Rajiv Gandhi Mission for Watershed Management

Rajiv Gandhi Mission for Watershed Management

Rajiv Gandhi Mission for Watershed Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER - 1<br />

INTRODUCTION<br />

1.1 These regulations may be called the Administrative and Financial<br />

Regulations of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For <strong>Watershed</strong> <strong>Management</strong>.<br />

1.2 These regulations shall come into effect from the date, these are adopted by<br />

the Executive Committee of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For <strong>Watershed</strong><br />

<strong>Management</strong>. They shall be placed be<strong>for</strong>e the General Body <strong>for</strong> ratification at<br />

its next meeting.<br />

1.3 Any other item/clause having implications and not covered under these<br />

regulations shall be decided by the Executive Committee.

CHAPTER - 2<br />

DEFINITIONS<br />

2.1 Unless the context requires otherwise :<br />

a. Words and expressions used in these regulations but not defined shall<br />

have the meanings respectively assigned to them in Rule 4 of the Rules of<br />

the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For <strong>Watershed</strong> <strong>Management</strong>.<br />

b. The word "Rules" means the Rules of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For<br />

<strong>Watershed</strong> <strong>Management</strong> registered alongwith the Memorandum of<br />

Association and as modified from time to time in accordance with the<br />

procedure laid down in this regard.<br />

c. The word "Regulations" means the Regulations of <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong><br />

For <strong>Watershed</strong> <strong>Management</strong> framed under para 3 5 of the Rules adopted<br />

by the Executive Committee in consultation with the Government of<br />

Madhya Pradesh.<br />

d. The-word "<strong>Mission</strong>" means <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For <strong>Watershed</strong><br />

<strong>Management</strong>.<br />

e. "<strong>Mission</strong> Director" shall mean the <strong>Mission</strong> Director of the <strong>Rajiv</strong> <strong>Gandhi</strong><br />

<strong>Mission</strong> For <strong>Watershed</strong> <strong>Management</strong>, appointed by the Government of<br />

Madhya Pradesh. The <strong>Mission</strong> Director shall also be the Ex-Officio<br />

Additional Secretary or Deputy Secretary of Government of Madhya<br />

Pradesh. <strong>Mission</strong> Director shall be responsible <strong>for</strong> the administration of the<br />

affairs and funds of the <strong>Mission</strong>. <strong>Mission</strong> Director shall work under the<br />

direction and guidance of Chairman of the Executive Committee. <strong>Mission</strong><br />

Director will have the power to exercise all the powers mentioned in Rule<br />

40 of the Rules of <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> <strong>for</strong> <strong>Watershed</strong> <strong>Management</strong>.<br />

f. "Administrative Officer" means an of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For<br />

<strong>Watershed</strong> <strong>Management</strong> at the State <strong>Mission</strong> Office declared as such<br />

under an order issued by the <strong>Mission</strong> Director <strong>for</strong> dealing with all<br />

administrative and office matters of the <strong>Mission</strong>.<br />

g. "Accounts Officer" means the Accounts Officer of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong><br />

For <strong>Watershed</strong> <strong>Management</strong> appointed by the <strong>Mission</strong> Director. He will:

i. Advise the <strong>Mission</strong> Director in dealing with all financial, accounting<br />

and audit matters and act under the control, direction and guidance of<br />

the <strong>Mission</strong> Director.<br />

ii.<br />

iii.<br />

iv.<br />

Supervise the day to day work of the Budget, Finance. Audit and<br />

Accounts in the State <strong>Mission</strong> Office and guide the Chief Executive<br />

Officer of Zila Panchayat of each district in these matters as and when<br />

required.<br />

Inspect the accounts at all levels or at any other place where the<br />

accounts of the <strong>Mission</strong> are maintained.<br />

Call <strong>for</strong> such in<strong>for</strong>mation from any authority as may be required <strong>for</strong> the<br />

preparation and sanction of the budget estimates, preparation of<br />

annual accounts and processing of objections raised by the Audit. All<br />

matters of the <strong>Mission</strong> requiring financial advice shall be referred to<br />

<strong>Mission</strong> Director.<br />

h. "Bank" means a nationalised public sector bank or its subsidiary institution in<br />

which the funds of the <strong>Mission</strong> may be kept in current/savings or fixed deposit<br />

account.<br />

i. "Head of Department" means the <strong>Mission</strong> Director at the State level.<br />

j. "Budget" means the statement of estimated income and expenditure of the<br />

<strong>Mission</strong> <strong>for</strong> any Financial year as approved by the Competent Authority.<br />

k. "Capital. Expenditure" means expenditure involved in the acquisition of assets of<br />

permanent nature including a portion of revenue expenditure, which is especially<br />

treated so under the orders of competent authority.<br />

l. "Capital Receipts" means receipts realised from the sale or disposal of assets,<br />

equipments or any specific portion of revenue receipts so treated.<br />

m. "Recurring Expenditure" means expenditure other than capital and debt<br />

expenditure on items of routine nature, such as, pay and allowances of staff,<br />

office expenses, expenditure on minor repairs etc.<br />

n. "Receipts" means receipts other than capital and debt receipts, of routine nature,<br />

such as, rent receipts, interest on Bank deposits. etc.

o. "Head of Account" means the sector of component programme provided in the<br />

budget with the objective of classifying the income and expenditure of the<br />

<strong>Mission</strong>.<br />

p. "Sub-Head" means a head Subordinate to a Head of Account indicating a series<br />

of activities within a programme<br />

q. "Detailed Head" means a breakup below a Sub Head. A detailed head indicates<br />

the nature of expenditure on a scheme: activity in terms of inputs, such as.<br />

"Salaries" office expenses" etc.<br />

r. "Financial Year" means the year commencing on 1st April of a calendar year and<br />

ending on 3 1st March of the following calendar year.<br />

s. "Competent Authority" means Authority to whole powers to accord approval or<br />

sanction expenditure vests or is delegated.<br />

t. "Administrative Approval" means <strong>for</strong>mal acceptance by the competent authority<br />

<strong>for</strong> incurring expenditure on a work or piece of the work as the case may be.<br />

u. "Financial Sanction" means sanction accorded by the competent authority to the<br />

expenditure by a separate order or by signature or countersignature on bills or<br />

proposals.<br />

v. "Non-Recurring Expenditure" means expenditure on items or works incurred less<br />

frequently in a year or <strong>for</strong> less than one year.<br />

w. "Recurring Charge or Expenditure" means expenditure incurred on an item or a<br />

work, frequently or <strong>for</strong> a period more than a year.<br />

x. "Secured Advance" means an advance made on the security- of materials<br />

brought at s of work by a contractor.<br />

y. "Technical Sanction" means sanction given to a properly detailed design and<br />

estimate of the cost a work of construction or repair proposed or to be carried out<br />

<strong>for</strong> the <strong>Mission</strong> by a Technical Officer to whom the power is delegated.<br />

z. "District <strong>Mission</strong> Leader" means the Collector of the District concerned.

