VAT Rates - Malta Institute of Management

VAT Rates - Malta Institute of Management

VAT Rates - Malta Institute of Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Malta</strong> <strong>VAT</strong> Compliance Diploma<br />

Session 3 – Liability <strong>of</strong> Supply, Deemed Supplies & Self-Supplies<br />

Dr. Sarah Aquilina<br />

29 October 2008<br />

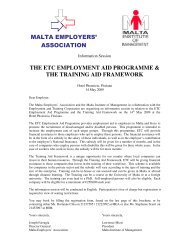

Liability <strong>of</strong> the Supply - Introduction<br />

Article 2 <strong>VAT</strong>A:<br />

“Supply” = an operation treated as a supply <strong>of</strong><br />

goods or a supply <strong>of</strong> services in terms <strong>of</strong> 2 nd<br />

Schedule <strong>VAT</strong>A<br />

“Taxable Supply” = a supply on which tax is<br />

chargeable in terms <strong>of</strong> article 4 <strong>VAT</strong>A and which<br />

is not exempt from tax in terms <strong>of</strong> article 9 <strong>VAT</strong>A<br />

<strong>VAT</strong> <strong>Rates</strong><br />

1

Liability <strong>of</strong> the Supply<br />

18%<br />

5%<br />

0%<br />

-<br />

Standard Rate<br />

Reduced Rate<br />

Exempt with credit/zerorate<br />

Exempt without credit<br />

Article 19<br />

Article 19(2);<br />

8 th Schedule<br />

Article 9;<br />

5 th Schedule Part 1<br />

Article 9;<br />

5 th Schedule Part 2<br />

Reduced rate – 5%<br />

1. Letting/provision <strong>of</strong> accommodation in<br />

premises which is required to be licensed<br />

under the <strong>Malta</strong> Travel & Tourism<br />

Services Act<br />

• Where price <strong>of</strong> supply includes other goods<br />

and services, the taxable value <strong>of</strong><br />

accommodation shall be deemed to be 80% <strong>of</strong><br />

the said price and the taxable value <strong>of</strong> he other<br />

supplies the remaining 20% <strong>of</strong> the price);<br />

• Definition <strong>of</strong> “accommodation” in the context <strong>of</strong><br />

B/B, HB or FB includes services falling within<br />

the definition <strong>of</strong> accommodation on that basis.<br />

Reduced rate – 5%<br />

2. Supply <strong>of</strong> electricity<br />

3. Confectionery and similar items<br />

4. Medical accessories<br />

5. Printed Matter<br />

6. Items for the exclusive use <strong>of</strong> the disabled<br />

reference to<br />

C.N. Codes<br />

7. Works <strong>of</strong> art, collector’s items, antiques<br />

8. Minor repairs to bicycles, shoes, leather goods,<br />

clothing and household linen<br />

9. Domestic care services (incl. domestic help, care<br />

for the elderly)<br />

10. hiring <strong>of</strong> premises for cultural/artistic activities,<br />

entrance to museums and exhibitions<br />

2

Exempt with credit – 0%<br />

Part 1 Fifth Schedule <strong>VAT</strong>A<br />

Zero-rated<br />

No <strong>Malta</strong> <strong>VAT</strong> charged<br />

Supplier can recover inputs attributable to<br />

those supplies<br />

Exempt with credit – 0%<br />

5 th Schedule, Part 1<br />

1. EXPORTS<br />

(1) Supply <strong>of</strong> goods dispatched/transported to a destination outside<br />

the EC by/o.b.o the seller.<br />

(2) Supply <strong>of</strong> goods dispatched/transported to a destination outside<br />

the EC by/o.b.o the purchaser not established in <strong>Malta</strong> except for<br />

goods transported by the purchaser for fuelling/provisioning<br />

pleasure boats & private aircraft or means <strong>of</strong> transport for private<br />

use. (this exemption applies to travelers under the Retail Export<br />

Scheme)<br />

(3) Work on goods imported into <strong>Malta</strong> for that purpose and reexported<br />

by supplier, non-established customer or o.b.o. either.<br />

Exempt with credit – 0%<br />

Retail Export Scheme (SL 406.13)<br />

Persons domiciled outside EU who visit <strong>Malta</strong> are<br />

entitled, when leaving <strong>Malta</strong> (when their final destination<br />

is outside EU), to a refund <strong>of</strong> <strong>Malta</strong> <strong>VAT</strong> paid on goods<br />

