />

UHL Power<br />

Ultima Hygiene<br />

Varun Prakashan<br />

Venus<br />

Zenith<br />

Description<br />

Scheme of arrangement and demerger dated April 1, 2006 between Bilt Power Limited,<br />

BILT and Janpath Investments and Holdings Limited (currently Avantha Realty<br />

Limited) and which was approved by the High Court of Delhi by an order dated May<br />

25, 2006 and the Mumbai High Court (Nagpur Bench) by an order dated April 25, 2006<br />

Our 13MW captive power plant located at Sewa, Orissa<br />

Salient Financial Solutions Limited<br />

Solaris Holdings Limited<br />

Solaris Chemtech Industries Limited<br />

Our 24.50 MW captive power plant located at Yamuna Nagar, Haryana<br />

South Eastern Coalfields Limited<br />

Solaris Industrial Chemicals Limited<br />

Subsidiaries of our Company, being Jhabua Power Investments Private Limited, Jhabua<br />

Power Limited, Korba West Power Company Limited, TKS Developers Limited and<br />

Malanpur Captive Power Limited. See ―History and Certain Corporate Matters - Our<br />

Subsidiaries‖ on page 104<br />

Toscana Footwear Components Limited<br />

Toscana Lasts Limited<br />

TKS Developers Limited<br />

UHL Power Company Limited<br />

Ultima Hygiene Products Private Limited<br />

Varun Prakashan Private Limited<br />

Venus Financial Services Limited<br />

Zenith Drugs and Allied Enterprises<br />

Issue Related Terms<br />

Term<br />

Allotted/Allotment/Allot<br />

Allottee<br />

Anchor Investor<br />

Anchor Investor Bid<br />

Anchor Investor Bidding Date<br />

Anchor Investor Issue Price<br />

Anchor Investor Margin<br />

Amount<br />

Anchor Investor Portion<br />

ASBA / Application<br />

Supported by Blocked<br />

Amount<br />

ASBA Account<br />

ASBA Bid cum Application<br />

Form<br />

ASBA Bidder<br />

ASBA Revision Form<br />

Banker(s) to the Issue<br />

Basis of Allotment<br />

Description<br />

Unless the context otherwise requires, the issue and allotment of Equity Shares pursuant<br />

to this Issue to the successful Bidders<br />

A successful Bidder to whom Equity Shares are Allotted<br />

A Qualified Institutional Buyer, who applies under the Anchor Investor Portion with a<br />

minimum Bid of Rs. 100 million<br />

Bid made by an Anchor Investor<br />

The date which is one Working Day prior to the Bid Opening Date, prior to or after<br />

which the Syndicate will not accept any Bids from Anchor Investors<br />

The final price at which Equity Shares will be issued and Allotted in terms of the Red<br />

Herring Prospectus and the Prospectus to the Anchor Investors, which will be a price<br />

equal to or higher than the Issue Price but not higher than the Cap Price. The Anchor<br />

Investor Issue Price will be decided by our Company in consultation with the BRLMs<br />

An amount representing 25% of the Bid Amount payable by Anchor Investors at the time<br />

of submission of their Bid<br />

Up to 30% of the QIB Portion or a maximum of [●] Equity Shares of our Company,<br />

which may be allocated to Anchor Investors by our Company in consultation with the<br />

BRLMs, on a discretionary basis. One third of the Anchor Investor Portion shall be<br />

reserved for domestic Mutual Funds, subject to valid Anchor Investor Bids being<br />

received from domestic Mutual Funds at or above the price at which allocation will be<br />

made to Anchor Investors<br />

The application (whether physical or electronic) used by an ASBA Bidder to make a Bid<br />

authorizing the SCSB to block the Bid Amount in his/her specified bank account<br />

maintained with the SCSB<br />

Account maintained by an ASBA Bidder with an SCSB which will be blocked by such<br />

SCSB to the extent of the Bid Amount of the ASBA Bidder<br />

The form, whether physical or electronic, used by an ASBA Bidder to make a Bid, which<br />

will be considered as the application for Allotment for the purposes of the Red Herring<br />

Prospectus and the Prospectus<br />

Any Bidder (other than a QIB) who intends to apply through ASBA<br />

The form used by the ASBA Bidders to modify the quantity of Equity Shares or the Bid<br />

Amount in any of their ASBA Bid cum Application Forms or any previous revision<br />

form(s)<br />

The bank(s) which is / are clearing member and registered with the SEBI as Bankers to<br />

the Issue with whom the Escrow Account will be opened, in this case being [●]<br />

The basis on which the Equity Shares will be Allotted, described in ―Issue Procedure‖<br />

on page 229.<br />

iii

Bid<br />

Term<br />

Description<br />

An indication to make an offer during the Bidding Period by a Bidder, or on the Anchor<br />

Investor Bidding Date by an Anchor Investor, pursuant to submission of a Bid cum<br />

Application Form to subscribe to our Equity Shares at a price within the Price Band,<br />

including all revisions and modifications thereto<br />

Bid Amount<br />

Bid Closing Date<br />

Bid cum Application Form<br />

Bid Opening Date<br />

Bidder<br />

Bidding Period<br />

Book Building Process<br />

BRLMs / Book Running Lead<br />

Managers<br />

CAN / Confirmation of<br />

Allocation Note<br />

Cap Price<br />

Controlling Branches of the<br />

SCSBs<br />

Cut-off Price<br />

Designated Branches<br />

Designated Date<br />

Designated Stock Exchange<br />

Draft Red Herring Prospectus<br />

Eligible NRI<br />

For the purposes of ASBA Bidders, a Bid means an indication to make an offer during<br />

the Bidding Period by an ASBA Bidder pursuant to the submission of an ASBA Bid cum<br />