CHAPTER -3<br />

COMMITTEES TO BE APPOINTED BY THE EXECUTIVE COMMITTEE<br />

3.1 The Executive Committee shall appoint the following committees <strong>for</strong> enabling it<br />

to exercise its responsibility/authority efficiently :<br />

1. Programme <strong>Management</strong> Committee<br />

2. Purchase Committee<br />

The constitution, powers and functions of the Programme <strong>Management</strong> Committee<br />

and Purchase Committee are laid out in this section<br />

3.2 Programme <strong>Management</strong> Committee :<br />

1. It shall consist of :<br />

i. Secretary (Rural-Development Department)<br />

ii.<br />

iii.<br />

iv.<br />

Secretary (Panchayat Department)<br />

<strong>Mission</strong> Coordinator<br />

<strong>Mission</strong> Director<br />

v. <strong>Mission</strong> Advisor<br />

vi.<br />

Chief Executive Office: of three Zila Panchayats on rotation basis<br />

The Programme <strong>Management</strong> Committee may co-opt any other member,<br />

official or non-official, as deemed necessary <strong>for</strong> the successful conduct of<br />

the programme.<br />

2. The functions of this committee will be<br />

a. To meet once in three months<br />

b. To plan and promote the activities of the <strong>Mission</strong>, so as to achieve<br />

the objectives of the programme.<br />

c. To ensure convergence and synergy between the activities and<br />

schemes of various departments having an impact of integrated and<br />

sustainable development in rural areas.<br />

d. To design institutional arrangements- both <strong>for</strong>mal and in<strong>for</strong>mal <strong>for</strong> the<br />

smooth implementation of watershed management programme.

e. To monitor the implementation of the programme and take corrective<br />

steps whenever necessary.<br />

f. To ensure that there is an internal audit each year.<br />

g. To ensure that all district units and other bodies receiving funds <strong>for</strong><br />

implementation of the <strong>Mission</strong> activities, maintain records in the<br />

prescribed manner.<br />

h. To prescribe action to be taken in case of noncompliance with rules,<br />

regulations and norms by an individual or a unit or any associated<br />

body.<br />

I. To ensure that the annual report and statement of accounts are<br />

submitted to the Executive Committee and General Body within a<br />

reasonable time.<br />

3. The Programme <strong>Management</strong> Committee is an Authority of the <strong>Mission</strong><br />

under Rule 20 (ii) of the <strong>Mission</strong>'s Rules.<br />

3.3 Purchase Committee :<br />

1. It shall consist of :<br />

i. <strong>Mission</strong> Director - Chairman<br />

ii.<br />

iii.<br />

iii.<br />

iv.<br />

Joint Development Commissioner of <strong>Mission</strong> (ex-officio)<br />

Joint Development Commissioner or Superintending Engineer of the<br />

Office of Development Commissioner (Nominated by Development<br />

Commissioner)<br />

Chief Accounts Officer of Office of Development Commissioner. (Esofficio)<br />

Accounts Officer of the <strong>Mission</strong><br />

The Committee may co-opt any other person as a member, depending on<br />

the requirements of the situation<br />

2. The functions of this committee will be to :-<br />

a. Meet as and when required<br />

b. Float tenders, valuate and negotiate offers and award purchase

orders <strong>for</strong> items costing Rs. 50000.00 and up to Rs. 10.00 lakh.<br />

c. Ensure that all purchases from the funds of the <strong>Mission</strong> are in<br />

compliance with regulations and norms.<br />

The Purchase Committee is an Authority of the <strong>Mission</strong> under Rule<br />

20 (ii) of the <strong>Mission</strong>'s Rules and it will frame regulations, byelaws<br />

and procedures relating to procurement of materials as per financial<br />

code of Government of Madhya Pradesh.

CHAPTER - 4<br />

BUDGET ESTIMATES<br />

4.1 The Budget Estimates of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For <strong>Watershed</strong> <strong>Management</strong><br />

will be prepared annually <strong>for</strong> each Financial year on the basis of the guidelines of<br />

the Executive Committee. The Budget <strong>for</strong> each Financial year shall be prepared by<br />

the Administrative Officer under the overall guidance of the <strong>Mission</strong> Director. The<br />

Administrative Officer will be assisted by the Accounts Officer.<br />

4.2 The Budget estimates will consist of the following :<br />

i. A statement of Budget proposals at a glance.<br />

ii.<br />

iii.<br />

A statement of Income of the <strong>Mission</strong> <strong>for</strong> the relevant financial year.<br />

A statement of Expenditure <strong>for</strong> the relevant financial year which will<br />

comprise of Capital Expenditure and Recurring Expenditure including<br />

management expenses.<br />

4.3 The main items of receipts of the <strong>Mission</strong> are :<br />

i. Grant in aid received from the Department of Panchayat and Rural<br />

Development, Government of M.P.<br />

ii.<br />

iii.<br />

iv.<br />

Donations or assistance of any kind received from <strong>for</strong>eign governments or<br />

multi-national agencies. Donors under bilateral or multilateral agreements.<br />

Contributions from the Training and Community Organisation component of<br />

the funds made available to districts <strong>for</strong> implementation of <strong>Rajiv</strong> <strong>Gandhi</strong><br />

<strong>Mission</strong> For <strong>Watershed</strong> <strong>Management</strong>.<br />

Contributions from the outside institutions and public as may be decided by<br />

the Executive Committee.<br />

v. Miscellaneous Receipts.<br />

4.4 The main items of expenditure of the <strong>Mission</strong> fall under the following categories :<br />

A. Capital Expenditure - Non-Recurring Expenditure On :<br />

i. Purchase of office equipment including Computers office machines<br />

and office furniture and fixtures <strong>for</strong> State <strong>Mission</strong> Office<br />

ii.<br />

Purchase of Vehicles

iii.<br />

Purchase of miscellaneous field equipments and apparatus<br />

B. Recurring Expenditure On :<br />

i. Salary including allowances of<br />

a. Officers and staff including those appointed on deputation or on<br />

contract.<br />

ii.<br />

iii.<br />

iv.<br />

Honorarium to experts and guest lecturers<br />

Office expenses including electricity charges, water charges, printing<br />

and stationery, post and telegraph charges, telephone charges, fax<br />

charges etc.<br />

Fuel, Oil and lubricants <strong>for</strong> vehicles.<br />

v. Repairs to vehicles.<br />

vi.<br />

vii.<br />

Repairs to machines, apparatus and equipments.<br />

Repairs and maintenance of buildings.<br />

viii. Preparation of manuals and Purchase of various kits.<br />

equipments/materials <strong>for</strong> training<br />

ix.<br />

Purchase of Library Books, Journals etc.<br />

x. Supply of Hand Book and training manual, material etc. to Resource<br />

persons<br />

xi.<br />

xii.<br />

xiii.<br />

xiv.<br />

Expenses on Meetings.<br />

Expenditure on Trainings/Seminars Workshops/Exhibition etc.<br />

Expenditure on pilot studies and evaluation studies.<br />

Traveling allowances.<br />

4.5 The major expenditure of the mission is financed from graint in aid received from<br />

Government of Madhya Pradesh. It is, there<strong>for</strong>e, necessary to prepare Budget<br />

estimate of the <strong>Mission</strong> as required by government <strong>for</strong> incorporation of the figures<br />

in their Budget estimates. Similarly, there is time schedule prescribed by<br />

Government <strong>for</strong> the Heads of Government Offices <strong>for</strong> submission of their budget<br />

estimates. The time schedule prescribed by Government <strong>for</strong> submission of Annual

and Revised Estimates shall be adhered to while submitting budget estimate of<br />

<strong>Mission</strong> to the respective Government Departments.<br />

4.6 The estimates under detailed heads will be rounded off to the nearest thousand of<br />

Rupees.<br />

4.7 Approval of Executive Committee : The State Budget Estimates will be prepared on<br />

the basis of assessment of activities and requirement as per the action plan. The<br />

Budget estimate duly prepared will be placed be<strong>for</strong>e the Executive Committee <strong>for</strong><br />

scrutiny and approval.<br />

4.8 The fund of the <strong>Mission</strong> shall not be re-appropriated by such expenditure which has<br />

not been sanctioned by the competent authority in this regard.<br />

The following general conditions shall be kept in view while proposing reappropriation<br />

of funds :<br />

a. Re-appropriation of funds from one unit to another unit may be sanctioned<br />

by the authority so empowered under delegation of Financial Power Rules,<br />

any time during the year but be<strong>for</strong>e the close of the financial year.<br />

b. Re-appropriation of fund shall be made only when it is known or anticipated<br />

that funds to be transferred from one unit to another unit will not be utilised<br />

in full and that savings under the Heads of Account are likely to become<br />

available.<br />

c. Fund shall not be re-appropriated to meet expenditure on any item not<br />

provided <strong>for</strong> or contemplated in the Sanctioned Budget Estimates.<br />

d. Re-appropriation of funds shall not be permitted from Revenue to Capital<br />

and Capital to Revenue.<br />

4.9 Watching the progress of expenditure :- It is the duty of Accounts Officer to watch<br />

the progress of expenditure under each head as compared to the budget<br />

provisions made and grants received and expected to be received from<br />

government. If abnormal increase in expenditure is noticed under any particular<br />

head it shall be promptly brought to the notice of the <strong>Mission</strong> director.

