Company Details Form - C - BMI

Company Details Form - C - BMI

Company Details Form - C - BMI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

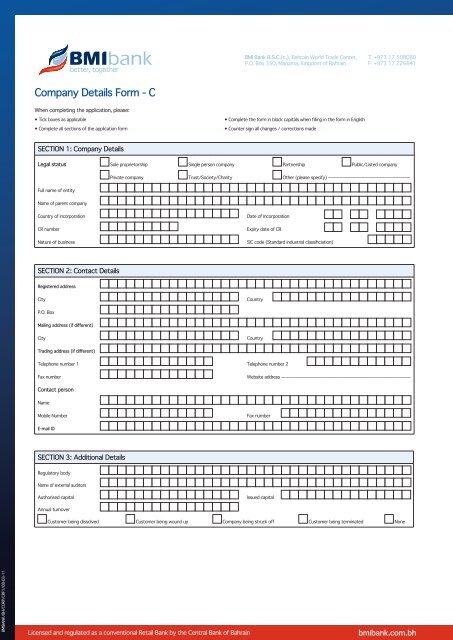

<strong>Company</strong> <strong>Details</strong> <strong>Form</strong> - C<br />

When completing the application, please:<br />

• Tick boxes as applicable<br />

• Complete all sections of the application form<br />

• Complete the form in block capitals when filling in the form in English<br />

• Counter sign all changes / corrections made<br />

SECTION 1: <strong>Company</strong> <strong>Details</strong><br />

Legal status Sole proprietorship Single person company Partnership Public/Listed company<br />

Private company Trust/Society/Charity Other (please specify) _____________________________<br />

Full name of entity<br />

Name of parent company<br />

Country of incorporation<br />

CR number<br />

Nature of business<br />

Date of incorporation<br />

Expiry date of CR<br />

SIC code (Standard industrial classificiation)<br />

SECTION 2: Contact <strong>Details</strong><br />

Registered address<br />

City<br />

Country<br />

P.O. Box<br />

Mailing address (if different)<br />

City<br />

Country<br />

Trading address (if different)<br />

Telephone number 1 Telephone number 2<br />

Fax number<br />

Website address ______________________________________________<br />

Contact person<br />

Name<br />

Mobile Number<br />

Fax number<br />

E-mail ID<br />

SECTION 3: Additional <strong>Details</strong><br />

Regulatory body<br />

Name of external auditors<br />

Authorised capital<br />

Issued capital<br />

Annual turnover<br />

Customer being dissolved Customer being wound up <strong>Company</strong> being struck off Customer being terminated None<br />

<strong>BMI</strong>BANK/BH/CORP/CRF1/08-03-11<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

Proprietor/Partners/Shareholders (If more than 20%) information (please provide constitutional documentation):<br />

Name<br />

(as per passport/CPR)<br />

CR number CPR/Passport number Country of residence Nationality<br />

Directors information:<br />

Name (as per passport/CPR) Country of residence Nationality<br />

SECTION 4: Services Required<br />

ATM/Debit card Treasury Trade finance/GTS Sweeping service Internet banking<br />

Delivery instruction Registered address Mailing address<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

Account <strong>Details</strong> <strong>Form</strong> - C<br />

Please note: A current account in BHD is mandatory for customers opening a liability account as part of the financing process.<br />

If you require a <strong>BMI</strong> Bank liability account, please complete all sections.<br />

SECTION 1- Account <strong>Details</strong><br />

Type of account Current Savings Term deposit Call deposit Super current account<br />

Ayadi Visa Diners club Prestige Non-checking account<br />

Please provide details of the term deposits on the seperate term deposits form<br />

Account number<br />

Currency Bahrain dinars US dollars Euro Other<br />

Purpose of account<br />

Initial deposit amount Mode of payment Cash Cheque Fund transfer Other ______<br />

Cheque book required Yes No<br />

SECTION 2: Additional <strong>Details</strong><br />

Source of funds Salary Business If others, please specify –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

Anticipated volume of monthly transactions<br />

Debit amount Mode Cash Cheque Fund transfer Other<br />

Credit amount Mode Cash Cheque Fund transfer Other<br />

Frequency of bank statements Daily Weekly Monthly Quarterly<br />

Delivery instruction Registered address Mailing address<br />

For charities, do you have another account with a different bank in Bahrain Yes No<br />

SECTION 3: Declaration for <strong>BMI</strong> Liability Account<br />

The details provided in these forms are true to the best of my/our knowledge and ability. The general terms and conditions and the tariff and commission schedule<br />

that apply, have been read and understood and I/we expressly agree to abide by them and any new terms and conditions that may come into effect from time to<br />

time as advised by the Bank, by mail to my/our last recorded address and/or displayed conspiculously on the Bank´s premises.<br />

I/we undertake to regularly provide the bank with renewed/updated documents that need to be provided to keep the relationship regularized.<br />

Signature ––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

<strong>BMI</strong>BANK/BH/CORP/CRF1/08-03-11<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

SECTION 4: Authorized Signatories<br />

For joint accounts, please confirm the preferred operating mode:<br />

Any one<br />

Any two<br />

Name CPR/Passport Nationality Date Signature Remarks<br />

Account introduced by:<br />

Signature ______________________________<br />

Branch<br />

In case the customer is not introduced by an existing customer, branch manager’s approval must be obtained.<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

Document Requirements – C<br />

• This form should be completed by non-individual customers initiating a relationship with <strong>BMI</strong> Bank.<br />

• In order to process this application the following, as relevant, must be provided with the completed form. Inadequate supporting documentation could result in<br />

the process being delayed.<br />

• If original documents are sighted, bank officer must certify the copy stating, “Original Seen”. This must be signed, dated and the name of the officer provided. If<br />

copies are given, they have to be certified by: a Lawyer, a Notary, a Chartered Accountant, an Official of a Government Ministry, an Official of an Embassy, or an<br />

Official of a Licenced Financial Institution.<br />

SECTION 1: Supporting Documents (required for opening a <strong>BMI</strong> Bank account:)<br />

Sole Proprietorship/Single Person <strong>Company</strong><br />

Identification documents (must include a clear photograph)<br />

Passport (with valid Residence Permit for expatriates only) Central Population Register (CPR) Drivers’ Licence<br />

Commercial Registration (CR)<br />

Authorization letter<br />

Proof of address (if physical address does not match ID or is not shown)<br />

Latest business bank statements (last 3 months)<br />

Partnerships<br />

Partnership Agreement<br />

Identification documents of the partners<br />

Partnership registration documents<br />

List of authorized signatories and identification documents<br />

Copy of latest financial statements<br />

Public/Private/WLL Companies<br />

Copy of Commercial Registration (CR) or Incorporation Certificate*<br />

Articles of Association<br />

Identification documents for authorized signatories<br />

Board resolution authorizing operation of the account<br />

List of shareholders with 20% of issued capital and<br />

Identification/constitutional documents<br />

Memorandum of Association<br />

Passport and CPR copies for Directors<br />

Copy of latest financial statements<br />

Board resolution appointing signatories. For banks, Original<br />

authorized signatory list is acceptable<br />

* If older than 1 year please present a Certificate of Good Standing or a receipt of License Renewal.<br />

Trusts<br />

Trust deed<br />

Identification documents of the settler and Trustee<br />

Copy of latest financial statements (audited where possible)<br />

Trust registration documents<br />

Clear authority from the Settler to the Trustee to operate<br />

the account<br />

Charities/Societies (provide the following documents in addition to the above requirements, depending on the type of entity)<br />

Certification of authorization from Ministry<br />

List of authorized signatories<br />

<strong>BMI</strong>BANK/BH/CORP/CRF1/08-03-11<br />

Written confirmation of GOYS registration<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

Politically Exposed Persons (PEP) <strong>Details</strong> <strong>Form</strong><br />