Application Form to subscribe to the Equity Shares<br />

The highest value of the optional Bids indicated in the Bid cum Application Form and<br />

payable by a Bidder on submission of a Bid in the Issue<br />

Except in relation to Anchor Investors, the date after which the Syndicate and SCSBs<br />

will not accept any Bids, which shall be notified in an English national newspaper and a<br />

Hindi national newspaper, each with wide circulation<br />

The form in terms of which the Bidder shall make an offer to purchase Equity Shares and<br />

which shall be considered as the application for the issue of Equity Shares pursuant to the<br />

terms of the Red Herring Prospectus and the Prospectus including the ASBA Bid cum<br />

Application as may be applicable<br />

Except in relation to Anchor Investors, the date on which the Syndicate and SCSBs shall<br />

start accepting Bids, which shall be notified in an English national newspaper and a<br />

Hindi national newspaper, each with wide circulation<br />

Any prospective investor who makes a Bid pursuant to the terms of the Red Herring<br />

Prospectus and the Bid cum Application Form, including an ASBA Bidder and an<br />

Anchor Investor<br />

The period between the Bid Opening Date and the Bid Closing Date, inclusive of both<br />

days during which prospective Bidders (excluding Anchor Investors) can submit their<br />

Bids, including any revisions thereof<br />

Book building process as provided in Schedule XI of the ICDR Regulations, in terms of<br />

which this Issue is being made<br />

The merchant bankers appointed by our Company to undertake the Book Building<br />

Process in respect of the Issue, being Enam Securities Private Limited, Kotak Mahindra<br />

Capital Company Limited, Citigroup Global Markets India Private Limited and Axis<br />

Bank Limited<br />

The note or advice or intimation of allocation of Equity Shares sent to successful Bidders<br />

who have been allocated Equity Shares after discovery of the Issue Price in accordance<br />

with the Book Building Process, including any revisions thereof<br />

In relation to Anchor Investors, the note or advice or intimation of allocation of Equity<br />

Shares sent to the successful Anchor Investors who have been allocated Equity Shares<br />

after discovery of the Anchor Investor Issue Price, including any revisions thereof<br />

The higher end of the Price Band, above which the Issue Price and Anchor Investor Issue<br />

Price will not be finalized and above which no Bids will be accepted, including any<br />

revisions thereof<br />

Such branches of the SCSBs which coordinate Bids in the Issue by ASBA Bidders with<br />

the BRLMs, the Registrar to the Issue and the Stock Exchanges, a list of which is<br />

provided on www.sebi.gov.in<br />

The Issue Price finalized by our Company in consultation with the BRLMs which shall<br />

be any price within the Price Band. Only Retail Individual Bidders are entitled to Bid at<br />

the Cut-off Price. QIBs (including Anchor Investors) and Non-Institutional Bidders are<br />

not entitled to Bid at the Cut-off Price<br />

Such branches of the SCSBs which shall collect the ASBA Bid cum Application Form<br />

used by ASBA Bidders and a list of which is available at www.sebi.gov.in<br />

The date on which funds are transferred from the Escrow Account(s) to the Public Issue<br />

Account and the amount blocked by the SCSBs are transferred from the bank account of<br />

the ASBA Bidders to the Public Issue Account, as the case may be, after the Prospectus<br />

is filed with the RoC, following which the Board of Directors shall Allot Equity Shares to<br />

the Allottees<br />

[●]<br />

This Draft Red Herring Prospectus dated March 30, 2010, filed with the SEBI and issued<br />

in accordance with Section 60B of the Companies Act, which does not contain <strong>com</strong>plete<br />

particulars on the price at which the Equity Shares are offered and the size (in terms of<br />

value) of the Issue<br />

A Non-Resident Indian in a jurisdiction outside India where it is not unlawful to make an<br />

offer or invitation under the Issue and in relation to whom the Red Herring Prospectus<br />

will constitute an invitation to subscribe for the Equity Shares<br />

iv

Term<br />

Equity Shares<br />

Escrow Account (s)<br />

Escrow Agreement<br />

Escrow Collection Bank(s)<br />

First Bidder<br />

Floor Price<br />

Issue<br />

Issue Agreement<br />

Issue Price<br />

Margin Amount<br />

Monitoring Agency<br />

Mutual Fund Portion<br />

Mutual Fund(s)<br />

Net Proceeds<br />

Non-Institutional Bidders<br />

Non-Institutional Portion<br />

Non-Resident Indian / NRI<br />

Pay-in Date<br />

Pay-in-Period<br />

Description<br />

Equity Shares of our Company of face value Rs. 10 each<br />

Account(s) opened with the Escrow Collection Bank(s) for the Issue and in whose favour<br />

the Bidder (excluding ASBA Bidders) will issue cheques or drafts in respect of the Bid<br />

Amount<br />

Agreement to be entered into among our Company, the Registrar, the BRLMs, the<br />

Syndicate Members and the Escrow Collection Bank(s) for collection of the Bid<br />

Amounts and remitting refunds, if any of the amounts to the Bidders (excluding ASBA<br />

Bidders) on the terms and conditions thereof<br />

The bank(s) which is / are clearing members and registered with the SEBI as Bankers to<br />

the Issue with whom the Escrow Account will be opened, in this case being [●]<br />

The Bidder whose name appears first in the Bid cum Application Form or the Revision<br />

Form or the ASBA Bid cum Application Form<br />

The lower end of the Price Band, at or above which the Issue Price and Anchor Investor<br />