CHAPTER - 5<br />

ACCOUNTS<br />

5.1 Complete Accounts in respect of each transaction by the <strong>Mission</strong> and its Officers in<br />

the districts as well, shall be maintained in the same manner as required by any<br />

Drawing and Disbursing officer of the state government departments. All provisions<br />

relating to custody, preparation and maintenance of such accounts shall apply as<br />

prescribed <strong>for</strong> a state government office mutadis-mutandis.<br />

5.2 The following registers and records shall be maintained by the <strong>Mission</strong> office at the<br />

State level.<br />

1. Initial Accounts<br />

i. Cash Book<br />

ii.<br />

Ledger<br />

iii.<br />

Journal<br />

iv.<br />

Register of Temporary Advances<br />

v. Register of Cheques/Bank Drafts and Money Orders Received.<br />

vi.<br />

Cheque Book and Receipt Book Register.<br />

vii.<br />

Cheques Issue Register.<br />

viii.<br />

Register of Remittances Made To The Bank.<br />

ix.<br />

Bank Pass Book<br />

x. Register of Money Orders, Postal Orders And Bank Drafts<br />

Dispatched<br />

xi.<br />

Bill Register

xii.<br />

Salary And Acquaintance Register<br />

xiii.<br />

Register of Fixed Charges<br />

xiv.<br />

Petty Cash Book<br />

xv.<br />

Register of Government Grants Received.<br />

xvi.<br />

Stock Register.<br />

xvii.<br />

Register of Works<br />

xviii.<br />

Register of Grants To NGOs etc.<br />

xix.<br />

Fixed Assets Register.<br />

xx.<br />

Register of Investments.<br />

xxi.<br />

Classified A/C of The <strong>Mission</strong>.<br />

xxii.<br />

Monthly Accounts of Receipts And Payments.<br />

5.3 Cash :<br />

The term includes legal tender, coins, currency notes, cheques payable on demand<br />

and demand drafts.<br />

Note : A small supply of revenue stamps may, where necessary <strong>for</strong> use as receipt<br />

stamps, be kept as part of the cash balance<br />

5.4 Custody of Cash :<br />

1 Every officer and/or employee who is authorised to receive and disburse<br />

<strong>Mission</strong> money shall keep a cash chest <strong>for</strong> its security, and <strong>for</strong> proper<br />

accounting daily cash book will be maintained.<br />

2 Duplicate keys of the cash chest of the State <strong>Mission</strong> office shall be kept<br />

duly sealed in the custody of the Accounts Officer.

5.5 Verification of Cash Balance :<br />

1. The contents of the cash chest must be counted by the Account Officer<br />

atleast once in a month and the amount compared with the cash book's<br />

balance.<br />

2. The result of verification should be recorded in cash book each time as<br />

follows "Cash Balance" verified by me today and found to be Rupees (in<br />

figures) Rupees (In words) on actual account. Date----------------------<br />

Designation of officer.<br />

Note:- It is advisable to count the cash balance at convenient intervals and record<br />

certificate of counting in the body of the cash-book.<br />

3. Whenever on counting, the cash balance is not found to be as per the cash<br />

book, the position must be recorded on the cash book and a report shall be<br />

submitted to the next higher authority.<br />

4. Unless an error can be set right at once, the excess should be rectified by<br />

making the necessary receipt entry "Cash found excess"' as miscellaneous<br />

revenue. In case of shortage the recovery will be made from the Cashier.<br />

5.6 Receipt of Money :<br />

1. Money on behalf of <strong>Mission</strong> shall be received only by the employee in<br />

Finance Section who is authorised to do so under special orders of the<br />

<strong>Mission</strong> Director. In his casual absence, the Accountant shall receive<br />

money.<br />

2. The payer must be given a receipt from the receipt book at the time of<br />

receiving money. All receipts should be signed by the Accounts officer or by<br />

the Accountant.<br />

3. It is the duty of the Accounts Officer to satisfy himself that all money<br />

received has been deposited in the Bank and properly entered in the Cash<br />

Book on the same date.

4. Where money is realised not in cash but by the way of deductions made<br />

from the bills, a receipt may be granted from Receipt Book, if specially<br />

desired by the payer, clearly specifying on the top of receipt "Recovery<br />

made by Deduction" in red ink.<br />

5. If demand <strong>for</strong> issuing a receipt is made on the ground that the original is lost<br />

only a certificate that the certain sum of certain account from certain person<br />

is received should be issued under the signature of Accounts Officer on<br />

separate paper.<br />

6. Cheques received and accepted should be entered in the Bank column on<br />

receipt side of the Cash Book on the day of the receipt and their credit on<br />

realisation to <strong>Mission</strong>'s account by the bank should be watched. However in<br />

such cases, official receipt to be issued should indicate that receipt is issued<br />

subject to realisation of cheque.<br />

7. In the event of the cheque received being dis-honoured by the bank, on<br />

presentation, the infect shall be promptly reported to tendered by the<br />

Accounts Officer with a demand <strong>for</strong> payment <strong>for</strong> cash.<br />

5.7 Form and Custody of Receipt books :<br />

1. Receipt books in machine numbered <strong>for</strong>m should be got printed from the<br />

printing press. This standard <strong>for</strong>m shall be used by the Accounts<br />

Officer/employees authorised to receive the money on behalf of the <strong>Mission</strong>.<br />

2. The blank receipt books must be kept under lock and key in the personal<br />

custody of the Accounts Officer.<br />

3. An account of money receipt books may be kept in the <strong>for</strong>m of a register<br />

showing their balance in stock from previous year, new books printed, books<br />

issued and the books in balance.<br />

4. The physical verification of blank receipt books in stock should be carried<br />

out every six months on 30th June and 31st December by the Accounts<br />

Officer and a certificate to that effect may be recorded in the register so

maintain.<br />

5.8 Imprest :<br />

1. An imprest representing a standing advance of a fixed sum of money may<br />

be given to the state level officer with the sanction of the <strong>Mission</strong> Director<br />

who has to make payments of urgent nature frequently. The amount of<br />

imprest to be fixed <strong>for</strong> the office as a whole should be based on monthly<br />

estimated expenditure on such items which the officer has to incur.<br />

2. The account of Imprest cash should be kept in duplicate by the Imprest<br />

holder. The Counterfoils should be retained by the imprest holder and the<br />

original supported by the necessary vouchers should be <strong>for</strong>warded to the<br />

Accounts Officer after due sanction to expenditure incurred is obtained from<br />

the competent authority and with an endorsement, "Pass <strong>for</strong> Payment" on<br />

each voucher <strong>for</strong> recoupment, duly initialised in token of approval.<br />

3. Since the imprest cash is held outside the accounts of the <strong>Mission</strong>, the<br />

impress holding officer should not .keep it idle. The process of incurring<br />

expenditure there from and recouping it from time to time should continue.<br />

The account should be rendered atleast monthly by 25th of each month to<br />

the Accounts Officer <strong>for</strong> incorporating the expenditure in the cash book and<br />

other accounts. The Accounts Officer should examine the imprest cash<br />

account and supporting vouchers, initial with date in token of approval and<br />

by a <strong>for</strong>mal pay order recorded on the account to authorise the recoupment.<br />

The account should be incorporated in the cash book and other accounts.<br />

4. The imprest holder is responsible <strong>for</strong> the safe custody of imprest money and<br />

he must at all times be ready to produce the total amount of the imprest in<br />

vouchers and in cash.<br />

5. On the last day of the financial year the balance of the imprest together with<br />

vouchers <strong>for</strong> expenditure incurred upto that date shall be submitted <strong>for</strong> credit<br />

to <strong>Mission</strong>'s Account or adjustment as the case may be and a fresh imprest<br />

advance shall be drawn in next financial year.

