Financial Statements - Mewah Group

Financial Statements - Mewah Group

Financial Statements - Mewah Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MEWAH INTERNATIONAL INC.<br />

ANNUAL REPORT 2011<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

For the financial year ended 31 December 2011<br />

2. Significant accounting policies (continued)<br />

2.4 Property, plant and equipment (continued)<br />

(a)<br />

Measurement (continued)<br />

(i)<br />

Property, plant and equipment (continued)<br />

Increase in carrying amount arising from revaluation, including currency translation differences, are recognised<br />

in the asset revaluation reserve, unless they offset previous decreases in the carrying amounts of the same<br />

asset, in which case, they are recognised in profit or loss. Decreases in carrying amounts that offset previous<br />

increases of the same asset are recognised against the asset revaluation reserve. All other decreases in carrying<br />

amounts are recognised as a loss in the statement of comprehensive income.<br />

The <strong>Group</strong> on 1 January 2007 has elected to adopt FRS 101 exemption to deem the previous revaluation of<br />

certain property, plant and equipment as deemed cost (Note 18(c)).<br />

(ii)<br />

Components of costs<br />

The cost of an item of property, plant and equipment initially recognised includes its purchase price and<br />

any cost that is directly attributable to bringing the asset to the location and condition necessary for it to be<br />

capable of operating in the manner intended by management. Cost also includes borrowing costs that are<br />

directly attributable to the acquisition, construction or production of a qualifying asset (refer to Note 2.8 on<br />

borrowing costs).<br />

(b)<br />

Depreciation<br />

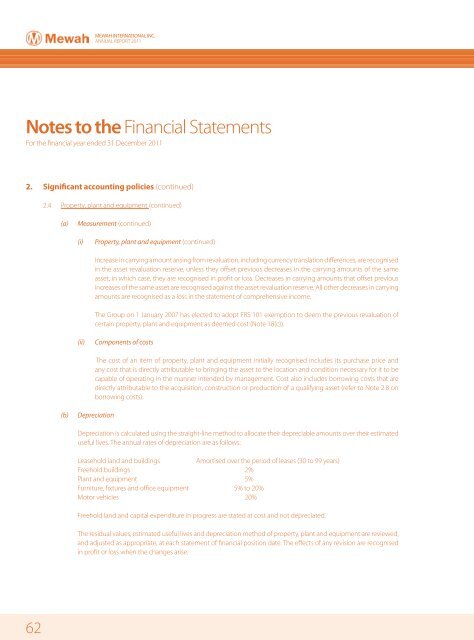

Depreciation is calculated using the straight-line method to allocate their depreciable amounts over their estimated<br />

useful lives. The annual rates of depreciation are as follows:<br />

Leasehold land and buildings<br />

Amortised over the period of leases (30 to 99 years)<br />

Freehold buildings 2%<br />

Plant and equipment 5%<br />

Furniture, fixtures and office equipment 5% to 20%<br />

Motor vehicles 20%<br />

Freehold land and capital expenditure in progress are stated at cost and not depreciated.<br />

The residual values, estimated useful lives and depreciation method of property, plant and equipment are reviewed,<br />

and adjusted as appropriate, at each statement of financial position date. The effects of any revision are recognised<br />

in profit or loss when the changes arise.<br />

62