Issue Price will be finalized and below which no Bids will be accepted including any<br />

revisions thereof<br />

This public issue of [●] Equity Shares of Rs. [●] each at the Issue Price by our Company<br />

aggregating up to Rs. 12,500 million<br />

Our Company is considering a Pre-IPO Placement, which is at the discretion of our<br />

Company. Our Company will <strong>com</strong>plete the issuance and allotment of such Equity Shares,<br />

if any, prior to the filing of the Red Herring Prospectus with the RoC. If the Pre-IPO<br />

Placement is <strong>com</strong>pleted, the Issue size offered to the public would be reduced to the<br />

extent of such Pre-IPO Placement<br />

The agreement entered into on March 27, 2010 amongst our Company and the BRLMs,<br />

pursuant to which certain arrangements are agreed to in relation to the Issue<br />

The final price at which Equity Shares will be issued and Allotted to successful Bidders,<br />

which may be equal to or lower than the Anchor Investor Issue Price, in terms of the Red<br />

Herring Prospectus and the Prospectus. The Issue Price will be decided by our Company<br />

in consultation with the BRLMs on the Pricing Date<br />

The amount paid by the Bidder (excluding Anchor Investors) at the time of submission of<br />

the Bid, being 10% to 100% of the Bid Amount<br />

[●]<br />

5% of the QIB Portion (excluding Anchor Investor portion) equal to a minimum of [●]<br />

Equity Shares available for allocation to Mutual Funds only on a proportionate basis<br />

A mutual fund registered with the SEBI under the Securities and Exchange Board of<br />

India (Mutual Funds) Regulations, 1996<br />

Proceeds of the Issue that are available to our Company, excluding Issue-related<br />

expenses. See ―Objects of the Issue‖ on page 35<br />

All Bidders, including sub-accounts of FIIs registered with the SEBI, which are foreign<br />

corporate or foreign individuals that are not QIBs (including Anchor Investors) or Retail<br />

Individual Bidders and who have Bid for Equity Shares for an amount more than Rs.<br />

100,000<br />

The portion of the Issue being not less than [●] Equity Shares available for allocation to<br />

Non Institutional Bidders<br />

Non Resident Indian, is a person resident outside India, who is a citizen of India or a<br />

person of Indian origin and shall have the same meaning as ascribed to such term in the<br />

Foreign Exchange Management (Deposit) Regulations, 2000, as amended<br />

With respect to QIB Bidders, the Bid Closing Date or the last date specified in the CAN<br />

sent to Bidders, as applicable and which shall with respect to the Anchor Investors, be a<br />

date not later than two days after the Bid Closing Date<br />

Except with respect to ASBA Bidders, those Bidders whose Margin Amount is 100% of<br />

the Bid Amount, the period <strong>com</strong>mencing on the Bid Opening Date and extending until<br />

the Bid Closing Date; and<br />

With respect to Bidders, except Anchor Investors whose Margin Amount is less than<br />

100% of the Bid Amount, the period <strong>com</strong>mencing on the Bid Opening Date and<br />

extending until the last date specified in the CAN<br />

Pre-IPO Placement<br />

With respect to Anchor Investors, the period <strong>com</strong>mencing on the Anchor Investor<br />

Bidding Date and extending until the last date specified in the CAN which shall not be<br />

later than two days after the Bid Closing Date<br />

Proposed preferential issue of up to 65,000,000 Equity Shares and/or aggregating up to<br />

Rs. 3,000 million to certain investors is being considered by our Company, and will be<br />

<strong>com</strong>pleted prior to the filing of the Red Herring Prospectus with the RoC<br />

v

Term<br />

Price Band<br />

Pricing Date<br />

Prospectus<br />

Public Issue Account<br />

QIB Margin Amount<br />

QIB Portion<br />

Qualified Institutional Buyers<br />

or QIBs<br />

Red Herring Prospectus / RHP<br />

Refund Account(s)<br />

Refund Bank(s)<br />

Registrar / Registrar to the<br />

Issue<br />

Retail Individual Bidder(s)<br />

Retail Portion<br />

Revision Form<br />

RoC<br />

Self Certified Syndicate Bank/<br />

SCSB<br />

Stock Exchanges<br />

Syndicate<br />

Syndicate Agreement<br />

Syndicate Member(s)<br />

TRS / Transaction<br />

Registration Slip<br />

Underwriters<br />

Underwriting Agreement<br />

Working Day<br />

Description<br />

Price band of a minimum Floor Price of Rs. [●] and a maximum Cap Price of Rs. [●]<br />

including revisions thereof<br />

The date on which our Company in consultation with the BRLMs will finalize the Issue<br />

Price<br />

The Prospectus to be filed with the RoC in terms of Section 60 of the Companies Act,<br />

containing, inter alia, the Issue Price that is determined at the end of the Book Building<br />

Process, the size of the Issue and certain other information and including any<br />

corrigendum thereof<br />

Account opened with the Bankers to the Issue to receive monies from the Escrow<br />

Account on the Designated Date<br />

An amount representing at least 10% of the Bid Amount payable by QIBs (other than<br />

Anchor Investors) at the time of submission of their Bid<br />

The portion of the Issue being a minimum of [●] Equity Shares to be Allotted to QIBs<br />

(including the Anchor Investor Portion) at the time of submission of their Bid<br />

Public financial institutions as defined in Section 4A of the Companies Act, FIIs and subaccounts<br />

registered with the SEBI, other than a sub-account which is a foreign corporate<br />

or foreign individual, scheduled <strong>com</strong>mercial banks, mutual funds registered with SEBI,<br />

multilateral and bilateral development financial institutions, venture capital funds<br />

registered with the SEBI, foreign venture capital investors registered with the SEBI, state<br />

industrial development corporations, insurance <strong>com</strong>panies registered with Insurance<br />

