May-June 2012 - The International Organization of Masters, Mates ...

May-June 2012 - The International Organization of Masters, Mates ...

May-June 2012 - The International Organization of Masters, Mates ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Masters</strong>, <strong>Mates</strong> & Pilots Plans<br />

Princeton, N.J. <strong>The</strong> Scholarship Recognition Award Program<br />

will review the qualifications <strong>of</strong> all applicants and then select<br />

the winners. <strong>The</strong> names <strong>of</strong> the winners will be presented to the<br />

Trustees for final approval at their meeting in <strong>June</strong> 2013. To<br />

request an application packet, please contact Madeline Petrelli at<br />

the Plan Office at 410-850-8615.<br />

Medicare Part D<br />

For pensioners and their dependents who are covered under<br />

Medicare and are secondary under the MM&P Health & Benefit<br />

Plan, the Plan’s Prescription Drug Program has been and continues<br />

to be comparable to the prescription coverage <strong>of</strong>fered<br />

by the Medicare Part D Program. <strong>The</strong> Plan in September 2011<br />

sent participants the required annual notice explaining that<br />

the Plan’s prescription coverage is “creditable” for <strong>2012</strong>. This is<br />

why we advise pensioners and dependents not to enroll in the<br />

Medicare Part D program. <strong>The</strong> only exception is for retirees and<br />

dependents belonging to the Columbia Northwest Group; their<br />

prescription drug coverage is “non-creditable.” Participants and<br />

dependents in the Columbia Northwest Retiree Group should<br />

enroll in the Medicare Part D Prescription Drug Program.<br />

Because the MM&P Health & Benefit Prescription Drug<br />

Program is “creditable,” the Plan has applied for and received a<br />

subsidy for a percentage <strong>of</strong> the prescription drug costs incurred<br />

by Medicare-eligible Offshore retirees and dependents. To<br />

receive the subsidy, every year the Plan must file an application<br />

with the Center for Medicare and Medicaid Services (CMS).<br />

<strong>The</strong> subsidy equals approximately 28 percent <strong>of</strong> the cost <strong>of</strong> the<br />

prescription drug benefit <strong>of</strong> this Group.<br />

For the <strong>2012</strong> calendar year, the Plan’s application has been<br />

approved. For 2011, the Plan requested and received approximately<br />

$1,074,800 in subsidies, which have helped defray the<br />

costs <strong>of</strong> providing this benefit to the Plan’s Offshore retirees and<br />

dependents.<br />

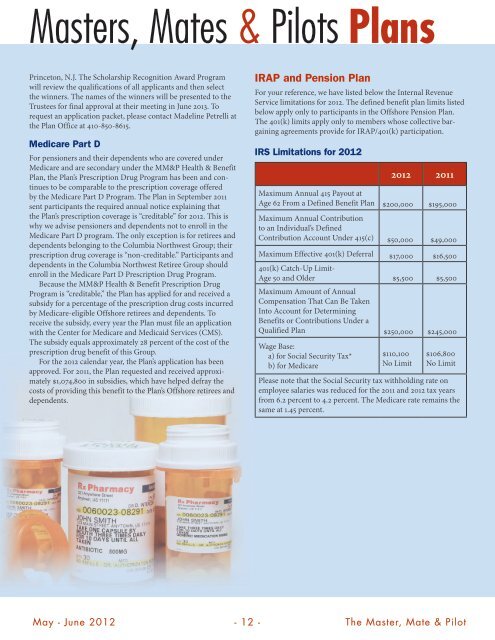

IRAP and Pension Plan<br />

For your reference, we have listed below the Internal Revenue<br />

Service limitations for <strong>2012</strong>. <strong>The</strong> defined benefit plan limits listed<br />

below apply only to participants in the Offshore Pension Plan.<br />

<strong>The</strong> 401(k) limits apply only to members whose collective bargaining<br />

agreements provide for IRAP/401(k) participation.<br />

IRS Limitations for <strong>2012</strong><br />

<strong>2012</strong> 2011<br />

Maximum Annual 415 Payout at<br />

Age 62 From a Defined Benefit Plan $200,000 $195,000<br />

Maximum Annual Contribution<br />

to an Individual’s Defined<br />

Contribution Account Under 415(c) $50,000 $49,000<br />

Maximum Effective 401(k) Deferral $17,000 $16,500<br />

401(k) Catch-Up Limit-<br />

Age 50 and Older $5,500 $5,500<br />

Maximum Amount <strong>of</strong> Annual<br />

Compensation That Can Be Taken<br />

Into Account for Determining<br />

Benefits or Contributions Under a<br />

Qualified Plan $250,000 $245,000<br />

Wage Base:<br />

a) for Social Security Tax*<br />

b) for Medicare<br />

$110,100<br />

No Limit<br />

$106,800<br />

No Limit<br />

Please note that the Social Security tax withholding rate on<br />

employee salaries was reduced for the 2011 and <strong>2012</strong> tax years<br />

from 6.2 percent to 4.2 percent. <strong>The</strong> Medicare rate remains the<br />

same at 1.45 percent.<br />

<strong>May</strong> - <strong>June</strong> <strong>2012</strong> - 12 - <strong>The</strong> Master, Mate & Pilot