purchased:<br />

• Goods must be taken out in luggage accompanying<br />

traveler within 3 months from purchase<br />

• Goods cannot be wholly/partly consumed nor exported<br />

for business purposes<br />

• The total value <strong>of</strong> goods purchased relating to one<br />

departure must be at least EUR315<br />

• The value <strong>of</strong> goods on one receipt is at least EUR55<br />

3

Exempt with credit – 0%<br />

2. INTERNATIONAL GOODS TRAFFIC<br />

(1) Supply <strong>of</strong> goods intended to be placed or while they are placed<br />

under a customs duty suspension regime.<br />

(2) Work on goods intended to be/whilst placed in customs duty<br />

suspension regime.<br />

Customs duty suspension regime =<br />

• Temporary storage<br />

• Free zone/free warehouse<br />

• Customs warehousing/ inward processing<br />

• Admittance <strong>of</strong> goods in territorial waters on drilling & production platforms<br />

• Temporary entry<br />

• External transit procedures<br />

• Internal transit procedures<br />

Exempt with credit – 0%<br />

3. INTRA-COMMUNITY SUPPLIES<br />

(1) Intra- Community supply (“ICS”) to a <strong>VAT</strong>-registered<br />

person in another EC Member State<br />

• ICS = supply <strong>of</strong> goods transported by/o.b.o the supplier or<br />

purchaser from one EC Member State to another<br />

• The exemption does not apply to ICS by small undertaking or<br />

by 2 nd hand goods/works <strong>of</strong> art/collectors items dealer<br />

(2) ICS <strong>of</strong> a “New Means <strong>of</strong> Transport” to a non-<strong>VAT</strong><br />

registered person (see definition <strong>of</strong> New Means <strong>of</strong><br />

Transport” in article 2).<br />

Exempt with credit – 0%<br />

(3) ICS <strong>of</strong> excise goods to a non-<strong>VAT</strong> registered person<br />

Excise goods = mineral oils, alcohol, tobacco (16 th Schedule)<br />

The Exemption does not apply to an ICS by a small undertaking<br />

(4) ICS <strong>of</strong> own goods transferred to another Member<br />

State<br />

The transfer by a business <strong>of</strong> its goods to anther Member State<br />

(see 2 nd Schedule, item 17) is treated as an ICS for <strong>VAT</strong><br />

purposes, which ICS is exempt with credit.<br />

The exemption does not apply to an ICS by a small undertaking<br />

4

Exempt with credit – 0%<br />

4. INTERNATIONAL TRANSPORT<br />

(1) International transport <strong>of</strong> persons (incl. transport <strong>of</strong> accompanying luggage and<br />

motor vehicles and services related to international transport <strong>of</strong> persons).<br />

(2) Transport <strong>of</strong> goods from outside the EC and services ancillary thereto where<br />

the value <strong>of</strong> the transport and the ancillary services is included in the taxable<br />

value <strong>of</strong> the imported goods.<br />

(3) Transport <strong>of</strong> goods connected with the export <strong>of</strong> those goods outside the EC.<br />

(4) Transport <strong>of</strong> goods subject to a customs duty suspension regime.<br />

(5) Services used for the purposes <strong>of</strong> transporting goods referred to in (3) & (4)<br />

relating to loading, unloading, transshipment, handling, valuation, storage etc.<br />

rendered in connection with the transport referred to above.<br />

(6) Services relating to customs formalities on importation/exportation/transit <strong>of</strong><br />

goods.<br />

(7) Intra-EC transport <strong>of</strong> goods to/from Azores or Madeira.<br />

Exempt with credit – 0%<br />

5. BROKERAGE/INTERMEDIARY SERVICES<br />

(see below)<br />

6. SEA VESSELS<br />

(1)Supply <strong>of</strong> sea vessels<br />

• used for navigation on high seas and carrying passengers for reward<br />

or used for the purposes <strong>of</strong> commercial, industrial or fishing activities;<br />

• used for rescue, assistance or coastal fishing<br />

• <strong>of</strong> war<br />

(2) Supply to constructors, owners or operators <strong>of</strong> the aforementioned<br />

sea vessels <strong>of</strong> equipment to be used/incorporated therein.<br />

Exempt with credit – 0%<br />

(3) modification, maintenance, chartering and hiring <strong>of</strong> vessels<br />

referred to in (1) or equipment referred to in (2).<br />

(4) Supply to owners or operators <strong>of</strong> the aforementioned sea<br />

vessels <strong>of</strong> goods for the fuelling/provisioning there<strong>of</strong> except<br />