For Retail customer<br />

PEP: ’Politically exposed persons’ means individuals who are, or have been, entrusted with prominent public functions in Bahrain - or a foreign country, such as<br />

Heads of State or government, senior politicians, senior government, judicial or military officials, senior executives of state owned corporations or important<br />

political party officials. Bahraini PEPs would include all ministers, all MPs, and all ministry officials with the rank of Undersecretary or above.<br />

1. Is the customer a politically exposed person<br />

Yes<br />

No<br />

Position title/Description<br />

2. Is the customer related to a PEP<br />

Yes<br />

No<br />

Any person who is a member of the immediate family of a PEP (e.g. parent, brother, sister, son, daughter, father-in-law, mother-in-law;<br />

or a senior advisor or other person known to be closely associated with a PEP)<br />

Position title/Description of PEP<br />

For Corporate customer<br />

1. Is anyone of the directors, shareholders (holding more than 20% stake individually), proprietor or partners a politically exposed person<br />

Yes<br />

No<br />

Other <strong>Details</strong><br />

Directorship<br />

Shareholdings<br />

Business ownerships<br />

Other sources of income<br />

____________________________________________________________________________________<br />

____________________________________________________________________________________<br />

____________________________________________________________________________________<br />

____________________________________________________________________________________<br />

Declaration<br />

Customer service agent<br />

Date<br />

X<br />

Signature<br />

Head of business name<br />

Date<br />

X<br />

Signature<br />

Copy of a PEP customer’s completed application form should be sent to the compliance department.

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

For Bank Use Only - C (to be completed by <strong>BMI</strong> Bank staff)<br />

KYC Review<br />

Confirm having met customer in person Original documents seen, copies made OR Certified documents seen, copies made<br />

Risk Classification<br />

Standard Enhanced Due Diligence Simplified<br />

Reason<br />

Reason<br />

Standard:<br />

Enhanced:<br />

Simplified:<br />

For all customers other than those mentioned below.<br />

For Business from Societies, Charieties, Clubs and and PEP related. Approval from Head of Business is required. A copy must be sent to Compliance.<br />

For Banks, Governments, Semi Governments, CBB, BSE Listed Companies, ministry of a Gulf Cooperation Council (GCC) or Financial Action Task Force (FATF).<br />

Reference Check<br />

With Whom<br />

Database/Directory Search<br />

Trust <strong>Details</strong><br />

Name of Trustee<br />

Name of Settler<br />

Name of Beneficaries/<br />

Unit Holder<br />

Type of Trust Discretionary Unit Family Pension Charitable Mutual Fund<br />

Anticipated Transcation With<br />

Countries<br />

Organization<br />

Customer Relationship <strong>Form</strong> And Supporting Documents Checked By<br />

Officer Name Signature _________________ Date<br />

Account Authorized By Signature _________________ Date<br />

System Input By Signature _________________ Date<br />

Authorized By Signature _________________ Date<br />

Account Number<br />

Risk Country<br />

KYC Review History (to be performed every 3 years)<br />

Year 1<br />

Confirm having met Customer in person Original documents seen, copies made OR Certified documents seen, copies made<br />

Risk Classification<br />

Date<br />

Standard Enhanced Due Diligence Simplified<br />

Reason<br />

Reason<br />

Year 2<br />

Confirm having met Customer in person Original documents seen, copies made OR Certified documents seen, copies made<br />

Risk Classification<br />

Date<br />

Standard Enhanced Due Diligence Simplified<br />

Reason<br />

Reason<br />

Year 3<br />

<strong>BMI</strong>BANK/BH/CORP/CRF1/08-03-11<br />

Confirm having met Customer in person Original documents seen, copies made OR Certified documents seen, copies made<br />

Risk Classification<br />

Date<br />

Standard Enhanced Due Diligence Simplified<br />

Reason<br />

Reason<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

Terms and Conditions<br />

Serial No.<br />

GENERAL TERMS AND CONDITIONS GOVERNING OPERATION OF ACCOUNTS WITH <strong>BMI</strong> Bank B.S.C. (c)<br />

These general terms and conditions govern all transactions between <strong>BMI</strong> Bank and the account holder. There may be specific product/service related terms<br />

and conditions which will apply, if the customer avails the product or service, in addition to these terms and conditions.<br />

1. Definitions<br />

a. “Account holder” means the person/s in whose name(s) the account is held.<br />

b. “Account” means the account/s opened or to be opened in future as mutually agreed or as required from time to time as per <strong>BMI</strong> Bank’s accounting<br />

and internal processes/regulation.<br />

c. “Authorized Signatory”, in case of individual accounts and joint accounts means signatory to the document and in case of non-individuals, means<br />

persons duly authorised by such non-individual entity by way of a Board resolution in case of companies or partnership deed in case of partnerships,<br />

Copy of resolution of a committee in case of clubs and associations or any other applicable document as <strong>BMI</strong> Bank may request.<br />

d. “Place of Business” means <strong>BMI</strong> Bank’s head office or any of its branches in the Kingdom of Bahrain.<br />

2. Deposits and withdrawals<br />

(a) Account holder may withdraw cash in person against <strong>BMI</strong> Bank cheques or withdrawal voucher. Third party withdrawals can be made only against<br />

<strong>BMI</strong> Bank cheques. Withdrawal by any other means may be allowed at the sole discretion of <strong>BMI</strong> Bank.<br />

(b) <strong>BMI</strong> Bank shall, without enquiry, honour any cheques or other orders for the payment of money and shall debit the amounts payable as<br />

a result thereof to the account, whether the account is in credit or overdrawn or may become overdrawn as a result, without prejudice to<br />

<strong>BMI</strong> Bank’s right to refuse to honour such payments in the event of the account becoming overdrawn or an existing overdraft in the account being<br />

increased.<br />

(c) Any indebtedness or liability on part of the account holder to <strong>BMI</strong> Bank must, unless otherwise agreed in writing, be settled on demand from <strong>BMI</strong><br />

Bank.<br />

(d) <strong>BMI</strong> Bank may, at any time, refuse to accept a deposit, or limit the amount of any deposit, without assigning any reason.<br />

3. Cheque books, cheques/instruments deposited for collection and unpaid cheques<br />

(a) Issuance of cheque books shall be at the sole discretion of <strong>BMI</strong> Bank and for account types as decided by <strong>BMI</strong> Bank.<br />

(b) <strong>BMI</strong> Bank is not liable in case of cheques dishonoured due to insufficient balance in the account. <strong>BMI</strong> Bank shall not be liable or responsible for failure<br />

to give notice of non-payment or dishonour of any cheque, or for any claims, losses or expenses which may arise as a result of dishonoured cheque.<br />

(c) <strong>BMI</strong> Bank, at its discretion, may honour cheques in case of insufficient balance, causing the account to go in overdraft, it will be the account holder’s<br />

responsibility to regularize the account.<br />

(d) Acting as the account holder’s collection agent, <strong>BMI</strong> Bank may agree to accept, but without assuming any responsibility for their realization,<br />

cheques, drafts and other similar payment instruments for deposit, provided they are made out in form and substance acceptable to<br />

<strong>BMI</strong> Bank, in favour of the account holder or endorsed to their order.<br />

(e) <strong>BMI</strong> Bank shall collect cheques and other instruments deposited for collection, directly or indirectly or through any agents at the entire risk and<br />

responsibility of the account holder.<br />

(f) Cheques crossed as account payee only will be deposited only to such specific account.<br />

(g) <strong>BMI</strong> Bank reserves the right to decline deposit of pay order or cheques with single or multiple endorsements.<br />