6. Whenever the employee concerned proceeds on leave, it shall be his duty to<br />

handover the complete account of imprest to the person taking charge of the<br />

post.<br />

7. The imprest granted should be reviewed by the <strong>Mission</strong> Director and it may<br />

be increased on decreased under his orders on the basis of monthly<br />

average expenditure during the last year.<br />

5.9 Payments :<br />

1. All the payment on behalf of the <strong>Mission</strong> should be made either in cash by<br />

withdrawing money from account with the bank or by cheques or by advising<br />

Bank to credit money due to an employee to his/her account with the Bank.<br />

2. It is permissible to make payment to supplier of stores or any other person<br />

at his request at his cost and risk through bank drafts with the adjustment of<br />

Bank Commission from his bill.<br />

3. As a rule no cheque should be drawn until it is intended <strong>for</strong> payment.<br />

Cheques drawn in favour of any contractor/supplier by the Accounts Officer<br />

who has entered in to the contract with the person <strong>for</strong> work or supply of the<br />

material on proper identification. However, when the payment is made<br />

through other officer such officer should give certificate below the receipt of<br />

the payee contractor or supplier that the cheque is handed over to the payee<br />

or his authorised person on identification.<br />

4. All cheques issued to the outside persons should be "crossed" and payable<br />

to order "A/C Payee" only. Cheques should not be drawn and deposited in<br />

cash chest when they are not required <strong>for</strong> immediate payment <strong>for</strong> the<br />

purpose of showing the full amount of grant as utilised.<br />

5. Payment due to contractors or outside suppliers may if so desired by them,<br />

be made to their banks instead of directly making to them provided that (i)<br />

an authorisation from the contractor/supplier is produced in the <strong>for</strong>m of<br />

legally valid document. such as, power of attorney containing authority of the

ank to receive payment and (ii) the contractor's/ supplier's own acceptance<br />

of correctness of the account made out as being due to him by the <strong>Mission</strong><br />

or his signature on the bill or other claim preferred against the <strong>Mission</strong><br />

be<strong>for</strong>e settlement of accounts or claim by payment to the said bank. The<br />

receipt obtained from the bank will constitute a full and sufficient proof of<br />

discharge of payment.<br />

5.10 Cheques and Cheque Book:<br />

1. Cheques/Cheque Books required should be obtained from the Bank on<br />

getting the printed requisition <strong>for</strong>m signed by the officer's authorised to draw<br />

on the bank. The <strong>Mission</strong> Director and Accounts Officer shall be authorised<br />

to sign cheques. All cheques should be signed by both the officers.<br />

2. Only one cheque book should be used ax a time.<br />

3. Cheque Books on receipt should be carefully examined by the Accounts<br />

Officer, who should count the no. of <strong>for</strong>ms contained in each book and<br />

record a certificate of count on the fly leaf.<br />

4, Cheque Books must be kept in the personal custody of the Accounts Officer.<br />

5. Counterfoils of used books should be preserved <strong>for</strong> a period of atleast three<br />

years or till the audit by the Accountant General <strong>for</strong> the period is over<br />

whichever is later.<br />

6. A register of cheques drawn should be maintained in the <strong>Mission</strong>. Similarly,<br />

stock account of cheque books obtained from the bank should be<br />

maintained showing particulars of the cheque numbers, date of receipt of<br />

cheque books, date of issue <strong>for</strong> use and balance of bank cheque books. The<br />

physical verification of the blank cheque books in the custody should be<br />

carried out every three months and a certificate recorded in the Stock<br />

Account by the Joint Development Commissioner of <strong>Mission</strong>.<br />

7. The loss of a cheque book or blank cheque <strong>for</strong>m shall be promptly reported<br />

by the Accounts Officer to the <strong>Mission</strong> Director and the Bank.

8. If the validity currency of a cheque issued expires owing to it not being<br />

presented at bank within the validity period stipulated by the Bank, it may be<br />

taken back by the Account Officer who should then cancel and attach with<br />

counter foil and draw a new cheque in lieu of it. The fact of cancellation and<br />

the number and date of the new cheque being issued should be entered on<br />

the counterfoil of the old cheque and the number and date of the old cheque<br />

that is cacelled should be entered on the counterfoil of the new one. The fact<br />

that the new cheque having been issued should be entered on the date of<br />

issue in red ink in the cash book but not in the column <strong>for</strong> payment, a note<br />

being made at the same time against the original entry in the cash book.<br />

9. When it is necessary to cancel a cheque, the cancellation should be<br />

recorded against the relevant entry in the Register of cheques drawn. If it is<br />

in the drawer's possession, it should be destroyed. If the cheque is not in his<br />

possession, the Accounts Officer should promptly request the bank to stop<br />

the payment and after ascertaining that it has been stopped, he should write<br />

back the entry in the cash book and reduce the expenditure in the accounts.<br />

10. A cheque remaining unpaid <strong>for</strong> any cause <strong>for</strong> 12 months after its issue,<br />

should be cancelled and its amount written back in cash book and accounts.<br />

11. All corrections and alterations in a cheque should be attested by the signing<br />

officer/s by their full signatures.<br />

5.11 Vouchers :<br />

1. A bill or a cheque becomes a voucher when it is received and stamped<br />

"paid'. As a general rule, every payment including repayment of money<br />

previously lodged with-the <strong>Mission</strong> <strong>for</strong> whatever purpose must be supported<br />

by a voucher setting <strong>for</strong>th full and clear particulars of the claim and its<br />

classification in accounts including those of deductions made from the bill.<br />

2. When it is not possible to support a payment by a voucher or payee's<br />

receipt, a certificate of payment prepared in -manuscript signed by the<br />

Accounts Officer and countersigned by the <strong>Mission</strong> Director together with a

note explaining the circumstances should always be placed on records. Full<br />

particulars of claim, amount paid, date of payment, object of payment should<br />

invariably be set <strong>for</strong>th and where this necessitates the use of a regular bill<br />

<strong>for</strong>m, the certificate may be recorded thereon.<br />

3. Every voucher must bear a pay order signed or initialed and dated by the<br />

Accounts Officer. This order should specify the amount payable both in<br />

words and figures. All pay orders must be signed by hand and in ink.<br />

4. Every voucher should also bear or have attached to it an acknowledgment<br />

or receipt of the claimant or payee. This receipt should be taken at the time<br />

of payment.<br />

5. Receipts <strong>for</strong> net payments exceeding Rs. 500/- must be stamped under the<br />

Indian Stamps Act unless they are exempted from Stamp Duty.<br />

6. As adjustment bills <strong>for</strong> "NIL" amount involve no payment it is not necessary<br />

to insist upon any acknowledgment of payment in respect of such bills.<br />

7. A single receipt, stamped where ever necessary, given by payee in<br />

acknowledgment of several payments or lump sum payment either in cash<br />

or by cheque made to him on one occasion shall constitute a valid a<br />

quittance. The Accounts Officer should, in such cases give cross reference<br />

on all vouchers to which the receipt relates.<br />

8. All paid vouchers must be stamped "paid & cancel" that they can not be<br />

used a second time. Stamps affixed to vouchers must also be cancelled so<br />

that they may not be used again.<br />

9. Vouchers and quittances shall be filed and retained carefully in "Accounts<br />

Section" as important documents till they are destroyed under the order of<br />

competent authority.<br />

10. Whenever cash memorandums are obtained from the dealers or suppliers,<br />

they are not considered as valid receipts under the provisions of Indian<br />

Stamp Act, unless they contain an acknowledgment of receipt of money

from the person named therein.<br />

5.12 Instructions <strong>for</strong> Preparation of Form of Bills :<br />

The following instructions with regard to the preparation of <strong>for</strong>m of bills should be<br />

observed :<br />

i. Printed <strong>for</strong>ms of bills should be adopted as far as possible.<br />

ii.<br />

Different <strong>for</strong>ms of bills are prescribed in the regulations <strong>for</strong> different claims.<br />

Suitable <strong>for</strong>ms of bills appropriate to the types of claims to be prepared and<br />

should be used<br />

iii.<br />

All corrections and alterations in the total of a bill whether made in words or<br />

figures should be attested by the Accounts Officer.<br />

iv.<br />

Corrections and alterations in any part of bills should be attested by the<br />

Accounts Officer by dated initials.<br />

v. When the bills cover charges incurred under special orders or sanctions,<br />

copies of orders or sanctions should be attached to the bills as far as<br />

possible. Otherwise reference of such orders or sanctions should be quoted<br />

against/be<strong>for</strong>e the item in the bill.<br />

vi.<br />

The budget provision i.e. sanctioned allotment, expenditure incurred upto<br />

date including the bill and the balance of the provision or budget grain<br />

should be mentioned in appropriate columns in each bill.<br />

vii.<br />

The full account classification i.e. the head of account to which expenditure<br />

is to be debited should be recorded.<br />

viii.<br />

Charges against two or more heads of accounts should not be included in<br />

one bill.<br />

ix.<br />

Any space left blank either in the money column or in the column <strong>for</strong><br />

particulars of the bill should be covered by oblique lines.

