Council Tax Summary 2012-13 in PDF format - Allerdale Borough ...

Council Tax Summary 2012-13 in PDF format - Allerdale Borough ...

Council Tax Summary 2012-13 in PDF format - Allerdale Borough ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

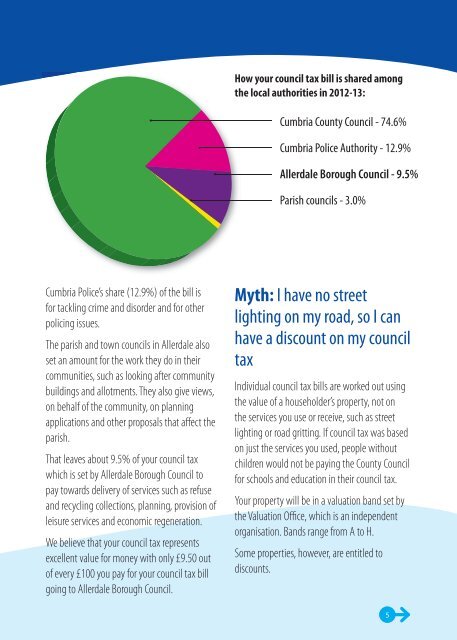

How your council tax bill is shared among<br />

the local authorities <strong>in</strong> <strong>2012</strong>-<strong>13</strong>:<br />

Cumbria County <strong>Council</strong> - 74.6%<br />

Cumbria Police Authority - 12.9%<br />

<strong>Allerdale</strong> <strong>Borough</strong> <strong>Council</strong> - 9.5%<br />

Parish councils - 3.0%<br />

Cumbria Police’s share (12.9%) of the bill is<br />

for tackl<strong>in</strong>g crime and disorder and for other<br />

polic<strong>in</strong>g issues.<br />

The parish and town councils <strong>in</strong> <strong>Allerdale</strong> also<br />

set an amount for the work they do <strong>in</strong> their<br />

communities, such as look<strong>in</strong>g after community<br />

build<strong>in</strong>gs and allotments. They also give views,<br />

on behalf of the community, on plann<strong>in</strong>g<br />

applications and other proposals that affect the<br />

parish.<br />

That leaves about 9.5% of your council tax<br />

which is set by <strong>Allerdale</strong> <strong>Borough</strong> <strong>Council</strong> to<br />

pay towards delivery of services such as refuse<br />

and recycl<strong>in</strong>g collections, plann<strong>in</strong>g, provision of<br />

leisure services and economic regeneration.<br />

We believe that your council tax represents<br />

excellent value for money with only £9.50 out<br />

of every £100 you pay for your council tax bill<br />

go<strong>in</strong>g to <strong>Allerdale</strong> <strong>Borough</strong> <strong>Council</strong>.<br />

Myth: I have no street<br />

light<strong>in</strong>g on my road, so I can<br />

have a discount on my council<br />

tax<br />

Individual council tax bills are worked out us<strong>in</strong>g<br />

the value of a householder’s property, not on<br />

the services you use or receive, such as street<br />

light<strong>in</strong>g or road gritt<strong>in</strong>g. If council tax was based<br />

on just the services you used, people without<br />

children would not be pay<strong>in</strong>g the County <strong>Council</strong><br />

for schools and education <strong>in</strong> their council tax.<br />

Your property will be <strong>in</strong> a valuation band set by<br />

the Valuation Office, which is an <strong>in</strong>dependent<br />

organisation. Bands range from A to H.<br />

Some properties, however, are entitled to<br />

discounts.<br />

5