(h) Save for a manifest error, <strong>BMI</strong> Bank or its agents shall not be held liable for the loss, mutilation or dishonour of a cheque or other instrument or for the<br />

failure to credit, late presentation, and granting time, any delay in crediting the account or non-payment and return of cheques or other instruments<br />

or for non-compliance with the account holder’s instructions.<br />

(i) <strong>BMI</strong> Bank reserves the right to debit any account or demand payment from the account holder for any amounts exceptionally credited or credited<br />

under reserve which are subsequently unpaid.<br />

(j) Any discounting of third-party cheques or cheque purchase if made is done with full recourse to the account holder. <strong>BMI</strong> Bank reserves the right to<br />

debit the account with the amount of any cheque which was drawn or endorsed in favour of the account holder (whether or not the cheque is drawn<br />

on <strong>BMI</strong> Bank, its branches, affiliates, subsidiaries) that has been credited to the account and is subsequently unpaid, whether or not the cheque itself<br />

can be returned.<br />

(k) Reference in any statement of account to a value date for a cheque deposited for collection shall not be interpreted as a representation of that date<br />

at all, unless or until such proceeds are actually collected by <strong>BMI</strong> Bank.<br />

(l) In case of abuser of cheque, <strong>BMI</strong> Bank shall follow the guidelines issued by the Central Bank of Bahrain from time to time.<br />

(m) A cheque shall be effective for six months from the date of its receipt by <strong>BMI</strong> Bank or the date of the cheque, whichever is earlier.<br />

(n) The account holder waives the right of protest of any negotiable instrument to which the account holder is a party, acquired or held by<br />

<strong>BMI</strong> Bank or received by it for credit, collection or otherwise.<br />

4. Stop payments<br />

(a) “Stop Payment Orders” (instructions given to <strong>BMI</strong> Bank by the account holder not to honour a cheque or any other payment instruction) shall only<br />

be accepted by <strong>BMI</strong> Bank if given in writing and only in the event of the loss or theft, or the bankruptcy of the holder of such instrument. Where a<br />

stop payment order arises as a result of the loss or theft of a blank cheque or a cheque book, <strong>BMI</strong> Bank shall have the right to require the account<br />

holder to close the account and open a new one.<br />

(b) <strong>BMI</strong> Bank shall not be held liable for its failure to act on a stop payment order whether such failure be due to error, inadvertence, oversight or any<br />

other reason whatsoever.<br />

(c) All costs, claims, and expenses arising from the non-payment of such cheques, instruments shall be borne by the account holder and will be debited<br />

to his account.<br />

5. Foreign currency<br />

(a) Deposits in foreign currency may be accepted by <strong>BMI</strong> Bank at its sole discretion.<br />

(b) Withdrawal in foreign currency notes shall be subject to their availability.<br />

(c) In the absence of specific written instructions, inward remittances can be credited to any account of the customer.<br />

6. Interest<br />

(a) Overdraft – Interest on authorized overdrafts shall be calculated at the contracted rate and interest on unauthorized overdrafts shall be calculated<br />

at a rate decided by <strong>BMI</strong> Bank. Such interest shall be debited to the account on monthly basis and shall become an integral part of the indebtedness<br />

of the account holder to <strong>BMI</strong> Bank.<br />

(b) Current/savings/Ayadi account – Interest, if any, on current/saving /Ayadi accounts shall be computed at a rate decided by <strong>BMI</strong> Bank from time to<br />

time, and will be credited to the account at a frequency as decided by <strong>BMI</strong> Bank.<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

(c) Time Deposit - Interest on time deposits shall be paid by <strong>BMI</strong> Bank at the contracted rate and credited to the account on maturity or at a frequency<br />

as agreed between the account holder and <strong>BMI</strong> Bank. Customer may instruct <strong>BMI</strong> Bank to automatically roll over the time deposit, in such a case the<br />

interest on the new contract will be as decided by <strong>BMI</strong> Bank. A time deposit may be withdrawn prematurely only at the sole discretion of <strong>BMI</strong> Bank,<br />

and shall be subject to a penalty as decided by <strong>BMI</strong> Bank.<br />

(d) Call Deposit - Call deposit interest rate, as determined by <strong>BMI</strong> Bank from time to time, shall be calculated on the daily credit balances above the<br />

minimum amount stipulated, and credited monthly or quarterly, at the discretion of <strong>BMI</strong> Bank.<br />

(e) <strong>BMI</strong> Bank reserves the right to change interest rates without reference to the account holder. Interest rate changes will be displayed on the notice<br />

board at <strong>BMI</strong> Bank premises.<br />

7. Ayadi account<br />

(a) There is no limit as to the number of entries in to the draw.<br />

(b) Draw entries are equivalent to minimum balance of multiple of BD 50.<br />

(c) In case a deposit is made by cheque, the eligibility date will be the date the cheque is cleared.<br />

(d) Draw eligibility, frequency of draw and draw dates shall be displayed on the Bank’s website at all times.<br />

(e) Each draw is independent of the previous draw hence an account drawn as the winner in one draw will be eligible for the subsequent draws as well.<br />

(f) All draws shall be held under the supervision of the Bank’s Internal and External Auditors, and Ministry of Commerce. The draw result is final and the<br />

customer shall not contest it.<br />

(g) Prizes will only be credited to customer account maintained with the Bank.<br />

(h) No interest is payable on Ayadi account balances.<br />

(i) The Bank reserves the right to use winners’ name and/or photographs for promotional and/or marketing purposes.<br />

(j) The Bank shall not issue cheque book or ATM card in relation to this account.<br />

(k) The Bank reserves the right to change the frequency of draw, eligibility criteria, prizes and prize structure any time at its absolute discretion. The<br />

Bank will notify the customer about the changes through such channels as deemed appropriate by the Bank.<br />

(l) This account can be opened by individuals of all nationalities above the age of 21 years and non - individuals with the exception being that all the<br />

Bank’s employees, directors and their immediate family member are not allowed to open account and in case of non- individuals, Bank’s subsidiaries<br />

will not be allowed to participate.<br />

(m) Ayadi Student Account can be opened by students of all nationalities resident in Bahrain between the ages of 6 and 21. Students between the ages<br />

of 18-21 must provide a copy of their student ID, current course schedule, current semester payment or any other evidence of being a student<br />

acceptable to the Bank. In addition to the above, in case of non-nationals, a valid Bahrain resident permit must be provided at the time of opening the<br />

Ayadi Student Account as well as in the case of claiming the draw. For students below the age of 18, the Bank’s requirements on minor’s accounts<br />

will apply.<br />

8. Minor’s account<br />

(a) Accounts maintained for minors shall be operated by a parent or legally appointed guardian until the minor attains the age of 21.<br />

(b) All the monies standing to the credit of such accounts shall be held for the benefit of the minor and shall not form part of the assets of the operator<br />

of the account.<br />

(c) The operator of the account shall promptly inform <strong>BMI</strong> Bank on the minor reaching the age of 21, after which the minor will be entitled to operate<br />

the account.<br />

(d) The Bank may at its sole discretion open savings accounts for minors between the age of 18 and 21 years, in their own names without the<br />

requirement of a guardian, provided such a minor submits a proof of employment and any other documents as the Bank may require.<br />

9. Joint account<br />

(a) In case of joint accounts, <strong>BMI</strong> Bank shall rely on the operating mandate as per the instructions given by the account holder and reserves the right to<br />

reject any instructions to the contrary.<br />

(b) Any overdraft, loans or other obligations incurred on the account or otherwise shall be the joint and several liability of each and every individual<br />

constituting the account holder.<br />

(c) In the event of the death of any of the individuals constituting the account holder, the surviving individuals shall undertake to notify <strong>BMI</strong> Bank of the<br />

death within 10 days from the date thereof, whereupon <strong>BMI</strong> Bank shall stop any drawing from the account until the legal successors of the deceased<br />

appoint their representative in accordance with the personal law of the deceased. In the case of a Muslim resident in the Kingdom of Bahrain, the<br />

disposition of any credit balance, security or property available to the account and remaining unencumbered shall be governed by and carried on in<br />

accordance with the order of the competent Sharia Court.<br />

(d) <strong>BMI</strong> Bank is not liable or responsible for honouring instructions that contravene the operating mandate.<br />