x. A note to the effect that the amount of the bill is below a specified amount<br />

expressed in whole rupees which is slightly in excess of the total amount of<br />

the bill should be recorded in the body of the bill.<br />

xi.<br />

Rounding - The amount of bill <strong>for</strong> payment and incorporation in accounts<br />

involving a fraction of a rupee should be rounded off to the nearest full<br />

rupee.<br />

xii.<br />

Payment Vouchers : All bills should be accompanied by a payment voucher.<br />

Payment vouchers should be printed in different colors <strong>for</strong> easy<br />

identification. The types of vouchers are :<br />

a. Payment in Cash<br />

b. Payment by Cheque<br />

c. Adjustment vouchers<br />

5.13 Register of Investments/Fixed Deposits with Banks etc.:<br />

1. Surplus funds with the <strong>Mission</strong> not required <strong>for</strong> immediate expenditure<br />

should be invested in short term deposits with banks or recognised financial<br />

institutions. It is necessary to keep a watch over their investment, renewal<br />

and encashment from time to time. An investment / deposit register shall be<br />

maintained by the Account Officer. The entries in the register should be<br />

attested by him with dated initials.<br />

2. The investment should be made with the sanction of the <strong>Mission</strong> Director. It<br />

should be ensured that the funds are not lying idle- without interest and are<br />

promptly invested. Certificates /Deposit receipts obtained should be kept in<br />

the safe custody of the Account Officer.

Chapter -6<br />

FINANCIAL RULES<br />

6.1 Arrear Claims :<br />

1. Normally no claim against the <strong>Mission</strong> should remain in arrears <strong>for</strong> more<br />

than one year from the date it is due <strong>for</strong> payment. The claims upto one year<br />

old may be paid after sanction is accorded by the competent authority under<br />

the delegation of powers.<br />

2. The claims which have not been settled within one year <strong>for</strong> one reason or<br />

the other shall be paid only with the special sanction of the <strong>Mission</strong> Director.<br />

The officer preferring the claim of more than one year should satisfactorily<br />

explain the reasons <strong>for</strong> delay to the sanctioning authority and give a<br />

certificate that the claim was not preferred and paid previously. The<br />

Accounts Officer should satisfy himself from the records that no payment<br />

was made previously and take proper precautions to ensure that there is not<br />

entertainment of double claim in future on same account.<br />

3. The one year mentioned in the Rule 6.1.1 should be reckoned as follows :-<br />

a. In case of Traveling Allowance bills from the date of return to head<br />

quarters.<br />

b. In the case of pay on promotion, from the date of order sanctioning<br />

the promotions.<br />

c. In the case of leave salary, the date of order granting the leave.<br />

d. In other cases, from the date on which the claim becomes due.<br />

4. The claims barred by time under the law of limitation or any other law would<br />

not be entertained,<br />

6.2 Pay and Allowances :

1. The employees appointed on deputation and contract, shall draw such pay<br />

and allowances as are provided in the terms of their appointment.<br />

2. The pay an allowances and arrears thereof as sanctioned and revised by<br />

Government of M.P. <strong>for</strong> its employees from time to time shall also be<br />

applicable <strong>for</strong> the employees of <strong>Mission</strong> and shall deemed be automatically<br />

approved and revised as such.<br />

3. The pay and allowances of all employees of the <strong>Mission</strong> should be drawn in<br />

such <strong>for</strong>m as prescribed by the <strong>Mission</strong> Director.<br />

4. The Pay Bill should show clearly the sanctioned strength of each cadre with<br />

authority <strong>for</strong> creation of post. The name of each incumbent shall be shown<br />

against each sanctioned post, under the category of post in which he/she is<br />

working by suitable arrangements.<br />

5. The pay and allowances to be drawn and the deductions to be made from<br />

the pay bill should be strictly according to Service Rules or other rules or<br />

instructions or orders issued in this behalf by the Competent Authority.<br />

6. The Pay bill should be supported by increment certificates signed by the<br />

<strong>Mission</strong> Director when the increments of the employees are to be drawn.<br />

Similarly copies of orders sanctioning regular leave or appointment orders<br />

should accompany the Pay Bill when leave salary or first duty pay and<br />

allowances are to be drawn.<br />

7. All other accompaniments, such as recovery schedules, in the proper <strong>for</strong>m<br />

should be correctly prepared in respect of GPF/CPF, recovery of advances,<br />

etc.<br />

8. With a view to ensure that the employees get the salary on due date, the<br />

Accounts Officer should see that the pay bills are prepared and signed by<br />

him atleast 4 days in advance. They should be entered in the bill register.<br />

9. In the first week of the month next to that <strong>for</strong> which the pay and allowances<br />

are drawn, the Accounts Officer should ensure that the deductions made in

espect of each employee from the pay bill are sent by cheques or in cash<br />

as the case may be to the respective officers/institutions/banks concerned<br />

with a <strong>for</strong>warding letter where necessary and with schedules of recovery.<br />

The receipts of acknowledgement of the offices to which amounts are<br />

remained should be watched and kept in record. An account of all such<br />

deductions made from the pay bills should be maintained.<br />

10. If any claim of pay and allowances of an employee are drawn <strong>for</strong> part of a<br />

month or omitted from the monthly pay bill due to leave being not sanctioned<br />

or <strong>for</strong> any other reason, such claim as soon as it becomes due <strong>for</strong> payment,<br />

may be drawn in the next month's arrear bill.<br />

11. The pay and allowances/leave salary of the employees of the <strong>Mission</strong> will be<br />

due <strong>for</strong> payment on the last working day of the month to which they relate<br />

except <strong>for</strong> the month of March.<br />

12. However if there are important festivals or bank remains closed on such last<br />

working day the <strong>Mission</strong> Director may permit the drawal and payment on the<br />

working day earlier to such holidays.<br />

13. The pay and allowances of employees due <strong>for</strong> part of a month may be paid<br />

be<strong>for</strong>e the end of the month when he finally quits service. In such cases the<br />

payment will be due on the day of quitting from service.<br />

14. When an employee dies, his pay and allowances upto the date of his death<br />

should be paid to his legal heirs without considering the time his death or<br />

whether he attending office or not on the date of death.<br />

15. All bills received or prepared and subsequently passed <strong>for</strong> payment should<br />

be entered in Bill Register to ensure their payments and pendency.<br />

16. The details of individual employees, their scale of pay, provident fund and<br />

other deductions should be maintained in the <strong>Mission</strong> in the Pay Bill<br />

Register.<br />

6.3 Refund of Revenue :

1. If any amount is credited to <strong>Mission</strong>'s account on account of excess<br />

recovery of rent or any other charges, etc., the refund of such amount to the<br />

person concerned shall be made with the prior sanction of the <strong>Mission</strong><br />

Director.<br />

2. Be<strong>for</strong>e a remission or refund is allowed the original receipt and entries in<br />

cash book and other accounts should be traced and a note of refund should<br />

be taken against original entries, so as to avoid entertainment of double<br />

claim in future.<br />

6.4 Advance To Employees For Official Purpose :<br />

1. Advance <strong>for</strong> official purpose such as advance <strong>for</strong> traveling allowance on<br />

tour, advance <strong>for</strong> purchase of certain articles/material from the market may<br />

be granted to the employees of the <strong>Mission</strong>. Bill of such advances should be<br />

preferred in prescribed <strong>for</strong>m. The advance to be granted should be restricted<br />

to the probable expenditure likely to be incurred by the employees on the<br />

object and further to the amount required <strong>for</strong> one month only.<br />

2. The employees to whom these advances are given should furnish a detailed<br />

account of expenditure incurred, supported by vouchers or by refund as may<br />

be necessary to the sanctioning authority through Accounts Officer within 30<br />

days from the date of sanctioning advance. Normally no further advance<br />

should be granted unless and until the first advance is adjusted/recovered or<br />

account is submitted. Powers of sanctioning advances will be regulated as<br />

per the administrative order of the <strong>Mission</strong> Director.<br />

3. It is the personal responsibility of the employee to whom the advance is<br />

granted to follow the prescribed procedure in incurring expenditure. He will<br />

be responsible <strong>for</strong> safe custody of the vouchers and balance amount with<br />

him.<br />

4. The powers to sanction second advance when first advance is outstanding,<br />

in exceptional circumstances, are delegated to the <strong>Mission</strong> Director within<br />

the limit as specified in administrative order in this behalf.

