ASX ANNOUNCEMENT Bega Cheese Limited ... - Open Briefing

ASX ANNOUNCEMENT Bega Cheese Limited ... - Open Briefing

ASX ANNOUNCEMENT Bega Cheese Limited ... - Open Briefing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements<br />

Year Ended 30 June 2011<br />

Notes to the Financial Statements (cont.)<br />

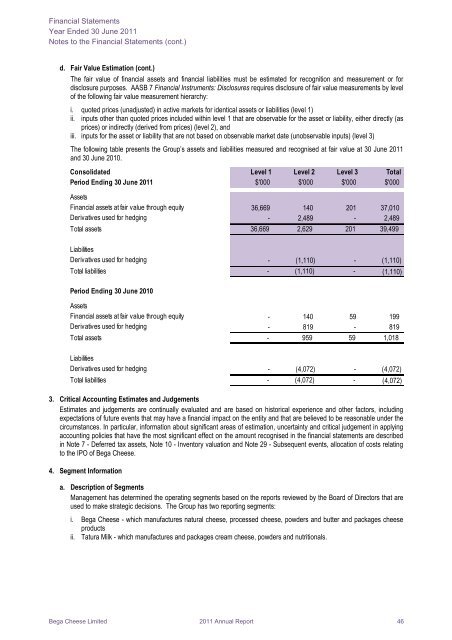

d. Fair Value Estimation (cont.)<br />

The fair value of financial assets and financial liabilities must be estimated for recognition and measurement or for<br />

disclosure purposes. AASB 7 Financial Instruments: Disclosures requires disclosure of fair value measurements by level<br />

of the following fair value measurement hierarchy:<br />

i. quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1)<br />

ii. inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (as<br />

prices) or indirectly (derived from prices) (level 2), and<br />

iii. inputs for the asset or liability that are not based on observable market date (unobservable inputs) (level 3)<br />

The following table presents the Group’s assets and liabilities measured and recognised at fair value at 30 June 2011<br />

and 30 June 2010.<br />

Consolidated Level 1 Level 2 Level 3 Total<br />

Period Ending 30 June 2011 $'000 $'000 $'000 $'000<br />

Assets<br />

Financial assets at fair value through equity 36,669 140 201 37,010<br />

Derivatives used for hedging - 2,489 - 2,489<br />

Total assets 36,669 2,629 201 39,499<br />

Liabilities<br />

Derivatives used for hedging - (1,110) - (1,110)<br />

Total liabilities - (1,110) - (1,110)<br />

Period Ending 30 June 2010<br />

Assets<br />

Financial assets at fair value through equity - 140 59 199<br />

Derivatives used for hedging - 819 - 819<br />

Total assets - 959 59 1,018<br />

Liabilities<br />

Derivatives used for hedging - (4,072) - (4,072)<br />

Total liabilities - (4,072) - (4,072)<br />

3. Critical Accounting Estimates and Judgements<br />

Estimates and judgements are continually evaluated and are based on historical experience and other factors, including<br />

expectations of future events that may have a financial impact on the entity and that are believed to be reasonable under the<br />

circumstances. In particular, information about significant areas of estimation, uncertainty and critical judgement in applying<br />

accounting policies that have the most significant effect on the amount recognised in the financial statements are described<br />

in Note 7 - Deferred tax assets, Note 10 - Inventory valuation and Note 29 - Subsequent events, allocation of costs relating<br />

to the IPO of <strong>Bega</strong> <strong>Cheese</strong>.<br />

4. Segment Information<br />

a. Description of Segments<br />

Management has determined the operating segments based on the reports reviewed by the Board of Directors that are<br />

used to make strategic decisions. The Group has two reporting segments:<br />

i. <strong>Bega</strong> <strong>Cheese</strong> - which manufactures natural cheese, processed cheese, powders and butter and packages cheese<br />

products<br />

ii. Tatura Milk - which manufactures and packages cream cheese, powders and nutritionals.<br />

<strong>Bega</strong> <strong>Cheese</strong> <strong>Limited</strong> 2011 Annual Report 46