Losing Employer-Provided Health Insurance - Ohio Department of ...

Losing Employer-Provided Health Insurance - Ohio Department of ...

Losing Employer-Provided Health Insurance - Ohio Department of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

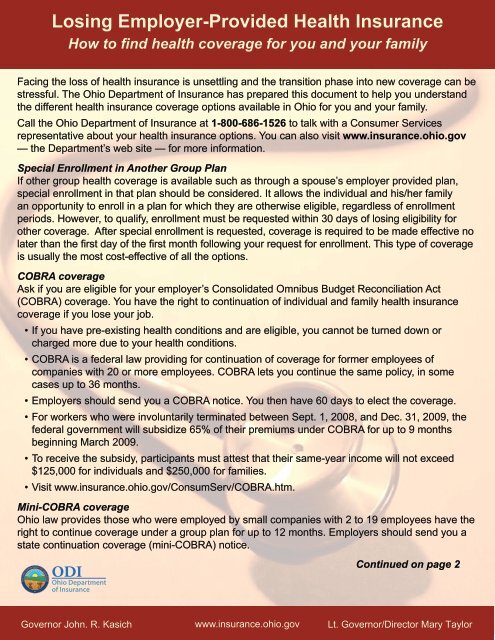

<strong>Losing</strong> <strong>Employer</strong>-<strong>Provided</strong> <strong>Health</strong> <strong>Insurance</strong><br />

How to find health coverage for you and your family<br />

Facing the loss <strong>of</strong> health insurance is unsettling and the transition phase into new coverage can be<br />

stressful. The <strong>Ohio</strong> <strong>Department</strong> <strong>of</strong> <strong>Insurance</strong> has prepared this document to help you understand<br />

the different health insurance coverage options available in <strong>Ohio</strong> for you and your family.<br />

Call the <strong>Ohio</strong> <strong>Department</strong> <strong>of</strong> <strong>Insurance</strong> at 1-800-686-1526 to talk with a Consumer Services<br />

representative about your health insurance options. You can also visit www.insurance.ohio.gov<br />

— the <strong>Department</strong>’s web site — for more information.<br />

Special Enrollment in Another Group Plan<br />

If other group health coverage is available such as through a spouse’s employer provided plan,<br />

special enrollment in that plan should be considered. It allows the individual and his/her family<br />

an opportunity to enroll in a plan for which they are otherwise eligible, regardless <strong>of</strong> enrollment<br />

periods. However, to qualify, enrollment must be requested within 30 days <strong>of</strong> losing eligibility for<br />

other coverage. After special enrollment is requested, coverage is required to be made effective no<br />

later than the first day <strong>of</strong> the first month following your request for enrollment. This type <strong>of</strong> coverage<br />

is usually the most cost-effective <strong>of</strong> all the options.<br />

COBRA coverage<br />

Ask if you are eligible for your employer’s Consolidated Omnibus Budget Reconciliation Act<br />

(COBRA) coverage. You have the right to continuation <strong>of</strong> individual and family health insurance<br />

coverage if you lose your job.<br />

• If you have pre-existing health conditions and are eligible, you cannot be turned down or<br />

charged more due to your health conditions.<br />

• COBRA is a federal law providing for continuation <strong>of</strong> coverage for former employees <strong>of</strong><br />

companies with 20 or more employees. COBRA lets you continue the same policy, in some<br />

cases up to 36 months.<br />

• <strong>Employer</strong>s should send you a COBRA notice. You then have 60 days to elect the coverage.<br />

• For workers who were involuntarily terminated between Sept. 1, 2008, and Dec. 31, 2009, the<br />

federal government will subsidize 65% <strong>of</strong> their premiums under COBRA for up to 9 months<br />

beginning March 2009.<br />

• To receive the subsidy, participants must attest that their same-year income will not exceed<br />

$125,000 for individuals and $250,000 for families.<br />

• Visit www.insurance.ohio.gov/ConsumServ/COBRA.htm.<br />

Mini-COBRA coverage<br />

<strong>Ohio</strong> law provides those who were employed by small companies with 2 to 19 employees have the<br />

right to continue coverage under a group plan for up to 12 months. <strong>Employer</strong>s should send you a<br />

state continuation coverage (mini-COBRA) notice.<br />

Continued on page 2<br />

Governor John. R. Kasich<br />

www.insurance.ohio.gov<br />

Lt. Governor/Director Mary Taylor

<strong>Losing</strong> <strong>Employer</strong>-<strong>Provided</strong> <strong>Health</strong> <strong>Insurance</strong> Page 2<br />

• For workers who were involuntarily terminated between Sept. 1, 2008, and Dec. 31, 2009 and<br />

who are eligible for state continuation coverage, the federal government will subsidize 65% <strong>of</strong><br />

their premiums for up to 9 months beginning March 2009.<br />

• To receive the subsidy, participants must attest that their same-year income will not exceed<br />

$125,000 for individuals and $250,000 for families.<br />

• Visit www.insurance.ohio.gov/ConsumServ/COBRA.htm.<br />

HIPAA coverage<br />

If you are not eligible for COBRA or when COBRA expires, but you have had 18 months <strong>of</strong><br />

continuous group health coverage where the most recent coverage was under an employer<br />

group health plan, you are considered “Federally Eligible” for a <strong>Health</strong> <strong>Insurance</strong> Portability and<br />