5. The advances granted but not adjusted within maximum period of one<br />

month from the date of sanction are liable to be recovered from the salary of<br />

the employee concerned.<br />

6. The Accounts Officer should keep a proper watch over adjustment of such<br />

advances by keeping a register of advances. A list of advances remaining<br />

outstanding <strong>for</strong> more than one month should be submitted by him to the<br />

<strong>Mission</strong> Director in the first week of each month.<br />

6.5 Advances To Employees of The <strong>Mission</strong> on Personal Account :<br />

1. Employees of the mission shall be paid advances on personal account as<br />

per the rules prescribed by Govt. of M.P.<br />

2. The names of the employees with their designation and the amount of<br />

advances sanctioned with other pertinent details <strong>for</strong> each should be clearly<br />

indicated in the <strong>for</strong>m of bill.<br />

3. The bills in which advances are drawn must quote the authority sanctioning<br />

and should have a copy of sanction attached to it.<br />

4. The recoveries of advances through the pay bill should be supported by the<br />

schedules of recoveries of advances in prescribed <strong>for</strong>m.<br />

5. A personal advance to employee i.e. advance granted <strong>for</strong> purchase of<br />

bicycle, festival advance etc. may be recovered in each or by deduction from<br />

his pay.<br />

6.6 Service Records of <strong>Mission</strong> Employees :<br />

1. Service records of the mission employees shall be maintained as per the<br />

rules and procedures prescribed by Govt. of M.P.<br />

6.7 Deposits :<br />

1. Deposits received by the <strong>Mission</strong> should be accounted <strong>for</strong> in prescribed <strong>for</strong>m<br />

allotting separate pages <strong>for</strong> each kind of deposit, if necessary.

2. Refund of deposit should be made on the application itself on the sanction of<br />

authority who ordered the acceptance and on the receipt of the person<br />

entitled to receive it.<br />

3. The refund of deposit should as far as possible be supported by original<br />

receipt issued to the depositor. If the deposit is given in the Bank's fixed<br />

deposit or in any other certificate <strong>for</strong>m, the discharge should be given on the<br />

receipt or certificate itself.<br />

4. Be<strong>for</strong>e refund is allowed, original entry of receipt in the Deposit Register<br />

should be traced and note of refund against the entry should be made.<br />

5. An abstract of Deposits pending as on 31st March each year should be<br />

drawn, indicating reference of entry in Deposit Register, date of receipt of<br />

deposit and amount.<br />

Lapsed Deposits :<br />

6. Deposits due but not claimed by the parties within three complete account<br />

years should be treated to have been lapsed and will <strong>for</strong>m part of <strong>Mission</strong><br />

fund.<br />

7. Refund of lapsed deposits should not be made except with sanction of<br />

<strong>Mission</strong> Director.<br />

8. The procedure as in the case of deposits should be followed <strong>for</strong> refund of<br />

lapsed deposit also. The bill should be prominently marked on the top in red<br />

ink "Refund of Lapsed Deposit" to avoid misclassification in accounts.<br />

6.8 Graints-in-Aid From Government :<br />

The <strong>Mission</strong> receives graints-in-aid every year from the state and central<br />

governments. A register of grants-in-aid in prescribed <strong>for</strong>m should be maintained<br />

so as to know the amount, date of receipt of each type of grants-in-aid and<br />

expenditure booked against each, every month and the balance if any. In order that<br />

the register should serve the purpose of submitting utilisation certificates to

espective governments in time. Separate page may be allotted <strong>for</strong> each type of<br />

grants-in-aid. The figures of expenditure booked in this Register should be finally<br />

accepted as reconciled figures.<br />

6.9 Transfer Of Charge :<br />

When an employee of the <strong>Mission</strong> entrusted with the charge of each, store,<br />

stationery, valuable articles or any other property, is transferred or has to relinquish<br />

his charge due to transfer, retirement, resignation or <strong>for</strong> any other reason, the full<br />

charge thereof should be given by him to his successor. The following points<br />

should be observed :<br />

i. The cash book, imprest and other accounts as the case may be<br />

should be closed on the date of transfer and a note recorded in each<br />

of them over the signature of both the relieved and relieving<br />

employees, showing the cash balance number of unused cheques,<br />

blank receipt books, balance of postage stamps made over and<br />

received in transfer by them respectively.<br />

ii.<br />

In case of stores stationery, a list of articles handed over giving<br />

reference of page of the Stock Register where the articles in balance<br />

are recorded should be prepared and signed by the respective<br />

employees after examination/inspection and counting.<br />

iii.<br />

The relieving employee in reporting to <strong>Mission</strong> Director that the<br />

transfer of charges has been completed should bring to his notice any<br />

shortage or irregularity noticed during the taking over of charge.<br />

6.10 Security Deposits :<br />

1. Employees of the <strong>Mission</strong> who are handling cash and entrusted with custody<br />

of cash, store, stamps, cheque book or any other property may be required<br />

to furnish security of the following amount :<br />

S.No. Name of Post<br />

Amount of Security Deposit

(Rs.)<br />

1. Cashier Rs. 2000/-<br />

2. Stores and Stationery Clerk Rs. 1000/-<br />

3. Any other employee Amount will be decided by the<br />

<strong>Mission</strong> Director<br />

2. The security in the <strong>for</strong>m of financial Guarantee, Policies from the Public<br />

Sector Insurance with a bond to be executed by employee may be obtained<br />

at the cost of the <strong>Mission</strong>.<br />

3. A Register of security deposits of Employees showing name, designation of<br />

employee, amount of security prescribed, particulars of security furnished<br />

and their further disposal may be maintained by the Accounts Officer.<br />

4. All documents in respect of security should be kept in the personal custody<br />

of the Accounts Officer.<br />

6.11 Preservation & Destruction of Records :<br />

1. The following records should on no account be destroyed :<br />

i. Records connected with expenditure of <strong>Mission</strong>'s work not completed<br />

although beyond the period of limit.<br />

ii.<br />

Records pertaining to cases in which litigation is in progress.<br />

iii.<br />

Records connected with claims to service, personal matters affecting<br />

persons in the service.<br />

iv.<br />

Orders and sanctions of permanent character until revised.<br />

2. The following records may/should be preserved not less than the period<br />

specified against them :

S.No. Description of Records Period Remarks<br />

of Preservation<br />

In Complete Years<br />

1. Cash Book Permanent<br />

2. Pay bills and acquittance 10<br />

rolls<br />

3. Service Book 10 After death or<br />

retirement which ever<br />

is earlier<br />

4. Leave Accounts 5 -Do-<br />

5. TA Bills & Acquittance 5<br />

rolls<br />

6. Account of service postage 5<br />

stamps<br />

7. Register of Dead Stock Permanent When the register is<br />

articles<br />

full, check and carry<br />

<strong>for</strong>ward all live entries<br />

to a new register.<br />

Enter in register with<br />

sufficient details.<br />

8. Annual Report on dead stock Permanent<br />

9. Stationery & <strong>for</strong>ms Register 5<br />

10. Vouchers Permanent<br />

11. Account of expenditure Permanent

S.No. Description of Records Period Remarks<br />

of Preservation<br />

In Complete Years<br />

12. Charge Report 5<br />

13. Casual Leave Register 2<br />

and Papers<br />

14. Register of cheques drawn Permanent<br />

15. Challans/Registers Permanent<br />

16. Office copies of provident Permanent<br />

fund schedules<br />

17. Increment Certificate 5<br />

18. Sanction to advances 5<br />

19. Government resolutions Permanent<br />

20. Agreement with contractors Permanent<br />

21. Comparative Statement of Permanent<br />

tenders<br />

22. Measurement books Permanent<br />

23. Register of contracts Permanent<br />

24. Register of Deposits/ Permanent<br />

Advances<br />

25. Tender A-1 or A-2 <strong>for</strong>m Permanent<br />

3. The sanction of <strong>Mission</strong> Director should be obtained <strong>for</strong> destruction of any of<br />

the records of the <strong>Mission</strong> giving full particulars.