10. Dormant account<br />

a) A current or savings or call deposit account will become dormant if there are no account holder originated transactions for 12 months. In such a case<br />

the account shall be blocked for account holder or a third party originated transactions, such as, but not limited to, cheque debit/credit, inward/<br />

outward remittance, etc. <strong>BMI</strong> Bank may also decide to withdraw/restrict services such as ATM access, net banking, SMS banking, etc. for dormant<br />

accounts. <strong>BMI</strong> Bank shall not be liable or responsible for any loss to the account holder in such a scenario.<br />

b) <strong>BMI</strong> Bank shall make every reasonable effort to inform the account holders of dormant accounts with a view to ascertaining the wishes of the<br />

account holder vis-à-vis continuation/closure of account and having the account reactivated.<br />

c) If an account holder wishes to regularise his dormant account he will need to submit the required forms and complete the necessary formalities<br />

including providing the required identification documents. Regularizing a dormant account is at the sole discretion of <strong>BMI</strong> Bank.<br />

d) If a dormant account has debit balance or goes into debit balance due to levying of charges etc. <strong>BMI</strong> Bank may decide to close the account<br />

without any liability to account holder whatsoever. In such a case account holder shall continue to be liable for the moneys he owes to<br />

<strong>BMI</strong> Bank. If a dormant account has credit balance, the bank will not close the account but will levy applicable charges (like minimum balance non<br />

maintenance, etc) periodically.<br />

e) No statement of account will be issued in relation to such accounts.<br />

11. Statement of account<br />

(a) Statement of account shall be provided to the account holder periodically as agreed between the customer and <strong>BMI</strong> Bank except in case of dormant accounts.<br />

(b) <strong>BMI</strong> Bank shall not be liable for any losses to the account holder due to postal errors, delays, theft or for any other claim which may arise due to<br />

delay/non receipt on the statement.<br />

(c) In case of joint accounts, statement will be mailed to the first account holder.<br />

(d) If no objection to the contents of the statement is received within 30 days from the date of the statement, the statement shall be deemed to be<br />

correct. No claim whatsoever about the incorrectness of any entry in the statement shall be entertained after this 30 day period.<br />

12. Expenses and charges<br />

<strong>BMI</strong> Bank shall levy applicable service charges as mentioned in the tariff sheet, which may be changed by <strong>BMI</strong> Bank from time to time. The tariff sheet<br />

will be made available at <strong>BMI</strong> Bank branch and on its website (bmibank.com.bh).<br />

<strong>BMI</strong> Bank has the right, without references to the account holder, to debit the account with all expenses, fees, interest, commissions, taxes, stamp duties,<br />

postage, telex, telephone, fax, court fees, lawyers fees and other expenses, whether paid or incurred on the account holder’s behalf or arising out of any<br />

dealings between <strong>BMI</strong> Bank and the account holder including fees incurred by <strong>BMI</strong> Bank in the course of recovery of its debt.<br />

13. Right to set off and lien<br />

(a) <strong>BMI</strong> Bank shall apply credit funds held in any one account to discharge any debit that the account holder/s may have with <strong>BMI</strong> Bank in any other account.<br />

(b) <strong>BMI</strong> Bank shall have a right of lien on all properties of whatever nature (whether stocks, shares, placements, bills, precious metals or otherwise<br />

whatsoever) deposited with or held by the <strong>BMI</strong> Bank in the name of the account holder, and shall hold the same as security for the payment of any<br />

indebtedness due from the account holder to <strong>BMI</strong> Bank. Account holder waives the right to interpose any counter-claim or set-off of any nature or<br />

description in any litigation between <strong>BMI</strong> Bank and the account holder.<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

Serial No.<br />

14. Address<br />

(a) Address as given by the account holder shall be deemed to be the proper address for any communication, notice, statement or letter between <strong>BMI</strong><br />

Bank and the account holder. Any change of address of the account holder should be promptly notified to <strong>BMI</strong> Bank in writing. Failure to do so will<br />

be at the risk and responsibility of the account holder.<br />

(b) In the event that at the request of the account holder in writing, <strong>BMI</strong> Bank agrees at its sole discretion to hold any correspondence, documents or<br />

papers for periodic collection personally by the account holder, <strong>BMI</strong> Bank will do so only at the express risk and responsibility of the account holder as<br />

to all or any consequences that may arise there from and the account holder indemnifies <strong>BMI</strong> Bank in full for the same.<br />

(c) Any communication shall be deemed to be delivered to the account holder, if sent to the address as provided by the account holder.<br />

15. Closing of accounts<br />

(a) <strong>BMI</strong> Bank reserves the right to close any account, after deduction of all monies due to <strong>BMI</strong> Bank at the time of such closing of the account, and to<br />

cease the acceptance of funds for the credit of the account, without giving any reason after giving prior notice to the customer.<br />

(b) The account holder may close the account by giving <strong>BMI</strong> Bank written notice thereof.<br />

16. <strong>BMI</strong> Bank & account holder’s liabilities<br />

(a) <strong>BMI</strong> Bank shall bear no responsibility and shall not be held liable to the account holder for any diminution, depreciation or loss in the value of the funds,<br />

or for the unavailability of such funds, credited to the account or an account with any office, branch or correspondent of <strong>BMI</strong> Bank due to any present<br />

or future order, decree, law or legislation, tax or levy, embargo, moratorium, sequestration, devaluation, blocking, exchange restrictions, confiscations,<br />

seizure, destruction, involuntary transfers, exercise of military or usurped powers, domestic or foreign political change, invasion, insurrection or internal<br />

revolt. Neither <strong>BMI</strong> Bank nor any of its agents or correspondents nor any respective employees shall be liable for any mutilation, interruption, error of<br />

transmission, omission, or delay occurring in any transmission medium (including without limitation, cables, swift, radio, telephonic systems, airlines,<br />

emails, faxes, courier services, ,telex systems, etc.) howsoever occurring,<br />

(b) In the event of the death or insanity of the account holder, <strong>BMI</strong> Bank shall not be held liable for continuing to act on any instructions received prior<br />

to receipt of written notification of such debt or insanity.<br />

(c) Any acts carried out or performed by a power of attorney holder duly empowered by the account holder will be fully binding on the account holder<br />

and will continue to be under the liability of the account holder till such time as a written notice is received by <strong>BMI</strong> Bank at its office withdrawing the<br />

power of attorney.<br />

17. Account holder documents<br />

The account holder agrees and undertakes to provide up-to-date identification documents viz. CPR, copy of passport [for expats], any other relevant<br />

documents to <strong>BMI</strong> Bank, as and when any of these documents provided is renewed, or updated; or otherwise requested by <strong>BMI</strong> Bank..<br />

18. Automated teller machine (ATM) /Visa electron debit cards (the “card/s”)<br />

18.1 Definitions:<br />

Cardholder: means cardholder in whose name the card and the PIN are issued by <strong>BMI</strong> Bank.<br />

Merchant: means any corporate entity, person, or establishment supplying goods and/or services who accepts the card or the card number as a made<br />

payment or reservation by the cardholder.<br />

PIN: means the personal identification number issued to the cardholder for use in conjunction with the card where required.<br />

POS: means a sales outlet at retail or other business establishments.<br />

POS transaction: means purchase of goods and services.<br />

Principal cardholder: means the cardholder whose <strong>BMI</strong> Bank accounts and facility (ies) are linked to the card.<br />

Supplementary/additional cardholder: means a cardholder nominated by the principal cardholder.<br />