Regulatory and Development Authority, provident funds (subject to applicable law) with<br />

minimum corpus of Rs. 250 million and pension funds with minimum corpus of Rs. 250<br />

million, the National Investment Fund set up by resolution F. No. 2/3/2005-DD-II dated<br />

November 23, 2005 of the GoI published in the Gazette of India, and insurance funds set<br />

up and managed by the army, navy or air force of the Union of India<br />

The Red Herring Prospectus to be issued in accordance with Section 60B of the<br />

Companies Act, which will not have <strong>com</strong>plete particulars of the price at which the Equity<br />

Shares shall be issued and which shall be filed with the RoC at least three days before the<br />

Bid Opening Date and will be<strong>com</strong>e the Prospectus after filing with the RoC after the<br />

Pricing Date<br />

Account(s) opened with the Refund Bank(s) from which refunds of the whole or part of<br />

the Bid Amount (excluding to the ASBA Bidders), if any, shall be made<br />

The bank(s) which is a/ are clearing member(s) and registered with the SEBI as Bankers<br />

to the Issue, at which the Refund Accounts will be opened, in this case being [●]<br />

Registrar to the Issue in this case being Link Intime India Private Limited<br />

Individual Bidders (including HUFs and NRIs) who have submitted Bids for Equity<br />

Shares for an aggregate amount less than or equal to Rs. 100,000 in all of the bidding<br />

options in the Issue<br />

The portion of the Issue being up to [●] Equity Shares available for allocation to Retail<br />

Bidder(s)<br />

The form used by Bidders to modify the quantity of Equity Shares or the Bid Amount in<br />

any of their Bid cum Application Forms or any previous Revision Form(s)<br />

Registrar of Companies, National Capital Territory of Delhi and Haryana, located at New<br />

Delhi<br />

The banks which are registered with SEBI under the SEBI (Bankers to an Issue)<br />

Regulations, 1994 and offer services of ASBA, including blocking of bank account, a list<br />

of which is available on http://www.sebi.gov.in<br />

The BSE and the NSE<br />

Collectively, the BRLMs and the Syndicate Members<br />

Agreement among the Syndicate and our Company in relation to the collection of Bids<br />

(excluding Bids from ASBA Bidders) in this Issue<br />

Intermediary appointed in respect of the Issue, registered with the SEBI and permitted to<br />

carry on activities as an underwriter, in this Issue being [●]<br />

The slip or document issued only on demand by the Syndicate or the SCSB to the Bidder<br />

as proof of registration of the Bid<br />

BRLMs and the Syndicate Member(s)<br />

The Agreement among the Underwriters and our Company to be entered into on or after<br />

the Pricing Date<br />

Any day other than Saturday and Sunday on which <strong>com</strong>mercial banks in Mumbai and<br />

New Delhi are open for business<br />

Conventional and General Terms<br />

vi

Term<br />

Description<br />

Air Act The Air (Prevention and Control of Pollution) Act, 1981<br />

CERC Tariff Regulations The Central Electricity Regulatory Commission (Terms and Conditions of Tariff)<br />

Regulations, 2009<br />

CERC Trading Margin<br />

Regulations<br />

The Central Electricity Regulatory Commission (Fixation of Trading Margin)<br />

Regulations, 2010<br />

CLRA Contract Labour (Regulation and Abolition) Act, 1970<br />

Companies Act Companies Act, 1956<br />

Competition Act Competition Act, 2002<br />

Depositories Act Depositories Act, 1996<br />

Depository<br />

A depository registered with SEBI under the Securities and Exchange Board of India<br />

(Depositories and Participants) Regulations, 1996<br />

DP/ Depository Participant A depository participant as defined under the Depositories Act, 1996<br />

EPA The Environment (Protection) Act, 1986<br />

EIA Notification The Environment Impact Assessment Notification S.O. 1533(E), 2006<br />

Electricity Act The Electricity Act, 2003<br />

ERC Act Electricity Regulatory Commissions Act, 1998<br />

FEMA Foreign Exchange Management Act, 1999<br />

Factories Act<br />

The Factories Act, 1948, as amended<br />

FEMA Regulations<br />

Foreign Exchange Management (Transfer or Issue of Security by a Person Resident<br />

Outside India) Regulations, 2000<br />

FIRs<br />

First Information Reports<br />

Financial Year/ fiscal/ fiscal<br />

year<br />

Period of 12 months ended March 31 of that particular year<br />

GoI<br />

Government of India<br />

GDP<br />

Gross domestic product<br />

GIR No<br />

General index register number<br />

Hazardous Waste Rules The Hazardous Wastes (Management, Handling and Transboundary Movement) Rules,<br />

2008<br />

ICDR Regulations<br />

Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements)<br />

Regulations, 2009<br />

I.T. Act In<strong>com</strong>e Tax Act, 1961<br />

Indian GAAP<br />

Generally accepted accounting principles in India<br />

NRE Account<br />

Non Resident External Account<br />

NRO Account<br />

Non Resident Ordinary Account<br />

Press Note 2 of 2009<br />

Press Note No. 2 (2009 Series), dated February 13, 2009, issued by the DIPP<br />

Press Note 4 of 2009<br />

Press Note No. 4 (2009 Series), dated February 25, 2009, issued by the DIPP<br />