4. No accounts or other record which is subject to audit by the Accountant<br />

General or any other Authority should be destroyed unless the audit of the<br />

period <strong>for</strong> which record is maintained is completed and the audit objections<br />

are settled.<br />

5. The above list of presentation of record is not exhaustive. Any other record<br />

not required <strong>for</strong> further use may be destroyed on the responsibility of the<br />

employee concerned under the order of the <strong>Mission</strong> Director.<br />

6.12 T.A./D.A. Bills of <strong>Mission</strong> Staff :<br />

The T.A./D.A. claims of <strong>Mission</strong> employees should be prepared/preferred in<br />

prescribed <strong>for</strong>m and sanctioned in accordance with the rules and regulations of the<br />

Government of Madhya Pradesh.<br />

6.13 Write off and Recovery of Losses :<br />

1. The irrecoverable value of stores or money belonging to the <strong>Mission</strong> lost by<br />

fraud or negligence of individuals or other causes must immediately brought<br />

to the notice of the Programme <strong>Management</strong> Committee which after<br />

examining the case shall immediately bring it to the notice of the Executive<br />

Committee <strong>for</strong> further necessary action. If it discloses some defect in the<br />

system, the existing system may be reviewed and proper safeguards may<br />

be introduced so as to avoid such losses in future. Be<strong>for</strong>e issuing order <strong>for</strong><br />

write off, it should be further examined that there is no possibility of recovery<br />

of loss and there has not been any serious negligence on the part of<br />

individual employee or employees which might possibly call <strong>for</strong> disciplinary<br />

action.<br />

6.14 Correction of Errors :<br />

If any item of receipts or charges, which belongs to one head has been wrongly<br />

shown under another head, the error shall be corrected in the following manner :-<br />

a. If the error is discovered be<strong>for</strong>e the close of the day's accounts,<br />

necessary correction should be made in the original entry be<strong>for</strong>e the<br />

accounts of the day are closed.<br />

b. If the error is discovered after the close of the day's a accounts but<br />

be<strong>for</strong>e the end of the month the correction should take the <strong>for</strong>m of a<br />

fresh entry in the cash book.<br />

Note :- Error affecting only classification i.e. receipts or payments on one<br />

side of cash book without any changes in monetary values shall be<br />

corrected in the manner prescribed above, if the same has been<br />

detected be<strong>for</strong>e the close of the month's accounts.

c. If the error is detected after the accounts of March have been closed,<br />

after the accounts of March have been closed, the correction should be<br />

carried out through a journal entry.<br />

d. In all such cases, the correcting entry should be supported by a transfer<br />

entry approved by the Administrative Officer in the <strong>for</strong>m below and note<br />

of correction shall be made against the original entry in red ink.<br />

Transfer Entry Memo<br />

No.__________________________<br />

Date _________________<br />

Particulars of the original Debit Credit<br />

transaction with reasons <strong>for</strong> Head of Amount Head of Amount<br />

the proposed adjustment A/c Rs. P. A/c Rs. P

ACCOUNTANT/AO<br />

APPROVED<br />

Administrative Officer<br />

CHAPTER - 7

7.7 Journal :<br />

Journal is one of the important Account Book. It's use is restricted to<br />

recording/transfer adjustment entries only other than cash transactions. Each<br />

adjustment entry passed through a journal shall be supported by vouchers. Brief<br />

narration of each entry shall be given in the voucher and it shall be signed by the<br />

Head of Office. The Asst. Accounts Officer/Accountant will check each entry of the<br />

journal with the journal voucher and other subsidiary vouchers and place dated<br />

initials against the entries checked.<br />

7.8 Ledger :<br />

1. i. It is a register in which all transactions recorded in the Cash Book or<br />

Journal shall be classified under different heads of accounts or<br />

objects of expenditure to any sub-unit.<br />

ii.<br />

This will be kept in prescribed <strong>for</strong>m<br />

Notes :-<br />

(a)<br />

These ledger accounts should be arranged and grouped in such a<br />

manner that the desired in<strong>for</strong>mation is promptly secured.<br />

(b)<br />

Combined ledger accounts can be maintained <strong>for</strong> various detailed<br />

heads. The combined register will be maintained in such a manner<br />

that it is used a ledger <strong>for</strong> recording expenditure on other charges.<br />

iii. a. Every ledger A/c is divided into two sides. The left hand side is<br />

known as "Debit" side and the right hand side as "Credit" side. All<br />

items of debits and credits of the cash book and journal shall be<br />

posted the same day in the respective ledger account.<br />

b. The ledger folio must be given the column provided in the cash book and<br />

corresponding cash book folio in the ledger.<br />

iv.<br />

All the days' totals are given and progressive total given where necessary

v. Bank account will be posted from the daily totals of cheques issued,<br />

challans, remittances made into the bank.<br />

2. Monthly Closing :<br />

i. All the ledger accounts will be closed at the end of the month. Totals will<br />

then be struck in the classified account.<br />

ii. Monthly totals of various ledger accounts will then be tallied with the<br />

totals of classified abstract and discrepancies if any, reconciled/rectified.<br />

iii. Monthly account by receipts and payments will be prepared in the<br />

prescribed <strong>for</strong>m by Accounts Officer by the 3rd of each month.<br />

7.9 Bank Pass Book :<br />

i. All amounts deposited to the credit of the <strong>Mission</strong> and all payments<br />

made by the Bank shall be entered in a pass book.<br />

ii. The pass book shall remain in the custody of the<br />

Accounts/Accountant and it shall be presented to the bank on the last<br />

working day of the month or at suitable intervals <strong>for</strong> posting/updating.<br />

iii.<br />

On receipt of the completed pass book, the entries of receipts and<br />

payments and balances will be tallied and discrepancies, if any, will<br />

be located/reconciled by the Accounts Officer and brought to the<br />

notice of <strong>Mission</strong> Director.<br />

iv.<br />

the Account Officer/Accountant will prepare a Bank Reconciliation<br />

Statement specifying differences that may appear between the<br />

credits and debits shown in the pass books and those in the Cash<br />

Book/accounts of the <strong>Mission</strong> in the following manner :-<br />

Bank Reconciliation Statement<br />

Amount<br />

Balance as per Cash Book 20,000

Add<br />

i. Cheques issued but not encashed<br />

X Rs. 500.00<br />

Y Rs. 2,000.00 2500.00<br />

ii.<br />

Direct credit af<strong>for</strong>ded by bank but<br />

not adjusted in the <strong>Mission</strong> A/c 800.00<br />

23,300.00<br />

Less<br />

i. Amounts deposited but not credited<br />

in the A/c Rs. 3,000.00<br />

ii.<br />

Direct debits of commission not<br />

Accounted in the <strong>Mission</strong> A/c<br />

Rs. 500.00 3,500.00<br />

Balance as per pass book 19,800.00<br />

7.10 Annual Accounts :<br />

1. In addition to the preparation of normal financial accounts as may be<br />

prescribed by the <strong>Mission</strong>, Account Officer will prepare receipts & payments<br />

Account. Income & Expenditure Account and Balance Sheet which should<br />

depict complete picture of financial per<strong>for</strong>mance at the state level <strong>for</strong> the<br />

particular financial year.

7.11 Audit of Accounts :<br />

The accounts of the <strong>Mission</strong> will be audited by a Chartered Accountant selected by<br />

the Executive Committee. Representatives of the Controller and Auditor General of<br />

India may also audit the accounts of <strong>Mission</strong> at such intervals as the CAG may<br />

deem necessary.<br />

7.12 Miscellaneous :<br />

In cases where these regulations are silent on a particular point or issue, the<br />

normal rules and regulations of the state government shall apply.