• board provisioning <strong>of</strong> coastal fishing vessels<br />

• war vessels unless specified vessels (CN Code) bound for<br />

foreign ports<br />

(5) Services for the direct needs <strong>of</strong> vessels referred to in (a) [except<br />

war vessels] and for direct needs <strong>of</strong> cargo (e.g. towage,<br />

pilotage, mooring, rescue services), services provided to shipowners<br />

by maritime agents, services necessary for entrance,<br />

departure or stay <strong>of</strong> vessels in port, and assistance provided to<br />

the passengers or crew for the account <strong>of</strong> ship-owners.<br />

5

Exempt with credit – 0%<br />

7. AIRCRAFT<br />

(1) Aircraft to be used by airline operators for reward chiefly for<br />

international transport <strong>of</strong> passengers/goods.<br />

(2) Supply to constructors, owners or operators <strong>of</strong> the aforementioned<br />

aircraft <strong>of</strong> equipment used/incorporated therein.<br />

(3) modification, maintenance, chartering and hiring <strong>of</strong> aircraft referred<br />

to in (1) or equipment referred to in (2).<br />

(4) Supply to owners or operators <strong>of</strong> the aforementioned aircraft <strong>of</strong><br />

goods for the fuelling/provisioning there<strong>of</strong>.<br />

(5) Services for direct needs <strong>of</strong> aircraft or cargo e.g. towage, pilotage,<br />

valuation, use <strong>of</strong> airports, services provided to operators by agents,<br />

services necessary for landing, take <strong>of</strong>f or stay in airports,<br />

assistance to passengers and crew.<br />

Exempt with credit – 0%<br />

8. GOLD<br />

(a)<br />

Supply <strong>of</strong> gold to Central Bank<br />

(b)<br />

(c)<br />

Supply <strong>of</strong> investment gold - Subject to option for taxation (14 th<br />

Schedule)<br />

Services <strong>of</strong> agents/intermediaries in the supply <strong>of</strong> investment gold<br />

- Subject to option for taxation (14 th Schedule)<br />

See Definition <strong>of</strong> “Investment Gold” in Part 6 <strong>of</strong> the 14 th Schedule.<br />

Exempt with credit – 0%<br />

9. FOOD<br />

The supply <strong>of</strong> food for human consumption, excluding food supplied in<br />

the course <strong>of</strong> catering.<br />

“Food” – references to CN Codes<br />

Food supplied in the course <strong>of</strong> catering = food suitable for immediate<br />

consumption whether consumed in place where supplied or not and<br />

consisting <strong>of</strong>:<br />

Meals/snacks (incl. sandwiches, pastizzi, pizza, & biscuits, cakes<br />

etc except items sealed by manufacturer and items weighing 500g<br />

or more)<br />

Milkshake, tea, c<strong>of</strong>fee and liquid chocolate<br />

Ice-cream (except family packs <strong>of</strong> 350g or more)<br />

6

Exempt with credit – 0%<br />

10. PHARMACEUTICALS<br />

Reference to CN Codes<br />

11. TRANSPORT<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

Transport by scheduled bus service<br />

Scheduled inter-island sea transport<br />

School transport<br />

Transport organized by employer to/from work as approved by<br />

Commissioner<br />

12. SUPPLIES OF GOODS ON BOARD CRUISE LINERS<br />

The supply <strong>of</strong> goods for consumption on board cruise liners where the<br />

place <strong>of</strong> supply <strong>of</strong> those goods is <strong>Malta</strong>. Refer to 3 rd Schedule Item 3<br />

for the purposes <strong>of</strong> determining whether a supply <strong>of</strong> goods on board a<br />

cruise liner takes place in <strong>Malta</strong>.<br />

Exempt with credit – 0%<br />

5. BROKERAGE/INTERMEDIARY SERVICES<br />

Services <strong>of</strong> brokers or other intermediaries acting in the name<br />

and for the account <strong>of</strong> another person in the context <strong>of</strong> the<br />

following supplies:<br />

Exports (5 th Schedule item 1)<br />

International goods traffic (5 th Schedule item 2)<br />

Sea vessels (5 th Schedule item 6)<br />

Aircraft(5 th Schedule item 7)<br />

Gold(5 th Schedule item 8)<br />

Food(5 th Schedule item 9)<br />

Pharmaceuticals(5 th Schedule item 10)<br />

Exempt without credit<br />

<br />

<br />

<br />

<br />

Part 2 Fifth Schedule<br />

Supplies which are exempt from <strong>VAT</strong><br />

No <strong>Malta</strong> <strong>VAT</strong> is charged on these supplies<br />