18.2 Card transactions<br />

(a) A card may at the account holder’s request be issued for the account holders current or savings account or for any banking facilities opened and<br />

maintained with or made available by <strong>BMI</strong> Bank and can be used by the cardholder at any <strong>BMI</strong> Bank ATM machine in Bahrain Benefit Switch, GCC Net and<br />

any ATM that displays “VISA” logo for purchase of goods or services at VISA merchant outlets worldwide and for cash withdrawals.<br />

(b) Maximum amount of withdrawal and purchases on the card will be as decided by <strong>BMI</strong> Bank from time to time.<br />

(c) The card must be signed by the cardholder immediately on receipt and shall only be used by the cardholder.<br />

(d) <strong>BMI</strong> Bank reserves the right to refuse any transaction if in excess of the available balance. If, however, for whatever reason, the cardholder exceeds<br />

any such available balance or facility, the cardholder shall forthwith pay to the <strong>BMI</strong> Bank, upon demand by <strong>BMI</strong> Bank, the full sum by which such<br />

available balance or facility is exceeded and <strong>BMI</strong> Bank may at its discretion charge the account holder its prevailing fees and charges. The cardholder<br />

authorizes <strong>BMI</strong> Bank to debit any of the cardholder’s accounts with the amount of any withdrawal or other transaction effected by use of an ATM/<br />

Debit card.<br />

(e) <strong>BMI</strong> Bank at its sole discretion and without notice to the cardholder may cancel, suspend, or refuse to reissue, renew or replace the card if the<br />

transaction is deemed suspicious.<br />

(f) For all withdrawals and transactions made outside the Kingdom of Bahrain or in a foreign currency, <strong>BMI</strong> Bank shall be entitled to recover applicable<br />

foreign exchange rates and levy a fee for international transactions.<br />

(g) All refunds in relation to the payments made through the card will be done subject to receipt by <strong>BMI</strong> Bank, of refund voucher or refund verification<br />

acceptable to the <strong>BMI</strong> Bank.<br />

(h) The number, amount and currency of withdrawals shall be limited and subject to any restriction of the terminal or outlets required under the<br />

applicable laws and regulations or by these terms and conditions.<br />

18.3 Supplementary/additional cards<br />

At the request of the account holder, <strong>BMI</strong> Bank may issue additional cards, at its sole discretion and all payments and debits under additional cards will be<br />

covered by the account holder. Any supplement card may be restricted or terminated at the written request of the principal card holder.<br />

18.4 Personal Identification Number (‘PIN)<br />

<strong>BMI</strong> Bank will issue a PIN to the cardholder for use at ATM’s and terminals that will accept the ATM/Debit ca rd. The cardholder agrees that:<br />

(a) The PIN may be sent by post to the account holder at their own risk.<br />

(b) The cardholder shall not disclose the PIN to any person and shall take all possible care to prevent the discovery of the PIN by any other person.<br />

(c) The cardholder shall be fully liable to <strong>BMI</strong> Bank for all transactions made with the PIN whether with or without the knowledge or the authorization of<br />

the cardholder.<br />

18.5 Renewal<br />

<strong>BMI</strong> Bank at its discretion will renew the card automatically one month before the expiry date. If the cardholder does not wish to renew the card, the<br />

cardholder should inform <strong>BMI</strong> Bank in writing at least two months prior to the expiry date of the card.<br />

18.6 Lost or stolen ATM/debit card or PIN<br />

(a) In the event that an ATM/debit card is lost or stolen or the PIN is disclosed to any other party, the cardholder, shall immediately, thereafter,<br />

report the said loss, theft or disclosure, together with the particulars of the card, to <strong>BMI</strong> Bank in writing to the Branch Manager along with<br />

a copy of the Police report such loss or theft or disclosure occurred. Until the loss, theft or disclosure (as the case may be) is reported to<br />

<strong>BMI</strong> Bank, the cardholder will be responsible for all transactions processed by use of the ATM/debit card.<br />

(b) The cardholder also undertakes to provide <strong>BMI</strong> Bank with all information as to the circumstances of any loss or misuse of a card and to take<br />

necessary steps to assist <strong>BMI</strong> Bank to recover the missing card.<br />

(c) <strong>BMI</strong> Bank may at its discretion issue a replacement ATM/debit card for any lost or stolen card and new PIN subject to these terms and conditions<br />

as <strong>BMI</strong> Bank may require (at its discretion), subject to an administrative charge.<br />

(d) In the event that the lost or stolen card is recovered by the cardholder, they shall immediately return the same cut in half to <strong>BMI</strong> Bank without using<br />

it. The cardholder shall not use the PIN after reporting the disclosure thereof to <strong>BMI</strong> Bank.<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

18.7 Exclusion of liability<br />

<strong>BMI</strong> Bank shall be under no liability whatsoever to the cardholder in respect of any loss or damage arising directly or indirectly out of:<br />

(a) Any loss or damages arising incurred or suffered by the cardholder by reason of the bank or a merchant or other bank or financial institution or any<br />

ATM or other party refusing to allow a card transaction or refusing to accept the card or PIN.<br />

(b) Refusal of any merchant or member institution of Visa to honour or accept the card or for any defect or deficiency in the goods or services supplied<br />

to the cardholder by any merchant.<br />

(c) The malfunction of any ATM or POS device or disruption of communication systems.<br />

(d) Any dispute between the cardholder and any merchant of bank or financial institution or any other person, the liability of <strong>BMI</strong> Bank to the cardholder<br />

shall not in any way be affected by such dispute or counterclaim or right of set off which the cardholder may have against such merchant or bank<br />

or financial institution or person.<br />

18.8 Uncollected cards<br />

If the cardholder fails to collect the cards within a period of 90 days, the cards will be destroyed by <strong>BMI</strong> Bank and any re-issuance will attract an<br />

administrative charge.<br />

19. Automated teller machine (ATM) /Visa electron debit cards (the “card/s”)<br />

<strong>BMI</strong> Bank offers automated teller machine (ATM)/Visa electron debit cards to its customers who wish to avail these services. In addition to these general<br />

terms and conditions these specialized services are governed by the specific automated teller machine (ATM)/Visa electron debit cards terms and<br />

conditions, which are available at <strong>BMI</strong> Bank branches and its website www.bmibank.com.bh. The customer understands the technological risks involved<br />

in such services and confirms that he has read and agrees to abide by all instructions and the terms and conditions in relation to these services and take<br />

the necessary care and precautions in relation to the passwords, etc.<br />

20. Net banking and SMS banking service<br />

<strong>BMI</strong> Bank offers Internet banking and SMS banking services to its customers who wish to avail these services. In addition to these general terms and<br />

conditions these specialized services are governed by the specific net banking and SMS banking terms and conditions, which are available at <strong>BMI</strong> Bank<br />

branches and its website bmibank.com.bh. The customer understands the technological risks involved in such services and confirms that he has read<br />

and agrees to abide by all instructions and the terms and conditions in relation to these services and take the necessary care and precautions in relation<br />

to the passwords, user IDs, etc.<br />

21. Amendments & waivers<br />

<strong>BMI</strong> Bank shall, at all times, have the right to modify these conditions by simple notice in writing to the account holder. <strong>BMI</strong> Bank may waive compliance<br />

with any of these terms and conditions, but such waivers shall be without prejudice to <strong>BMI</strong> Bank’s rights including its right to enforce compliance in the<br />

same or similar matter at any future date.<br />

22. Instructions from account holder<br />

(a) Unless informed to the contrary, <strong>BMI</strong> Bank is authorized to rely on and the account holder be bound by any instructions made either by telephone or<br />

telex or facsimile transmission and appearing to come from or be authorized by an authorized person or persons in relation to any matter and <strong>BMI</strong><br />