P/E Ratio<br />

Price/earnings ratio<br />

RBI<br />

Reserve Bank of India<br />

RBI Act Reserve Bank of India Act, 1934<br />

Rs.<br />

Indian Rupees<br />

Securities Act<br />

U.S. Securities Act of 1933, as amended<br />

Supply Act Electricity (Supply) Act, 1948<br />

SICA Sick Industrial Companies (Special Provisions) Act, 1985<br />

SEBI Act Securities and Exchange Board of India Act 1992<br />

State Government<br />

The government of a state of the Republic of India<br />

Supply Act The Electricity (Supply) Act, 1948<br />

Takeover Code<br />

Securities and Exchange Board of India (Substantial Acquisition of Shares and<br />

Takeovers) Regulations, 1997<br />

Water Act The Water (Prevention and Control of Pollution) Act, 1974<br />

Water Cess Act The Water (Prevention and Control of Pollution) Cess Act, 1977<br />

US GAAP<br />

Generally accepted accounting principles in the United States of America<br />

USD / US$<br />

United States Dollars<br />

Technical/Industry Related Terms<br />

Term<br />

APDRP<br />

AT&C<br />

Bidding Guidelines<br />

BOO<br />

BTG<br />

Description<br />

Accelerated Power Development Reform Programme<br />

Aggregate Technical and Commercial Losses<br />

Guidelines for Determination of Tariff by Bidding Process for Procurement of Power by<br />

Distribution Licensees, 2005<br />

Build own and operate<br />

Boiler, Turbine and Generator<br />

vii

Term<br />

Description<br />

CDM<br />

Clean Development Mechanism<br />

CDSL<br />

Central Depository Services (India) Limited<br />

CEA<br />

Central Electricity Authority<br />

CEA January 2010 Report CEA Power Scenario At A Glance, dated January 2010<br />

CER<br />

Certified Emission Reduction<br />

CERC<br />

Central Electricity Regulatory Commission<br />

COD<br />

Commercial Operation Date<br />

CTU<br />

Central Transmission Utility as defined in the Electricity Act<br />

EPS 17 th Electric Power Survey, May 2007<br />

ERC<br />

Electricity Regulatory Commission<br />

ERU<br />

Electricity Reduction Unit<br />

IAEA<br />

International Atomic Energy Agency<br />

IEX<br />

India Energy Exchange<br />

IPP<br />

Independent Power Producers<br />

JI<br />

Joint Implementation<br />

KW<br />

Kilo Watt<br />

kWh<br />

Kilo Watt Hour<br />

LoA<br />

Letter of Assurance<br />

MCL<br />

Mahanadi Coalfields Limited<br />

MoC<br />

Ministry of Coal, GoI<br />

MPCB<br />

Maharashtra Pollution Control Board<br />

mtpa<br />

Million tonnes per annum<br />

MU<br />

Million units where one unit is one kWh<br />

MPP<br />

Merchant power plants<br />

NTP<br />

National Tariff Policy<br />

MW<br />

Megawatts<br />

NLDC<br />

National Load Dispatch Centre<br />

NTPC<br />

National Thermal Power Corporation Limited<br />

PCA<br />

Power Consumption Agreement<br />

PGCIL<br />

Power Grid Corporation of India Limited<br />

PLF<br />

Plant Load Factor<br />

PPA<br />

Power Purchase Agreement<br />

PXIL<br />

Power Exchange India Limited<br />

RFP<br />

Request for Proposal<br />

RFQ<br />

Request for Qualification<br />

RLDC<br />

Regional Load Dispatch Centre<br />

sq. km.<br />

Square kilometre<br />

STU State Transmission Utility as defined in the Electricity Act, 2003<br />

Trading License Regulations CERC (Procedure, Terms and Conditions for grant of trading license and other related<br />

matters) Regulations, 2009<br />

UMPP<br />

Ultra Mega Power Project<br />

Units<br />

kWh<br />

VERs<br />

Verified Emission Reductions<br />

Abbreviations<br />

Term<br />

AS<br />

AY<br />

BSE<br />

CAGR<br />

CBI<br />

CEO<br />

CFO<br />

CPCB<br />

CSEB<br />

CSPHCL<br />

CSO<br />

CSR<br />

CIN<br />

DIPP<br />

Description<br />

Accounting Standards issued by the Institute of Chartered Accountants of India<br />

Assessment Year<br />

Bombay Stock Exchange Limited<br />

Compounded Annual Growth Rate<br />

Central Bureau of Investigation<br />

Chief Executive Officer<br />

Chief Financial Officer<br />

Central Pollution Control Board<br />

Chhattisgarh State Electricity Board<br />

Chhattisgarh State Power Holding Company Limited<br />

Central Statistical Organisation<br />

Corporate Social Responsibility<br />

Company Identification Number<br />

Department of Industrial Policy and Promotion, Ministry of Commerce, GoI<br />

viii

Term<br />

Description<br />

DP ID<br />

Depository Participant‘s Identity<br />

ECS<br />

Electronic Clearing Service<br />

EEA<br />

European Economic Area<br />

EGM<br />

Extraordinary General Meeting<br />

EPS<br />

Earnings per share, i.e., profit after tax for a fiscal year divided by the weighted average<br />

outstanding number of equity shares at the end of that fiscal year<br />

FDI<br />

Foreign Direct Investment<br />

FI<br />

Financial Institutions<br />

FII(s)<br />

Foreign Institutional Investors as defined under the Securities and Exchange Board of<br />

India (Foreign Institutional Investor) Regulations, 1995 registered with the SEBI<br />

FIPB<br />

Foreign Investment Promotion Board<br />

FVCI<br />

Foreign Venture Capital Investor registered under the Securities and Exchange Board of<br />