The supplier cannot recover inputs attributable to those<br />

supplies [exception for exported financial services article<br />

22(4)(d) <strong>VAT</strong>A]<br />

7

Exempt without credit<br />

5 th Schedule, Part 2<br />

1. IMMOVABLE PROPERTY<br />

(1) Letting <strong>of</strong> immovable property except:<br />

accommodation licensed under <strong>Malta</strong> Travel and Tourism<br />

Services Act (5%)<br />

Designated parking sites (see Legal Notice 88 <strong>of</strong> 1999)<br />

Permanently installed equipment/machinery<br />

Letting by a Limited Liability Company to a person registered<br />

under article 10 for the purposes <strong>of</strong> the economic activity <strong>of</strong> that<br />

person<br />

(2) Transfer <strong>of</strong> immovable property<br />

Exempt without credit<br />

Definitions:<br />

“immovable property” = an asset that is immovable property by definition <strong>of</strong><br />

law<br />

“Letting <strong>of</strong> immovable property” includes:<br />

- the provision <strong>of</strong> accommodation under any title and any other supply <strong>of</strong><br />

the use <strong>of</strong> immovable property;<br />

- Emphyteutical grant <strong>of</strong> less than 50 years<br />

Exempt without credit<br />

2. INSURANCE<br />

The supply <strong>of</strong> insurance, reinsurance services and related transactions<br />

by persons licensed under the Insurance Business Act and the Insurance<br />

Intermediaries Act.<br />

3. CREDIT, BANKING AND SIMILAR SERVICES<br />

Includes:<br />

Granting and negotiation <strong>of</strong> credit and the management <strong>of</strong> credit by the person<br />

granting it;<br />

Transactions, including negotiation, concerning deposit and current accounts,<br />

payments, transfers debts etc;<br />

Transactions, including negotiation, concerning currency etc;<br />

Transactions, including negotiation, excluding management and safekeeping, in<br />

shares, interest in companies etc, (subject to exceptions)<br />

<strong>Management</strong> <strong>of</strong> any investment scheme by a person duly licensed under the<br />

Investment Services Act provided that these services are limited to those activities<br />

that are specific and essential to the core activity <strong>of</strong> the scheme<br />

8

Exempt without credit<br />

4. CULTURAL & RELIGIOUS SERVICES<br />

The cultural services must be approved by the Minister<br />

5. SPORTS<br />

the supply <strong>of</strong> services related to sport by non-pr<strong>of</strong>it making<br />

organizations to persons taking part in sport, as approved by the<br />

Minister<br />

6. SERVICES RELATED TO EXEMPT SERVICES<br />

e.g. goods/services by non-pr<strong>of</strong>it making organizations to raise<br />

funds for the provision <strong>of</strong> exempt medical, welfare or education<br />

services<br />

Exempt without credit<br />

7. SERVICES BY INDEPENDENT GROUPS<br />

Services supplied by independent groups <strong>of</strong> persons whose activities are<br />

exempt from or not subject to value added tax, for the purpose <strong>of</strong> rendering to<br />

their members the services directly necessary for the exercise <strong>of</strong> their activity,<br />

where these groups merely claim from their members exact reimbursements <strong>of</strong><br />

their share <strong>of</strong> the joint expenses, provided that such exemption is not likely to<br />

produce distortion <strong>of</strong> competition.<br />

8. SERVICES BY NON-PROFIT MAKING ORGANISATIONS<br />

The supply <strong>of</strong> services for the benefit <strong>of</strong> their members in return for a<br />

subscription fixed in accordance with their rules by non-pr<strong>of</strong>it making<br />

organisations with aims <strong>of</strong> a political, trade union, religious, patriotic,<br />

philosophical, philanthropic or civic nature or whose main purpose is to<br />

represent and promote the common business or pr<strong>of</strong>essional interests<br />

<strong>of</strong> their members<br />

Exempt without credit<br />

9. LOTTERIES<br />

Government lotto and lotteries, the supply <strong>of</strong> agency services<br />

related thereto and supplies relating to gambling as may be<br />

approved by the Minister.<br />

10. POSTAL SERVICES<br />

Public postal services and the supply <strong>of</strong> goods (incl. stamps) incidental<br />

thereto<br />

11. HEALTH & WELFARE<br />

Services supplied by a person in the exercise <strong>of</strong> a licensed medical<br />

pr<strong>of</strong>ession;<br />

Care, medical or surgical treatment in a government hospital or an<br />

approved hospital;<br />

supply <strong>of</strong> organs, blood, milk,<br />

Care facilities & homes (welfare services)<br />

transport for the disabled<br />

supply by a hospital, institution or home <strong>of</strong> goods connected with and<br />

essential for the provision <strong>of</strong> medical or welfare services<br />