Bank shall not in any way be liable if such instructions prove not to be authorized by the account holder. The account holder will bear any loss arising<br />

from mistakes or misunderstandings arising from communications by telephone or telex or facsimile transmission, and <strong>BMI</strong> Bank shall be indemnified<br />

by the account holder for relying upon any instructions or request made by telephone or telex or facsimile transmission and believed by <strong>BMI</strong> Bank to<br />

have been made by a duly authorized person or persons.<br />

(b) If instructions are accepted by <strong>BMI</strong> Bank, it shall use reasonable endeavours to carry out such instructions as soon as is reasonably practicable,<br />

subject to prevailing market conditions and other circumstances outside <strong>BMI</strong> Bank’s control.<br />

(c) Instructions to <strong>BMI</strong> Bank shall, unless otherwise agreed in writing by <strong>BMI</strong> Bank be validly issued to <strong>BMI</strong> Bank only if issued in English<br />

or Arabic language.<br />

(d) <strong>BMI</strong> Bank has the right to record phone calls between <strong>BMI</strong> Bank and the account holder.<br />

23. Complaints<br />

Any complaint should be addressed to the complaints officer as per the procedure available in the customer complaints leaflet which is available in our<br />

branches and on our website www.bmibank.com.bh.<br />

24. Governing law<br />

These account terms and conditions, the opening and operation of any account and/or the relation thereby created are governed by the laws of the<br />

Kingdom of Bahrain. The parties agree to subject themselves to the non-exclusive jurisdiction of the Courts of Kingdom of Bahrain.<br />

25. Declaration<br />

The account holder hereby declares and undertakes that any transaction or related moneys routed through the account is not and will not be related to<br />

any transaction or related moneys routed through the account is not and will not be related to any money laundering or either activities contrary to the<br />

laws of the Kingdom of Bahrain or the International Community or the laws of other countries as in force from time to time.<br />

26. Disclosure<br />

<strong>BMI</strong> Bank shall maintain confidentiality of all information relating to the account but is authorized by the account holder to disclose without prior or<br />

otherwise reference to it, information to the regulators i.e. Central Bank of Bahrain and for other purposes if it is required to do so under the applicable<br />

law or by general Banking practice in the jurisdiction of its incorporation. In order to comply with the regulatory requirements, <strong>BMI</strong> Bank is authorized to<br />

forward any account holder information as well as reporting of any suspicious transactions. <strong>BMI</strong> Bank shall seek credit reference and respond to request<br />

for credit references made by other Banks and Financial Institutions at its sole discretion and without any further reference to the account holder.<br />

27. Conflicts of Interest<br />

<strong>BMI</strong> Bank is regulated by the Central Bank of Bahrain and its guidance on conflict of interest. <strong>BMI</strong> Bank has aligned its internal policies to be consistent<br />

with the guidelines for handling all matters including conflict of interest whereby, the account holder will not be treated unfairly and as such <strong>BMI</strong> Bank will<br />

take necessary steps to manage the conflict of interest if/when an actual or potential conflict arises. <strong>BMI</strong> Bank will take all necessary steps to manage<br />

the conflict in accordance with <strong>BMI</strong> Bank’s conflict policy.<br />

I/We acknowledge having received one copy of these general terms and conditions. I, the undersigned, confirm that I am the beneficial owner of the<br />

account, that I am acting on my own behalf. I/We have taken note of their contents and I/we consider myself/ourselves bound thereby and to any new<br />

terms and conditions that may come into effect from time to time as agreed by <strong>BMI</strong> Bank, by mail to my/our last recorded address and/or displayed<br />

conspicuously at <strong>BMI</strong> Bank’s premises or website.<br />

Place:<br />

Date:<br />

<strong>BMI</strong> Bank -bh-tnc-27-12-12<br />

Signature(s) of Authorized Signatory/ies:<br />

Licensed and regulated as a conventional Retail Bank by the Central Bank of Bahrain<br />

bmibank.com.bh

<strong>Form</strong><br />

W-8BEN<br />

Certificate of Foreign Status of Beneficial Owner<br />

for United States Tax Withholding<br />

(Rev. February 2006)<br />

OMB No. 1545-1621<br />

Department of the Treasury<br />

Section references are to the Internal Revenue Code. See separate instructions.<br />

Internal Revenue Service<br />

Give this form to the withholding agent or payer. Do not send to the IRS.<br />

Do not use this form for:<br />

Instead, use <strong>Form</strong>:<br />

● A U.S. citizen or other U.S. person, including a resident alien individual W-9<br />

● A person claiming that income is effectively connected with the conduct<br />

of a trade or business in the United States<br />

W-8ECI<br />

● A foreign partnership, a foreign simple trust, or a foreign grantor trust (see instructions for exceptions)<br />

W-8ECI or W-8IMY<br />

● A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization,<br />

foreign private foundation, or government of a U.S. possession that received effectively connected income or that is<br />

claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b) (see instructions)<br />

W-8ECI or W-8EXP<br />

Note: These entities should use <strong>Form</strong> W-8BEN if they are claiming treaty benefits or are providing the form only to<br />

claim they are a foreign person exempt from backup withholding.<br />

● A person acting as an intermediary<br />

W-8IMY<br />

Note: See instructions for additional exceptions.<br />

Part I Identification of Beneficial Owner (See instructions.)<br />

1 Name of individual or organization that is the beneficial owner<br />

2<br />

Country of incorporation or organization<br />

3<br />

4<br />

Type of beneficial owner: Individual Corporation Disregarded entity Partnership Simple trust<br />

Grantor trust<br />

Complex trust<br />

Estate<br />

Government<br />

International organization<br />

Central bank of issue<br />

Tax-exempt organization Private foundation<br />

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.<br />

City or town, state or province. Include postal code where appropriate.<br />

Country (do not abbreviate)<br />

5<br />

Mailing address (if different from above)<br />

City or town, state or province. Include postal code where appropriate.<br />

Country (do not abbreviate)<br />

6 U.S. taxpayer identification number, if required (see instructions)<br />

7<br />

SSN or ITIN EIN<br />

8 Reference number(s) (see instructions)<br />

Foreign tax identifying number, if any (optional)<br />

Part II<br />

9<br />

10<br />

a<br />

b<br />

c<br />

d<br />

e<br />

Claim of Tax Treaty Benefits (if applicable)<br />

I certify that (check all that apply):<br />

The beneficial owner is a resident of<br />

within the meaning of the income tax treaty between the United States and that country.<br />

If required, the U.S. taxpayer identification number is stated on line 6 (see instructions).<br />

The beneficial owner is not an individual, derives the item (or items) of income for which the treaty benefits are claimed, and, if<br />

applicable, meets the requirements of the treaty provision dealing with limitation on benefits (see instructions).<br />

The beneficial owner is not an individual, is claiming treaty benefits for dividends received from a foreign corporation or interest from a<br />

U.S. trade or business of a foreign corporation, and meets qualified resident status (see instructions).<br />

The beneficial owner is related to the person obligated to pay the income within the meaning of section 267(b) or 707(b), and will file<br />

<strong>Form</strong> 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000.<br />

Special rates and conditions (if applicable—see instructions): The beneficial owner is claiming the provisions of Article<br />

of the<br />

treaty identified on line 9a above to claim a % rate of withholding on (specify type of income): .<br />

Explain the reasons the beneficial owner meets the terms of the treaty article:<br />

Part III<br />

Notional Principal Contracts<br />

11 I have provided or will provide a statement that identifies those notional principal contracts from which the income is not effectively<br />

connected with the conduct of a trade or business in the United States. I agree to update this statement as required.<br />

Part IV Certification<br />

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I<br />

further certify under penalties of perjury that:<br />

1 I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates,<br />

2 The beneficial owner is not a U.S. person,<br />

3 The income to which this form relates is (a) not effectively connected with the conduct of a trade or business in the United States, (b) effectively connected but is<br />

not subject to tax under an income tax treaty, or (c) the partner’s share of a partnership’s effectively connected income, and<br />