India (Foreign Venture Capital Investor) Regulations, 2000 registered with SEBI<br />

GoI / Government<br />

Government of India<br />

GoCH<br />

Government of Chhattisgarh<br />

GoMP<br />

Government of Madhya Pradesh<br />

HNI<br />

High Net worth Individual<br />

HUF<br />

Hindu Undivided Family<br />

IDC<br />

Interest during <strong>com</strong>mission<br />

IFRS<br />

International Financial Reporting Standards<br />

IPC Indian Penal Code, 1860<br />

I.T. Act In<strong>com</strong>e Tax Act, 1961<br />

IPO<br />

Initial Public Offering<br />

MoEF<br />

Ministry of Environment and Forests, GoI<br />

MoU<br />

Memorandum of understanding<br />

NA<br />

Not Applicable<br />

NAV<br />

Net Asset Value<br />

NGOs<br />

Non-governmental organizations<br />

NEFT<br />

National Electronic Fund Transfer<br />

NIA Negotiable Instruments Act, 1881<br />

NOC<br />

No Objection Certificate<br />

NR / Non-Resident<br />

A person residing outside India, as defined under the FEMA and includes a Non-<br />

Resident Indian<br />

NRI<br />

Non Resident Indian, is a person resident outside India, as defined under the FEMA and<br />

the FEMA Regulations<br />

NSDL<br />

National Securities Depository Limited<br />

NSE<br />

The National Stock Exchange of India Limited<br />

O&M<br />

Operation and Maintenance<br />

OCB<br />

A <strong>com</strong>pany, partnership, society or other corporate body owned directly or indirectly to<br />

the extent of at least 60% by NRIs including overseas trusts, in which not less than 60%<br />

of beneficial interest is irrevocably held by NRIs directly or indirectly as defined under<br />

the FEMA Regulations. OCBs are not allowed to invest in this Issue.<br />

PAN<br />

Permanent Account Number allotted under the I.T. Act<br />

PIO<br />

Persons of Indian Origin<br />

PLR<br />

Prime Lending Rate<br />

RFQ<br />

Request for qualification<br />

RFP<br />

Request for proposal<br />

RoNW<br />

Return on Net Worth<br />

RTGS<br />

Real Time Gross Settlement<br />

Supreme Court/SC<br />

Supreme Court of India<br />

SEBs<br />

State Electricity Boards<br />

SERC<br />

State Electricity Regulatory Commission<br />

SEZ<br />

Special Economic Zone<br />

SGO<br />

State Government of Orissa<br />

SPV<br />

Special Purpose Vehicle<br />

UIN<br />

Unique Identification Number<br />

US / USA<br />

United States of America<br />

VAT<br />

Value added tax<br />

w.e.f./wef<br />

With effect from<br />

ix

PRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATA<br />

Financial Data<br />

Unless indicated otherwise, the financial data in this Draft Red Herring Prospectus is derived from our financial<br />

statements as on the end of and for the six months ended September 30, 2009 and fiscal 2009, fiscal 2008 on a<br />

consolidated basis and for the nine months period ended March 31, 2007 on an unconsolidated basis, prepared in<br />

accordance with the Generally Accepted Accounting Principles in India (the ―Indian GAAP‖) and the Companies<br />

Act, and restated in accordance with the Securities and Exchange Board of India (Issue of Capital and Disclosure<br />

Requirements) Regulations, 2009, as amended (the ―ICDR Regulations‖). Our fiscal year <strong>com</strong>mences on April 1<br />

and ends on March 31, so all references to a particular fiscal year are to the twelve-month period ended March 31<br />

of that year, unless stated otherwise.<br />

In this Draft Red Herring Prospectus, any discrepancies in any table between the total and the sums of the amounts<br />

listed are due to rounding off. All decimals have been rounded off to two decimal points.<br />

Our consolidated financial statements and reported earnings could be different in a material manner from those<br />

which would be reported under IFRS or U.S. GAAP. There are significant differences between Indian GAAP,<br />

IFRS and U.S. GAAP. This Draft Red Herring Prospectus does not contain a reconciliation of our consolidated<br />

financial statements to IFRS or U.S. GAAP nor does it include any information in relation to the differences<br />

between Indian GAAP, IFRS and U.S. GAAP. Had the financial statements and other financial information been<br />

prepared in accordance with IFRS or U.S. GAAP, the results of operations and financial position may have been<br />

materially different.<br />

Accordingly, the degree to which the financial information prepared in accordance with Indian GAAP and restated<br />

in accordance with the ICDR Regulations, included in this Draft Red Herring Prospectus will provide meaningful<br />

information is entirely dependent on the reader‘s level of familiarity with Indian standards and accounting<br />

practices, Indian GAAP, the Companies Act and the ICDR Regulations. Any reliance by persons not familiar with<br />

Indian accounting practices, Indian GAAP, the Companies Act and the ICDR Regulations on the financial<br />

disclosures presented in this Draft Red Herring Prospectus should accordingly be limited. In making an<br />

investment decision, investors must rely upon their own examination of our Company, the terms of the Issue and<br />

the financial information relating to our Company. Potential investors should consult their own professional<br />

advisors for an understanding of these differences between Indian GAAP and IFRS or U.S. GAAP, and how such<br />

differences might affect the financial information contained herein.<br />

Currency and Units of Presentation<br />

All references to ―Rupees‖ or ―Rs.‖ are to Indian Rupees, the official currency of the Republic of India. All<br />

references to ―EUR‖ are to Euro, the official currency of the European Union. All references to ―US$‖ or ―USD‖<br />

or ―U.S. Dollar‖ are to United States Dollars, the official currency of the United States of America. All references<br />

to ―CAD‖ are to Canadian Dollars, the official currency of the Republic of Canada. All references to ―MYR‖ are<br />

to Malaysian Ringgit, the official currency of the Republic of Malaysia.<br />

Industry and Market Data<br />

Unless stated otherwise, industry and market data used throughout this Draft Red Herring Prospectus has been<br />

obtained from industry publications. Industry publications generally state that the information contained in those<br />

publications has been obtained from sources believed to be reliable but that their accuracy and <strong>com</strong>pleteness are<br />

not guaranteed and their reliability cannot be assured. Although we believe that industry data used in this Draft<br />