9

Exempt without credit<br />

12. EDUCATION<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

Education, educational research and distance learning by the University <strong>of</strong> <strong>Malta</strong>,<br />

licensed schools or an approved establishment<br />

Education/research by approved non-pr<strong>of</strong>it making organizations<br />

Private tuition <strong>of</strong> subjects normally taught in school/university excluding<br />

recreational, physical or sporting activities<br />

training and education in the Arts by accredited organizations<br />

Goods supplied by school/teacher in connection with the provision <strong>of</strong> the above<br />

education services (For example the supply to students by an institution <strong>of</strong> books<br />

or uniforms or other items essential for the provision <strong>of</strong> its educational services)<br />

13. SUPPLY OF GOODS IN RESPECT OF WHICH SUPPLIER DID NOT QUALIFY<br />

FOR INPUT TAX CREDIT<br />

14. BROADCASTING<br />

The activities <strong>of</strong> public radio/TV bodies other than commercial activities<br />

15. WATER<br />

The supply <strong>of</strong> water by public authorities<br />

Exempt intra-community acquisitions<br />

5 th Schedule, Part 3<br />

<br />

Intra Community Acquisition (“ICA”) made for the purpose <strong>of</strong> a subsequent<br />

supply in a triangular transaction (to be discussed in a subsequent lecture)<br />

<br />

ICA <strong>of</strong> goods whose importation would be exempt<br />

<br />

ICA <strong>of</strong> goods by persons not/not required to be art.10 registered where <strong>VAT</strong><br />

on the ICA would have been refundable if charged<br />

<br />

<br />

<br />

ICA <strong>of</strong> goods intended to be placed under a customs duty suspension<br />

regime<br />

ICA <strong>of</strong> food (as defined)<br />

ICA <strong>of</strong> Investment gold (unless option for taxation is exercised)<br />

<br />

ICA <strong>of</strong> goods supplied under margin scheme for second hand goods, works<br />

<strong>of</strong> art etc.<br />

Exempt importations<br />

5 th Schedule, Part 4<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Goods the supply <strong>of</strong> which is exempt<br />

Goods exempt from customs duty on import<br />

Goods intended to be placed under a customs duty suspension<br />

regime<br />

Goods imported for the purposes <strong>of</strong> onward supply (Onward Supply<br />

Relief)<br />

Catches <strong>of</strong> fish<br />

Re-importation <strong>of</strong> exported goods in the same state<br />

Re-importation <strong>of</strong> goods exported for repair, transformation or<br />

adaptation (exemption limited to value <strong>of</strong> goods at time <strong>of</strong> export)<br />

Food (as defined)<br />

Investment gold (where option for taxation is not exercised)<br />

10

Onward Supply Relief<br />

5 th Schedule, Part 3 item 3<br />

<br />

<br />

<br />

<br />

<br />

<br />

Guidance notes issued by the <strong>VAT</strong> department<br />

Exemption from the payment <strong>of</strong> import <strong>VAT</strong> on goods imported into<br />

<strong>Malta</strong> and subsequently dispatched to another EC Member State as<br />

an exempt with credit intra-community supply;<br />

The goods must not undergo any processing in <strong>Malta</strong>;<br />

The goods must be dispatched to another EC Member State within<br />

30 days;<br />

The relevant reporting and documentary requirements must be met;<br />

<strong>VAT</strong> is accounted for by the purchaser in the MS <strong>of</strong> arrival as an<br />

Intra-community acquisition.<br />

Supplies <strong>of</strong> Goods & Services:<br />

Deemed supplies and<br />

Self-supplies<br />

Supplies <strong>of</strong> Goods & Services<br />

<br />

2 nd Schedule <strong>VAT</strong> Act – rules for determining what constitutes a<br />

supply <strong>of</strong> goods and what constitutes a supply <strong>of</strong> services;<br />