CHAPTER -8<br />

DELEGATION OF ADMINISTRATIVE AND FINANCIAL POWERS<br />

8.1 The Executive Committee of the <strong>Mission</strong> will have full powers required <strong>for</strong><br />

execution of the <strong>Rajiv</strong> <strong>Gandhi</strong> <strong>Mission</strong> For <strong>Watershed</strong> <strong>Management</strong>. However, in<br />

case of any emergency <strong>Mission</strong> Director shall be empowered to take appropriate<br />

action and decisions, which will be post-facto confirmed in rotation by the Executive<br />

Committee.<br />

8.2 The exercise of the delegated powers in Appendix -I schedule (Annexed to these<br />

regulations) shall be subject to the observance of these Regulations. These will be<br />

subject to the conditions that a specific budget provision exists <strong>for</strong> meeting the<br />

expenditure in the financial year in which it is proposed to be incurred.<br />

8.3 The <strong>Mission</strong> Director will exercise all the powers of Head of the Department of the<br />

State Government.<br />

8.4 The powers delegated o a lower authority can be exercised by a higher authority.<br />

8.5 Further detailed regulations and procedures will be laid down by the concerned<br />

authorities i.e. Programme <strong>Management</strong> Committee and Purchase Committee.<br />

8.6 Unless otherwise decided by the Executive Committee, in matters where detailed<br />

rules and procedures with regard to the incurring of expenditure are not laid down.<br />

Government of Madhya Pradesh rules and procedures shall be followed.

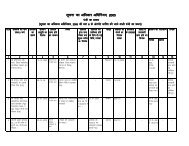

Schedule of Administrative And Financial Powers<br />

S.No. Nature of Power Executive Committee <strong>Mission</strong> Director Remarks<br />

1. Creation of posts in prescribed pay scale Full Powers With the permission of<br />

Govt.<br />

2. Appointment of staff on deputation and contract Full Powers Class II and below<br />

3. Fixation and revision of qualifications and pay<br />

scale<br />

Full Powers<br />

As per GoMP Norms<br />

and Orders<br />

4. To sanction special pay Full powers<br />

5. to sanction and withhold annual increment Full Powers<br />

6. To sanction D.A., A.D.A. and other allowances Full Powers As per GoMP Norms<br />

7. To grant advances<br />

Full Powers<br />

As per GoMP Norms<br />

(festival/grain/vehicle/GPF/House Loan etc.)<br />

8. To draw salary, wages, advances and other<br />

Full Powers<br />

allowances of staff<br />

9. Recoveries from pay Full Powers<br />

10. To approve tour programme Full Powers<br />

11. To authorise/permit an employee to undertake<br />

Full Powers<br />

journey by special means of conveyance<br />

including taxi and other<br />

12. To authoritise/permit an employee to stay in Full Powers<br />

accommodation of higher class then his eligibility<br />

during official tour<br />

13. To accord approval and sanction <strong>for</strong> Tour<br />

Full Powers<br />

As per GoMP Norms<br />

advances/LTC<br />

14. To sanction TA/DA bills Full Powers<br />

15. To sanction medical bills Full Powers<br />

16. To sanction leave Full Powers As per GoMP Norms<br />

17. To order DE, impose minor punishment and cash<br />

penalties<br />

Full Poers

S.No. Nature of Power Executive Committee <strong>Mission</strong> Director Remarks<br />

18. Suspension of the staff appointed on deputation<br />

or contract<br />

Full Powers Full Powers in respect<br />

of employees <strong>for</strong><br />

whom <strong>Mission</strong> is<br />

appointing authority.<br />

In case of employees<br />

appointed on<br />

deputation EC would<br />

make<br />

recommendation to<br />

19. To accord administrative approval and financial<br />

sanction <strong>for</strong> purchase of office material office<br />

equipment other miscellaneous field/office<br />

equipments and apparatus<br />

20. To accord administrative approval and financial<br />

sanction <strong>for</strong> purchase office stationery including<br />

computer consumable<br />

21. To accord administrative approval and financial<br />

sanction <strong>for</strong> purchase of computer hardware and<br />

software<br />

22. To accord administrative approval and financial<br />

sanction <strong>for</strong> purchase of furniture and fixtures<br />

23. To accord administrative approval and financial<br />

sanction <strong>for</strong> purchasing books, Journals and<br />

news letter<br />

24. To accord administrative approval and financial<br />

sanction <strong>for</strong> petty construction in nature of repairs<br />

25. To accord administrative approval and financial<br />

sanction <strong>for</strong> purchase of consumable stores and<br />

fuel, oil and lubricants<br />

parent department<br />

Full Power Upto Rs. 1.00 lakh As per GoMP Norms<br />

Full Power Upto Rs. 1.00 lakh As per GoMP Norms<br />

Full Power Upto Rs. 1.00 lakh As per GoMP Norms<br />

Full Powers Upto Rs. 1.00 lakh As per GoMP Norms<br />

Full Powers Upto Rs. 1.00 lakh As per GoMP Norms<br />

Full Powers Upto Rs. 25,000/yr. As per GoMP Norms<br />

Full Powers<br />

As per GoMP Norms

S.No. Nature of Power Executive Committee <strong>Mission</strong> Director Remarks<br />

26. To accord administrative approval and financial Full Powers Upto Rs. 50,000.00 As per GoMP Norms<br />

sanction <strong>for</strong> purchase of Photographic<br />

equipments and projector including multimedia<br />

players, projectors, pannels etc./Cinematic and<br />

display equipments/Audio-Visual equipments<br />

27. To accord approval <strong>for</strong> maintenance/repairs of<br />

- Vehicles<br />

- Office equipments/Machines/Apparatus<br />

Full Powers<br />

As per GoMP Norms<br />

- Furniture<br />

Full Powers<br />

As per GoMP Norms<br />

- Computers and peripherals (servers/work<br />

stations)<br />

Full Powers<br />

28. To accord administrative approval and financial<br />

sanction <strong>for</strong> field visits and attending<br />

trainings/seminars/workshops within the state<br />

and<br />

29. To accord administrative approval and financial<br />

sanction <strong>for</strong> attending trainings/seminars and<br />

workshops abroad<br />

30. To invite experts/members of EC/VIPs and<br />

appoint consultants or agencies, outside<br />

government sector <strong>for</strong> :<br />

- Meetings and discussions<br />

- Technical Assistance<br />

- Designing and preparing training modules<br />

- Monitoring and evaluation<br />

Full Powers<br />

Full Powers<br />

As per GoMP Norms<br />

As per GoMP Norms<br />

Full Powers With Permission of<br />

Govt.<br />

Full Powers<br />

Full Powers<br />

Full Powers<br />

Full Powers

S.No. Nature of Power Executive Committee <strong>Mission</strong> Director Remarks<br />

31. To sanction expenditure incurred on visits of<br />

invited experts/members of EC/VIPs and<br />

consultants or agencies outside government<br />

sector For :<br />

- Meeting and Discussion<br />

- Technical Assistance<br />

- Designing and preparing training modules<br />

- Monitoring and evaluation<br />

Full Powers<br />

Full Powers<br />

Full Powers<br />

32. To accord administrative approval and financial<br />

sanction <strong>for</strong> hosting lunch/dinner <strong>for</strong> invitee, VIPs,<br />

experts and delegates attending meetings<br />

33. To accord administrative approval and financial<br />

sanction to undertake pilot studies<br />

34. To accord administrative approval and financial<br />

sanction to undertake still photography/video<br />

shooting/slide/transparency preparation and<br />

production and purchase of films, video,<br />

cassettes, CDs, DVDs etc. and other media<br />

means <strong>for</strong> training, community organisation and<br />

dissemination of in<strong>for</strong>mation knowledge and<br />

technology through government institutions and<br />

non-government organisations<br />

35. To accord administrative approval and financial<br />

sanction to undertake preparation and production<br />

of training modules, literature, pamphlets in<br />

various languages/medium etc.<br />