Red Herring Prospectus is reliable, it has not been independently verified. The extent to which the market and<br />

industry data used in this Draft Red Herring Prospectus is meaningful depends on the reader‘s familiarity with and<br />

understanding of the methodologies used in <strong>com</strong>piling such data.<br />

Exchange Rates<br />

The following table shows the relevant exchange rates:<br />

Currency Exchange rate as on March 31, 2009 Exchange rate as on September 30,<br />

2009<br />

x

Source:www.oanda.<strong>com</strong><br />

Currency Exchange rate as on March 31, 2009 Exchange rate as on September 30,<br />

2009<br />

US$ 52.17 48.34<br />

EUR 68.91 70.54<br />

CAD 41.78 44.53<br />

MYR 14.31 13.89<br />

xi

NOTICE TO INVESTORS<br />

The Equity Shares have not been re<strong>com</strong>mended by any U.S. federal or state securities <strong>com</strong>mission or regulatory<br />

authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of<br />

this Draft Red Herring Prospectus. Any representation to the contrary is a criminal offence in the United States.<br />

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the<br />

―Securities Act‖) and, unless so registered, may not be offered or sold within the United States except pursuant to<br />

an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act.<br />

Accordingly, the Equity Shares are being offered and sold (a) in the United States only to persons reasonably<br />

believed to be ―qualified institutional buyers‖ (as defined in Rule 144A under the Securities Act and referred to in<br />

this Draft Red Herring Prospectus as ―U.S. QIBs‖, for the avoidance of doubt, the term U.S. QIBs do not refer to a<br />

category of institutional investor defined under applicable Indian regulations and referred to in the Draft Red<br />

Herring Prospectus as ―QIBs‖) in transactions exempt from the registration requirements of the Securities Act and<br />

(b) outside the United States in <strong>com</strong>pliance with Regulation S and the applicable laws of the jurisdiction where<br />

those offers and sales occur.<br />

This Draft Red Herring Prospectus has been prepared on the basis that all offers of Equity Shares will be made<br />

pursuant to an exemption under the Prospectus Directive, as implemented in Member States of the European<br />

Economic Area (―EEA‖), from the requirement to produce a prospectus for offers of Equity Shares. The<br />

expression ―Prospectus Directive‖ means Directive 2003/71/EC of the European Parliament and Council and<br />

includes any relevant implementing measure in each Relevant Member State (as defined below). Accordingly,<br />

any person making or intending to make an offer within the EEA of Equity Shares which are the subject of the<br />

placement contemplated in this Draft Red Herring Prospectus should only do so in circumstances in which no<br />

obligation arises for the Company or any of the Underwriters to produce a prospectus for such offer. None of the<br />

Company and the Underwriters has authorized, nor do they authorize, the making of any offer of Equity Shares<br />

through any financial intermediary, other than the offers made by the Underwriters which constitute the final<br />

placement of Equity Shares contemplated in this Draft Red Herring Prospectus.<br />

xii

FORWARD-LOOKING STATEMENTS<br />

This Draft Red Herring Prospectus contains certain ―forward-looking statements‖. These forward-looking<br />

statements generally can be identified by words or phrases such as ―aim‖, ―anticipate‖, ―believe‖, ―contemplate‖,<br />

―expect‖, ―estimate‖, ―future‖, ―goal‖, ―intend‖, ―propose‖, ―may‖, ―objective‖, ―plan‖, ―project‖, ―seek‖, ―will‖,<br />

―will continue‖, ―will seek to‖ or other words or phrases of similar import. Similarly, statements that describe our<br />

strategies, objectives, plans or goals are also forward-looking statements. All forward-looking statements are<br />

subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those<br />

contemplated by the relevant statement.<br />

Actual results may differ materially from those suggested by the forward looking statements due to risks or<br />

uncertainties associated with our expectations with respect to, but not limited to, regulatory changes pertaining to<br />

the industries in India in which we have our businesses and our ability to respond to them, technological changes,<br />

our exposure to market risks, general economic and political conditions in India, which have an impact on our<br />

business activities or investments, the performance of the financial markets in India and globally, and changes in<br />

<strong>com</strong>petition in our industry. Important factors that could cause actual results to differ materially from our<br />

expectations include, but are not limited to, the following:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Out<strong>com</strong>e of outstanding litigation, including any criminal litigation, in which we, our Subsidiaries, our<br />

Directors, our Promoters or our Group Entities are involved;<br />

Our ability to <strong>com</strong>mence operations as expected because of delays or otherwise;<br />

Our ability to obtain or renew necessary approvals, licenses, registrations and permits for our business;<br />

Potential liability to a third party for the sale of power from our power project under implementation in<br />