<br />

Concepts <strong>of</strong> deemed supplies, self-supplies, private use, free<br />

supplies;<br />

<br />

Principle: where <strong>VAT</strong> on goods was deducted, the private use or<br />

free supply there<strong>of</strong> is considered to be a supply for consideration <strong>of</strong><br />

those goods;<br />

<br />

“Self-supply” = the use or application <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity <strong>of</strong> a person that does not consist <strong>of</strong> the delivery <strong>of</strong><br />

the goods to or the performance <strong>of</strong> services for another person but<br />

which is treated as a supply <strong>of</strong> goods/services in terms <strong>of</strong> the 2 nd<br />

Schedule <strong>VAT</strong>A<br />

11

Supplies <strong>of</strong> Goods & Services<br />

2 nd Schedule <strong>VAT</strong>A:<br />

Item 14 – the application <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity<br />

Item 15 – the private use <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity<br />

“goods forming part <strong>of</strong> an economic activity = goods,<br />

including fixed assets, used by a taxable person for the<br />

purpose <strong>of</strong> his economic activity<br />

Application <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity<br />

2 nd Schedule item 14:<br />

<br />

<br />

<br />

<br />

Private use by Article 10 registered<br />

person<br />

Private use by person’s staff<br />

Disposal free <strong>of</strong> charge<br />

Application for purposes other than<br />

economic activity<br />

…Where the <strong>VAT</strong> on the<br />

goods/components there<strong>of</strong> was<br />

wholly/partially deducted<br />

Treated as a supply <strong>of</strong><br />

goods for consideration<br />

The ‘supplier’ must<br />

account for <strong>VAT</strong> on<br />

taxable value (rules for<br />

determining the taxable<br />

value in the 7 th Schedule)<br />

The ‘supplier’, if registered<br />

under article 10, must<br />

issue tax invoice to<br />

himself (article 50(2))<br />

Application <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity<br />

Exception:<br />

Gifts made for business purposes where cost to donor is<br />

not more than EUR46 (unless a series <strong>of</strong> gifts to the<br />

same person)<br />

Gift <strong>of</strong> industrial samples in the form not available for<br />

sale to public<br />

<br />

the above are not considered to be supplies made for<br />

consideration by a taxable person acting as such and<br />

therefore they fall outside the scope <strong>of</strong> <strong>Malta</strong> <strong>VAT</strong>.<br />

gifts which form part <strong>of</strong> a “series or succession” <strong>of</strong> gifts<br />

made to the same person fall within the scope <strong>of</strong> <strong>VAT</strong>.<br />

12

Application <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity<br />

Goods forming part <strong>of</strong> the economic activity <strong>of</strong> a person<br />

registered under article 10 at the time when the article 10<br />

registration <strong>of</strong> that person is cancelled (Where the <strong>VAT</strong><br />

on the goods/components there<strong>of</strong> was wholly/partially<br />

deducted):<br />

- The person shall be considered to have made a supply <strong>of</strong> those<br />

goods for consideration and must therefore account for <strong>VAT</strong> on<br />

the ‘supply’ (unless the business is transferred as a going<br />

concern to a person registered under article 10);<br />

- The Commissioner may exempt that person from accounting for<br />

<strong>VAT</strong> on the supply when the taxable value is less than EUR232.<br />

Private Use <strong>of</strong> goods forming part <strong>of</strong> an<br />

economic activity<br />

2 nd Schedule item 15:<br />

The use <strong>of</strong> goods forming part <strong>of</strong> an economic activity <strong>of</strong><br />

a taxable person registered under article 10 by that<br />

person himself or by another person other than for the<br />

purpose <strong>of</strong> that economic activity<br />

…is treated as a supply <strong>of</strong> services for consideration<br />

made by that taxable person acting as such<br />

<br />

<br />

The taxable person must therefore account for <strong>VAT</strong> on the<br />

supply;<br />

The taxable person, if registered under article 10, must issue tax<br />

invoice to himself (article 50(2))<br />

Transfer <strong>of</strong> a going concern<br />

2 nd Schedule item 16:<br />

Transfer <strong>of</strong> assets <strong>of</strong> an economic activity;<br />

To a person registered under article 10;<br />

Activity/part there<strong>of</strong> being transferred is capable <strong>of</strong><br />

separate operation;<br />

Assets transferred are to be used in carrying on the same<br />

kind <strong>of</strong> activity (whether or not as part <strong>of</strong> an existing<br />

activity <strong>of</strong> the transferee);<br />

Transfer is recorded in the records <strong>of</strong> the transferor<br />

indicating the registration number <strong>of</strong> the transferee;<br />

…NOT a supply <strong>of</strong> goods/services for <strong>Malta</strong> <strong>VAT</strong> purposes.<br />

13