Accountability Act (HIPAA) plan. The 18 months could be a combination <strong>of</strong> any creditable health<br />

coverage, including Medicare. You need to apply for either the “<strong>Ohio</strong> basic” or “<strong>Ohio</strong> standard”<br />

health plan within 63 days <strong>of</strong> losing your previous coverage.<br />

Individual coverage<br />

Individual means the insurance is not connected to an employer plan. Individual plans are<br />

medically underwritten. Companies can decline you based on your health or attach exclusions to<br />

your policy. Individual plans take into account your past and present health and then factor it into<br />

your premium. Costs vary so shop around and also consider working with an insurance agent.<br />

Open enrollment<br />

If you are unable to secure coverage through the normal enrollment process, you may be able<br />

to get coverage through open enrollment, which is conducted on a first-come, first-served basis.<br />

Applicants are accepted until each <strong>Health</strong> Maintenance Organization (HMO) and traditional insurer<br />

reaches a statutory quota. Coverage secured during open enrollment can be expensive and it<br />

must take effect within 90 days after the company accepts your application. However, the policy<br />

may require you to wait one year before preexisting conditions are covered.<br />

High-deductible major medical policy<br />

When it comes to insurance, no matter the type, higher deductibles usually mean lower premiums.<br />

That is because you are taking more responsibility for your own care. You may be able to combine<br />

a Major Medical plan with a <strong>Health</strong> Savings Account, which basically allows you to spend pre-tax<br />

money on your smaller health bills and use the Major Medical plan for the catastrophic expenses.<br />

Short-term insurance<br />

While this won’t cover pre-existing conditions, it is better than no coverage at all. You can generally<br />

take these out either on a month-to-month basis or on a term <strong>of</strong> six to 12 months. Even though this<br />

doesn’t cover pre-existing conditions, it may cover unexpected or acute conditions, for example, a<br />

broken leg.<br />

Continued on page 3<br />

Governor John R. Kasich<br />

www.ohioinsurance.gov<br />

Lt. Governor/Director Mary Taylor

<strong>Losing</strong> <strong>Employer</strong>-<strong>Provided</strong> <strong>Health</strong> <strong>Insurance</strong> Page 3<br />

Discount health plans<br />

These plans are not insurance products; instead, they discount services provided by certain<br />

physicians, hospitals and pharmacies. If insurance is unaffordable to you, a discount health<br />

plan may serve as an option to lower your costs in certain situations. Be certain to read the<br />

membership agreement. The <strong>Department</strong> has limited authority over these plans.<br />

Pr<strong>of</strong>essional organizations and association plans<br />

Sometimes local associations such as chambers <strong>of</strong> commerce and pr<strong>of</strong>essional groups<br />

<strong>of</strong>fer health insurance. Coverage may also be available through a religious or fraternal<br />

organization.<br />

Veteran benefits<br />

If you are a veteran, the <strong>Ohio</strong> <strong>Department</strong> <strong>of</strong> Veterans Services at 1-877-644-6838 can<br />

outline assistance that may be available to you, such as TRICARE.<br />

Free Clinics<br />

Free clinics assist in providing health services for the underserved and underinsured. Call<br />

614-221-6494 or visit www.ohi<strong>of</strong>reeclinics.org to find one in your area.<br />

Retirement benefits<br />

If you lose your job, make sure you have a copy <strong>of</strong> your plan’s current summary plan<br />

description (SPD) and your individual benefit statement. If not, request a copy. The SPD tells<br />

you if and when you can collect your benefits or how to roll over your 401(k) account to a new<br />

employer’s plan or to an IRA (if your old plan permits you to do so). The individual benefit<br />

statement lets you monitor your account balance and is an important statement to keep on file.<br />

Your retirement savings could also remain in your former employer’s plan. If your benefits<br />

are in a traditional pension plan and your plan ends without enough money to pay the<br />

promised benefits, the Pension Benefit Guaranty Corporation will assume responsibility as<br />

trustee <strong>of</strong> the plan and pay benefits up to a maximum guaranteed amount set by law.<br />

Tips:<br />

• Talk with an insurance agent.<br />

• Comparison shop, call around and ask questions. Premiums for similar products can<br />

vary.<br />

• If you are healthy, don’t assume you can go without insurance.<br />

• If you’re without coverage: ask your doctor about a payment plan, don’t visit the doctor<br />

for essential reasons, switch from brand name to generic prescription drugs and check<br />

for free medication samples.<br />

• Contact your physician, drug manufacturers and the State <strong>of</strong> <strong>Ohio</strong> to learn <strong>of</strong><br />

prescription drug patient assistance programs. Call 1-877-794-6446 for more<br />

information.<br />

• Contact the <strong>Ohio</strong> <strong>Department</strong> <strong>of</strong> <strong>Insurance</strong> at 1-800-686-1526 with any insurance<br />

questions and to request informational materials.<br />

• Contact the <strong>Ohio</strong> <strong>Department</strong> <strong>of</strong> Job and Family Services at 1-877-852-0010 if you are<br />

unemployed and without coverage.<br />

Governor John R. Kasich<br />

www.ohioinsurance.gov<br />

Lt. Governor/Director Mary Taylor