4 For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.<br />

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or<br />

any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.<br />

Sign Here Signature of beneficial owner (or individual authorized to sign for beneficial owner) Date (MM-DD-YYYY)<br />

Capacity in which acting<br />

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 25047Z <strong>Form</strong> W-8BEN (Rev. 2-2006)<br />

Printed on Recycled Paper

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

Client Information Sheet<br />

Account No.<br />

Name<br />

Resident address<br />

Mailing address<br />

Contact Fixed line Mobile<br />

Fax<br />

E-mail<br />

National ID number<br />

Date of issue<br />

Passport number<br />

Date of issue<br />

Years of investment<br />

experience<br />

Issuing country<br />

Expiry date<br />

Issuing country<br />

Expiry date<br />

Area of expertise Equities<br />

Options<br />

Fixed income (Bonds & Preferred shares)<br />

Other derivatives<br />

Futures<br />

Annual income (USD) < 100,000<br />

100,000 - 250,000<br />

250,000 - 500,000<br />

500,000 - 1 million<br />

1 million - 5 million<br />

> 5 million<br />

Source & Income Salary (with check box)<br />

Business (with check box & please specify _____________________________________)<br />

Inheritance (with check box)<br />

Gift (with check box)<br />

Other (with check box & please specify _______________________________________)<br />

Liquid networth (USD)<br />

(excluding value of<br />

your house)<br />

< 100,000<br />

100,000 - 250,000<br />

250,000 - 500,000<br />

500,000 - 1 million<br />

1 million - 5 million<br />

> 5 million<br />

Account objective Risk exposure Investment objective<br />

Low<br />

Moderate<br />

Speculation/High risk<br />

Employment status Employed<br />

Self Employed<br />

Retired<br />

Occupation<br />

Employer’s name<br />

Income<br />

Long term growth<br />

Short term growth<br />

Unemployed<br />

Homemaker<br />

Student<br />

Years of experience<br />

Type of business

Employer’s address<br />

(office telephone/fax no)<br />

Number of dependents<br />

Tax status<br />

Please name the banks<br />

with which you transact<br />

Are you an employee<br />

of a broker/dealer<br />

or a financial<br />

institution<br />

Yes No Are you related to an<br />

employee of a broker/<br />

dealer or a financial<br />

institution<br />

Yes<br />

No<br />

If yes, provide the name<br />

of the institution and the<br />

relationship<br />

Are you maintaining any<br />

other private banking<br />

accounts<br />

Yes No If yes, provide the name<br />

of the institutions<br />

Are you a senior officer,<br />

Director or a significant<br />

Shareholder of a public<br />

company<br />

Yes No If yes, please provide<br />

details<br />

Do you hold positions in<br />

the Government agencies/<br />

Parliament/Armed Forces/<br />

related to Royalty<br />

Yes No If yes, provide details<br />

I certify that the above information is accurate and can be relied upon by <strong>BMI</strong> Bank in determining the suitability of<br />

investments and offering advice for my account.<br />

Date<br />

Signature<br />

Place<br />

Relationship manager<br />

Signature

<strong>BMI</strong> Bank B.S.C.(c.), Bahrain World Trade Center,<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

T +973 17 508080<br />

F +973 17 226641<br />

Private Banking Client Notification and Terms of Business<br />

<strong>BMI</strong> Bank B.S.C (c) (“the Bank”), a joint stock closed company incorporated under the laws of the Kingdom of Bahrain registered<br />

with commercial registration number 55436 and authorized, regulated and bound by The Central Bank of Bahrain (CBB) regulations<br />

and licensing conditions, under license no. FCB/034, whose address is at:<br />

World Trade Center, East Tower, 16 th Floor<br />

P.O. Box 350, Manama, Kingdom of Bahrain<br />

Tel: +973 17 508080, Fax: +973 17 131035<br />

1. General<br />

Definitions:<br />

“Applicable Rules” means (a) the rules of the CBB; (b) the rules<br />

of any market regulatory body that supervises the Bank services;<br />

(c) the Bank’s internal policies and procedures; and (d) all other<br />

laws, rules and regulations in force from time to time.<br />

“Customer” means the clients of the Bank who are investing in<br />

the private banking products.<br />

“Events of Default” has the meaning attributed to it in Clause 5.<br />

“Material Adverse Change” means an event or circumstance<br />

which (when taken alone or together with any previous event or<br />

circumstances) constitutes:<br />

• a material adverse change in the international financial<br />

markets; or<br />

• a material adverse change in the political, social or economic<br />

situation in the country where the Customer/Bank is located;<br />

or<br />

• an adverse change to the validity, legality or enforceability<br />

of any document.<br />

“Real Time Promotions” means a promotion made in the<br />

course of a personal visit, telephone conversation or other<br />

interactive dialogue.<br />

“Services” means the services rendered by the Bank in<br />

accordance with Clause 2 of these terms of business and which<br />

fall under the scope of CBB license.<br />

“Settlement” means to close the transaction by paying<br />

the transaction amount or receiving purchased securities in<br />

stipulated time period.<br />

“Settlement date” means the date by which an executed<br />

security trade must be settled. On settlement date the buyer<br />

must make payment and seller must deliver the security.<br />

“Transaction” means an agreement between a buyer and seller<br />

to exchange an asset or services for payment.<br />

“Transaction Confirmation” means the official notification of<br />

a trade or deal done on behalf of the Customer detailing the<br />

Transaction and the net transaction amount.<br />

2. Services<br />

2.1 The Bank may provide Services which include, but are not<br />

limited to, brokerage services, derivatives products, structured<br />

products, fixed income securities, leveraged products, trading<br />

activities, leveraged financing and the arrangement of deals<br />

in all kinds of securities, including executing transactions in<br />

units in unregulated collective investment schemes. Unless<br />

the Bank expressly otherwise agrees in writing, it shall not be<br />

responsible for managing or supervising the management of<br />

any of the Customer’s investments.<br />

2.2 The Customer acknowledges and agrees that the<br />

transactions stipulated herein are related to sophisticated<br />

private banking products and is aware of the risks associated<br />

therein and in these Terms of Business. The Customer shall<br />

not be entitled to request the Bank to provide investment<br />

advice relating to a Transaction or make any statement<br />

of opinion to encourage the Customer to enter into a<br />

particular Transaction. Consequently, trade ideas, research,<br />

other communication, market information, advice or<br />

recommendations that the Customer may receive from time<br />

to time are not, unless it is clearly stated to the contrary,<br />

presented as being suitable to its specific circumstances<br />

and should not be taken as a recommendation to make<br />

guaranteed profit making trades.<br />

2.3 However, the Bank may in its absolute discretion seek<br />

additional information or other confirmation in relation to<br />

the transaction, as the Bank thinks fit and without having<br />

to give any reason for doing so, refuse to provide particular<br />

services or activities.