Seoni in Madhya Pradesh (the ―Madhya Pradesh Power Project‖);<br />

Our ability to raise additional capital to fund the construction and development of our projects and future<br />

capital expenditure requirements or to obtain the necessary funds on <strong>com</strong>mercially acceptable terms or in<br />

a timely manner;<br />

Our indebtedness and the impact of the conditions and restrictions imposed on us by our debt financing<br />

arrangements on our ability to conduct our business operations and maintain our financial condition;<br />

The exercise by lenders, in the event of a default on our part, of their rights with respect to equity<br />

interests in our Subsidiaries that we have pledged;<br />

Our lack of a track record in implementing and operating large-scale power projects;<br />

Availability of water, quality fuel at <strong>com</strong>petitive prices or at all, power evacuation facilities, land or<br />

transportation infrastructure for our power plants;<br />

Our ability to enter into off-take arrangements in a timely manner and on terms that are <strong>com</strong>mercially<br />

acceptable to us;<br />

Our ability to effectively manage our growth and expansion or to successfully implement our power<br />

projects and growth strategy;<br />

Changes in tariffs, custom duties and government assistance and changes in applicable laws and<br />

regulations;<br />

Our inability to acquire land in connection with our power projects in a timely manner or at all and/or the<br />

increase in the cost of acquisition of such land;<br />

Our ability to retain our senior management team and other key personnel and hire and retain sufficiently<br />

skilled labour to support our operations;<br />

Changes in foreign exchange rates, equity prices or other rates or prices;<br />

Worldwide economic and business conditions and political or general economic instability in India;<br />

Costs of <strong>com</strong>pliance with environmental laws or damage due to natural or man-made disasters or events;<br />

Increasing <strong>com</strong>petition in the Indian power sector;<br />

The monetary and interest policies of India, inflation, deflation and unanticipated increases in interest<br />

rates; and<br />

Terrorist attacks and other acts of violence, natural calamities and other environmental conditions in<br />

India and around the region.<br />

For further discussion of factors that could cause our actual results to differ from our expectations, see ―Risk<br />

Factors‖, ―Our Business‖ and ―Management‘s Discussion and Analysis of Financial Condition and Results of<br />

Operations‖ on pages xv, 67 and 154, respectively.<br />

xiii

By their nature, certain market risk disclosures are only estimates and could be materially different from what<br />

actually occurs in the future. As a result, actual future gains or losses could materially differ from those that have<br />

been estimated. Our Company, the BRLMs, the Syndicate Members or their respective affiliates do not have any<br />

obligation to, and do not intend to, update or otherwise revise any statements reflecting circumstances arising after<br />

the date hereof or to reflect the occurrence of underlying events, even if the underlying assumptions do not <strong>com</strong>e<br />

to fruition. In accordance with the requirements of SEBI and applicable law, we will ensure that investors are<br />

informed of material developments until the time of the grant of final listing and trading approvals by the Stock<br />

Exchanges.<br />

xiv

SECTION II – RISK FACTORS<br />

An investment in our Equity Shares involves a high degree of risk. You should carefully consider all the<br />

information in this Draft Red Herring Prospectus, including the risks and uncertainties described below, before<br />

making an investment in our Equity Shares. The risks and uncertainties described in this section are not the only<br />

risks that we currently face. Additional risks and uncertainties not presently known to us or that we currently<br />

believe to be immaterial may also have an adverse effect on our business, results of operations and financial<br />

condition. If any of the following risks, or other risks that are not currently known or are now deemed immaterial,<br />

actually occur, our business, results of operations and financial condition could suffer, the price of our Equity<br />

Shares could decline, and you may lose all or part of your investment. In making an investment decision,<br />

prospective investors must rely on their own examination of the Company and the terms of the Issue, including the<br />

merits and risks involved.<br />

Unless otherwise stated, the financial information of the Company used in this section is derived from our restated<br />

audited consolidated financial statements under Indian GAAP. Unless otherwise stated, we are not in a position to<br />

quantify the financial or other risks described in any risk factor.<br />

INTERNAL RISK FACTORS<br />

1. Certain criminal proceedings have been instituted against two of our Promoters, Crompton Greaves<br />

and BILT and some of our Group Entities.<br />

Our Promoters, Crompton Greaves and BILT, are involved in certain criminal proceedings. The brief details of<br />

which are as follows:<br />

<br />

<br />

There are two criminal proceedings against Crompton Greaves, including one against Mr. Sudhir Mohan<br />

Trehan, Managing Director of Crompton Greaves, in his capacity as a factory occupier, for alleged nonmaintenance<br />

of health records and other documents for hazardous processes. This proceeding has been<br />

challenged before the High Court of Bombay at Goa.<br />

There are eight criminal proceedings against BILT, among others, alleging forgery, contempt of court,<br />

wrongfully withholding property and violations of provisions of the Standards of Weights and Measures<br />

Act, 1976, as amended.<br />

In addition, some of our Group Entities are involved in criminal proceedings. The brief details of these criminal<br />

proceedings are as follows:<br />

<br />

<br />

There is one criminal proceeding against BILT Tree Tech Limited (―BTTL‖) and its employees alleging<br />

negligence on the part of an employee of BTTL that caused an accident.<br />

There is one criminal proceeding against KCTBL alleging pollution of the river Ganga due to discharge<br />

of effluent from its distillery.<br />

We cannot provide any assurance that these matters will be decided in favour of our Promoters or in the favour of<br />

the respective Group Entities, as the case may be. Further, there is no assurance that similar proceedings will not<br />

be initiated against our Promoters or our Group Entities in the future. For further details of the cases described<br />

above, see ―Outstanding Litigation and Material Developments‖ on page 182.<br />

2. Delays in the <strong>com</strong>pletion of our power projects currently under implementation for any reason could<br />