Financial Statements - Mewah Group

Financial Statements - Mewah Group

Financial Statements - Mewah Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MEWAH INTERNATIONAL INC.<br />

ANNUAL REPORT 2011<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

For the financial year ended 31 December 2011<br />

32. <strong>Financial</strong> risk management (continued)<br />

(a)<br />

Market risk (continued)<br />

(i)<br />

Currency risk (continued)<br />

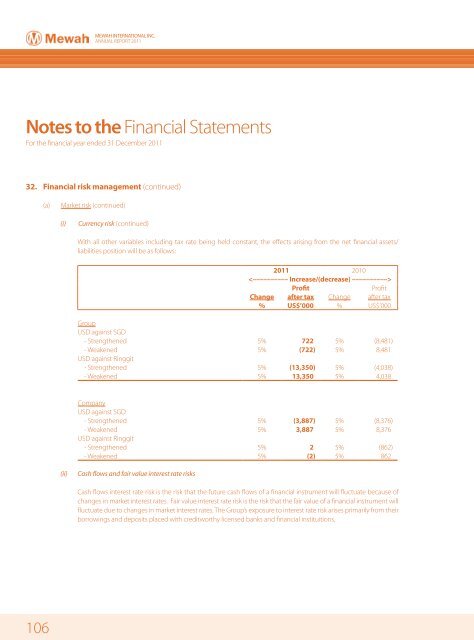

With all other variables including tax rate being held constant, the effects arising from the net financial assets/<br />

liabilities position will be as follows:<br />

2011 2010<br />

<br />

Change<br />

Profit<br />

after tax Change<br />

Profit<br />

after tax<br />

% US$’000 % US$’000<br />

<strong>Group</strong><br />

USD against SGD<br />

- Strengthened 5% 722 5% (8,481)<br />

- Weakened 5% (722) 5% 8,481<br />

USD against Ringgit<br />

- Strengthened 5% (13,350) 5% (4,038)<br />

- Weakened 5% 13,350 5% 4,038<br />

Company<br />

USD against SGD<br />

- Strengthened 5% (3,887) 5% (8,376)<br />

- Weakened 5% 3,887 5% 8,376<br />

USD against Ringgit<br />

- Strengthened 5% 2 5% (862)<br />

- Weakened 5% (2) 5% 862<br />

(ii)<br />

Cash flows and fair value interest rate risks<br />

Cash flows interest rate risk is the risk that the future cash flows of a financial instrument will fluctuate because of<br />

changes in market interest rates. Fair value interest rate risk is the risk that the fair value of a financial instrument will<br />

fluctuate due to changes in market interest rates. The <strong>Group</strong>’s exposure to interest rate risk arises primarily from their<br />

borrowings and deposits placed with creditworthy licensed banks and financial instituitions.<br />

106