2.4 The Customer also agrees to receive any real time<br />

promotions from the Bank.<br />

3. Dealing<br />

3.1 Dealings between the Customer and the Bank shall be carried<br />

out in writing (including fax), by phone or email (Provided<br />

phone, fax and email indemnity is executed by the Customer<br />

in form and acceptable to the Bank) or other electronic<br />

means (including online order placement) or orally. The Bank<br />

shall not be obliged to acknowledge or accept any request to<br />

sell or purchase any particular investment. Subject to these<br />

terms of business, the Bank shall use all reasonable endeavors<br />

to carry out the Customer’s request but shall be under no<br />

liability for any loss or expense the Customer may incur by<br />

reason of any delay or change in market conditions before<br />

the transaction is effected or by any failure to execute such<br />

transaction, including but not limited to failure to execute a<br />

stop loss (limit) order.<br />

3.2 The Bank will execute all the Customer’s orders sequentially<br />

and promptly unless it considers that characteristics of a<br />

Customer’s order or prevailing market conditions make<br />

this impracticable, or that a Customer’s interests require<br />

otherwise. The Bank does not represent or warrant that<br />

it will be possible to execute such order or that execution<br />

will be possible according to the Customer’s instructions,<br />

including but not limited to receiving a large buy or sell<br />

market order in an illiquid stock will result in unanticipated<br />

execution price than the quoted price on receiving the order.<br />

In case of such situations the Bank will use its own discretion<br />

to place it as market or limit orders in small lots. The Bank<br />

shall carry out an order on behalf of the Customer only when<br />

the relevant market is open for dealings, and the Bank shall<br />

deal with any instructions received outside market hours as<br />

soon as possible when that relevant market is next open for<br />

business.<br />

3.3 When the Transaction is carried out in currencies other than<br />

BHD and USD, the Bank may need to convert the transaction<br />

currency to the currency in which the Customer’s account is<br />

denominated, at the prevailing market exchange rate.<br />

4. Settlement<br />

4.1 The Customer is obliged to pay for the securities purchased<br />

by the Bank on or before the settlement date. If at the time<br />

of settlement of a Transaction, there are insufficient funds<br />

in the Customer’s account to enable the Bank to meet the<br />

settlement obligations, the Bank shall not be obliged to<br />

settle the Transaction. Where there are insufficient funds<br />

in the Customer’s account and the Bank does proceed to<br />

settlement, the Bank may at its sole discretion decide to<br />

accept delivery of securities, debit the Customer’s account<br />

for the payment to satisfy Customer’s obligation, sell<br />

the securities without any further confirmation from the<br />

Customer (one or more securities to cover the obligation) at<br />

any price the Bank believes to be reasonable, and credit the<br />

Customer’s account with net proceeds thereof. In case the<br />

proceeds are less than the settlement amount paid by the<br />

Bank, then clause 4.4 of the Terms of Business shall apply.<br />

4.2 The Bank shall promptly send the Transaction Confirmation<br />

executed by the Bank on your behalf on any particular day,<br />

by post, to the address given by you on the Bank’s record.<br />

The Bank shall keep such records for a maximum of 5 years<br />

or as otherwise required by Bahrain Law. Any change in the<br />

Customer’s address, email address, fax number or any other<br />

means of communication, should be promptly notified to<br />

the Bank in writing. Failure to do so will be at the Customer’s<br />

risk and responsibility.<br />

4.3 Third party’s risk of non-performance<br />

The Customer agrees and understands that in some security<br />

markets, the delivery of securities and payment thereon may<br />

not be made simultaneously. In such markets, the Bank may<br />

make payments or delivery of securities at such time and in<br />

such manner as is in accordance with relevant local law and<br />

practice or with the customs prevailing in the relevant markets.<br />

The Customer shall bear the risk that the counterparty to the<br />

transaction may not pay or perform on time or at all.<br />

4.4 If the Customer defaults in paying any amount by the due<br />

date (including without limitation, any interest payments<br />

due on any outstanding amount), the Bank shall be entitled<br />

on such date to pay to the credit of, or as the case may be,<br />

debit to any holding, book entries, account or accounts of the<br />

Customer held with the Bank (including any joint account)<br />

in which the Customer may have an interest, the amount<br />

in question in the appropriate currency or, at our option,<br />

equivalent thereof (at current market rates as determined<br />

by the Bank’s treasury department at its sole discretion),<br />

in any other currency or currencies in which any balance on<br />

such account or accounts may then be denominated. The<br />

Customer waives the right to interpose any counter-claim or<br />

set-off of any nature or description in any litigation between<br />

the Bank and the Customer.<br />

5. Events of Default<br />

“Event of Default” includes, but is not limited to, the following.<br />

(a) the Customer’s failure to make any payment to the Bank in<br />

accordance with Clause 4; or<br />

(b) the Customer’s failure to perform any obligation due to the<br />

Bank; or<br />

(c) if the Customer is an individual, the Customer’s death; or<br />

(d) the initiation by the Customer or any third party of<br />

proceedings for the Customer’s bankruptcy or liquidation<br />

or if the Customer makes an arrangement or composition<br />

with Customer’s creditors or any other similar or analogues<br />

procedure is commenced in respect of the Customer; or<br />

(e) the Customer is or becomes unable to pay his debts as and<br />

when they fall due; or<br />

(f) a Material Adverse Change occurs.

6. Expense & Charges<br />

6.1 The Bank shall levy applicable service charge as mentioned<br />

in the tariff sheet or as agreed in writing, which may be<br />

amended by the Bank from time to time. In consideration of<br />

the Services provided by the Bank in accordance with these<br />

terms of business or otherwise, the Bank may charge a mark<br />

up or a mark down on transaction effected on behalf of the<br />

Customer as agent, or both.<br />

7.5 At any time after termination of these terms of business<br />

under clause 7.1, or after the occurrence of any of the<br />

Events of Default or after the Bank has determined at its<br />

sole discretion that the Customer has not performed (or<br />

may not be able to willing in the future to perform) one<br />

or more of its obligations or following a Material Adverse<br />

Change, the Bank shall be entitled without notice:<br />

6.2 In addition to the above, the Bank has a right without<br />

reference to the Customer, to debit the Customer’s<br />

account with all expenses, fees, interest, commissions, tax,<br />

duty, levy, fee, other expenses, whether paid or incurred on<br />

behalf of the Customer or arising out of any dealing between<br />

the Bank and the Customer or incurred by the Bank in<br />

connection with the transactions effected with or for the<br />

Customer, including fees incurred by the Bank in the course<br />

of recovery of its debt.<br />

6.3 The Bank may add more services in addition to the one<br />

described above and the charges for the new services will<br />

be informed upon request or prior to any transaction of the<br />

new products.<br />

7. Termination<br />

7.1 The Bank reserves the right to terminate these terms of<br />

business and any Services provided hereunder by giving a<br />

written notice to the Customer at any time with or without<br />

cause and such notice shall be effective on the date<br />

mentioned in the notice. The Customer may terminate these<br />

terms of business and any services provided in accordance<br />

herewith by seven business days’ written notice, such notice<br />

taking effect from the date of receipt.<br />

7.2 No penalty will become due from either party in respect<br />

to the termination of these terms of business. However,<br />

any termination of these terms of business will not affect<br />

any outstanding orders or Transactions or any legal rights,<br />

duties, liabilities (whether actual, contingent or otherwise) or<br />

other obligations which may already have arisen or accrued<br />

at the date of termination.<br />

7.3 Transaction in progress at the date of termination will be<br />

completed by the Bank as soon as practicable.<br />

7.4 On termination by either party, the Bank will:<br />

(a) be entitled to receive from the Customer, all fees, costs,<br />

charges, expenses and liabilities accrued or incurred under<br />

these terms of business up to the time of termination<br />

including any additional expenses or losses reasonably and<br />

properly incurred by the Bank in terminating these terms; and<br />

(b) as soon as reasonably practicable subject to (a), deliver<br />

or cause the securities to be delivered to the Customer<br />

or Customer’s order.<br />

(a) to treat any or all Transactions then outstanding as<br />

having been cancelled and terminated; and/or<br />

(b) to sell Customer’s securities as the Bank may in its sole<br />

discretion select in order to realize funds sufficient to<br />

cover any outstanding amounts.<br />

8. Indemnity and liability<br />

(i) The Customer will indemnify the Bank, and keep it<br />

indemnified, in respect of all liabilities, losses or costs of any<br />

kind or nature whatsoever that my be incurred by the Bank<br />

(including obligations of the Bank under any Intermediary<br />

Agreement) as a direct or indirect result of any failure by<br />

the Customer to perform any of its obligations under this<br />

Agreement, in relation to any Transaction or in relation to<br />

any false information or declaration made either to the Bank<br />

or to any third party, in particular to any exchange.<br />

(ii) The Bank will not be liable for any direct, indirect, special,<br />